On a busy Monday morning in Austin, Texas, 34-year-old business owner Sarah reviews her finances at the kitchen table, pondering how much is business insurance going to cost her company for the coming year. It’s a common worry—especially when recent data shows that close to 60% of small businesses across the United States are underinsured in 2024 (National Association of Insurance Commissioners). Why does insurance cost vary so much? Understanding the factors can be confusing and, frankly, overwhelming. But knowing the details can make a big difference. This guide breaks down everything you need to know about how much is business insurance to help you plan smarter and protect your company effectively.

On This Page

1. What Is Business Insurance?

1.1. Definition and Purpose

Business insurance includes a range of coverage options that help protect companies from unexpected financial setbacks caused by incidents like damage to property, lawsuits, or employee injuries. Essentially, it serves as a financial shield that allows businesses to recover and continue operations when such events occur.

1.2. Types of Business Insurance

Several types of business insurance exist to address different risks, including general liability, property insurance, workers’ compensation, and professional liability. Each type covers specific aspects of potential losses, allowing businesses to tailor protection to their unique needs.

1.3. Why It Matters for Your Business

Failing to have proper insurance can expose a business to severe financial risks, possibly forcing it to shut down or file for bankruptcy. Beyond protecting assets, having insurance also reassures customers and partners by showing that the business takes risk management seriously and is prepared for uncertainties.

- Pro Tip: In Texas, businesses with employees are required by law to carry workers’ compensation insurance (Texas Labor Code § 406.001).

- Dialogue: Mike from Houston says, “I didn’t realize how critical business insurance was until a client slipped on my store’s floor. That claim could have ruined us without coverage.”

- Statistic 2024: According to the NAIC, 58% of small businesses in the US report having at least one type of business insurance in 2024.

2. Factors That Affect Business Insurance Costs

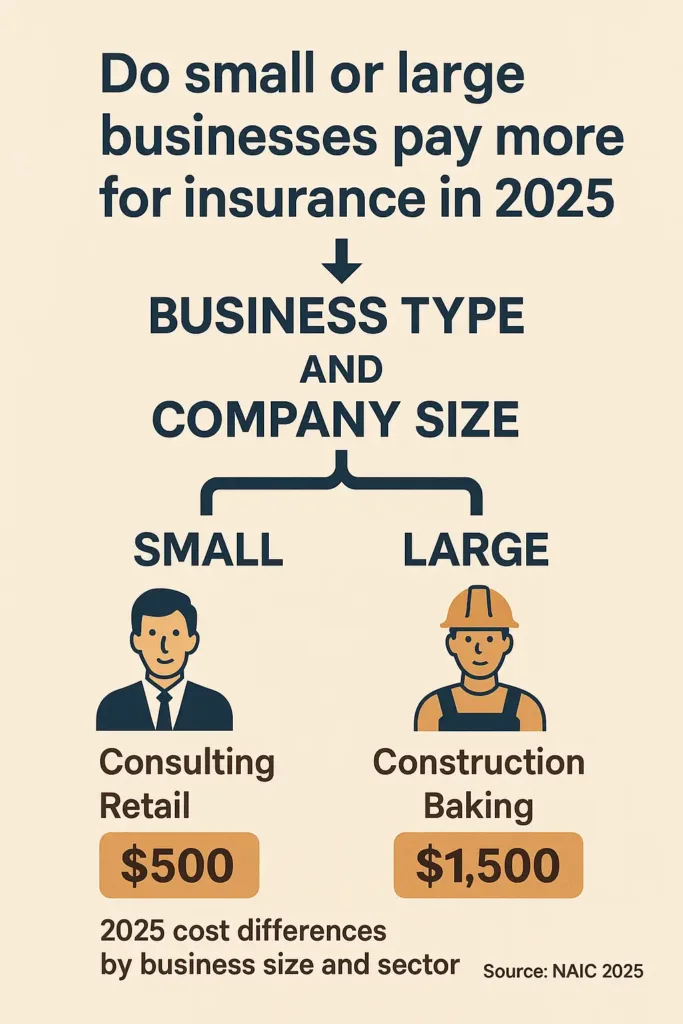

2.1. Business Type and Size

How big your business is and what kind it is play major roles in determining insurance premiums. For example, a solo consultant working from home usually pays less for insurance compared to a large factory because the risks involved are very different.

2.2. Location and Industry Risk

The cost of insuring a business varies greatly depending on its location. Factors such as local crime rates, vulnerability to natural disasters like floods or hurricanes, and local government regulations all affect the price. Businesses in high-risk sectors like construction or healthcare often face higher insurance costs due to their greater legal and financial exposure.

2.3. Coverage Limits and Deductibles

The level of coverage you choose and your deductible amount directly impact your premium. Higher coverage limits offer more protection but come with increased costs, while higher deductibles can reduce premiums but require more out-of-pocket expenses during claims.

2.4. Claims History and Credit Scores

Insurers consider your past claims and creditworthiness when pricing policies. Businesses with frequent claims or poor credit scores usually face higher premiums as they are perceived as higher risk.

- Pro Tip: In California, insurance companies must consider your business credit score but cannot use it as the sole factor for denial (California Insurance Code § 1861.05).

- Dialogue: Lisa, a bakery owner in San Diego, shares, “After a minor claim last year, my premium increased noticeably. I wasn’t aware how much claims history affected costs.”

- Statistic 2024: According to the Insurance Information Institute, 45% of small businesses report claims impacting their insurance costs in 2024.

3. Average Cost of Business Insurance in the USA (2024 Data)

3.1. National Averages by Industry

In 2024, the cost of business insurance differs greatly across industries. While many small businesses pay approximately $750 per year for general liability coverage, sectors like construction often face higher premiums, sometimes surpassing $1,200, due to their elevated risk profiles.

3.2. Cost Ranges for Small Businesses

Small businesses typically pay between $400 and $1,500 per year for basic coverage, though this range can shift based on factors like location, coverage limits, and claims history. Startups may find lower rates initially but should plan for increases as they grow. Seniors starting small businesses should also consider dental insurance for seniors, as personal health benefits can impact long-term financial planning.

3.3. Impact of Coverage Choices

Choosing higher coverage limits or adding specialized policies such as professional liability or cyber insurance can increase premiums substantially. However, these choices provide critical protection against costly lawsuits or data breaches.

- Pro Tip: Consider bundling multiple policies, as insurers often offer discounts for combined coverage.

- Dialogue: Jake, a restaurant owner in Chicago, notes, “When I added cyber liability insurance, my premium rose, but it gave me peace of mind against online threats.”

- Statistic 2024: According to the National Association of Insurance Commissioners, average small business insurance costs rose 5% nationwide in 2024.

4. State-Specific Business Insurance Cost Variations

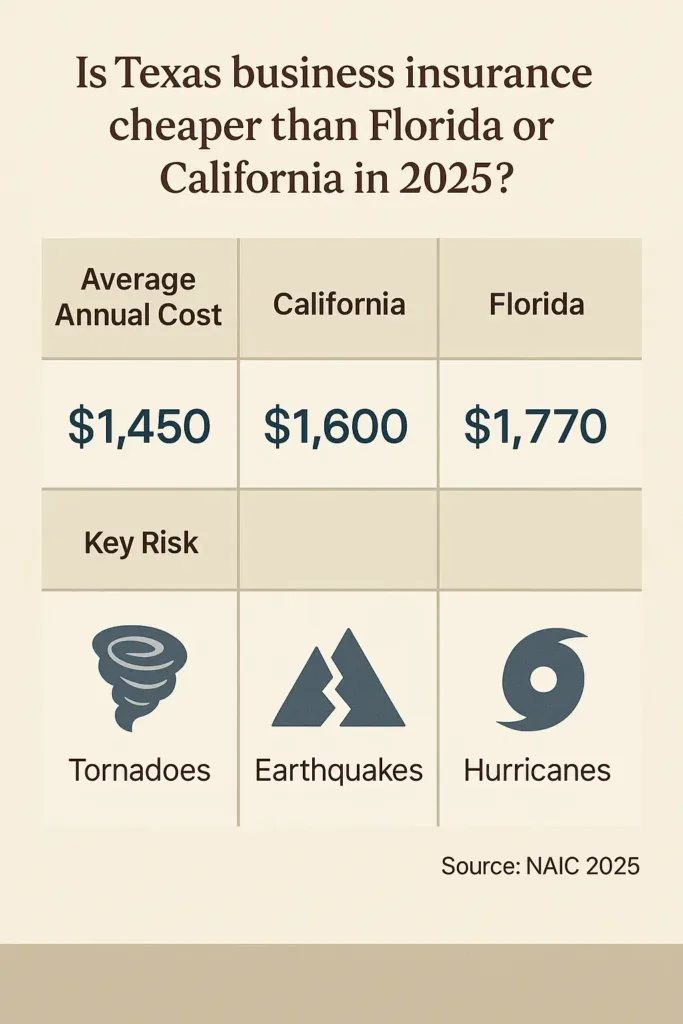

4.1. Comparison: Texas vs California vs Florida

Insurance costs vary by state due to different regulations, risk exposures, and market conditions. Texas tends to have moderate premiums, while in California, stricter regulations and the need for specialized protections like builders risk coverage often raise business insurance costs.

4.2. Regulatory Impact on Costs

State regulations, such as mandatory coverage requirements or premium taxes, affect overall insurance pricing. For instance, California imposes higher minimum coverage limits, increasing premiums for many businesses.

4.3. Local Risk Factors and Insurance Pricing

Within states, local risk factors like urban crime rates or proximity to flood zones also influence premiums. Businesses located in high-risk zip codes, particularly those prone to flooding, may need separate flood insurance to supplement their commercial policies.

- Pro Tip: It’s important to review FEMA’s flood hazard maps for your business address to assess flood exposure and determine if flood insurance is necessary.

- Dialogue: Maria, a boutique owner in Miami, says, “Knowing my flood risk helped me choose the right insurance to protect my property.”

- Statistic 2024: FEMA reports that 20% of small businesses in Florida are located in high-risk flood zones.

5. State-Specific Business Insurance Cost Variations

5.1. Comparison: Texas vs California vs Florida

Business insurance premiums vary significantly between states due to differing regulations, natural disaster risks, and market competition. Texas often offers more affordable rates, California tends to have higher premiums influenced by strict state laws and earthquake risks, while Florida’s rates are elevated largely due to hurricane exposure and flooding risks.

5.2. Regulatory Impact on Costs

States impose different insurance requirements, affecting costs. For example, California requires higher minimum coverage limits for certain policies, pushing premiums upward. Conversely, Texas has fewer mandated coverages, sometimes lowering costs but increasing risk exposure.

5.3. Local Risk Factors and Pricing

Insurance pricing is also influenced by local conditions like crime rates and disaster history. Businesses in urban centers or flood-prone areas often pay more for coverage, reflecting the higher risks insurers face.

- Pro Tip: Businesses in high-risk zones should evaluate both state regulations and local hazards when choosing insurance to avoid costly gaps in coverage.

- Dialogue: Javier, a store owner in Houston, says, “Understanding local regulations helped me avoid expensive surprises when renewing my policy.”

- Statistic 2024: According to the Insurance Information Institute, 35% of businesses in flood-prone areas report paying 20% more for insurance.

6. How to Estimate Your Business Insurance Costs

6.1. Using Online Calculators and Simulators

Many insurance providers offer online tools that provide rough estimates based on your business type, size, location, and coverage needs. These calculators can help you understand potential costs before requesting quotes.

6.2. Getting Quotes from Multiple Providers

Obtaining quotes from several insurers is crucial to compare pricing and coverage options. Each provider may weigh risk factors differently, so shopping around can yield significant savings.

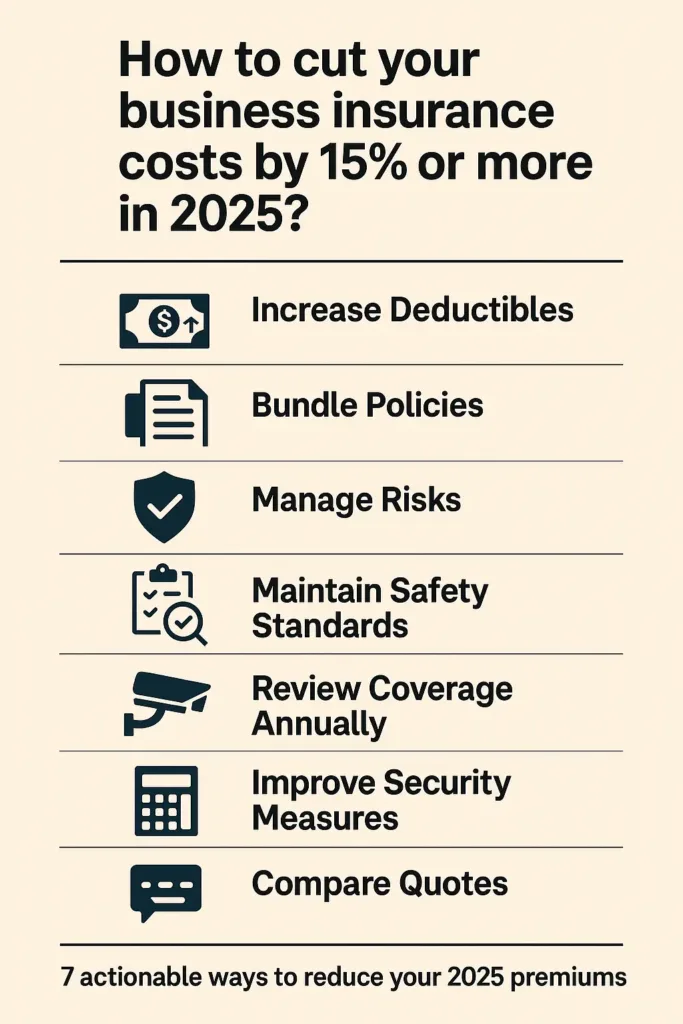

6.3. Practical Tips to Lower Your Premiums

To reduce insurance costs, consider increasing deductibles, bundling policies, improving business security measures, and maintaining a strong claims history. Regularly reviewing and adjusting coverage to match current business needs also helps avoid unnecessary expenses.

- Pro Tip: Regularly updating your risk management strategies can positively impact your insurance premiums over time.

- Dialogue: Rachel, a tech startup founder in Seattle, shares, “Investing in cybersecurity lowered my liability premiums significantly.”

- Statistic 2024: A 2024 study found businesses that actively manage risks save up to 15% on insurance costs annually.

7. Common Business Insurance Policies and Their Costs

7.1. General Liability Insurance

General liability insurance is often the foundation of a business’s coverage, protecting against claims of bodily injury, property damage, and advertising mistakes. For small businesses, average annual premiums typically range from $400 to $1,000 depending on industry and risk.

7.2. Property Insurance

Property insurance covers damages to business premises, equipment, and inventory caused by fire, theft, or natural disasters. Premiums vary widely, with average costs between $500 and $1,500 annually, influenced by location and coverage limits.

7.3. Workers’ Compensation Insurance

Required in most states for businesses with employees, workers’ compensation insurance covers medical expenses and lost wages for work-related injuries. Rates depend heavily on the type of work performed and payroll size, averaging around $0.75 to $2.74 per $100 of payroll.

7.4. Professional Liability Insurance

Often called errors and omissions insurance, this coverage protects businesses from lawsuits alleging negligence or failure to perform professional duties properly. Premiums vary widely by profession, typically ranging from $600 to $2,000 per year for small enterprises.

- Pro Tip: Bundling general liability with professional liability insurance often leads to lower overall premium payments.

- Dialogue: Emily, a Denver-based graphic designer, shares, “Having professional liability coverage gave me the assurance to pursue larger clients confidently.”

- Statistic 2024: In 2024, approximately 42% of small businesses maintained professional liability insurance, according to the Insurance Information Institute.

8. Legal Requirements and State Laws Affecting Business Insurance Costs

8.1. Mandatory Insurance by State

Several states require businesses to carry specific types of insurance. Workers’ compensation is the most common mandate, with requirements varying depending on the size of the business and the industry sector.

8.2. Key Laws Impacting Pricing (with citations)

State regulations such as California’s Insurance Code and Texas’s Workers’ Compensation Act set minimum coverage requirements and influence how premiums are calculated, affecting the overall cost of business insurance.

8.3. Penalties for Non-Compliance

Businesses that do not maintain mandatory insurance coverage may face financial penalties, legal consequences, and in severe cases, forced shutdown. State authorities rigorously apply these regulations to safeguard employees, consumers, and the broader community.

- Pro Tip: Regularly review your state’s insurance laws to ensure your business stays compliant and avoids costly fines.

- Dialogue: Carlos, a restaurant owner in Austin, says, “I was fined for missing my workers’ compensation renewal deadline. Since then, I maintain a compliance checklist to avoid similar issues.”

- Statistic 2024: Recent reports from state agencies indicate that nearly 15% of small businesses faced penalties in 2024 due to insurance compliance failures.

Conclusion

Understanding the factors that influence business insurance costs is essential for entrepreneurs across the United States. By considering industry risks, location, coverage choices, and legal requirements, business owners can make informed decisions to protect their investments without overspending. Staying compliant with state laws and regularly reviewing insurance needs helps avoid penalties and ensures adequate protection. While insurance premiums vary, proactive risk management and shopping around for the best options can help reduce costs. Having the right business insurance is fundamental to building a resilient and protected company.

FAQ

How much is insurance for a small business?

Typical cost range: Small businesses generally pay between $400 and $1,500 per year for basic insurance coverage such as general liability.

Factors influencing cost: Business type and size, location, industry risk, coverage limits, deductibles, and claims history all affect premiums.

Industry variations: For example, a small retail store might pay near the lower end, while a construction company faces higher premiums (often $1,200+ annually) due to increased risk.

Additional coverage: Adding policies like professional liability or cyber insurance raises premiums but offers crucial protection.

State differences: Insurance costs vary by state; California tends to be more expensive than Texas, and Florida’s rates can be higher due to hurricane risk.

How much is a $2 million dollar insurance policy for a business?

The article doesn’t specify exact prices for $2 million policies, but generally:

Higher coverage limits significantly increase premiums.

Since small business insurance averages $400–$1,500 annually for lower limits, a $2 million policy could cost several thousand dollars per year, depending on the business type, risk, and location.

Large coverage amounts are often needed for liability-heavy industries or those with significant property/assets.

Tip: It’s essential to get quotes from multiple insurers to find competitive rates and coverage tailored to your specific needs.