Meet Sarah, a 38-year-old project manager from Dallas, Texas, overseeing the construction of a new commercial building. She recently heard that nearly 40% of construction projects in the US face unexpected delays or damages (source: NAIC, 2024), causing costly setbacks and insurance headaches. Worried about protecting her project, Sarah wonders: is there a way to safeguard the investment during construction?

This article explores builders risk insurance, a specialized policy designed to cover buildings and materials while under construction. This guide breaks down coverage details, operational insights, pricing elements, claim filing steps, and important legal points—so you can steer clear of mistakes and keep your project protected.

Ready to explore the crucial details of builders risk insurance? Let’s jump right in.

On This Page

1. What Is Builders Risk Insurance?

1.1. Definition and Purpose

Builders risk insurance offers tailored protection for buildings, materials, and equipment throughout the construction or renovation process. Unlike typical property insurance, this coverage is specifically meant for projects actively under construction or undergoing changes. But what makes this type of insurance so crucial? Construction sites face specific risks such as theft, extreme weather, and accidents that can result in significant financial losses.

Consider Mark, a 42-year-old contractor from Miami, Florida, who had to pause his project when a strong storm damaged the framework. Without builders risk insurance, he would have faced major out-of-pocket costs that could have jeopardized his business.

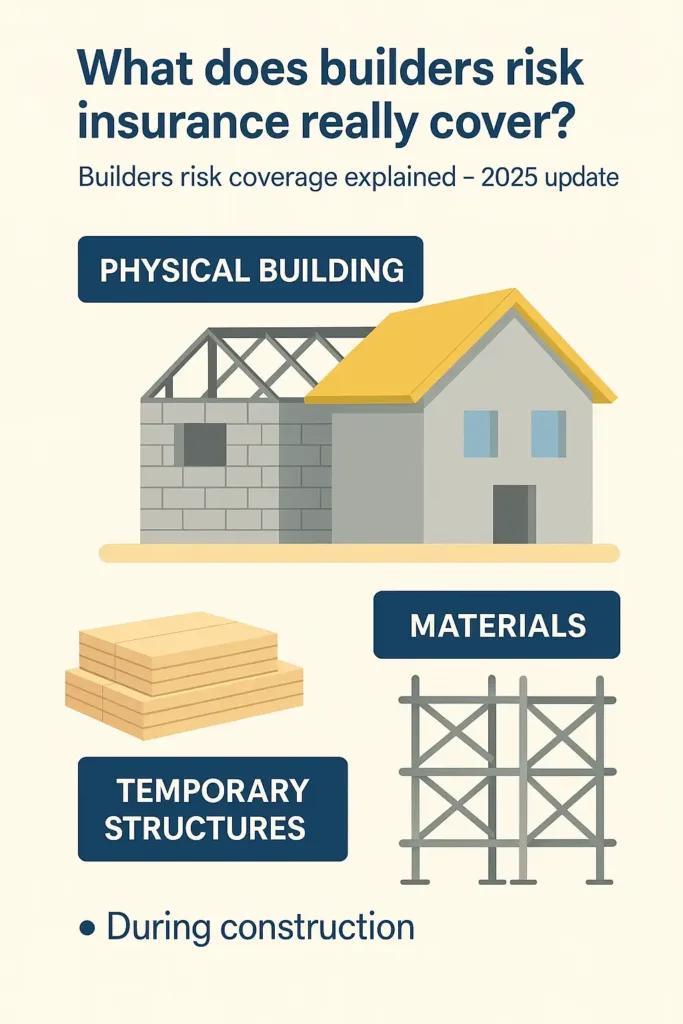

1.2. Coverage Details

This insurance generally protects the physical building, materials located at the construction site or being transported, and occasionally temporary structures such as scaffolding or fencing. This ensures that most physical elements essential to the project are protected from common risks.

For example, materials delivered to a site but not yet installed are usually covered, helping contractors avoid significant losses in case of theft or damage during transport.

1.3. Who Needs It and When

Builders risk insurance is essential for contractors, property owners, and developers aiming to protect their financial interests throughout the construction process. This coverage helps mitigate risks that arise during the building phase, whether the project is a modest residential property or a large-scale commercial development.

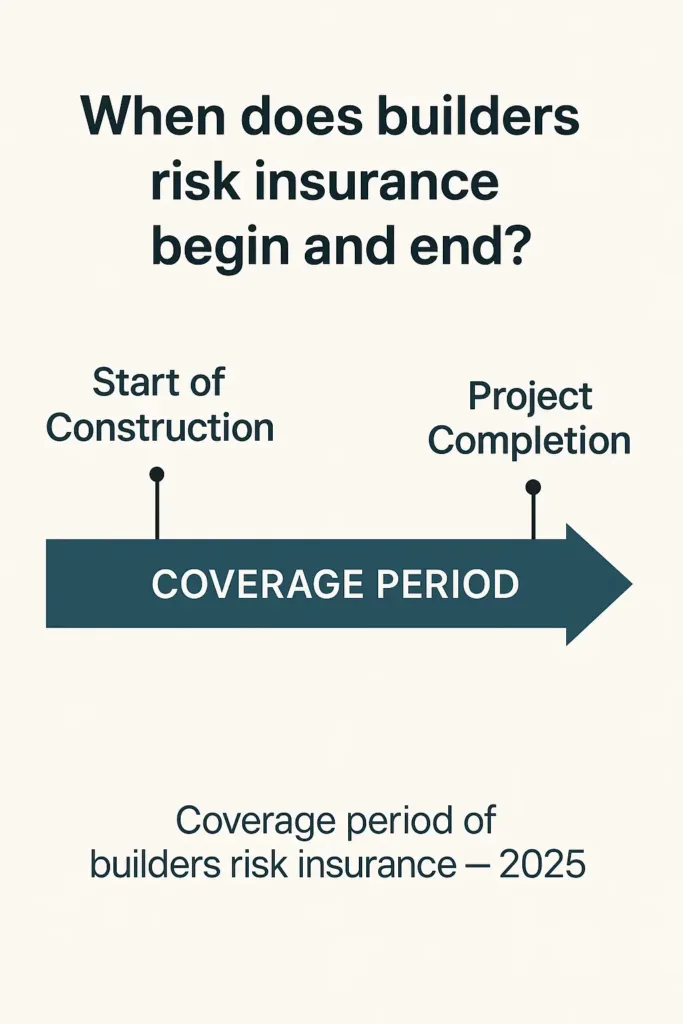

Coverage typically begins when construction commences and continues until the building is fully completed and ready for occupancy. But construction delays can happen. That’s why many policies offer options to extend the coverage period as needed.

For example, Lisa, a homeowner in Seattle, Washington, bought builders risk insurance to protect her new home build from unexpected issues during construction.

Pro Tip: Review your policy’s effective dates carefully to avoid any gaps that could leave your project vulnerable.

2. How Builders Risk Insurance Works

2.1. Policy Duration and Coverage Period

Builders risk insurance policies are designed to cover the project only during the active construction phase. Coverage typically begins when construction starts and ends once the building is ready for use or occupancy. However, because construction projects often face delays due to weather, supply chain issues, or permitting, many policies offer options to extend the coverage period to avoid gaps in protection.

Consider Carlos, a project manager from Denver, Colorado, who had to extend his policy after unforeseen delays pushed back his completion date. Thanks to the extension, his project remained covered despite the setback.

2.2. Types of Covered Property

This insurance covers a wide array of assets related to the construction project. It includes the physical structure under construction, construction materials stored on-site or in transit, and sometimes temporary structures such as scaffolding or fencing. This ensures that most physical elements essential to the project are protected from common risks.

For example, materials delivered to a site but not yet installed are usually covered, helping contractors avoid significant losses in case of theft or damage during transport.

2.3. Common Exclusions

Despite broad coverage, builders risk insurance does not cover everything. Typical exclusions include damage resulting from faulty workmanship, design flaws, normal wear and tear, and certain natural disasters such as earthquakes and floods. These often require separate policies or endorsements.

In areas prone to floods like New Orleans, Louisiana, contractors often purchase additional flood insurance to fill these gaps and fully protect their investments.

Pro Tip: Always review your policy carefully to understand what risks are excluded and consider purchasing additional coverage if necessary.

3. Who Needs It and When

3.1. Who Needs Builders Risk Insurance?

Builders risk insurance is essential for contractors, property owners, and developers who want to safeguard their investments during construction. Whether you’re building a new home, renovating an office building, or constructing a commercial property, this coverage ensures you’re protected against common risks during the construction process.

For instance, Sarah, a developer in Chicago, Illinois, opted for builders risk insurance to protect her new mixed-use commercial property. Without the insurance, she would have been liable for damages caused by unexpected events like storms or vandalism that occurred while the building was under construction.

3.2. When Does Coverage Start and End?

Generally, builders risk insurance coverage kicks in at the start of construction and lasts until the property is complete and ready for use. However, it’s important to note that policies can vary based on the project’s timeline and the insurance provider.

For example, Mark, a contractor in San Francisco, had to extend his policy after delays in materials supply caused a two-month setback. Thankfully, his policy included an extension option, so he wasn’t left exposed during the extra time it took to complete the project.

3.3. Extended Coverage Options

Many builders risk insurance policies offer the possibility to extend coverage, a feature that plays a vital role in maintaining uninterrupted protection. The duration and cost of this extension can vary, so it’s important to carefully evaluate whether additional coverage is necessary.

For example, in Austin, Texas, many large construction projects extend their builders risk insurance due to unpredictable weather patterns that may delay progress. Builders who choose to extend coverage can rest easy knowing their investments are fully protected during the entire construction process.

Pro Tip: Always clarify with your insurer whether your policy includes an automatic extension option or if additional costs are involved for prolonged coverage periods.

4. Cost Factors for Builders Risk Insurance

4.1. Premium Influencers

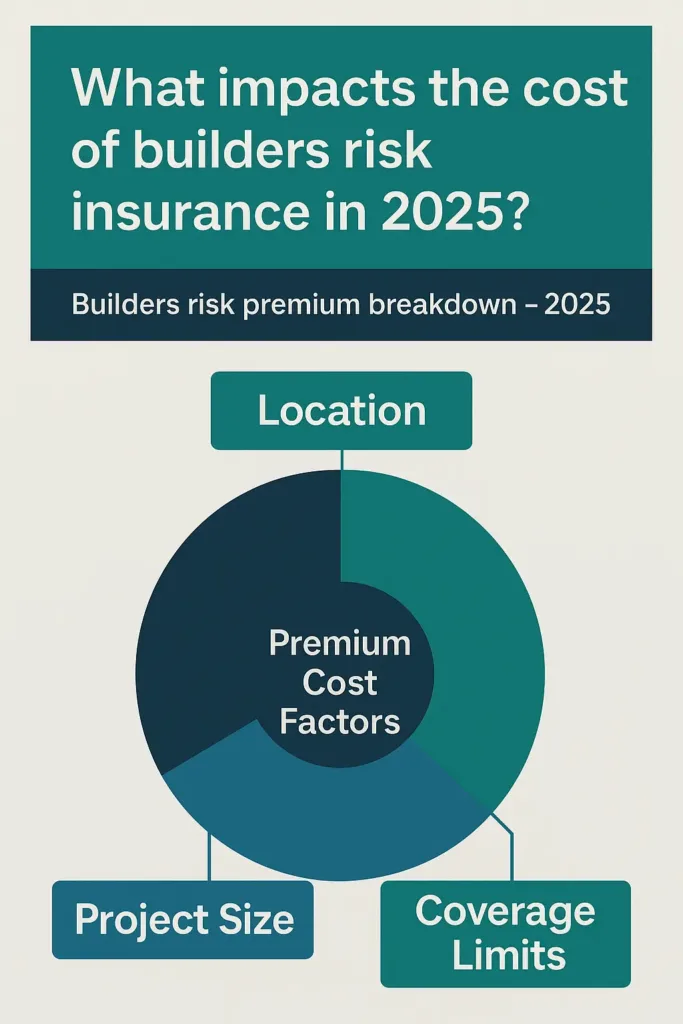

Several elements affect the price of builders risk insurance, with the project’s size and complexity being among the most significant factors. Larger buildings or more intricate structures, such as high-rise commercial developments, usually come with higher premiums compared to smaller residential projects.

For some contractors, opting for combined insurance coverage can help manage both builders risk and liability needs under a unified policy, streamlining operations and potentially reducing costs.

For example, John, a contractor in New York, found that insuring a multi-story office building cost significantly more than a smaller, single-family home project he previously worked on. The complexity of the construction process and the higher risk associated with the building’s size contributed to the increased premium.

4.2. Deductibles and Limits

Another important cost factor is the deductible. Builders risk insurance policies usually require the insured to pay a certain amount out-of-pocket before the insurance coverage kicks in. Higher deductibles can lower premiums but also mean that the insured will be responsible for more in case of a claim.

Additionally, policy limits also play a role in the cost. Higher coverage limits, which protect against more substantial losses, come with higher premiums. Builders and developers need to balance their coverage needs with their budget constraints to find the right amount of protection at a reasonable price.

4.3. Regional Variations

Regional differences also affect the cost of builders risk insurance. Areas prone to natural disasters, such as floods, hurricanes, or earthquakes, may see higher premiums due to the increased risk of damage. For example, in Florida, contractors often pay higher premiums for builders risk insurance due to the state’s vulnerability to hurricanes.

On the other hand, regions with fewer environmental risks may have lower insurance costs, but it’s important to factor in local conditions and ensure the coverage adequately protects against potential hazards specific to the area.

Pro Tip: Always compare policies from different insurers and evaluate how they fit with the risks specific to your project’s location to get the best coverage for the price.

5. Claims Process for Builders Risk Insurance

5.1. Filing a Claim Step-by-Step

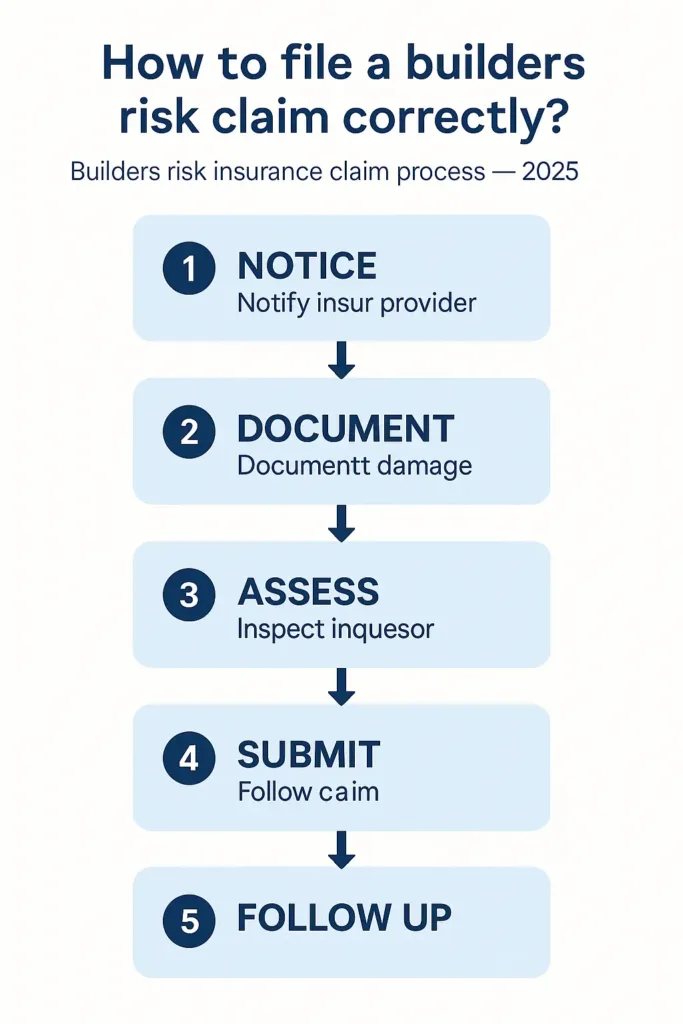

When an unexpected event occurs, such as a fire or a storm causing damage to the project, it’s essential to file a claim with your builders risk insurance provider as soon as possible. The claims process typically involves the following steps:

- Notify the insurer: Contact your insurance company immediately after the damage occurs to initiate the claims process.

- Document the damage: Take detailed photographs and notes of the damage to provide evidence when filing the claim.

- Assess the loss: The insurer may send an adjuster to evaluate the damage and determine the compensation amount based on the coverage terms.

- Provide additional documentation: Submit any required documents, such as repair estimates or contractor reports, to support your claim.

For example, Carlos, a contractor in Miami, had to file a claim when a hurricane damaged the roofing materials at his construction site. He immediately contacted his insurer, documented the damage, and provided estimates from local contractors. The insurer processed his claim promptly, covering the cost of replacing the damaged materials.

5.2. Documentation Required

The documentation required for filing a claim may vary by insurer, but generally, you’ll need to provide:

- Photos of the damaged property

- Repair estimates or contractor invoices

- A statement detailing the event that caused the damage

- Proof of ownership for any damaged materials or equipment

Ensuring you have thorough documentation is crucial for a smooth claims process and ensures you can receive fair compensation for the damages covered under your policy.

5.3. Typical Challenges in Claims

While builders risk insurance can provide valuable protection, there are common challenges in the claims process. One issue is the determination of whether the damage is covered under the policy. For instance, damage caused by faulty construction practices is typically not covered, which can lead to disputes over the cause of the damage.

Additionally, delays in repairs and incomplete documentation can slow down the claims process, leaving the builder vulnerable during the downtime. To avoid these issues, it’s important to keep all records organized and consult your insurance agent to ensure your coverage adequately protects against potential risks.

In some cases, especially when projects involve on-site personnel or subcontractors, additional policies such as hospital indemnity coverage may help cover medical expenses not handled by workers’ compensation.

Pro Tip: Keep a detailed record of all communications with your insurer and any contractors involved in repairs to ensure a smooth claims process.

6. Builders Risk vs. Other Insurance Types

6.1. Comparison with General Liability Insurance

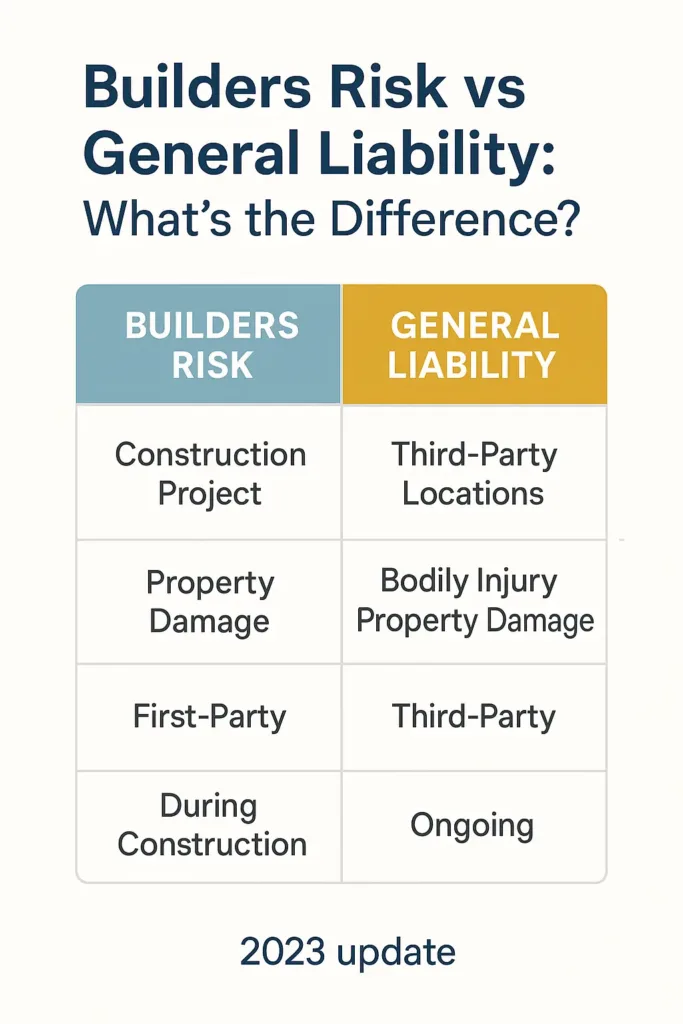

Builders risk insurance and general liability insurance serve different purposes, though both are important for construction projects. Builders risk insurance is specifically designed to protect against damage to the structure being built, as well as to materials and equipment on-site. In contrast, general liability insurance offers coverage for third-party claims, such as injuries or property damage caused by the contractor’s activities.

For instance, if someone is hurt on the job site, general liability insurance would cover the medical costs, whereas builders risk insurance would not apply in this case.

6.2. Difference from Property Insurance

Standard property insurance typically covers completed buildings and is not designed to protect structures during construction. Builders risk insurance fills this gap by covering buildings and materials in the process of being built or renovated.

A commercial developer in Boston, Massachusetts, discovered this distinction when his standard property insurance declined a claim for damage that occurred before the building was finished. Builders risk insurance would have covered such damages.

6.3. When Builders Risk Ends and Other Policies Begin

Builders risk insurance typically ends when construction is finished, and the building is ready to be occupied. Afterward, other insurance types, like standard property insurance and general liability, take over as the primary protection for the property owner and the business.

Pro Tip: Coordinate with your insurance agent to ensure there are no coverage gaps when transitioning from builders risk insurance to other policies.

7. Legal and Regulatory Considerations

7.1. State-Specific Regulations

Builders risk insurance is regulated at both the federal and state levels, with certain states imposing unique requirements or restrictions. For instance, in Florida, where hurricane risk is high, insurers may have specific clauses or additional coverage requirements to address storm-related damages. Understanding these state-specific rules is critical for ensuring your policy complies with local laws and adequately protects your project.

Some insurers also provide coverage designed for senior homeowners involved in renovation or construction projects, offering policies tailored to their financial and physical needs.

Take, for example, Florida’s regulations that require disclosure of hurricane deductibles, helping property owners prepare financially for storm seasons.

7.2. Contractual Requirements for Builders Risk Insurance

Construction contracts often mandate builders risk insurance coverage, outlining minimum coverage amounts, policy terms, and parties responsible for maintaining the policy. Contractors and developers must carefully review these provisions to avoid legal disputes or gaps in insurance protection during construction.

In Texas, some contracts explicitly require builders risk policies to be in place before work begins, ensuring that all parties are protected from the outset.

7.3. Pro Tip: Keeping Compliant During Construction

Compliance with insurance requirements is not just a legal formality—it’s essential for managing risk effectively. Regularly review your policy to confirm it meets all regulatory and contractual obligations. Engage with your insurance provider and legal counsel to stay updated on changes that could impact your coverage.

Conclusion

Builders risk insurance is a vital safeguard for construction projects, providing protection against unforeseen risks that can significantly impact a project’s timeline and budget. Whether you are building a home, renovating an existing structure, or developing a commercial property, this specialized insurance ensures your investment is protected during the construction process.

While this coverage is essential, it’s important to understand the specifics of your policy, including what is and isn’t covered, and any exclusions that may apply. Additionally, it’s essential to regularly consult with your insurance agent to make sure your coverage fully accounts for the specific risks your project may face.

Pro Tip: Review your policy periodically and consult with your insurance provider to adjust your coverage as your project progresses or if delays occur.

FAQ

What is builders risk insurance used for?

Builders risk insurance protects buildings, materials, and equipment during construction or renovation. It covers physical damage caused by events like fire, theft, storms, or accidents while the structure is being built or improved. This insurance helps contractors, property owners, and developers safeguard their financial investment until the project is complete and ready for occupancy.

How much should a builder’s risk policy cost?

The cost varies widely based on factors such as:

Project size and complexity (larger or more complex projects cost more)

Coverage limits and deductibles (higher limits and lower deductibles increase premiums)

Regional risks (areas prone to hurricanes, floods, or earthquakes typically have higher rates)

For example, commercial high-rises will cost significantly more to insure than a small residential renovation. Policies can be adjusted for longer durations if projects are delayed, affecting costs. Always compare quotes and consider location-specific risks.

Who typically buys builder risk insurance?

Contractors overseeing construction projects

Property owners who want to protect their investment during building or renovation

Developers managing commercial or residential developments

It is essential for anyone responsible for the physical structure and materials during construction, from small home renovations to large commercial builds.

What is covered under the Builders Risk Coverage Form?

Coverage usually includes:

The physical structure under construction

Construction materials on-site or in transit

Sometimes temporary structures like scaffolding or fencing

Protection against risks such as fire, theft, vandalism, storms, and accidental damage

Exclusions commonly are:

Damage from faulty workmanship or design flaws

Normal wear and tear

Certain natural disasters like earthquakes and floods (often require separate coverage)