At 59, Michael from Grand Rapids, Michigan, had just finished his shift at the factory when a back injury changed everything. After weeks of pain and tests, his doctor told him he wouldn’t be able to work for months—maybe longer. He assumed his company benefits would cover him, but soon realized he only had short-term disability insurance, which was about to run out.

Michael’s story isn’t rare. In 2024, the National Association of Insurance Commissioners (NAIC) reported that nearly 40% of working adults have no long term disability insurance—despite the fact that 1 in 4 Americans will experience a disabling condition before retirement.

For self-employed individuals, income protection through tailored insurance plans is even more essential.

This guide explains exactly how long term disability insurance works, what it covers, who needs it, and how to avoid common claim pitfalls. Whether you’re already covered or just exploring options, you’ll find clear, practical answers to protect your income when life gets unpredictable.

On This Page

1. Understanding Long Term Disability Insurance

1.1. What Qualifies as a Long-Term Disability?

Long term disability insurance is designed to replace a portion of your income when a serious illness or injury prevents you from working for an extended period. To qualify for long term disability insurance, your condition must meet the insurer’s definition of disability, which typically means being unable to perform the duties of your occupation for 90 days or more.

According to the National Association of Insurance Commissioners (NAIC), over 51% of long-term disability claims in 2024 stem from musculoskeletal disorders, cancers, and nervous system conditions.

Real-Life Example : Claire, a 47-year-old accountant from Portland, Oregon, was diagnosed with multiple sclerosis. As her symptoms progressed, she could no longer manage client reports or financial audits. Her LTD policy activated after a 90-day waiting period, covering 60% of her lost income for nearly three years.

Pro Tip – Texas Insurance Code § 1364.005 : In Texas, insurers are legally required to disclose how they define “disability” in the policy contract. Always verify whether your plan uses the “own occupation” or “any occupation” standard—this can drastically affect your eligibility for benefits.

1.2. The Role of Disability Insurance in Income Protection

For many working adults, long term disability insurance is the only line of defense against financial instability when illness or injury strikes. Without it, a disabling condition could wipe out years of savings and retirement planning. Most plans provide between 50% and 70% of your income, depending on policy terms.

Fictional Dialogue :

Marcus (Chicago, 55): “I thought my employer benefits would cover me, but they only offered short-term disability.”

HR Rep: “That’s common. Long term disability is usually optional—you have to elect it during open enrollment.”

Local Anecdote : Lillian, 61, from Jacksonville, Florida, experienced a heart attack while teaching at a public school. Thanks to her district’s LTD plan, she received income support during rehabilitation. “Without that policy,” she said, “I wouldn’t have been able to keep my mortgage current.”

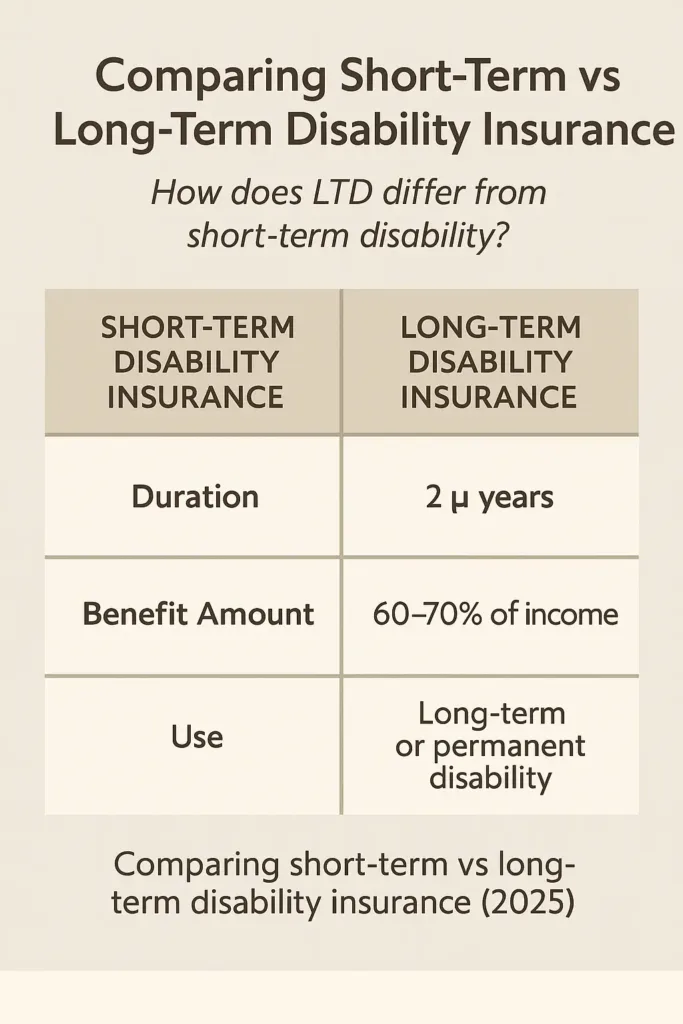

1.3. How LTD Differs from Short-Term Disability

While both short-term and long term disability insurance provide income during health-related absences, they serve different purposes. STDI covers immediate needs—typically up to six months—while LTD is designed for longer disruptions that extend beyond a few months and may last for years.

1.3.1. Short-Term vs Long-Term Disability Insurance

| Feature | Short-Term Disability (STDI) | Long Term Disability Insurance (LTD) |

|---|---|---|

| Coverage Duration | Up to 6 months | 2 years to retirement age |

| Elimination Period | 0–14 days | 60–180 days |

| Benefit Amount | 60%–70% of salary | 50%–70% of salary |

| Typical Use | Recovery from injury, surgery, childbirth | Chronic illness, cancer, permanent conditions |

Understanding this distinction allows you to prepare for both brief disruptions and extended periods without work. Many employees opt to carry both types of coverage for broader financial protection.

2. How Long Term Disability Insurance Works

2.1. Benefit Periods, Elimination Periods, and Coverage Caps

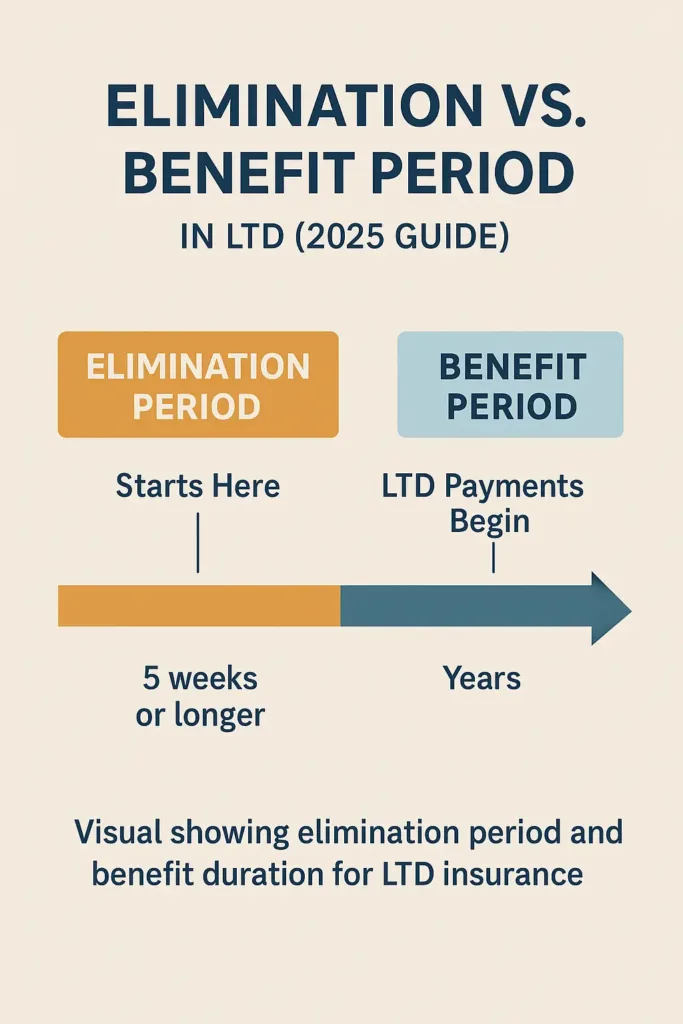

Long term disability insurance begins paying benefits only after the elimination period ends—typically 60, 90, or 180 days. This is the waiting time during which you’re disabled but not yet receiving payments from your long term disability insurance policy.. Once benefits start, they continue through the chosen benefit period, which may be two years, five years, or even until retirement age.

Most policies also include a monthly coverage cap—often between $3,000 and $6,000—regardless of your previous income. It’s critical to understand these limits before enrolling.

Pro Tip – California Insurance Code § 10133.8: In California, all disability policies must disclose elimination periods and maximum benefits in plain language. Be sure to review your plan’s benefit summary in detail before you agree to any policy terms.

2024 U.S. Statistic : Data from NAIC shows that 67% of LTD claimants in 2024 received payments for more than two years. This underscores the need to choose your benefit period wisely.

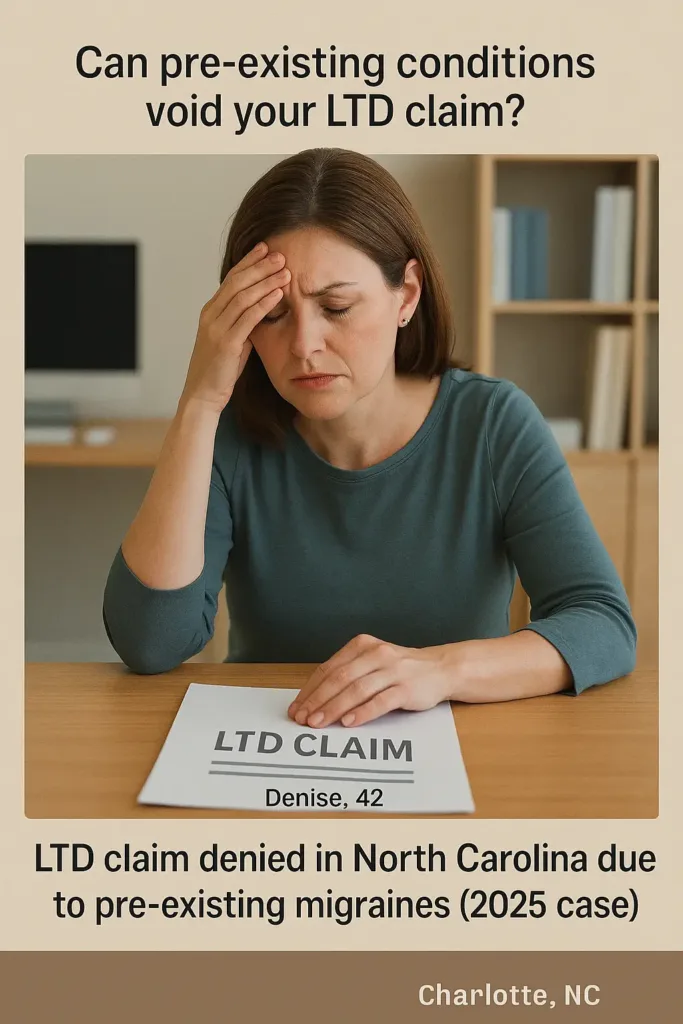

2.2. Pre-Existing Conditions and Coverage Limits

Most long term disability insurance policies include clauses limiting coverage for pre-existing conditions. Typically, if you received treatment or diagnosis within the 12 months before your policy began, you may not be covered for related disabilities during the first 12–24 months of the policy.

Local Anecdote : Denise, 42, from Charlotte, North Carolina, had chronic migraines before enrolling in LTD. When her condition worsened a year later, her claim was denied. She shared, “No one explained the lookback rule—I assumed coverage meant I’d be safe.”

Real-Life Example : A marketing manager with diabetes applies for LTD benefits six months into the policy. Because he had been treated for the condition before enrolling, the insurer invokes the exclusion clause and denies payment. This underscores the need to understand pre-existing condition policies upfront.

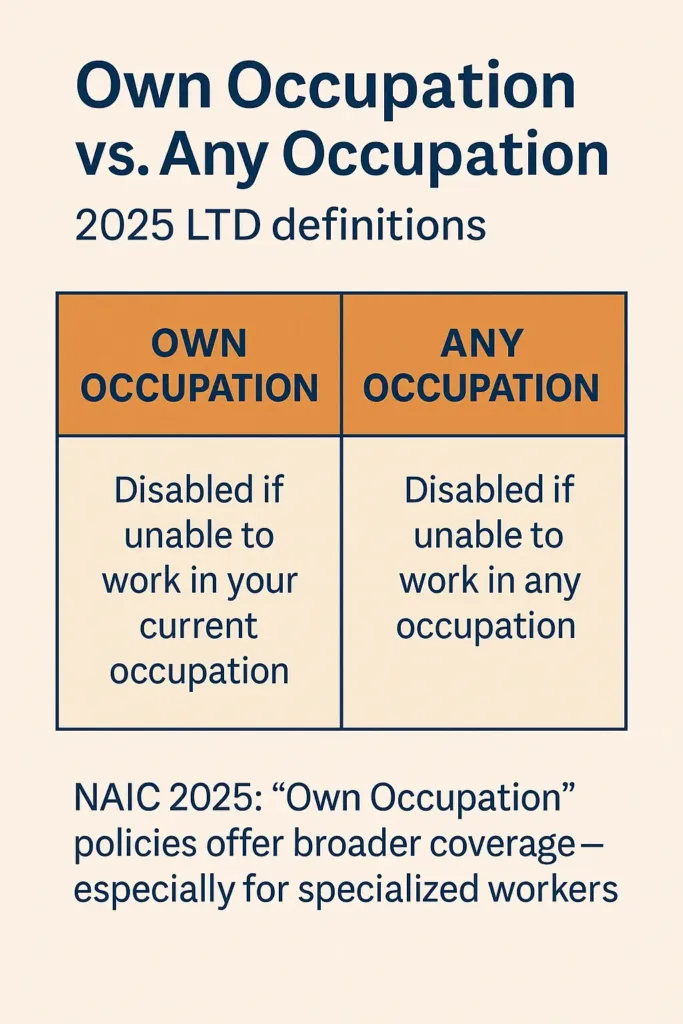

2.3. Definitions of Disability: “Own Occupation” vs. “Any Occupation”

Every LTD policy defines disability differently. Some plans pay benefits if you’re unable to work in your own occupation—meaning your specific job. Some plans demand that you’re incapable of doing any job that fits your background or skill level.

Fictional Dialogue :

Rachel (Denver, 50): “I’m an ER nurse, and I can’t stand for long hours anymore. Will LTD help me?”

Claims Specialist: “If your plan uses an ‘own occupation’ definition, you’re likely covered. With an ‘any occupation’ policy, they might argue you’re still able to take on less demanding office tasks, which could disqualify your claim.”

2.3.1. Comparison: Own Occupation vs. Any Occupation Policies

| Criteria | Own Occupation | Any Occupation |

|---|---|---|

| Definition | Unable to perform your specific job duties | Unable to work in any job you’re qualified for |

| Typical Use | High-skill professions (doctors, engineers) | Broad workforce policies |

| Claim Approval | Higher approval rate | Often challenged or denied |

| Premium Cost | Higher | Lower |

The wording your plan uses to define disability can directly impact whether your application for benefits is accepted or not. Picking the appropriate disability definition is just as vital as selecting how much income your policy will protect.

3. Employer-Sponsored vs. Individual LTD Policies

3.1. Key Differences in Coverage and Cost

Long term disability insurance can be obtained either through your employer or individually. While employer-sponsored long term disability insurance policies often come at little to no cost, they may offer limited options, lower benefit caps, or reduced portability. In contrast, individual policies offer more customization—but with higher premiums.

Comparison Table :

| Feature | Employer-Sponsored LTD | Individual LTD Policy |

|---|---|---|

| Cost to Employee | Low or no cost | Higher (paid by individual) |

| Customization | Limited | High (benefit %, duration, riders) |

| Portability | Ends with job | Stays with you |

| Underwriting | Group-based (no medical exam) | Individual review often required |

| Tax Implications | Benefits may be taxable | Non-taxable if paid post-tax |

3.2. Tax Implications and Premium Payments

If your employer pays the premium for your long term disability insurance, any benefits you receive are generally taxable income. For other types of policies, it’s also important to ask: is life insurance taxable and under what conditions?

However, if you purchase your own LTD policy and pay premiums with after-tax dollars, the benefits are usually tax-free. This distinction can significantly impact your monthly income during a disability.

Pro Tip – New York Tax Code § 612: In New York, LTD benefits paid under employer-sponsored plans are considered income and must be reported for state tax purposes unless premiums were paid entirely by the employee post-tax.

2024 US Statistic : The NAIC reports that 72% of employer-sponsored LTD plans offer benefit caps of $5,000/month or less, while individual plans are more likely to offer tailored benefit amounts based on income level and profession.

3.3. What Happens if You Change Jobs?

One major downside of employer-sponsored long term disability insurance is that coverage usually ends when you leave your job. While some group plans offer conversion options, they often come with strict deadlines and cost increases.

Local Anecdote : When Andrew, 45, from Boulder, Colorado, left his marketing job for a startup, he discovered too late that his LTD coverage didn’t follow him. A back injury six months later left him without any income replacement. “I thought I’d be covered—it never crossed my mind that LTD wasn’t portable,” he said.

Fictional Dialogue :

Susan (Atlanta, 52): “If I leave my job, can I keep my LTD coverage?”

HR Manager: “Only if your plan has a conversion option—and you act fast. Otherwise, you’ll need to apply for a new individual policy.”

Real-Life Example : A tech worker in Seattle switches employers and assumes LTD transfers automatically. After a diagnosis of a neurological condition two months into the new role, her new insurer denies coverage due to the condition being classified as pre-existing. Without transitional coverage, she is left without benefits.

Understanding the differences between employer-based and individual long term disability insurance policies is essential—especially if you plan to change jobs or value full control over your benefits. Each option has trade-offs that affect cost, coverage, and long-term security.

4. What Kinds of Conditions Does Long Term Disability Insurance Cover?

4.1. Covered Illnesses and Conditions

When an illness or injury keeps you away from work for months or even years, long term disability insurance steps in to replace part of your lost income. Most LTD plans cover a wide range of medical issues, from chronic illnesses to severe injuries and progressive conditions.

2024 U.S. Statistic : According to the NAIC, the top five causes of approved LTD claims in 2024 were: musculoskeletal disorders (29%), cancer (15%), mental health conditions (13%), cardiovascular disease (11%), and neurological disorders (9%).

Table: Common Medical Conditions Frequently Cited in LTD Claims

| Condition | Typically Covered? | Key Considerations |

|---|---|---|

| Lumbar Disc Herniation | Yes | Often approved but requires consistent medical documentation |

| Major Depression | Yes, with limitations | Most policies cap mental health benefits, often around 24 months |

| Parkinson’s Disease | Yes | Generally accepted once it impairs functional work ability |

| Cancer (with long-term effects) | Yes | Post-treatment complications may extend benefit eligibility |

| Chronic Fatigue Syndrome | Rarely | Extremely difficult to prove without extensive and specialized medical evidence |

4.2. Mental Health and Chronic Conditions

Mental illnesses and chronic pain syndromes are among the most disputed areas of long term disability insurance, with policies often setting strict limits. While many policies include these conditions, coverage may be capped—often to 24 months—and subject to stricter medical proof requirements.

Pro Tip – Illinois Administrative Code § 2001.70: In the state of Illinois, disability insurers are required to disclose any time-restricted benefits—like those related to psychiatric care or addiction treatment—directly in the plan documents. Make sure to get this in writing before you finalize your enrollment.

Fictional Dialogue :

Jason (Austin, TX, 38): “My doctor just confirmed a serious anxiety disorder. Does that mean my LTD will continue paying if I can’t work for a year or more?”

Case Manager: “It depends on your policy—many set strict limits for mental health coverage, usually around two years, and they’ll want updated evaluations from your provider.”

4.3. Exclusions to Be Aware Of

Not everything is covered under long term disability insurance. Common exclusions include self-inflicted injuries, disabilities resulting from illegal activities, and conditions tied to pre-existing illnesses if within the exclusion period. Some policies also exclude substance abuse-related claims unless specified otherwise.

Local Anecdote : After moving to Dallas, Erica, 44, found herself out of work due to fibromyalgia. Despite her doctor’s support, her LTD claim was denied—her policy excluded chronic pain syndromes not tied to measurable physical damage. “I never imagined something invisible could be uninsurable,” she said.

Real-Life Example : A software engineer suffers burnout and seeks LTD benefits for major depressive disorder. Although his psychiatrist supports the claim, his policy limits mental health benefits to 24 months and requires updated evaluations every 90 days. As a result, he receives only partial coverage and must return to work before full recovery.

Understanding what long term disability insurance typically covers—and doesn’t—can help avoid surprises. Reviewing conditions, exclusions, and documentation requirements upfront is essential to secure dependable income protection when you need it most.

5. Applying for LTD: Process and Documentation

5.1. Steps to File a Claim

Starting a long term disability insurance claim isn’t as simple as getting a doctor’s note—it involves paperwork, deadlines, and clear proof of how your condition affects your job. You’ll need to follow your insurer’s process carefully, submit specific forms, and gather proper documentation to avoid delays or denials. Most policies require filing within a set timeframe after the onset of the disability—often 30 to 90 days.

US Stat 2024: According to the NAIC, over 22% of LTD claims in 2024 were initially denied due to incomplete forms or missing medical certification.

Table – Key Steps When Filing for LTD Benefits

| Step | Required Action | Typical Timeframe |

|---|---|---|

| 1. Notify your employer or insurer | Call or email to report your condition | Within 30–90 days of becoming disabled |

| 2. Complete the claim form | Submit personal, employment, and medical details | Soon after initial notice |

| 3. Provide a physician statement | Ask your doctor to confirm your condition and limitations | Within 10–20 days of your claim |

| 4. Wait for insurer review | They will review medical and vocational records | Up to 45 days (ERISA standard) |

5.2. Required Medical Evidence

Medical records are the backbone of a long term disability insurance claim. You’ll need comprehensive reports from your treating physicians, lab or imaging results, and a clear explanation of how your condition affects your ability to work. Gaps or inconsistencies may weaken your case.

Pro Tip – ERISA § 2560.503-1: Under federal law, LTD insurers must notify you of any missing documentation and give you at least 45 days to respond before making a final decision. Use that time wisely to strengthen your claim.

Real-life story: Rachel, 51, from Tucson, Arizona, was denied LTD benefits for chronic fatigue because her file lacked a functional capacity assessment. “I didn’t even know that was required. One missing form shut the door on my entire claim,” she said.

5.3. Employer Forms and Statements

If your LTD coverage is through your employer, the HR department must usually complete a portion of the paperwork verifying your last day worked, your earnings, and your job description. Insurers compare this to your doctor’s statement. If the information doesn’t match, your claim may be delayed or denied.

Fictional dialogue:

James (Detroit, 46): “My HR says they won’t send their part of the form until next week. Should I wait to submit?”

LTD Advocate: “Don’t wait. Submit what you have and let them add their portion when ready. The clock starts with your initial filing.”

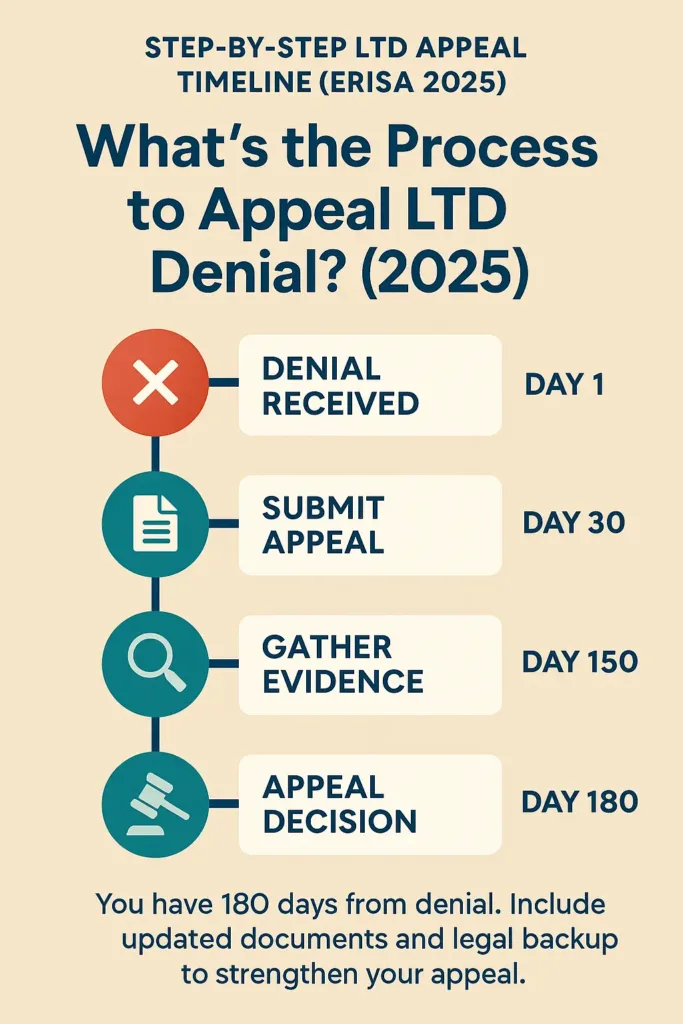

5.4. Timelines and Appeals

Federal regulations under ERISA give insurers 45 days to respond to an LTD claim, with one possible 30-day extension if more information is needed. Once your claim is accepted, payments usually begin after the waiting period defined in your policy. If your claim is denied, the insurance provider must send you a detailed explanation and let you know how to request a formal review.

Case study: A warehouse supervisor with a serious back injury submitted a strong LTD claim, including surgeon letters and MRI reports. The insurer requested a third-party functional capacity evaluation, delaying the process. His benefits were finally approved after 71 days—just under the ERISA maximum.

Applying for long term disability insurance is not just a formality. It’s a legal and medical process that requires precision, persistence, and documentation. Knowing the rules and timelines can make the difference between receiving benefits or facing months without income.

6. Understanding LTD Benefit Payments and Taxes

6.1. How LTD Payments Are Calculated

Long term disability insurance helps cover your income by paying out a percentage of what you earned before becoming unable to work—often around 60%, depending on your specific plan. These benefits may be adjusted based on other income you receive, such as Social Security Disability Insurance (SSDI) or workers’ compensation.

2024 U.S. Statistic: According to the U.S. Bureau of Labor Statistics, the average LTD benefit paid in 2024 was $2,364 per month for private sector plans.

Pro Tip – Offset Clause (ERISA § 502): Many group LTD policies include an offset provision, which lowers your monthly benefit if you’re also receiving SSDI or other public disability assistance. Read your policy’s benefit coordination terms to avoid surprises.

6.2. Tax Implications of LTD Benefits

Your tax liability on LTD benefits depends on how your premiums were handled. If your employer paid for the policy and didn’t report it as income to you, the benefits are generally taxable. If you paid with after-tax dollars, you typically receive those payments tax-free.

Angela (Seattle, 34): “I get $3,000 a month from my LTD plan. Will I owe taxes?”

Tax Advisor: “If your employer covered the premiums and it wasn’t taxed as income, then yes—those payments are subject to federal income tax.”

6.3. Lump Sum vs. Monthly Payments

Some insurers offer a one-time lump sum as an alternative to ongoing monthly LTD payments. While attractive, lump sums are often less than the total value you’d receive over time and may trigger larger tax burdens. Consider consulting a financial planner before agreeing to a buyout.

Jerome, 48, from Dayton, Ohio, accepted a $90,000 buyout after four years on LTD. “It helped pay off our mortgage, but I didn’t realize I’d owe income tax on the full amount that year,” he said.

6.4. Case Scenario: Payment Breakdown

Case Example: Heather, a 42-year-old physical therapist from Portland, Oregon, earned $5,800/month before becoming disabled. Her LTD plan replaced 60% of her income, or $3,480. She was later approved for SSDI at $1,450/month, which triggered a benefit offset.

| Source | Monthly Amount | Net After Offset |

|---|---|---|

| Initial LTD Benefit | $3,480 | — |

| SSDI Award | $1,450 | — |

| Adjusted LTD Benefit | $2,030 | (LTD – SSDI offset) |

| Total Monthly Received | $3,480 | — |

Grasping how long term disability insurance payments work—from how they’re calculated to whether they’re taxed—can save you from financial surprises. Planning with complete information makes recovery a little easier to manage.

You can apply the same mindset when reviewing your homeowners policy to cut home insurance costs strategically.

7. How to Maintain Your Coverage Over Time

7.1. Paying Premiums During Disability

In many long term disability insurance policies, your coverage remains active during a claim period—but only if premiums continue to be paid. Some plans include a waiver of premium clause, meaning you won’t have to pay while receiving benefits.

Pro Tip – Waiver Clause (NAIC Model § 182): Look for the “waiver of premium” provision in your certificate. If you’re approved for LTD benefits, this clause often suspends your payment obligations during the benefit period.

7.2. Reporting Changes in Medical or Work Status

Keeping your insurer informed of any updates to your health or work activities—like part-time jobs or modified duties—is critical when receiving long term disability insurance benefits. If you fail to notify them, your benefits could be suspended or even canceled retroactively.

Fictional Dialogue :

Carlos (Atlanta, 44): “I started working 10 hours a week from home. Do I have to report that?”

Claims Agent: “Yes—any work activity must be reported, even if it’s part-time or unpaid.”

7.3. Re-certification Requirements

Most LTD plans require updated medical certifications from your doctor at regular intervals. If these updates aren’t provided on time, your benefits may be paused until documentation is received.

Lydia, 55, from Tulsa, OK, missed her re-certification appointment due to hospitalization. Her LTD payments were paused until new paperwork was submitted, which took nearly five weeks.

7.4. Duration of Coverage

Some LTD policies provide benefits until you reach retirement age, while others have fixed durations like 2 or 5 years. It’s important to understand how long your benefits will last, as defined in your plan.

| Plan Type | Coverage Duration |

|---|---|

| Group LTD | Until age 65 or retirement age |

| Individual LTD | As defined in contract (2, 5, or 10 years) |

| Supplemental LTD | Follows base plan limits |

Maintaining long term disability insurance coverage means more than just collecting payments. Staying compliant with reporting rules and plan timelines is essential to protecting your financial security over time.

8. Common Reasons for LTD Claim Denials

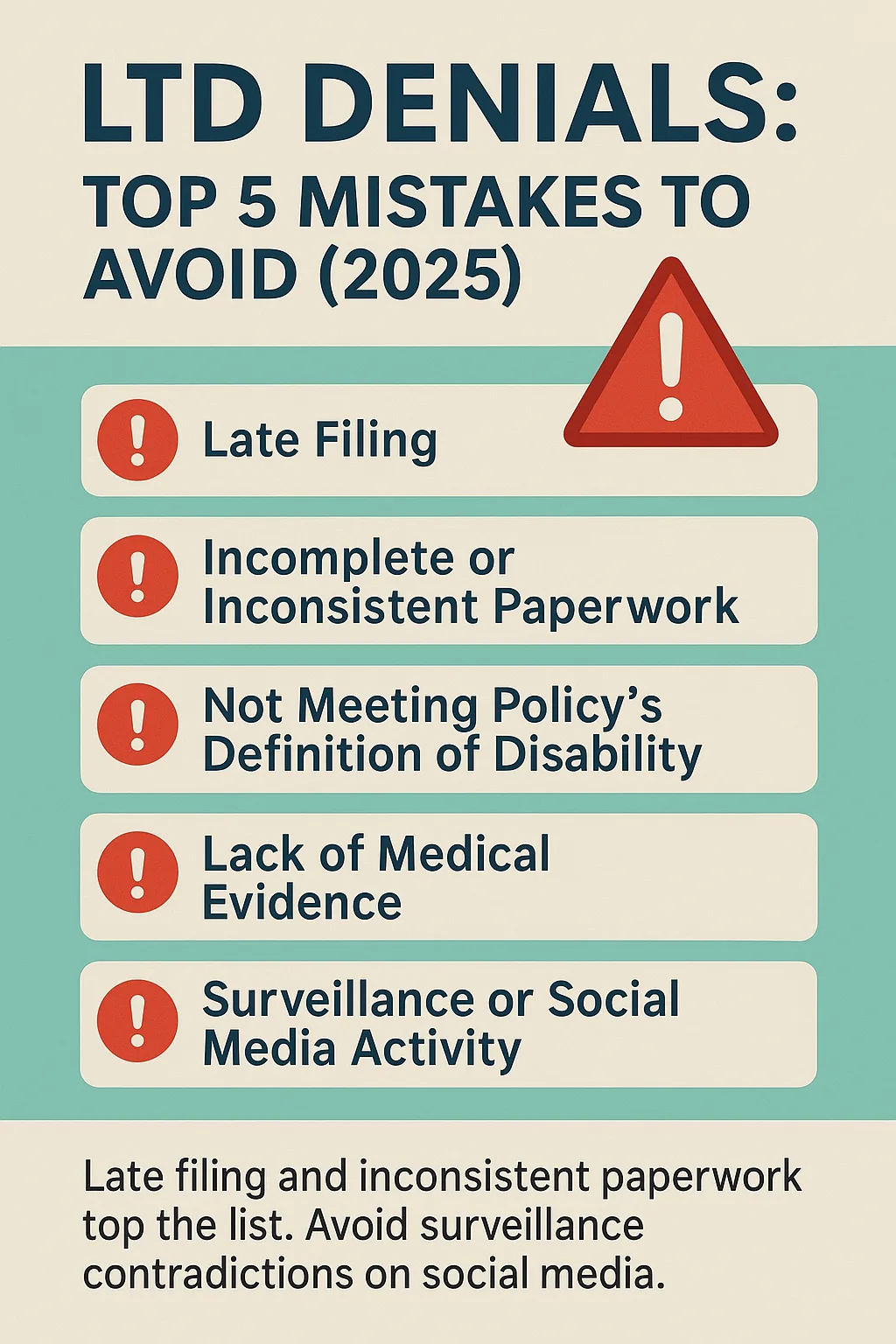

8.1. Incomplete or Inaccurate Paperwork

Many LTD claims are denied due to missing medical documentation or discrepancies between your claim and physician’s notes. If your doctor’s report contradicts your own description of limitations, insurers may see that as a red flag.

Case study: Leah, 37, from Tampa, FL, submitted an LTD claim after spinal surgery. Her physician noted she could sit for brief intervals. The insurer concluded she could work at a desk job, disregarding her daily need for rest and pain management.

8.2. Missed Deadlines

If your claim isn’t filed within the deadline—usually within 90 days of when your disability began—it may be rejected outright. Some plans allow for extensions under special circumstances, but these must be clearly documented and approved ahead of time.

After recovering from an unexpected hospitalization, Brian, 41, from Albuquerque, NM, missed his LTD filing deadline by ten days. He believed the delay wouldn’t matter, but his request was denied. “No one told me the clock started ticking from my last workday,” he said. “It was a harsh way to find out.”

8.3. Policy Exclusions and Limitations

Some conditions are excluded under LTD policies, including self-inflicted injuries, certain pre-existing conditions, or short-duration mental health issues. Even valid disabilities can be denied if they fall within restricted categories.

Pro Tip – Know Your Exclusions: Every LTD policy includes a section on exclusions. Always check for clauses on substance abuse, pre-existing conditions, or disputed mental health definitions before filing.

8.4. Surveillance or Social Media Evidence

Insurers sometimes hire private investigators or review social media to find evidence contradicting a disability claim. If your activities online or offline don’t align with your reported limitations, your benefits may be denied or revoked.

Fictional Dialogue :

Nathan (San Diego, 45): “I posted photos at my cousin’s wedding, and my insurer said it proved I could stand and travel. They used that to deny my claim.”

Claims Consultant: “Insurers may view any activity as evidence. Even attending an event for a few hours can be misconstrued.”

Understanding why claims are denied helps you prepare a stronger application—and avoid costly mistakes that could delay or eliminate your benefits.

9. Appealing a Denied LTD Claim

9.1. Understanding the Denial Letter

If your long-term disability (LTD) claim is turned down, your insurance provider must send you a written notice explaining the reason. This letter is key—it details the justification for denial and outlines what you can do next if you choose to challenge the decision.

Review the denial letter carefully. Identify any gaps or inaccuracies and take note of the response timeline.

Pro Tip – Know Your ERISA Rights: Under ERISA, your insurer is legally required to issue a written explanation and let you know that you’re entitled to request your full claim file. This file contains notes and records that may be helpful for your appeal.

9.2. Gathering Additional Evidence

To improve your chances of winning an appeal for your long term disability insurance claim, submit updated medical reports, independent evaluations, or statements from healthcare providers or coworkers. Make sure all added documentation supports your inability to work based on your policy terms.

9.3. Writing a Strong Appeal Letter

Craft a clear, focused letter that explains why you believe the denial was incorrect. Use updated evidence, clarify inconsistencies, and organize all medical paperwork logically.

If your situation is complex, consider getting help from an attorney experienced in disability insurance law—they can help make your appeal stronger.

9.4. Respecting the Appeal Timeline

Deadlines are crucial. ERISA-based LTD policies usually give you 180 days from the date on the denial letter to submit an appeal. Missing this deadline can eliminate your ability to contest the decision.

Case study: Jordan, 46, from Minneapolis, delayed taking action after receiving his denial. When he finally sought legal help, the 180-day clock had run out. “I didn’t know the countdown had already started,” he said. “Now there’s nothing I can do.”

Acting fast and following the correct process can significantly improve your odds of having the denial reversed.

10. Legal Support and When to Hire an Attorney

10.1. When Legal Help Becomes Essential

Not every long term disability insurance claim demands a lawyer, but in certain cases, having legal representation can significantly strengthen your chances, especially if you face a denial. If your claim gets denied, experiences unexplained delays, or involves confusing documents and constant requests from the insurer, a legal expert can help protect your rights and guide you through the process.

2024 U.S. Statistic: A 2024 survey by the American Bar Association found that 68% of long-term disability appeals represented by attorneys were resolved more favorably than those filed without legal help.

10.2. Signs You Should Consult a Disability Lawyer

- Your benefits have been denied and the reason isn’t clear

- The appeals process feels overwhelming or confusing

- Your insurer is requesting a large volume of documentation or has initiated monitoring

- Your coverage ended without a clear explanation

- You’re nearing the deadline to appeal (180 days from denial)

Pro Tip: Reaching out to an attorney early on can help avoid costly missteps that become harder to correct down the road.

10.3. What to Expect from a Disability Insurance Attorney

A qualified LTD attorney will analyze your case, collect medical evidence and professional evaluations, draft a compelling appeal, and speak directly with the insurer on your behalf. Most attorneys work on a contingency fee, so you won’t pay unless your claim succeeds.

Case study: Renee, 51, from Portland, OR, struggled to get benefits for fibromyalgia. After being denied twice, she contacted a disability attorney. “He found errors in the insurer’s denial and helped me get my benefits reinstated. I couldn’t have done it alone.”

When your livelihood is at stake, seeking legal help can be the smartest step. It’s not just about legal battles—it’s about having someone who understands the system and advocates for your best outcome.

Conclusion

Long-term disability insurance is more than a policy—it’s a financial safety net during one of life’s most unpredictable moments. Throughout this article, we explored how LTD insurance works, what it covers, how to qualify, and what to expect during the claims process. We also answered common questions and explained important terms like elimination period, benefit duration, and policy definitions.

Understanding these elements is key to avoiding delays and denials when you need support the most. Whether you’re currently navigating a claim or simply reviewing your options, being informed can make a significant difference.

If you’re unsure about your coverage or eligibility, consider reaching out to a licensed insurance professional or disability advocate. They can help clarify your rights and guide you through next steps with confidence.

Glossary of Key Terms

Decoding long-term disability insurance (LTD) jargon can help you make smarter choices. Here’s a breakdown of essential terms in everyday language:

- Elimination Period: The time you must wait after becoming disabled before your LTD payments begin—usually 90 to 180 days.

- Benefit Period: The maximum span your policy will pay benefits if you qualify. This could be a few years, or even up to retirement, depending on your plan.

- Own Occupation: You’re considered disabled if you’re unable to perform your specific job duties, even if you’re able to work in another field.

- Any Occupation: A more stringent definition of disability, where you’re only covered if you can’t do any job that matches your experience, skills, or education.

- Residual Disability: Partial benefits provided when you’re still able to work, but only in a reduced capacity that lowers your earnings.

- Offset: A clause in your LTD policy that may reduce your monthly benefit if you receive other income like SSDI or workers’ compensation.

- ERISA: A federal law that regulates most employer-sponsored disability plans. It outlines timelines and procedures for appealing claim denials.

- IME (Independent Medical Examination): A medical review requested by your insurer to confirm the extent of your disability, typically performed by a third-party doctor.

- Functional Capacity Evaluation (FCE): A set of physical and/or mental tests used to evaluate your ability to meet job demands.

Pro Tip: Keep this glossary handy as a quick reference during claims, appeals, or policy reviews.

FAQ

What is Long-Term Disability Insurance?

Long-term disability insurance replaces a portion of your income if illness or injury prevents you from working for an extended period—usually after an elimination period of 60 to 180 days. It typically covers 50% to 70% of your salary and can last for years or until retirement age. LTD differs from short-term disability, which covers only brief absences (up to 6 months).

Is it worth it to get long-term disability insurance?

Yes, it’s worth considering because:

About 1 in 4 Americans will face a disabling condition before retirement.

LTD can protect your financial stability when you cannot work long-term.

Without LTD, disabling injuries or illnesses can drain savings and retirement funds.

Employer plans often have limited coverage and may not be portable if you change jobs.

Individual policies offer customization and longer coverage but at a higher cost.

If you have a high risk of disability or little income protection otherwise, LTD is an important safety net.

What is the best long-term disability insurance?

The best LTD plan depends on your needs but look for:

“Own occupation” definition of disability (covers inability to work your specific job) versus “any occupation” (more restrictive).

Reasonable elimination period (90 days common).

Benefit amount replacing 60%–70% of your income.

Adequate benefit period (until retirement age or a long-term fixed period).

Coverage for common disabling conditions (musculoskeletal, cancer, mental health).

Waiver of premium during disability.

Portability if you change jobs (individual policies usually better here).

Clear documentation on pre-existing conditions and exclusions.

Consult reviews, insurer financial strength, and licensed advisors to find a reputable plan.

What is a good price for long-term disability insurance?

Costs vary by age, occupation, coverage amount, and whether the policy is group or individual:

Employer-sponsored LTD is often low or no cost to employee but limited.

Individual policies cost more, often based on 1%–3% of your annual income replacement amount.

Premiums typically rise with age and health risks.

For a $3,000 monthly benefit, expect $30–$90+ per month depending on coverage details.

Always compare premiums relative to benefit amounts, waiting periods, and policy terms. Beware of policies that seem very cheap but have restrictive definitions or exclusions.