Without incident, the yearly insurance premium for a small Dallas logistics firm increased from $8,200 to $12,700 in March of last year. And why? The increased load capacity of one of their box trucks led to its reclassification, which in turn triggered a higher insurance tier.

What will the actual cost of box truck insurance be in the year 2025? Monthly premiums often fall between $750 to $1,500, with the exact amount depending on factors such as driving history, vehicle type, route radius, and operating state. When you’re an owner-operator or have a small fleet, you’re required by FMCSA regulations to have insurance. This coverage should include primary liability, physical damage, and occasionally cargo and bobtail insurance.

What accounts for the large range, and how can one stay away from paying too much?

Rising inflation and the severity of claims have contributed significantly to an 18.6% increase in box truck insurance premiums between May 2023 and May 2024, as reported by the American Transportation Research Institute. (June 2024 ATRI Report)

We’ll explain the factors that truly affect these prices and show you how to save money while running your box truck business.

On This Page

1. Understand the Real Box Truck Insurance Cost in 2025

1.1 What Defines a Box Truck in Insurance Terms?

Insurers do not necessarily consider a vehicle to be a “box truck” simply because it includes a storage box. A box truck is defined for insurance purposes as a vehicle with a cube-shaped cargo body that is positioned independently of the cab and is commonly used for local delivery or freight routes.

Carrier considerations go beyond size when estimating box truck insurance costs. They check the truck’s operating status (whether it crosses state lines or not), the commodities it transports, and the operator’s status (whether they are independent contractors or part of a larger fleet). Class 3 to Class 6 vehicles, which include most insurable box trucks, typically weigh between 10,000 and 26,000 lbs.

Independent owner-operators for package networks like FedEx or Amazon typically pay 22% more than drivers in an internal fleet, owing to increased claim frequency and stricter delivery dates, according to a report published in April 2024 by the Insurance Information Institute.

1.2 Typical Insurance Cost Range by Vehicle Type

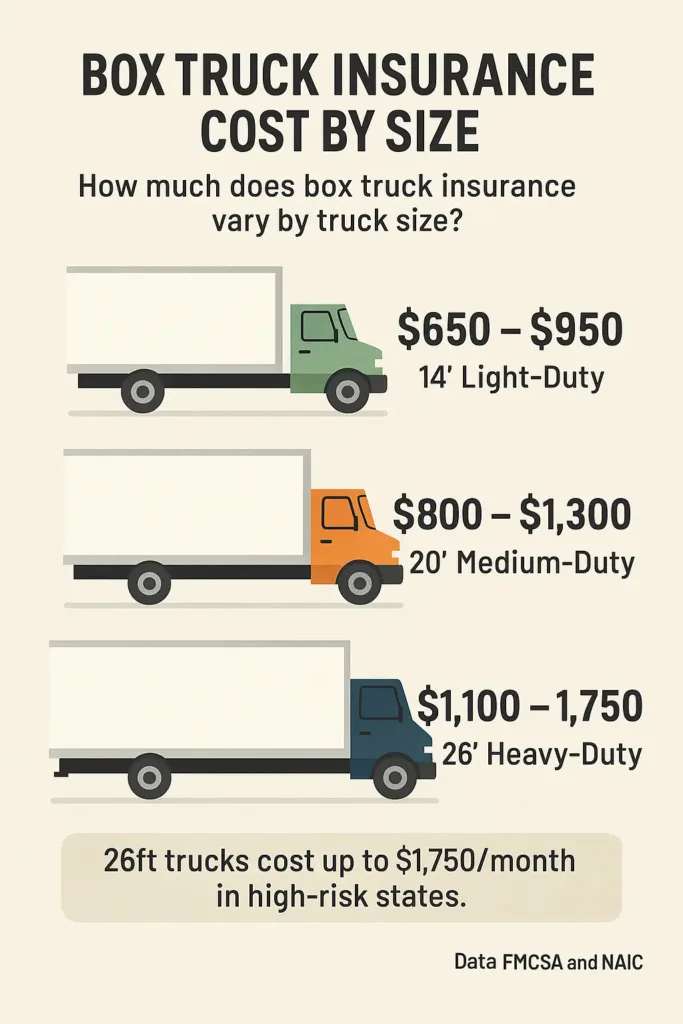

Depending on the truck size and how it’s used, monthly premiums for box truck insurance in 2025 can vary by more than $1,000. Here’s a snapshot based on national underwriting data:

| Box Truck Type | Usage Profile | Monthly Insurance Cost (2025) |

|---|---|---|

| 14′ Light-Duty | In-town deliveries, under 150 miles/day | $650 – $950 |

| 20′ Medium-Duty | Commercial hauling, regional radius | $800 – $1,300 |

| 26′ Heavy-Duty | FMCSA-regulated interstate transport | $1,100 – $1,750 |

The spread depends heavily on whether you’re insuring a single unit or a fleet, your operating authority status, and whether the truck is leased or owned outright. Vehicles tied to a DOT number with active FMCSA registration usually incur higher liability thresholds.

For exact classifications and required minimums by state, the Department of Transportation and your local insurance commissioner’s office are key references.

🔗 External Source : Insurance Information Institute – U.S. Commercial Insurance Trends (April 2024)

2. Explore the Main Factors That Influence Premiums

2.1 Driver History and Business Type

Your box truck insurance premium is heavily influenced by your driving record. Commercial drivers typically get a higher grade if they have a spotless record, have never been in an accident in which they were at fault, and have their CDLs on hand. Insurance companies place policies in a higher-risk category with as little as one speeding ticket, which can result in premium increases of 15% or more.

The underwriters look at more than just the person when they assess your box truck. Paid less than drivers operating fixed local routes for a single dispatch system are independent owner-operators who take on more clients. This is due to the fact that insurers view unpredictable cargo and workloads as more likely to result in claims or regulatory shortfalls.

After adopting a telematics system and a dedicated driver model, a Cincinnati delivery service witnessed a nearly 20% reduction in their box truck insurance premium in early 2025. This demonstrates that the frequency of use of a truck is just as important as the driver’s identity when it comes to risk classification.

2.2 Location-Based Rate Differences

How much your box truck insurance will cost is heavily dependent on your business’s address and operation zone. Insurance prices tend to be more expensive in densely populated, high-crime regions like New York City and Chicago. Businesses located in more remote areas or smaller towns, on the other hand, may be eligible for significantly reduced rates (up to 25%).

Travel time is another important factor. Insurance companies typically offer discounts to box trucks that operate within a 50-100 mile radius. Crossing state boundaries raises the bar for commercial liability and the complexity of regulations. This has an immediate impact on your ability to qualify for specific insurance plans and how much it will cost you.

Less exposure and easier claims handling contributed significantly to the 22% average savings for regional box truck operators compared to long-haul carriers, as reaffirmed in the NAIC’s 2025 bulletin.

3. Compare Box Truck Insurance by State

3.1 California, Texas, and Florida Pricing Examples

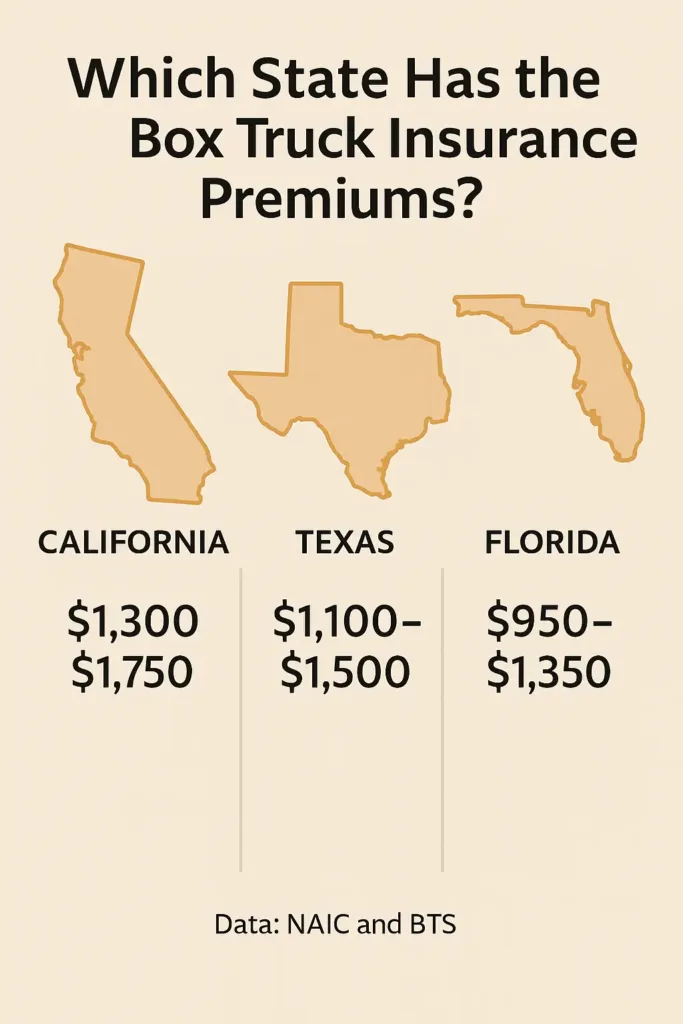

Commercial box truck insurance rates might differ substantially from one state to the next. Insurance premiums are influenced by geography and regulations; three of the most important logistical centers in the United States are located in Florida, Texas, and California.

Average monthly premiums for 26-foot box trucks in California exceed $1,750 due to stringent pollution regulations, crowded roadways, and higher minimum liability requirements. Different counties and types of businesses in Texas see different cost ranges, but on average, you can expect to pay between $1,100 and $1,500. Seasonal weather risks and more claims per capita in Florida add complexity, increasing annual premiums by 12-18% on average.

The importance of comparing providers at the state level is shown by these variations. When determining premiums for commercial truck policies, factors such as local restrictions, the frequency of FMCSA enforcement, and exposure in urban vs rural areas are taken into consideration.

3.2 States with the Lowest and Highest Premiums

The average cost of commercial box truck coverage is consistently lower in states like North Dakota, Iowa, and Nebraska. Reduced regulatory red tape, smaller population densities, and fewer claims all work to these areas’ advantage. In these states, a regular Class 5 car might have a monthly premium as cheap as $700.

However, owing to more stringent commercial insurance requirements and urban risk zones, New Jersey and Illinois rank among the most costly states. For independent operators, the monthly cost of box truck insurance in Newark or Chicago can easily surpass $1,900 when comprehensive and cargo coverage are added on.

According to transportation cost data from the BTS in early 2025, the charges for commercial vehicles are about 25% higher in metropolitan cities with populations above two million than in rural areas.

4. Break Down the Types of Coverage Required

4.1 Primary Liability and Physical Damage

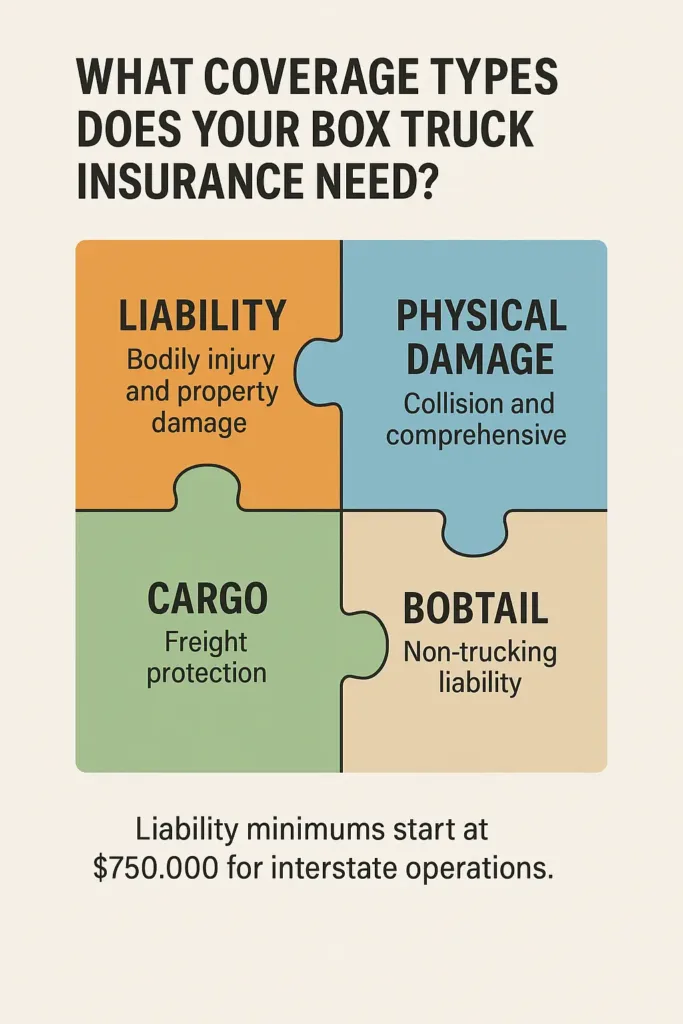

Insurance against legal action is a must for any commercial use of a box truck. If you cause harm to another person while driving, this portion of your coverage will cover the costs. It is common practice to need minimum coverage of $750,000 or more when transporting products across state boundaries or when operating under FMCSA jurisdiction. Increasing it to $1 million is now recommended by several carriers, particularly for novice operators or long-haul services.

Your box truck insurance premium is directly affected by that choice. Recent underwriting trends for 2025 indicate that, depending on your company type and claims history, a $250,000 increase in liability limits might increase your monthly premium by $70 to $110.

Afterwards, there is your vehicle. Physical damage coverage is what you need if you want it protected from things like theft, storms, and wrecks. If you’re getting financing for the truck, this is usually a must. The price depends on a number of factors, including the vehicle’s age, current market value, and the safety of its overnight parking. Consider a vehicle that is three years old and has a value of $58,000; this extra layer of security alone may cost an extra $100 to $140 per month.

4.2 Non-Trucking Liability, Cargo & Bobtail Coverage

The miles your truck clocks don’t always add up to profit. Even when you’re not on the clock, as when you’re driving home from a drop-off, you’re still covered by non-trucking liability. For leased operators, this is of utmost importance since the main policy only covers dispatch. This can increase your monthly cost by $30 to $75, subject to the terms of your contract.

Your haul is also important. The items on your vehicle are protected by cargo coverage, which differs according to risk class. Carrying electronics or drugs will substantially increase your premiums, although transporting fresh food or construction supplies is typically low-risk. Prior to assigning freight shipments, some brokers demand a minimum of $100,000 in cargo protection.

The frequently erroneous belief that “bobtail coverage” applies when a driver is in the absence of a delivery or cargo assignment (such as in the time between loads) is unfounded. It’s not always required, although many clients and carriers want it in leases. If your company uses a third party for dispatch, this additional coverage could affect how much your box truck insurance costs.

5. Calculate Your Premium with Real-World Examples

5.1 Case Study: Owner-Operator in Atlanta, GA

Suppose you own your own DOT and operate a 2019 24-foot box truck out of your Atlanta home. Delivery of various types of freight, including furniture and electronics, is your specialty within a 200-mile radius. Some of the factors that determine the cost of box truck insurance in this case are the vehicle’s age, the value of the cargo, the driver’s history, and the operational zone.

In 2025, this is how the price structures usually work:

Basic liability coverage up to $1 million: $540 per month

Physical harm (for a $42,000 truck): $115/month

Cargo insurance with $100,000 coverage is $85 per month.

bobtail and non-trucking liability: $55 monthly

This adds up the final price for box truck insurance.

5.2 Cost Table: Local vs Long-Haul Truckers

The distance you cover has a direct impact on your box truck insurance cost. Insurers distinguish between local, regional, and interstate operations. Here’s a snapshot comparison based on 2025 average data:

| Operation Type | Average Monthly Premium | Key Cost Drivers |

|---|---|---|

| Local (≤100 miles) | $650 – $900 | Lower mileage, fewer compliance requirements |

| Regional (100–300 miles) | $800 – $1,100 | Expanded risk zone, moderate FMCSA oversight |

| Long-haul (multi-state) | $1,100 – $1,600 | Interstate liability, cargo volatility, fuel tax compliance |

Even for two identical trucks, the box truck insurance cost can swing by over $700 per month based solely on route type and coverage needs.

Looking for personal savings? Explore the cheapest cars to insure and lower your everyday auto expenses.

That’s why many operators work with transportation specialists who understand commercial risk classes by region.

6. Discover Ways to Lower Your Box Truck Insurance Cost

6.1 Improve Driver Habits Before Negotiating Your Rate

The way you drive your box truck has a big effect on how much your insurance costs, not simply the specs of the truck. Insurance companies now use telematics, computer logs, and historical behavior to get a better idea of how risky something is. Even if you don’t crash, late-night travels, sudden braking, or surges in idle time can all raise your premium.

A driver’s record is just the first step. What underwriters want in 2025 is consistency: Do your operators obey the laws of HOS? Do they stay away from sudden changes in speed? Small mistakes that don’t seem like a big deal, like not doing a pre-trip check or logging hours late, might set up commercial policy red lights.

Fleet owners who pay for proactive coaching, telematics scorecards, and monitoring for tiredness likely to pay less for their box truck insurance in the long run. A routine of safe and legal behavior can help you make more money.

6.2 Review Your Liability Limits and Coverage Structure

Overestimating their liability demands leads many small carriers to pay more than necessary. Your risk profile and operating region will determine the exact amount by which increasing your coverage from $750,000 to $1 million can affect your monthly cost. When it comes to reducing the cost of your box truck insurance, it is crucial to know where you actually require larger limits and where you do not.

One way to lower total exposure without increasing base premiums is to bundle cargo coverage with general liability or use tiered deductibles or split policies. One way to lower the total cost is to agree to a larger deductible; some insurance companies even give discounts to policyholders who do so.

You can avoid being either over-insured or under-compliant by working with a broker that is knowledgeable with intrastate and interstate standards. Aligning protection with budget and necessity is more important than simply protecting.

7. Understand the Hidden Factors That Inflate Box Truck Insurance Cost

7.1 How Vehicle Age, Size, and Modifications Affect Premiums

The type of box truck you operate has a direct impact on how much you’ll pay for insurance. A large, high-value box truck—especially one built in the last five years—will almost always trigger higher premiums than an older, compact unit with basic specs. That’s because insurance companies don’t just look at accident likelihood—they consider repair costs, replacement value, and how much damage the truck could cause in a collision.

Even minor upgrades like aluminum shelving, side steps, or temperature-control units can slightly raise your box truck insurance cost, especially if they increase the overall asset value. Always inform your insurer about physical modifications, or you may risk partial denial in a future claim.

7.2 The Impact of Usage Type and Route Patterns

Insurers analyze more than just what kind of box truck you drive—they also look at how and where it’s used. A vehicle running daily deliveries across congested urban areas will be rated differently than one making occasional regional hauls. Short mileage doesn’t always mean lower premiums if it includes frequent stop-and-go traffic.

Telematics data and electronic logging devices (ELDs) help insurers evaluate route consistency, driver shifts, and idle time. Unpredictable usage or erratic patterns can increase your box truck insurance cost, even when your overall mileage is low. Keeping a clean, stable schedule across known zones helps insurers rate you more favorably.

8. Evaluate Coverage Gaps That Could Spike Your Box Truck Insurance Cost

8.1 Why Minimum Liability Isn’t Always Enough

While meeting your state’s minimum liability requirements might seem like a smart way to reduce insurance expenses, it can backfire when a claim arises. For instance, if your liability limit is set at $750,000 and a collision causes damages exceeding $1 million, you’re personally responsible for the difference. That gap can be financially devastating.

Higher limits, such as $1.5 million or $2 million, often raise your monthly box truck insurance cost—but they also offer peace of mind and protect your business from ruin.

If you’re planning for long-term risk protection beyond vehicles, single premium term life insurance may be a smart one-time investment.

In 2025, more brokers and logistics platforms are requiring elevated limits before allowing vendor participation.

8.2 Overlooked Endorsements That Matter

Some policy add-ons may not be required by law but could shield you from massive out-of-pocket expenses. For example, coverage for loading and unloading incidents or rental reimbursement during repairs isn’t included by default in most policies.

Failing to include these endorsements may leave you exposed during everyday operations. If your truck is sidelined for two weeks after a collision and you don’t have downtime coverage, lost revenue could easily surpass the monthly cost of that rider. Reviewing each clause with an insurance advisor helps minimize hidden vulnerabilities that drive up your long-term box truck insurance cost.

9. Compare Regional Variations in Box Truck Insurance Pricing

9.1 Why Location Heavily Influences Premiums

Your ZIP code can drastically affect your box truck insurance premium. In dense urban regions like Los Angeles or New York City, insurers often calculate elevated rates due to high accident frequency, increased theft risk, and congested traffic conditions. Conversely, rural operators in areas like Nebraska or Idaho may benefit from lower base premiums, assuming all other factors are equal.

A 2025 survey by the Commercial Vehicle Risk Index revealed that insurance rates for similar vehicles varied by over 28% between states with equivalent coverage levels. This difference is driven by regional claim history, local legal systems, and even weather-related risks. Understanding these patterns helps you anticipate the regional cost of commercial truck insurance for your box unit.

9.2 State-Specific Rules That Affect Box Truck Insurance Cost

Each state applies unique regulations that impact how commercial truck insurance is priced. For example, Florida mandates higher minimum coverage thresholds for certain commercial vehicles, while Oregon has stricter reporting standards that may indirectly influence underwriting. If you’re operating across state lines, your insurer will often price your policy based on the state where your business is domiciled—but exposure in other states can still affect your rate.

Make sure your policy accounts for both your base of operations and the jurisdictions where your trucks regularly travel. Failing to disclose route geography could result in denied claims or unexpected premium hikes. Multi-state businesses should regularly review their policies with regional insurance advisors.

10. Choose the Right Coverage Types for Your Box Truck

10.1 Liability vs. Physical Damage Coverage

When selecting box truck insurance, understanding the difference between liability and physical damage coverage is crucial. Liability coverage helps pay for injuries or damages you may cause to others while operating your vehicle. On the other hand, physical damage insurance protects your own truck from perils such as collisions, weather events, or vandalism. Skipping this protection might reduce premiums but could expose you to major financial risks after an incident.

If your box truck is leased or financed, your lender may require full coverage. But even for outright owners, combining liability and physical damage coverage often leads to more predictable expenses. Making informed choices based on your driving routes, risk exposure, and asset value helps control your box truck insurance cost effectively.

10.2 Optional Add-Ons That Can Reduce Long-Term Costs

Beyond basic protection, insurers offer optional coverages that can make a real difference in the long run. For instance, cargo insurance safeguards the merchandise you transport—critical for freight contracts. If you occasionally haul equipment that isn’t owned by your business, add-ons like trailer interchange or rental trailer coverage can provide peace of mind.

Additional endorsements such as downtime reimbursement, towing assistance, or rental replacement may increase premiums slightly but can prevent major revenue losses during disruptions. Choosing relevant extras aligned with your operations is a strategic move to stabilize your box truck insurance cost and avoid unexpected financial strain.

11. Compare Quotes Strategically to Lower Your Premium

11.1 Don’t Accept the First Offer

One of the most effective ways to reduce your box truck insurance cost is by gathering and comparing rates from a diverse pool of insurers. Premiums often fluctuate significantly—even by thousands of dollars per year—based on factors like your driving record, business model, and fleet condition. Instead of accepting the initial quote, reach out to a minimum of five carriers and carefully assess what each policy includes.

Don’t just focus on the price tag. Sometimes, a higher monthly rate may include broader protection, lower deductibles, or fewer restrictions—ultimately costing you less in the long run. Review policy terms closely, particularly around exclusions, liability caps, and deductible structures. Strong safety records, consistent operational history, and business longevity can all serve as bargaining chips to lower your commercial truck insurance premium.

11.2 Use Brokers and Digital Tools to Your Advantage

Licensed insurance brokers and modern comparison websites offer a strategic edge when shopping for affordable box truck insurance rates. Brokers often have access to discounted rates or specialty insurers that aren’t visible to the general public. These professionals understand underwriting trends and can tailor your application to appeal to lower-risk categories.

Online platforms let you instantly tweak coverage amounts, test higher deductibles, and simulate premium changes—all from one interface. To ensure valid results, keep your input data consistent across tools. A short time investment—often under an hour—can unlock major savings on your annual box truck insurance premiums while preserving comprehensive protection.

12. Identify and Eliminate Hidden Cost Drivers

12.1 Audit Your Policy for Redundant Coverage

Reducing your box truck insurance cost starts with examining your current policy for overlapping or unnecessary coverage types. For instance, if your fleet already includes roadside assistance via a separate vendor or manufacturer warranty, you may be paying for redundant benefits within your truck insurance policy. Evaluate whether optional protections like rental reimbursement or non-owned trailer coverage genuinely apply to your operations.

By trimming unused add-ons, you can directly influence your commercial auto insurance premiums. Speak with your agent about streamlining the policy while maintaining essential protections like liability, physical damage, and cargo insurance. Remember, optimizing coverage—not stripping it—keeps your business legally protected while lowering ongoing box truck insurance premiums.

12.2 Track Policy Endorsements and Annual Increases

Many box truck owners overlook how endorsements—add-on clauses or adjustments—affect overall insurance expenses. Something as simple as adding a second driver or updating a vehicle use type (like switching from regional to long-haul) can trigger pricing revisions. Over time, these silent cost drivers compound and inflate your box truck insurance policy.

Request a full endorsement history and premium breakdown from your insurer. Then, cross-check whether these changes are still relevant to your fleet’s current operations. If not, request adjustments or removals during your next renewal cycle. This simple audit process can stabilize your box truck insurance cost and prevent future rate creep.

FAQ

How much is 100k cargo insurance?

The cost for $100,000 cargo insurance typically ranges around $80 to $100 per month, depending on the type of cargo and risk level. Low-risk goods like produce cost less, while higher-risk items such as electronics or pharmaceuticals increase the premium. Cargo coverage requirements also depend on your freight contracts and broker policies.

How much is insurance for a 26ft box truck near me?

Insurance for a 26-foot box truck usually ranges from $1,100 to $1,750 per month, but prices vary widely depending on location, driver history, and truck usage. Urban areas with heavy traffic and stricter regulations tend to have higher premiums, while rural or less congested regions offer lower rates. To get an accurate quote, it’s best to contact local insurers with details about your business and routes.

How much is the down payment for insurance on a box truck?

Down payments for box truck insurance generally range from 10% to 25% of the annual premium. For example, if your yearly insurance cost is around $9,500, your initial payment might be between $950 and $2,375. The exact amount depends on the insurer’s policies, your credit history, and payment plan options.