When Mike, a retired veteran from Phoenix, bought a vintage Corvette in Illinois and hired a driveaway service to deliver it home, he thought everything was covered. Three states later, the car was totaled in Missouri—uninsured. His personal auto policy didn’t apply, and the driver’s coverage had lapsed.

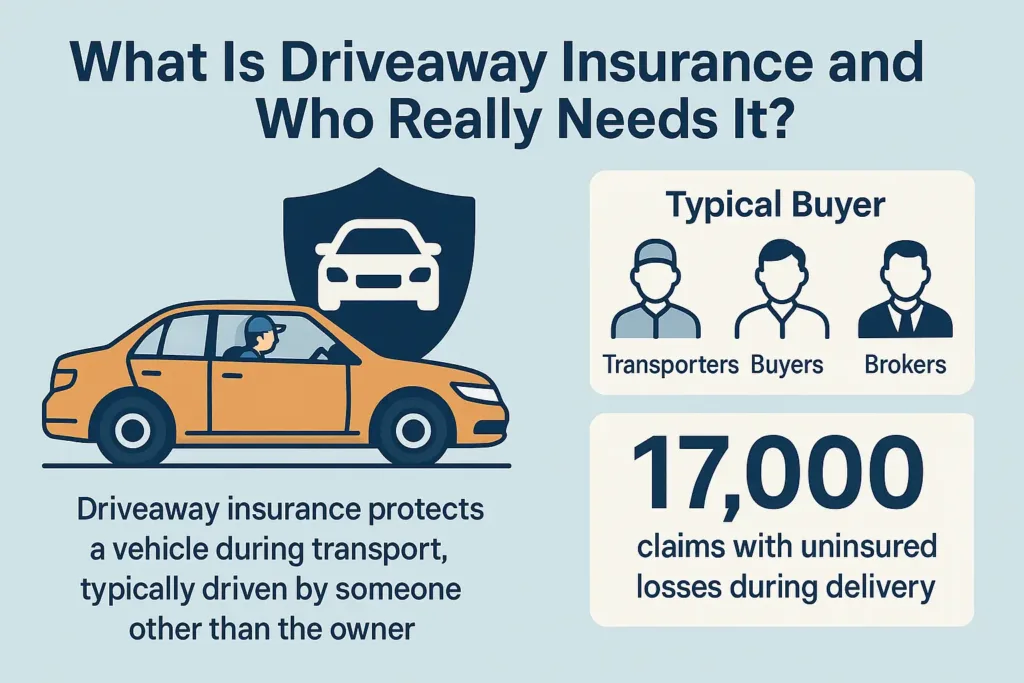

Driveaway insurance is a specific type of coverage that protects vehicles being delivered by a third party—not by the owner. It’s used in situations like cross-country purchases, dealership transfers, or fleet deliveries. According to a June 2024 report by the National Association of Motor Vehicle Boards, nearly 17,000 vehicle transport claims in the U.S. involved uninsured losses during delivery.

So how do you protect your vehicle in transit—without overpaying or exposing yourself to gaps? Let’s break down how driveaway insurance works, when you need it, and how it compares to non-owner car insurance and other temporary policies.

On This Page

1. What Is Driveaway Insurance and Who Really Needs It?

1.1 Understanding Driveaway Insurance in Simple Terms

Driveaway insurance is a specialized short-term policy that protects a vehicle during transport—typically when it’s being driven by someone other than the owner. Unlike standard auto insurance, it’s designed for vehicle relocation: dealer-to-dealer transfers, out-of-state purchases, or fleet deliveries handled by hired drivers or professional driveaway services.

The policy usually includes liability coverage and physical damage protection, and may extend to towing or temporary storage. It fills a crucial gap when personal auto insurance doesn’t apply—especially if the vehicle is unregistered, sold, or not yet titled. According to the National Association of Insurance Commissioners (NAIC), misclassification of use in vehicle delivery is among the top five reasons for claim denials in 2024.

Driveaway coverage is common in the used car trade, fleet logistics, and snowbird vehicle transfers. If you’re moving a car across state lines without registering it first, this is the kind of insurance that protects both the driver and the owner.

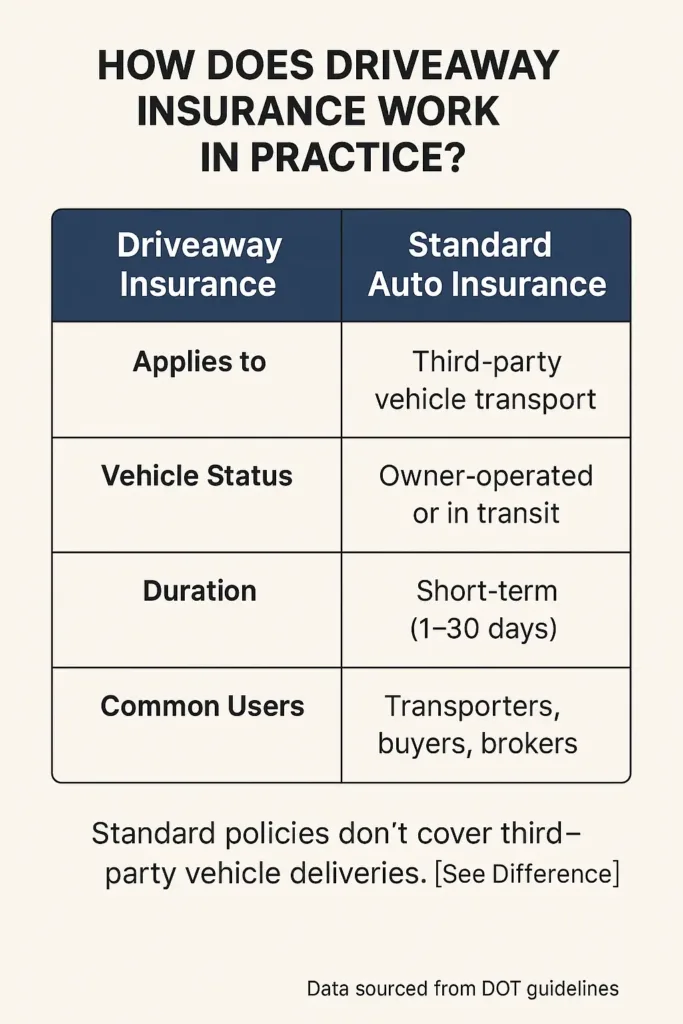

To better understand how it differs from regular auto coverage, here’s a side-by-side comparison:

| Feature | Driveaway Insurance | Standard Auto Insurance |

|---|---|---|

| Applies to | Third-party vehicle transport | Owner-operated driving |

| Vehicle status | Often unregistered or in transit | Registered and owned vehicles |

| Duration | Short-term (1–30 days) | Ongoing, annual policy |

| Common users | Transporters, buyers, brokers | Everyday drivers |

1.2 Who Typically Buys Driveaway Insurance in the U.S.?

Driveaway insurance is mostly used by independent contractors, auto transporters, fleet managers, or private buyers shipping a car across states. It’s not designed for daily commuters or standard leasing situations—it’s for short-term, high-risk transits involving valuable or unregistered vehicles.

In 2024, over 42% of driveaway policyholders were businesses or professional drivers, according to a survey by the American Transportation Research Institute (ATRI). Use cases range from dealership-to-dealership transfers to individuals buying cars out-of-state without tags or plates.

Here’s a quick real-world breakdown:

- 📦 Auto auction buyers moving untitled cars to their home state

- 🚚 Logistics companies coordinating new fleet delivery

- 👤 Private individuals relocating for work and needing transport

- 🏷️ Dealers shipping inventory between locations

Driveaway insurance ensures that any loss, damage, or liability during the handoff doesn’t fall through the cracks. It’s especially valuable when non-owner car insurance doesn’t apply to the specific vehicle in motion.

2. How Does Driveaway Insurance Work in Practice?

2.1 Driveaway Insurance vs. Traditional Auto Insurance

Let’s say you’re transporting a vehicle from New Jersey to Nevada using a professional driveaway driver. Your personal auto insurance won’t cover that trip—because you’re not the one driving, and the vehicle might not even be registered in your name. That’s where driveaway insurance steps in.

Unlike traditional car insurance, driveaway coverage is written for the purpose of one-way or short-term relocation. It applies to the vehicle—not necessarily the driver—and typically includes collision, liability, and sometimes even storage or off-loading protections. A policy might only last 7 to 15 days but can save you tens of thousands in case of an accident mid-journey.

Here’s a quick dialogue that sums it up:

Client: “So, my regular car insurance won’t cover a stranger driving my car across five states?”

Agent: “Correct. You’ll need driveaway insurance—it covers the car, the trip, and the risk of delivery, not daily use.”

More technical guidance is available via U.S. Department of Transportation guidelines, especially for fleet operators.

2.2 What’s Actually Covered by Driveaway Insurance?

Driveaway insurance kicks in when a vehicle is in someone else’s hands—not yours—and needs coverage that follows the car, not the person. Most policies offer a core set of protections: they cover damage you might cause to others (liability), damage to the car itself while it’s being driven (collision or full coverage), and sometimes extras like roadside assistance, storage during transit, or towing if the vehicle breaks down en route.

The important part? This type of coverage applies specifically to the vehicle during transit—it doesn’t rely on who owns it or carries the primary policy. If a third-party driver crashes your unregistered car while delivering it across state lines, this policy is what protects your investment. Think of it like a bridge between ownership and safe delivery.

| Coverage Type | Typical Limit | Purpose |

|---|---|---|

| Liability (BI/PD) | $100,000–$300,000 | Covers damage you may cause to others |

| Collision/Comprehensive | Up to the car’s market value | Pays for damage to the vehicle in transit |

| Towing & Storage | Varies by policy | Covers roadside events during the delivery trip |

Notably, some policies exclude damage during loading/unloading or restrict coverage to certain states. In June 2024, the NAIC reported a 16% rise in denied claims due to geographic exclusions buried in policy fine print.

3. When Do You Need Driveaway Insurance?

3.1 Real-Life Scenarios That Require Driveaway Insurance

Driveaway insurance isn’t just for businesses—it applies in several surprisingly common situations. Imagine you just bought a car at auction in Ohio but live in Arizona. You don’t want to fly out, register the vehicle, and drive it cross-country yourself. So you hire a transport driver. The car isn’t titled in your name yet. Your personal auto insurance won’t cover it. That’s when driveaway insurance becomes essential.

Other typical use cases include:

- 🔑 Buying or selling a car across state lines

- 🚚 Fleet delivery for corporate vehicles or dealerships

- 🏡 Relocating long-distance and having your car driven separately

- 🎯 Using temporary drivers or brokers for one-time deliveries

According to Statista (March 2024), over 39 million used vehicles were sold in the U.S. last year—and roughly 11% involved some form of third-party delivery.

3.2 State-to-State Vehicle Delivery: Legal and Insurance Needs

Crossing state lines creates legal complications—especially with registration, liability, and coverage requirements. A vehicle legally transported from California to Texas may pass through up to five states. If it’s uninsured during any stretch, the financial risk is yours.

Here’s a quick comparison of driveaway insurance requirements by state:

| State | Minimum Transport Coverage | Special Rules |

|---|---|---|

| California | $15,000 (BI) / $30,000 (PD) | Must declare non-operational status if not registered |

| Texas | $30,000 (BI) / $60,000 (PD) | Commercial transporters must file proof of insurance |

| Florida | $10,000 PIP + $10,000 PD | Driveaway must include PIP waiver if unregistered |

These legal thresholds can create gaps if the policy isn’t written correctly for multi-state use. According to the NAIC, improperly disclosed transport routes caused over $37 million in denied claims in 2024.

4. What’s the Cost of Driveaway Insurance in 2025?

4.1 Key Factors That Influence Driveaway Insurance Rates

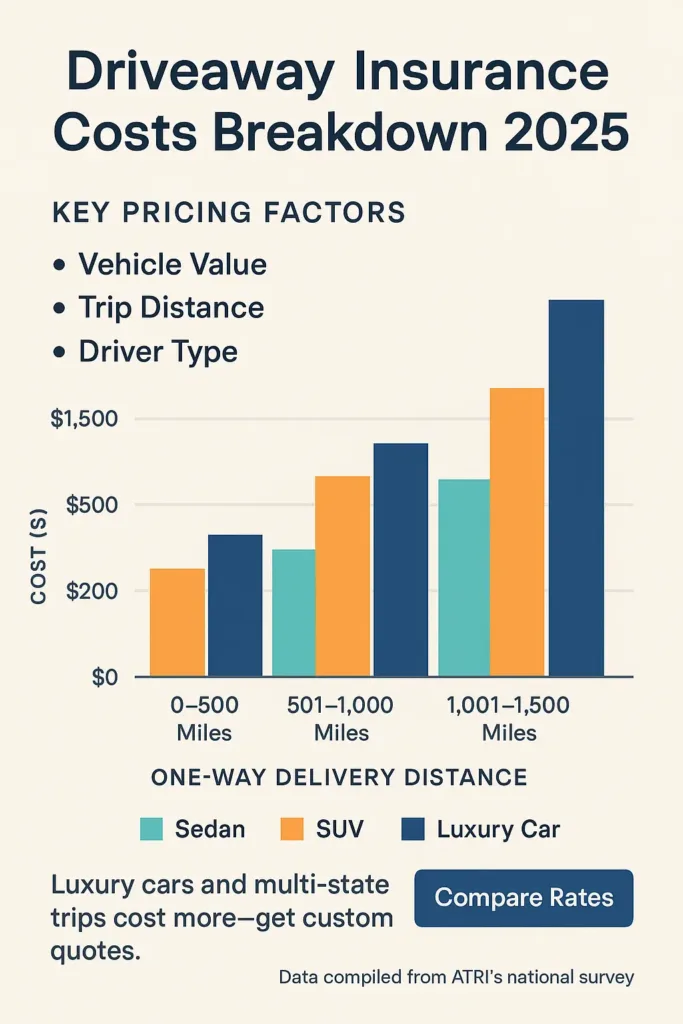

Driveaway insurance isn’t a flat-rate product. Like most auto-related coverages, the price depends on several moving parts. The most significant factors include the distance of the trip, the type and value of the vehicle, the driver’s experience (if known), and whether the vehicle is registered or in-transit status.

For example, moving a $65,000 electric SUV from California to Texas will cost more to insure than transporting a $12,000 used sedan across Florida. Why? Distance, replacement cost, risk of theft, and even weather patterns along the route all play into underwriting.

According to a pricing survey conducted in May 2025 by ATRI, average premiums range from $85 to $350 for short-term policies under 15 days.

Here’s what typically drives the price up or down:

- 🚗 Vehicle type and value (luxury or modified cars cost more)

- 🛣️ Number of states crossed (more jurisdictions = more risk)

- 🕒 Duration of coverage (longer trips raise premiums)

- 👤 Driver info (named drivers vs. blanket coverage)

- 🚚 Route type and delivery zone (city traffic vs remote areas)

4.2 Sample Quotes by Distance, Vehicle Type, and State

To give you a clearer picture, we’ve modeled actual driveaway insurance quotes from 2025 using average provider data. These are for one-time policies covering physical damage and liability, valid for up to 14 days.

| Trip Scenario | Estimated Premium | Notes |

|---|---|---|

| Compact sedan, NY to NJ (120 miles) | $88 | Short route, low vehicle value |

| Luxury SUV, TX to FL (1,100 miles) | $235 | Higher value + multi-state |

| Pickup truck, WA to CO (1,400 miles) | $310 | Includes mountain route surcharge |

| Used hybrid, IL to IN (150 miles) | $95 | Standard flat rate + local tax |

Note: Prices vary by provider and whether you insure the driver, the vehicle, or both. Always confirm if roadside assistance, storage, or delay protection is included.

5. What Are the Legal Requirements by State?

5.1 Is Driveaway Insurance Mandatory in Every State?

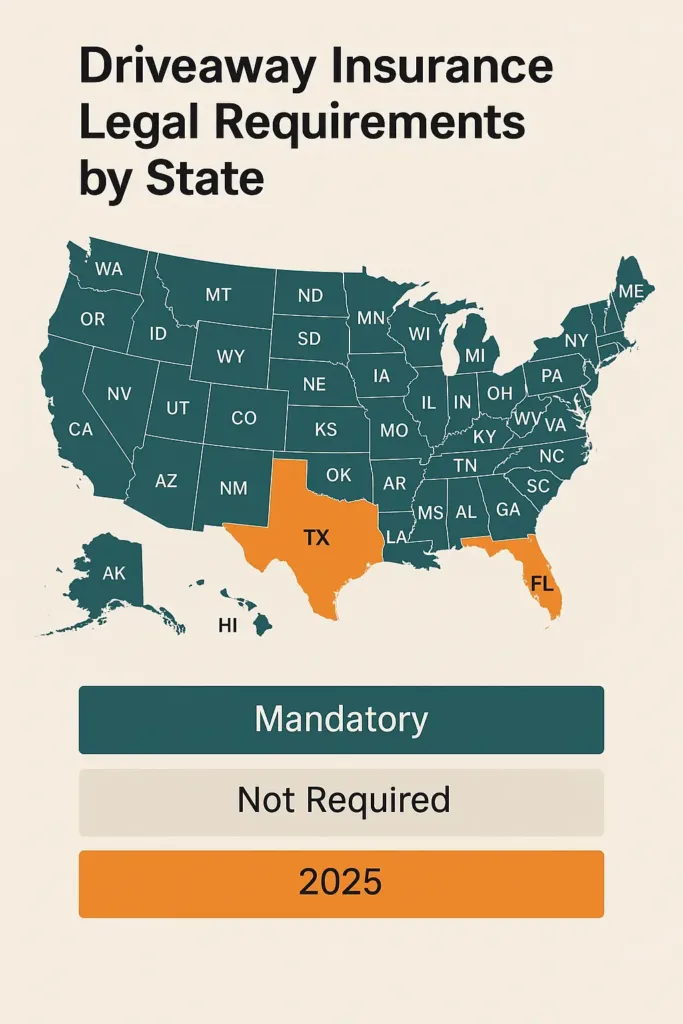

No, driveaway insurance isn’t legally required in all 50 states—but in many cases, it’s the only way to meet liability requirements during interstate transport. Most states treat a vehicle in transit as uninsured unless there’s a valid, active policy that explicitly names the trip, the vehicle, or the commercial purpose.

Some states, like **Nevada** and **Colorado**, require proof of insurance at checkpoints if the vehicle is being delivered commercially—even if it’s not registered yet. Others, such as **New York**, consider driveaway vehicles subject to minimum liability rules even if the driver is a third party.

In 2024, the National Highway Traffic Safety Administration reported that 1 in 7 cross-state vehicle deliveries involved coverage issues—either lapses, denied claims, or improperly declared drivers.

5.2 Focus: California, Texas, and Florida Specific Rules

Here’s how **three major states** handle driveaway insurance requirements for in-transit vehicles:

| State | Minimum Legal Requirement | Notable Rule |

|---|---|---|

| California | $15,000 BI / $30,000 PD | Unregistered vehicles must show non-operational status or temporary transport permit |

| Texas | $30,000 BI / $60,000 PD | Commercial transporters must submit insurance verification with DOT filing |

| Florida | $10,000 PIP + $10,000 PD | PIP waiver may be required for third-party delivery across county lines |

Each of these states has quirks: California prioritizes environmental compliance for transporters, Texas enforces DOT alignment for fleet deliveries, and Florida requires tight proof of insurance if the vehicle hasn’t been registered locally.

For drivers, brokers, or buyers operating between states, the safest approach is to secure a driveaway insurance policy that clearly defines trip duration, route, and liability limits. If you’re working with a third-party hauler, make sure they comply with interstate car transport rules—especially if you’re the legal owner of record.

6. What’s Included—and Not Included—in Driveaway Insurance?

6.1 Coverage Limits, Exclusions, and Liability Rules

Driveaway insurance may look comprehensive on paper, but there are limits you need to understand before assuming you’re fully protected. Most policies include liability (bodily injury and property damage), physical damage to the car, and optional add-ons like roadside service or short-term storage. But what’s often excluded is where the risk hides.

Common exclusions include:

- 🔧 Damage during vehicle loading or unloading

- 👥 Unauthorized drivers not listed on the policy

- 🌪️ Weather-related damage in high-risk zones (e.g. flood-prone Gulf states)

- 🚫 Commercial use when policy was written for private delivery

For example, if you’re transporting a vehicle from Georgia to North Carolina through a subcontracted driver who isn’t named on the policy, and the vehicle is involved in a crash, the claim could be denied—even if you paid for full coverage.

In a 2024 report from the NAIC, nearly 19% of driveaway claims were rejected due to policy misclassification—often involving vehicle use or driver status.

6.2 What If You’re Driving Someone Else’s Car?

This is where things get tricky. If you’re not the owner—but you’re the one driving—a typical personal policy won’t protect you unless it’s a non-owner policy or the vehicle is covered under driveaway insurance that names you.

Let’s say your cousin in Arizona asks you to deliver his unregistered car to Colorado. Wondering how insurance costs vary beyond vehicles? See how much a dental crown costs without insurance to understand hidden out-of-pocket risks. You’re doing him a favor. He assumes his regular auto insurance will cover you. It won’t. And unless he bought driveaway coverage that includes your name, you’re personally liable if anything happens during that trip.

Pro tip: Always check if the driveaway policy is “vehicle-bound” (any licensed driver) or “driver-bound” (named only). The difference could mean full coverage—or zero coverage.

7. Driveaway Insurance for Auto Transporters and Brokers

7.1 Coverage Needs for Professional Drivers

If you’re a professional driver moving vehicles across states for dealerships, auctions, or leasing companies, your personal auto insurance won’t cover those trips. Even commercial auto policies may fall short unless they’re specifically written for driveaway work. That’s why most transporters carry their own driveaway insurance policy—or operate under a blanket policy from their broker or dispatch company.

Driveaway insurance for transport professionals typically includes:

- ✅ Broad-form liability for any vehicle in possession

- ✅ Physical damage (collision + comprehensive)

- ✅ On-hook cargo insurance (if towing)

- ✅ General liability (in case of injury at pickup/drop-off)

Case study: A Denver-based transporter contracted to deliver five unregistered fleet vehicles to Salt Lake City had his trailer jackknife in icy conditions. Because his driveaway policy included both the cars and his equipment, the claim—over $120,000—was fully covered. Without that policy, he’d have been personally liable.

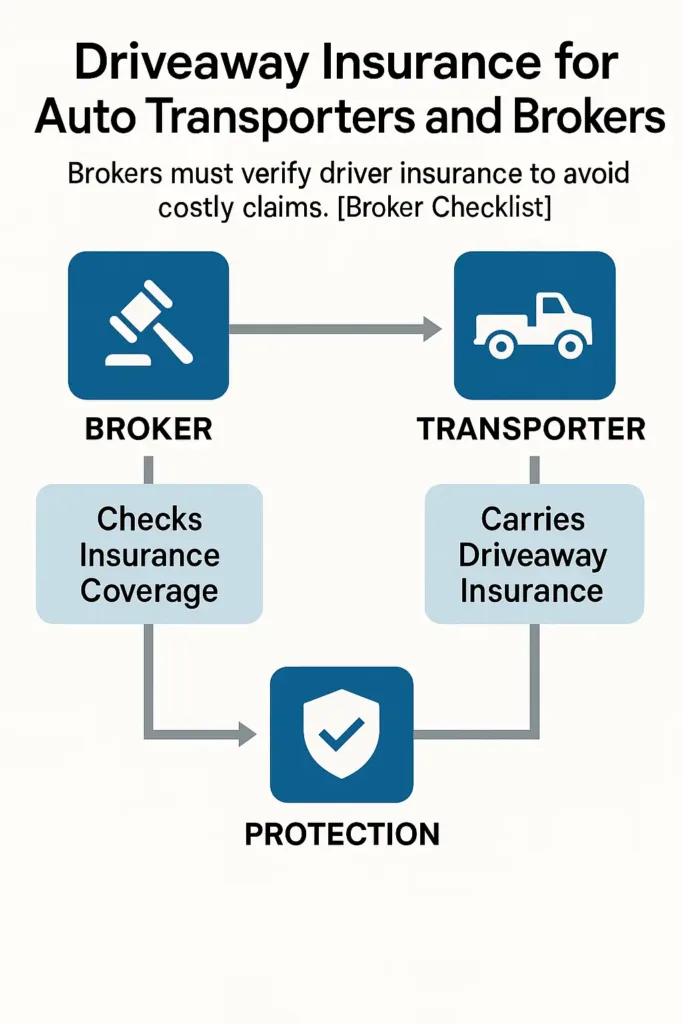

7.2 Broker Responsibility and Risk Transfer

Brokers often coordinate the handoff between a vehicle seller and a hired driver. But here’s where things get risky: unless the broker explicitly requires driveaway insurance as part of the job, neither the driver nor the vehicle owner may be covered.

If you’re brokering driveaway contracts, you need to:

- 📄 Request and retain valid proof of current driveaway insurance from each driver

- 🛑 Avoid assuming the vehicle owner has coverage

- 🗂️ Document state-to-state transport terms in writing

In a 2024 compliance notice, the Federal Motor Carrier Safety Administration (FMCSA) highlighted an uptick in liability claims against brokers who failed to verify insurance coverage—particularly in dealer auctions and interstate delivery arrangements.

8. How to Get Short-Term or Temporary Driveaway Insurance

8.1 What to Look for in Temporary Driveaway Insurance

Not all driveaway insurance policies are designed for long hauls or commercial work. If you’re just looking for short-term coverage—say, to deliver a vehicle over a weekend—you need a temporary policy that activates quickly, covers all key risks, and doesn’t require a commercial license.

Here’s what matters most when shopping for short-term driveaway coverage:

- 📅 Flexible duration (from 1 to 30 days)

- 🚘 Coverage for unregistered or untitled vehicles

- 🛡️ Physical damage + liability minimums that meet state laws

- 📍 Trip-specific coverage: from point A to B, not blanket-use

- 📱 Fast digital access to documents and proof of coverage

Pro tip: Avoid policies that list “garage use only” or exclude interstate travel—they’re usually not designed for vehicle delivery and may void claims.

8.2 Tips to Get Fast Coverage for One-Time Trips

Need coverage in a hurry? Most driveaway insurance providers now offer instant quotes and digital binders—meaning you can get insured the same day, often within an hour. But to speed things up, you’ll want to have a few key details ready:

- 🔎 VIN number (or at least make/model/year)

- 📍 Pickup and drop-off addresses

- 🗓️ Confirmed trip duration (start and end dates)

- 👤 Driver’s license info (if a named-driver policy)

Need coverage for just a few days? One week truck insurance may be faster and cheaper for short-term needs.

Some insurers even offer mobile apps that let you track coverage status and upload trip photos for added protection. According to an April 2025 survey by Insurance Information Institute, 64% of temporary auto policies issued that month were finalized via smartphone.

9. What Real People Say: Driveaway Insurance Experiences

9.1 Testimonies from Independent Drivers and Businesses

Driveaway insurance may seem niche, but for the people who rely on it—it’s essential. We spoke with drivers, small dealers, and buyers across the country who’ve used it in real-world deliveries. Their experiences highlight not just the advantages, but also the unexpected challenges that come with using driveaway insurance.

Jason H., independent transporter, Ohio: “I picked up a vehicle in Pennsylvania headed to New Mexico. Without the right insurance, I would’ve been liable for $18,000 in damage when a tire blew out on I-70. Luckily, my driveaway policy had me covered for physical damage and even roadside help.”

Karen L., small car dealer, Florida: “I used to assume my business policy protected my inventory during delivery. Turns out it didn’t. I had to add a separate driveaway policy for third-party drivers. One claim saved me thousands after a fender bender in Georgia.”

Whether you’re hauling one car a month or dozens a week, it’s clear: driveaway insurance isn’t optional—it’s protection against major financial fallout.

9.2 Common Claims and What Triggers Denials

Most denied claims fall into just a few categories—often avoidable with better paperwork or clearer coverage. Based on 2025 data from NAIC investigations, the top denial reasons include:

- 🚫 Vehicle used outside the defined trip or time window

- 🧾 Driver not listed on the active policy

- 📍 Transport route passed through a state not listed in policy territory

- 🛠️ Damage occurred during loading/unloading (often excluded)

Driveaway insurance works well—when used correctly. But it’s not a catch-all. The best way to avoid disputes? Clarify exactly what’s covered, who’s driving, and where the vehicle is going before you hit the road.

10. Key Takeaways: Is Driveaway Insurance Worth It?

10.1 When It’s a Smart Move—and When It’s Not

If you’re shipping a car across state lines, letting someone else drive it, or delivering an unregistered vehicle—you need driveaway insurance. It’s particularly valuable for:

- 🚘 Individuals buying out-of-state vehicles

- 🏢 Dealerships coordinating fleet delivery

- 👨🔧 Independent transporters or contract drivers

However, if you’re the vehicle owner and driving it yourself under an existing auto policy, or the trip is local and the vehicle is registered—this type of insurance may be unnecessary. In those cases, temporary personal auto coverage may be enough.

10.2 Alternatives to Driveaway Insurance You Should Know

Before buying a driveaway policy, consider if another type of insurance might suit your needs better. Here are some viable options:

| Alternative | Best For | Key Limitation |

|---|---|---|

| Temporary Auto Insurance | Short trips in your own vehicle | Doesn’t cover third-party drivers or untitled vehicles |

| Non-Owner Car Insurance | Frequent drivers without car ownership | No coverage for the vehicle itself |

| Commercial Auto Policy | Businesses with regular transport needs | More expensive and harder to qualify |

Choosing the right option depends on who owns the car, who’s driving it, and how far it’s going.

FAQ

What is Driveaway Coverage?

Driveaway coverage is a temporary auto insurance policy that protects a vehicle during transport when it’s being driven by someone other than the owner. It’s commonly used for:

Out-of-state car purchases

Dealership or fleet vehicle transfers

Hired or contracted vehicle deliveries

Not just for drivers—if you’re renting, you should also compare how much renters insurance costs to avoid unexpected expenses.

It typically includes liability, collision, and comprehensive coverage for short-term periods (1–30 days), especially for unregistered or untitled vehicles in transit.

🛡️ Key point: It covers the vehicle—not necessarily the driver—during a delivery trip.

How Do I Insure a Rarely Driven Car?

If you rarely drive your car, you can save money by choosing low-mileage or pay-per-mile car insurance. Other smart options include:

Storage insurance: Covers theft, fire, and weather damage while your car is parked long-term

Comprehensive-only policy: Drops liability if the car isn’t driven

Classic/collector car insurance: For vintage or collectible cars driven occasionally

💡 Tip: Be honest about usage to avoid claim denial—some insurers offer discounts for under 3,000 miles/year.

How Much Is Off-Road Vehicle Insurance?

Off-road vehicle insurance typically costs between $100 and $600 per year, depending on:

Vehicle type (ATV, UTV, dirt bike, dune buggy, etc.)

State requirements

Liability and optional coverage (e.g. collision, theft, accessories)

It usually includes liability, collision, and comprehensive protection. Some states require minimum coverage if the off-road vehicle is used on public lands or roads.

📍 Pro tip: Bundling with auto or homeowners insurance can reduce the premium.

What Is Drive Car Insurance?

The phrase “drive car insurance” is not a standard industry term, but it may refer to:

Non-owner car insurance: Covers you when driving someone else’s car

Driveaway insurance: Temporary coverage for vehicle deliveries

Short-term auto insurance: For occasional or one-time trips

🔍 Clarify if you mean insurance to drive a car you don’t own, or to insure a car you rarely drive—the answer differs.