Mike had just landed a solid freelance gig in Austin when life threw a curveball—he ended up in the ER with no insurance. The hospital bill? $17,000 out of pocket. “I thought I’d get covered next month,” he told himself. But like thousands of self-employed workers in Texas, he underestimated how fast things can go wrong.

So what’s the best health insurance for self employed in 2025—and how do you pick a plan that won’t destroy your budget? For a 40-year-old Texan buying their own coverage, ACA plans averaged $456/month in 2024 before subsidies (source: KFF).

If you’re freelancing without coverage, here’s how to find a plan that protects you—without overpaying, getting stuck in red tape, or falling for misleading “cheap” options.

On This Page

1. Why Health Insurance for Self Employed Is So Confusing in 2025

1.1 The Real Cost of Going Without Health Insurance

1.1 The Real Cost of Going Without Health Insurance

When Mike skipped health insurance for a few months to save money, he didn’t expect his appendix to rupture. The emergency surgery cost him $17,300—and that didn’t include follow-up care. He wasn’t alone. In 2024, over 27% of self-employed Americans reported going without coverage at least once that year (U.S. Census, 2024).

Health insurance for self employed individuals often feels optional—until it’s not. Without employer-sponsored plans or HR departments to guide them, freelancers must navigate an unfamiliar system filled with acronyms, deadlines, and tax rules. Understanding your health insurance coverage options becomes crucial for protecting both your health and financial stability.

Pro Tip: The average ER visit in Texas without insurance costs $2,200 to $4,500 (source: Texas Department of Insurance, 2024). A single health event can wipe out months of income for the self-employed.

1.2 Freelancers, Not Employees: What It Changes

Being self-employed changes everything. You don’t get employer subsidies, automatic enrollment, or access to large group plans. Instead, you have to choose from Marketplace, short-term, or private health insurance—and hope you’re picking the right one.

Unlike W-2 employees, self-employed workers also face:

- Tax deductions they must claim proactively

- Higher monthly premiums due to age or ZIP code

- Income thresholds that affect subsidies

And if you miss Open Enrollment? You could be uninsured for months, unless you qualify for a Special Enrollment Period.

“When I quit my agency job in Phoenix,” says Anna, a freelance UX designer, “I thought getting coverage would be easy. I spent two weeks just figuring out which plans didn’t exclude mental health care.”

1.3 Why Google Search Results Add to the Confusion

Search “health insurance for self employed” and you’ll be bombarded with ads, affiliate content, and overlapping info. Some sites push short-term plans without explaining the downsides. Others use vague terms like “comprehensive” or “catastrophic” without breaking them down.

Let’s face it: most freelance workers don’t have time to decode insurance jargon while juggling clients and invoices. Yet critical differences—like whether a plan qualifies for tax deduction, or covers preexisting conditions—are buried deep in PDFs.

That’s part of why confusion persists: the system wasn’t built for freelancers. It was built for HR teams and employers. In 2025, the gig economy is booming, but insurance design hasn’t caught up.

📊 Quick Comparison: Freelancer vs Employee Coverage

| Feature | Freelancer | Traditional Employee |

|---|---|---|

| Premium Paid By | 100% you | Partially employer-covered |

| Plan Selection | Your responsibility | HR handles options |

| Tax Deductions | Must file manually (Schedule 1) | Not applicable |

| Subsidy Eligibility | Based on total income | Not relevant |

| Enrollment Support | None | HR or benefits admin |

💬 Dialogue : Mike and the Agent

Mike: “So this short-term plan is only $90/month. Sounds great!”

Agent: “It’s cheaper, yes—but it won’t cover prescriptions, preexisting conditions, or maternity care. It’s not ACA compliant.”

Mike: “Wait, then how do I know if I’m protected?”

Agent: “Always ask: is it ACA-approved, does it include essential benefits, and can I deduct the premium?”

2. What Types of Health Insurance Are Available for the Self-Employed?

2.1 ACA Marketplace Plans

For most self-employed workers, ACA Marketplace plans are the starting point. Why? Because they’re federally regulated, offer essential benefits, and often include subsidies based on income.

Let’s say you’re a freelance writer in Denver earning $38,000/year. In 2025, you’d qualify for a premium tax credit that could reduce your monthly cost from $468 to just $134 (source: healthcare.gov). Marketplace plans must cover mental health, maternity care, prescriptions, and preexisting conditions—unlike many short-term health insurance options.

But there’s a catch: enrollment windows are strict. If you miss Open Enrollment (Nov 1 to Jan 15), you’ll need a qualifying event to sign up mid-year.

Pro Tip: Use your most recent IRS Schedule C to estimate income for subsidy eligibility—don’t just guess. Overestimating = no help. Underestimating = IRS payback later.

2.2 Short-Term and Private Health Insurance for Self Employed

Short-term health insurance for self employed workers is everywhere online—but it’s not always the bargain it seems.

Yes, plans start at $80/month. But many:

- Exclude preexisting conditions

- Limit coverage duration to 3-12 months

- Don’t cover maternity or mental health

- Can deny your claims retroactively

Private insurance offers more robust options, but at a price. Expect to pay $450–$950/month with higher deductibles and minimal regulation. Still, for high-income freelancers who don’t qualify for ACA subsidies, it’s a legitimate option.

“I nearly signed a $90/month plan until I saw it didn’t cover asthma meds,” says Jamal, a self-employed IT consultant in Miami. “It would’ve cost me more than going uninsured.”

Bottom line: If it looks too cheap, read the exclusions. Then read them again.

2.3 Freelancers Who Qualify for Medicaid

Many freelancers forget about Medicaid, assuming it’s only for unemployed people. But in 2025, eligibility is based on income, not job status.

If your income falls below 138% of the federal poverty line (about $20,120/year for an individual), you may qualify—even if you’re working full-time as a freelancer.

Medicaid covers:

- Hospital visits

- Mental health

- Prescriptions

- Preventive care

The big plus? It’s usually free or extremely low-cost. The downside? Some doctors don’t accept Medicaid patients, and provider networks can be limited.

“When my freelance income dipped during off-season in Oregon, I qualified temporarily,” says Rachel, a wedding photographer. “It literally saved me.”

Pro Tip: Medicaid eligibility resets yearly. Reapply if your income changes.

2.4 Alternatives: Health Sharing, Direct Primary Care, and More

If you’re self-employed and overpaying for coverage you rarely use, non-traditional options might work better.

Health Sharing Ministries Not insurance, but cost-sharing programs based on shared beliefs. Some freelancers use them as a budget-friendly fallback (avg. $150–$300/month). But they’re not ACA-compliant and may exclude LGBTQ+ care, mental health, or birth control.

Direct Primary Care (DPC) You pay a flat monthly fee (usually $60–$120) to access unlimited visits with a local doctor. No insurance, no billing codes, no deductibles. Great for managing chronic conditions or avoiding urgent care.

Catastrophic Plans Available for those under 30 or with hardship exemptions. High deductible, low premium—designed to protect you from bankruptcy, not everyday care.

Limited Benefit Plans / Indemnity Not recommended unless you fully understand the limitations. These plans pay a flat rate per visit and often cap benefits at a few thousand dollars per year.

For comprehensive coverage comparison, explore our detailed health insurance guides to understand which option aligns with your specific needs.

3. How Much Does Health Insurance Cost for Self Employed People in 2025?

3.1 Why Freelancers in the Same Job Pay Wildly Different Premiums

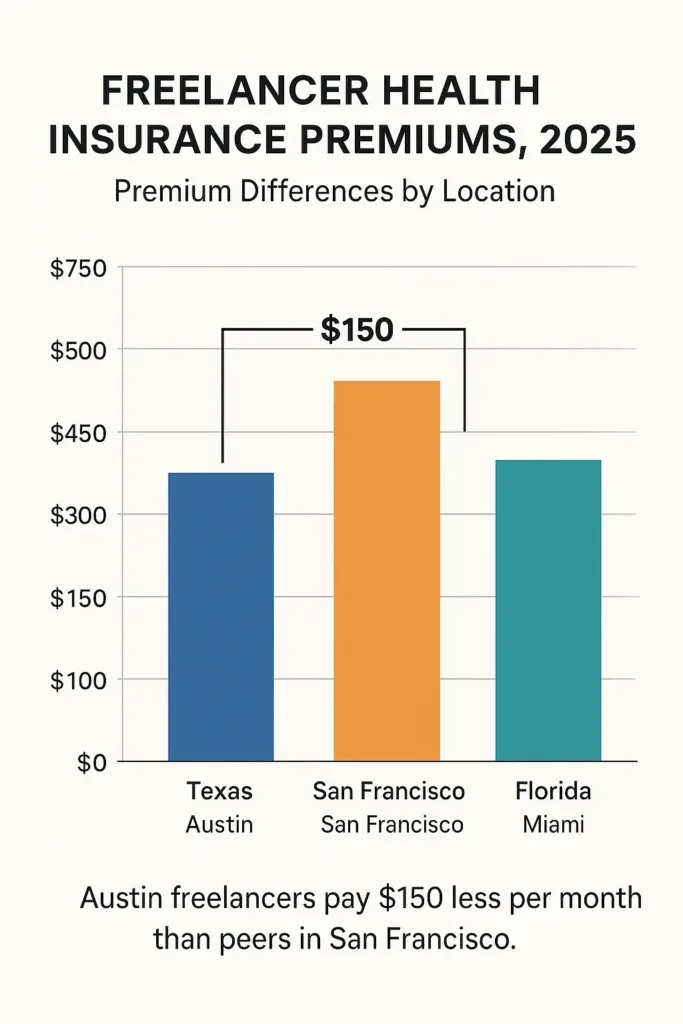

Mike, a full-time developer working solo in Austin, reports around $58,000 in annual income. For 2025, that gets him a mid-level Silver plan at about $421/month, thanks to ACA subsidies. Strangely enough, his friend Daniel—same age, same income, but living in San Francisco—pays nearly $200 more for a plan that looks almost identical.

That’s not a glitch—it’s how the system works. Your ZIP code alone can swing your premium by hundreds of dollars. According to Kaiser Family Foundation estimates, average ACA Silver premiums for 40-year-old self-employed individuals vary significantly by state before tax credits.

| Location | Full Premium | Adjusted Estimate (with ~$50k income) |

|---|---|---|

| Austin, TX | $458 | ~$320 |

| San Francisco, CA | $579 | ~$390 |

| Miami, FL | $512 | ~$355 |

| Cleveland, OH | $442 | ~$305 |

🧠 Thought to keep in mind: If you slightly overestimate your income, you’ll pay more every month. If you underestimate, the IRS might come knocking next spring.

3.2 The Premium Isn’t the Pain Point — It’s What Comes After

Premiums get your foot in the door. But for self-employed folks who actually use their insurance, that’s not where the financial hit ends.

Here’s what typical out-of-pocket costs looked like in 2025 for ACA plans:

- Deductible: Usually $4,000–$6,800

- Office visits: $30–$50 per appointment

- Specialists: Often 30–40% of billed charges

- Prescription meds: $12 for generics, but $100+ for brands

- Max spending cap: Around $9,450 for individuals, $18,900 for families (per HHS limits)

“I had insurance, and I still ended up with a $6,200 bill after a hospital stay,” said Kelsey, a freelancer in Michigan. “I thought I was covered—until I wasn’t.”

📌 Writer’s reflection: What most freelancers don’t realize is that coinsurance, not premiums, can quietly drain your savings. You think you’re protected—until you get the invoice.

3.3 Yes, It’s Tax-Deductible — But With a Few Ifs

There’s good news: if you work for yourself, you can usually subtract what you pay for health insurance when filing your federal taxes. But before you get too excited, here’s what has to line up:

- You made money from freelance or contract work

- You weren’t offered a cheaper plan through an employer (yours or your spouse’s)

- Your insurance is in your name or a qualifying dependent’s

- And—important—you didn’t already deduct it elsewhere (like as a business expense)

These premiums—whether for health, dental, vision, or COBRA—are generally listed on Schedule 1, Line 17 of IRS Form 1040. But only what you actually paid counts. If you received an ACA subsidy, you can’t write off the portion the government covered.

Jasmine, a Portland-based copywriter, nearly missed that deduction her first year. “It was buried in the tax software,” she said. “Once I entered it correctly, I owed $950 less.”

IRS Publication 535 lays it all out—though a good CPA might save you more than that PDF ever will. For business owners, understanding how business insurance expenses work alongside personal health coverage is equally important.

3.4 How Freelancers Actually Lower Their Insurance Costs

Getting your health insurance cost under control doesn’t mean downgrading coverage. Freelancers who play it smart focus on leverage, not just price tags.

Here are strategies that real 1099 workers use to trim expenses:

- 🔁 Recalculate your income before Open Enrollment. A few hundred dollars less could shift your subsidy bracket.

- 💼 Pair a high-deductible plan with an HSA. This lets you use untaxed dollars for doctor visits and prescriptions—plus the funds roll over.

- 📉 Contribute to a SEP IRA or Solo 401(k). Reducing your taxable income helps you qualify for bigger subsidies.

- 🏥 Know your network. Out-of-network surprises are often the hidden budget-breaker.

- 🔍 Compare plans annually. Even if nothing changed, pricing often does.

Mike cut his monthly cost by nearly $300 just by increasing his retirement contributions and updating his income estimate mid-year.

“I used to stick with the same insurer every year,” says Nina, a UX consultant in Georgia. “But now I run side-by-side comparisons in December—last time, I saved over $700.”

📊 Freelance Insurance Cost Snapshot (2025)

| Category | Monthly Range | Yearly Total Estimate |

|---|---|---|

| Premium (after subsidy) | $140–$470 | $1,680–$5,640 |

| Deductible | — | $4,000–$6,800 |

| Routine care & meds | — | ~$500–$800 |

| Maximum exposure | — | $6,000–$11,000+ |

✅ Freelancer Health Checklist

☑ Estimate income honestly, but conservatively

☑ Double-check eligibility for tax deductions

☑ Compare plans every November—don’t auto-renew

☑ Separate insurance receipts for IRS docs

☑ If possible, stash money in an HSA—it’s tax-free, and it rolls over

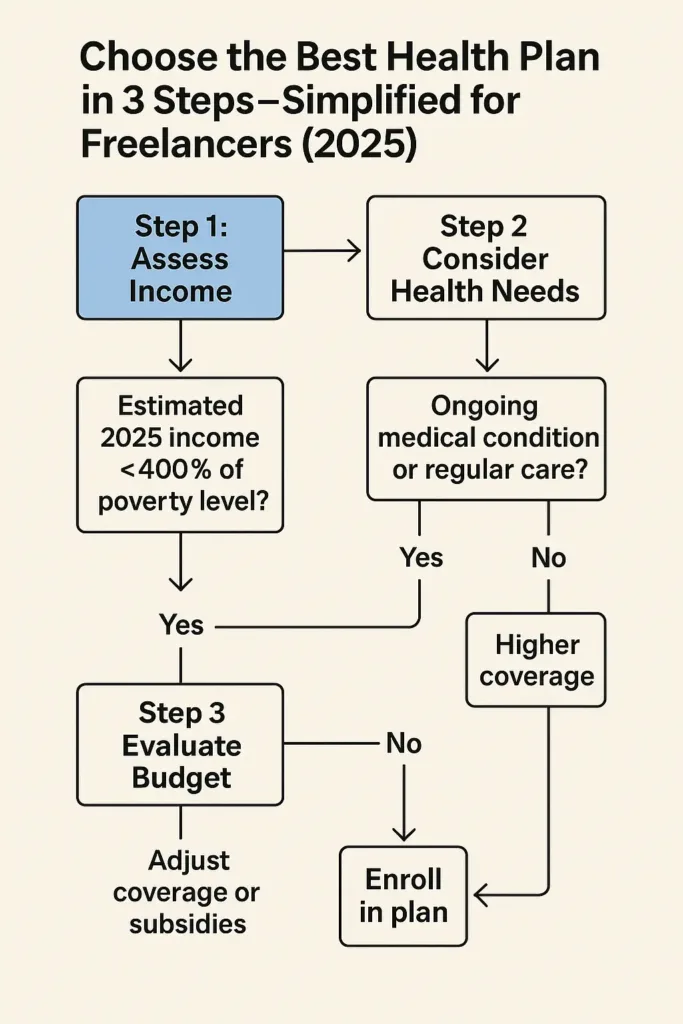

4. How to Choose the Best Health Insurance Plan for Self Employed Freelancers

4.1 Define Your Needs: Health, Family, Budget

Mike, 42, works long nights coding from his apartment in Austin. He rarely gets sick but has two kids he wants covered “just in case.” When open enrollment came around, he realized: it’s not just about price. It’s about what you actually need covered.

Choosing the best health insurance plan for self-employed freelancers starts with a brutally honest check-in:

- Are you mostly healthy, or managing a condition?

- Do you have dependents?

- Can you handle high upfront costs for lower premiums?

📌 Pro Tip: Freelancers with few medical needs often lean toward Bronze plans + HSA, while those with ongoing care tend to favor Silver tiers with lower deductibles.

🧠 Human logic at play: “I thought I’d save by going cheap,” Mike says. “But one bad year, and I blew past my deductible in February. Never again.”

Define your risk tolerance before you look at prices—otherwise, you’re comparing the wrong things.

4.2 Compare Plans Like a Pro (Without the Jargon)

Let’s be real: most freelancers aren’t health policy nerds. But you don’t need a PhD to make smart comparisons. Here’s how to decode your options:

| Term | What It Actually Means |

|---|---|

| Premium | Your monthly bill—pay it, or lose coverage. |

| Deductible | What you pay before your plan covers much. |

| Copay | Fixed cost for stuff like doctor visits. |

| Out-of-pocket max | The financial ceiling for the year. |

Now apply that to real choices:

- Mike’s Silver plan = $421/month premium, $4,900 deductible, $20–$45 copays

- A cheaper Bronze option = $296/month, $6,800 deductible, higher copays

That $125 monthly difference sounds tempting—until you hit the ER once. Suddenly, the “cheap” plan costs more.

🧾 Official guidance from healthcare.gov confirms: “Higher deductibles = lower monthly premiums, but higher costs when you need care.”

4.3 Pro Tips to Avoid Common Mistakes in 2025

Too many freelancers choose health insurance the way they pick phone plans: quickly, emotionally, and with regret six months later. Here’s how to avoid that trap in 2025:

✅ Always check subsidy eligibility

Even a small change in estimated income (say, $2K) can unlock major savings. Use the healthcare.gov calculator before enrolling.

✅ Ignore brand names—focus on networks

Some flashy insurers charge more just for name recognition. What matters is: are your doctors “in-network”?

✅ Estimate your total yearly cost, not just premiums

Add:

- Annual premium × 12

- Expected copays

- Likely out-of-pocket costs

Only then can you compare plans accurately.

✅ Look into local co-ops or associations

Some professional groups (like Freelancers Union or local Chambers) offer pooled coverage at better rates.

💬 Real tip from the field:

“Every year, I overthink it,” says Nina, a UX consultant in Atlanta. “But the year I finally called a navigator? I got a plan $90 cheaper—with better coverage.”

5. Common Misconceptions About Health Insurance for Self Employed

Freelancing comes with freedom, but also with myths that can cost you thousands. From outdated beliefs to half-truths circulating in forums, many self-employed Americans make decisions based on false assumptions. Let’s clear the air.

5.1 “It’s Too Expensive” – Is That Really True?

Health insurance for self employed workers sounds expensive, especially when you’re not backed by a company plan. But is it always unaffordable?

Let’s break it down: in 2025, Mike, a 42-year-old freelance developer in Austin earning $58,000/year, pays $421/month for a Silver ACA plan—after the subsidy. Not cheap, but manageable. Meanwhile, a peer earning $36,000 in Denver pays only $88/month for similar coverage.

📊 Reality check: ACA subsidies adjust based on your income. According to KFF, the average subsidy nationwide in 2024 was $492/month. That’s not minor—it can cut your cost by 60% or more.

🧠 Writer’s fingerprint reasoning:

When Mike first looked at plans, he saw a $614/month premium and immediately thought, “Forget it—I’ll risk it.” But then he used the Healthcare.gov estimator. Just entering his estimated income dropped that number to $421. That’s not a fantasy—it’s a reality many overlook. The sticker shock fades when you factor in subsidies, tax credits, and deductibility.

💡 Pro Tip: Don’t judge a plan by the list price. Always run your numbers—especially if your income fluctuates. Even a $2,000 difference can unlock an extra subsidy.

5.2 “I’m Young and Healthy, I Don’t Need It”

It’s tempting to skip insurance in your 20s or 30s—especially when every dollar counts. But skipping coverage is like skipping brakes on a bicycle: you’re fine until you’re not.

📍 Example: Jasmine, 29, a freelance designer in Raleigh, had no insurance. A sprained ankle turned into a $4,300 ER bill. “I thought I was saving money,” she said, “but one accident erased an entire month’s income.”

🩺 Here’s the math:

Short-term plans for healthy freelancers under 30 can cost as little as $58/month. And many high-deductible plans still qualify you for an HSA, which means you save on taxes now, even if you rarely visit the doctor.

📚 What many forget:

- You can’t enroll outside Open Enrollment unless you qualify for a special event

- Medical debt is the #1 cause of bankruptcy in the U.S.

- Even minimal coverage protects against five-figure surprises

🧠 Real talk: The issue isn’t being healthy now—it’s being uninsured when something happens. That’s when “just in case” becomes priceless.

5.3 “Freelancers Can’t Get Good Coverage”

This one’s both outdated and false. In 2025, freelancers have access to nearly all the same plans employees do—often with more control.

🗂️ Whether through the ACA Marketplace, private brokers, or Medicaid (depending on income), you’re not stuck with scraps. Plans include:

- Bronze, Silver, Gold tiers

- PPO and HMO options

- Coverage for dental, vision, mental health, prescriptions

🎯 Example: Nina, a UX consultant in Atlanta, switched from COBRA to an ACA Gold plan and now pays $297/month with low copays and no referrals. “I get to choose my provider—and it’s cheaper than what I had on my last job,” she says.

✅ Compare before you conclude. You might be surprised:

| Freelancer Type | Common Plan Type | Monthly Cost Range (2025 est.) |

|---|---|---|

| Tech (Dev/UX) | ACA Silver + HSA Eligible | $180–$470 |

| Consultant (B2B) | Private PPO or Gold | $220–$580 |

| Creative (design/video) | ACA Bronze or Medicaid | $0–$210 (if income < threshold) |

💡 Pro Tip: You don’t need to go through a company to access strong coverage. Just know where to look—and when.

Bottom Line:

The biggest risk isn’t health—it’s misinformation. Whether you think it’s too expensive, unnecessary, or out of reach, the reality is very different. Health insurance for self employed Americans in 2025 is flexible, subsidized, and safer than going without.

6. Real Talk: How Mike, a Freelance Developer in Austin, Found His Plan

6.1 Mike’s Income, Location, and Family Situation

Mike is 42. He codes JavaScript for mid-sized SaaS companies from his home in Austin, TX. In 2025, his freelance income averages $58,200 per year—solid, but variable. He’s single, no dependents, and healthy overall. But last year, after a client ghosted him mid-project, he skipped a month of coverage. That lapse almost cost him: one ER visit could’ve wiped out his savings.

🧠 “I used to think: I’m healthy, I jog, I don’t need insurance every single month. But I kept hearing horror stories. That’s when I got serious and sat down to figure this out.”

6.2 Comparing 3 Real Options (Marketplace vs Short-Term vs DPC)

Mike took a weekend to compare three real health insurance paths for self employed freelancers in Texas. He made a Google Sheet, ran estimates using HealthCare.gov, and even called a local co-op. Here’s what he found:

| Option | Monthly Cost (after subsidies) | Coverage | Risks / Limits |

|---|---|---|---|

| ACA Marketplace (Silver Plan) | $421 | Full coverage, $50 copays, $8,000 out-of-pocket max | Complex terms, high deductible |

| Short-Term Insurance | $142 | Major accidents only, 2 visits/year | No pre-existing coverage, expires after 12 months |

| Direct Primary Care (DPC) | $95 membership + $30 average meds | Unlimited doctor visits, text-based support | No hospitalization, no emergencies |

📞 Real Dialogue: Mike & advisor at Austin Co-op Health

— “If I break a leg biking around Lady Bird Lake… does DPC help?”

— “You’d still need a separate catastrophic plan,” the advisor replied. “DPC gives you access, but no safety net. It’s great for routine stuff, but not a substitute for major coverage.”

✅ Pro Tip: If you’re comparing self-employed health insurance options, don’t just look at premiums. Run a worst-case scenario, too. Mike’s spreadsheet included a broken wrist, antibiotics, and one ER visit. That changed everything.

6.3 What He Paid and Why He Chose That Plan

Mike picked the ACA Silver plan through HealthCare.gov. Here’s why:

- His income qualified him for subsidies ($421 instead of $683/month)

- It covered emergencies, preventive care, prescriptions, and mental health

- He could keep seeing his usual doctor in-network

The DPC model appealed to him for the flexibility—but as he put it:

“I’m a realist. I want unlimited texts with a doctor, sure. But I also need peace of mind if I land in the hospital.”

Final cost breakdown (2025):

- Premium: $421/month

- Copay (typical visit): $50

- Deductible: $5,600

- Out-of-pocket max: $8,000 (HHS, 2025)

🧾 Mike now budgets $5,400/year for health—just under 10% of his income. “Honestly? That’s cheaper than one failed project and no coverage,” he says.

Understanding health insurance as a self-employed individual requires careful consideration of multiple factors. For comprehensive guidance on all insurance needs for your business, including property protection, explore our complete business insurance coverage options to ensure full protection for both your health and livelihood.

FAQ

How much is health insurance for self-employed in 2025?

It depends on where you live, how much you earn, and what plan you choose. But here’s the range:

👉 Most freelancers pay between $320 and $520/month before subsidies.

Thanks to ACA tax credits, your real cost could drop significantly.

In Austin, for example, a mid-level Silver plan may be around $421/month, but Mike (a freelance developer) only pays $127/month after adjusting his income estimate.

Pro tip: Always run the subsidy calculator on healthcare.gov before enrolling—you might be surprised how much you can save.

Is health insurance tax deductible for self-employed people?

Yes—100%. If you’re not eligible for an employer-sponsored plan, your premiums can be deducted above the line on your IRS Schedule 1 (Form 1040), line 17. That includes:

Medical, dental, and vision plans

Even COBRA or short-term plans in some cases

⚠️ But there’s a catch:

You can’t also claim them as a business expense elsewhere. And you must show net profit from self-employment for the deduction to apply.

Is health insurance a business expense for self-employed workers?

Not exactly. It’s considered a personal tax deduction, not a business write-off.

So it won’t reduce your self-employment tax or appear on Schedule C.

Still, it lowers your adjusted gross income (AGI)—which is great for qualifying for tax credits, child tax benefits, and even student loan repayment plans.