Premium deficiency reserve calculations affect 73% of property and casualty insurance companies annually, creating significant regulatory compliance challenges and capital allocation requirements. These mandatory reserves represent one of the most complex aspects of statutory accounting principles, directly impacting insurer solvency and regulatory standing across all fifty states.

Insurance companies face mounting pressure to accurately calculate and maintain adequate reserves as state insurance departments intensify oversight of reserve adequacy testing. The National Association of Insurance Commissioners reports that improper reserve calculations contributed to 18% of regulatory enforcement actions in 2024, highlighting the critical importance of understanding these sophisticated financial mechanisms.

Modern actuarial science demands precise premium deficiency reserve calculations that balance policyholder protection with operational efficiency. Companies must navigate evolving NAIC guidelines while maintaining comprehensive regulatory compliance requirements that encompass multiple statutory accounting principles and reserve testing methodologies across diverse insurance product lines.

This comprehensive analysis examines premium deficiency reserve requirements, calculation methodologies, and regulatory compliance standards essential for insurance industry professionals and stakeholders.

On This Page

Essential Overview

Premium deficiency reserve represents statutory reserves established when unearned premium and anticipated investment income prove insufficient to cover expected claims, expenses, and maintenance costs for remaining policy coverage periods.

What Are Premium Deficiency Reserves Under NAIC Standards

Premium deficiency reserve constitutes a mandatory statutory liability established when an insurance company’s unearned premium reserves, combined with anticipated investment income, cannot adequately cover expected future claims, claim adjustment expenses, and policy maintenance costs for unexpired coverage periods. This reserve mechanism serves as a critical financial safeguard ensuring policyholder protection and regulatory compliance.

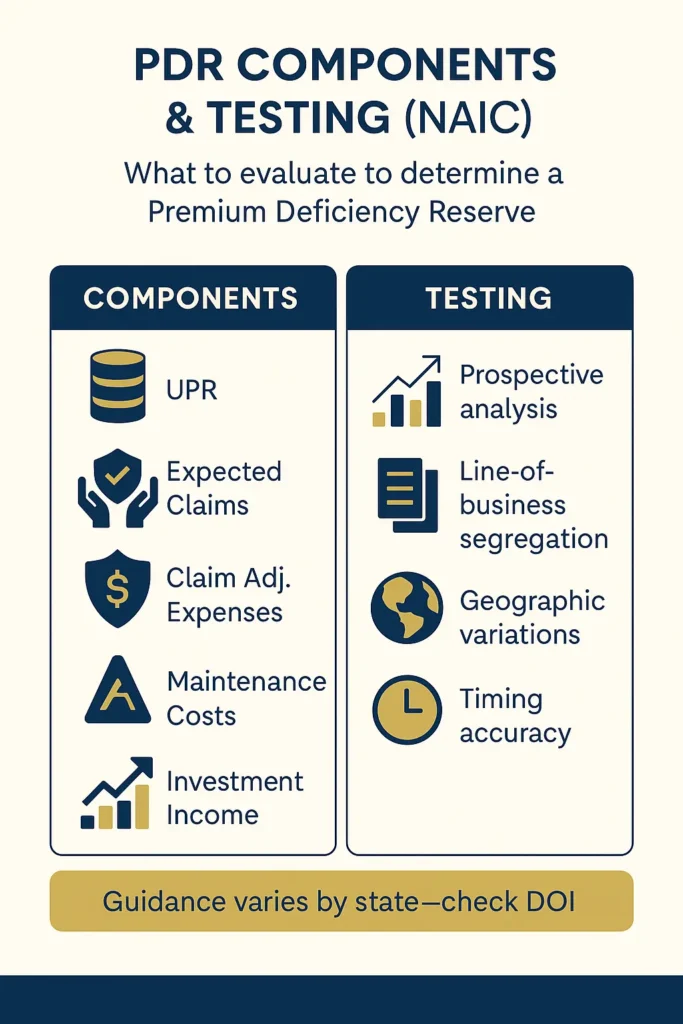

Key Components of Premium Deficiency Reserve Calculations:

| Component | Description | Calculation Impact |

|---|---|---|

| Unearned Premium | Portion of premium collected but not yet earned | Primary reserve base |

| Expected Claims | Projected claim payments for coverage period | Major cost factor |

| Claim Adjustment Expenses | Administrative costs for claim processing | Secondary cost element |

| Policy Maintenance Costs | Ongoing administrative expenses | Operational consideration |

| Investment Income | Anticipated returns on reserve funds | Offsetting revenue |

The premium deficiency reserve calculation process requires actuarial analysis of multiple risk factors including claim frequency trends, severity patterns, and expense inflation projections. Insurance companies must evaluate these components at the individual line of business level, ensuring that reserve adequacy testing captures product-specific risk characteristics and regulatory requirements.

Modern premium deficiency reserve calculations incorporate sophisticated actuarial models that analyze historical claim patterns, emerging trends, and economic conditions affecting future liabilities. Companies typically perform these calculations quarterly, with annual comprehensive reviews ensuring ongoing compliance with evolving NAIC statutory accounting principles.

Critical Testing Requirements:

- Prospective Analysis: Evaluation of future liabilities versus available resources

- Line-of-Business Segregation: Separate testing for each insurance product category

- Geographic Considerations: State-specific regulatory variations and claim patterns

- Temporal Accuracy: Precise timing of cash flows and liability recognition

State insurance departments require detailed documentation supporting premium deficiency reserve calculations, including actuarial memoranda explaining methodologies, assumptions, and sensitivity testing results. This documentation serves as evidence of proper fiduciary responsibility and regulatory compliance during examination processes.

How Premium Deficiency Reserve Calculations Work in Practice

Premium deficiency reserve calculations follow standardized actuarial methodologies prescribed by NAIC Statement of Statutory Accounting Principles Number 54, requiring systematic evaluation of prospective cash flows for unexpired policy coverage periods. The calculation process begins with comprehensive analysis of unearned premium balances and progresses through detailed projections of expected claims, expenses, and investment income.

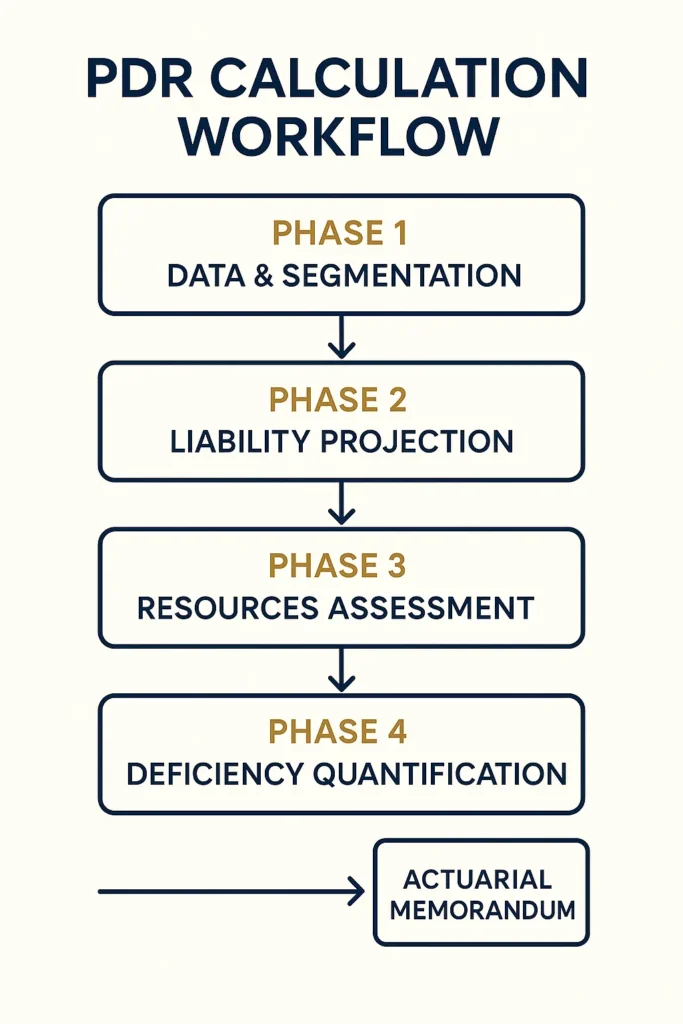

Step-by-Step Calculation Process:

Phase 1: Data Collection and Segmentation Insurance companies must organize policy data by line of business, geographic region, and coverage period to ensure accurate reserve testing. This segmentation enables precise analysis of risk characteristics and regulatory requirements specific to each insurance product category.

Phase 2: Liability Projection Modeling Actuaries develop prospective models estimating future claims payments, claim adjustment expenses, and policy maintenance costs for remaining coverage periods. These projections incorporate historical claim patterns, emerging trends, and economic factors affecting liability development.

Phase 3: Resource Availability Assessment Companies calculate available resources including unearned premium balances and anticipated investment income from reserve funds. This assessment requires careful consideration of investment portfolio composition, expected returns, and liquidity requirements.

Phase 4: Deficiency Identification and Quantification The premium deficiency reserve equals the excess of projected liabilities over available resources when liabilities exceed resources. If available resources exceed projected liabilities, no deficiency reserve is required for that particular line of business or coverage period.

Calculation Formula Framework:

| Calculation Element | Formula Component | Regulatory Consideration |

|---|---|---|

| Expected Claims | Historical patterns + trend factors | State-specific development |

| Claim Expenses | Administrative costs × expense ratios | Inflation adjustments |

| Maintenance Costs | Policy administration + regulatory fees | Operational efficiency |

| Investment Income | Portfolio yield × reserve duration | Credit risk adjustments |

| Deficiency Amount | (Liabilities) – (Unearned Premium + Investment Income) | Positive values only |

Modern actuarial software enables sophisticated premium deficiency reserve calculations incorporating Monte Carlo simulations, stochastic modeling, and sensitivity analysis. These advanced techniques help insurance companies understand potential variability in reserve requirements and develop appropriate risk management strategies.

Documentation Requirements for Regulatory Compliance:

State insurance departments expect comprehensive documentation supporting these reserve calculations, including detailed actuarial memoranda explaining methodologies, key assumptions, and sensitivity testing results. This documentation must demonstrate compliance with professional liability insurance protection standards and actuarial best practices.

Medicare Premium Deficiency Reserve Requirements and Healthcare Applications

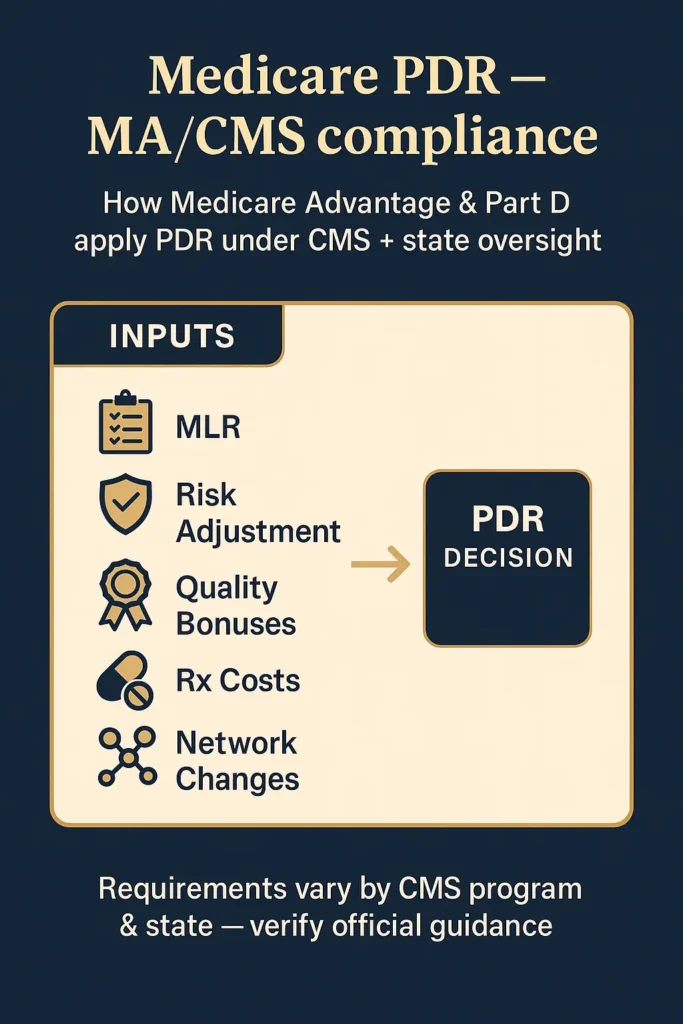

PDR requirements for Medicare-related insurance products involve specialized calculations addressing unique healthcare industry characteristics, regulatory oversight, and Centers for Medicare & Medicaid Services compliance standards. Medicare Advantage plans, Medicare Supplement policies, and Medicare Part D prescription drug coverage each require distinct actuarial approaches reflecting product-specific risk profiles and federal regulatory requirements.

Medicare Advantage Premium Deficiency Reserve Considerations:

Medicare Advantage organizations must evaluate premium deficiency reserve requirements considering federal capitation payments, member premiums, and projected medical costs for remaining contract periods. These calculations incorporate medical loss ratio requirements, quality bonus payments, and risk adjustment mechanisms specific to Medicare Advantage program operations.

Key Healthcare-Specific Factors:

| Healthcare Element | Premium Impact | Reserve Calculation |

|---|---|---|

| Medical Loss Ratios | Minimum benefit requirements | Claims projection accuracy |

| Risk Adjustment | Member acuity variations | Actuarial factor calibration |

| Quality Bonuses | Performance-based payments | Revenue projection uncertainty |

| Prescription Drug Costs | Formulary management | Trend factor applications |

| Provider Network Changes | Access and cost implications | Expense assumption updates |

Medicare Supplement insurance carriers face distinct premium deficiency reserve challenges related to guaranteed renewable policies, aging policyholder populations, and medical cost inflation exceeding general economic trends. These factors require sophisticated actuarial modeling incorporating longevity improvements, morbidity changes, and healthcare utilization patterns.

Federal Regulatory Coordination Requirements:

Insurance companies offering Medicare-related products must coordinate PDR calculations with both state insurance department requirements and federal oversight from CMS. This dual regulatory environment necessitates careful documentation ensuring compliance with both statutory accounting principles and federal program requirements.

Deficiency reserve testing for Medicare products typically involves quarterly calculations with comprehensive annual reviews addressing changing demographics, medical cost trends, and regulatory modifications. Companies must maintain detailed documentation supporting reserve adequacy decisions, including sensitivity testing demonstrating reserve sufficiency under various economic and utilization scenarios.

Healthcare Industry Best Practices:

Modern Medicare-focused insurers employ predictive analytics, machine learning algorithms, and population health management data to enhance PDR accuracy. These advanced techniques enable more precise projection of medical costs, administrative expenses, and member behavior patterns affecting reserve requirements.

State insurance departments recognize the unique complexities of Medicare-related deficiency reserve calculations and often provide specialized examination procedures addressing healthcare industry characteristics. Examiners focus on actuarial assumption reasonableness, methodology consistency, and compliance with both state and federal regulatory requirements.

PDR Calculation Methodologies and Actuarial Standards

Reserve adequacy calculation methodologies require sophisticated actuarial analysis incorporating multiple variables, regulatory standards, and industry best practices to ensure accurate reserve determination and ongoing compliance with statutory accounting principles. Modern PDR calculations employ advanced statistical techniques, predictive modeling, and sensitivity analysis to address the inherent uncertainty in prospective liability estimation.

Primary Actuarial Methodologies:

Deterministic Approach: Traditional deficiency reserve calculations utilize deterministic models incorporating single-point estimates for key variables including claim frequency, severity, expenses, and investment returns. This methodology provides baseline reserve estimates suitable for routine quarterly calculations and regulatory reporting requirements.

Stochastic Modeling Techniques: Advanced actuarial practices incorporate stochastic modeling enabling analysis of reserve requirement variability under different economic scenarios, claim development patterns, and operational conditions. These techniques provide enhanced understanding of potential reserve adequacy risks and support more informed capital management decisions.

Key Calculation Variables and Assumptions:

| Actuarial Variable | Calculation Impact | Regulatory Consideration |

|---|---|---|

| Claim Development Factors | Future liability projection | Historical pattern analysis |

| Expense Inflation Rates | Administrative cost trends | Economic environment assessment |

| Investment Yield Assumptions | Income offset calculations | Portfolio risk evaluation |

| Policy Lapse Rates | Coverage period adjustments | Product line considerations |

| Catastrophe Provisions | Extreme event allowances | Geographic risk factors |

Premium deficiency reserve calculations must address temporal considerations including claim reporting delays, settlement patterns, and cash flow timing affecting present value calculations. Actuaries employ discounting techniques consistent with statutory accounting principles while ensuring conservative assumptions appropriate for policyholder protection.

Quality Control and Validation Procedures:

Modern actuarial practices require comprehensive validation procedures ensuring premium deficiency reserve calculation accuracy and regulatory compliance. These procedures include back-testing of previous reserve estimates, sensitivity analysis of key assumptions, and peer review of methodologies and results.

Documentation Standards for Regulatory Examination:

State insurance departments expect detailed actuarial documentation supporting premium deficiency reserve calculations, including comprehensive memoranda explaining methodologies, assumption development, and sensitivity testing results. This documentation must demonstrate compliance with Actuarial Standards of Practice and state-specific regulatory requirements.

Technology Integration and Automation:

Contemporary insurance companies leverage advanced actuarial software platforms enabling automated premium deficiency reserve calculations, scenario analysis, and regulatory reporting. These systems enhance calculation accuracy, reduce operational risk, and support more frequent reserve monitoring addressing changing business conditions.

Professional actuarial organizations provide ongoing guidance regarding PDR calculation best practices, emerging methodologies, and regulatory developments affecting reserve requirements. Insurance companies must stay current with these professional standards to maintain actuarial credibility and regulatory compliance.

Differences Between Claims Reserves and Premium Reserves

PDR and claims reserves serve distinct functions within insurance company financial reporting, addressing different aspects of policyholder obligations and regulatory requirements under statutory accounting principles. Understanding these fundamental differences enables proper financial management, accurate regulatory reporting, and effective capital allocation decisions across insurance operations.

Claims Reserve Characteristics and Functions:

Claims reserves represent estimated liabilities for reported claims and incurred but not reported losses, addressing past events affecting current and future cash flows. These reserves focus on claims that have already occurred, requiring actuarial estimation of ultimate settlement costs, claim adjustment expenses, and payment timing patterns.

Premium Reserve Functions and Applications:

Premium reserves, including unearned premium and premium deficiency reserve components, address future obligations arising from unexpired policy coverage periods. These reserves ensure adequate resources for prospective claims, expenses, and administrative costs during remaining policy terms.

Fundamental Operational Differences:

| Reserve Type | Time Orientation | Calculation Basis | Regulatory Purpose |

|---|---|---|---|

| Claims Reserves | Retrospective analysis | Historical loss development | Past event obligations |

| Premium Deficiency Reserve | Prospective analysis | Future liability projection | Future coverage adequacy |

| Unearned Premium | Coverage period tracking | Premium collection timing | Earned revenue recognition |

| Loss Adjustment Expense | Claims processing costs | Administrative expense patterns | Settlement cost provisions |

Premium deficiency reserve calculations require forward-looking analysis incorporating assumptions about future claim frequency, severity trends, expense inflation, and investment income potential. This prospective orientation contrasts with claims reserve methodologies that analyze historical claim development patterns and settlement experience.

Regulatory Treatment and Reporting Requirements:

State insurance departments require separate disclosure and analysis of premium deficiency reserve and claims reserves, recognizing their distinct functions in policyholder protection and company solvency assessment. Regulatory examination procedures address different risk factors, calculation methodologies, and documentation requirements for each reserve category.

Capital Impact and Management Considerations:

Premium deficiency reserve establishment immediately impacts statutory surplus, requiring companies to evaluate potential capital implications during business planning and pricing decisions. Claims reserves affect surplus through development gains or losses as actual experience emerges relative to original estimates.

Actuarial Profession Standards:

Professional actuarial standards provide distinct guidance for PDR versus claims reserve calculations, recognizing different methodological requirements, assumption development processes, and validation procedures. Actuaries must demonstrate competency in both areas to effectively support insurance company operations and regulatory compliance.

Modern insurance companies employ integrated actuarial systems enabling coordinated analysis of deficiency reserves and claims reserves, ensuring consistency in assumption development and facilitating comprehensive capital adequacy assessment. These systems support business insurance compliance requirements and enhance overall financial management capabilities.

Healthcare PDR Applications and Industry-Specific Considerations

Premium deficiency reserve applications in healthcare insurance involve specialized calculations addressing unique industry characteristics including medical cost inflation, regulatory requirements, and product design features specific to health insurance coverage. Healthcare insurers must navigate complex federal and state regulatory environments while maintaining adequate reserves for policyholder protection and operational sustainability.

Health Insurance Product Categories Requiring PDR Analysis:

Individual Health Insurance Markets: Individual health insurance policies sold through state exchanges and direct markets require premium deficiency reserve calculations considering medical loss ratio requirements, guaranteed issue provisions, and community rating restrictions. These factors create unique actuarial challenges requiring sophisticated modeling of member behavior, medical utilization, and cost trends.

Group Health Insurance Programs: Employer-sponsored group health insurance plans involve premium deficiency reserve calculations addressing experience rating, stop-loss coverage, and administrative cost variations. Large group markets require consideration of self-insurance options, medical management programs, and employer risk-sharing arrangements affecting reserve adequacy.

Healthcare-Specific Actuarial Considerations:

| Healthcare Factor | Reserve Impact | Calculation Adjustment |

|---|---|---|

| Medical Cost Trends | Primary cost driver | Trend factor application |

| Prescription Drug Inflation | Formulary cost management | Pharmacy benefit modeling |

| Provider Network Changes | Access and cost implications | Network adequacy provisions |

| Regulatory Changes | Benefit mandate modifications | Compliance cost assessment |

| Medical Technology | Treatment cost evolution | Innovation impact analysis |

Federal Regulatory Coordination Requirements:

Healthcare insurers operating in multiple states must coordinate premium deficiency reserve calculations with Affordable Care Act requirements, including medical loss ratio compliance, essential health benefit provisions, and risk adjustment program participation. This regulatory complexity requires specialized actuarial expertise and comprehensive documentation supporting reserve adequacy decisions.

Risk Adjustment and Premium Stabilization Programs:

Federal risk adjustment, reinsurance, and risk corridor programs affect premium deficiency reserve calculations for qualified health plans, requiring careful analysis of program mechanics, timing considerations, and settlement procedures. These programs create additional complexity in reserve adequacy testing and financial reporting.

Healthcare Industry Best Practices:

Modern healthcare insurers employ advanced analytics, population health management data, and predictive modeling techniques to enhance premium deficiency reserve accuracy. These approaches enable more precise estimation of medical costs, administrative expenses, and member behavior patterns affecting reserve requirements.

State insurance departments provide specialized examination procedures for healthcare premium deficiency reserve calculations, recognizing industry-specific challenges and regulatory requirements. Examiners focus on medical cost assumption reasonableness, methodology consistency, and compliance with both insurance and healthcare regulatory standards.

FAQ

What triggers the need for a premium deficiency reserve?

Premium deficiency reserve becomes necessary when an insurance company’s actuarial analysis demonstrates that unearned premium reserves plus anticipated investment income cannot adequately cover expected future claims, claim adjustment expenses, and policy maintenance costs for unexpired coverage periods. This situation typically arises from inadequate original pricing, emerging claim trends exceeding expectations, or significant changes in economic conditions affecting investment returns or expense levels.

How often must insurance companies calculate premium deficiency reserves?

NAIC statutory accounting principles require insurance companies to perform premium deficiency reserve calculations at least quarterly as part of regular financial reporting processes. However, companies must also conduct calculations whenever significant changes occur in business conditions, claim experience, or economic factors that could affect reserve adequacy. Annual comprehensive reviews involving detailed actuarial analysis and documentation are standard industry practice.

Can premium deficiency reserves be released back to surplus?

Premium deficiency reserve can be released to statutory surplus when subsequent actuarial analysis demonstrates that unearned premium and anticipated investment income again become sufficient to cover expected future obligations. This typically occurs through favorable claim development, improved investment performance, or changes in expense assumptions. However, releases require careful actuarial documentation and regulatory approval in some jurisdictions.

What documentation do regulators require for PDR calculations?

State insurance departments require comprehensive actuarial memoranda supporting premium deficiency reserve calculations, including detailed explanations of methodologies, key assumptions, data sources, and sensitivity testing results. Documentation must demonstrate compliance with professional actuarial standards, statutory accounting principles, and state-specific regulatory requirements. Regular examination processes focus heavily on reserve adequacy testing and supporting documentation quality.

How do premium deficiency reserves affect insurance company ratings?

Premium deficiency reserve establishment can negatively impact insurance company financial strength ratings by reducing statutory surplus and indicating potential pricing inadequacy or reserve deficiencies. Rating agencies analyze reserve adequacy trends, calculation methodologies, and management’s response to deficiency situations when assessing overall financial stability and operational effectiveness. Significant or recurring deficiency reserves may trigger rating downgrades or negative outlook assignments.

Are there industry-specific variations in PDR requirements?

Different insurance lines require specialized premium deficiency reserve approaches reflecting unique risk characteristics, regulatory requirements, and product features. Healthcare insurance involves federal compliance considerations, while workers’ compensation requires state-specific regulatory coordination. Professional liability insurance demands longer-tail development analysis, and personal lines require consideration of catastrophe exposures and geographic concentration risks.

Conclusion

Premium deficiency reserve represents a critical component of insurance company financial management, serving as an essential safeguard ensuring adequate resources for policyholder obligations while maintaining regulatory compliance across diverse insurance markets. The sophisticated actuarial calculations required for PDR determination demand comprehensive understanding of prospective liability analysis, statutory accounting principles, and evolving regulatory requirements affecting insurance operations.

Modern insurance companies must employ advanced actuarial methodologies, technology platforms, and risk management practices to effectively calculate and maintain premium deficiency reserve requirements. The increasing complexity of insurance products, regulatory environments, and economic conditions necessitates ongoing investment in actuarial capabilities, documentation procedures, and quality control systems supporting accurate reserve determination.

Key Takeaways

Essential PDR Requirements: Insurance companies must establish premium deficiency reserve when unearned premium and anticipated investment income prove insufficient to cover expected future claims, expenses, and maintenance costs for unexpired policy coverage periods.

Calculation Complexity: Premium deficiency reserve calculations require sophisticated actuarial analysis incorporating multiple variables including claim projections, expense trends, investment income assumptions, and regulatory requirements specific to different insurance product lines.

Regulatory Compliance: State insurance departments require detailed documentation supporting PDR calculations, including comprehensive actuarial memoranda explaining methodologies, assumptions, and sensitivity testing results demonstrating reserve adequacy and regulatory compliance.

Industry Applications: Healthcare insurance, workers’ compensation, professional liability, and other specialized insurance lines require unique premium deficiency reserve approaches addressing product-specific risk characteristics and regulatory requirements.

Financial Impact: Premium deficiency reserve establishment directly affects statutory surplus, capital adequacy, and financial strength ratings, requiring careful integration with business planning, pricing decisions, and capital management strategies.

Disclaimer

Data Freshness: Insurance rates and regulations change frequently. Data accuracy depends on timing of official releases from state insurance departments and federal regulatory agencies.

Geographic Variations: Insurance requirements vary significantly by state and product line. Always consult your state’s insurance department and relevant federal agencies for current regulatory requirements.

Professional Advice: This information is for educational purposes only. Premium deficiency reserve calculations and insurance company financial management decisions should be made in consultation with qualified actuarial professionals and regulatory compliance experts.