Average roof replacement insurance cost claims range from $8,000 to $16,000 annually according to the NAIC 2024 Property Insurance Market Report, yet 43% of homeowners remain unaware of their actual dwelling coverage limits. Understanding how insurance covers roof replacement costs becomes critical when facing storm damage, aging materials, or structural failures that threaten your home’s protective barrier.

Homeowners frequently discover coverage gaps only after filing claims, often learning that their homeowners policy provides actual cash value rather than full replacement cost coverage. The difference between these coverage types can mean thousands of dollars in out-of-pocket expenses, especially when depreciation reduces claim payouts by 20-40% for roofs over ten years old.

Learning about dwelling coverage components and deductible structures helps homeowners make informed decisions about comprehensive home insurance coverage before emergencies arise. Professional claims adjusters recommend understanding policy exclusions, coverage limits, and documentation requirements to maximize insurance benefits when roof replacement becomes necessary.

This comprehensive analysis examines insurance coverage for roof replacement costs, claim processing procedures, and strategies for optimizing your homeowners policy benefits in 2025. Understanding roof replacement insurance cost variables helps homeowners prepare for potential claims and maximize coverage benefits when roofing emergencies occur.

On This Page

Essential Overview

Insurance typically covers roof replacement costs when damage results from covered perils like storms or fire, subject to deductible amounts and coverage type limits that vary significantly between actual cash value and replacement cost policies.

When Does Insurance Cover Roof Replacement Costs?

Insurance coverage for roof replacement depends primarily on the cause of damage and specific policy terms outlined in your homeowners policy. Understanding roof replacement insurance cost eligibility requires careful evaluation of covered perils versus excluded maintenance issues. According to NAIC homeowners insurance guidelines, covered perils typically include wind damage, hail, fire, lightning, and falling objects, while maintenance-related deterioration remains excluded from standard policies.

Coverage Triggering Events:

| Covered Perils | Coverage Status | Typical Claim Range |

|---|---|---|

| Storm damage (wind/hail) | ✅ Fully covered | $8,000-$25,000 |

| Fire damage | ✅ Fully covered | $12,000-$40,000 |

| Falling trees/debris | ✅ Covered if sudden | $5,000-$15,000 |

| Age-related wear | ❌ Not covered | $0 |

| Poor maintenance | ❌ Not covered | $0 |

| Flood damage | ❌ Requires separate policy | $0 |

The Insurance Information Institute reports that weather-related roof damage accounts for 78% of all dwelling coverage claims nationwide as of 2024. Wind damage claims average $9,100 per incident, while hail damage claims typically range from $5,000 to $20,000 depending on roof size and materials. These statistics highlight the importance of understanding roof replacement insurance cost coverage before damage occurs.

PRO TIP: Document your roof’s condition annually with photographs and maintenance records. This evidence proves proper upkeep if disputes arise about coverage eligibility.

Insurance companies require clear evidence that damage resulted from a sudden, covered event rather than gradual deterioration. Claims adjusters evaluate damage patterns, timing of reported incidents, and maintenance history when determining coverage eligibility for roof replacement costs.

How Much Does Roof Replacement Insurance Coverage Pay?

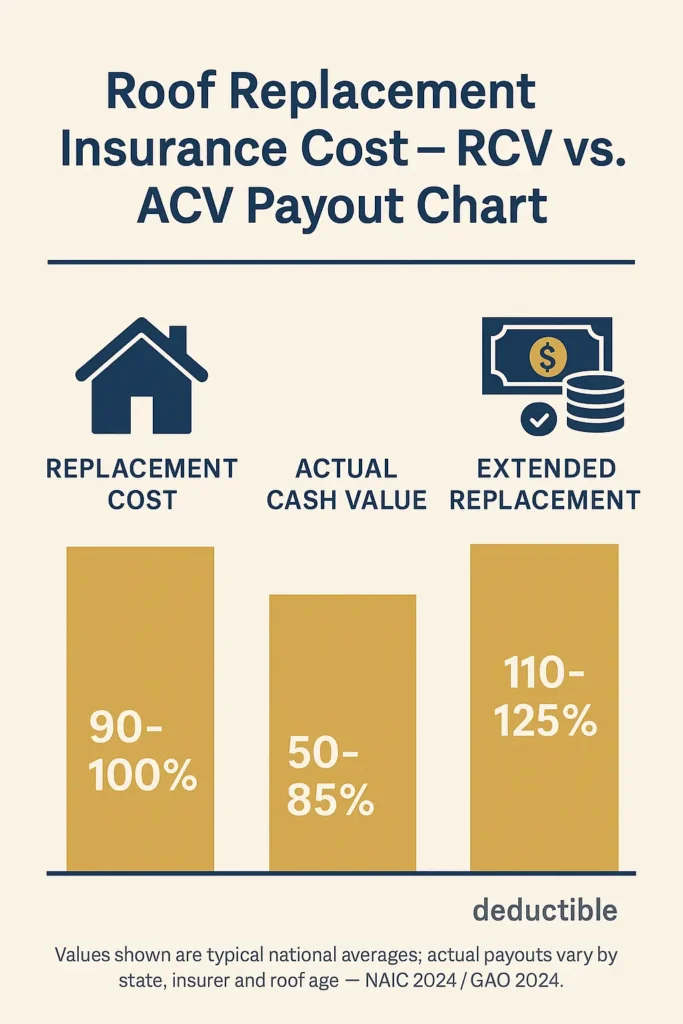

The amount insurance pays for roof replacement costs depends on your policy’s coverage type, deductible amount, and dwelling coverage limits. Replacement cost coverage pays the full amount needed to rebuild with similar materials, while actual cash value coverage deducts depreciation from claim settlements.

GAO insurance industry analysis reveals significant variations in claim payouts based on coverage type and roof age. Replacement cost policies typically pay 85-100% of roof replacement costs after deductible, while actual cash value policies may only cover 50-70% for roofs over fifteen years old.

Coverage Type Comparison:

| Coverage Type | Payout Calculation | Average Settlement | Best For |

|---|---|---|---|

| Replacement Cost | Full rebuild cost minus deductible | 90-100% of costs | Newer homes |

| Actual Cash Value | Replacement cost minus depreciation | 50-85% of costs | Older homes |

| Extended Replacement | 110-125% of dwelling limit | 100-125% of costs | High-value homes |

| Functional Replacement | Similar function, lower cost materials | 70-90% of costs | Budget policies |

Deductible amounts significantly impact out-of-pocket expenses for roof replacement insurance cost calculations. Standard homeowners policies feature deductibles ranging from $500 to $2,500, though wind and hail deductibles may be percentage-based (1-5% of dwelling coverage) in storm-prone regions.

IMPORTANT NOTE: Review your dwelling coverage components annually to ensure limits match current replacement costs. Inflation has increased construction costs by 23% since 2020.

The National Association of Insurance Commissioners reports that average dwelling coverage limits range from $200,000 to $400,000 across U.S. markets, though actual roof replacement costs vary dramatically by region, materials, and labor availability. Homeowners should regularly review their coverage limits to ensure adequate protection for current roof replacement insurance cost levels in their specific markets.

What Factors Affect Insurance Roof Replacement Claims?

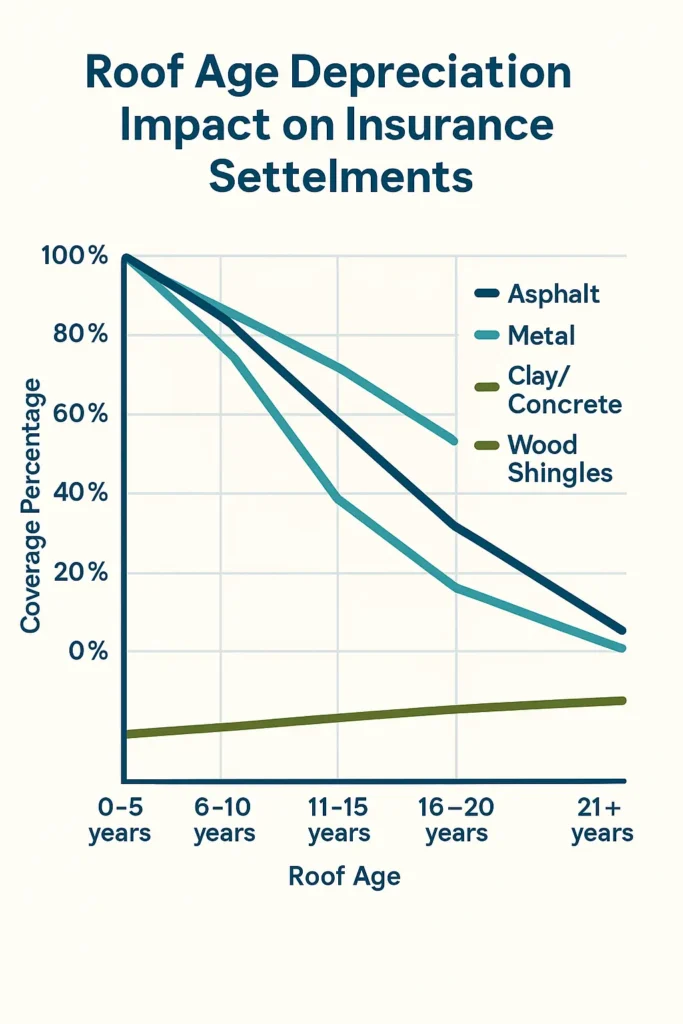

Multiple factors influence how insurance companies evaluate and settle roof replacement insurance cost claims, including roof age, material type, local building codes, and documentation quality. Understanding these variables helps homeowners prepare stronger claims and avoid common settlement disputes while minimizing out-of-pocket roof replacement insurance cost expenses.

Roof age represents the primary factor affecting claim settlements, as depreciation schedules reduce payouts for older roofing materials. The Treasury Department housing policy indicates that asphalt shingles depreciate at approximately 4-6% annually, while metal roofing depreciates at 2-3% annually due to longer lifespans.

Age-Based Depreciation Schedule:

| Roof Age | Asphalt Shingles | Metal Roofing | Clay/Concrete Tiles | Wood Shingles |

|---|---|---|---|---|

| 0-5 years | 100% coverage | 100% coverage | 100% coverage | 100% coverage |

| 6-10 years | 85-95% coverage | 90-98% coverage | 95-100% coverage | 80-90% coverage |

| 11-15 years | 70-85% coverage | 85-95% coverage | 90-98% coverage | 60-80% coverage |

| 16-20 years | 50-70% coverage | 80-90% coverage | 85-95% coverage | 40-60% coverage |

| 21+ years | 25-50% coverage | 75-85% coverage | 80-90% coverage | 20-40% coverage |

Material quality and local building code requirements affect replacement costs and insurance settlements. Hurricane-resistant shingles, impact-rated materials, and enhanced installation methods may increase costs but often qualify for insurance discounts ranging from 5-15% on premiums.

WARNING: Policy exclusions may limit coverage for specific materials or installation methods. Review your policy’s dwelling coverage section for material restrictions or upgrade limitations.

Claims adjusters evaluate damage extent, repair versus replacement necessity, and compliance with current building codes when calculating roof replacement insurance cost settlements. Proper documentation and professional assessments significantly improve claim outcomes and reduce roof replacement insurance cost disputes.

How Do Age and Material Impact Insurance Coverage?

Roof age and material composition directly influence insurance coverage availability, premium costs, and claim settlement amounts for roof replacement insurance cost calculations. Insurance companies assess risk based on expected lifespan, durability, and maintenance requirements of different roofing materials, with newer materials typically qualifying for better roof replacement insurance cost coverage terms.

The FEMA home protection standards establish minimum performance criteria for roofing materials in different climate zones, affecting both insurance eligibility and premium pricing. Homes with roofs exceeding 20 years old may face coverage restrictions or require professional inspections to maintain full dwelling coverage.

Material-Based Coverage Guidelines:

| Material Type | Typical Lifespan | Insurance Rating | Premium Impact | Coverage Notes |

|---|---|---|---|---|

| Asphalt Shingles | 15-25 years | Standard | Baseline rates | Most common, standard coverage |

| Metal Roofing | 30-50 years | Preferred | 5-10% discount | Lower claim frequency |

| Clay/Concrete Tiles | 40-100 years | Preferred | 10-15% discount | Excellent durability |

| Wood Shingles | 20-30 years | Restricted | 10-25% surcharge | Fire risk concerns |

| Slate | 75-100+ years | Premium | 15-20% discount | Superior longevity |

Geographic location significantly affects material requirements and insurance considerations for roof replacement costs. Hurricane-prone regions require impact-resistant materials, while fire-prone areas may restrict wood shingles or require specific treatments for coverage eligibility. These regional variations directly impact roof replacement insurance cost calculations and coverage availability.

PRO TIP: Consider specialized coverage requirements when selecting roofing materials in high-risk areas. Some materials qualify for additional discounts or enhanced coverage terms.

Insurance companies increasingly require professional roof inspections for homes with roofs over 15 years old, particularly in severe weather regions. These inspections assess structural integrity, material condition, and maintenance history to determine continued coverage eligibility and premium pricing.

Age-related coverage limitations may include percentage deductibles for wind and hail damage, reduced coverage limits, or requirements for specific materials during replacement to maintain full dwelling coverage benefits.

What Documentation Is Required for Roof Insurance Claims?

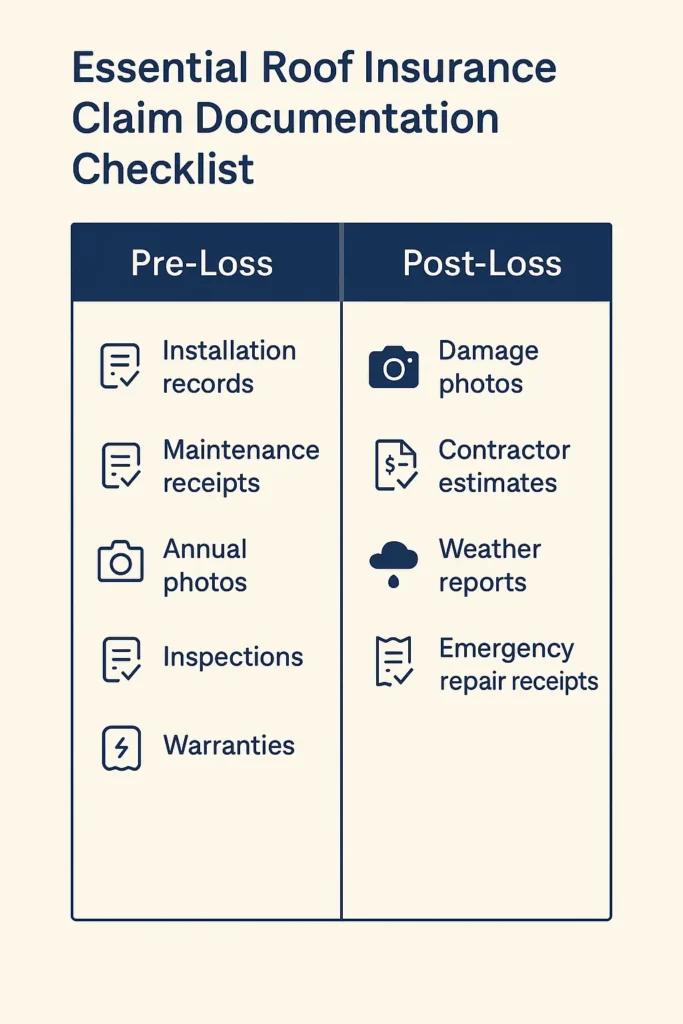

Proper documentation forms the foundation of successful roof replacement insurance cost claims, requiring systematic record-keeping before damage occurs and comprehensive evidence collection afterward. Insurance companies demand specific documentation to verify coverage eligibility and calculate appropriate settlement amounts, making preparation essential for optimal roof replacement insurance cost outcomes.

Pre-loss documentation establishes baseline conditions and proves proper maintenance, critical factors in coverage determinations. The Insurance Information Institute recommends maintaining detailed records including installation dates, material specifications, maintenance receipts, and annual condition photographs.

Essential Pre-Loss Documentation:

| Document Type | Purpose | Retention Period | Storage Recommendation |

|---|---|---|---|

| Installation records | Prove material quality and workmanship | Lifetime of roof | Digital and physical copies |

| Maintenance receipts | Demonstrate proper upkeep | 10 years minimum | Cloud storage backup |

| Annual photographs | Document condition changes | Continuous | Dated digital files |

| Professional inspections | Verify structural integrity | 5 years | Insurance company copies |

| Warranty documents | Support material defect claims | Warranty period | Fireproof storage |

Post-loss documentation must capture damage extent, repair estimates, and temporary protection measures taken to prevent additional damage. Professional claims processing procedures require specific formats and timeframes for optimal settlement outcomes.

IMPORTANT NOTE: Report damage within 24-48 hours of discovery and take immediate steps to prevent additional damage. Failure to mitigate losses may reduce claim settlements.

Post-Loss Documentation Requirements:

- Immediate damage photographs from multiple angles

- Professional contractor estimates (minimum of three)

- Weather reports confirming covered peril timing

- Receipts for emergency repairs and temporary protection

- Documentation of personal property affected by roof damage

Claims adjusters evaluate documentation quality when determining settlement amounts and processing timeframes. Complete, organized records typically result in faster claim resolution and more favorable settlements for roof replacement insurance cost claims. Understanding documentation requirements helps homeowners prepare stronger cases and avoid common roof replacement insurance cost disputes.

Digital documentation systems with cloud backup ensure accessibility during claim processes, particularly important when homes suffer extensive damage requiring temporary relocation during roof replacement projects.

How Can You Maximize Your Roof Replacement Insurance Benefits?

Maximizing roof replacement insurance cost benefits requires proactive policy management, strategic timing of claims, and understanding of coverage optimization techniques. Homeowners can significantly improve claim outcomes through proper preparation and informed decision-making about coverage options, ultimately reducing their financial exposure to roof replacement insurance cost burdens during emergencies.

Policy review and updates ensure adequate coverage limits and optimal deductible structures for current market conditions. The National Association of Realtors reports construction cost increases of 23% since 2020, requiring corresponding adjustments to dwelling coverage limits for adequate protection against rising roof replacement insurance cost trends.

Coverage Optimization Strategies:

| Strategy | Benefit | Implementation | Cost Impact |

|---|---|---|---|

| Increase dwelling limits | Full replacement coverage | Annual policy review | 5-15% premium increase |

| Lower deductibles | Reduced out-of-pocket costs | Policy amendment | 10-25% premium increase |

| Add replacement cost coverage | Eliminates depreciation | Policy upgrade | 15-30% premium increase |

| Material upgrade coverage | Premium materials allowed | Endorsement addition | 5-10% premium increase |

Understanding federal emergency management regulations helps homeowners navigate complex claim requirements and benefit maximization opportunities. Some regions offer enhanced coverage options or state-sponsored programs for specific risks like hurricanes or wildfires that can reduce overall roof replacement insurance cost burdens.

PRO TIP: Implement cost reduction strategies like security systems, impact-resistant materials, and maintenance programs to qualify for premium discounts while maintaining comprehensive coverage.

Timing considerations affect claim outcomes, particularly for policies with calendar-year deductibles or specific coverage periods. Understanding your policy’s terms allows strategic planning for major repairs or replacements to maximize insurance benefits.

Strategic contractor selection influences both repair quality and insurance settlements. Choose contractors experienced with insurance claims who understand documentation requirements and can work effectively with claims adjusters to ensure fair settlements.

Professional consultation with licensed insurance agents or public adjusters may improve complex claim outcomes, particularly for high-value properties or disputed settlements. These professionals understand insurance company procedures and can advocate for optimal settlements within policy terms, often reducing overall roof replacement insurance cost exposure through strategic claim management.

FAQ

Will insurance pay for roof replacement?

Insurance will pay for roof replacement when damage results from covered perils like storms, fire, or sudden accidents, subject to your deductible and coverage limits. Coverage excludes normal wear, poor maintenance, or gradual deterioration. The amount paid depends on whether you have replacement cost or actual cash value coverage, significantly affecting your overall roof replacement insurance cost responsibility.

How much will my insurance go down if I get a new roof?

Insurance premiums may decrease 5-15% with a new roof, particularly when using impact-resistant materials or hurricane-rated shingles. Premium reductions vary by location, material type, and insurance company. Some insurers offer immediate discounts, while others require inspection verification of the new installation.

How much does insurance cost for a roofing company?

Commercial roofing companies typically pay $3,000-$8,000 annually for general liability insurance, plus $2,000-$5,000 for workers compensation coverage. Costs vary based on company size, location, claims history, and coverage limits. Additional bonds and professional liability coverage may increase total insurance expenses.

Will insurance cover a 10 year old roof?

Insurance typically covers a 10-year-old roof for damage from covered perils, though claim settlements may include depreciation deductions. Actual cash value policies reduce payouts by 15-30% for roof age, while replacement cost coverage provides full rebuilding costs. Coverage eligibility depends on maintenance history and current condition.

Is it worth claiming roof damage on insurance?

Filing roof damage claims is worthwhile when repair costs exceed your deductible by at least $2,000-$3,000, considering potential premium increases. Claims for storm damage typically don’t affect rates, while multiple claims may impact future coverage. Document all damage and obtain professional estimates before deciding whether to file, as proper evaluation helps determine if roof replacement insurance cost claims justify potential rate impacts.

Conclusion

Understanding roof replacement insurance cost coverage requires comprehensive knowledge of policy terms, coverage types, and claim procedures that significantly impact financial outcomes for homeowners. The difference between replacement cost and actual cash value coverage can mean thousands of dollars in out-of-pocket expenses, particularly for homes with aging roofing materials where roof replacement insurance cost considerations become more complex.

Proactive policy management, including regular coverage limit reviews and strategic deductible selection, helps homeowners optimize their insurance benefits while maintaining adequate protection. Proper documentation, both before and after damage occurs, forms the foundation of successful claims that maximize insurance settlements within policy terms.

Key Takeaways

- Coverage depends on cause: Insurance covers roof replacement for sudden damage from covered perils but excludes normal wear and poor maintenance

- Coverage type matters: Replacement cost coverage pays full rebuilding costs while actual cash value deducts depreciation, significantly affecting claim settlements

- Age affects payouts: Roof age directly impacts claim settlements through depreciation schedules that reduce coverage by 4-6% annually for most materials

- Documentation is critical: Comprehensive pre-loss and post-loss documentation ensures optimal claim outcomes and reduces settlement disputes

- Proactive management pays: Regular policy reviews, coverage updates, and strategic material choices can reduce premiums while maximizing protection benefits

Disclaimer

Data freshness: Insurance rates and regulations change frequently. Data accuracy depends on timing of official releases. Market data reflects conditions as of 2024-2025 reporting periods.

Geographic variations: Insurance requirements vary significantly by state. Always consult your state’s insurance department and local building codes for specific requirements in your area.

Professional advice: This information is for educational purposes only. Insurance decisions should be made in consultation with licensed professionals who can evaluate your specific circumstances and coverage needs.