How much do braces cost without insurance affects over 28 million Americans who lack dental coverage, with traditional metal braces ranging from $3,000 to $7,500 for complete treatment in 2025. Understanding how much do braces cost without insurance becomes essential for families planning orthodontic care budgets. Recent data from the American Association of Orthodontists shows that 4.5 million Americans currently wear braces, yet rising orthodontic costs create significant financial barriers for uninsured families seeking essential dental care.

Without comprehensive dental coverage, families face the full financial burden of orthodontic treatment, including consultation fees, appliance costs, monthly adjustments, and emergency visits. The average American household pays $6,200 annually for out-of-pocket dental expenses according to recent Health and Human Services data, with orthodontic care representing the largest single expense category for families with school-age children.

Understanding your payment options becomes crucial when navigating comprehensive insurance coverage considerations that affect both individual and family financial planning. Many orthodontic practices now offer flexible financing solutions, payment plans, and alternative treatment approaches specifically designed to make quality care accessible for uninsured patients seeking affordable orthodontic solutions.

This comprehensive guide examines current pricing trends, explores cost-reduction strategies, and provides actionable information to help families make informed decisions about orthodontic care without relying on traditional insurance coverage.

On This Page

Essential Overview

Without insurance, braces cost $3,000-$12,000 depending on type and complexity. Metal braces remain most affordable at $3,000-$7,500, while ceramic and lingual options cost $4,000-$12,000. Payment plans and financing make treatment accessible.

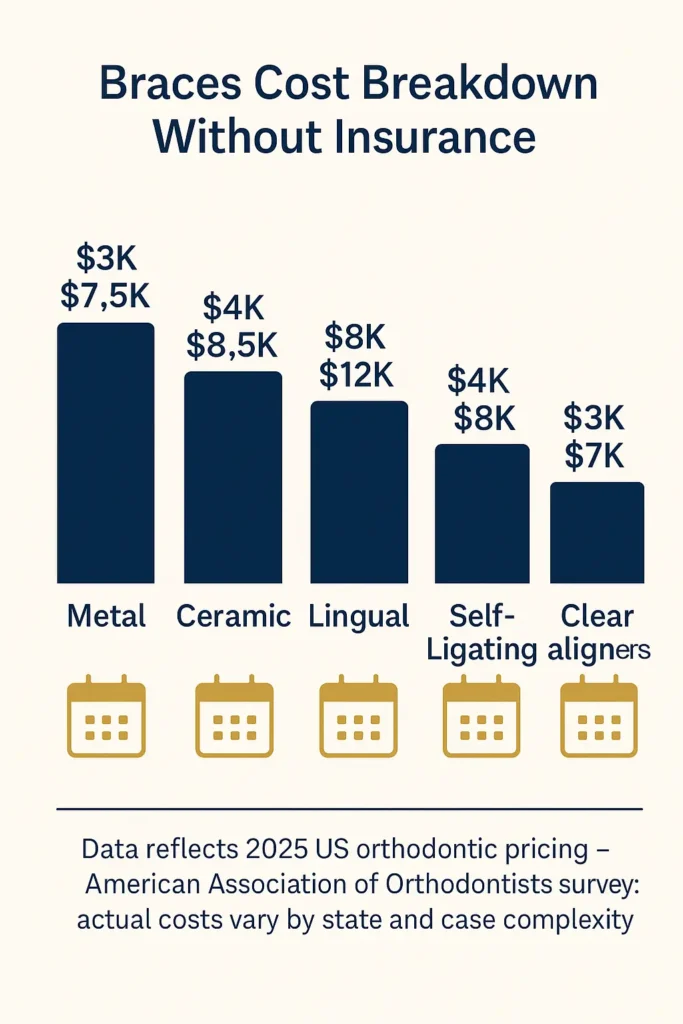

Average Braces Costs Without Insurance by Type

Traditional metal braces remain the most cost-effective option for uninsured patients in 2025, with total treatment costs ranging from $3,000 to $7,500 according to recent orthodontic industry surveys. Families researching how much do braces cost without insurance find these appliances utilize high-grade stainless steel brackets and wires, offering proven effectiveness for correcting complex alignment issues.

2025 Braces Cost Breakdown by Type

| Braces Type | Cost Range | Treatment Duration | Monthly Payment Options |

|---|---|---|---|

| Traditional Metal | $3,000-$7,500 | 18-24 months | $125-$300 |

| Ceramic/Clear | $4,000-$8,500 | 18-26 months | $175-$350 |

| Lingual (Behind Teeth) | $8,000-$12,000 | 24-36 months | $300-$500 |

| Self-Ligating | $4,000-$8,000 | 16-22 months | $200-$375 |

| Clear Aligners | $3,000-$7,000 | 12-24 months | $150-$300 |

Ceramic braces offer aesthetic advantages with tooth-colored brackets that blend naturally with teeth, commanding premium pricing between $4,000 and $8,500 for complete treatment. These appliances require more careful maintenance and may extend treatment duration due to their more delicate construction, but provide significantly improved appearance during the treatment process.

PRO TIP: Self-ligating braces eliminate the need for elastic bands, potentially reducing treatment time by 2-4 months and decreasing total costs through fewer adjustment appointments.

Lingual braces represent the highest-cost option, with pricing typically ranging from $8,000 to $12,000 due to their custom fabrication and specialized placement techniques. These appliances attach to the back surfaces of teeth, making them completely invisible but requiring additional expertise from orthodontists trained in lingual orthodontic techniques.

Clear aligners have emerged as a popular middle-ground option when evaluating how much do braces cost without insurance, with costs ranging from $3,000 to $7,000 depending on case complexity and treatment duration. Major aligner companies now offer direct-to-consumer options starting at $1,200, though these require careful evaluation to ensure appropriate case selection and treatment monitoring.

Treatment complexity significantly impacts final costs across all appliance types. Simple spacing corrections may require 12-18 months of treatment, while severe malocclusions or bite corrections can extend treatment to 36 months or longer, proportionally increasing total expenses for uninsured patients.

Factors That Influence Braces Pricing

Geographic location creates substantial cost variations when determining how much do braces cost without insurance, with metropolitan areas typically charging 15-25% above national averages according to recent American Dental Association pricing surveys. Northeast and West Coast regions command the highest fees, with average treatment costs reaching $8,000-$10,000 in cities like New York, San Francisco, and Boston.

IMPORTANT NOTE: Rural and smaller metropolitan areas often provide the same quality of care at significantly reduced costs, with potential savings of $1,500-$3,000 for identical treatment plans.

Patient age affects both treatment duration and how much do braces cost without insurance, with adult orthodontic care typically requiring 20-30% longer treatment periods compared to adolescent patients. Adult bone density requires more gradual tooth movement, extending average treatment from 20 months for teenagers to 26 months for adults, directly impacting monthly payment obligations and total expenses.

Case complexity represents the primary cost driver beyond appliance selection, with simple alignment corrections requiring minimal intervention compared to comprehensive bite corrections involving multiple phases of treatment. Severe cases may require preliminary procedures such as tooth extractions, palatal expansion, or jaw surgery, adding $2,000-$5,000 to base orthodontic fees.

Treatment Complexity Cost Modifiers

| Complexity Level | Description | Cost Increase | Duration Impact |

|---|---|---|---|

| Simple | Minor crowding/spacing | Base cost | 12-18 months |

| Moderate | Bite corrections, rotations | +15-25% | 18-24 months |

| Complex | Severe malocclusions | +30-50% | 24-36 months |

| Surgical | Combined ortho/surgical | +100-200% | 36-48 months |

Orthodontist experience and specialization also influence pricing structures, with board-certified specialists typically charging premium fees compared to general dentists offering orthodontic services. However, specialist care often provides more predictable outcomes and potentially shorter treatment durations, offering better value for complex cases despite higher upfront costs.

Practice overhead costs vary significantly based on location, technology investments, and staffing models. Modern practices utilizing digital treatment planning, 3D imaging, and accelerated orthodontic techniques may charge higher fees but can deliver superior results with reduced treatment times, potentially offsetting increased costs through efficiency gains.

Payment Options for Uninsured Patients

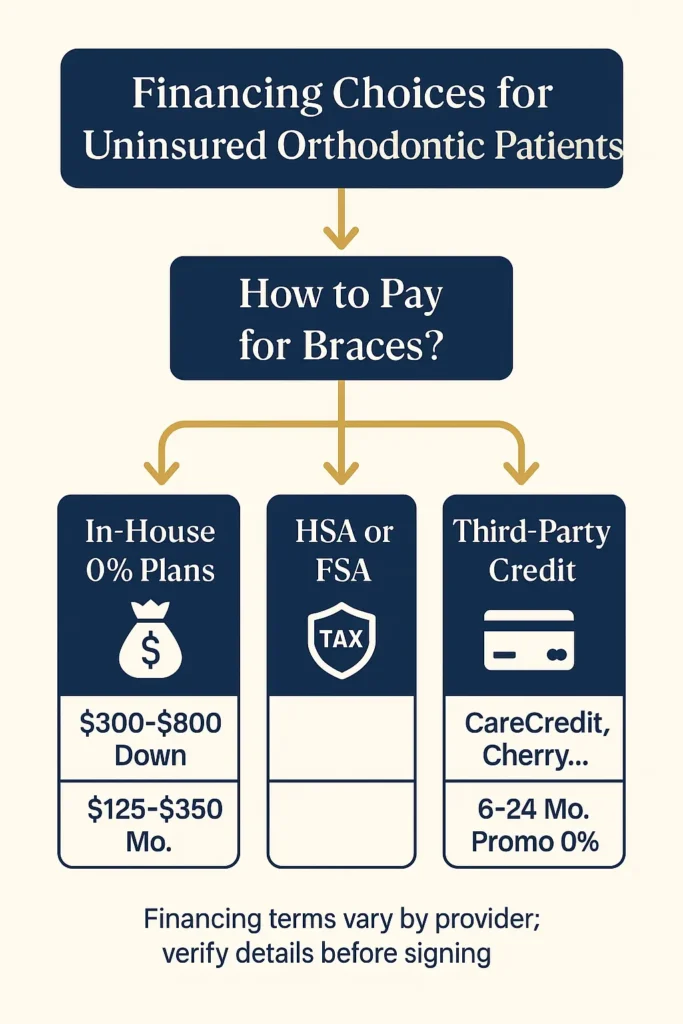

Most orthodontic practices offer in-house financing plans specifically designed for patients wondering how much do braces cost without insurance, with typical arrangements requiring minimal down payments of $300-$800 and monthly installments ranging from $125 to $350 over 18-36 month periods. These payment plans often feature 0% interest for qualified applicants, making them more affordable than traditional credit card financing options.

Third-party healthcare financing companies like CareCredit, Cherry Financing, and LendingClub provide specialized orthodontic loans with promotional interest rates and flexible repayment terms. CareCredit offers 6-24 month 0% APR promotional periods for qualified applicants, while longer-term options extend payments over 3-7 years with competitive interest rates for larger treatment costs.

Financing Options Comparison

| Financing Type | Down Payment | Monthly Range | Interest Rate | Approval Requirements |

|---|---|---|---|---|

| In-House Plans | $300-$800 | $125-$350 | 0-8% APR | Minimal credit check |

| CareCredit | $0-$500 | $100-$400 | 0-26.99% APR | Credit approval required |

| Cherry Financing | $0 | $75-$300 | 0-35.99% APR | Soft credit check |

| Personal Loans | Varies | $150-$500 | 6-36% APR | Full credit evaluation |

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) provide tax-advantaged payment methods for families researching how much do braces cost without insurance, with annual contribution limits of $4,150 for individual HSAs and $8,300 for family coverage in 2025. These accounts allow families to pay for orthodontic treatment with pre-tax dollars, effectively reducing treatment costs by 20-30% depending on tax bracket.

WARNING: FSA funds typically expire annually, requiring careful planning to align orthodontic payments with account funding cycles to avoid losing unused contributions.

Many practices offer family discounts when multiple children require treatment simultaneously, with savings ranging from 5-15% off total fees for each additional family member. Some orthodontists also provide cash payment discounts of 3-8% for patients who pay treatment costs in full at the start of treatment.

Employment benefits may include dependent care assistance programs or supplemental insurance options that partially cover orthodontic expenses. Federal employees and military families often have access to specialized dental plans through FEDVIP or TRICARE that provide meaningful orthodontic benefits for qualifying dependents.

Understanding the comprehensive coverage component structures helps families evaluate various payment strategies and identify the most cost-effective financing approach for their specific financial situation.

Low-Cost Alternatives to Traditional Braces

Dental schools provide orthodontic services at substantially reduced costs for families asking how much do braces cost without insurance, typically charging 30-50% below private practice fees while maintaining high-quality care standards under experienced faculty supervision. Major dental schools like University of California San Francisco, University of Pennsylvania, and Harvard School of Dental Medicine operate comprehensive orthodontic clinics serving uninsured patients.

Student treatment at accredited dental schools requires additional time commitments due to educational requirements and faculty supervision, with typical appointment durations extending 50-75% longer than private practice visits. However, students receive intensive oversight from board-certified orthodontists, often resulting in exceptionally thorough care and attention to treatment details.

Top Dental School Orthodontic Programs

| Institution | Location | Cost Reduction | Application Process |

|---|---|---|---|

| UCSF School of Dentistry | San Francisco, CA | 40-60% | Screening required |

| University of Pennsylvania | Philadelphia, PA | 35-55% | Waiting list |

| Harvard School of Dental Medicine | Boston, MA | 45-65% | Case evaluation |

| University of Michigan | Ann Arbor, MI | 30-50% | Income verification |

Community health centers funded through the Health Resources and Services Administration offer sliding-scale orthodontic services based on family income and household size. These federally qualified health centers (FQHCs) provide comprehensive dental care in underserved areas, with payment structures designed to accommodate uninsured and low-income families.

Charitable organizations like Smiles Change Lives provide orthodontic treatment for children from low-income families, with participating orthodontists offering services at significantly reduced fees. This national nonprofit coordinates care through volunteer orthodontists who commit to treating qualifying patients at fees based on family financial capacity.

IMPORTANT NOTE: Charitable programs typically have income requirements and waiting lists, requiring advance planning and application submission 6-12 months before desired treatment start dates.

At-home clear aligner companies have introduced budget-friendly options starting at $1,200-$1,800 for simple cases, representing significant savings for patients concerned about how much do braces cost without insurance compared to traditional orthodontic treatment. Companies like Byte, SmileDirectClub, and Candid offer direct-to-consumer treatment with remote monitoring, though these options require careful case evaluation for appropriate candidate selection.

Clinical trials and research studies occasionally seek orthodontic patients for treatment studies, providing free or low-cost care in exchange for participation in approved research protocols. The National Institute of Dental and Craniofacial Research maintains databases of current studies, though availability varies by location and research focus areas.

State-sponsored programs in several jurisdictions provide orthodontic assistance for children from low-income families, with eligibility typically tied to Medicaid income thresholds even when families don’t qualify for full Medicaid benefits. Programs vary significantly by state, requiring direct contact with state dental health departments for current availability and requirements.

Dental Schools and Community Health Centers

Accredited dental school programs operate orthodontic clinics in 65 U.S. cities, providing supervised student treatment at substantially reduced costs for families wondering how much do braces cost without insurance while maintaining rigorous quality standards through faculty oversight and accreditation requirements. The American Dental Association’s Commission on Dental Accreditation ensures all participating schools meet strict educational and clinical care standards.

Treatment at dental schools typically requires extended appointment times and may involve multiple student providers throughout the treatment process as students advance through their training programs. However, this educational environment often provides exceptionally thorough care with comprehensive treatment planning and close faculty supervision at each treatment stage.

Geographic Distribution of Dental School Programs

| Region | Schools Available | Average Savings | Typical Wait Times |

|---|---|---|---|

| Northeast | 15 schools | 45-65% | 2-6 months |

| Southeast | 12 schools | 40-60% | 1-4 months |

| Midwest | 18 schools | 35-55% | 3-8 months |

| West Coast | 20 schools | 50-70% | 4-12 months |

Community health centers receiving federal funding through Section 330 grants operate dental clinics in over 1,400 locations nationwide, with many offering orthodontic services on sliding fee scales based on federal poverty guidelines for patients researching how much do braces cost without insurance. These centers prioritize serving uninsured and underinsured populations, with payment structures designed to ensure accessibility regardless of insurance status.

Federally Qualified Health Centers (FQHCs) utilize income-based fee schedules that can reduce orthodontic costs by 40-80% for qualifying families, with some centers offering payment plans that further distribute costs over extended periods. Location availability varies significantly by region, with rural and urban underserved areas receiving priority for federal funding assistance.

PRO TIP: Many community health centers maintain waiting lists for orthodontic services, requiring advance registration and periodic contact to maintain active status on appointment scheduling lists.

The National Association of Community Health Centers maintains a comprehensive directory of participating locations, allowing families to identify nearby centers offering orthodontic services and verify current service availability. Many centers also provide transportation assistance and bilingual services to improve accessibility for diverse communities.

Native American communities have access to orthodontic services through Indian Health Service facilities and tribally operated dental programs, with services typically provided at no cost to qualifying tribal members. These programs often have limited capacity and may require coordination with contract orthodontists in nearby metropolitan areas.

For families exploring different approaches to insurance alternatives for seniors and multigenerational planning, understanding community-based dental resources becomes essential for comprehensive healthcare financial planning across different life stages.

Insurance Alternatives and Financing Programs

Discount dental plans offer an alternative to traditional insurance for families concerned about how much do braces cost without insurance, providing 10-30% reductions on orthodontic treatment through negotiated provider networks. Companies like Careington, Aetna Vital Savings, and 1Dental offer annual memberships ranging from $80-$200 per family, with immediate access to participating orthodontists who have agreed to reduced fee schedules.

These membership plans function differently from insurance by providing direct discounts at the point of service rather than reimbursement systems, eliminating waiting periods, annual maximums, and pre-authorization requirements common in traditional dental insurance policies. However, savings vary significantly by provider and geographic location, requiring careful comparison of participating orthodontists and negotiated fee schedules.

Discount Plan Comparison

| Plan Provider | Annual Cost | Orthodontic Discount | Network Size | Geographic Coverage |

|---|---|---|---|---|

| Careington | $149 family | 15-25% | 290,000+ providers | National |

| Aetna Vital Savings | $180 family | 20-30% | 385,000+ providers | 50 states |

| 1Dental | $99 family | 10-20% | 100,000+ providers | Regional focus |

Supplemental orthodontic insurance can be purchased independently from traditional dental coverage, with specialized carriers offering plans specifically designed for orthodontic treatment. These policies typically feature waiting periods of 6-24 months before benefits become available, making them most suitable for families planning future treatment rather than immediate needs.

Employer-sponsored supplemental benefits increasingly include orthodontic coverage options through voluntary benefit programs, allowing employees to purchase additional coverage through payroll deduction at group rates. These programs often provide more affordable premiums compared to individual policies while offering guaranteed acceptance regardless of pre-existing dental conditions.

IMPORTANT NOTE: Most supplemental orthodontic insurance policies impose annual or lifetime maximum benefits between $1,000-$2,500, covering only partial treatment costs and requiring additional payment methods for comprehensive care.

Healthcare credit cards like CareCredit, Wells Fargo Health Advantage, and Synchrony CareCredit provide specialized financing for medical and dental expenses, offering solutions for patients asking how much do braces cost without insurance with promotional interest rates and extended repayment terms. These cards often feature 6-24 month promotional periods with 0% APR for qualified applicants, followed by standard interest rates ranging from 14.99% to 26.99%.

Employer-sponsored Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) provide tax-advantaged savings for orthodontic expenses, with contribution limits for 2025 set at $4,150 for individual HSAs and $8,300 for family coverage. HSA funds roll over annually and can be invested for growth, while FSA contributions typically must be used within the plan year.

Understanding claims procedures and documentation requirements for various financing and discount programs helps families navigate reimbursement processes and maximize available benefits from alternative payment arrangements.

FAQ

What is the cheapest type of braces available?

Traditional metal braces represent the most affordable orthodontic option when considering how much do braces cost without insurance, with costs ranging from $3,000 to $7,500 for complete treatment without insurance. These appliances utilize proven technology and standard materials, keeping costs minimal while providing effective treatment for most alignment and bite correction needs. Some discount providers and dental schools offer metal braces for as low as $2,000-$3,500 for simple cases.

Can you negotiate braces costs with orthodontists?

Many orthodontic practices offer flexibility in pricing and payment arrangements, particularly for uninsured patients wondering how much do braces cost without insurance who are paying cash or requiring extended payment plans. Successful negotiation often involves requesting cash payment discounts (typically 3-8%), comparing quotes from multiple providers, or bundling treatment for multiple family members. Practices may also adjust fees based on case complexity, treatment duration, or patient financial circumstances.

How long do you typically pay for braces?

Payment periods for braces typically range from 12 to 36 months, depending on financing arrangements and total treatment costs. Most orthodontic practices offer payment plans that align with treatment duration, allowing monthly payments throughout the active treatment period. Some financing companies extend payment terms to 48-60 months for higher-cost treatments, though longer terms increase total interest costs.

Are payment plans available for braces?

Nearly all orthodontic practices offer payment plan options, ranging from in-house financing to third-party healthcare credit arrangements. Common options include 0% interest in-house plans with 18-30 month terms, CareCredit promotional financing, and extended payment arrangements through companies like Cherry Financing. Down payment requirements typically range from $300-$1,000, with monthly payments adjusted based on total treatment costs and selected payment term.

What happens if you can’t finish paying for braces?

Most orthodontic practices work with patients experiencing financial difficulties to modify payment arrangements or adjust treatment plans as needed. Options may include extended payment terms, temporary payment suspensions, or alternative finishing treatments if full orthodontic correction becomes financially impossible. However, discontinuing treatment before completion can compromise results and may require additional future treatment to achieve desired outcomes.

Do braces costs vary significantly by state?

Geographic cost variations significantly impact how much do braces cost without insurance, with differences exceeding 40% between high-cost metropolitan areas and lower-cost regions. States like California, New York, and Massachusetts typically command premium pricing 20-30% above national averages, while states in the Southeast and Midwest often offer treatment at below-average costs. Rural areas within expensive states may offer significant savings compared to urban centers in the same state.

Conclusion

Understanding how much do braces cost without insurance in 2025 ranges from $3,000 for basic metal braces to $12,000 for premium lingual appliances, with most families paying between $4,000-$7,000 for comprehensive orthodontic treatment. Understanding available financing options, alternative treatment settings, and cost-reduction strategies enables uninsured families to access quality orthodontic care through manageable payment arrangements.

Geographic location, case complexity, and provider selection significantly impact total treatment costs, with potential savings of 30-60% available through dental schools, community health centers, and alternative financing arrangements. Payment plans, healthcare credit cards, and tax-advantaged savings accounts provide multiple pathways for distributing orthodontic expenses over manageable time periods.

The orthodontic industry has responded to insurance coverage limitations by expanding financing options and developing alternative treatment delivery models that prioritize accessibility for uninsured patients. Families should evaluate multiple providers, explore all available financing options, and consider long-term oral health benefits when making orthodontic treatment decisions.

Key Takeaways

• Traditional metal braces cost $3,000-$7,500 without insurance, representing the most affordable orthodontic option in 2025 • Dental schools and community health centers offer 30-60% cost savings through supervised student treatment programs • In-house payment plans and healthcare financing provide 0% interest options for qualified patients • Geographic location impacts costs by 20-40%, with rural areas typically offering significant savings • HSAs and FSAs provide 20-30% effective cost reductions through tax-advantaged payment methods • Alternative financing through discount plans and supplemental insurance can reduce out-of-pocket expenses • Case complexity and treatment duration directly correlate with total costs across all appliance types

Disclaimer

Data Freshness: Insurance rates and orthodontic costs change frequently. Data accuracy depends on timing of official releases from dental associations and healthcare organizations. Current information reflects 2024-2025 market conditions and may not represent future pricing trends.

Geographic Variations: Orthodontic costs vary significantly by state and metropolitan area. Always consult local providers for accurate pricing information specific to your geographic region and treatment needs.

Professional Advice: This information is for educational purposes only. Orthodontic treatment decisions should be made in consultation with licensed dental professionals who can evaluate individual needs and provide personalized treatment recommendations.