Total trucking insurance costs have surged 12.5% from 2023 to 2024 according to the latest RPS Transportation Market Outlook, affecting over 350,000 commercial motor carriers nationwide as operational expenses continue climbing across the industry. This dramatic increase reflects rising liability concerns, escalating repair costs, and new regulatory requirements that significantly impact total trucking insurance affordability and long-term sustainability in an increasingly competitive marketplace.

Commercial trucking operators face mounting financial pressures from multiple directions including higher liability premiums, increased cargo theft risks, and stricter compliance standards that demand comprehensive total trucking insurance solutions. Many drivers discover their current policies lack adequate protection when claims exceed minimum federal requirements, leaving businesses vulnerable to catastrophic financial losses that can destroy years of hard work and total trucking insurance investment.

Understanding total trucking insurance requirements becomes essential for protecting your business against these evolving risks while maintaining comprehensive business insurance coverage that meets both federal mandates and practical operational needs. Smart trucking entrepreneurs recognize that proper total trucking insurance planning today prevents devastating financial consequences tomorrow, ensuring business continuity even when faced with unexpected accidents or regulatory changes.

This comprehensive guide examines current total trucking insurance requirements, costs, coverage options, and compliance strategies to help you make informed decisions about protecting your commercial operation throughout 2025.

On This Page

Essential Overview

Total trucking insurance provides mandatory liability coverage ranging from $300,000 to $5 million based on cargo type and vehicle weight, with average annual premiums increasing 12.5% in 2024 due to rising operational costs and liability risks.

How Much Will Insurance Give Me for My Totaled Truck?

Insurance compensation for totaled trucks depends on actual cash value calculations, policy terms, and depreciation factors that vary significantly by vehicle age, condition, and market conditions. IMPORTANT NOTE: Most commercial truck policies use actual cash value rather than replacement cost, meaning settlements reflect current market value minus depreciation rather than original purchase price or replacement cost.

The Federal Motor Carrier Safety Administration reported in their 2024 Financial Responsibility Study that average truck values range from $45,000 for older Class 8 tractors to $180,000 for new specialized equipment, with total loss settlements typically representing 70-85% of pre-accident market value depending on policy terms and adjuster evaluations. Current FMCSA insurance filing requirements mandate electronic submission of all insurance documentation through their updated portal system.

Truck Valuation Factors for Total Loss Claims:

| Factor | Impact on Settlement | Typical Adjustment |

|---|---|---|

| Vehicle Age | High impact | -15% to -25% annually |

| Mileage | Moderate impact | -$0.08 to -$0.15 per mile |

| Maintenance Records | Low to moderate | +5% to +10% with documentation |

| Market Demand | Variable | ±10% to ±20% |

| Equipment Condition | High impact | -20% to +15% |

| Modifications | Variable | ±5% to ±25% |

Total trucking insurance settlements include deductible considerations, with most commercial policies carrying $1,000 to $5,000 deductibles that reduce final payouts. Insurance companies typically require independent appraisals for vehicles valued over $75,000, with settlement negotiations often extending 30-90 days depending on claim complexity and documentation quality.

PRO TIP: Maintain detailed maintenance records, recent appraisals, and equipment inventories to maximize total loss settlements and expedite claim processing.

Gap coverage becomes crucial for financed trucks, as standard total trucking insurance policies may not cover the difference between actual cash value and outstanding loan balances. Many trucking companies discover after total losses that depreciation created substantial gaps between insurance settlements and remaining debt obligations, emphasizing the importance of gap coverage evaluation during policy selection.

How Much is CDL Truck Insurance Per Month?

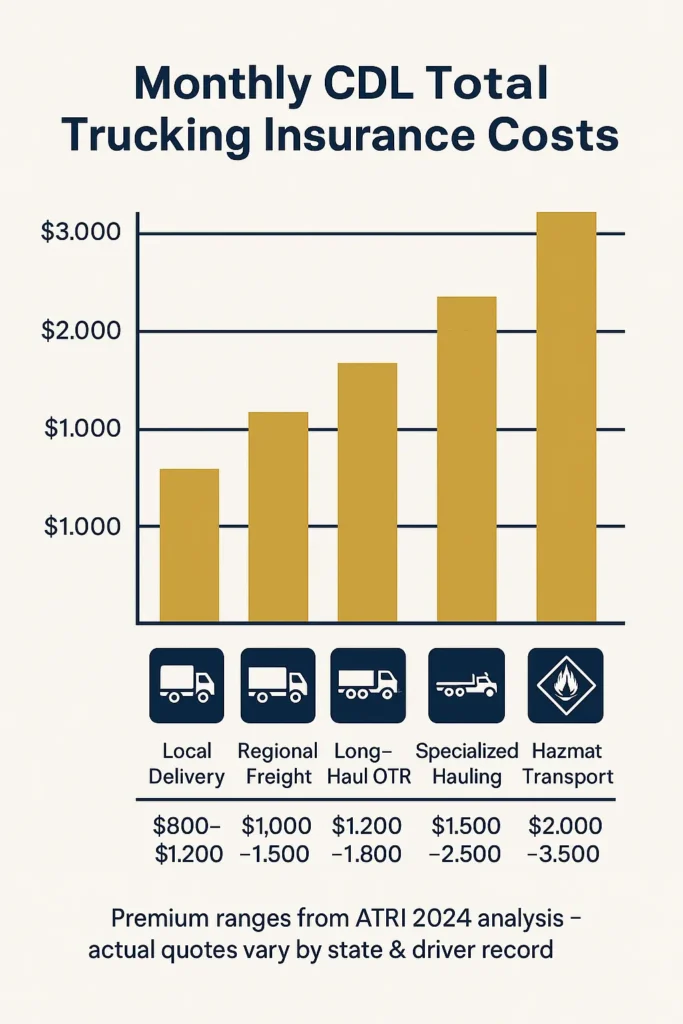

CDL truck insurance costs vary dramatically based on experience, driving record, cargo type, and operational radius, with monthly premiums ranging from $800 to $2,500 for owner-operators and significantly higher for fleet operations. Recent industry data shows that total trucking insurance represents approximately 4-6% of total operational costs, making it a substantial but manageable business expense when properly planned and optimized.

The American Transportation Research Institute’s 2024 operational cost analysis revealed that insurance expenses averaged $1.89 per mile for long-haul operations, translating to monthly costs between $1,200-$1,800 for drivers covering 8,000-10,000 miles monthly depending on coverage levels and risk factors.

Monthly CDL Insurance Cost Breakdown by Operation Type:

| Operation Type | Average Monthly Premium | Coverage Level | Deductible Range |

|---|---|---|---|

| Local Delivery | $800 – $1,200 | $750,000 – $1M | $1,000 – $2,500 |

| Regional Freight | $1,000 – $1,500 | $1M – $2M | $1,000 – $5,000 |

| Long-Haul OTR | $1,200 – $1,800 | $1M – $2M | $2,500 – $7,500 |

| Specialized Hauling | $1,500 – $2,500 | $2M – $5M | $5,000 – $10,000 |

| Hazmat Transport | $2,000 – $3,500 | $5M minimum | $5,000 – $15,000 |

Commercial truck insurance specialists like those handling commercial dump truck insurance emphasize that experience significantly impacts pricing, with new CDL holders paying 25-50% higher premiums than drivers with 5+ years of clean driving records. Insurance companies evaluate factors including previous claims, driving violations, credit scores, and business stability when determining individual rates.

WARNING: Monthly payment plans often include financing charges that increase total annual costs by 8-15% compared to semi-annual or annual payment options.

Total trucking insurance pricing varies by state due to different regulatory requirements, with states like California, New York, and Florida typically commanding higher premiums due to population density, traffic conditions, and higher claim frequencies. Rural states often offer lower base rates but may require higher coverage limits for interstate operations.

What is the Best Insurance Company for Trucks?

Selecting optimal trucking insurance requires evaluating financial stability, claims handling, specialized trucking expertise, and pricing rather than seeking generic “best” rankings that may not reflect your specific operational needs. IMPORTANT NOTE: Insurance Zenith maintains editorial independence and provides educational information only – we never recommend specific insurance companies or products to ensure unbiased consumer education.

Financial strength ratings from A.M. Best provide crucial insights into insurer stability, with trucking companies advised to select carriers with A- ratings or higher to ensure claims-paying ability during difficult economic periods. The NAIC’s 2024 market share data shows that commercial auto insurance represents approximately $89 billion in direct premiums written annually, with the top 10 carriers controlling roughly 45% of the market.

Key Evaluation Criteria for Trucking Insurance Carriers:

| Evaluation Factor | Weight | Key Considerations |

|---|---|---|

| Financial Strength | Critical | A.M. Best rating A- or higher |

| Trucking Expertise | High | Specialized commercial vehicle experience |

| Claims Handling | High | Average settlement time, customer satisfaction |

| Coverage Options | Moderate | Policy flexibility, endorsement availability |

| Pricing Competitiveness | Moderate | Rate stability, discount programs |

| Geographic Coverage | Low | Operating territory alignment |

Specialized trucking insurers often provide superior service compared to general commercial carriers because they understand industry-specific risks, regulatory requirements, and operational challenges that affect claims and coverage needs. These specialists typically offer enhanced services including safety programs, regulatory compliance assistance, and loss prevention resources that add value beyond basic coverage.

Regional vs. national carriers present different advantages, with regional insurers often providing more personalized service and local market knowledge while national carriers may offer broader geographic coverage and more extensive resources for large fleet operations requiring comprehensive business insurance compliance requirements.

PRO TIP: Request references from current customers operating similar equipment and routes to evaluate real-world claims experience and customer service quality.

Claims handling efficiency varies significantly among carriers, with some specializing in rapid claim resolution while others may prioritize thorough investigation that extends settlement timelines. Trucking companies should evaluate historical claims data, customer testimonials, and industry reputation when selecting carriers rather than relying solely on premium quotes or marketing materials.

How Much is $1 Million Cargo Insurance?

One million dollar cargo insurance typically costs $2,000 to $6,000 annually depending on commodity types, route characteristics, theft exposure, and deductible selections, making it a significant but essential component of comprehensive total trucking insurance protection. The FMCSA Financial Responsibility Study indicates that cargo insurance rates have increased substantially due to rising theft claims and higher commodity values, particularly affecting electronics, pharmaceuticals, and high-value manufactured goods transportation.

Cargo insurance pricing operates on a per-mile or per-load basis with annual minimums, typically ranging from $0.75 to $3.50 per $100 of cargo value depending on risk factors including commodity type, geographic routes, security measures, and historical loss experience. High-risk commodities like electronics or pharmaceuticals may require specialized coverage with rates reaching $5.00 per $100 of value.

Annual Cargo Insurance Costs by Commodity Type:

| Commodity Category | Rate per $100 Value | Annual Minimum | Typical Coverage |

|---|---|---|---|

| General Freight | $0.75 – $1.25 | $2,000 – $3,000 | $100,000 – $250,000 |

| Electronics | $2.50 – $4.00 | $4,000 – $6,000 | $500,000 – $1,000,000 |

| Pharmaceuticals | $3.00 – $5.00 | $5,000 – $8,000 | $1,000,000+ |

| Food Products | $1.00 – $1.75 | $2,500 – $4,000 | $250,000 – $500,000 |

| Automotive Parts | $1.50 – $2.50 | $3,000 – $5,000 | $500,000 – $750,000 |

| Raw Materials | $0.75 – $1.00 | $1,500 – $2,500 | $100,000 – $300,000 |

Deductible options significantly impact cargo insurance premiums, with higher deductibles reducing annual costs but increasing out-of-pocket expenses during claims. Most carriers offer deductible ranges from $1,000 to $25,000, with $5,000 being common for million-dollar coverage limits.

WARNING: Cargo insurance excludes certain perils including war, nuclear hazards, governmental seizure, and inherent vice, requiring additional endorsements for comprehensive protection.

Geographic risk factors influence cargo insurance rates substantially, with high-crime metropolitan areas, border crossings, and specific interstate corridors commanding premium surcharges due to elevated theft risks. Insurance companies maintain detailed loss databases that identify high-risk routes and facilities, adjusting rates accordingly.

How Much Does State Farm Pay for Total Loss?

State Farm’s total loss settlements follow standard industry practices using actual cash value calculations, though specific payout amounts depend on policy terms, vehicle condition, local market values, and state regulations that govern claim settlement procedures. Commercial truck settlements vary significantly based on depreciation schedules, pre-loss condition assessments, and market valuation methodologies that differ among insurance carriers.

IMPORTANT NOTE: Insurance companies, including State Farm, calculate total loss settlements based on actual cash value (replacement cost minus depreciation) rather than original purchase price or outstanding loan balances, which may create coverage gaps for newer vehicles or those with high loan-to-value ratios.

State Farm typically uses third-party valuation services including CCC Information Services, Mitchell International, or Audatex to determine vehicle values, comparing similar vehicles within geographic areas to establish fair market value ranges. These services consider factors including vehicle age, mileage, condition, equipment, and recent sales of comparable trucks.

Total Loss Settlement Process Timeline:

| Stage | Typical Duration | Key Activities |

|---|---|---|

| Claim Report | 1-2 days | Initial damage assessment, file setup |

| Investigation | 3-7 days | Scene investigation, police reports, witness statements |

| Total Loss Declaration | 7-14 days | Damage evaluation, repair cost estimates |

| Valuation Process | 10-21 days | Market research, comparable vehicle analysis |

| Settlement Negotiation | 7-14 days | Value disputes, additional documentation |

| Final Payment | 3-5 days | Title transfer, lien satisfaction, check processing |

Settlement amounts reflect market conditions at the time of loss rather than historical values, meaning appreciating vehicle markets may result in higher settlements while depreciating markets reduce payouts. State Farm adjusters consider recent sales data, dealer prices, and auction results when establishing settlement ranges.

PRO TIP: Maintain detailed maintenance records, recent appraisals, and equipment inventories to support higher settlement negotiations and expedite the claims process.

Gap insurance becomes particularly important for financed commercial trucks, as depreciation often exceeds principal payments during the first several years of ownership. Many trucking companies discover significant differences between insurance settlements and outstanding loan balances, emphasizing the importance of gap coverage evaluation during policy selection.

How Does a Totaled Car Affect My Credit Score?

Vehicle total losses typically don’t directly impact credit scores unless loan obligations remain unresolved after insurance settlements, creating potential payment issues that could affect credit standing if not properly managed through insurance proceeds and financial planning. IMPORTANT NOTE: The insurance claim itself doesn’t appear on credit reports, but subsequent loan defaults or collection actions resulting from inadequate coverage could damage credit ratings.

Gap coverage becomes crucial for financed vehicles where insurance settlements may not cover outstanding loan balances, potentially leaving borrowers responsible for remaining debt that could impact credit if not properly addressed. Many commercial truck operators discover that depreciation creates substantial gaps between actual cash value settlements and loan obligations, particularly during the first 2-3 years of ownership.

When insurance settlements fall short of loan balances, borrowers have several options including negotiating with lenders for reduced payoffs, refinancing remaining balances, or using personal funds to satisfy obligations. Failing to address these situations promptly may result in loan defaults, repossession proceedings, or collection activities that significantly damage credit scores and future financing ability.

Credit Impact Management Strategies:

| Situation | Credit Risk | Recommended Action |

|---|---|---|

| Insurance Covers Full Loan | None | Standard claim processing |

| Small Gap ($1,000-$5,000) | Low | Pay difference, continue payments |

| Moderate Gap ($5,000-$15,000) | Moderate | Negotiate with lender, consider refinancing |

| Large Gap ($15,000+) | High | Legal consultation, workout arrangements |

| No Insurance | Severe | Immediate professional assistance required |

Professional consultation becomes essential when facing significant coverage gaps, as comprehensive car insurance experts can provide guidance on claim optimization, lender negotiations, and financial planning strategies to minimize credit impact and preserve business operations.

Lenders may offer workout arrangements for borrowers facing coverage gaps, including payment deferrals, loan modifications, or reduced settlement agreements that help preserve credit standing while resolving debt obligations. Early communication with lenders often produces better outcomes than waiting until payment problems develop.

WARNING: Ignoring loan obligations after total loss events can result in rapid credit score deterioration, future financing difficulties, and potential legal consequences including wage garnishment or asset seizure.

Some insurance policies include loan/lease gap coverage that automatically addresses differences between settlements and outstanding balances, eliminating credit risks associated with coverage shortfalls. This coverage typically costs $200-$500 annually but provides valuable protection for heavily financed vehicles.

FAQ

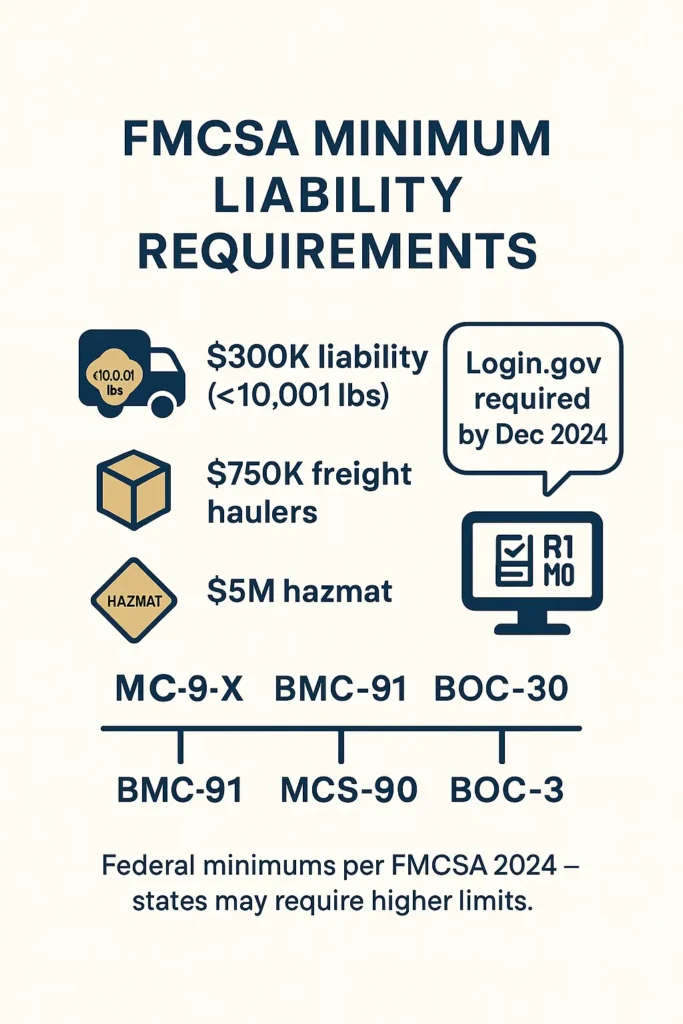

What are the minimum FMCSA insurance requirements for commercial trucks?

FMCSA requires minimum liability coverage ranging from $300,000 for vehicles under 10,001 pounds to $5 million for hazardous materials transport, with most freight haulers needing $750,000 minimum coverage for interstate operations. Additional requirements include cargo insurance for household goods carriers and specific endorsements for passenger transportation.

How do I file FMCSA insurance forms for my trucking company?

Insurance companies file required FMCSA forms electronically including BMC-91 for liability coverage, MCS-90 endorsements, and BOC-3 process agent designations. The FMCSA transition to Login.gov authentication requires all insurance filers to create new portal accounts by December 2024 for continued electronic filing access. Complete NAIC industry analysis reports provide detailed guidance on regulatory compliance and market trends affecting commercial trucking operations.

Can I reduce total trucking insurance costs through safety programs?

Yes, many total trucking insurance carriers offer premium discounts ranging from 5-25% for companies implementing approved safety technologies, driver training programs, and fleet monitoring systems. NAIC industry analysis shows that proactive safety measures significantly reduce claim frequencies and severity, resulting in lower total trucking insurance costs over time.

What happens if my total trucking insurance lapses during operations?

Operating without required total trucking insurance violates FMCSA regulations and can result in immediate shutdown orders, substantial fines, and operating authority suspension. Drivers face personal liability exposure for accidents exceeding their ability to pay, potentially resulting in asset seizure and business closure.

How does cargo type affect total trucking insurance premiums?

High-value or high-risk cargo including electronics, pharmaceuticals, and hazardous materials significantly increases total trucking insurance costs due to elevated theft risks and potential liability exposure. General freight typically qualifies for standard rates while specialized commodities may require enhanced coverage and security measures.

Should I choose higher deductibles to reduce total trucking insurance costs?

Higher deductibles reduce annual total trucking insurance premiums but increase out-of-pocket expenses during claims, requiring careful cash flow analysis to ensure adequate reserves for potential losses. Most successful trucking operations balance deductible levels with operational cash flow capabilities to optimize total cost of risk.

Conclusion

Total trucking insurance represents a critical business investment that protects against catastrophic financial losses while ensuring regulatory compliance and operational continuity in an increasingly complex transportation environment. Rising premium costs, evolving regulations, and new risk factors require careful planning and expert guidance to optimize coverage while controlling expenses.

Understanding minimum requirements, evaluating coverage options, and selecting appropriate deductibles helps trucking companies balance protection needs with budgetary constraints while maintaining competitiveness in challenging market conditions. Regular policy reviews and risk assessments ensure coverage remains adequate as business operations evolve and regulatory requirements change.

Key Takeaways

- Premium Increases: Total trucking insurance costs rose 12.5% in 2024, requiring budget adjustments and coverage optimization

- FMCSA Compliance: Minimum liability requirements range from $300,000 to $5 million based on cargo and vehicle specifications

- Total Loss Settlements: Insurance pays actual cash value minus depreciation, not replacement cost or loan balances

- Cargo Coverage: Million-dollar cargo insurance costs $2,000-$6,000 annually depending on commodity risk factors

- Credit Protection: Gap coverage prevents loan defaults and credit damage when settlements exceed outstanding balances

- Safety Discounts: Implementing approved safety programs can reduce premiums by 5-25% through demonstrated risk reduction

Disclaimer

Data Freshness: Insurance rates and regulations change frequently. Data accuracy depends on timing of official releases from FMCSA, NAIC, and industry organizations.

Geographic Variations: Insurance requirements vary significantly by state. Always consult your state’s insurance department and FMCSA regulations for current requirements.

Professional Advice: This information is for educational purposes only. Insurance decisions should be made in consultation with licensed professionals familiar with your specific operational requirements and risk profile.