Convenience store insurance costs averaged $3,200-$7,800 annually for small retailers in 2024, yet 43% of convenience store owners report being underinsured for their actual operational risks. With over 148,000 convenience stores operating across the United States generating $906 billion in annual sales according to recent industry data, adequate insurance protection becomes essential for financial survival in this high-traffic retail environment.

Operating a convenience store presents unique liability exposures that distinguish these businesses from traditional retail establishments. Customer slip-and-fall incidents, product liability claims from contaminated food items, and theft-related losses create substantial financial vulnerabilities. Additionally, many convenience stores sell gasoline, tobacco products, and prepared foods, each introducing specialized regulatory compliance requirements and potential legal exposures that standard convenience store insurance policies must adequately address through specialized endorsements.

Successful convenience store operators recognize that comprehensive insurance protection extends beyond basic commercial property coverage to include specialized policies addressing their industry-specific risks. Understanding business insurance compliance requirements becomes particularly critical given the complex federal and state regulations governing convenience store operations, from food safety standards to fuel handling protocols.

This guide examines essential convenience store insurance requirements, analyzes current market pricing trends, and provides practical strategies for optimizing coverage while managing premium costs effectively.

On This Page

Essential Overview

Convenience store insurance requires specialized coverage combining general liability, commercial property, workers compensation, and industry-specific policies. Average annual premiums range $3,200-$7,800 depending on location, size, and risk factors, with gasoline sales significantly impacting costs.

What Insurance Coverage Do Convenience Stores Need?

Convenience store insurance encompasses multiple coverage types designed to protect against the diverse risks inherent in this retail format. The foundational policy structure typically includes general liability insurance, which provides protection against customer injury claims, property damage lawsuits, and advertising injury disputes that commonly arise in high-traffic retail environments.

Essential Coverage Requirements Table:

| Coverage Type | Purpose | Typical Limits | Annual Cost Range |

|---|---|---|---|

| General Liability | Customer injuries, property damage | $1M per occurrence / $2M aggregate | $800-$2,400 |

| Commercial Property | Building, inventory, equipment | Full replacement cost | $1,200-$3,600 |

| Workers Compensation | Employee injury protection | State-mandated minimums | $600-$2,100 |

| Business Interruption | Lost income during closures | 12-24 months coverage | $400-$1,200 |

| Commercial Auto | Delivery vehicles, business use | $1M liability minimum | $1,800-$4,200 |

Commercial property protection forms the cornerstone of convenience store insurance, covering physical assets including the building structure, inventory, point-of-sale equipment, and specialized fixtures like refrigeration units and fuel dispensing systems. This coverage becomes particularly complex for stores selling gasoline, as petroleum products require environmental liability protection and specialized storage tank coverage within comprehensive convenience store insurance programs.

IMPORTANT NOTE: Stores selling tobacco products must carry product liability protection specifically addressing these regulated items, as standard general liability policies often exclude tobacco-related claims.

Workers compensation requirements vary significantly by state, but all convenience stores with employees must maintain this coverage. According to business insurance guidance from the SBA, the federal government requires every business with employees to have workers’ compensation, unemployment, and disability insurance, with convenience stores facing elevated premiums due to higher-than-average workplace injury rates in the retail sector.

Business interruption insurance provides crucial protection for convenience store insurance portfolios, covering lost income and ongoing expenses during forced closures due to covered perils. This coverage proves especially valuable for stores in areas prone to natural disasters or those dependent on foot traffic from nearby businesses.

PRO TIP: Many convenience store owners overlook employment practices liability insurance, which protects against wrongful termination, discrimination, and harassment claims from employees.

Commercial auto coverage becomes essential for convenience stores offering delivery services or utilizing company vehicles for business operations. Even personal vehicles used for business purposes, such as bank deposits or supply runs, may require commercial coverage rather than personal auto insurance policies.

Cyber liability insurance has emerged as a critical component of modern convenience store insurance programs, protecting against data breaches involving customer payment information and point-of-sale system compromises. With most transactions now involving electronic payments, this coverage addresses both first-party costs and third-party liability claims.

Coverage Optimization Checklist:

- Verify general liability limits match your highest risk exposures

- Ensure commercial property coverage includes all business personal property

- Confirm workers compensation meets state minimum requirements

- Add business interruption coverage for income protection

- Include commercial auto for any business vehicle use

- Consider cyber liability for payment processing protection

How Much Does Convenience Store Insurance Cost in 2025?

Convenience store insurance premiums demonstrate significant variation based on location, store size, product mix, and risk management practices. Current market data indicates average annual costs ranging from $3,200 for basic coverage packages to $7,800 for comprehensive protection including specialized endorsements and higher liability limits.

2025 Premium Analysis by Store Type:

| Store Category | Average Annual Premium | Primary Cost Drivers | Coverage Highlights |

|---|---|---|---|

| Basic Convenience | $3,200-$4,500 | Location, crime rates | Standard GL + Property |

| With Gas Station | $5,200-$7,800 | Environmental liability | Pollution + Tank coverage |

| Prepared Food Sales | $4,100-$6,200 | Product liability exposure | Food contamination protection |

| Urban High-Crime | $4,800-$8,400 | Theft, vandalism rates | Enhanced security requirements |

Geographic location substantially impacts convenience store insurance costs, with urban markets typically commanding 15-25% higher premiums than rural locations due to increased crime rates and higher claim frequencies. According to productivity and costs industry data, labor productivity grew 1.8 percent in wholesale trade and 4.6 percent in retail trade in 2024, yet convenience store insurance costs continue rising as claims severity increases across retail segments, particularly affecting specialized operations with gasoline sales or prepared food offerings.

Stores selling gasoline face significantly elevated convenience store insurance costs due to environmental liability exposures. Underground storage tank coverage, pollution liability protection, and specialized cleanup cost coverage can increase annual premiums by $1,800-$3,200 compared to stores without fuel sales.

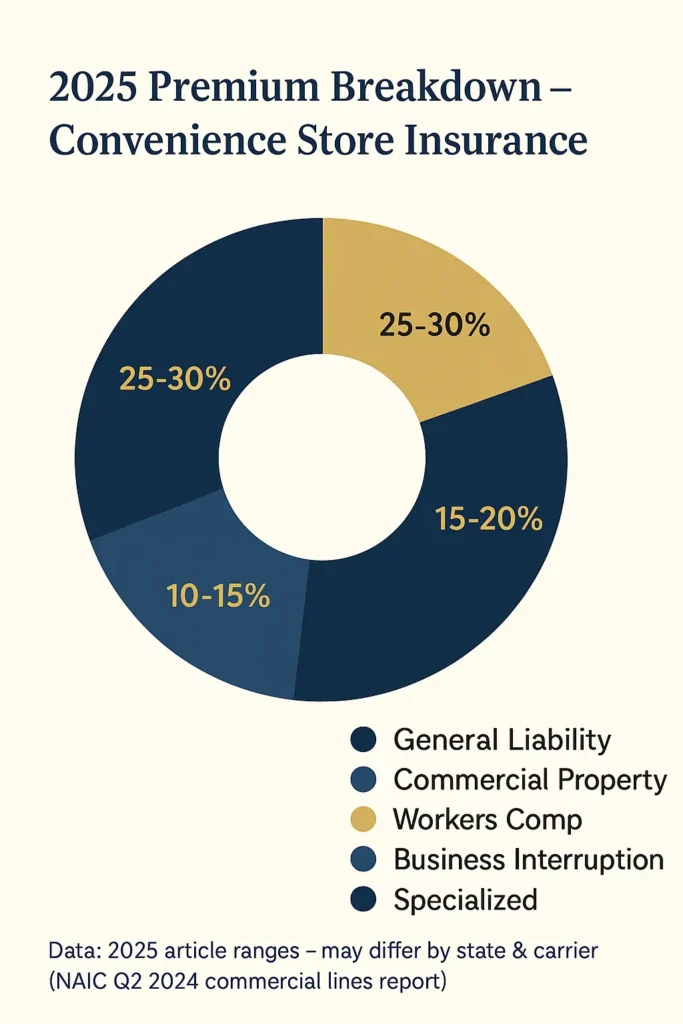

Cost Breakdown by Coverage Component:

- General Liability: 25-30% of total premium

- Commercial Property: 35-40% of total premium

- Workers Compensation: 15-20% of total premium

- Business Interruption: 8-12% of total premium

- Specialized Coverages: 10-15% of total premium

WARNING: Convenience stores in states with high natural disaster frequency may face premium surcharges of 20-40% above baseline rates for property coverage.

Premium financing options allow convenience store owners to spread annual costs across monthly payments, though financing fees typically add 8-12% to total costs. Many insurers offer premium reduction opportunities through safety programs, security system installations, and claims-free experience credits.

Market conditions in 2025 reflect continued rate increases for convenience store insurance, with commercial lines experiencing average premium increases of 5.2% across all account sizes. According to the NAIC property and casualty industry report, respondents reported an average premium increase of 5.2% across all account sizes for commercial lines in Q2 2024.

Premium Reduction Strategies:

- Install comprehensive security systems with monitoring

- Implement employee safety training programs

- Maintain claims-free operating history

- Bundle multiple coverage types with single carrier

- Increase deductibles on property coverage

- Participate in insurer loss control programs

The complexity of convenience store insurance pricing requires professional risk assessment to accurately determine appropriate coverage levels and cost-effective policy structures for individual operations.

What Factors Affect Convenience Store Insurance Premiums?

Multiple variables influence convenience store insurance pricing, with location demographics serving as the primary determinant of premium calculations. Insurance carriers analyze crime statistics, natural disaster frequencies, and local economic conditions when establishing base rates for specific geographic areas.

Store size and annual revenue directly impact convenience store insurance costs through exposure calculations. Larger stores with higher sales volumes face increased liability exposures from greater customer traffic, expanded inventory values, and typically more complex operations requiring proportionally higher coverage limits.

Premium Impact Factors Analysis:

| Risk Factor | Premium Impact | Mitigation Strategies | Cost Reduction Potential |

|---|---|---|---|

| High Crime Location | +25% to +45% | Security systems, cameras | 10-15% reduction |

| Gasoline Sales | +40% to +60% | Tank monitoring, compliance | 5-10% reduction |

| Prepared Food | +20% to +35% | Food safety training | 8-12% reduction |

| Multiple Locations | -5% to -15% | Fleet discounts | 10-20% savings |

Employee count and payroll exposure significantly affect workers compensation premiums within convenience store insurance packages. According to Bureau of Labor Statistics retail trade data, the retail trade sector accounted for 12.4 percent of nonfarm business sector employment (16.3 million jobs), with convenience stores experiencing workplace injury rates 18% above the retail industry average due to manual lifting, extended standing, and interaction with potentially dangerous customers, making comprehensive convenience store insurance protection essential for employee safety and regulatory compliance.

Product mix composition creates substantial premium variations for convenience store insurance policies. Stores selling alcohol, tobacco products, or prepared foods face elevated liability exposures requiring specialized coverage endorsements and higher base rates due to increased regulatory compliance requirements and potential health-related claims.

PRO TIP: Installing advanced point-of-sale systems with integrated security features can reduce premiums by 8-12% through demonstrated risk reduction and theft prevention capabilities.

Building characteristics influence property coverage costs within convenience store insurance programs. Older structures, buildings without sprinkler systems, or stores located in areas with limited fire protection services face higher property insurance rates due to increased loss potential.

Claims history represents perhaps the most controllable factor affecting convenience store insurance premiums. Stores maintaining claims-free records for three or more years typically qualify for experience modification factors reducing premiums by 10-25% depending on carrier programs and policy size.

Loss Control Measures Impact:

- Employee Training Programs: 5-10% premium reduction

- Security System Installation: 10-15% premium reduction

- Safety Equipment Upgrades: 8-12% premium reduction

- Professional Monitoring Services: 12-18% premium reduction

Environmental factors specifically impact stores with gasoline sales, as soil contamination risks and groundwater protection requirements create additional liability exposures. Stores near water sources, in environmentally sensitive areas, or with aging underground storage tanks face premium surcharges reflecting these elevated risks.

Credit ratings and financial stability of business owners increasingly influence convenience store insurance pricing, with carriers using business credit scores to predict claim likelihood and policy persistency rates.

How Do State Regulations Impact Convenience Store Insurance Requirements?

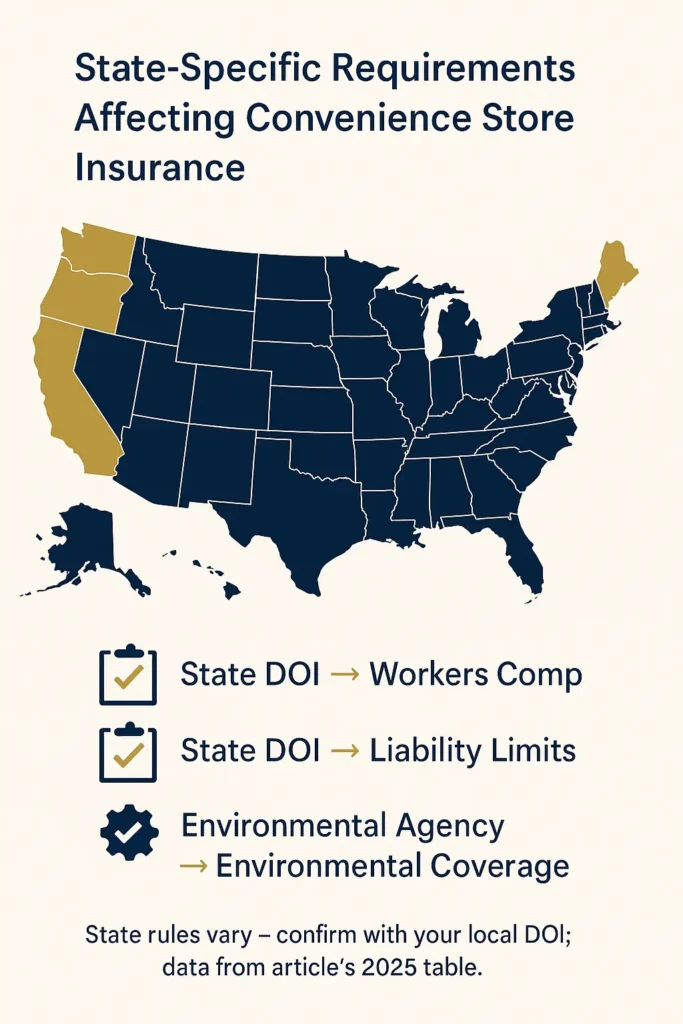

State-specific regulations create varying convenience store insurance requirements across the United States, with significant differences in minimum coverage limits, mandatory policy types, and compliance obligations. These regulatory variations directly impact insurance costs and coverage structures for multi-location operators.

Workers compensation requirements demonstrate the most dramatic state-by-state differences affecting convenience store insurance programs. While all states mandate coverage for businesses with employees, minimum benefit levels and premium calculation methods vary substantially, creating cost differences of 40-60% between highest and lowest cost states.

State Regulatory Variations Table:

| Regulation Type | High-Requirement States | Low-Requirement States | Impact on Premiums |

|---|---|---|---|

| Workers Comp Minimums | CA, NY, NJ, MA | TX, FL, NC, TN | 35-50% difference |

| Liability Limits | NY, CT, NJ, HI | AL, MS, AR, WV | 20-30% difference |

| Environmental Regs | CA, WA, OR, VT | WY, ND, SD, MT | 25-40% difference |

| Food Safety Reqs | CA, NY, IL, MA | Various southern states | 15-25% difference |

Laws requiring insurance vary by state, so visit your state’s website to find out the requirements for your business. This variation particularly affects convenience store insurance for operations selling gasoline, as environmental regulations differ dramatically between states with stringent pollution control requirements and those with more permissive approaches.

Liquor license requirements create additional convenience store insurance obligations in states permitting alcohol sales in convenience stores. These regulations often mandate higher liability limits, specific dram shop coverage, and enhanced employee training documentation affecting both compliance costs and premium calculations.

IMPORTANT NOTE: Some states require convenience stores to maintain specific coverage for underground storage tanks even when not actively selling gasoline, if tanks remain on the property.

Tobacco sales regulations impact convenience store insurance requirements through product liability exposures and regulatory compliance obligations. States with strict tobacco control laws may require specialized liability coverage or enhanced documentation of compliance with age verification and sales restriction requirements.

Food safety regulations create state-specific convenience store insurance requirements for stores preparing or selling ready-to-eat foods. States with comprehensive food safety programs typically require higher liability limits and may mandate specific coverage for foodborne illness claims.

State-Specific Compliance Requirements:

- California: Enhanced environmental liability, seismic coverage considerations

- New York: Higher minimum liability limits, strict worker safety requirements

- Texas: Specific dram shop liability for alcohol sales

- Florida: Hurricane/windstorm coverage mandates

- Illinois: Stricter food safety insurance requirements

Professional liability requirements vary by state for convenience stores providing services like check cashing, money transfers, or bill payment processing. Some states classify these services as financial activities requiring errors and omissions coverage within convenience store insurance packages.

Interstate commerce regulations affect convenience store insurance for businesses operating across state lines, requiring compliance with the highest regulatory standards among all operating locations and potentially necessitating separate policy endorsements for different states. Effective convenience store insurance programs must address these multi-jurisdictional requirements while maintaining cost efficiency across all locations.

Multi-state operators benefit from understanding complete workers comp requirements by state to ensure comprehensive compliance across all operating locations while optimizing coverage costs.

What Are Common Claims and Risk Management Strategies?

Convenience store insurance claims follow predictable patterns, with slip-and-fall incidents representing approximately 35% of all liability claims according to industry loss data. These accidents typically occur near entrance areas, around beverage coolers, or in restroom facilities where spills and wet surfaces create hazardous conditions for customers.

Theft-related losses constitute the second most frequent convenience store insurance claim category, encompassing both external robbery incidents and internal employee theft. Armed robberies peak during evening and overnight hours, while employee theft often involves cash register shortages or inventory shrinkage over extended periods.

Most Common Claims Analysis:

| Claim Type | Frequency | Average Cost | Prevention Strategies |

|---|---|---|---|

| Slip and Fall | 35% | $18,500 | Floor maintenance, warning signs |

| Theft/Robbery | 28% | $12,300 | Security systems, cash management |

| Product Liability | 15% | $24,700 | Quality control, supplier verification |

| Vehicle Incidents | 12% | $16,800 | Parking lot maintenance, lighting |

| Employee Injuries | 10% | $21,400 | Safety training, ergonomic equipment |

Product liability claims affect convenience store insurance when contaminated food items, defective products, or age-restricted sales to minors result in customer harm or regulatory violations. These claims often involve prepared foods past expiration dates, contaminated fountain drinks, or tobacco/alcohol sales compliance failures.

WARNING: Gasoline-related environmental claims can exceed $500,000 for soil remediation and groundwater cleanup, making environmental liability coverage essential for fuel-selling locations.

Vehicle-related incidents in parking areas generate significant convenience store insurance claims through customer vehicle damage, pedestrian injuries, or accidents involving delivery trucks. Poor lighting, inadequate traffic flow design, or failure to maintain parking surfaces contribute to these losses.

Employee injury claims primarily involve back strains from lifting inventory, cuts from handling merchandise, or slips on wet floors during cleaning activities. According to NAIC 2024 market share analysis, direct losses incurred were 7.2% higher in commercial lines, resulting in a moderate deterioration in the PDLR to 60.2%, indicating increasing severity in workplace injury costs across commercial segments.

Effective Risk Management Strategies:

- Security Protocols: Install monitored alarm systems, maintain adequate lighting, implement cash management procedures limiting register amounts

- Safety Procedures: Establish floor cleaning protocols, post wet floor warnings, provide non-slip footwear for employees

- Product Management: Implement rotation systems ensuring fresh inventory, maintain temperature logs for refrigerated items

- Employee Training: Conduct regular safety meetings, provide proper lifting techniques training, establish emergency response procedures

Comprehensive loss prevention programs can reduce convenience store insurance premiums by 15-25% while significantly decreasing claim frequency. These programs typically include employee safety training, security system installations, and regular facility maintenance protocols.

Cyber Security Measures:

- Install updated point-of-sale systems with encryption

- Implement network security protocols

- Train employees on data protection procedures

- Maintain backup systems for transaction processing

Food safety protocols become critical for convenience store insurance claims prevention when selling prepared foods or fountain beverages. Regular equipment cleaning, temperature monitoring, and staff hygiene training significantly reduce contamination risks and associated liability exposures.

Professional business insurance guidance helps convenience store owners implement effective risk management strategies while ensuring adequate coverage for unavoidable exposures.

How Should Convenience Store Owners Compare Insurance Policies?

Comparing convenience store insurance policies requires systematic evaluation of coverage components, limits, deductibles, and carrier-specific exclusions that may significantly impact protection quality. Standard comparison approaches focusing solely on premium costs often overlook critical coverage gaps that become apparent only during claims situations.

Coverage limit adequacy represents the most crucial factor when comparing convenience store insurance options. Policies with seemingly similar descriptions may offer substantially different protection levels through aggregate limits, per-occurrence restrictions, or sublimits on specific coverage types like cyber liability or employment practices liability.

Policy Comparison Framework:

| Evaluation Criteria | Weight Factor | Key Questions | Red Flags |

|---|---|---|---|

| Coverage Breadth | 40% | Are all exposures covered? | Significant exclusions |

| Financial Strength | 25% | Carrier A.M. Best rating? | Below A- rating |

| Claims Handling | 20% | Response time reputation? | Poor review patterns |

| Premium Value | 15% | Cost per coverage dollar? | Unusually low quotes |

Deductible structures significantly impact convenience store insurance value propositions, with higher deductibles reducing premiums but increasing out-of-pocket exposure during claims. Smart comparison strategies evaluate total cost of ownership including potential deductible payments rather than focusing exclusively on annual premium amounts.

PRO TIP: Request detailed policy documents rather than relying on quotation summaries, as coverage differences often appear in policy language not reflected in proposal formats.

Carrier financial strength ratings deserve careful consideration when comparing convenience store insurance options, as financially unstable insurers may struggle to pay claims during economic downturns or major catastrophic events. A.M. Best ratings of A- or higher indicate stable financial condition for claims-paying ability.

Claims handling reputation varies dramatically among carriers, with some specializing in commercial lines offering superior service while others prioritize personal lines customers. Commercial insurance agents can help you find policies that match your business needs, providing valuable insights into carrier-specific advantages and limitations.

Essential Policy Features Comparison:

- Business Interruption: Verify coverage period and expense categories included

- Equipment Breakdown: Confirm coverage for refrigeration and POS system failures

- Cyber Liability: Review data breach response services and credit monitoring provisions

- Employment Practices: Check coverage for third-party harassment claims

- Commercial Auto: Ensure hired and non-owned vehicle protection

Premium payment options affect convenience store insurance affordability, with annual payments typically offering 5-8% discounts compared to monthly payment plans. However, monthly options provide cash flow benefits for businesses with seasonal revenue variations.

Coverage territory restrictions may limit protection for convenience store insurance policies, particularly affecting businesses with delivery services or multiple locations across state boundaries. Verify policy territory includes all operational areas.

Policy Exclusions Analysis:

- Review pollution exclusions for gasoline-selling locations

- Examine cyber exclusions for payment processing activities

- Verify employee theft coverage limitations and requirements

- Check product liability exclusions for specific inventory items

Industry-specific endorsements enhance convenience store insurance value through targeted coverage for unique exposures like food contamination, fuel system failures, or ATM liability. Standard commercial policies may require numerous endorsements to achieve adequate protection.

Professional insurance consultation helps optimize convenience store insurance decisions through professional liability insurance protection expertise and market knowledge of carrier specializations and coverage innovations.

FAQ

What is the minimum insurance required for convenience stores?

Most states require convenience stores to maintain workers compensation insurance for all employees, plus general liability coverage ranging from $300,000 to $1 million per occurrence depending on state regulations. Additionally, stores with commercial vehicles must carry commercial auto liability insurance meeting state minimum requirements, typically $750,000 to $1 million. Stores selling gasoline often face additional environmental liability requirements through state environmental agencies.

How does selling gasoline affect convenience store insurance costs?

Gasoline sales typically increase convenience store insurance premiums by 40-60% due to environmental liability exposures and underground storage tank risks. Required coverage includes pollution liability protection, tank leak coverage, and soil remediation costs. Environmental cleanup claims can exceed $500,000, making specialized coverage essential for fuel-selling locations.

Are convenience stores required to have cyber liability insurance?

While not legally mandated in most states, cyber liability insurance has become practically essential for convenience stores processing electronic payments. This coverage protects against data breaches involving customer payment information and point-of-sale system compromises. With most transactions now electronic, lack of cyber coverage creates substantial financial exposure for business owners.

What factors make convenience store insurance more expensive?

High-crime locations, gasoline sales, prepared food offerings, and extended operating hours significantly increase convenience store insurance costs. Urban locations typically cost 15-25% more than rural areas due to higher crime rates. Stores open 24 hours face elevated premiums due to increased robbery risks during overnight operations.

How can convenience store owners reduce insurance premiums?

Installing comprehensive security systems can reduce premiums 10-15%, while employee safety training programs may provide 5-10% discounts. Maintaining claims-free history for three years typically qualifies for experience credits reducing costs 10-25%. Bundling multiple coverage types with a single carrier often provides additional savings of 8-15%.

Does convenience store insurance cover employee theft?

Most general liability policies exclude employee theft, requiring separate employee dishonesty coverage or crime insurance. This specialized coverage protects against cash register theft, inventory shrinkage, and embezzlement by employees. Coverage limits typically range from $25,000 to $100,000 depending on business size and risk assessment.

Conclusion

Convenience store insurance requirements reflect the unique risk profile of this retail segment, combining high customer traffic, diverse product offerings, and extended operating hours into complex exposure scenarios requiring specialized coverage approaches. Successful operators recognize that adequate protection extends beyond basic commercial policies to include industry-specific endorsements addressing gasoline sales, prepared foods, and cyber security vulnerabilities.

Premium optimization strategies focus on risk management implementations rather than coverage reductions, as comprehensive protection proves more cost-effective than paying claims from inadequate coverage limits. Security system installations, employee training programs, and proactive maintenance protocols not only reduce insurance costs but also create safer operating environments for customers and staff.

Market conditions in 2025 continue favoring convenience store owners who work with specialized commercial insurance agents understanding the industry’s unique requirements and available coverage options. Professional guidance helps navigate state regulatory variations while optimizing coverage structures for individual operational characteristics.

Key Takeaways

Essential Coverage Requirements: Convenience store insurance must include general liability, commercial property, workers compensation, and business interruption coverage, with specialized endorsements for gasoline sales, prepared foods, and cyber security exposures.

Cost Management Strategies: Annual premiums averaging $3,200-$7,800 can be reduced through security system installations, employee safety programs, and maintaining claims-free operating histories while avoiding coverage gaps that create larger financial exposures.

State Regulatory Compliance: Workers compensation requirements, environmental regulations, and liability limits vary significantly by state, requiring specialized knowledge for multi-location operators and compliance with the highest standards across all operating jurisdictions.

Risk Prevention Focus: Effective loss control programs including employee training, security protocols, and facility maintenance can reduce both insurance premiums and claim frequency while creating safer operating environments for customers and employees.

Disclaimer

Data Freshness: Insurance rates and regulations change frequently. Data accuracy depends on timing of official releases and market conditions affecting carrier pricing strategies.

Geographic Variations: Insurance requirements vary significantly by state. Always consult your state’s insurance department and local regulations for specific compliance requirements in your operating jurisdiction.

Professional Advice: This information is for educational purposes only. Insurance decisions should be made in consultation with licensed professionals familiar with your specific business operations and local regulatory requirements.