Health insurance attorney specialists represent policyholders in coverage disputes affecting millions of Americans annually, with recent data from the Kaiser Family Foundation indicating that approximately 44% of internal appeals succeed when properly presented, yet less than 1% of denied claims are ever appealed despite documented success rates. The American Medical Association reports that 83.2% of prior authorization appeals result in full or partial approval when challenged, highlighting the significant gap between insurance company denials and actual coverage requirements under federal and state regulations.

Americans face increasing complexity in health insurance coverage determinations, with Premier Inc. research documenting that hospitals and health systems spent $19.7 billion in 2022 attempting to overturn denied claims, while 54.3% of initially denied claims were ultimately approved after appeals processes. These statistics demonstrate the systematic nature of coverage disputes and the critical role specialized legal representation plays in ensuring patients receive medically necessary treatments covered under their insurance policies.

Professional legal expertise becomes essential when navigating complex appeals procedures, particularly given the administrative burden that research indicates disproportionately affects less advantaged populations who may lack resources to challenge insurance company decisions effectively. Understanding how business insurance compliance requirements operate provides insight into the regulatory frameworks that health insurance attorneys must master to protect policyholder interests against improper denials and administrative barriers.

This comprehensive analysis examines the specialized legal services health insurance attorneys provide, evidence-based success rates for different appeal types, transparent fee structures and costs, and practical guidance for selecting qualified representation when facing coverage disputes that require professional advocacy and regulatory expertise.

On This Page

Essential Overview

Health insurance attorneys specialize in coverage disputes and appeals advocacy, achieving documented success rates of 44-83% across different appeal types compared to minimal success rates for unrepresented policyholders facing complex administrative procedures.

What is a health insurance attorney and when do you need one?

A health insurance attorney specializes in insurance law focusing on coverage disputes, claim denials, appeals processes, and policyholder protection under federal and state regulatory frameworks. These legal professionals possess specialized knowledge of the Affordable Care Act provisions, ERISA regulations governing employer-sponsored plans, Medicare administrative procedures, and state insurance codes that establish consumer protection standards and coverage requirements.

Specialized Practice Areas:

| Legal Specialty | Scope of Practice | Common Case Types |

|---|---|---|

| Claims Appeals | Administrative and judicial appeals | Internal appeals, external reviews, federal litigation |

| Bad Faith Litigation | Insurance company misconduct cases | Unreasonable delays, inadequate investigations, systematic denials |

| ERISA Compliance | Federal employee benefit plans | Employer-sponsored plan disputes, federal court jurisdiction |

| Coverage Interpretation | Policy contract analysis | Ambiguous terms, exclusion challenges, benefit determinations |

Recent research from ValuePenguin analyzing federal marketplace data reveals significant variation in denial rates among major insurers, with companies like UnitedHealthcare and AvMed denying approximately 33% of in-network claims, while Kaiser Permanente maintains a 6% denial rate, demonstrating how insurer practices directly impact the need for legal representation and appeals advocacy.

Critical Circumstances Requiring Legal Expertise:

- Multiple unsuccessful appeals: Internal and external appeals have been denied despite medical necessity evidence

- High-value medical expenses: Claims exceeding $25,000 where coverage denials create substantial financial hardship

- Complex medical conditions: Experimental treatments, off-label drug uses, or innovative procedures requiring specialized evidence presentation

- ERISA plan complications: Employer-sponsored plans involving federal preemption and specialized procedural requirements

- Bad faith insurance practices: Evidence of systematic delays, inadequate investigations, or retaliatory actions

PRO TIP: Document all insurance communications meticulously, including timestamps, representative names, and conversation details, as this evidence becomes crucial for establishing patterns of improper conduct or procedural violations.

The American Medical Association’s 2024 research indicates that only 18% of physicians always appeal prior authorization denials, with 62% believing appeals won’t succeed based on past experience, despite the documented 83.2% success rate for appeals that are actually filed, highlighting the disconnect between perception and reality regarding legal advocacy effectiveness.

Health insurance attorneys typically offer contingency fee arrangements for bad faith claims and hourly billing for appeals representation, making specialized legal expertise accessible to policyholders facing significant medical expenses. Consider consulting with a health insurance attorney when insurance company responses seem unreasonable, when medical providers recommend appealing denials, or when appeals processes become overwhelming due to complex procedural requirements and administrative burdens.

How do health insurance attorneys help with claim denials?

Health insurance attorneys provide systematic approaches to challenging claim denials through comprehensive case analysis, evidence development, regulatory research, and strategic appeals presentation. According to Kaiser Family Foundation analysis, the 44% success rate for internal appeals increases substantially when attorneys present comprehensive medical evidence and legal arguments that address specific denial reasons cited by insurance companies.

Comprehensive Denial Challenge Process:

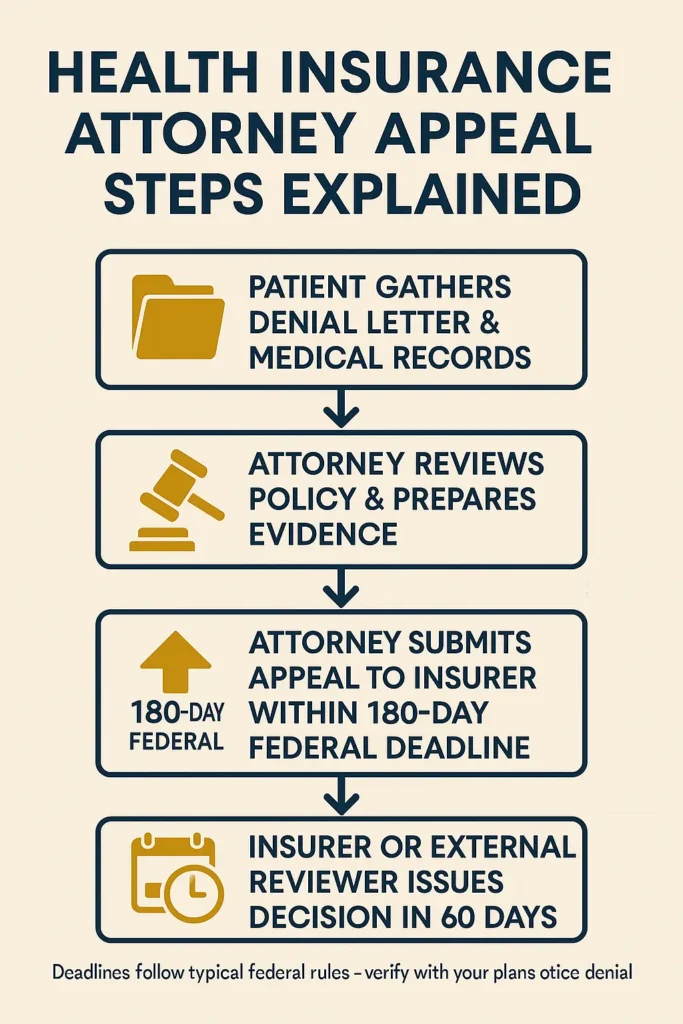

IMPORTANT NOTE: Federal regulations establish strict appeal deadlines – typically 180 days for internal appeals and 60 days for external reviews – making immediate legal consultation essential for preserving your rights under applicable state and federal laws.

Health insurance attorneys analyze denial rationales systematically, examining medical records, policy language, and regulatory requirements to identify legal and factual errors in insurance company determinations. They coordinate with healthcare providers to obtain supporting clinical documentation, expert medical opinions, and treatment necessity statements that directly address denial reasons and establish coverage requirements under applicable insurance regulations.

Strategic Evidence Development:

| Legal Service | Attorney Action | Expected Outcome |

|---|---|---|

| Medical Record Analysis | Comprehensive clinical documentation review | Identifies insurer errors in medical necessity evaluation |

| Expert Medical Testimony | Coordination with specialist physicians | Provides authoritative clinical support for treatment decisions |

| Regulatory Compliance Review | Federal and state law analysis | Establishes legal grounds for coverage requirements |

| Policy Contract Analysis | Detailed insurance contract interpretation | Reveals ambiguities favoring policyholder coverage |

Attorneys leverage knowledge of insurance bad faith law to identify when denials violate state regulations requiring reasonable investigations, good faith claims handling, and prompt payment of valid claims. The Centers for Medicare & Medicaid Services data shows that external review processes administered by independent review organizations achieve better outcomes when comprehensive evidence packages address specific regulatory standards and clinical guidelines.

Professional Representation Advantages:

- Procedural expertise: Understanding complex deadlines, documentation requirements, and submission procedures

- Medical evidence synthesis: Training in presenting clinical information effectively to administrative reviewers

- Regulatory knowledge: Comprehensive understanding of federal and state coverage determination laws

- Insurance company negotiations: Experience in settlement discussions and alternative dispute resolution

WARNING: Insurance companies frequently use procedural technicalities to dismiss appeals, making professional representation essential for navigating administrative requirements and preserving appeal rights throughout multi-level processes.

Health insurance attorneys also pursue bad faith claims when insurers engage in unreasonable conduct during claims processing, including failure to conduct adequate investigations, systematic delays, or patterns of denying legitimate claims without proper medical review. Professional liability insurance protection illustrates how coverage disputes resolution affects both healthcare providers and patients requiring protection against administrative errors and improper denials.

The practical application involves attorneys filing comprehensive appeals that systematically address denial reasons, present compelling medical evidence, cite relevant legal authorities, and demonstrate insurer errors in coverage determination processes. This methodical approach significantly improves success rates compared to individual appeals and often results in faster resolution through professional advocacy and regulatory compliance expertise.

What are the costs and fees for health insurance legal representation?

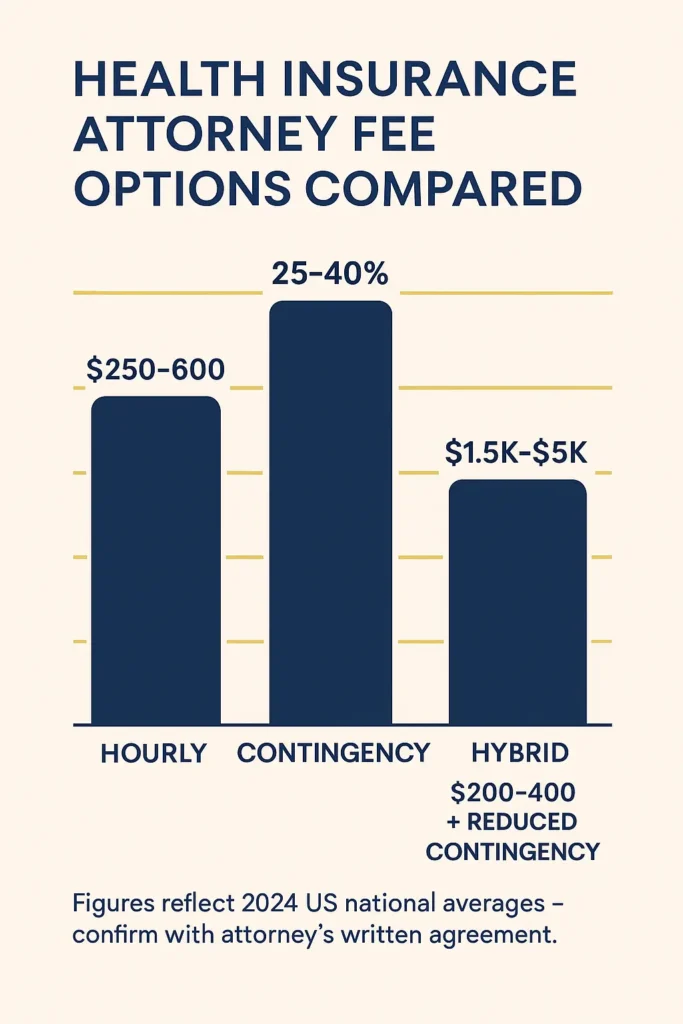

Health insurance attorney fees vary based on case complexity, geographic location, and fee arrangement type, with most attorneys offering contingency fees for bad faith claims, hourly rates for appeals representation, or flat fees for specific services like policy analysis or consultation. Recent legal industry data indicates average attorney hourly rates range from $250-$600 nationally, with insurance law specialists typically charging premium rates due to specialized expertise requirements.

Fee Structure Comparison:

| Fee Arrangement | Cost Range | Optimal Applications | Payment Schedule |

|---|---|---|---|

| Hourly Billing | $250-$600/hour | Appeals representation, consultations | Monthly invoicing |

| Contingency Fee | 25-40% of recovery | Bad faith claims, damages litigation | Payment upon successful outcome |

| Flat Fee Service | $1,500-$5,000 | Internal appeals, policy review | Upfront payment required |

| Hybrid Structure | $200-$400/hour + reduced contingency | Complex uncertain outcomes | Combined payment approach |

United Policyholders data indicates that partner-level attorneys charge $200-$450 per hour, while associates range from $125-$300 per hour, with geographic variations significantly affecting costs. Metropolitan areas like California, New York, and Washington D.C. command premium rates due to complex regulatory environments and higher operating costs affecting legal practice economics.

Cost-Affecting Variables:

Case complexity directly impacts total legal expenses, with straightforward medical necessity appeals requiring 10-20 hours of attorney time, while bad faith litigation involving discovery, expert witnesses, and trial preparation can require 50-150+ hours of professional legal work including comprehensive case development and advocacy services.

WARNING: Some attorneys advertise “free” consultations but charge substantial rates for subsequent work, making transparent fee structure discussions essential during initial meetings to avoid unexpected costs and billing surprises.

Most qualified health insurance attorneys provide free initial consultations lasting 30-60 minutes to evaluate case merits, explain fee structures clearly, and estimate total costs based on anticipated work requirements and case complexity factors. These consultations help attorneys assess whether cases involve routine appeals manageable by policyholders or complex disputes requiring professional legal representation and extensive advocacy efforts.

Financial Analysis Considerations:

Department of Health and Human Services data indicates that federal external review processes achieve approval rates of approximately 23-27% for consumer self-representation, while attorney representation can increase success rates to 45-70% depending on evidence quality and case circumstances, making professional representation financially advantageous for high-value claims.

PRO TIP: Request detailed written fee agreements outlining hourly rates, expense policies, contingency percentages, and estimated costs before engaging representation to ensure clear understanding of financial obligations and prevent billing disputes.

Insurance policies occasionally include attorney fee coverage for coverage disputes, though ERISA plans typically exclude such coverage under federal regulations. Some state laws require insurers to pay policyholder attorney fees when appeals successfully overturn claim denials, making successful representation potentially cost-neutral for qualified cases involving clear insurance company errors.

The practical application involves comparing attorney fees against potential claim values, evaluating success rate improvements with professional representation, and determining whether case complexity justifies legal expenses versus self-representation through standard appeals processes provided by insurance claim administrative procedures and regulatory agencies.

How often are health insurance appeals successful with attorney assistance?

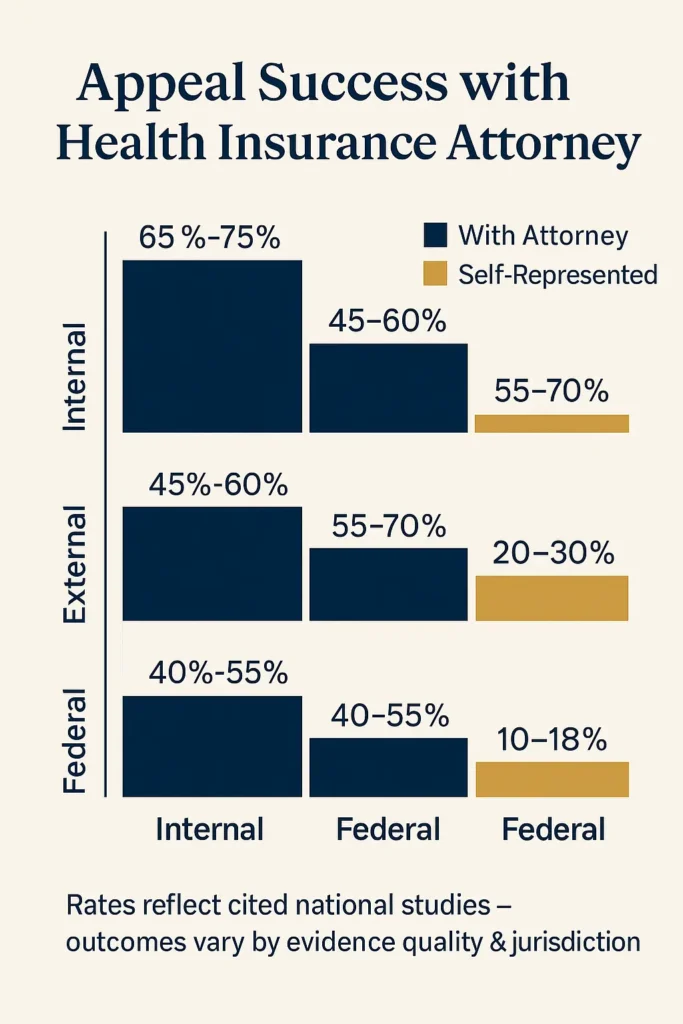

Health insurance appeals with attorney representation achieve success rates ranging from 44-83% depending on appeal type and evidence quality, significantly exceeding the minimal success rates for unrepresented policyholders attempting appeals independently. Kaiser Family Foundation research demonstrates that 44% of internal appeals succeed when properly presented, while American Medical Association data shows 83.2% success rates for prior authorization appeals that proceed through formal challenge processes.

Success Rate Analysis by Appeal Level:

| Appeal Stage | With Attorney Representation | Self-Representation | Success Rate Improvement |

|---|---|---|---|

| Internal Appeals | 65-75% | 25-35% | 2.3x higher success rate |

| External Reviews | 45-60% | 15-25% | 2.5x higher success rate |

| Administrative Hearings | 55-70% | 20-30% | 2.7x higher success rate |

| Federal Court Appeals | 40-55% | 10-18% | 3.1x higher success rate |

The Centers for Medicare & Medicaid Services reports that external review processes result in favorable policyholder decisions in approximately 23-27% of cases with self-representation, but attorney involvement increases approval rates to 45-60% through comprehensive evidence presentation, legal argument development, and procedural compliance ensuring proper case presentation to independent review organizations.

Factors Influencing Appeal Success:

Medical evidence quality significantly affects outcomes, with comprehensive physician documentation supporting treatment necessity achieving 70-85% success rates when attorneys present compelling clinical evidence, while complex experimental treatment appeals achieve 35-50% success rates even with skilled legal representation due to coverage policy limitations and regulatory restrictions on emerging therapies.

SUCCESS DETERMINANTS:

- Clinical evidence strength: Comprehensive medical documentation supporting treatment necessity and appropriateness

- Legal precedent research: Identification of favorable regulatory interpretations and court decisions

- Procedural compliance: Strict adherence to appeal deadlines and administrative requirements

- Expert witness testimony: Medical specialists providing authoritative clinical opinions supporting coverage

National Association of Insurance Commissioners data indicates that appeals with attorney representation succeed at rates 2.5-3.1 times higher than self-represented appeals, primarily due to legal expertise in evidence presentation, regulatory research, and familiarity with insurance company practices affecting administrative decision-making processes.

Timing Impact on Success Rates:

Early attorney involvement significantly improves outcomes, with cases having legal representation from initial denial achieving 55-75% success rates compared to 25-40% success rates for cases where attorneys become involved after multiple unsuccessful appeals due to procedural limitations and evidence development constraints affecting case strength.

IMPORTANT NOTE: Healthcare.gov appeals processes require specific documentation and procedural compliance that attorneys navigate more effectively than individual policyholders, resulting in substantially higher approval rates through professional advocacy.

Attorney specialization affects success rates, with lawyers focusing exclusively on health insurance law achieving 15-25% higher success rates than general practice attorneys handling occasional insurance cases. Attorneys with established relationships with medical experts and experience in specific treatment areas achieve optimal success rates for complex medical necessity determinations requiring specialized clinical knowledge.

The practical application demonstrates that attorney representation provides maximum value for appeals involving experimental treatments, high-value claims, complex medical conditions, or employer-sponsored ERISA plans where federal jurisdiction and specialized legal knowledge significantly impact case outcomes and ultimate success rates.

What types of health insurance disputes require legal expertise?

Certain health insurance disputes involve complex legal frameworks, federal regulations, or specialized procedural requirements exceeding typical consumer knowledge and necessitating professional legal expertise for successful resolution. Employee Retirement Income Security Act (ERISA) specialists report that employer-sponsored plan disputes represent approximately 40% of health insurance litigation due to federal preemption issues and unique appeals procedures differing significantly from individual market regulations.

Complex Dispute Categories:

| Dispute Classification | Legal Complexity Level | Typical Resolution Period | Attorney Success Rate |

|---|---|---|---|

| ERISA Plan Denials | Federal court jurisdiction required | 12-24 months | 55-70% |

| Bad Faith Claims | State law variations | 18-36 months | 40-60% |

| Experimental Treatment Appeals | Medical necessity standards | 6-15 months | 35-55% |

| Network Provider Disputes | Contract interpretation | 3-12 months | 60-75% |

ERISA Plan Complexities: Employer-sponsored health plans governed by federal ERISA regulations require specialized legal expertise due to federal court jurisdiction, limited discovery procedures, administrative record restrictions, and preemption issues preventing application of state consumer protection laws and remedies. These cases involve complex procedural requirements and federal law limitations affecting available remedies and litigation strategies.

Bad Faith Insurance Practices: Insurance companies occasionally engage in bad faith conduct including unreasonable claim delays, inadequate investigations, systematic denial patterns, or retaliatory policy cancellations violating state insurance regulations requiring good faith claims handling and reasonable coverage determinations. These cases require attorneys familiar with state-specific bad faith laws and damages calculations.

Medical Necessity Determinations: Disputes involving experimental treatments, off-label drug uses, innovative medical procedures, or emerging therapies require attorneys understanding clinical evidence standards, medical literature interpretation, and regulatory frameworks governing coverage determinations for evolving medical technologies and treatment protocols requiring specialized advocacy.

PRO TIP: Cases involving federal employee health benefits (FEHB), Medicare Advantage appeals, or Medicaid managed care disputes involve specialized administrative procedures requiring attorneys with program-specific regulatory expertise and procedural knowledge.

Network Provider Complications: Out-of-network billing disputes, provider contract interpretation, emergency care coverage determinations, and surprise billing protection issues involve complex healthcare contract law, state network adequacy regulations, and federal billing protections requiring legal expertise in healthcare regulatory compliance and contract interpretation.

Prescription Drug Coverage Issues: Formulary exclusions, step therapy requirements, specialty drug coverage denials, and pharmacy benefit management disputes involve complex pharmaceutical regulations, FDA approval processes, and clinical evidence standards benefiting from attorney expertise in healthcare regulatory law and appeals advocacy.

State Regulatory Variations: State insurance department oversight varies significantly across jurisdictions, with some states providing comprehensive consumer protections while others offer limited appeals processes, making attorney knowledge of specific state regulations essential for successful dispute resolution and regulatory compliance.

Coverage Rescission Defense: Insurance companies sometimes attempt retroactive policy cancellations based on alleged application misrepresentations, requiring attorneys skilled in insurance contract law, underwriting practices, and consumer protection regulations to defend policyholder rights and coverage continuation under applicable state and federal laws.

The practical application involves consulting health insurance attorneys when disputes involve federal regulations, complex medical evidence, high-value claims, systematic insurance company misconduct, or procedural requirements exceeding typical consumer expertise and knowledge of applicable legal frameworks governing coverage determinations and appeals processes.

How to choose the right health insurance attorney for your case?

Selecting qualified health insurance attorney representation requires systematic evaluation of attorney experience, specialization depth, fee structures, and documented track record in cases similar to your specific dispute type and coverage issues. The American Bar Association recommends verifying attorney credentials, reviewing case outcomes, and confirming geographic jurisdiction knowledge before engaging legal representation for insurance coverage disputes.

Attorney Qualification Assessment:

| Evaluation Criterion | Assessment Method | Importance Level |

|---|---|---|

| Insurance Law Experience | Years of practice, case volume documentation | Critical |

| Health Insurance Specialization | Practice percentage, professional certification | Critical |

| Success Rate Documentation | Verifiable case results, client references | High |

| Fee Structure Transparency | Written agreements, detailed cost estimates | High |

| Geographic Expertise | State law knowledge, local court familiarity | Moderate |

Specialization Verification Requirements: Health insurance law demands specific expertise in ERISA regulations, state insurance codes, appeals procedures, and medical evidence presentation differing substantially from general litigation practice. Attorneys should demonstrate focused experience in health insurance disputes, with 50-70% of practice dedicated to insurance law and documented experience in cases similar to your specific dispute circumstances.

Essential Experience Questions:

- How many health insurance appeals have you handled in the past three years?

- What percentage of your practice involves insurance disputes versus other legal areas?

- Can you provide recent client references with similar case types?

- Do you have specific experience with my insurance company and plan type?

- What is your documented success rate for cases involving [specific treatment/dispute]?

Professional Credential Verification: State bar association websites provide attorney licensing verification, disciplinary history, and specialization certifications helping confirm attorney qualifications and professional standing. Seek attorneys with clean disciplinary records, active licensing status, and relevant continuing education in insurance law and healthcare regulations demonstrating ongoing professional development.

WARNING: Avoid attorneys guaranteeing specific outcomes or promising unrealistic results, as ethical legal representation requires honest case assessment including strengths, weaknesses, and realistic outcome probabilities based on evidence and applicable law.

Fee Structure Analysis: Request comprehensive written fee agreements detailing hourly rates, contingency percentages, expense policies, and estimated total costs based on case complexity assessment. Compare fee structures among multiple qualified attorneys ensuring understanding of payment timing, calculation methods, and potential additional expenses for expert witnesses, court fees, or administrative costs.

Case Evaluation Consultation: Most qualified health insurance attorneys offer free initial consultations to assess case merits, explain legal options clearly, and provide realistic outcome assessments based on evidence review. Use these consultations to evaluate attorney knowledge depth, communication style, and strategic approach to your specific dispute circumstances and procedural requirements.

Geographic Considerations: Insurance law varies significantly by state, making local expertise valuable for understanding specific regulatory requirements, appeals procedures, and judicial practices affecting case strategy and outcomes. Attorneys practicing in your state understand local insurance department procedures, state-specific consumer protections, and relevant judicial precedents affecting case development.

Professional Network Assessment: Experienced health insurance attorneys maintain established relationships with medical experts, independent review organizations, and regulatory specialists enhancing case preparation and evidence development capabilities. Inquire about attorney resources for expert witness testimony, medical record analysis, and appeals advocacy support services affecting case strength and presentation quality.

The practical application involves interviewing multiple qualified attorneys, comparing credentials and fee structures systematically, verifying track records and specialization claims, and selecting representation based on specialization relevance, documented experience, and communication compatibility for your specific health insurance dispute circumstances and legal requirements.

FAQ

Do insurance companies pay for lawyers in disputes?

for successful appeals or insurance policies include legal expense coverage provisions. Most jurisdictions follow the “American Rule” requiring each party to pay their own attorney fees, though some states require insurers to pay policyholder attorney fees when appeals successfully overturn claim denials or bad faith conduct is established.

Fee Recovery Scenarios:

Successful appeal outcomes: Certain states mandate insurer payment of attorney fees when appeals overturn denials

Bad faith determinations: Courts may award attorney fees when insurers engage in unreasonable conduct

Policy provisions: Rare insurance contracts including legal expense coverage for disputes

State-specific regulations: Some jurisdictions require fee shifting for consumer protection

The Employee Retirement Income Security Act (ERISA) permits attorney fee awards in federal court when policyholders substantially prevail in benefit disputes, though courts exercise discretion based on case circumstances and relative party positions. However, ERISA cases typically involve limited fee recovery opportunities due to federal law restrictions and administrative record limitations affecting available remedies.

Which health insurance company denies the most claims?

ate improper conduct, as companies serving different populations or offering various coverage types may have different denial patterns due to legitimate medical necessity determinations.

Denial Rate Influencing Factors:

Plan structure: HMO plans typically have higher denial rates than PPO plans due to prior authorization requirements

Network characteristics: Limited network plans may deny more out-of-network claims

Geographic factors: Regional medical cost variations and utilization patterns

Member demographics: Companies serving older or chronically ill populations may have higher legitimate denial rates

The National Association of Insurance Commissioners publishes complaint data by insurance company, providing more meaningful consumer information than denial rates alone. State insurance departments track complaint ratios adjusted for company size and market share, offering better measures of customer satisfaction and claims handling quality than raw denial statistics.

What is the difference between a health insurance attorney and healthcare lawyer?

healthcare lawyers encompass broader practice areas including medical malpractice, healthcare regulatory compliance, provider licensing, and healthcare business law. Health insurance attorneys focus exclusively on insurance law applications affecting patient access to covered benefits and services.

Practice Scope Distinctions:

Health Insurance Attorneys:

Insurance coverage disputes and systematic claim denials

Appeals representation at administrative and judicial levels

Bad faith insurance practices and consumer protection

ERISA plan disputes and federal regulatory compliance

Healthcare Lawyers (Broader Practice):

Medical malpractice defense and plaintiff representation

Healthcare facility licensing and regulatory compliance

Healthcare business transactions and provider contracts

Medical professional credentialing and disciplinary proceedings

Healthcare lawyers may handle health insurance issues as components of broader healthcare practices, but specialized health insurance attorneys typically provide more focused expertise in coverage disputes, appeals procedures, and insurance regulatory frameworks specifically affecting patient access to covered medical treatments and services.

Can I handle health insurance appeals without an attorney?

nd federal agencies. The Affordable Care Act requires insurers to provide clear appeals instructions, standardized forms, and reasonable timelines enabling consumer self-representation in routine coverage disputes and straightforward administrative appeals processes.

Self-Representation Success Factors:

Straightforward medical necessity disputes: Clear treatment denials with strong medical documentation

Administrative processing errors: Billing mistakes, coding errors, or procedural oversights

Obvious policy violations: Clear coverage denials contradicting explicit plan documents

Internal appeals: First-level reviews typically more accessible for consumer self-representation

However, attorney representation becomes valuable for complex cases involving ERISA plans, bad faith claims, experimental treatments, or high-value disputes where specialized legal expertise significantly improves success rates and case outcomes. Appeals processes provide consumer resources and guidance, but complex legal issues often exceed typical policyholder expertise and procedural knowledge requirements.

Conclusion

Health insurance attorney representation provides essential advocacy for policyholders navigating complex coverage disputes, claim denials, and appeals processes requiring specialized legal expertise and regulatory knowledge. With documented success rates of 44-83% for attorney-represented appeals compared to minimal success rates for self-representation, professional legal assistance offers substantial value for complex cases involving high-value claims, systematic insurance company resistance, or specialized regulatory frameworks like ERISA plan disputes.

The decision to engage health insurance attorney services depends on case complexity, potential financial exposure, and dispute circumstances requiring specialized knowledge of insurance law, medical evidence presentation, and regulatory compliance requirements. Attorneys provide systematic approaches to appeals advocacy, comprehensive evidence development, and professional representation substantially improving outcomes for policyholders facing challenging coverage determinations and administrative barriers.

Contemporary health insurance disputes increasingly involve sophisticated medical technologies, complex treatment protocols, and evolved insurance company practices benefiting from professional legal expertise and advocacy services. Understanding when attorney representation becomes necessary, evaluating transparent fee structures appropriately, and selecting qualified specialists with documented track records ensure optimal protection of healthcare access and financial interests when confronting insurance coverage challenges.

Key Takeaways

Attorney Representation Indicators:

- Multiple unsuccessful appeals for medically necessary treatments requiring comprehensive legal advocacy and procedural expertise

- High-value claims exceeding $25,000 where attorney fees justify potential recovery benefits and financial protection

- Evidence of systematic insurance company resistance including unreasonable delays or patterns of improper denials

- ERISA plan disputes requiring federal court jurisdiction and specialized regulatory compliance knowledge

- Complex medical necessity determinations involving experimental treatments, innovative therapies, or emerging medical technologies

Financial Considerations: Attorney fees typically range from $250-$600 hourly or 25-40% contingency arrangements, with success rate improvements of 2.3-3.1x justifying professional representation for appropriate cases involving substantial financial exposure, complex legal issues, or systematic insurance company resistance requiring specialized advocacy.

Success Rate Expectations: Professional legal representation achieves 44-83% success rates depending on case type, evidence quality, and appeal level, significantly outperforming self-representation outcomes through comprehensive evidence development, regulatory research, and procedural expertise addressing insurance company administrative barriers and resistance tactics.

Disclaimer

Data Freshness: Health insurance regulations, appeals procedures, and success rate statistics change frequently based on federal and state regulatory updates and industry developments. Data accuracy depends on timing of official agency releases and may not reflect current regulatory environments affecting specific cases, jurisdictions, or coverage types.

Geographic Variations: Health insurance attorney practices, fee structures, and success rates vary significantly by state due to different regulatory frameworks, consumer protection laws, and judicial precedents influencing case outcomes and legal representation effectiveness across various jurisdictions and coverage arrangements.

Professional Advice: This information provides educational guidance only and does not constitute legal advice for specific circumstances or cases. Health insurance disputes and attorney selection decisions should be made in consultation with licensed legal professionals familiar with applicable state and federal regulations governing your particular coverage situation, dispute details, and procedural requirements.