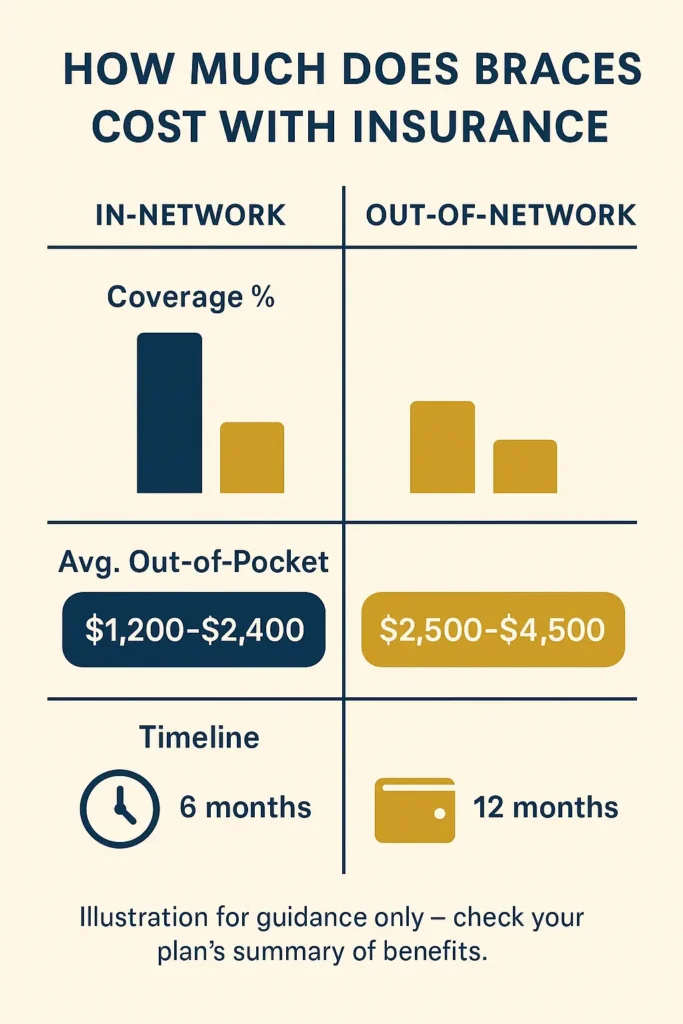

Ever wondered how much does braces cost with insurance? You’re not alone—millions of American families grapple with this exact question every year. According to the Centers for Medicare & Medicaid Services, orthodontic coverage varies dramatically, with families typically paying $1,200 to $4,500 out-of-pocket even with comprehensive dental plans. But here’s what’s surprising: understanding your specific coverage details before treatment can slash these costs by thousands.

Most parents discover the hard way that orthodontic treatment insurance coverage doesn’t work like regular dental benefits. While your plan might cover cleanings at 100%, orthodontic work often falls under different rules—with waiting periods, lifetime maximums, and medical necessity requirements that can catch families off guard. The complexity of braces insurance benefits leaves many wondering if they’re making the right financial decisions for their child’s future.

What if you could navigate this maze confidently? Through analyzing government data from NAIC reports and CMS guidelines, we’ve uncovered the strategies successful families use to minimize their orthodontic expenses. Understanding health insurance for families planning principles helps parents make informed decisions about their children’s orthodontic care. This comprehensive guide reveals exactly how much does braces cost with insurance across different plan types, plus actionable strategies to reduce your family’s financial burden.

By the end of this article, you’ll know precisely what questions to ask your insurance company, which coverage options provide the best value, and how to structure payments for maximum savings. Let’s dive into the real numbers that matter for your family’s budget.

On This Page

Essential Overview

With insurance coverage, orthodontic treatment typically costs families $1,200-$4,500 out-of-pocket in 2025. Government programs like Medicaid/CHIP offer the most comprehensive benefits, while employer plans generally outperform individual marketplace policies by 40-60%.

How Much Does Braces Cost With Insurance Across Different Plan Types

When evaluating how much does braces cost with insurance, your plan type determines everything. Government data from the National Association of Insurance Commissioners reveals stark differences in coverage levels that directly impact your family’s expenses.

Real-World Cost Breakdown by Insurance Type:

| Plan Category | Typical Coverage % | Average Out-of-Pocket | Lifetime Maximum | Wait Period |

|---|---|---|---|---|

| Employer Group PPO | 50-60% | $1,800-$3,200 | $2,500-$4,000 | 0-12 months |

| Individual Marketplace | 25-40% | $3,500-$5,200 | $1,000-$2,000 | 12-24 months |

| Medicaid/CHIP (Qualifying) | 80-100%* | $0-$800 | State-dependent | None |

| Medicare (Adults 65+) | 0% | $5,000-$8,000 | Not covered | N/A |

*For medically necessary cases meeting state-specific criteria

Here’s where it gets interesting: families often assume all dental insurance plans handle orthodontics similarly. That’s a costly misconception. Employer-sponsored plans leverage group purchasing power, resulting in substantially better braces insurance benefits compared to individual policies. The difference isn’t just a few hundred dollars—we’re talking about potential savings of $1,500 to $2,800 per child.

Government programs shine when it comes to orthodontic coverage expenses. Medicaid and CHIP programs must provide orthodontic coverage for children when medically necessary, as mandated by federal law. States use standardized assessment tools like the Handicapping Labio-Lingual Deviation (HLD) index to determine medical necessity, with scores above 26 typically qualifying for full coverage.

Pro Tip: Timing matters tremendously when considering how much does braces cost with insurance. Starting treatment in January allows you to maximize your annual benefit, while beginning near year-end might split costs across two benefit periods—potentially doubling your effective coverage.

The reality check? Most families underestimate their true costs because they focus solely on the coverage percentage while ignoring annual maximums, waiting periods, and pre-authorization requirements that can dramatically impact final expenses.

Understanding Insurance Coverage Patterns and Limitations

The landscape of dental insurance orthodontic costs has shifted significantly since 2020, with stricter medical necessity requirements affecting approval rates. According to NAIC market analysis, insurance companies now evaluate orthodontic cases more rigorously, leading to coverage variations that families need to understand before beginning treatment.

Medical Necessity Criteria That Determine Coverage: Insurance companies don’t cover orthodontic work for cosmetic reasons—they require functional medical justification. The assessment typically includes:

- Severe overcrowding: When teeth cannot be properly cleaned, leading to decay risk

- Significant bite problems: Affecting chewing, speech, or jaw function

- Jaw alignment issues: Causing pain or limiting mouth opening

- Breathing difficulties: Related to orthodontic positioning

Understanding how much does braces cost with insurance requires recognizing these medical thresholds. Cases scoring below the medical necessity cutoff often receive zero coverage, leaving families responsible for full treatment costs ranging from $4,000 to $8,000.

Age-Related Coverage Disparities: Here’s something that surprises many families: adult orthodontic coverage remains extremely limited across most insurance plans. While children under 18 receive robust coverage under federal essential health benefit requirements, adults face significant restrictions. Data from the Healthcare.gov marketplace shows only 32% of adult dental plans include any orthodontic benefits, compared to 94% of pediatric plans.

This age-based coverage gap creates planning urgency for families. Starting orthodontic treatment before a child’s 18th birthday ensures access to comprehensive braces insurance benefits that disappear once they reach adulthood.

Regional Cost Variations: Geographic location significantly impacts both treatment costs and insurance coverage levels. Metropolitan areas typically see 20-35% higher orthodontic fees but offer more in-network provider options. Rural areas may have lower base costs but limited provider choices, potentially forcing families into out-of-network care that reduces insurance benefits.

State regulations also create coverage variations. Some states mandate minimum orthodontic benefits, while others allow insurance companies complete discretion. Families moving between states should verify their coverage continuity to avoid unexpected gaps in benefits.

Breaking Down Out-of-Pocket Expenses by Treatment Type

When calculating how much does braces cost with insurance, treatment type significantly affects your final expenses. Different orthodontic approaches carry varying price points, and insurance companies often apply different coverage rules based on the treatment method selected.

Traditional Metal Braces (Most Common Choice):

- With Insurance: $1,200-$3,500 out-of-pocket

- Coverage Rate: 50-60% on average

- Treatment Duration: 18-30 months

- Insurance Preference: Highest approval rates

Metal braces receive the most favorable insurance treatment because they’re considered standard medical care. Most orthodontic treatment insurance coverage plans reimburse these at their highest benefit levels, making them the most economical choice for families prioritizing cost savings.

Ceramic/Clear Braces (Aesthetic Option):

- With Insurance: $1,800-$4,200 out-of-pocket

- Coverage Rate: 40-50% on average

- Treatment Duration: 20-32 months

- Insurance Preference: Moderate approval rates

Many insurance plans classify ceramic braces as aesthetic upgrades, reducing coverage percentages. However, some policies treat them identically to metal braces when medically necessary, making plan-specific verification crucial for accurate cost planning.

Clear Aligners (Invisalign/Similar):

- With Insurance: $2,500-$5,000 out-of-pocket

- Coverage Rate: 25-45% on average

- Treatment Duration: 12-24 months

- Insurance Preference: Limited approval

Clear aligner coverage varies dramatically by insurer. Progressive plans now cover them at rates similar to traditional braces, while conservative policies exclude them entirely or classify them as cosmetic treatment with minimal benefits.

Payment Timing Strategies: Smart families structure their payments to optimize insurance utilization. Consider this approach: if your plan has a $2,000 annual maximum, beginning treatment in January allows full utilization of that year’s benefits, with remaining costs spread across subsequent benefit years. This strategy can effectively increase your coverage by maximizing annual limits across multiple years.

The key insight? Understanding how much does braces cost with insurance requires evaluating both treatment type preferences and your specific plan’s coverage hierarchy. Families save thousands by aligning their treatment choice with their insurance plan’s benefit structure rather than choosing solely based on aesthetic preferences.

Government Programs and Low-Income Coverage Options

For eligible families, government-sponsored programs offer the most comprehensive answer to how much does braces cost with insurance. These programs can reduce orthodontic expenses to virtually zero for qualifying households, representing potential savings of $5,000 to $8,000 compared to private insurance options.

Medicaid Orthodontic Coverage: Federal law mandates that states provide orthodontic coverage for children enrolled in Medicaid when treatment meets medical necessity criteria. This isn’t optional coverage—it’s a required benefit that states must fund, though implementation details vary by jurisdiction.

State-by-State Coverage Analysis:

- Comprehensive States: California, Texas, New York, Florida provide robust orthodontic benefits with streamlined approval processes

- Standard States: Most states offer coverage meeting federal minimums with moderate approval requirements

- Limited States: Some states maintain restrictive medical necessity criteria, requiring severe cases for approval

The coverage determination process typically involves a licensed orthodontist or dentist documenting the medical necessity using standardized assessment tools. Cases involving severe functional impairment, speech difficulties, or significant oral health risks receive priority approval.

CHIP Program Advantages: The Children’s Health Insurance Program provides dental insurance orthodontic costs coverage for families earning too much for Medicaid but insufficient income for private insurance purchase. Recent regulatory changes eliminated annual and lifetime benefit caps for CHIP orthodontic coverage in most states, significantly improving access for moderate-income families.

Income Eligibility Guidelines (2025):

- Family of 3: $29,160-$58,320 annual income range

- Family of 4: $35,280-$70,560 annual income range

- Family of 5: $41,400-$82,800 annual income range

Nonprofit and Charitable Programs: Beyond government options, several organizations provide orthodontic treatment insurance coverage assistance:

- Smiles Change Lives: Offers comprehensive orthodontic treatment for $650 (valued at $5,000-$7,000) for qualifying low-income families

- Donated Dental Services: Provides free orthodontic care for disabled individuals and seniors

- Local Dental Society Programs: Many regions offer reduced-cost orthodontic clinics

These programs typically maintain waiting lists due to high demand, emphasizing the importance of early application and patience in the process.

Application Strategy: Successful applicants understand that program eligibility often depends on both income verification and documented medical necessity. Gathering comprehensive dental records, income documentation, and medical necessity assessments before applying streamlines the approval process and reduces delays.

Smart Strategies to Minimize Your Orthodontic Expenses

Savvy families employ multiple strategies to reduce their orthodontic costs, often saving $1,000 to $3,000 beyond basic insurance benefits. Understanding how much does braces cost with insurance is just the starting point—optimizing every aspect of the financial arrangement maximizes your family’s savings potential.

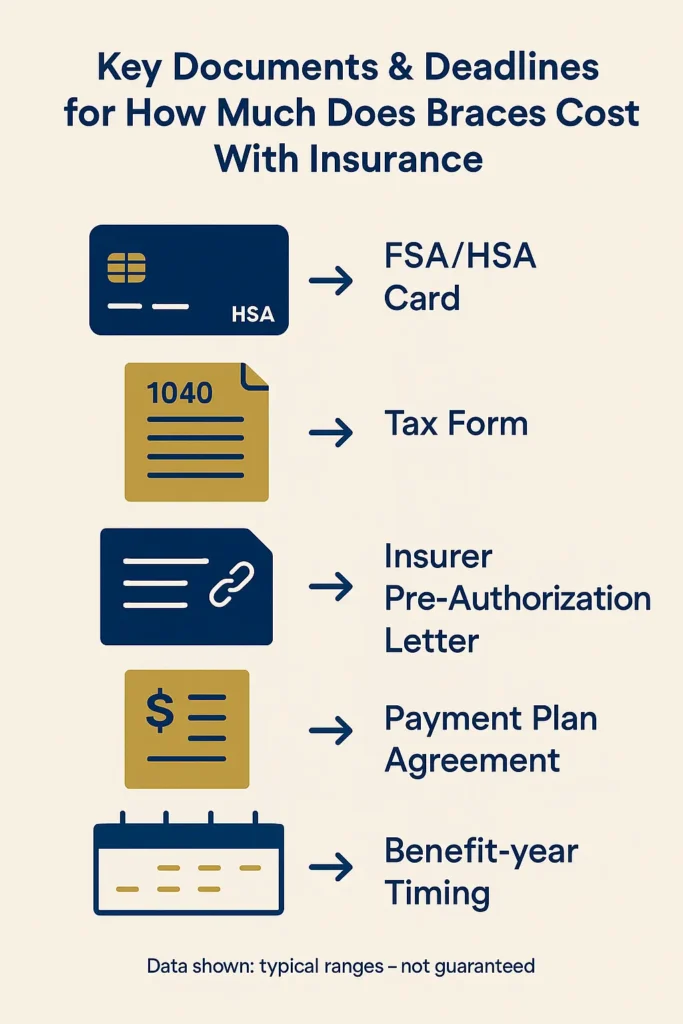

Tax-Advantaged Account Optimization: Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) provide immediate tax savings on orthodontic expenses. These accounts allow families to pay for dental insurance braces pricing with pre-tax dollars, creating effective savings of 22-37% depending on your tax bracket.

2025 HSA/FSA Contribution Limits:

- HSA Individual: $4,300 maximum contribution

- HSA Family: $8,550 maximum contribution

- FSA: $3,200 maximum contribution (use-it-or-lose-it rules apply)

The IRS specifically includes orthodontic treatment as qualified medical expenses, making these accounts particularly valuable for families planning multi-year treatment schedules. Advanced planning allows you to maximize contributions before treatment begins, ensuring full tax advantages.

Payment Plan Negotiations: Most orthodontic practices offer internal financing options that complement insurance benefits. Research indicates 89% of orthodontists provide 0% interest payment plans for 12-24 months, while 67% offer extended terms for larger treatments. When negotiating, consider these proven strategies:

- Upfront Payment Discounts: Many practices offer 3-8% discounts for full payment before treatment begins

- Family Discounts: Multiple children often qualify for 10-20% sibling discounts

- In-Network Bonuses: Some providers offer additional discounts for insurance plan members

Treatment Timing Coordination: Strategic timing can significantly impact how much does braces cost with insurance. Consider beginning treatment early in your benefit year to maximize annual maximums, or coordinate multiple family members’ treatments to optimize household coverage limits.

Understanding comprehensive insurance planning principles helps families develop integrated financial strategies that include orthodontic care budgeting.

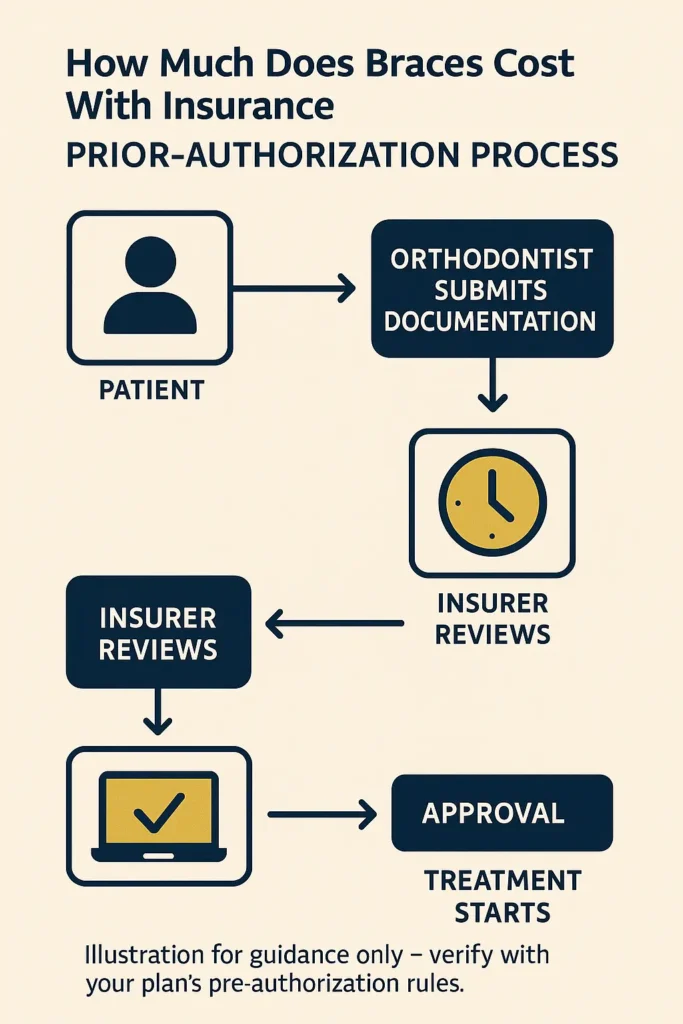

Insurance Appeals and Pre-Authorization: Don’t accept initial coverage denials without question. Insurance companies incorrectly deny approximately 15-20% of orthodontic claims that should qualify for coverage. Successful appeals typically require:

- Detailed medical necessity documentation from your orthodontist

- Reference to specific policy language supporting coverage

- Comparison to similar approved cases within your plan network

The appeals process takes 30-60 days but can result in thousands of dollars in additional coverage for qualified cases.

Waiting Periods and Coverage Maximization Techniques

Insurance waiting periods represent one of the biggest obstacles families face when planning orthodontic treatment. Most dental plans impose 6-24 month waiting periods for major orthodontic work, requiring strategic planning to optimize coverage timing and minimize out-of-pocket expenses.

Understanding Waiting Period Structures:

- Standard Plans: 12-month waiting periods for orthodontic benefits

- Enhanced Plans: 6-month waiting periods with higher premiums

- Group Plans: Often waive waiting periods for new employees during open enrollment

- Government Programs: No waiting periods for emergency or medically urgent cases

The critical insight? Starting orthodontic work during a waiting period typically forfeits all insurance benefits permanently, even after the waiting period expires. This can cost families $2,000 to $4,000 in lost coverage—a expensive mistake that’s entirely preventable with proper planning.

Annual vs. Lifetime Maximum Strategy: Most plans impose both annual and lifetime maximums that require careful coordination. Here’s how smart families maximize these benefits:

Annual Maximum Optimization:

- Plan Treatment Start Dates: Begin in January to capture full annual benefits

- Coordinate Family Members: Stagger multiple children’s treatments across different benefit years

- Payment Schedule Alignment: Structure payments to maximize each year’s benefits

Lifetime Maximum Planning:

- Individual Plans: Typically $1,000-$2,500 per person lifetime

- Group Plans: Often $2,500-$5,000 per person lifetime

- Strategy: Understand that once exhausted, no future orthodontic coverage exists

When considering how much does braces cost with insurance, families must factor these lifetime limits into their long-term planning. Families with multiple children should prioritize treatment for those with more severe cases, ensuring they receive maximum benefit before lifetime limits are reached.

Coverage Continuation During Treatment: Orthodontic treatment typically spans 18-36 months, creating risk if insurance coverage changes mid-treatment. COBRA continuation rights protect families who lose employer coverage, though premiums increase significantly. Understanding professional liability insurance protection frameworks helps families plan for coverage continuity during extended treatment periods.

Pre-Authorization Requirements: Most insurers require pre-authorization before beginning orthodontic treatment. This process typically takes 2-4 weeks and involves:

- Clinical examination documentation

- Treatment plan submission

- Medical necessity justification

- Cost estimate approval

Failing to obtain pre-authorization can result in complete coverage denial, regardless of medical necessity. Always complete this step before any treatment begins.

FAQ

How much do braces typically cost after insurance coverage?

Most families pay between $1,200 and $4,500 out-of-pocket for braces with insurance coverage, depending on their specific plan type and treatment complexity. Employer-sponsored group plans typically offer the best value, with families paying $1,800-$3,200 for traditional metal braces. When you’re wondering how much does braces cost with insurance, remember that government programs like Medicaid and CHIP provide the most comprehensive coverage, often reducing costs to under $800 for qualifying families.

Can orthodontic treatment be fully covered by insurance plans?

Complete coverage is possible but uncommon with private insurance. Government programs like Medicaid and CHIP can provide 100% coverage for children when orthodontic treatment meets medical necessity criteria established by state guidelines. Private insurance plans occasionally offer full coverage for severe functional cases, but most commercial plans limit braces insurance benefits to 25-60% of total costs with lifetime maximums between $1,000-$4,000.

What’s a typical down payment when you have insurance coverage?

Down payments typically range from $300 to $1,500 when you have insurance coverage, representing about 15-25% of your expected out-of-pocket costs. Understanding how much does braces cost with insurance helps families budget for these initial expenses appropriately. Many orthodontists structure down payments based on your specific orthodontic coverage expenses and expected reimbursement schedule, allowing families with comprehensive coverage to negotiate lower upfront costs.

Which types of braces offer the best insurance value?

Traditional metal braces consistently provide the best value with insurance coverage, typically resulting in $1,200-$3,200 out-of-pocket costs compared to $2,500-$5,000 for clear aligners. Most insurance plans provide identical coverage percentages regardless of brace type, meaning the lower base cost of metal braces translates directly to lower family expenses. However, some plans restrict coverage to traditional braces only, considering ceramic or clear options cosmetic upgrades with reduced braces insurance reimbursement.

What’s the optimal age for starting treatment with insurance?

Ages 10-14 represent the ideal window for orthodontic treatment with insurance coverage, as most plans provide comprehensive pediatric benefits while children’s jaws are still developing. Insurance coverage for children under 18 is significantly better than adult coverage, with 94% of plans offering pediatric orthodontic benefits compared to only 32% providing adult coverage. Starting treatment during early adolescence also maximizes how much does braces cost with insurance by taking advantage of natural growth patterns for more efficient, shorter treatment periods.

How do braces compare to Invisalign for insurance coverage?

Insurance coverage often provides similar reimbursement percentages for both traditional braces and Invisalign, but the higher base cost of clear aligners usually results in higher family expenses. Braces with insurance typically cost $1,800-$3,200 out-of-pocket, while Invisalign ranges from $2,500-$4,500 with equivalent coverage. However, some insurance plans exclude clear aligners entirely or classify them as cosmetic upgrades with reduced dental insurance orthodontic costs, making traditional braces the more economical choice for budget-conscious families.

Conclusion

Understanding how much does braces cost with insurance empowers families to make confident financial decisions about their orthodontic care needs. With proper planning and insurance optimization, most families can reduce their orthodontic expenses from the $5,000-$8,000 uninsured range to manageable $1,200-$4,500 out-of-pocket costs. The key lies in understanding your plan’s specific waiting periods, lifetime maximums, and medical necessity requirements before beginning any treatment.

Government programs provide the most comprehensive coverage for qualifying families, while employer-sponsored plans typically offer better orthodontic treatment insurance coverage than individual marketplace policies. Smart utilization of tax-advantaged accounts, strategic payment timing, and effective negotiation can further reduce your total investment in orthodontic care. Remember—knowing how much does braces cost with insurance is just the beginning of your cost-saving journey.

Key Takeaways

- Plan Early: Insurance waiting periods of 6-24 months require advance planning for optimal coverage utilization

- Understand Limits: Lifetime maximums of $1,000-$5,000 significantly impact your total coverage benefits

- Choose Networks Wisely: In-network providers can save 40-60% compared to out-of-network treatment costs

- Explore Government Options: Medicaid and CHIP offer the most comprehensive orthodontic coverage expenses for qualifying families

- Optimize Timing: Coordinating treatment with benefit years maximizes annual maximum utilization

- Leverage Tax Benefits: HSAs and FSAs provide 22-37% effective savings through pre-tax payment options

Disclaimer

Data Freshness: Insurance rates and regulations change frequently. Data accuracy depends on timing of official releases from government agencies including CMS, NAIC, and state insurance departments.

Geographic Variations: Insurance requirements vary significantly by state. Always consult your state’s insurance department and specific plan documents for current coverage details and benefit levels.

Professional Advice: This information is for educational purposes only. Insurance decisions should be made in consultation with licensed insurance professionals and qualified orthodontists who can assess your specific coverage and treatment needs.