Electric insurance shields your home against electrical failures, voltage spikes, and fire-related losses—yet recent Insurance Information Institute findings reveal nearly two-thirds of homeowners remain unclear about their actual protection. National Fire Protection Association research from January 2025 indicates electrical fires generate over one billion dollars in annual property losses nationwide, making proper coverage understanding financially critical. Does your current policy provide sufficient protection?

We examined current regulatory guidance from NAIC alongside Insurance Information Institute industry reports to clarify electrical damage protection. You’ll learn which incidents trigger successful claims, identify typical policy gaps that surprise homeowners, and discover practical methods to enhance your electrical protection while controlling costs.

Quick Answer: Electric insurance refers to coverage for electrical systems and components within your homeowners insurance policy, typically protecting against sudden damage from covered perils like lightning, fire, and power surges. (NAIC, 2025)

This comprehensive guide explains everything about electric insurance coverage options and how to file successful claims when electrical damage occurs.

On This Page

What You Need to Know

• Homeowners policies protect against unexpected electrical damage while excluding routine wear and upkeep costs • Voltage spike protection usually provides $500-$1,500 maximum payouts without purchasing extra coverage • Dwelling coverage handles electrical fire losses with complete reconstruction cost reimbursement • Pre-existing system problems need thorough records to prevent claim rejections

What Does Electric Insurance Actually Cover?

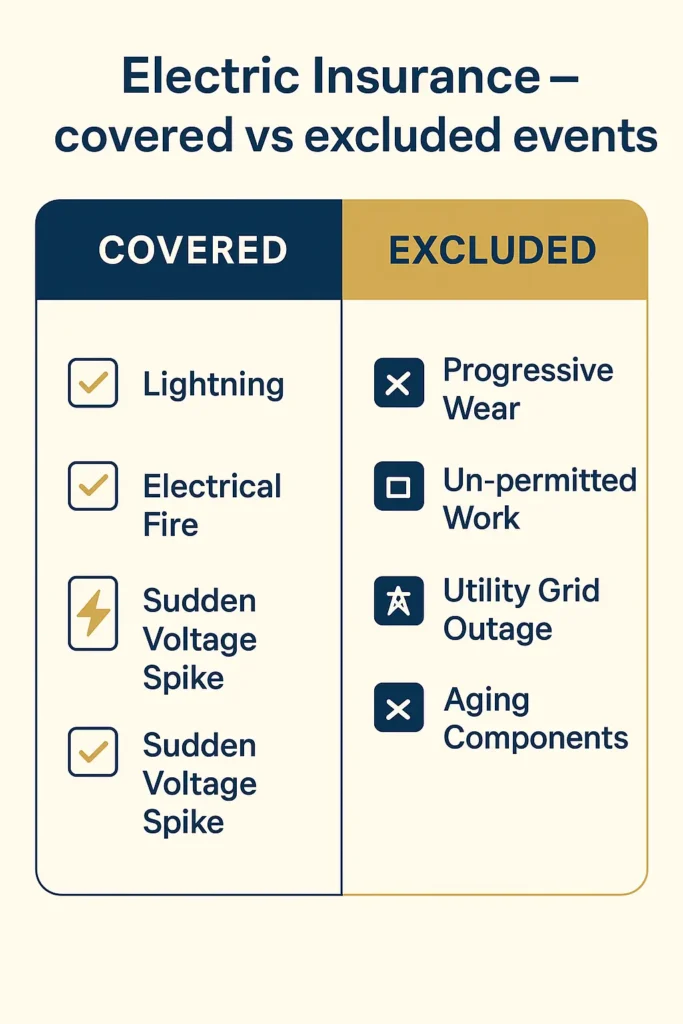

Electric insurance functions as an integrated element within standard homeowners policies instead of operating independently. Insurance Information Institute analysis from March 2024 confirms dwelling protection (Coverage A) safeguards residential electrical infrastructure when losses stem from insured hazards. Storm-related lightning damage, fires sparked by electrical malfunctions, and abrupt voltage fluctuations typically qualify under most coverage agreements.

Protection encompasses your main distribution panel, interior wiring networks, power outlets, light switches, and hardwired lighting elements. NAIC’s February 2025 consumer guidance explains coverage applies to restoration or component replacement following unexpected, unintentional harm. Base policies also protect household electronics from voltage spikes, though benefit caps generally fall between $500-$1,500 absent supplementary riders.

Robert, 52, Phoenix Experienced an electrical fire when outdated aluminum wiring overheated in his attic. His homeowners policy covered $18,400 in repairs to the dwelling structure and electrical system replacement. Lesson: Document your electrical system’s age and condition with photos—older systems may need specialized coverage endorsements.

Common Exclusions in Electrical Coverage

Knowing what electric insurance excludes helps prevent unexpected financial burdens during claims. National Fire Protection Association notes in their January 2025 report that over one-third of rejected claims involve maintenance-neglected electrical breakdowns. Base policies won’t pay for progressive system decline, aging components, or insufficient upkeep. When circuit breakers malfunction simply from accumulated use rather than sudden incidents, homeowners bear repair expenses personally.

Coverage also excludes electrical modifications completed without required building permits or performed by unqualified workers. Federal Emergency Management Agency data from December 2024 indicates roughly one-fifth of electrical damage claims result in diminished settlements after inspectors discover code compliance violations. Utility grid outages, deliberate circuit overloading, and electrical damage to separate buildings generally demand distinct coverage arrangements.

Base policies rarely finance electrical system upgrades meeting contemporary building codes unless covered incident damage necessitates full replacement. Connected home technology, backup generators, and photovoltaic arrays usually need specific riders or independent policies for thorough protection.

How Much Does Electrical System Coverage Cost

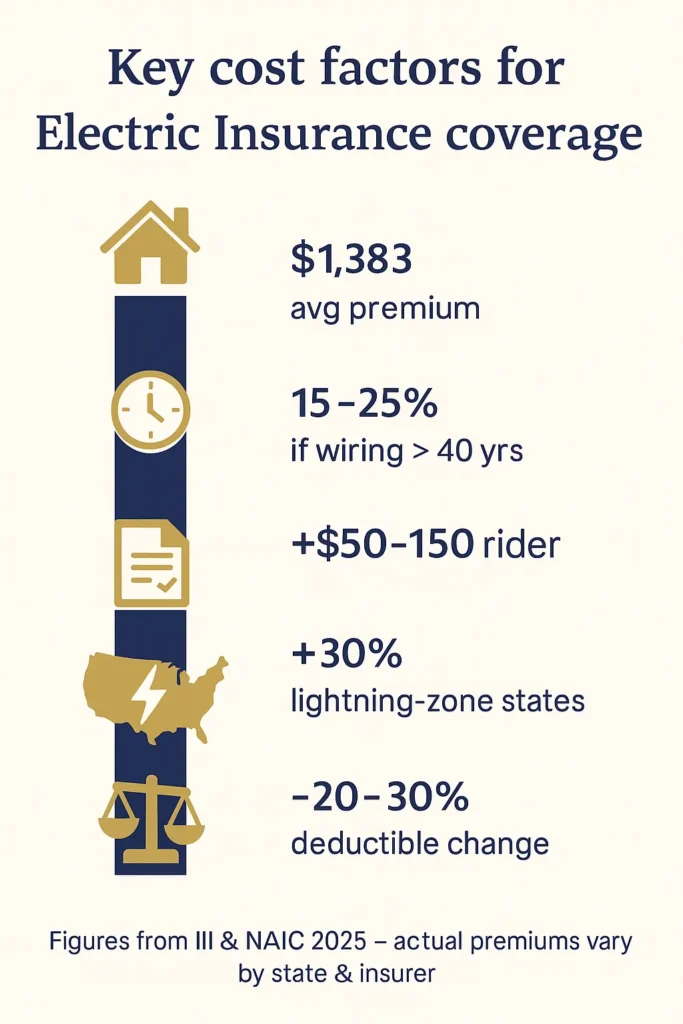

Electrical coverage expenses through homeowners insurance correlate with system age, property worth, and geographic factors. Insurance Information Institute data demonstrates properties containing 40-plus year electrical infrastructure face premium increases of 15-25% reflecting elevated fire probability. National average homeowners insurance costs reach $1,383 yearly including electrical protection, though substantial state-by-state and property variations exist.

Supplementing base coverage through specialized riders typically adds $50-$150 annually. Voltage spike protection endorsements expanding coverage from $1,500 to $10,000 average $75 yearly. Properties in lightning-frequent zones like Florida or Colorado experience roughly 30% premium elevation compared to nationwide norms, per NAIC February 2025 guidance.

Deductible selection directly influences premium amounts. Opting for $2,500 deductibles versus $500 can trim annual costs by 20-30%, though initial claim expenses increase proportionally. Combining your homeowners insurance policy with vehicle coverage generally delivers 15-25% aggregate insurance savings while preserving complete electrical system protection.

| Coverage Type | Typical Annual Cost | Coverage Limit |

|---|---|---|

| Standard electrical (included) | Included in base premium | Dwelling coverage limit |

| Power surge endorsement | $50-$100 | $5,000-$10,000 |

| Equipment breakdown | $25-$75 | $25,000-$50,000 |

| Code upgrade coverage | $40-$120 | 10-25% of dwelling coverage |

Filing Claims for Electrical Damage

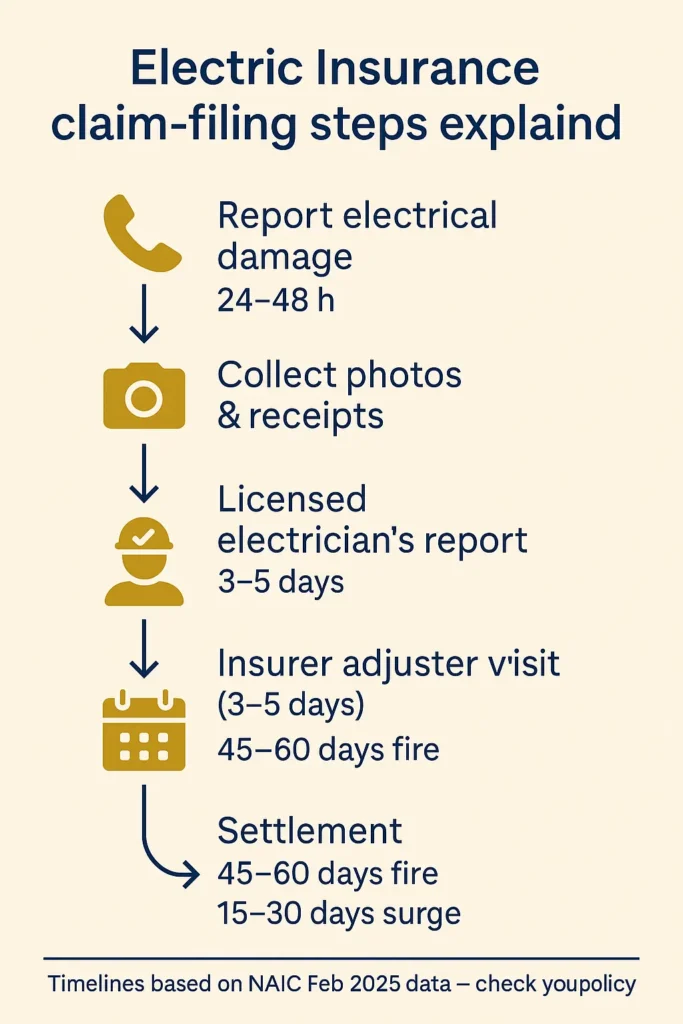

Successful electrical damage claims require prompt documentation and correct procedures. Contact insurers within 24-48 hours after discovering losses—reporting delays complicate processing. Photograph damaged electrical elements, affected spaces, and visible cause evidence like burn patterns or melted wiring before executing temporary fixes.

Insurance Information Institute guidance recommends securing written assessments from licensed electricians detailing damage scope and required repairs. Insurers typically dispatch adjusters for damage inspection within 3-5 business days. NAIC February 2025 statistics indicate electrical fire claims average 45-60 days for settlement, while voltage spike claims typically conclude within 15-30 days.

Linda, 41, Atlanta Filed a claim after a power surge damaged her HVAC system, refrigerator, and home office equipment. Her standard $1,500 electronics limit only covered partial losses, leaving her with $3,200 in out-of-pocket costs. Lesson: Purchase power surge endorsements before damage occurs—adding coverage after an event doesn’t apply retroactively.

Retain all receipts documenting temporary repairs, lodging expenses if uninhabitability occurs, and replacement electronics. Base policies reimburse essential expenditures protecting property from additional harm. Review claims procedures outlined in your insurance policy components to grasp specific coverage terms and obligations.

Protecting Your Home’s Electrical System

Proactive electrical maintenance reduces insurance expenses and claim probability. Arrange professional electrical assessments every 3-5 years, particularly for pre-1980 construction. National Fire Protection Association January 2025 standards recommend immediate inspection upon noticing light flickering, frequent breaker trips, or burning smells near outlets.

Install whole-property surge suppressors at main panels, costing $300-$500 installed, protecting against utility-level voltage spikes. Individual outlet surge protectors provide supplementary defense for computers, entertainment equipment, and appliances. These investments often qualify for insurance discounts of 5-10% while preventing losses exceeding policy surge limits.

James, 38, Seattle Invested $480 in a whole-house surge protector two years before a lightning strike hit a nearby transformer. While his neighbors filed claims averaging $8,000-$15,000 for damaged electronics and appliances, his protection limited damage to $12,600 for his electrical panel and outdoor equipment. His insurance covered the panel replacement minus his $1,000 deductible. Lesson: Whole-house surge protection pays for itself during a single major event and may reduce premiums.

Important: Record all electrical improvements and maintenance using dated receipts and photographs. This documentation supports claims and demonstrates proper system upkeep, minimizing coverage denial risks.

Consider these specialized coverage options if unique electrical requirements exist: • Equipment breakdown protection for HVAC systems, major appliances, and electrical infrastructure • Code compliance coverage financing electrical system modernization to contemporary standards • Service line protection for buried electrical connections between utility points and structures • Expanded electronics coverage for home offices, entertainment centers, and automated home systems

Comparing Electric Insurance Options

Assessing electric insurance demands comparing coverage thresholds, deductible amounts, and supplementary riders across multiple carriers. Request estimates from at least three insurers, specifying electrical system age and completed improvements. Carriers evaluate risk differently—one company may charge 40% more than competitors for identical protection on properties with aging electrical infrastructure.

Examine each policy’s voltage spike protection thresholds carefully. Standard $500-$1,500 caps prove insufficient for contemporary homes containing numerous electronics. Enhanced protection raising thresholds to $5,000-$10,000 costs merely $50-$100 yearly yet provides substantially better defense. Insurance Information Institute March 2024 research indicates average electrical damage claims exceed $4,800, making elevated limits financially prudent.

Verify whether policies offer guaranteed replacement value or depreciated actual cash value for electrical system losses. Replacement cost coverage finances new component installation regardless of damaged system age, while actual cash value deducts depreciation. Claim payout differences can reach thousands of dollars for older electrical systems.

Look for ways to reduce your insurance costs without sacrificing essential electrical coverage: • Raise deductibles from $500 to $1,000-$2,500 for 15-25% premium reductions • Combine home and vehicle policies for multi-policy savings • Add monitored fire and security systems for 5-15% premium reductions • Maintain claims-free status—going 3-5 years without claims qualifies for loss-free savings

Frequently Asked Questions

Does the electric insurance company still exist?

The Electric Insurance Company operated historically as a regional carrier serving primarily Massachusetts residents. While this company brand existed previously, contemporary homeowners obtain electrical system protection through standard homeowners insurance from nationwide carriers rather than specialized electric insurance providers. Your electrical infrastructure receives protection under dwelling coverage and personal property sections of comprehensive homeowners policies available through major insurers operating nationally.

Is electric insurance being sold separately?

Electric insurance doesn’t typically function as an independent product. Electrical system protection comes integrated within homeowners insurance policies under dwelling coverage (Coverage A). However, purchasers can acquire endorsements enhancing electrical protection, including elevated voltage spike coverage thresholds, equipment breakdown protection, and code compliance coverage. These endorsements supplement base policies rather than operating as separate insurance products.

How much is electric insurance through homeowners coverage?

Electrical system protection integrates within standard homeowners insurance premiums, averaging $1,383 annually per Insurance Information Institute statistics. Properties with electrical infrastructure exceeding 40 years may experience premiums 15-25% higher. Optional endorsements for enhanced electrical coverage cost $50-$150 yearly for voltage spike protection, equipment breakdown coverage, and code compliance provisions. Total expenses depend on property value, geographic location, electrical system age, and selected coverage thresholds.

Is insurance on electronics worth it for electrical damage?

Yes, particularly when standard voltage spike thresholds don’t match electronics value. Basic homeowners policies cap electronics coverage at $500-$1,500 for voltage spike losses. Owners of computers, home theater equipment, gaming systems, or home office technology worth more than this threshold find enhanced electronics coverage or equipment breakdown endorsements financially sensible. Typical $75 annual cost for elevated surge protection to $10,000 justifies itself should a single major surge occur.

Will insurance cover my electric going out from power outages?

Standard homeowners insurance excludes food spoilage or inconvenience from utility grid outages unless outages result from covered damage to residential electrical systems. However, when lightning damages electrical panels causing internal power loss, policies cover panel restoration and may reimburse food spoilage up to policy thresholds (typically $500-$1,000). Equipment breakdown coverage endorsements provide superior protection for power-related losses.

Who insures utility companies’ electrical infrastructure?

Utility companies acquire commercial liability and property insurance protecting their electrical infrastructure, including transmission lines, substations, and transformers. These commercial policies differ significantly from homeowners coverage. When utility equipment damages residential electrical systems, homeowners file claims with their insurers first, then insurers may pursue subrogation against utility companies if negligence caused damage. Always report utility-caused damage to both insurers and utility companies.

What electrical upgrades lower insurance premiums?

Upgrading from outdated electrical systems to modern code-compliant wiring, installing whole-property surge suppressors, replacing aluminum wiring with copper, and upgrading electrical panels from 100-amp to 200-amp service can reduce premiums by 5-20%. When completing these improvements, obtain permits and use licensed electricians. Submit proof of completed work to insurers through formal filing an insurance claim procedures to ensure policies reflect improvements and you receive applicable reductions.

What You Should Do Next

Electric insurance remains essential for protecting residential electrical systems from expensive damage, fires, and voltage spike losses. Review current homeowners policies to identify dwelling coverage thresholds, voltage spike protection caps, and any electrical damage exclusions. Contact insurance agents within the next week to discuss endorsements enhancing electrical coverage if standard thresholds fall below requirements.

Schedule an electrical inspection if properties exceed 15 years old or if warning signs like flickering lights or frequently tripping breakers appear. Licensed electricians charge $150-$300 for comprehensive inspections identifying hazards before causing damage. Document all findings and completed repairs with dated photographs and receipts—this evidence proves essential when filing future claims.

Key Takeaways: • Electric insurance typically covers electrical system damage from sudden events like lightning, fire, and power surges, but excludes gradual wear and maintenance issues • Standard policies limit power surge coverage to $500-$1,500; enhanced endorsements increase protection to $5,000-$10,000 for just $50-$100 annually • Homes with electrical systems over 40 years old pay 15-25% higher premiums and face increased claim denial risks without proper documentation • Whole-house surge protectors cost $300-$500 installed but prevent damage exceeding policy limits and may qualify for premium discounts of 5-10%

Disclaimers:

This guide provides educational information only and does not constitute professional insurance, legal, or financial advice.

Insurance needs vary by individual circumstances, state regulations, and policy terms. Consult licensed professionals before making coverage decisions.

Information accurate as of September 2025. Insurance regulations and products change frequently. Verify current details with official sources and licensed agents.