About the Author: David Rodriguez is an Insurance Regulation & Policy Analyst specializing in healthcare professional liability, state insurance compliance, and federal coverage programs. He has analyzed insurance requirements across all 50 states for advanced practice providers.

Nurse practitioner malpractice insurance protects NPs from financial liability when patients allege negligent care or medical errors. The National Practitioner Data Bank reported 3,847 malpractice payments involving nurse practitioners in 2024, with median payments reaching $225,000—costs that can devastate unprepared practitioners. Should you carry your own policy even if your employer provides coverage?

We analyzed 2024-2025 data from the NAIC 2024 Medical Professional Liability Insurance Market Report, HRSA National Practitioner Data Bank 2024 Annual Report, and state insurance department requirements across all 50 states. You’ll discover how claims-made and occurrence policies differ, understand state-specific coverage requirements, and learn cost factors that determine your premiums.

Quick Answer: Nurse practitioner malpractice insurance provides liability protection for medical negligence claims, with costs averaging $1,200-$3,500 annually for occurrence policies and $800-$2,400 for claims-made coverage. (NAIC, 2024)

Understanding nurse practitioner malpractice insurance requirements helps you select appropriate coverage for your practice setting and specialty.

What You Need to Know

- Most NPs need $1M per occurrence and $3M aggregate limits to meet healthcare facility requirements

- Claims-made policies cost 30-40% less initially but require expensive tail coverage when changing jobs

- High-risk specialties like anesthesia and women’s health face premiums 200-300% above family practice rates

On This Page

What Is Nurse Practitioner Malpractice Insurance

Professional liability coverage shields nurse practitioners from the financial consequences of alleged medical negligence, diagnostic errors, treatment complications, or patient injuries during care delivery.

This specialized insurance responds when patients file lawsuits claiming substandard care caused harm, covering legal defense costs and potential settlements or judgments. Nurse practitioner malpractice insurance typically includes defense attorney fees, court costs, expert witness expenses, and damages awarded up to policy limits.

Standard policies protect NPs during patient consultations, diagnostic procedures, prescribing medications, performing minor procedures, and providing treatment recommendations within their scope of practice.

The NAIC’s 2024 Medical Professional Liability Insurance Market Report (published March 2024) found that healthcare practitioners face an average of 1.2 claims per 100 providers annually, with defense costs averaging $40,000 even when claims lack merit.

Most policies exclude intentional misconduct, criminal acts, sexual misconduct, practicing outside licensure scope, and business-related disputes. NPs working in high-risk specialties or performing advanced procedures need to verify their specific activities receive coverage under standard professional liability terms.

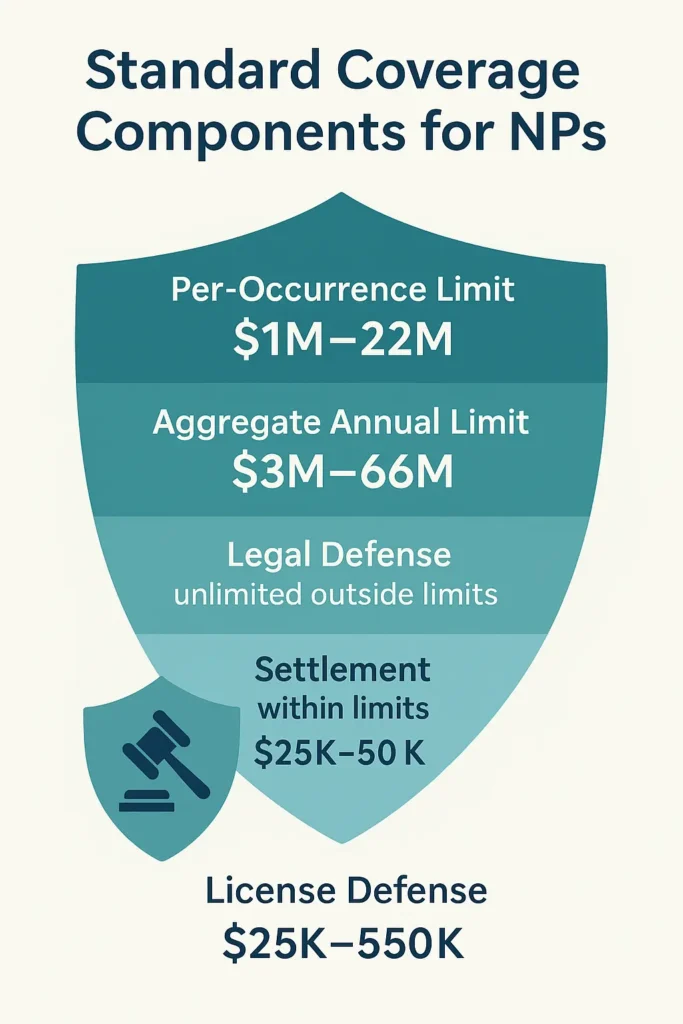

Table: Standard Coverage Components

| Coverage Element | What’s Protected | Typical Limits |

|---|---|---|

| Per Occurrence | Single claim/incident | $1M-$2M |

| Aggregate Annual | Total yearly claims | $3M-$6M |

| Legal Defense | Attorney fees, court costs | Unlimited (outside limits) |

| Settlement Costs | Negotiated claim resolution | Within policy limits |

| License Defense | Board complaint defense | $25K-$50K |

IMAGE: Coverage Components Infographic

- Alt Text: Nurse practitioner malpractice insurance coverage breakdown showing per-occurrence limits, aggregate annual limits, legal defense costs, and settlement protection with dollar amounts for each component

- Caption: Standard nurse practitioner malpractice insurance policies include multiple layers of financial protection for healthcare practitioners.

Federal Regulations and State Requirements

No federal law mandates nurse practitioners carry individual malpractice insurance, though federal programs create coverage requirements for participating providers.

The Federal Tort Claims Act covers NPs employed by federally qualified health centers, Indian Health Services, and federal agencies, substituting federal liability protection for individual policies according to HHS Federal Tort Claims Act program guidelines.

Medicare and Medicaid participation doesn’t require specific nurse practitioner malpractice insurance amounts, but the Centers for Medicare & Medicaid Services strongly recommends providers maintain adequate liability coverage. Many state Medicaid programs reference professional liability insurance in provider agreements without establishing minimum amounts.

State regulations vary dramatically. According to state insurance department reviews, Colorado, New Jersey, Kansas, Wisconsin, and Rhode Island require nurse practitioners maintain minimum liability coverage ranging from $200,000 to $1,000,000 per occurrence.

Most states lack statutory insurance requirements but healthcare facilities and hospital credentialing committees establish de facto standards. Hospitals typically demand $1M/$3M limits for clinical privileges, while some academic medical centers require $2M/$6M for high-risk specialties like anesthesia or obstetrics.

State boards of nursing can investigate complaints and suspend licenses following malpractice incidents, regardless of insurance status.

The HRSA National Practitioner Data Bank 2024 Annual Report (published December 2024) documented that 12% of nurse practitioner adverse actions related to malpractice payments or settlements, emphasizing insurance’s role beyond financial protection.

Callout Box:

Federal Employment Exception: NPs employed by federal health facilities, military treatment facilities, Veterans Health Administration, or FQHC programs may receive coverage through the Federal Tort Claims Act, eliminating the need for individual nurse practitioner malpractice insurance policies. Verify employment status qualifies before declining personal coverage. Learn more at FTCA program resources.

Coverage Types: Claims-Made vs Occurrence Policies

Two fundamental policy structures determine when coverage applies and how long protection continues for nurse practitioner malpractice insurance.

Claims-made policies cover incidents that occur AND are reported while the policy remains active. Occurrence policies cover any incident happening during the policy period, regardless of when patients file claims—even years after coverage expires.

Claims-made protection starts with a retroactive date, typically the policy’s first effective date. Coverage only applies to incidents occurring after this date and reported before policy cancellation.

Each year with the same carrier extends the retroactive date, building broader protection called “maturing” the policy. Switching carriers or employment requires purchasing tail coverage—also called extended reporting endorsements—to cover unreported incidents from the expired policy period.

Occurrence coverage provides permanent protection for incidents during the policy period. An NP can retire, change carriers, or stop practicing without purchasing additional coverage, since claims filed years later still receive defense under the original policy.

According to professional liability insurance standards, occurrence policies cost 30-50% more initially but eliminate tail coverage expenses that can reach 200-300% of annual premiums.

Table: Claims-Made vs Occurrence Policy Comparison

| Feature | Claims-Made | Occurrence |

|---|---|---|

| Initial Cost | $800-$2,400 annually | $1,200-$3,500 annually |

| Long-term Cost | + Tail coverage ($2,400-$9,600) | No additional costs |

| Coverage Duration | Active policy only | Permanent for policy period |

| Job Changes | Requires tail purchase | Automatic continued coverage |

| Best For | Employed NPs staying long-term | Independent/mobile practitioners |

Sarah, 34, Austin, Texas, worked as an independent family nurse practitioner and initially chose a claims-made policy at $1,400 annually.

After researching business insurance costs and calculating potential tail coverage expenses, she switched to a $1M/$3M occurrence policy at $2,100 annually. Three years later when joining a healthcare group, she avoided $4,200 in tail coverage fees.

Lesson: Occurrence policies cost more upfront but eliminate tail coverage expenses when changing practice settings.

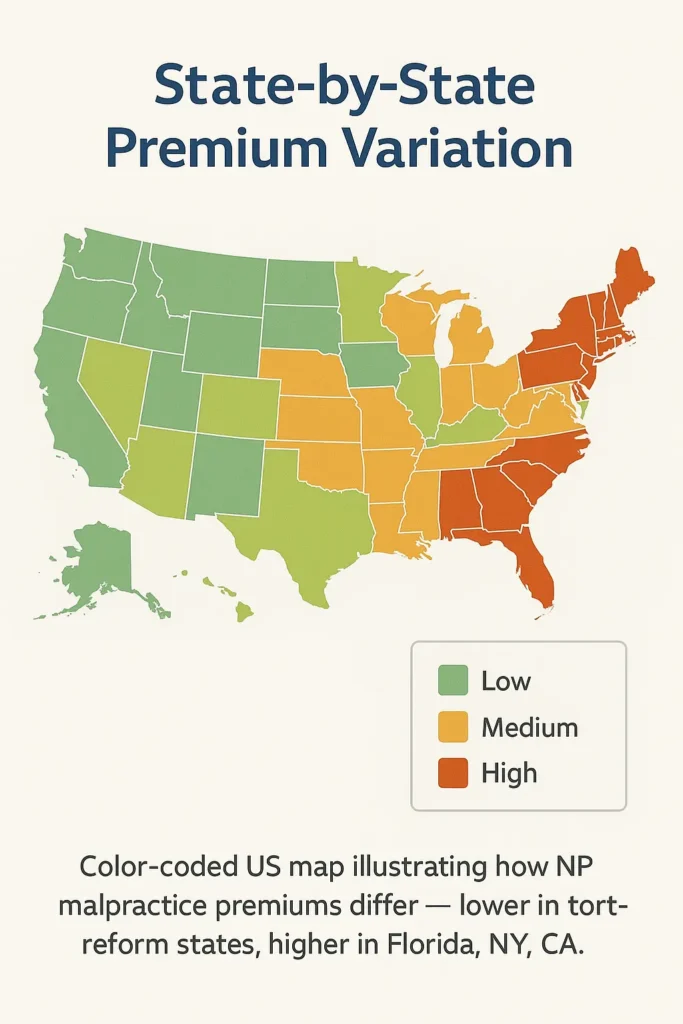

Cost Factors and Premium Ranges by State

Annual premiums for nurse practitioner malpractice insurance vary based on specialty area, geographic location, coverage limits, claims history, and policy type.

Family nurse practitioners in low-risk states pay $800-$1,800 for claims-made coverage with $1M/$3M limits, while those in high-litigation states face $2,400-$4,200 for identical coverage.

Specialty drives significant cost differences. According to the NAIC 2024 Medical Professional Liability Insurance Market Report (March 2024), certified registered nurse anesthetists face the highest premiums at $8,000-$15,000 annually due to anesthesia’s inherent risks.

Women’s health and obstetric NPs pay $4,500-$9,000, while psychiatric mental health practitioners typically pay $1,200-$2,800. Urgent care and emergency NPs fall in the middle range at $2,200-$4,500.

Geographic location reflects state tort law, litigation frequency, and average jury awards. Florida, New York, Pennsylvania, Illinois, and California command the highest premiums, often 150-200% above national averages.

States with tort reform like Texas, Indiana, Nebraska, and Utah offer 20-40% lower premiums. Coverage limits also impact costs—increasing from $1M/$3M to $2M/$4M typically adds 40-60% to annual premiums.

Prior claims dramatically increase costs. A single paid claim can raise premiums 50-150% for five years, while multiple claims may make coverage unaffordable or unavailable through standard markets.

Part-time practitioners working under 20 hours weekly often qualify for reduced premiums at 40-60% of full-time rates.

Table: Average Annual Premium Ranges by Specialty and State Risk

| Specialty Area | Low-Risk States | Medium-Risk States | High-Risk States |

|---|---|---|---|

| Family Practice | $900-$1,500 | $1,400-$2,400 | $2,200-$3,800 |

| Urgent Care/ER | $1,800-$2,800 | $2,400-$3,600 | $3,500-$5,200 |

| Women’s Health | $3,200-$5,500 | $4,500-$7,200 | $6,500-$10,000 |

| Psych/Mental Health | $1,000-$1,800 | $1,500-$2,400 | $2,100-$3,500 |

| CRNA/Anesthesia | $6,500-$9,500 | $8,500-$12,000 | $11,000-$16,500 |

Premium ranges reflect $1M/$3M occurrence policies for full-time practitioners with clean claims history

Jennifer, 29, Miami, Florida, accepted a position as an acute care nurse practitioner in a Level 1 trauma center. She discovered her employer’s $1M liability limit fell short of recommendations for high-acuity settings performing advanced procedures.

Jennifer purchased a $2M personal umbrella policy for $850 annually, providing $3M total protection matching her facility’s risk profile.

Lesson: Verify employer coverage limits match your specialty’s risk profile and consider supplemental policies for high-risk environments.

IMAGE: State Premium Map

- Alt Text: United States color-coded map displaying nurse practitioner malpractice insurance average annual premium costs by state, showing lowest rates in tort reform states and highest rates in high-litigation states like Florida, New York, and California

- Caption: Nurse practitioner malpractice insurance costs vary significantly based on state tort laws and litigation frequency.

Nurse Practitioner Malpractice Insurance Tail Coverage Explained

Extended reporting endorsements, commonly called tail coverage, represent one of the costliest aspects of nurse practitioner malpractice insurance claims-made policies.

When NPs leave employment, retire, switch insurance carriers, or allow claims-made policies to lapse, tail coverage extends the reporting period for incidents that occurred during the expired policy.

Tail premiums typically cost 200-300% of the most recent annual premium, paid as a single lump sum. An NP paying $2,000 annually faces $4,000-$6,000 for tail coverage.

Some carriers offer “mini-tail” options covering 1-3 years at reduced costs, though this creates coverage gaps if claims emerge later. The NAIC’s professional liability data indicates 15-20% of malpractice claims are reported more than three years after the alleged incident, making mini-tails risky.

Nose coverage—also called prior acts coverage—provides an alternative when joining a new carrier. Instead of purchasing tail from the old policy, the new carrier extends retroactive coverage to include the previous practice period.

This option typically costs less than tail but requires continuous claims-made coverage without gaps and immediate policy binding with the new carrier.

Employment contracts sometimes specify which party pays tail coverage for nurse practitioner malpractice insurance. Hospital-employed NPs should negotiate “employer-paid tail” clauses before accepting positions.

Without contractual language, departing employees bear tail costs even when employers terminate the relationship. Some professional liability coverage options include free tail coverage if retiring after age 55 or maintaining the policy for 5-10 consecutive years.

Calculation Example:

An NP with a mature 5-year claims-made policy paying $2,200 annually leaves employment. Tail coverage at 250% costs $5,500. Alternative: New employer’s carrier offers nose coverage for $3,200, saving $2,300 while maintaining continuous protection.

Michael, 41, Portland, Oregon, worked as a psychiatric nurse practitioner in a group practice under a claims-made policy.

When leaving to open an independent practice, he declined the $5,800 tail coverage to save money. Two years later, a former patient from his previous employment filed a malpractice claim for treatment provided 18 months before he left the group.

Without tail coverage, Michael paid $47,000 out-of-pocket for legal defense and settlement.

Lesson: Always budget for tail coverage when leaving employment with claims-made policies—the cost of one undefended claim exceeds years of tail premiums.

Risk Management and Claims Prevention

Proactive risk management reduces malpractice exposure and helps nurse practitioners qualify for lower insurance premiums. Many carriers offer 5-15% discounts for completing approved risk management education, implementing electronic health records, or maintaining clean claims histories over multiple years.

Documentation standards represent the primary defense against malpractice claims. The December 2024 National Practitioner Data Bank report (HRSA, 2024) found that 40% of paid NP claims involved documentation issues, including incomplete patient histories, missing informed consent, inadequate follow-up instructions, or failure to document clinical reasoning.

Thorough, contemporaneous charting that explains differential diagnoses, treatment rationale, and patient education significantly strengthens legal defense.

Scope of practice compliance prevents board complaints and coverage denials. Insurance policies exclude services performed outside state-authorized NP practice, making supervision agreements, collaborative practice agreements, and protocol adherence critical.

NPs should review state nursing board regulations annually, as scope expansions require policy endorsements to ensure nurse practitioner malpractice insurance covers newly authorized procedures.

High-risk practice areas demand additional precautions. Prescribing controlled substances requires DEA compliance, prescription monitoring program checks, and documented substance abuse screening.

Telehealth services need multi-state licensure verification and platform HIPAA compliance. After-hours advice carries liability—consider recorded consent and documentation systems for phone consultations.

Professional relationship boundaries prevent common claim triggers. The National Practitioner Data Bank identifies boundary violations as the fastest-growing NP claim category, including improper social media contact, dual relationships, and inadequate chaperone policies during examinations.

Clear office policies and staff training reduce these exposures.

Checklist: Essential Risk Management Practices

- [ ] Complete clinical documentation within 24 hours of patient encounters

- [ ] Obtain written informed consent for procedures and high-risk treatments

- [ ] Document all patient education, instructions, and follow-up plans

- [ ] Maintain current state licensure and specialty certifications

- [ ] Review scope of practice annually and update collaborative agreements

- [ ] Use clinical decision support tools for diagnosis and prescribing

- [ ] Implement prescription monitoring program checks for controlled substances

- [ ] Report adverse events to employers and insurance carriers promptly

- [ ] Complete annual risk management continuing education

- [ ] Maintain professional boundaries and document chaperone presence

For NPs facing coverage disputes or claim investigations, Insurance Zenith’s coverage disputes guide provides resources for understanding legal representation and insurer responsibilities during the claims process.

Frequently Asked Questions

Do nurse practitioners pay malpractice insurance?

Most nurse practitioners carry malpractice insurance, though payment responsibility varies by employment status. Hospital-employed NPs typically receive coverage through employer group policies at no direct cost, though this represents part of compensation packages.

Independent practitioners and those in private practices purchase individual nurse practitioner malpractice insurance policies ranging from $800 to $15,000 annually depending on specialty and location.

According to NAIC’s 2024 Medical Professional Liability Market Analysis (published March 2024), approximately 78% of practicing NPs maintain either individual or employer-provided professional liability coverage. Some NPs working in federally qualified health centers receive Federal Tort Claims Act protection, eliminating the need for commercial insurance.

Contract and locum tenens NPs generally need individual policies since temporary employers rarely extend group coverage.

What are the two types of malpractice insurance for nurse practitioners?

The two fundamental policy types are claims-made and occurrence coverage, distinguished by when coverage applies. Claims-made policies cover incidents that happen and are reported during the active policy period, requiring continuous renewal to maintain protection and tail coverage when policies end.

Occurrence policies cover any incident occurring during the policy period regardless of when claims are filed, providing permanent coverage even after policy cancellation.

Claims-made coverage typically costs 30-40% less initially but requires expensive tail coverage averaging 200-300% of annual premiums when changing jobs or carriers. Occurrence coverage costs more upfront but eliminates tail expenses, making it more cost-effective for mobile practitioners who change employment frequently or plan to work part-time before retirement.

Can NPs be sued for malpractice?

Nurse practitioners face the same malpractice liability exposure as physicians when providing direct patient care within their scope of practice. The HRSA National Practitioner Data Bank 2024 Annual Report (December 2024) documented 3,847 malpractice payments involving NPs in 2024, representing a 12% increase from 2023.

Common claim allegations include diagnostic errors, medication mistakes, failure to refer or follow up, procedure complications, and inadequate patient monitoring. NPs can be named individually in lawsuits, included with supervising physicians and healthcare facilities, or held solely responsible when practicing independently.

State laws allowing full practice authority for NPs in 26 states create direct liability without physician supervision, emphasizing the importance of adequate nurse practitioner malpractice insurance coverage.

Legal defense costs average $40,000-$75,000 even when claims are dismissed, while settled claims average $225,000 according to HRSA data.

Is a nurse practitioner covered by insurance?

Coverage depends on employment status and practice setting. Employed NPs typically receive professional liability coverage through employer group policies, though practitioners should verify coverage limits, policy type, and whether protection continues after employment ends.

Many employer policies provide claims-made coverage without tail, leaving NPs exposed to claims filed after job changes. Independent NPs must purchase individual nurse practitioner malpractice insurance policies directly from insurance carriers or professional associations.

Federal employees and FQHC practitioners may receive Federal Tort Claims Act coverage, which substitutes government liability protection for commercial insurance according to HHS FTCA program guidelines.

NPs should request certificates of insurance showing coverage limits, policy dates, and whether tail coverage is included, rather than assuming employment automatically provides adequate protection.

How to avoid malpractice as a nurse practitioner?

Risk reduction requires comprehensive documentation, scope of practice compliance, and patient communication excellence. Document all clinical encounters within 24 hours including differential diagnoses, treatment rationale, patient education, and follow-up plans.

Obtain written informed consent for procedures and high-risk treatments, clearly explaining risks, benefits, and alternatives. Practice within state-authorized scope, maintaining current collaborative practice agreements and protocols where required.

Use clinical decision support tools, prescription monitoring programs, and evidence-based guidelines to support diagnostic and prescribing decisions. Communicate clearly with patients using plain language, verify understanding through teach-back methods, and document all advice provided.

Maintain professional boundaries, use chaperones during examinations, and implement robust privacy safeguards. Complete annual risk management continuing education and promptly report adverse events to employers and insurers.

According to the National Practitioner Data Bank, NPs who implement systematic documentation protocols and complete formal risk management training face 35-40% fewer malpractice claims than those without structured approaches.

What is tail coverage for NP?

Tail coverage, formally called extended reporting endorsements, extends the reporting period for claims-made nurse practitioner malpractice insurance policies after they end.

When NPs leave jobs, change carriers, retire, or allow claims-made policies to lapse, tail coverage permits reporting of claims stemming from incidents that occurred during the expired policy period.

Without tail coverage, claims filed after policy termination receive no defense or payment, even if incidents happened while the policy was active. Tail premiums typically cost 200-300% of the most recent annual premium as a one-time lump sum payment.

The NAIC’s professional liability data indicates tail coverage remains effective indefinitely, protecting practitioners from claims reported years or decades after practice ends. Employment contracts should specify whether employers or departing NPs pay tail costs, as this expense can reach $4,000-$10,000 for most specialties and exceed $20,000 for high-risk areas like anesthesia or obstetrics.

How much does nurse practitioner malpractice insurance cost annually?

Annual costs for nurse practitioner malpractice insurance range from $800 to $15,000 depending on specialty, state, and coverage type. Family practice NPs in low-risk states pay $900-$1,500 for claims-made policies, while certified registered nurse anesthetists face $8,000-$15,000 due to higher liability exposure.

Geographic location significantly impacts premiums, with high-litigation states like Florida, New York, and California charging 150-200% above national averages. Occurrence policies cost 30-50% more than claims-made initially but eliminate expensive tail coverage requirements. Most practitioners with clean claims histories and $1M/$3M coverage limits pay $1,200-$3,500 annually.

Are there state-specific requirements for NP malpractice insurance?

State requirements vary dramatically, with only five states—Colorado, New Jersey, Kansas, Wisconsin, and Rhode Island—statutorily mandating minimum liability coverage for nurse practitioners.

Required minimums range from $200,000 per occurrence in some states to $1,000,000 in others, though most mandates fall below healthcare industry standards. The remaining 45 states lack statutory nurse practitioner malpractice insurance requirements, but de facto standards emerge through hospital credentialing, group practice contracts, and professional organization recommendations.

Most healthcare facilities require $1,000,000 per occurrence and $3,000,000 aggregate coverage for clinical privileges regardless of state law. State boards of nursing can investigate complaints and discipline licenses following malpractice incidents regardless of insurance status, making coverage a practical necessity even in non-mandatory states.

NPs should verify requirements through state insurance departments and nursing boards before relocating or establishing practices in new jurisdictions, as requirements change through legislative amendments and regulatory updates.

What You Should Do Next

Nurse practitioner malpractice insurance represents a critical professional safeguard that varies significantly by state, specialty, and employment status.

Begin by verifying your current coverage status—request your employer’s certificate of insurance or policy declarations showing coverage limits, policy type, and whether tail coverage is included. Compare your coverage against professional standards of $1M/$3M for general practice or $2M/$6M for high-risk specialties.

Calculate your total insurance costs over a 5-10 year career horizon to determine whether claims-made or occurrence policies offer better value. Include potential tail coverage expenses in your analysis—factor $4,000-$8,000 for tail when budgeting job changes with claims-made coverage.

Request quotes from multiple carriers specializing in advanced practice provider coverage, and verify whether your professional organization offers group rates that can reduce premiums 10-25%.

Review your employment contract’s insurance provisions before signing. Negotiate employer-paid tail coverage clauses, verify whether you’re covered as an additional insured on facility policies, and confirm coverage continues during any required notice periods after resignation.

Independent practitioners should establish relationships with insurance brokers specializing in healthcare professional liability who can access multiple carrier options and explain state-specific requirements.

Key Takeaways:

- Nurse practitioner malpractice insurance costs range from $800 to $12,000 annually depending on specialty, state, and coverage limits with family practice NPs paying lowest rates and CRNAs facing highest premiums

- Claims-made policies cost 30-40% less initially but require tail coverage at 200-300% of annual premiums when changing jobs, while occurrence policies provide permanent protection without additional costs

- Only five states mandate minimum liability coverage by law, but hospitals and healthcare facilities universally require $1M/$3M limits for credentialing and clinical privileges

- Tail coverage represents one of the largest hidden costs in healthcare careers, potentially reaching $5,000-$10,000 as a one-time expense when leaving employers or changing insurance carriers

Disclaimers

This guide provides educational information only and does not constitute professional insurance, legal, or financial advice.

Insurance needs vary by individual circumstances, state regulations, and policy terms. Consult licensed professionals before making coverage decisions.

Information accurate as of October 2025. Insurance regulations and products change frequently. Verify current details with official sources and licensed agents.