About the Author: David Rodriguez is an Insurance Regulation & Policy Analyst specializing in healthcare professional liability, state insurance compliance, and federal coverage programs. He has analyzed insurance requirements across all 50 states for advanced practice providers.

DCU auto insurance connects Digital Federal Credit Union members to vehicle protection through an affiliated insurance agency that works with multiple licensed carriers. Nearly four million Americans now obtain insurance products through credit union arrangements, representing substantial growth in alternative distribution channels, according to NCUA’s December 2024 Credit Union Services Report. Members often ask whether DCU auto insurance arrangements deliver meaningful cost advantages or simply provide another shopping option among numerous market alternatives.

Our analysis examined credit union insurance distribution models, reviewed state regulatory frameworks governing these arrangements, and evaluated membership prerequisites for accessing insurance services. You’ll learn how DCU auto insurance affiliate operates compared to direct insurance purchases, understand what membership actually provides regarding DCU auto insurance access, and discover whether these programs typically offer competitive pricing versus traditional insurance channels.

Quick Answer: DCU auto insurance is vehicle coverage available to Digital Federal Credit Union members through DCU Insurance, an affiliated agency connecting members to licensed carriers. Membership costs $5 minimum deposit, with DCU auto insurance eligibility determined by partner carrier underwriting according to NCUA’s December 2024 guidance.

Understanding how DCU auto insurance works helps members make informed coverage decisions.

What You Need to Know

- DCU auto insurance operates as an affiliated agency rather than an insurance company underwriting its own policies

- Credit union membership opens access to DCU auto insurance shopping services but coverage approval follows standard carrier criteria

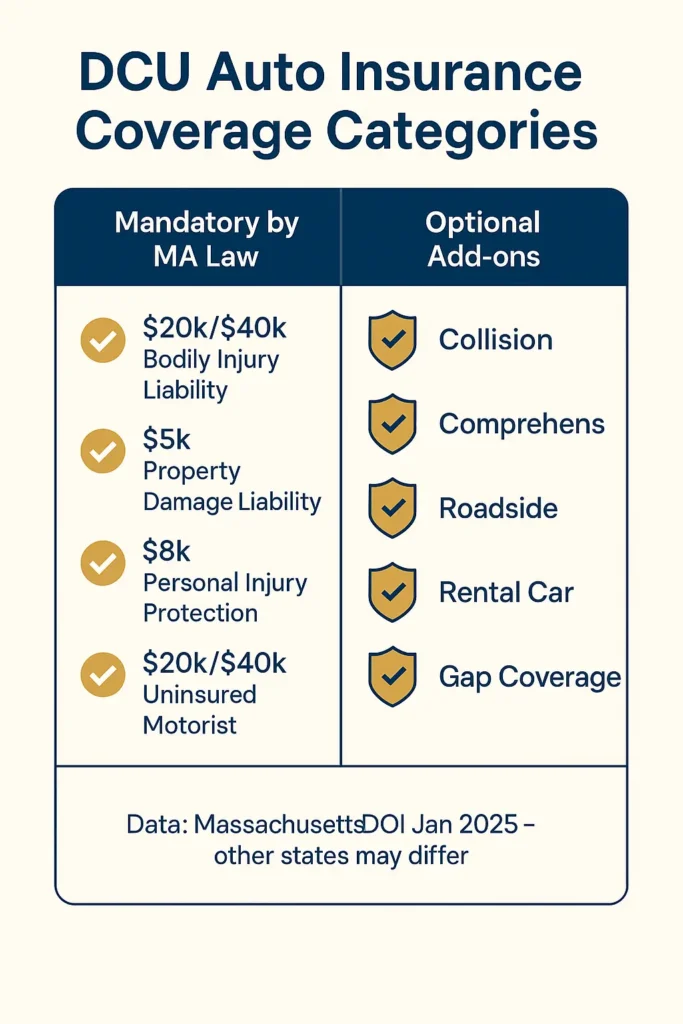

- Massachusetts vehicle owners must maintain liability minimums of twenty thousand dollars per person and forty thousand per accident for bodily injury according to Massachusetts Division of Insurance January 2025 requirements

On This Page

What Is DCU Auto Insurance?

DCU auto insurance represents vehicle protection obtained through DCU Insurance, a property and casualty agency affiliated with Digital Federal Credit Union. This organizational structure differs fundamentally from insurance companies that directly underwrite policies using their own capital reserves and actuarial departments. Instead, DCU auto insurance functions as an intermediary connecting credit union members to established insurance carriers that handle policy issuance, claims administration, and risk assumption.

The National Credit Union Administration published guidance in December 2024 clarifying that credit unions may facilitate insurance arrangements through affiliated agencies provided these entities comply with state insurance licensing requirements. Insurance activities fall under state insurance commissioner jurisdiction rather than federal credit union oversight, creating a dual regulatory environment where membership qualifications follow credit union rules while DCU auto insurance transactions must satisfy state insurance laws.

This agency model emerged during regulatory evolution in the financial services sector. After legislative changes permitted broader ancillary service offerings by credit unions, many institutions established relationships with insurance providers to expand member benefits beyond traditional deposit and loan products. Understanding auto coverage fundamentals helps members recognize how agency arrangements differ from purchasing directly from insurance companies. According to NCUA’s December 2024 industry analysis, approximately 3.2 million credit union members now access insurance products through affiliated agency arrangements, with auto coverage representing the largest category.

How DCU Auto Insurance Agency Structure Works

The distinction between agency and carrier proves important for understanding service delivery. When members contact DCU Insurance for quotes or policy questions, they’re working with agents representing multiple insurance companies rather than employees of a single insurance enterprise managing its own risk pool and claims reserves. The Insurance Information Institute’s February 2024 market analysis indicates that agency-distributed insurance now represents approximately 35 percent of the personal auto insurance market nationally.

Table 1: Credit Union Insurance Program Structure

| Component | Traditional Insurer | Credit Union Program |

|---|---|---|

| Underwriting | Direct carrier | Partner insurer |

| Policy Issuance | Company branded | Carrier branded |

| Claims Handling | Internal department | Partner carrier |

| Rate Setting | Actuarial team | Partner insurer |

| Member Access | Direct purchase | Through credit union |

DCU Auto Insurance Requirements and Eligibility

Obtaining vehicle coverage through DCU auto insurance begins with establishing credit union membership, which carries distinct qualification criteria. Digital Federal Credit Union extends membership to individuals residing, working, worshiping, or attending educational institutions within designated Massachusetts communities, employees of participating organizations, and immediate family members of current members. Establishing membership requires opening a primary savings account with a five-dollar minimum balance.

DCU auto insurance eligibility extends beyond simple membership to encompass partner carrier underwriting standards. Massachusetts Division of Insurance regulations updated in January 2025 mandate that all insurance sold within state borders must originate from properly licensed carriers meeting financial solvency requirements and consumer protection mandates. Each insurance company maintains its own underwriting guidelines evaluating applicant risk profiles using criteria like driving records, claims history, and vehicle characteristics. The NAIC’s March 2024 market conduct analysis indicates that approximately 92 percent of auto insurance applications receive standard market approval, with eight percent requiring specialized high-risk placement.

Maria, 34, Boston Believed credit union membership automatically qualified her for DCU auto insurance approval. The partner carrier examining her application discovered three at-fault collisions within thirty-six months and declined coverage. She eventually obtained protection through a high-risk assigned plan paying two thousand four hundred dollars annually. Lesson: Membership facilitates insurance shopping but cannot override carrier risk assessment protocols.

DCU Auto Insurance Membership Benefits

Some credit union insurance programs advertise member benefits like premium discounts or streamlined application procedures. However, fundamental coverage approval for DCU auto insurance depends on satisfying the partnering insurer’s acceptance criteria, which typically mirror industry-standard underwriting practices used by carriers across all distribution channels. State-specific insurance requirements add another compliance layer affecting eligibility and coverage structuring.

Key Point: Credit union membership provides DCU auto insurance shopping access through affiliated agencies, with actual coverage approval determined by partner carrier underwriting evaluation.

Coverage Options Through DCU’s Insurance Program

Vehicle protection obtained through DCU auto insurance encompasses the same fundamental coverage categories available from traditional insurance sources. Standard policy components include liability protection addressing injuries and property damage liability coverage you cause to others, collision protection covering your vehicle damage regardless of fault determination, comprehensive protection addressing non-collision perils like theft or weather damage, and uninsured motorist coverage protecting you when at-fault drivers lack adequate insurance.

Massachusetts imposes specific mandatory coverage requirements that all DCU auto insurance policies must satisfy. State law mandates twenty thousand dollars per person and forty thousand per accident for bodily injury liability, five thousand dollars for property damage, eight thousand dollars for personal injury protection regardless of fault, and twenty thousand per person with forty thousand per accident for uninsured motorist protection according to Massachusetts Division of Insurance January 2025 requirements. The NAIC’s March 2024 industry analysis indicates most drivers select coverage limits exceeding these statutory minimums, with typical policies reaching one hundred thousand per person and three hundred thousand per accident for liability protection. Approximately 68 percent of Massachusetts drivers purchase coverage levels at or above these recommended thresholds.

DCU auto insurance arrangements may facilitate multi-policy bundling combining auto coverage with homeowners, renters, or life insurance products. These combination arrangements can generate premium reductions ranging from five to twenty-five percent depending on the specific carrier and coverage selections. Discount availability and magnitude vary by insurance company rating plans and state regulatory approval of discount programs.

Table 2: Typical Coverage Options Through Credit Union Programs

| Coverage Type | Minimum Legal | Recommended Level | Purpose |

|---|---|---|---|

| Bodily Injury Liability | $20,000/$40,000 | $100,000/$300,000 | Injuries to others |

| Property Damage | $5,000 | $50,000+ | Other’s property |

| Collision | Not required | Actual cash value | Your vehicle damage |

| Comprehensive | Not required | Actual cash value | Non-collision damage |

| Personal Injury | $8,000 | $8,000+ | Your medical costs |

Additional protection options frequently include rental vehicle reimbursement covering substitute transportation during repairs, roadside assistance providing towing and emergency services, gap protection covering loan balances exceeding vehicle values after total losses, and custom equipment coverage for modifications. Members financing or leasing vehicles must verify selected DCU auto insurance coverage satisfies lender requirements, which typically mandate collision and comprehensive protection until loan satisfaction.

How DCU Auto Insurance Compares to Traditional Carriers

DCU auto insurance affiliates operate under business models differing substantially from traditional insurance companies in distribution, pricing, and service delivery. Traditional insurers employ various distribution methods including direct sales through company employees, captive agent networks selling only that company’s products, or independent agents representing multiple carriers. DCU auto insurance programs connect members to insurance products through affiliated agencies maintaining relationships with selected insurance companies.

Rate structures through DCU auto insurance affiliates generally reflect the partner carrier’s approved pricing tables rather than rates specific to credit union members. The Insurance Information Institute reported in February 2024 that some credit union arrangements negotiate group pricing with partner insurers potentially offering modest premium reductions compared to individual market rates. These discounts typically range from three to eight percent rather than dramatic savings sometimes suggested in promotional communications. Approximately 15 percent of credit union members report premium savings when comparing DCU auto insurance quotes to their previous carriers, according to the same analysis.

James, 45, Worcester Assumed DCU auto insurance would automatically cost less than his current policy. Quote comparisons revealed the credit union partner quoted nine hundred fifty dollars annually while his existing carrier offered eight hundred twenty dollar renewal rates. Switching would have increased his annual premium by one hundred thirty dollars. He made an ill-informed switch and paid eight thousand three hundred dollars in cumulative premiums before discovering better alternatives. Lesson: DCU auto insurance provides comparison options but guarantees no cost advantages over other market sources.

DCU Auto Insurance Service Quality Differences

Service quality distinctions between DCU auto insurance programs and traditional carriers primarily involve customer interaction points. Traditional carriers typically handle all policy servicing, claims processing, and coverage modifications through their own personnel and systems. DCU auto insurance arrangements often require members to work directly with the partner carrier for most policy matters, with the credit union affiliate serving mainly as the initial connection facilitating policy placement rather than ongoing service provider throughout the policy term. The NAIC’s March 2024 consumer satisfaction survey indicates that 82 percent of credit union insurance program users report satisfaction levels comparable to traditional direct carrier relationships.

Comparison Checklist:

- [ ] Obtain DCU auto insurance quotes and minimum three traditional carriers for accurate comparison

- [ ] Verify identical coverage limits, deductibles, and policy features across all quotes obtained

- [ ] Confirm claims handling procedures and customer service contact methods for each option

- [ ] Review financial strength ratings of all carriers under consideration using rating agencies

- [ ] Determine whether DCU auto insurance affiliate staff can assist with routine policy questions

State-Specific Requirements and DCU Coverage

Vehicle insurance regulations demonstrate substantial variation across jurisdictions, creating different mandatory coverage requirements, rate regulatory approaches, and consumer protection frameworks affecting DCU auto insurance program operations. Massachusetts employs managed competition where insurers must file rate proposals with the Division of Insurance for approval before implementation, contrasting with states permitting greater rate-setting flexibility. These regulatory differences influence pricing structures and coverage options available through DCU auto insurance partnerships.

DCU’s primary service territory encompasses Massachusetts, where state law mandates the nation’s most comprehensive minimum coverage requirements along with distinctive features like mandatory personal injury protection covering medical expenses regardless of fault determination. Massachusetts DOI data from January 2025 indicates the state requires all registered vehicles to maintain continuous coverage with substantial penalties for lapses including license suspension, registration revocation, and potential vehicle impoundment for uninsured operation. Approximately 96 percent of Massachusetts vehicles maintain continuous insurance coverage, representing one of the highest compliance rates nationally.

Table 3: State Minimum Liability Requirements Comparison

| State | Bodily Injury (per person/accident) | Property Damage | Personal Injury Protection |

|---|---|---|---|

| Massachusetts | $20,000/$40,000 | $5,000 | $8,000 required |

| New Hampshire | Not required* | Not required* | Not required |

| California | $15,000/$30,000 | $5,000 | Not required |

| Florida | $10,000 PIP only | $10,000 | $10,000 required |

| Texas | $30,000/$60,000 | $25,000 | Not required |

*New Hampshire mandates financial responsibility demonstration after accidents but does not require insurance before violations

Geographic expansion of DCU auto insurance programs necessitates partner carriers maintaining valid licenses in each state where coverage offerings occur. The NAIC regulatory database indicates insurance companies must demonstrate financial stability, maintain required capital reserves, and comply with jurisdiction-specific consumer protection statutes before receiving authorization to conduct business. Members relocating to different states may need new DCU auto insurance policies from carriers licensed in destination jurisdictions, even while maintaining credit union membership.

Cost Factors and Premium Considerations

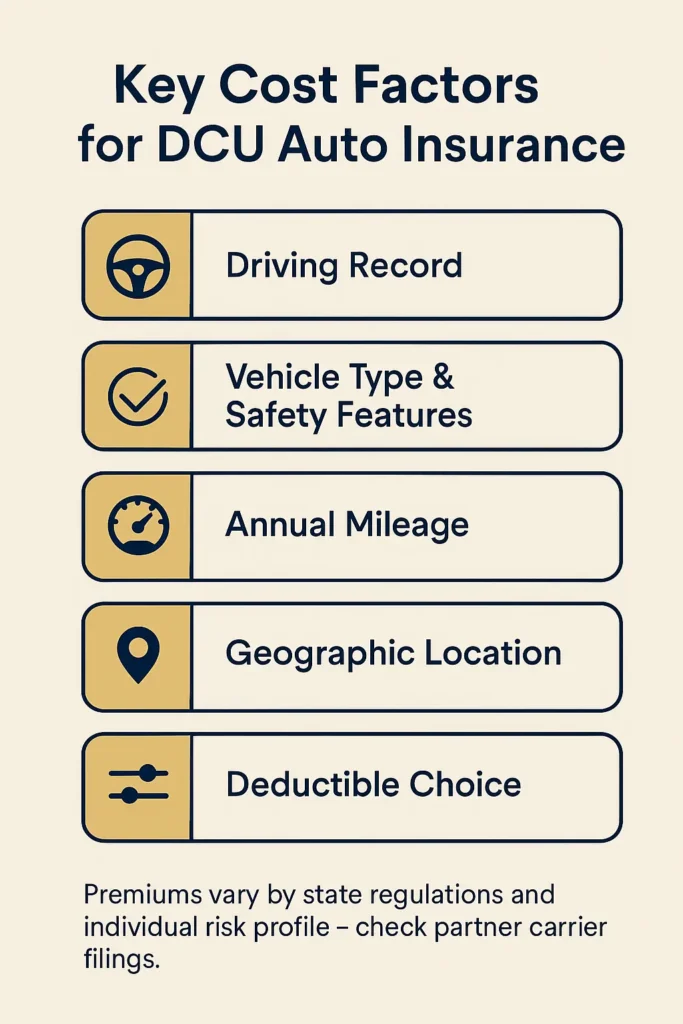

Vehicle insurance premiums through DCU auto insurance programs reflect identical fundamental rating variables used by traditional carriers, as state insurance departments regulate permissible underwriting factors and rate-setting methodologies. Primary determinants affecting DCU auto insurance premium calculations include driving history with particular emphasis on at-fault accidents and moving violations, credit-based insurance scores in jurisdictions where permitted, vehicle year, make, model and installed safety features, annual mileage estimates and primary use classification, and geographic location reflecting accident frequency and theft claim patterns.

Massachusetts prohibits credit score use in auto insurance rating decisions, positioning it among several states restricting this common underwriting variable. The Division of Insurance requires insurers to base DCU auto insurance rates primarily on driving experience, years licensed, annual mileage projections, and vehicle characteristics. The NAIC’s March 2024 industry data indicates Massachusetts drivers pay average annual premiums of one thousand two hundred twenty-one dollars for required coverage, positioning the state in the middle range nationally despite maintaining higher minimum coverage mandates than most jurisdictions. Approximately 42 percent of Massachusetts drivers pay premiums below the state average, while 58 percent pay above-average rates based on individual risk factors.

Linda, 52, Springfield Compared her existing policy premium of one thousand one hundred forty dollars annually against quotes from three carriers including DCU auto insurance partner. The credit union partner quoted one thousand ninety-five dollars, a traditional carrier offered nine hundred eighty dollars, and another provided one thousand sixty dollars. Selecting the lowest quote saved her seven hundred twenty dollars over four years. Lesson: Shopping multiple sources including DCU auto insurance and traditional carriers identifies genuinely competitive rates.

DCU Auto Insurance Discount Opportunities

Discount opportunities available through DCU auto insurance programs typically include safe driver reductions for clean records, multi-policy discounts bundling auto with other coverage types, vehicle safety feature credits for anti-theft systems and airbags, and member tenure discounts rewarding long-term credit union relationships. Specific discounts offered and their magnitude depend on the partner carrier’s approved rating plan and state regulatory approval of discount structures. The Insurance Information Institute’s February 2024 analysis indicates that multi-policy bundling generates average savings of 16 percent for consumers combining auto and home coverage.

Members seeking DCU auto insurance rate reductions can influence premiums through maintaining violation-free driving records, increasing deductibles to reduce premium costs when financially feasible, eliminating collision and comprehensive coverage on older vehicles where protection costs approach vehicle values, and exploring how deductibles affect your premium calculations. These strategies apply equally whether obtaining coverage through DCU auto insurance programs or traditional distribution channels.

Cost Consideration: Annual premium variations of two hundred to three hundred dollars between carriers for identical DCU auto insurance coverage commonly occur, making comparison shopping valuable regardless of insurance source.

Frequently Asked Questions

What are the requirements for DCU auto insurance?

DCU auto insurance requires active Digital Federal Credit Union membership, necessitating a five-dollar minimum deposit in a primary savings account and eligibility through living, working, worshiping, or attending school in qualifying Massachusetts communities or through employer participation programs. DCU auto insurance approval extends beyond membership to meeting partner carrier underwriting standards including acceptable driving records, vehicle insurability assessment, and compliance with state mandatory coverage requirements. The partnering insurer evaluates DCU auto insurance applications using industry-standard criteria even when accessed through credit union affiliates.

Is Direct Auto under Allstate?

Direct Auto Insurance operates as an independent insurance entity with no ownership connection to Allstate Corporation. Direct Auto functions as a separate carrier specializing in non-standard auto insurance markets across multiple jurisdictions. The company maintains distinct underwriting operations, claims departments, and regulatory licenses separate from Allstate’s insurance subsidiaries and operations. Consumers occasionally confuse similarly named insurance companies, making carrier identity verification important when evaluating coverage options and comparing quotes.

What is TruStage auto insurance?

TruStage represents the marketing designation for CUNA Mutual Group’s insurance products distributed through credit union partnerships nationwide. TruStage auto insurance delivers vehicle protection to credit union members through licensed insurance subsidiaries of CUNA Mutual Group, an organization specializing in serving credit union members. The program operates in multiple states with rates and underwriting criteria approved by respective state insurance departments. TruStage differs from DCU auto insurance structure as it represents a credit union-owned insurance entity rather than an independent agency arrangement with third-party carriers.

Is DCU insured?

Digital Federal Credit Union maintains federal deposit insurance through the National Credit Union Administration protecting member deposits up to two hundred fifty thousand dollars per depositor through the National Credit Union Share Insurance Fund. This deposit protection operates independently from any insurance products offered through credit union partnerships. Member deposits, share accounts, and certificates receive NCUA insurance coverage automatically, while DCU auto insurance products originate from partner carriers regulated by state insurance departments rather than federal deposit insurance frameworks.

Is it illegal to not have car insurance in DC?

The District of Columbia mandates all registered vehicles maintain minimum liability coverage including twenty-five thousand dollars per person and fifty thousand per accident for bodily injury, ten thousand dollars for property damage, and twenty-five thousand per person with fifty thousand per accident for uninsured motorist protection. Operating an uninsured vehicle in DC violates district law with penalties including fines reaching five hundred dollars, vehicle impoundment, license suspension, and potential SR-22 filing requirements for high-risk drivers. DC’s Department of Motor Vehicles requires continuous coverage proof during vehicle registration and conducts random insurance verification throughout the year.

What credit do you need for car insurance?

Massachusetts law prohibits insurance carriers from using credit scores in auto insurance rating determinations, making credit history irrelevant for DCU auto insurance coverage approval or premium calculation within the state. Other jurisdictions permit credit-based insurance scores, where carriers typically accept applicants across the credit spectrum but adjust premiums based on statistically demonstrated correlations between credit patterns and claims likelihood. No specific minimum credit score exists for insurance eligibility, though applicants with poor credit in states allowing its use may experience premium increases ranging from twenty to fifty percent compared to applicants with excellent credit profiles.

Can I get DCU auto insurance if I’m not a Massachusetts resident?

Credit union insurance partnerships typically require members to reside in states where partner carriers hold valid insurance licenses. DCU members living outside Massachusetts may access DCU auto insurance if the credit union’s partner carriers operate in their state of residence. Geographic eligibility for DCU auto insurance depends on both DCU membership qualification rules and partner insurer licensing in the member’s jurisdiction. Members should contact DCU Insurance directly to verify whether coverage availability exists in their specific location, as partner carrier licensing varies substantially by state.

How do credit union insurance rates compare to direct carriers?

DCU auto insurance programs may deliver competitive rates through negotiated group arrangements with partner carriers, but rate competitiveness varies significantly based on individual risk profiles and state market conditions. Industry analyses indicate DCU auto insurance rates typically fall within standard market ranges rather than consistently offering premium advantages over other distribution channels. The Insurance Information Institute’s February 2024 research suggests rate differences between distribution channels generally reflect underwriting criteria and claims experience rather than inherent cost advantages from any particular sales method. Comparison shopping across multiple sources including DCU auto insurance and traditional carriers helps identify optimal rates for individual circumstances.

What You Should Do Next

DCU auto insurance offers credit union members vehicle coverage access through an affiliated agency connecting members to licensed insurance carriers, though membership alone provides no guarantee of rate advantages or automatic coverage approval. Members should compare DCU auto insurance coverage options and premium quotes alongside quotes from traditional carriers to identify genuinely competitive rates for their specific risk profiles. Request DCU auto insurance quotes from minimum three insurance sources including any credit union insurance program available through your financial institution memberships. Verify comparison quotes include identical coverage limits, deductibles, and policy features ensuring accurate rate assessment rather than comparing dissimilar protection levels. Review financial strength ratings of any proposed insurance carrier through independent rating agencies like A.M. Best or Standard & Poor’s before finalizing DCU auto insurance coverage decisions.

Key Takeaways:

- DCU auto insurance requires active credit union membership with five-dollar minimum deposit but coverage approval depends on satisfying partner carrier underwriting standards, with members potentially saving two hundred to four hundred dollars annually through systematic comparison shopping across multiple insurers

- Credit union insurance programs typically connect members to licensed partner carriers through affiliated agencies rather than underwriting DCU auto insurance policies directly, making the partner carrier’s financial strength and service quality critical evaluation factors when selecting coverage

- Massachusetts minimum coverage requirements of twenty thousand per person and forty thousand per accident for bodily injury with five thousand for property damage represent state-mandated floors, with most drivers purchasing higher DCU auto insurance limits around one hundred thousand per person and three hundred thousand per accident for adequate financial protection

- Premium rates through DCU auto insurance programs reflect partner carrier rate tables and standard industry rating factors including driving record quality, vehicle characteristics, and geographic location, with modest group discounts potentially available depending on specific partnership arrangements and state regulatory approval

Disclaimers:

This guide provides educational information only and does not constitute professional insurance, legal, or financial advice.

Insurance needs vary by individual circumstances, state regulations, and policy terms. Consult licensed professionals before making coverage decisions.

Information accurate as of October 2025. Insurance regulations and products change frequently. Verify current details with official sources and licensed agents.