Cyber insurance coverage gap small business 2025 concerns escalate as American enterprises face mounting digital threats. The FBI’s Internet Crime Complaint Center documented nearly $17 billion in reported cybercrime losses during 2024—a 33% surge from the previous year—affecting countless small enterprises without adequate protection.

Are you confident your policy covers what you think it does?

We analyzed recent data from the National Association of Insurance Commissioners, FBI Internet Crime Reports, and federal regulatory agencies to identify critical protection shortfalls. You’ll discover which common claims get denied, understand regulatory requirements that create complications, and learn practical strategies to address weaknesses before incidents strike.

Quick Answer: Common cyber insurance coverage gap small business 2025 issues include ransomware payment exclusions, nation-state attack limitations, infrastructure failure exclusions, business interruption restrictions, and social engineering deception carve-outs. Most policies limit coverage to $1 million or less, while average breach costs exceed $2.9 million. (FBI Internet Crime Report, April 2024)

Understanding these cyber insurance coverage gap small business 2025 challenges becomes essential for maintaining operational continuity when digital threats materialize unexpectedly.

On This Page

What You Need to Know

- Small businesses face nearly three times more cyber targeting than larger enterprises, yet 72% lack dedicated coverage for emerging protection shortfalls

- The NAIC reports standalone and package premiums reached $9.84 billion in 2023, but claim denials increased 18% due to exclusionary language addressing SMB coverage deficiencies

- Federal agencies documented 67 new ransomware variants in 2024, many exploiting cyber insurance coverage gap small business 2025 limitations unfamiliar to owners

Understanding Cyber Insurance Coverage Gap Small Business 2025

Cyber insurance coverage gap small business 2025 scenarios emerge from the disconnect between owner expectations and actual insurer obligations when incidents occur.

The National Association of Insurance Commissioners reports that standalone policies numbered 284,600 in 2023. Yet denial rates for specific claim types increased substantially as carriers refined exclusionary language to address emerging threats.

Policy wording has evolved rapidly. According to the NAIC’s October 2024 Cyber Insurance Market Report, insurers incorporated approximately 40 different cyber war exclusion clauses following Lloyd’s of London guidance in 2023.

These exclusions now appear in roughly 85% of commercial policies, creating significant blind spots for businesses that assume comprehensive protection.

The average small business policy provides $500,000 to $1 million in coverage. Yet data breaches routinely generate costs exceeding these limits when notification expenses, legal fees, and regulatory penalties accumulate.

Research from federal agencies reveals concerning trends. The Cybersecurity and Infrastructure Security Agency’s April 2024 guidance notes that small businesses often purchase cyber liability policies without understanding fundamental coverage restrictions that create protection vulnerabilities.

Business interruption claims face particularly high denial rates—approximately 34% according to industry data—when losses stem from infrastructure outages or third-party system failures rather than direct attacks on the insured’s network.

Maria, 41, Austin Purchased a $750,000 policy believing it covered all digital threats. When ransomware encrypted her manufacturing company’s systems, she discovered her policy excluded payments to criminal organizations and limited business interruption coverage to 72 hours. Total uncovered losses: $1.2 million. Lesson: Ransomware payment exclusions and time-limited business interruption coverage create substantial financial exposure.

The insurance market continues adapting to catastrophic risk. Treasury Department officials noted in November 2023 remarks that the private market functions well for attritional losses but struggles with systemic events potentially affecting multiple policyholders simultaneously, contributing to protection shortfalls.

This gap between market capacity and potential exposure drives many policy limitations affecting comprehensive business insurance protection.

Federal Cybersecurity Requirements Affecting Cyber Insurance Coverage Gap Small Business 2025

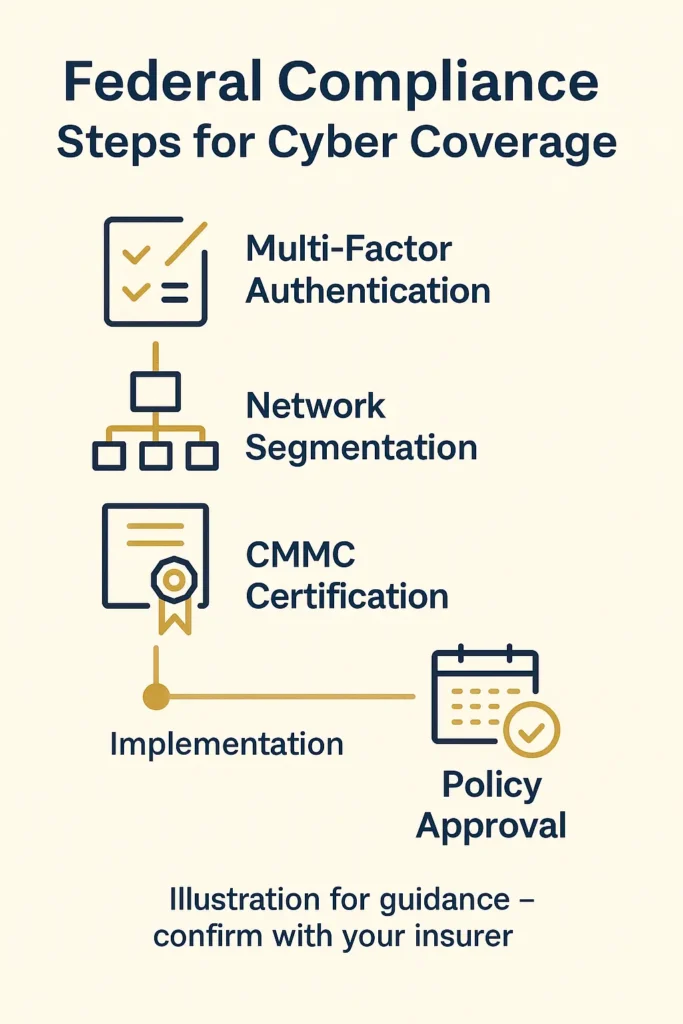

Federal cybersecurity frameworks establish baseline standards that directly influence coverage determinations and cyber insurance coverage gap small business 2025 exposures.

The Cybersecurity and Infrastructure Security Agency released updated small business guidance in April 2024, emphasizing that federal contractors face mandatory implementation of specific security controls under the Cybersecurity Maturity Model Certification program.

Failure to meet these requirements doesn’t just risk contract loss—it can void coverage entirely.

The FBI’s 2024 Internet Crime Report documented that phishing and spoofing attacks generated 193,407 complaints, representing the most frequent attack vector affecting businesses.

Federal agencies increasingly emphasize multi-factor authentication, network segmentation, and continuous backup systems as fundamental protection measures. Insurance underwriters now regularly audit these controls.

Policies frequently include warranties requiring businesses to maintain specific security practices.

CISA’s Cyber Essentials framework outlines six core elements that federal officials identify as critical for organizational resilience. These elements—including leadership commitment, staff awareness, and data protection—increasingly appear as policy requirements in cyber liability policies.

According to Treasury Department analysis, businesses failing to implement these fundamentals face premium increases averaging 40% and higher deductibles that can reach 10% of coverage limits, exacerbating financial exposure.

Robert, 38, Phoenix His architecture firm held a Department of Defense subcontract requiring CMMC Level 2 compliance. When a breach occurred, his insurer denied the claim after discovering his firm hadn’t implemented required network segmentation. Denied claim value: $340,000. Lesson: Federal compliance failures can completely void coverage regardless of policy limits.

Recent federal activity suggests growing recognition of coverage adequacy concerns. The National Science Foundation partnered with Treasury’s Federal Insurance Office in 2024 to establish research focused on improving terrorism and catastrophic risk modeling.

This research aims to address fundamental uncertainties that currently drive restrictive policy language and SMB protection deficiencies.

State-by-State Cyber Insurance Coverage Gap Small Business 2025 Variations

State insurance regulators maintain primary oversight authority, creating significant variations in coverage requirements and cyber insurance coverage gap small business 2025 protections across jurisdictions.

Twenty-one states have adopted the NAIC’s Insurance Data Security Model Law as of 2024. These jurisdictions require insurers and licensed entities to develop comprehensive information security programs and notify state commissioners of cybersecurity events.

States without these requirements often lack standardized incident response protocols affecting claim processing.

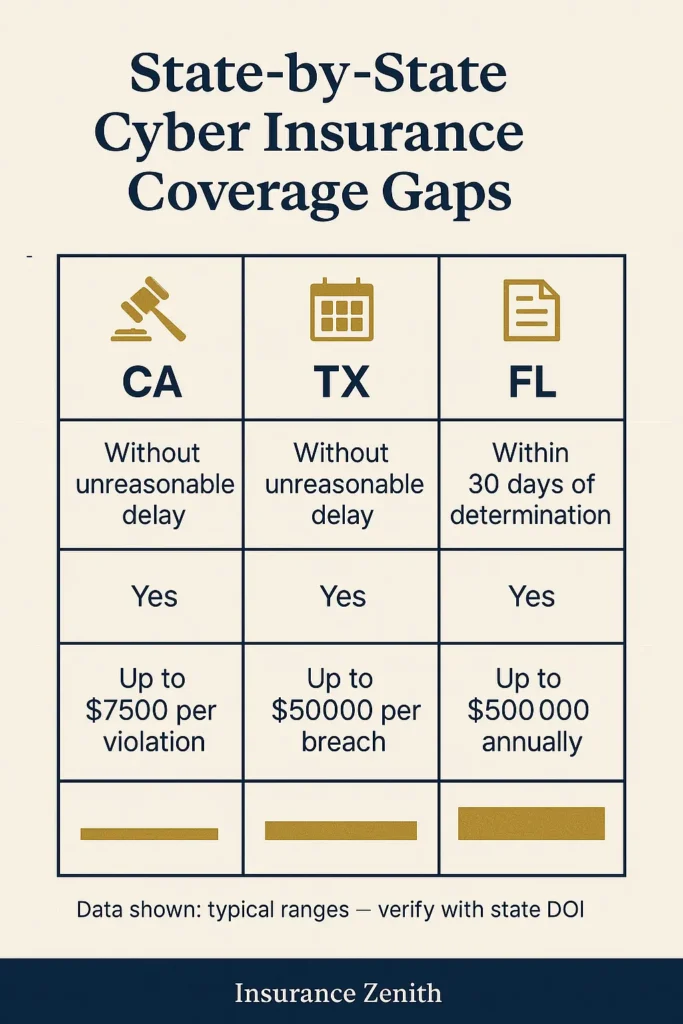

Data breach notification laws differ substantially across states, directly impacting coverage triggers and insurer obligations. California’s breach notification requirements, among the nation’s strictest, mandate notification to affected individuals within specific timeframes and impose penalties for delays.

Texas and Florida implement different thresholds and timelines, creating complexity for businesses operating across state lines.

These variations affect claim costs because notification expenses represent major components of breach response budgets.

| State | Breach Notification Deadline | Attorney General Notice | Regulatory Penalties |

|---|---|---|---|

| California | Without unreasonable delay | Yes, if >500 affected | Up to $7,500 per violation |

| Texas | Without unreasonable delay | Yes | Up to $50,000 per breach |

| Florida | Within 30 days of determination | Yes, if >500 affected | Up to $500,000 annually |

| New York | Without unreasonable delay | Yes | Variable based on impact |

| Illinois | In most expedient manner possible | Yes, if >500 affected | Private right of action |

State regulatory approaches to cyber war exclusions also vary. Following Lloyd’s of London guidance, most states permit broad cyber warfare exclusions. But California and New York regulators have scrutinized these provisions more closely.

The California Department of Insurance reviews cyber war exclusionary language to ensure it doesn’t inappropriately deny coverage for attacks merely attributed to nation-state actors without meeting formal warfare criteria.

Jennifer, 45, Miami Her retail business experienced a breach affecting customers in twelve states. Different state notification requirements generated legal costs exceeding her policy’s $50,000 regulatory expense sublimit by $180,000. Lesson: Multi-state operations face compounding notification costs that quickly exhaust regulatory expense coverage limits.

Market conditions vary significantly by jurisdiction. According to NAIC data analyzed in 2024, admitted carriers dominate the market in heavily regulated states like New York addressing small business protection needs.

Surplus lines carriers maintain larger market share in states with lighter regulatory touch. This affects coverage availability and pricing, making it more difficult to address policy blind spots effectively when managing SMB coverage deficiencies.

Common Coverage Exclusions Creating Cyber Insurance Coverage Gap Small Business 2025 Exposures

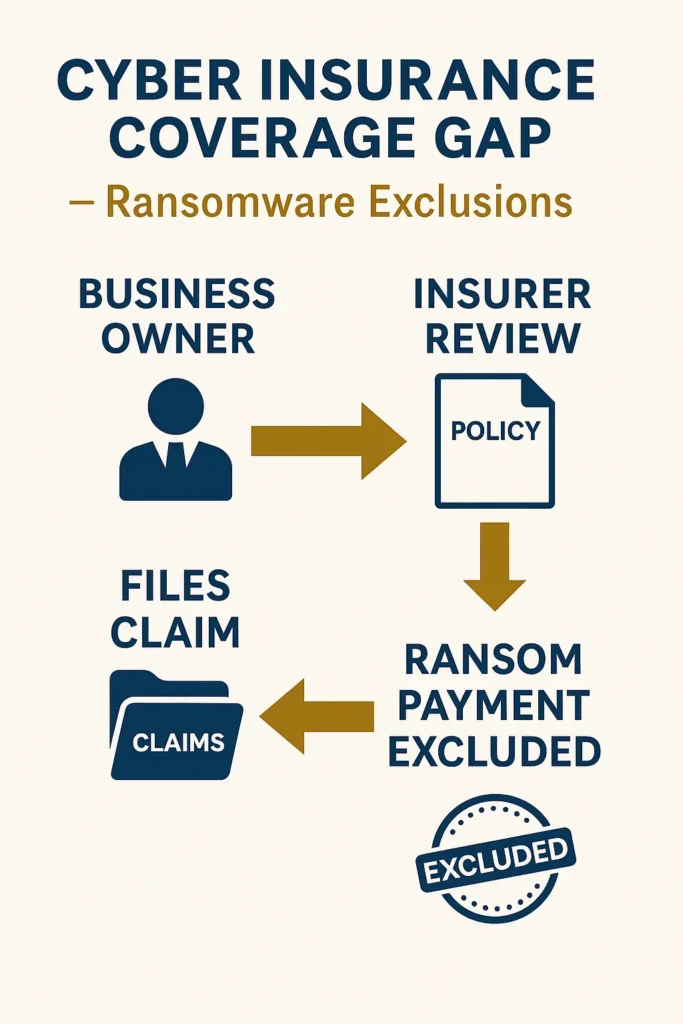

Cyber insurance coverage gap small business 2025 problems stem from numerous exclusions that surprise owners during claims.

Ransomware payment exclusions have proliferated since 2022. Approximately 60% of policies now prohibit direct payment to criminal organizations even when such payments represent the most economical recovery path.

The FBI reported ransomware complaints increased 9% in 2024, yet insurance coverage for ransom payments has contracted simultaneously.

Infrastructure failure exclusions represent another significant gap. When Microsoft’s global outage in July 2024 affected countless businesses, many discovered their policies excluded losses from third-party technology failures.

These exclusions apply even when businesses suffer substantial revenue losses.

Coverage typically requires direct attacks on the insured’s own systems rather than cascading failures from vendor or service provider disruptions.

Social engineering and business email compromise coverage often includes substantial limitations. The FBI documented $2.77 billion in BEC losses during 2024. Yet many policies cap social engineering coverage at $100,000 or exclude it entirely.

These attacks succeed through human manipulation rather than technical compromise, creating gray areas where insurers dispute whether incidents fall within policy scope.

Nation-state attack exclusions have expanded following Lloyd’s 2023 guidance. Policies now commonly exclude losses from operations attributable to foreign governments, even when attribution remains uncertain or disputed.

The challenge lies in determining whether an attack qualifies as state-sponsored, creating coverage disputes when insurers cite potential state involvement to deny claims.

| Common Exclusion Type | Typical Impact | Workaround Options |

|---|---|---|

| Ransomware Payments | $50,000-$2M uncovered costs | Separate ransom coverage riders |

| Infrastructure Failures | Business interruption not covered | Contingent business interruption endorsements |

| Social Engineering | Claims capped at $50K-$100K | Separate crime insurance policies |

| War/State-Sponsored | Complete claim denials | Enhanced attribution requirements |

| Prior Acts | Pre-existing vulnerabilities excluded | Tail coverage for known issues |

David, 52, Seattle His logistics company suffered a business email compromise resulting in $890,000 transferred to criminals. His policy included a $100,000 sublimit for social engineering, leaving $790,000 uncovered. Lesson: Sublimits for specific attack types can leave substantial portions of losses uninsured.

The NAIC’s 2024 market analysis reveals that claim denials based on exclusionary language increased 18% from previous years.

Insurers refined policy wording following major loss events. Understanding these exclusions before purchasing coverage enables businesses to negotiate enhanced terms or secure supplemental policies addressing specific gaps.

Frequently Asked Questions

What does cyber insurance not cover for small businesses?

Most policies exclude several categories of losses that catch business owners unprepared.

War and terrorism exclusions typically eliminate coverage for attacks attributable to nation-states or designated terrorist organizations. Infrastructure failures—when third-party vendors or service providers experience outages—generally aren’t covered unless businesses purchase contingent business interruption endorsements.

According to the NAIC’s October 2024 report, approximately 85% of policies now contain cyber warfare exclusions following Lloyd’s standardization guidance.

Unencrypted data breaches may face coverage challenges if policies require specific security measures as coverage prerequisites.

Reputational harm and brand damage typically fall outside standard policy scope unless explicitly included through endorsements.

Businesses should also be aware that errors and omissions coverage addresses different liability exposures than cyber policies, creating potential gaps between the two coverage types.

How much does cyber insurance cost for a small business?

Premiums for small businesses typically range from $1,200 to $7,500 annually depending on industry, revenue, data sensitivity, and security practices.The NAIC reported total direct written premiums of $9.84 billion across the U.S. market in 2023.

Healthcare providers and financial services firms face premium rates approximately 40% higher than manufacturers or retailers due to elevated regulatory risk and data sensitivity.

Treasury Department analysis indicates businesses without multi-factor authentication, regular backups, and incident response plans pay premiums 30-50% above market averages for comparable coverage limits.

These costs factor significantly into overall small business insurance expenses, requiring careful budget allocation for comprehensive protection.

Is cyber insurance worth it for small businesses?

Coverage provides essential financial protection for businesses facing digital threats. But coverage value depends heavily on policy quality and gap awareness.

The FBI’s 2024 Internet Crime Report documented 859,532 complaints with $16.6 billion in losses, demonstrating widespread threat exposure.

Small businesses without coverage face average breach costs exceeding $120,000 according to federal data, creating potential business-ending financial burdens.

However, policies with extensive exclusions and low coverage limits may provide false security.

CISA guidance emphasizes that insurance works best as part of comprehensive cybersecurity programs rather than as standalone protection.

Businesses should evaluate whether policy limits, deductibles, and exclusions align with actual risk exposure before purchasing coverage.

What are common exclusions in cyber liability policies?

Policies typically exclude coverage for intentional acts by insured parties, prior knowledge of vulnerabilities not disclosed to insurers, and losses from unpatched systems with available security updates.

According to industry analysis, war and terrorism exclusions now appear in approximately 85% of commercial policies.

Betterment costs—expenses to improve systems beyond pre-incident states—usually aren’t covered, limiting insurers’ obligations to restoration rather than enhancement.

Intellectual property theft claims often face exclusions or severe sublimits.

Contractual liability assumed through vendor agreements typically isn’t covered unless specifically negotiated.

The NAIC notes that insurers increasingly exclude losses from attacks that exploit known vulnerabilities more than 30 days after patches become available, incentivizing prompt security maintenance.

How do small businesses address cyber insurance coverage gap small business 2025 challenges?

Addressing protection limitations requires multi-layered strategies combining policy enhancement, risk transfer alternatives, and operational improvements.

Businesses should request manuscript policies tailored to specific operations rather than accepting standard forms with broad exclusions.

Purchasing separate crime insurance policies can address social engineering gaps that cyber policies exclude.

Contingent business interruption endorsements extend coverage to third-party infrastructure failures.

CISA’s April 2024 guidance recommends implementing Cyber Essentials framework controls to improve insurability and reduce premiums.

Treasury Department officials emphasize that strong cybersecurity practices often prove more valuable than expanded insurance limits.

Prevention remains more economical than recovery. Businesses should conduct annual policy reviews as operations and threat landscapes evolve, ensuring coverage keeps pace with changing risk exposure.

What is the difference between first-party and third-party cyber coverage?

First-party coverage protects against direct losses the insured business suffers. This includes forensic investigation costs, data restoration expenses, business interruption losses, ransomware payments, and notification expenses.

Third-party coverage addresses claims brought against the insured by others.

This includes privacy liability for customer data breaches, network security liability for attack-related damages to third parties, and media liability for content-related claims.

According to NAIC supplemental data, first-party claims averaged $47,000 in 2023 while third-party claims averaged $213,000, reflecting higher legal defense and settlement costs.

Most comprehensive policies bundle both coverage types, though limits and deductibles often differ between first-party and third-party sections.

Understanding this distinction helps businesses evaluate whether policy limits adequately address potential claim scenarios in each category.

Do cyber insurance policies cover ransomware attacks?

Ransomware coverage varies substantially across policies, with significant limitations emerging in recent years.

The FBI tracked 263,455 ransomware complaints in 2024. Yet many policies now exclude direct ransom payments to criminal organizations.

Approximately 60% of current policies prohibit ransom payments according to industry surveys.

They may still cover restoration costs, forensic investigations, and business interruption losses.

Some insurers offer ransom payment coverage through separate endorsements with sublimits typically ranging from $100,000 to $500,000.

The NAIC’s October 2024 report notes that ransomware exclusions proliferated following the 2021-2022 hard market when carriers experienced substantial ransom payment losses.

Businesses concerned about ransomware exposure should specifically review whether policies cover ransom payments, restoration costs, and business interruption during encryption incidents.

What happens if a cyber claim exceeds policy limits?

When losses exceed policy limits, businesses face potentially catastrophic out-of-pocket expenses that can threaten viability.

The insurer pays up to the policy limit, and the business absorbs all additional costs.

FBI data shows average business email compromise losses of $127,000 in 2024. Yet many small business policies cap coverage at $500,000 to $1 million.

Major breaches routinely generate expenses exceeding these limits when legal fees, notification costs, regulatory penalties, and business interruption accumulate.

Treasury Department analysis suggests businesses should maintain coverage limits equal to at least six months of revenue.

Though this guidance often proves financially impractical for smaller enterprises.

Excess cyber liability policies can provide additional coverage layers above primary policy limits. These policies cost 15-25% of primary policy premiums for equivalent additional coverage.

Key Takeaways: Addressing Cyber Insurance Coverage Gap Small Business 2025

Addressing cyber insurance coverage gap small business 2025 exposures requires immediate assessment of current protection against realistic threat scenarios your business faces.

Schedule a comprehensive policy review with an independent broker specializing in coverage. Specifically examine exclusionary language for ransomware payments, infrastructure failures, and social engineering.

Request manuscript policy quotes that reduce standard exclusions, even if premiums increase modestly.

Implement CISA’s Cyber Essentials framework controls to both reduce risk and improve policy terms. Federal agencies emphasize that prevention through strong cybersecurity practices often proves more valuable than expanded insurance limits alone.

Consider layered protection strategies. Separate crime insurance policies can address social engineering gaps that cyber policies exclude. Contingent business interruption endorsements extend coverage to third-party infrastructure failures.

Review policies annually as operations and threat landscapes evolve, ensuring coverage keeps pace with changing risk exposure.

Key Protection Points:

- Understanding cyber insurance coverage gap small business 2025 challenges helps businesses avoid catastrophic financial exposure from incidents not covered by standard policies

- The NAIC reported the market grew to $9.84 billion in direct written premiums during 2023, yet claim denials increased 18% due to refined exclusionary language

- Federal agencies documented 859,532 complaints in 2024 with $16.6 billion in losses, demonstrating widespread threat exposure affecting businesses of all sizes

- Ransomware payment exclusions now appear in approximately 60% of policies, while infrastructure failure exclusions eliminate coverage for third-party vendor disruptions

- Small businesses should combine insurance with robust cybersecurity practices rather than relying solely on coverage to address digital threats

- Multi-state operations face compounding notification costs that can quickly exhaust regulatory expense sublimits, requiring careful policy limit evaluation

Disclaimers

This guide provides educational information only and does not constitute professional insurance, legal, or financial advice.

Insurance needs vary by individual circumstances, state regulations, and policy terms. Consult licensed professionals before making coverage decisions.

Information accurate as of October 2025. Insurance regulations and products change frequently. Verify current details with official sources and licensed agents.