Colorado health premiums 2026 face dramatic increases according to preliminary regulatory filings released by the Division of Insurance. State insurance officials announced that carriers submitted requests averaging 28 percent higher than current rates for individual marketplace coverage. This represents the second-largest annual jump since federal health reform took effect in 2014, with only the 2018 rate cycle showing steeper increases. Close to 300,000 state residents purchasing non-employer coverage will encounter substantially elevated costs when November enrollment opens for the 2026 plan year.

Our analysis examined official rate documents from state regulators, federal enrollment statistics from the Centers for Medicare & Medicaid Services, and marketplace data from Connect for Health Colorado to reveal the complete picture. You’ll learn why Colorado health premiums 2026 are climbing faster than recent years, discover geographic differences statewide, and find practical approaches to managing higher expenses during the upcoming plan year.

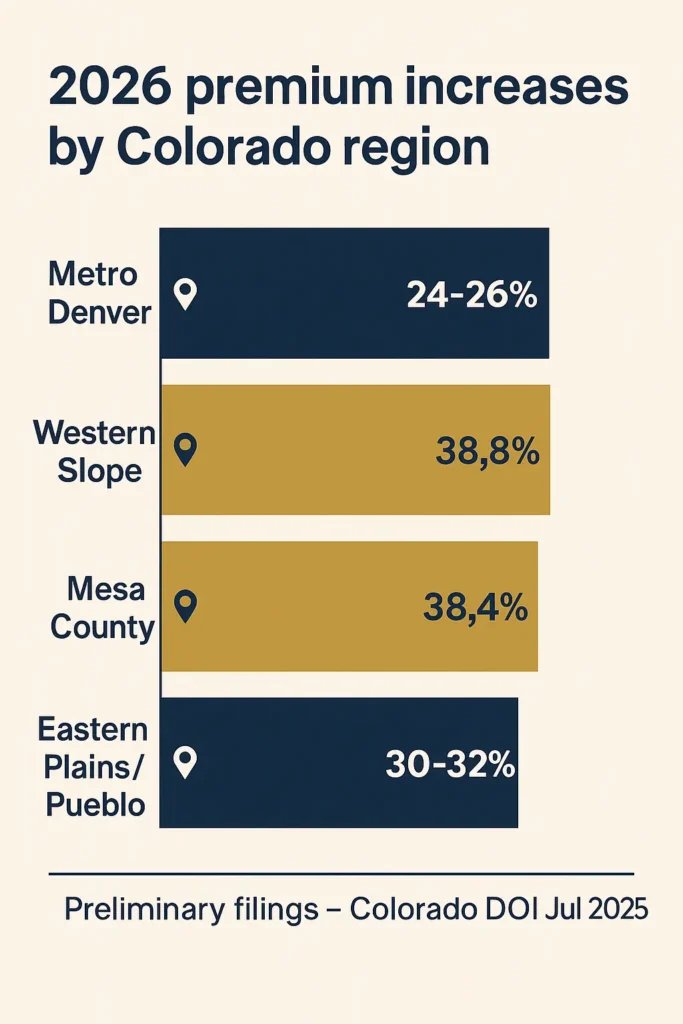

Quick Answer: Colorado health premiums 2026 show preliminary carrier requests averaging 28% statewide, with certain Western regions exceeding 38%. Primary factors include expiring enhanced federal tax credits scheduled to end December 31, 2025, plus diminished state reinsurance funding. (Colorado Division of Insurance, July 2025)

These health insurance costs Colorado residents encounter reflect complex interactions between federal policy shifts and state marketplace dynamics requiring careful examination.

On This Page

What You Need to Know

- Statewide preliminary rate requests average 28% higher for individual plans

- Western Colorado areas face proposed increases above 38%

- Changes affect approximately 321,000 state residents

- September legislative session funding may reduce final approved rates to roughly 16%

Understanding 2026 Premium Drivers in Colorado

Multiple interconnected elements determine what enrollees pay for marketplace coverage. Medical expense trends form the foundation—hospitals, pharmaceuticals, and physician services all contribute to actuarial projections carriers submit annually to the Division of Insurance.

The state operates a reinsurance mechanism that traditionally lowered individual market costs by subsidizing extraordinarily expensive claims. For the 2026 plan year, funding reductions to this program account for nearly eight percentage points of projected increases, according to the Colorado Division of Insurance July 2025 rate filing announcement released that month. When high-cost cases receive less support, carriers must spread those expenses across all enrollees.

State lawmakers convened a September 2025 special session to address affordability concerns surrounding Colorado health premiums 2026. The legislature appropriated additional dollars for both reinsurance enhancement and a new premium assistance program officials call a “premium wrap.” Combined, these state interventions could reduce the preliminary 28% request down to approximately 16% in final approved rates.

Maria, 42, Denver Operates a freelance graphic design business and enrolled in a Silver tier plan through the state marketplace. Her 2025 monthly cost was $487 with federal assistance. Without subsidy extension, her 2026 premium could reach $997—an additional $6,120 yearly. Lesson: Calculate your specific subsidy eligibility changes to avoid coverage gaps.

Risk pool composition matters significantly for Colorado health premiums 2026 projections. When healthy individuals exit coverage due to affordability barriers, the remaining enrolled population tends toward higher average medical utilization. This adverse selection dynamic creates upward cost pressure across all metal tiers.

According to state regulatory analysis released in July 2025, preliminary carrier filings reflect both baseline medical inflation around 20% and an additional eight percentage points specifically attributable to reinsurance funding shortfalls. The Connect for Health Colorado statement on navigating 2026 premium increases emphasized how federal policy changes drive these unprecedented increases.

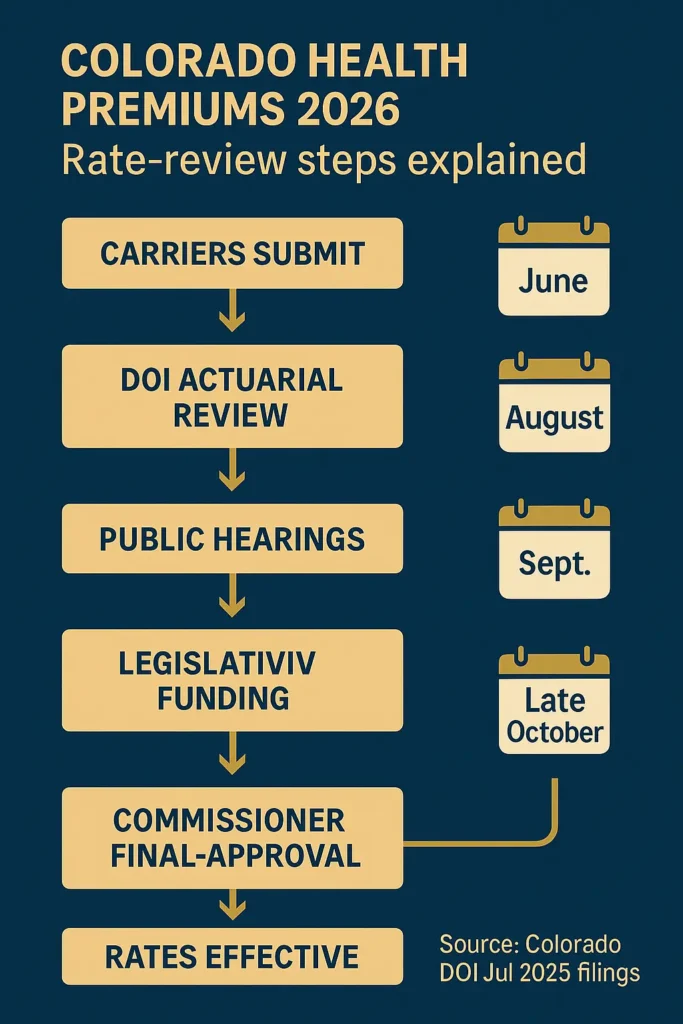

IMAGE: Premium Rate Filing Timeline Infographic Alt Text: Timeline infographic showing Colorado health insurance 2026 rate filing review process from June through December Caption: Critical milestones in Colorado’s regulatory review and premium approval process

How Federal and State Rate Review Works

Federal health reform established baseline standards for premium oversight while permitting states to implement stronger consumer protections. Colorado maintains a prior approval framework where the Division of Insurance must examine and authorize all proposed rate changes before carriers implement them for Colorado health premiums 2026.

The Medical Loss Ratio rule requires insurers to spend at least 80 cents of every premium dollar on actual medical care and quality improvements in individual and small group markets, as outlined in federal regulations from the Centers for Medicare & Medicaid Services on medical loss ratio standards. Plans falling below this standard must issue rebates to enrollees. State Insurance Commissioner Michael Conway emphasized thorough regulatory scrutiny to ensure carriers don’t exploit policy changes to inflate profit margins.

Enhanced Premium Tax Credits established during the pandemic significantly expanded middle-class affordability. These subsidies eliminated the previous “cliff” at 400% of federal poverty level where assistance abruptly ended. Research from the Kaiser Family Foundation analysis of average marketplace premiums by metal tier shows a 60-year-old earning $50,000 saved an average $356 monthly through these expanded credits.

| Regulatory Component | Federal Baseline | Colorado Application |

|---|---|---|

| Rate Review Threshold | ≥10% increases | All rate changes require approval |

| Medical Loss Ratio | 80% individual market | Strictly enforced with annual rebates |

| Premium Tax Credits | Up to 400% FPL (expiring 2025) | State supplements through reinsurance |

| Metal Tier Standards | Bronze 60%, Silver 70%, Gold 80%, Platinum 90% | Standardized designs mandated |

David, 55, Grand Junction Owns a small contracting business without employer-sponsored coverage options. His 2025 Bronze plan cost $520 monthly with tax credits. Western regions face the steepest proposed increases—Mesa County averages 38.4% in preliminary filings. David’s 2026 premium could exceed $720, adding $2,400 annually. Lesson: Geographic rating creates substantial cost variation across the state.

Regulators held public stakeholder meetings in August 2025 and accepted written public comment through early September. This transparent process allows affected residents to voice concerns before final rate approval.

IMAGE: Connect for Health Colorado Marketplace Interface Alt Text: Screenshot of state marketplace enrollment platform showing plan comparison and subsidy calculator tools Caption: The online marketplace where 282,000 Coloradans selected 2025 coverage

Colorado Health Premiums 2026 Compared to Other States

Rate increases reflect national patterns as enhanced federal assistance expires across all states. Comparing Colorado health premiums 2026 to neighboring states reveals both regional trends and policy impacts affecting individual marketplace enrollees nationwide.

Division of Insurance communications noted that circumstances driving increases aren’t unique to Colorado—officials expect similar patterns in other states. States operating robust reinsurance programs may experience somewhat smaller increases than those relying solely on federal marketplace infrastructure.

| State | 2025 Average Change | 2026 Projected Change | Marketplace Type | State Reinsurance |

|---|---|---|---|---|

| Colorado | 5.6% | 16-28%* | State-operated | Yes (reduced funding) |

| Wyoming | 8.2% | Pending | Federal | No |

| New Mexico | 7.1% | Pending | State-operated | Yes |

| Utah | 6.9% | Pending | State-operated | Yes |

| Arizona | 9.3% | Pending | Federal | No |

*Range reflects preliminary 28% carrier requests potentially reduced to 16% through state legislative appropriations

Historical context shows this year’s proposals represent dramatic departure from recent trends affecting Colorado health premiums 2026. Average increases were 5.6% in 2025, 9.7% in 2024, 10.4% in 2023, and 1.1% in 2022. The 2026 projections mark the largest year-over-year change since 2018 when rates climbed 34.3% during previous federal policy disruptions.

State health access survey data from 2023 indicates approximately 5% of Coloradans purchase individual marketplace plans. Roughly half obtain employer coverage, 30% enroll in Medicaid, and 10% have Medicare. Mountain corridor counties—Eagle, Garfield, Grand, Pitkin, Summit—see closer to 9% purchasing individual plans, reflecting unique employment patterns in resort economies.

Regional Variation Within Colorado

| Region | Preliminary Average Increase | Estimated Affected Enrollees | Contributing Factors |

|---|---|---|---|

| Metro Denver/Front Range | 24-26% | ~180,000 | Larger risk pools, more carrier competition |

| Western Slope (excluding Mesa) | 38.8% | ~42,000 | Limited carrier options, higher baseline costs |

| Mesa County (Grand Junction) | 38.4% | ~18,000 | Provider network concentration issues |

| Eastern Plains/Pueblo | 30-32% | ~40,000 | Rural healthcare infrastructure challenges |

Six insurance carriers serve the individual marketplace: Cigna Health & Life, Denver Health, Anthem, Kaiser Foundation Health Plan, Rocky Mountain HMO, and SelectHealth. Anthem HMO announced departure effective January 2026—the fifth carrier exit since 2022—though this affects under one percent of total enrollees.

CHART: Historical Colorado Premium Trends 2022-2026 Alt Text: Line chart displaying Colorado individual marketplace premium percentage changes from 2022 through preliminary 2026 rate requests Caption: Source: Colorado Division of Insurance annual rate review documentation (July 2025)

What Colorado Health Premiums 2026 Changes Mean for Enrollees

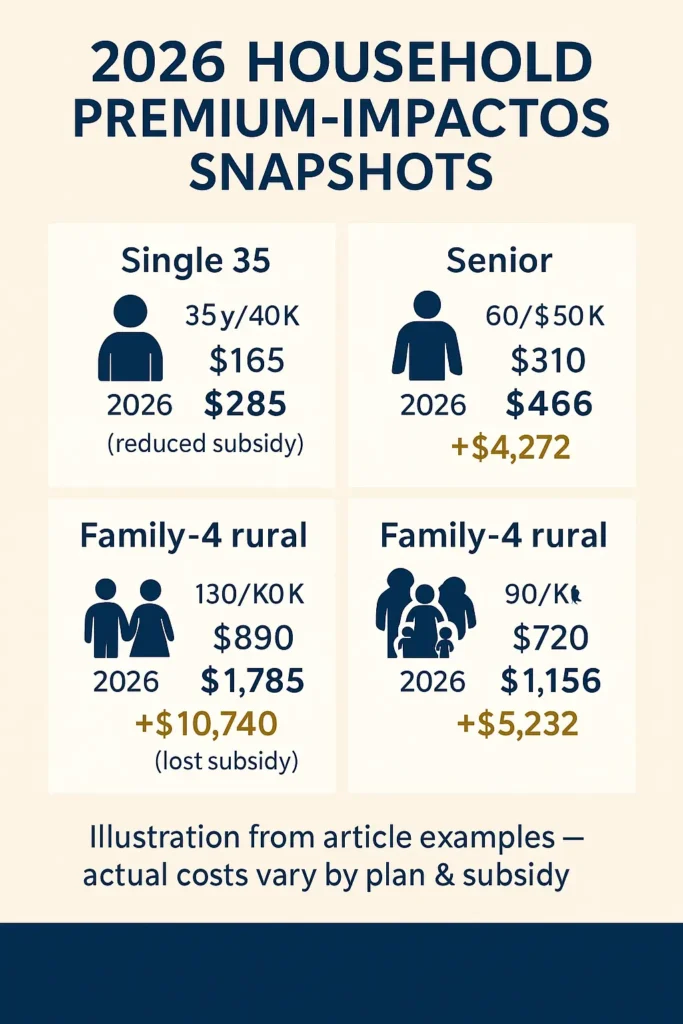

Combined effects of premium increases and subsidy modifications create varying financial scenarios depending on household income, age, family size, and geographic location. Understanding these variations helps individuals prepare for November enrollment when selecting Colorado health premiums 2026 plans.

The returning “subsidy cliff” affects middle-income households most severely. People earning over 400% federal poverty level—$62,600 for individuals or $128,600 for four-person families—lose all subsidies for individual marketplace coverage, requiring full premium payment. This policy reversal recreates significant financial hardship that enhanced credits had eliminated.

The state marketplace estimates more than 50,000 customers could lose coverage entirely if enhanced Premium Tax Credits expire, as they’d no longer afford even lowest-cost Bronze tier premiums. Approximately 80% of the marketplace’s 282,000 enrollees received financial assistance in 2025, making subsidy changes particularly consequential.

Annual Cost Impact Examples

| Household Profile | 2025 Monthly Premium | 2026 Projected Premium | Annual Increase | Subsidy Status |

|---|---|---|---|---|

| Single, Age 35, $40K income | $165 (after subsidy) | $285 (reduced subsidy) | $1,440 | Eligible but reduced |

| Single, Age 60, $50K income | $310 (after subsidy) | $666 (reduced subsidy) | $4,272 | Eligible but reduced |

| Family of 4, $130K income | $890 (after subsidy) | $1,785 (no subsidy) | $10,740 | Lost—above 400% FPL |

| Family of 4, rural CO, $90K | $720 (after subsidy) | $1,156 (reduced subsidy) | $5,232 | Eligible but reduced |

Commissioner Conway noted that even with state efforts reducing baseline increases to 16%, many households losing subsidies could see what they actually pay double—potentially 100% jumps in some cases. The distinction between carrier rate increases and consumer cost changes remains critical to understanding 2026’s impact.

Jennifer, 38, Colorado Springs Freelance photographer with spouse and two children; household income $135,000. Their 2025 Gold plan cost $647 monthly after enhanced subsidies. In 2026, they’ll exceed the 400% poverty threshold and lose all assistance, facing full premium costs estimated at $1,890 monthly—an additional $14,916 annually. Lesson: Families near income thresholds face sudden affordability crises requiring coverage alternatives or significant budget restructuring.

Healthcare provider impacts extend beyond individual policyholders. The Colorado Hospital Association warned that when patients forgo coverage due to cost, they delay necessary care, hospitals encounter more severe cases requiring intensive treatment, and uncompensated care costs strain already stressed medical infrastructure.

CHART: Contributing Factors to 2026 Rate Changes Alt Text: Pie chart breaking down elements driving Colorado 2026 premium increases including federal policy changes and reinsurance funding reductions Caption: Source: Colorado Division of Insurance preliminary rate analysis documentation (July 2025)

Frequently Asked Questions

Will insurance premiums increase in 2026?

Yes, Colorado health premiums 2026 are projected to increase substantially for individual marketplace coverage. Preliminary carrier filings show average statewide requests of 28%, though state legislative funding may reduce final approved rates to approximately 16%, according to the Colorado Division of Insurance September 2025 analysis. These increases affect only individuals purchasing coverage outside employer-sponsored plans—about 300,000 Coloradans. Geographic location significantly impacts specific rate changes, with Western Slope residents facing the highest proposed increases exceeding 38%. Final rates require Insurance Commissioner approval following regulatory review.

Why is Colorado health insurance so expensive?

Several structural factors drive marketplace costs in the state. Mountain corridor counties including Eagle, Garfield, Grand, Pitkin and Summit historically show higher uninsurance rates around 12.6%, creating smaller, less stable risk pools that increase volatility. Limited carrier competition in rural areas reduces market pressure for cost control. High medical care expenses in resort communities with seasonal population fluctuations affect actuarial risk calculations. State benefit mandates expand coverage requirements beyond federal minimums. Geography creates provider access challenges requiring higher reimbursement rates to maintain rural healthcare networks. These elements compound to produce premium costs consistently above national averages.

Why did insurance rates go up in Colorado?

The 2026 rate increases stem primarily from federal policy changes rather than state-level factors. Expiring enhanced Premium Tax Credits reduce federal funding for the state’s reinsurance program by approximately $100 million, cutting the program’s effectiveness by 40%. This reduction alone accounts for roughly eight percentage points of projected increases. Additional federal legislation included automatic renewal restrictions, shortened enrollment windows, and subsidy eligibility rule changes that destabilize individual markets. When healthy enrollees drop coverage due to higher costs, the remaining risk pool contains proportionally higher medical expenses, creating further upward premium pressure through adverse selection dynamics.

How much will Medicare go up in 2026?

Medicare Part B standard premium increases for 2026 have not been announced as of October 2025. The Centers for Medicare & Medicaid Services typically releases next year’s Medicare premiums in November during the annual fall announcement period. For reference, the 2025 Medicare Part B standard monthly premium stands at $174.70, with Part A remaining premium-free for most beneficiaries who paid Medicare taxes during employment. However, according to CMS Medicare Advantage and Part D stability announcement for 2026, Medicare Advantage plan premiums are expected to decrease from $16.40 monthly in 2025 to approximately $14 in 2026.

Cost-of-living adjustments and Medicare Advantage plan premiums vary by specific plan selection and geographic region. Colorado residents enrolled in Medicare should review the official Medicare.gov website in November for confirmed 2026 rates and detailed coverage information. Note that Colorado health premiums 2026 increases for individual marketplace plans do not affect Medicare beneficiaries.

What can Coloradans do to prepare for 2026 premium increases?

The state marketplace strongly encourages working with certified brokers or enrollment assisters—free services that help identify all available financial assistance and find plans matching health needs and budgets. Review household income projections carefully to understand 2026 subsidy eligibility under modified rules. Consider whether employer-sponsored coverage through your job or a spouse’s employment might become more cost-effective than individual marketplace plans. Evaluate Health Savings Account eligible high-deductible plans if expecting lower medical utilization. Compare metal tiers during open enrollment to balance premium costs against expected out-of-pocket expenses for your typical healthcare usage. Verify provider networks remain consistent across plan years to avoid access disruptions. Submit open enrollment applications before December deadlines to ensure January coverage takes effect without gaps.

Key Takeaways

Planning for Colorado health premiums 2026 requires understanding both projected rate increases and subsidy eligibility changes under new federal rules. Take action now by calculating your household’s federal poverty level percentage and estimating likely premium costs with reduced financial assistance. Review alternative coverage options including employer plans, spouse’s coverage opportunities, or COBRA eligibility if recently changed employment.

Essential Planning Points:

- Colorado health premiums 2026 preliminary carrier requests average 28%, potentially reduced to roughly 16% through state legislative funding appropriations, with final approved rates expected by late October following Division of Insurance review

- Western Slope residents face disproportionate impact with proposed increases exceeding 38%, requiring careful budget planning and thorough subsidy eligibility calculations before open enrollment

- Enhanced Premium Tax Credit expiration on December 31, 2025 eliminates subsidies for households above 400% federal poverty level while reducing assistance amounts for lower income brackets

- Open enrollment begins November 1, 2025 for Colorado health premiums 2026 coverage starting January 1—early research and broker consultations prove critical for identifying best available options within budget constraints

- State reinsurance program funding cuts account for approximately eight percentage points of increases, though special session appropriations may partially offset these reductions in final approved rates

Understanding health coverage options requires examining individual, employer-sponsored, and public program alternatives. For those facing Colorado health premiums 2026 increases, exploring strategies to reduce health insurance costs can help manage budget constraints. The open enrollment preparation process provides step-by-step guidance for selecting appropriate plans during the November 1 through December 15 window. When comparing plans, understanding choosing appropriate deductibles helps balance monthly premiums against out-of-pocket costs. Learn more about Insurance Zenith’s editorial team.

Disclaimers:

This guide provides educational information only and does not constitute professional insurance, legal, or financial advice.

Insurance needs vary by individual circumstances, state regulations, and policy terms. Consult licensed professionals before making coverage decisions.

Information accurate as of October 2025. Insurance regulations and products change frequently. Verify current details with official sources and licensed agents.