Health insurance when changing jobs requires strategic planning to prevent coverage interruptions that expose families to catastrophic medical expenses. Federal data reveals approximately 7.2 million Americans transition between employers each year, yet many remain unaware of their legal protections. Will you know how to safeguard your coverage when opportunity calls?

Our analysis of current federal enrollment statistics, employer benefit research, and marketplace data provides clarity for job transition health coverage. You’ll learn how continuation rights function, discover cost differences between coverage paths, and receive actionable guidance for maintaining protection during career changes.

Quick Answer: Health insurance when changing jobs involves selecting from continuation coverage (keeping your previous plan at full cost), new employer benefits (often requiring waiting periods), or marketplace plans through special enrollment. Each path differs in cost structure, timeline requirements, and coverage scope.

Protecting coverage continuity safeguards both health access and financial stability during employment shifts.

On This Page

What You Need to Know

- Federal law grants 60-day election periods for continuation coverage, with costs averaging 102% of total premiums

- Marketplace special enrollment opens for 60 days following employer coverage loss

- Employer waiting periods range from immediate access to 90-day delays under federal standards

- Coverage interruptions create financial vulnerability despite penalty elimination under current regulations

Understanding Coverage Options During Employment Changes

Job transitions trigger three distinct coverage pathways governed by federal statutes and regulatory frameworks. The Consolidated Omnibus Budget Reconciliation Act creates temporary continuation rights, while marketplace mechanisms provide alternative enrollment opportunities for switching employers with health benefits.

Current benefit data shows 87% of employees at covered firms qualify for health plans, though access varies dramatically by company size—only 56% at small organizations versus 98% at larger employers. Your insurance options between jobs depend heavily on new employer characteristics and benefit architecture.

Michael, 42, Phoenix Started at a growing company without confirming the 90-day benefit delay. Faced $31,400 in surgical costs during month two. Continuation would have required $1,836 for three-month coverage. Lesson: Verify benefit start dates and maintain bridge coverage when transitioning between jobs.

Federal guidelines establish that separation events—voluntary departure, termination, or hour reductions—activate continuation eligibility for employees and dependents. Mastering these frameworks ensures uninterrupted protection throughout career transitions. Learn more about coverage fundamentals and federal protections.

CONTEXTUAL IMAGE Filename: cobra-timeline-infographic-2025.jpg Alt Text: Federal continuation coverage timeline showing election periods and payment deadlines Title: Critical Deadlines for Continuation Coverage Elections Caption: Federal statutes establish specific timeframes for continuation coverage decisions and payment obligations.

Federal Protection Laws and Your Rights

Continuation Rights Under COBRA

Three federal statutes govern employment transition protections: COBRA, the Affordable Care Act, and the Health Insurance Portability and Accountability Act. Each law addresses distinct coverage continuity elements.

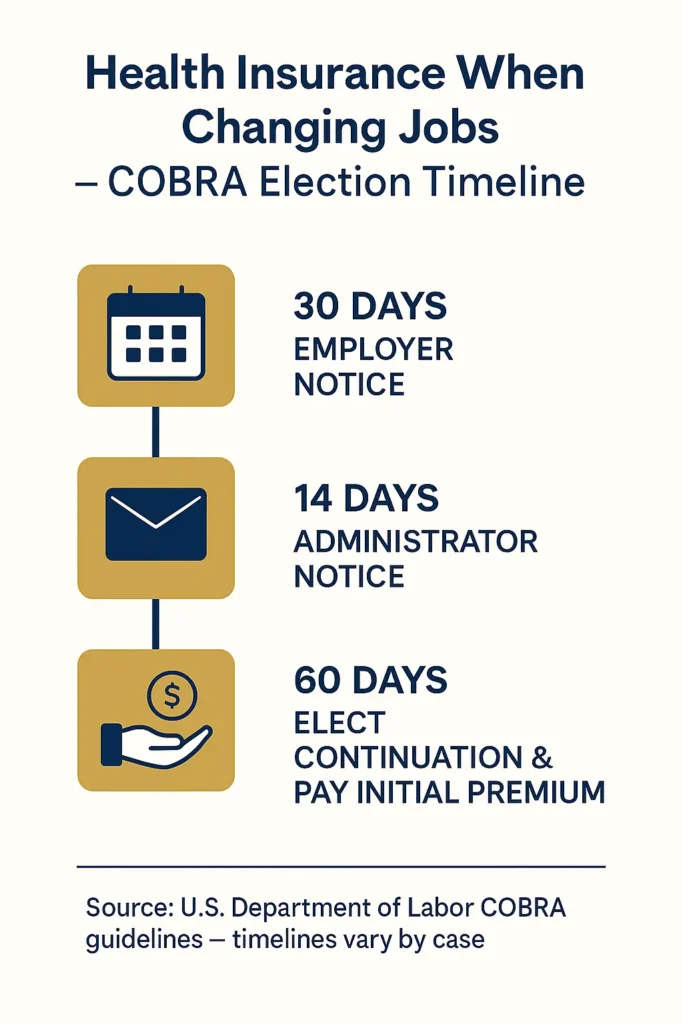

Federal mandates require employers with 20+ employees to offer 18-36 month continuation options based on qualifying circumstances. Compliance data indicates employers must notify administrators within 30 days of qualifying events, followed by 14-day beneficiary notification deadlines. Employees receive 60 days from the later of coverage termination or notice receipt to elect continuation.

Marketplace special enrollment activates when employer coverage ends—through separation, hour reduction, or voluntary departure. Recent enrollment statistics show 2.8 million Americans accessed special enrollment in 2024, with 41% involving employment-related coverage loss. Those exploring temporary coverage solutions between jobs should understand both federal and alternative protection mechanisms during career transitions.

Portability regulations prevent pre-existing condition exclusions when continuous coverage maintains gaps under 63 days. This “creditable coverage” standard protects job change coverage scenarios between employer plans, though broader reforms have largely eliminated pre-existing condition barriers across all qualified plans.

State Continuation Coverage by Jurisdiction

| State | Program Name | Maximum Duration | Qualifying Employers |

|---|---|---|---|

| California | Cal-COBRA | 18-36 months | 2-19 employees |

| New York | State Continuation | 36 months | 2-19 employees |

| Texas | Continuation Benefits | 6-9 months | 2-19 employees |

| Florida | None | N/A | Federal only |

| Illinois | State Program | 12 months | 2-19 employees |

State programs extend continuation access to workers at smaller companies not meeting federal employer size thresholds.

Comparing Your Coverage Alternatives

Navigating Health Benefits During Job Changes

Employment transition decisions require comprehensive evaluation of expenses, benefit quality, timing constraints, and household needs. Each alternative presents unique advantages and constraints based on individual circumstances and new employment situations.

Coverage Comparison Matrix

| Element | Continuation Coverage | New Employer Benefits | Marketplace Plans |

|---|---|---|---|

| Monthly Cost | 102% premium + fees | Employer subsidies apply | Income-based tax credits |

| Effective Date | Retroactive if elected within 60 days | Following waiting period | Month after enrollment |

| Benefit Level | Matches previous plan | Employer-determined | Metal tier selection |

| Provider Access | Unchanged network | Network may differ | Plan-specific networks |

| Decision Window | 60 days post-notice | Employer schedule | 60 days post-loss |

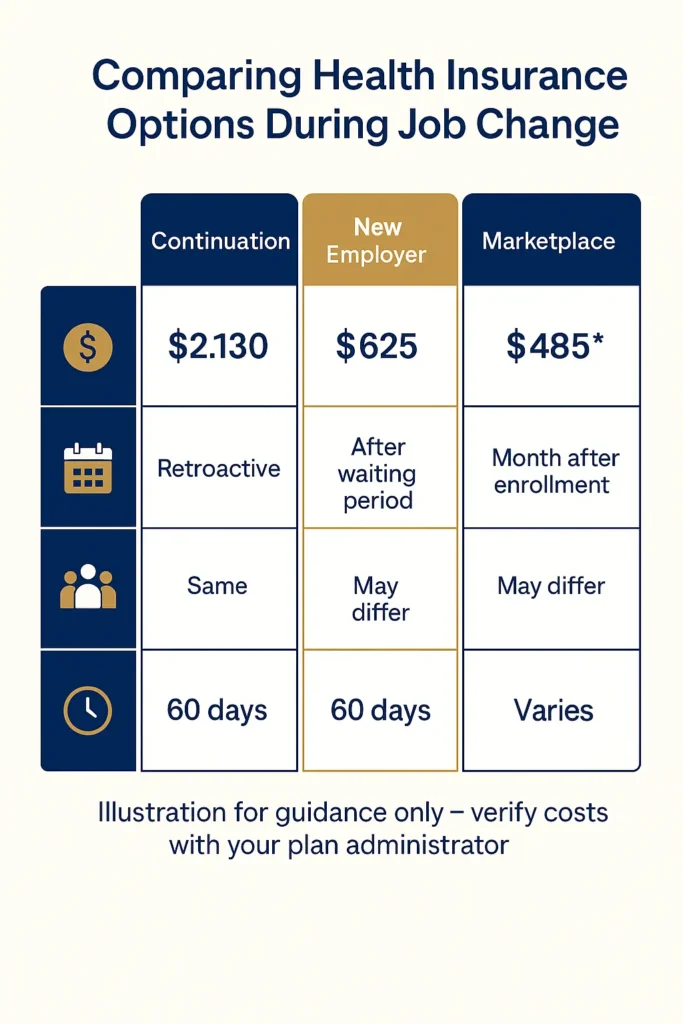

National averages show employer family coverage reaching $25,572 annually, with employee contributions averaging $6,575. Continuation participants cover full costs plus 2% administration fees—transforming a $548 employee share into $2,188 monthly continuation premiums.

Sarah, 36, Seattle Evaluated $2,100 monthly continuation against marketplace alternatives during transition. Selected subsidized Silver tier for $340 monthly. Achieved $8,800 savings over five months before new employer coverage activated. Lesson: Tax credit eligibility can dramatically reduce marketplace costs versus continuation when leaving one job for another.

For families seeking affordable coverage strategies during employment gaps, comprehensive option comparison proves essential. Short-term limited plans exist but fail federal adequacy standards and frequently exclude pre-existing conditions. Federal guidance indicates short-term products deliver only 50% actuarial value compared to compliant coverage.

DECISION FLOWCHART IMAGE Filename: health-coverage-decision-tree-2025.jpg Alt Text: Decision flowchart for selecting optimal coverage during employment transitions Title: Coverage Selection Framework for Job Changes Caption: Systematic evaluation process for identifying appropriate coverage based on individual circumstances and financial capacity.

Cost Analysis and Financial Planning

Understanding Total Coverage Expenses

Transition coverage expenses encompass premiums, deductibles, maximum out-of-pocket limits, and interruption risks. Thorough financial analysis identifies the most economical path for your situation.

Continuation’s true expense emerges through total cost examination. For family plans at $2,130 monthly (102% of national averages), three-month bridge coverage totals $6,390 in premiums alone. When new employers offer immediate access or substantial marketplace subsidies apply, continuation’s premium burden may prove unjustifiable.

Federal marketplace data reveals families earning 150-400% of poverty levels receive average monthly tax credits of $724. This subsidy framework frequently makes marketplace coverage substantially more affordable than continuation for transitioning workers experiencing temporary income fluctuations.

Comparative Cost Analysis

| Coverage Scenario | Monthly Premium | 3-Month Cost | Annual Deductible | Total Exposure |

|---|---|---|---|---|

| Continuation Family | $2,130 | $6,390 | $3,000 | $9,390 |

| Marketplace Silver (subsidized) | $485 | $1,455 | $8,000 | $9,455 |

| New Employer (post-waiting) | $625 | $625 | $2,500 | $3,125 |

| Uninsured Gap | $0 | $0 | N/A | Unlimited risk |

David, 51, Atlanta Elected 90-day coverage gap attempting $6,600 continuation savings. Acute diagnosis in month two generated $43,000 medical obligations. Lesson: Coverage interruptions create catastrophic financial exposure exceeding any premium savings when switching jobs.

Employer contribution research indicates average subsidies of 73% for individual coverage and 67% for family plans. These employer subsidies render new employer coverage substantially cheaper than continuation after waiting periods end, though gap periods demand careful bridging for changing jobs health insurance. Understanding marketplace enrollment timing and special enrollment rights optimizes coverage decisions during employment transitions.

CHART/INFOGRAPHIC Filename: employer-premium-contributions-2024.jpg Alt Text: Bar chart displaying average employer premium subsidies by coverage category Title: Employer Contribution Patterns 2024-2025 Caption: Source: KFF Employer Health Benefits Survey (October 2024) – Employer subsidies substantially reduce employee premium obligations versus full continuation costs.

Frequently Asked Questions

How long does coverage last after employment ends?

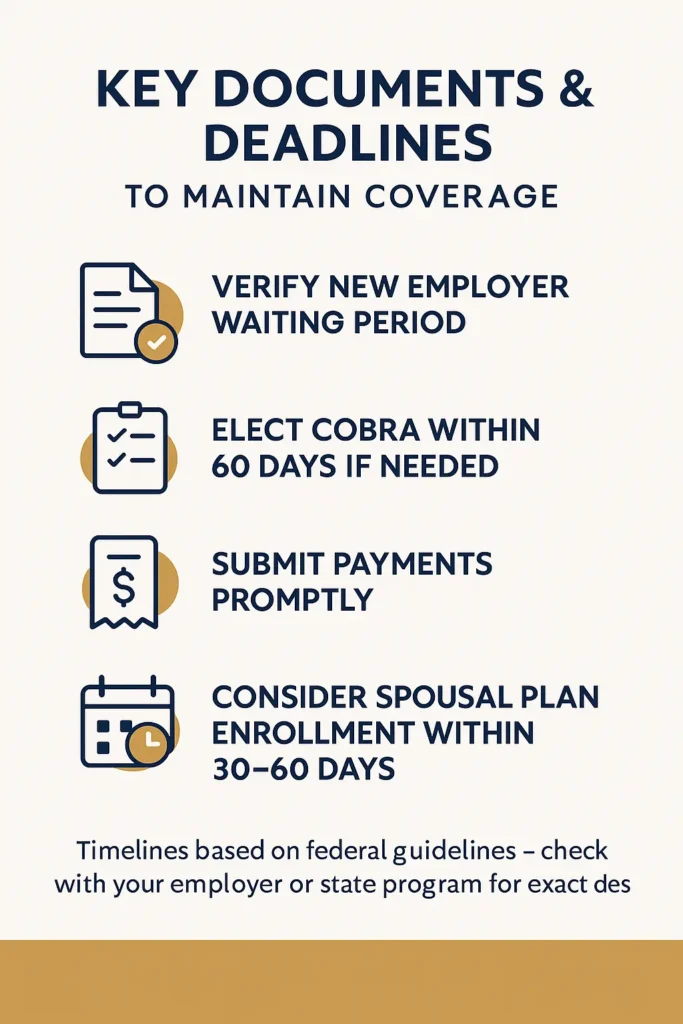

Employer plans typically terminate on your final work day or month-end, depending on plan design. Federal continuation rights extend identical coverage for 18-36 months when you pay full premiums plus administrative fees. Department of Labor continuation regulations (September 2024) detail employer obligations and beneficiary rights.

Can I maintain my plan after voluntary resignation?

Yes, through continuation coverage if your employer meets the 20-employee federal threshold, or via state programs where smaller employer exceptions apply. You must elect continuation within 60 days of receiving formal notice. Additionally, employer coverage loss qualifies you for marketplace special enrollment, enabling individual plan purchase within 60 days of coverage termination per CMS special enrollment policies (August 2024).

What is the 60-day rule for health insurance when changing jobs?

The 60-day standard applies to both continuation elections and marketplace special enrollment. For continuation, you have 60 days from notice receipt to elect coverage, with retroactive protection to your loss date upon election and premium payment. For marketplace plans, 60 days from employer coverage loss permits new enrollment, with coverage beginning the month following selection. This timeframe is critical for maintaining job transition health insurance continuity.

Is continuation necessary if my new position offers immediate benefits?

Not always. When new employers provide immediate coverage or brief waiting periods, you might bypass continuation through out-of-pocket gap coverage, marketplace subsidies, or spousal plan access. However, ongoing medical needs, prescription requirements, or provider network preferences may justify continuation despite higher costs.

How should I evaluate competing benefit packages?

Compare monthly premiums, annual deductibles, out-of-pocket maximums, provider networks, prescription coverage, and employer contribution levels. Request Summary Plan Descriptions from both employers, verify provider network participation, and calculate annual total costs including premiums and anticipated medical expenses. HHS portability guidance (July 2024) recommends minimum five-factor comparative analysis when evaluating employer insurance during job switches.

Can spousal coverage address transition gaps?

Yes, your coverage loss constitutes a special enrollment event for spousal employer plans regardless of annual enrollment timing. Spouses typically have 30-60 days from your coverage loss to add you and dependents, though precise deadlines vary by employer. This often provides better value than continuation when spousal employers subsidize dependent coverage.

What risks accompany coverage interruptions?

Coverage gaps create full financial responsibility for all medical costs, potentially causing delayed care or substantial debt. While federal individual mandates no longer apply nationally, some states impose uninsured penalties. More critically, unexpected medical emergencies during coverage gaps generate catastrophic financial exposure. Bridge options include continuation, subsidized marketplace plans, or alternative temporary solutions matching your income profile and circumstances.

Making Your Coverage Decision

Health insurance when changing jobs becomes manageable through understanding federal rights and available alternatives. The 60-day windows for continuation and marketplace enrollment provide decision flexibility, but demand prompt action preventing protection gaps.

Key Takeaways:

- Evaluate all coverage paths before your final work day, comparing continuation expenses, employer waiting periods, and marketplace subsidies to identify optimal solutions

- Federal continuation costs average 102% of total premiums—approximately $2,130 monthly for family coverage per KFF employer benefit data (October 2024)—warranting alternative exploration

- Marketplace special enrollment grants 60-day access following employer coverage loss, with subsidies reaching families earning up to 400% of federal poverty thresholds

- Federal regulations cap employer waiting periods at 90 days, though many organizations offer immediate or 30-day benefit access reducing continuation bridge requirements

- Coverage interruptions generate catastrophic financial risks vastly exceeding premium savings, making continuous protection essential throughout employment transitions

Protecting health insurance when changing jobs requires proactive planning, federal rights awareness, and comprehensive cost analysis. Your coverage decision impacts both immediate financial stability and long-term health access for your entire family.

Disclaimers:

This guide provides educational information only and does not constitute professional insurance, legal, or financial advice.

Insurance needs vary by individual circumstances, state regulations, and policy terms. Consult licensed professionals before making coverage decisions.

Information accurate as of October 2025. Insurance regulations and products change frequently. Verify current details with official sources and licensed agents.