Anthem exits Colorado counties health plans 2026, creating coverage disruption for roughly 14,000 individual marketplace participants across rural and suburban communities. The Colorado Division of Insurance confirmed this withdrawal in September 2025, triggering mandatory plan transitions during the upcoming enrollment window. How will this carrier departure affect your family’s healthcare access and costs?

Our analysis examined regulatory documents from state insurance authorities, federal enrollment statistics, and marketplace participation data to clarify this market shift. You’ll identify which specific counties lose Anthem coverage, discover replacement carrier alternatives with detailed comparison metrics, and learn the precise deadlines protecting your family’s continuous healthcare access through the transition period.

Quick Answer: Anthem exits Colorado counties health plans 2026 in fourteen specific counties, directly impacting roughly 14,000 people with individual marketplace policies who must choose replacement carriers before mid-December. (Colorado Division of Insurance, September 2025)

Understanding how Anthem exits Colorado counties health plans 2026 influences your options requires examining affected geographic areas, available replacement insurers, and critical enrollment timeline requirements.

What You Need to Know

- Anthem exits Colorado counties health plans 2026 effective January 1 across fourteen counties in three distinct geographic regions

- Affected enrollees face December 15, 2025 deadline for selecting replacement coverage to prevent gaps in healthcare access

- Three alternative insurers will provide marketplace options across all affected counties, though premium costs increase 8-12 percent and provider networks differ substantially

On This Page

Understanding the Anthem Colorado Market Withdrawal

Anthem exits Colorado counties health plans 2026 following formal regulatory notification submitted to state authorities during August 2025. The insurer documented sustained financial losses in affected service territories where medical claim payments exceeded collected premium revenue across multiple consecutive years. State marketplace data indicates Anthem controlled roughly one-fifth of individual enrollment in these specific counties throughout the 2025 coverage period.

This departure affects exclusively individual marketplace policies purchased through Colorado’s state exchange or directly from Anthem. Group employer coverage, Medicare Advantage programs, and Medicaid managed care contracts continue operating without interruption. State insurance regulators documented this represents Colorado’s third significant rural market insurer withdrawal since 2023, demonstrating broader industry challenges in lower-population areas where medical expenses outpace premium collections.

Maria Rodriguez, 42, Alamosa Purchased Anthem Silver tier coverage in 2024 paying $450 monthly after federal subsidies. Received transition notification in September requiring new plan selection before mid-December deadline. Preliminary estimates show replacement coverage costing $520 monthly with different physician networks, generating $840 additional annual expenses. Lesson: Carrier market exits generate significant cost increases and provider access disruptions even when continuous coverage continues.

State authorities collaborated with remaining insurers guaranteeing marketplace availability across all fourteen affected counties. The Colorado Division of Insurance confirmed no county will experience complete absence of individual marketplace options, though several territories transition from three-carrier competition to two-carrier markets for 2026.

The withdrawal eliminates approximately 8 percent of statewide individual marketplace enrollment according to exchange data. Anthem cited inability to negotiate sustainable reimbursement rates with healthcare providers in rural markets where hospital systems maintain significant pricing leverage. Federal regulations ensure affordable health insurance options remain available despite this carrier departure.

Fourteen Counties Where Anthem Exits Colorado Counties Health Plans 2026

Anthem exits Colorado counties health plans 2026 across Western Slope territories, San Luis Valley communities, and eastern plains regions. These fourteen counties represent distinct geographic markets where Anthem maintained dominant marketplace presence or offered lowest-cost Silver tier plan options. The departure creates particular challenges in areas where Anthem was primary or secondary carrier choice.

Geographic Distribution of Counties Where Anthem Exits Colorado Counties Health Plans 2026

| Geographic Region | Specific Counties Affected | Current Anthem Enrollment | Replacement Carriers |

|---|---|---|---|

| Western Slope | Delta, Montrose, Ouray | 3,200 individuals | Bright Health, Friday Health |

| San Luis Valley | Alamosa, Conejos, Costilla, Rio Grande | 4,100 individuals | Rocky Mountain Health, Friday Health |

| Eastern Plains | Cheyenne, Kit Carson, Lincoln, Phillips, Washington, Yuma | 6,700 individuals | Bright Health, Rocky Mountain Health |

State regulatory analysis indicates rural counties experience intensified challenges as marketplace competition decreases. Territories previously served by three distinct carriers now transition to two-carrier marketplaces, potentially reducing price competition pressures. Federal regulations mandate remaining carriers accept all applicants regardless of medical history, ensuring coverage availability even in reduced-competition markets.

James Mitchell, 56, Delta Maintained Anthem coverage for seven years with established specialist relationships for diabetes management. Discovered his endocrinologist and preferred hospital system participate in neither replacement carrier network. Faces choosing between changing longstanding providers or paying significantly higher out-of-network expenses estimated at $3,200 annually. Lesson: Provider network disruptions represent most significant challenge for individuals requiring ongoing specialist medical care.

Geographic distance to medical facilities creates additional complications. Several affected counties depend on hospitals and specialty practices maintaining exclusive network contracts with specific carriers, potentially requiring enrollees travel farther distances for in-network medical services. Understanding health insurance for self-employed individuals becomes critical during these transitions.

Federal Healthcare Marketplace Consumer Protections

The Affordable Care Act establishes specific safeguards for consumers experiencing involuntary coverage termination. Federal guidance released in August 2025 confirms individuals losing Anthem coverage qualify for Special Enrollment Period extending beyond standard December 15 deadline. Affected people can select replacement coverage through January 15, 2026, with benefits starting February 1, though earlier enrollment prevents coverage interruptions.

Federal subsidies continue automatically when transitioning between marketplace policies. Premium Tax Credits adjust based on newly selected plan costs, and Cost-Sharing Reductions transfer immediately for eligible households earning between 100-250 percent of Federal Poverty Level thresholds. Federal data indicates approximately 78 percent of affected Colorado enrollees receive financial assistance, protecting most households from complete premium increase impact.

Medical Loss Ratio regulations require insurers spend minimum 80 percent of premium revenue on actual medical care rather than administrative expenses. When carriers exit markets after failing claims obligations, affected enrollees face zero penalties or waiting periods when selecting replacement coverage. Colorado’s marketplace confirms all alternative carriers meet MLR requirements and maintain regulatory good standing.

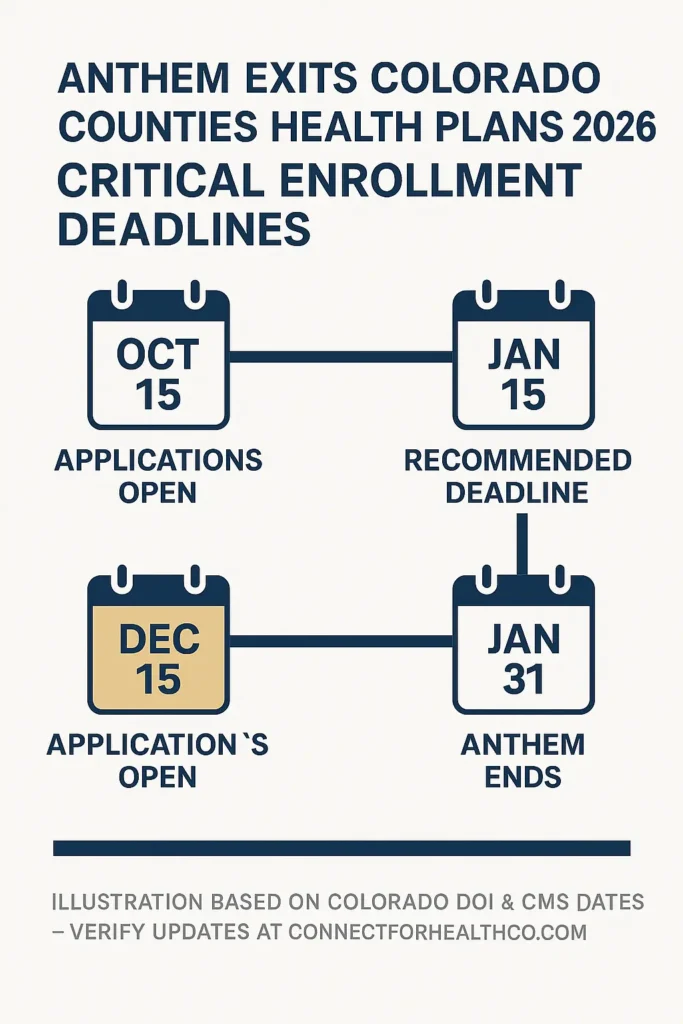

CRITICAL ENROLLMENT DEADLINES FOR ANTHEM EXITS COLORADO COUNTIES HEALTH PLANS 2026

- October 15, 2025: Colorado marketplace begins accepting 2026 plan applications

- December 15, 2025: Recommended deadline for January 1, 2026 coverage start

- January 15, 2026: Extended final deadline for affected Anthem enrollees (February 1 coverage start)

- January 31, 2026: Anthem individual marketplace policies terminate completely

Pre-existing condition protections remain absolute under federal law. No carrier can deny coverage, increase premiums, or exclude specific medical conditions based on health status. This federal guarantee ensures seamless transitions even for individuals with significant ongoing medical needs or recent diagnoses requiring continued treatment.

Colorado State Requirements and Regulatory Impact

Colorado’s individual marketplace serves roughly 177,000 enrollees statewide based on 2025 exchange data. Anthem exits Colorado counties health plans 2026 affecting approximately 8 percent of this population, concentrated in regions where replacement carrier options feature different plan designs and physician network structures. State regulations mandate all marketplace carriers offer standardized Silver plans with identical cost-sharing structures, helping consumers compare options despite network differences.

Premium rates for 2026 demonstrate significant geographic variation across affected counties. State insurance authority preliminary rate analysis indicates average statewide premium increases of 6.2 percent, but affected counties face additional 8-12 percent increases as marketplace competition decreases. Households earning below 400 percent of Federal Poverty Level see premium increases offset by enhanced subsidy calculations, while those above subsidy thresholds absorb complete rate changes.

State-Mandated Consumer Protections When Anthem Exits Colorado Counties Health Plans 2026

| Protection Category | Colorado State Requirement | Federal Minimum Standard | Consumer Benefit |

|---|---|---|---|

| Advance Notice Period | 90 days before termination | 60 days required | Additional comparison time |

| Prescription Continuity | 90-day transition fills | 30 days required | Prevents medication gaps |

| Prior Authorization | New carrier honors approvals 90 days | Not federally required | Continues approved treatments |

| Network Adequacy | State verifies provider sufficiency | Basic federal standards | Ensures specialist access |

Colorado law prohibits carriers from terminating coverage mid-year except for premium non-payment. Anthem must continue all 2025 policies through December 31, 2025, regardless of claims experience or financial losses. This protection prevents carriers abandoning enrollees who develop expensive medical conditions during coverage years.

The state operates reinsurance program helping stabilize premiums by reimbursing carriers for extremely high-cost medical claims. This Colorado-specific program, funded through state appropriations and federal pass-through savings, reduces average premiums by estimated 13.8 percent compared to markets without reinsurance according to state actuarial estimates. Consumers can review what is a good deductible for health insurance when comparing replacement options.

Replacement Insurance Carrier Analysis by Geographic Region

Two primary insurers will serve most territories where Anthem exits Colorado counties health plans 2026. Bright Health Plans and Friday Health Plans expand coverage territories ensuring marketplace access, while Rocky Mountain Health Plans maintains existing rural Colorado presence. Each carrier presents different plan structures, provider networks, and premium pricing significantly impacting consumer out-of-pocket expenses.

Bright Health Plans enters seven previously Anthem-served counties offering Bronze, Silver, and Gold tier products. The carrier’s network emphasizes telehealth services and retail clinic partnerships, potentially requiring adjustments for enrollees accustomed to traditional physician relationships. Premium rates for comparable Silver plans run 7-11 percent higher than 2025 Anthem rates in most affected counties according to preliminary regulatory filings.

Rocky Mountain Health Plans maintains largest provider network across Western Slope and San Luis Valley territories. As Colorado-based nonprofit cooperative, RMHP developed relationships with rural hospitals and specialist practices over three decades. The carrier’s 2026 rates show more modest increases of 4-6 percent in affected counties, though plan options emphasize narrow-network designs limiting provider choice in exchange for reduced premiums.

Replacement Carrier Comparison Where Anthem Exits Colorado Counties Health Plans 2026

| Insurance Carrier | Counties Served | Network Size | Silver Plan Monthly Premium | Telehealth Access | Rural Hospital Coverage |

|---|---|---|---|---|---|

| Bright Health Plans | 11 of 14 counties | Medium (regional) | $485-$620 | Extensive virtual care | Limited rural facilities |

| Friday Health Plans | 9 of 14 counties | Small (narrow) | $440-$575 | Basic telehealth | Varies by county |

| Rocky Mountain Health Plans | 10 of 14 counties | Large (statewide) | $470-$610 | Standard access | Strong rural presence |

Friday Health Plans offers lowest-cost Bronze options in most territories where Anthem exits Colorado counties health plans 2026, appealing to younger enrollees or those seeking catastrophic coverage with maximum subsidy benefits. However, the carrier’s narrow networks exclude many specialist practices, creating potential access challenges for individuals with complex medical needs requiring specialized care.

Colorado’s marketplace provides online comparison tools displaying side-by-side plan details including prescription drug formulary coverage, provider network directories, and total cost estimates based on expected healthcare utilization patterns. The platform’s enhanced decision support features help affected enrollees identify plans matching specific medical requirements and budget constraints during this transition period.

Premium Cost Changes and Subsidy Adjustments

Premium increases represent only one component of total healthcare expenses when Anthem exits Colorado counties health plans 2026. Deductibles, copayments, and out-of-pocket maximums vary significantly between carriers even within identical metal tier classifications. State insurance authority analysis shows benchmark Silver plan premiums increase average 8.7 percent in affected counties, while total annual costs including cost-sharing could rise 12-15 percent for households previously selecting Anthem’s lowest-cost options.

Federal subsidy calculations base on second-lowest-cost Silver plan in each county marketplace. When benchmark plan prices increase, subsidies automatically increase proportionally for eligible households. This mechanism partially shields subsidy-eligible enrollees from premium spikes, though plan design changes affect out-of-pocket cost obligations. Foundation research indicates approximately 62 percent of affected Colorado enrollees qualify for enhanced subsidies capping premiums at 2-8.5 percent of household income.

Premium Impact Analysis by Income Level (40-Year-Old Alamosa County Resident)

| Household Income Level | 2025 Anthem Premium | 2026 Replacement Premium | After-Subsidy Cost Change | Annual Financial Impact |

|---|---|---|---|---|

| 150% FPL ($22,590) | $95 monthly | $115 monthly | $0 change | Protected by enhanced credits |

| 250% FPL ($37,650) | $285 monthly | $340 monthly | +$25 monthly | +$300 annually |

| 350% FPL ($52,710) | $450 monthly | $520 monthly | +$70 monthly | +$840 annually |

| 450% FPL ($67,770) | $450 monthly | $520 monthly | +$70 monthly | +$840 annually |

Households earning above 400 percent of Federal Poverty Level face complete premium increases without subsidy protection. State health institute estimates approximately 3,100 affected Anthem enrollees fall into this category, potentially facing difficult decisions about maintaining comprehensive coverage versus switching to lower-cost plans with reduced benefits. Understanding average health insurance cost per month USA trends provides helpful context.

Sarah Chen, 33, Kit Carson Self-employed graphic designer earning $54,000 annually, positioning her slightly above enhanced subsidy eligibility. Her 2025 Anthem Silver plan cost $465 monthly. Comparable 2026 coverage from available alternatives ranges $535-$580 monthly, representing $840-$1,380 annual increase. Considering Bronze plans reducing premiums but concerned about $8,700 deductible amount. Lesson: Individuals earning slightly above subsidy thresholds experience largest financial impact when carriers exit markets.

Cost-sharing variations become critical factors. Anthem’s 2025 Silver plans featured $3,500 individual deductibles in many counties. Alternative carriers offer Silver plans with deductibles ranging $2,800 to $6,500, dramatically affecting total costs for enrollees regularly using healthcare services throughout the year.

Prescription drug formularies differ substantially between carriers. Medications covered as preferred generics under Anthem may shift to non-preferred brand tiers with alternative carriers, increasing copayments from $15 to $75 or more per prescription fill. Colorado’s marketplace formulary lookup tool allows affected enrollees verify specific medication coverage before enrollment, preventing unexpected cost increases after plan selection.

Additional Coverage Transition Considerations

Provider network adequacy extends beyond simply counting participating physicians when Anthem exits Colorado counties health plans 2026. Specialist access, hospital affiliations, and geographic proximity create practical limitations for rural enrollees. State insurance authority network adequacy standards require carriers maintain maximum travel distances of 60 miles for specialty care in rural counties, but this standard permits significant variation in convenience and access quality.

Mental health and substance abuse treatment networks demonstrate particular variation between carriers. Federal parity laws require equal coverage for behavioral health services, but networks may include different facilities and practitioners. Affected enrollees currently receiving ongoing mental health treatment should verify their specific providers participate with alternative carriers before selecting replacement coverage to ensure treatment continuity.

Telehealth capabilities expanded dramatically during recent years and now represent standard benefits across marketplace plans. However, carriers differ in virtual care platforms, specialist availability through telemedicine, and integration with local providers. Some alternative carriers emphasize virtual-first care models reducing need for in-person specialist visits, potentially benefiting rural enrollees facing long travel distances to specialty care facilities.

Out-of-network coverage provisions vary significantly between replacement carriers. Some plans offer zero out-of-network benefits except emergency care situations, while others provide coverage at reduced reimbursement rates of 50-60 percent. Enrollees with established specialist relationships outside available networks must evaluate whether maintaining continuity justifies higher out-of-pocket costs or whether transitioning to in-network providers represents more practical approach.

Colorado’s marketplace provides enrollment assistance through certified brokers and navigators at no cost to consumers. These professionals help affected enrollees compare plans based on specific medical needs, prescription requirements, and provider preferences. Assistance availability includes in-person appointments, telephone consultations, and virtual meetings throughout the open enrollment period, with extended hours during final weeks before enrollment deadlines approach.

Frequently Asked Questions

Why is Anthem exiting Colorado counties health plans in 2026?

Anthem exits Colorado counties health plans 2026 due to unsustainable financial losses where medical claim costs exceeded premium revenue over multiple consecutive years. Rural territories typically generate higher per-capita claims due to older population demographics, limited preventive care access, and reliance on hospital-based treatment facilities. The carrier’s decision reflects broader insurance industry challenges maintaining profitable operations in lower-population markets with limited healthcare provider competition and higher negotiated reimbursement rates.

Will I lose healthcare coverage immediately when Anthem exits Colorado counties health plans 2026?

No immediate coverage loss occurs. Anthem must continue all existing policies through December 31, 2025 under state regulations. You receive guaranteed issue rights to select alternative coverage during open enrollment or extended special enrollment periods specifically created for affected individuals. Your current coverage remains fully active until you begin a replacement plan in 2026, preventing any gap in insurance protection or access to medical services during the transition.

How do I identify which alternative carriers serve my specific county?

Colorado’s health insurance marketplace maintains online plan finder tool at connectforhealthco.com displaying all available carriers by county and zip code locations. Enter your residential address details to view every plan option available in your specific area for 2026 coverage year. The Colorado Division of Insurance also publishes county-by-county carrier participation lists updated monthly on their official website at doi.colorado.gov documenting all marketplace participants.

Can insurance carriers charge higher premiums because I have pre-existing medical conditions?

Absolutely not under federal law. Health status underwriting remains completely prohibited in individual marketplaces nationwide. All carriers must offer identical premiums based exclusively on age, tobacco use status, family composition size, and geographic location. Pre-existing conditions cannot affect your premium rates, coverage terms, benefit exclusions, or application acceptance. This protection applies universally across all marketplace plans regardless of your complete medical history or ongoing treatment requirements.

What happens to my current prescription medications during transition to replacement carrier?

Colorado state law requires new carriers provide 90-day transition fills of current medications at in-network cost-sharing levels even when the drug isn’t included on their standard formulary list. This gives you sufficient time working with your physician to either continue current medications through formulary exceptions or identify therapeutically equivalent formulary alternatives. Contact your new carrier’s pharmacy benefits manager during the first week of January 2026 to initiate transition prescription fills for all current medications.

Do I qualify for federal subsidies with replacement plan if I received them under Anthem?

Yes, absolutely. Premium Tax Credits and Cost-Sharing Reductions transfer automatically when you select any new marketplace plan. Your subsidy eligibility depends entirely on household income relative to Federal Poverty Level thresholds, not which specific carrier you choose. Most affected enrollees will see subsidies adjust upward as benchmark plan costs increase, partially offsetting premium changes and protecting eligible households from complete financial impact of rate increases.

Will my current doctors and hospitals accept my replacement insurance plan?

Provider network participation varies substantially by carrier. Check each alternative carrier’s online provider directory before enrolling, or contact your current physicians’ offices directly asking which 2026 marketplace plans they accept in their networks. Many providers participate with multiple carriers maintaining contracts with several insurers, but some maintain exclusive relationships with single carriers. Verify network participation status for all regular providers including primary care physicians, specialists, preferred hospital facilities, and retail pharmacy locations.

What happens if I miss the December 15 enrollment deadline?

Affected Anthem enrollees qualify for Special Enrollment Period extending through January 15, 2026 under federal regulations. Coverage selected by December 15 starts January 1 with no gap, while enrollment between December 16 and January 15 creates coverage effective February 1 generating one-month gap. Missing both deadlines leaves you uninsured until next annual open enrollment period unless you qualify for another special enrollment circumstance like household income changes, marriage, birth of child, or loss of other coverage.

What You Should Do Next

The reality that Anthem exits Colorado counties health plans 2026 creates immediate action requirements for affected enrollees. Begin comparing alternative carriers immediately rather than waiting until December deadline approaches. Review your 2025 healthcare utilization including prescription medication fills, specialist physician visits, and planned medical procedures to identify plans best matching your expected 2026 healthcare needs and budget constraints.

Verify your current healthcare providers participate with available alternative carrier networks. Call each physician’s office, preferred hospital facility, and retail pharmacy confirming their 2026 marketplace network participation with specific carriers. If critical providers don’t participate with any available carrier, discuss options with your physician about identifying acceptable in-network alternatives or understanding complete out-of-network cost implications for continued care.

Gather documentation needed for enrollment including Social Security numbers for all household members, current income verification documents, and existing insurance policy information. Colorado’s marketplace application requires proof of household income through recent tax returns, employer pay stubs, or government benefits statements. Having these documents prepared streamlines the enrollment process and prevents delays securing 2026 coverage protection.

Key Takeaways:

- Anthem exits Colorado counties health plans 2026 across fourteen counties in three geographic regions, requiring affected enrollees select replacement carriers by December 15, 2025 maintaining continuous coverage without interruption gaps

- Alternative carriers including Bright Health Plans, Friday Health Plans, and Rocky Mountain Health Plans will serve all affected counties, though premium increases of 8-12 percent and substantially different provider networks create significant financial and healthcare access challenges for transitioning enrollees

- Federal subsidies automatically adjust offsetting benchmark plan price increases for eligible households, protecting approximately 78 percent of affected enrollees from complete financial impact of premium changes through enhanced Premium Tax Credit calculations

- Provider network verification represents most critical step in replacement plan selection, as specialist physicians and preferred hospital facilities may not participate with all available carriers, potentially requiring changes in long-established care relationships and disrupting ongoing treatment continuity

Disclaimers

This guide provides educational information only and does not constitute professional insurance, legal, or financial advice.

Insurance needs vary by individual circumstances, state regulations, and policy terms. Consult licensed professionals before making coverage decisions.

Information accurate as of October 2025. Insurance regulations and products change frequently. Verify current details with official sources and licensed agents.