The average health insurance cost per month USA creates challenging financial decisions for 73% of American households navigating rising healthcare expenses and complex coverage options. Workers face difficult choices between employer benefits offering lower employee contributions and marketplace alternatives providing greater flexibility but higher out-of-pocket costs. Understanding these cost variations becomes essential for securing adequate healthcare protection while maintaining long-term financial stability and avoiding coverage gaps during medical emergencies.

Healthcare expense confusion affects millions of consumers struggling with overwhelming insurance terminology, income-based subsidy calculations, and competing coverage alternatives across different state marketplaces. Families must balance monthly premium affordability against deductible amounts, network restrictions, and out-of-pocket maximums that can reach thousands annually. These financial pressures create urgent risks of delayed medical care and inadequate protection during serious health conditions requiring expensive treatments.

This comprehensive analysis delivers actionable cost-reduction strategies based on federal CMS data and Treasury Department guidelines to help consumers optimize healthcare spending decisions. Discover proven methods for maximizing employer contributions, qualifying for marketplace subsidies, and selecting coverage that balances affordability with essential medical protection. Learn specific techniques for reducing healthcare expenses while maintaining access to quality providers and comprehensive benefits.

Our complete guide covers employer negotiations, subsidy calculations, age-based pricing strategies, and state variations, providing everything needed to secure affordable healthcare coverage that meets individual and family medical needs.

On This Page

Essential Overview

The average health insurance cost per month USA varies dramatically from $111 for employer-sponsored plans to $621 for marketplace coverage, with factors like age, location, and plan tier determining final premiums.

What Is the True Average Monthly Cost of Health Insurance in America

Healthcare premiums in the United States vary significantly based on coverage source and individual circumstances, with employer-sponsored plans averaging $111 monthly for employees while marketplace policies cost $456 per month for individual coverage. These figures represent employee contributions rather than total plan costs, as employers typically cover 70-80% of premium expenses for worker benefits.

Monthly Premium Breakdown by Coverage Type:

| Coverage Source | Employee Cost | Total Premium | Employer Contribution |

|---|---|---|---|

| Large Employer | $117/month | $703/month | $586/month |

| Small Employer | $143/month | $765/month | $622/month |

| Marketplace Silver | $621/month | $621/month | $0/month |

| COBRA | $589/month | $589/month | $0/month |

IMPORTANT NOTE Total healthcare costs include deductibles, copayments, and coinsurance beyond monthly premiums, often adding $2,000-$8,000 annually.

Health insurance rates range from $361 per month for a Catastrophic plan to $913 per month for a Platinum plan, demonstrating how plan tier selection dramatically impacts monthly expenses. Bronze plans provide the most affordable option at approximately $488 monthly, offering lower premiums but higher deductibles when medical care becomes necessary.

Geographic location creates substantial premium variations, with Virginia residents paying average premiums of $390 monthly while West Virginia costs reach $864 monthly for identical coverage levels. These regional differences reflect local healthcare costs, provider competition, and state regulatory environments affecting insurance company pricing strategies.

Age-based pricing significantly influences monthly costs, as 18-year-olds pay average premiums of $396 monthly compared to $781 for 50-year-olds and $1,187 for 60-year-olds under federal age rating guidelines. The Affordable Care Act limits age-based pricing to 3:1 ratios, preventing excessive discrimination against older consumers while acknowledging increased healthcare utilization patterns.

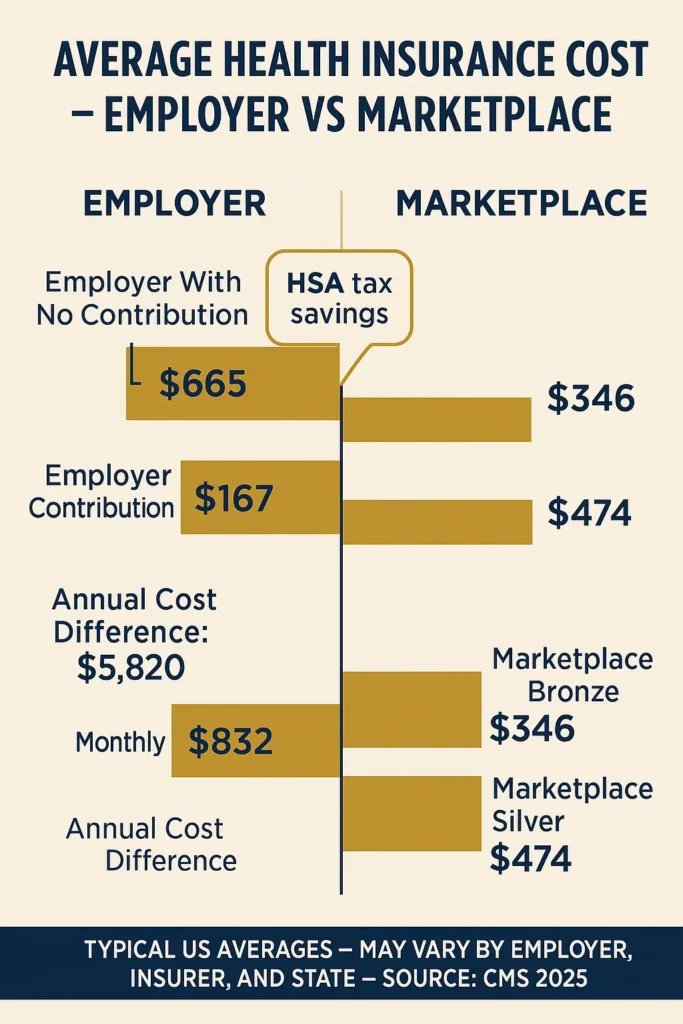

How Do Employer Health Insurance Costs Compare to Individual Marketplace Plans

Employer-sponsored health insurance provides substantial cost advantages through group purchasing power and tax-advantaged premium sharing arrangements. Twelve percent of workers participate in medical plans without employee contribution requirements, where average employer premiums reach $662 monthly for single coverage, representing significant value compared to individual marketplace alternatives.

Cost Comparison Analysis:

| Plan Type | Monthly Cost | Annual Cost | Coverage Level |

|---|---|---|---|

| Employer (No Contribution) | $0 | $0 | Full benefits |

| Employer (With Contribution) | $130 | $1,560 | Full benefits |

| Marketplace Bronze | $488 | $5,856 | Basic coverage |

| Marketplace Silver | $621 | $7,452 | Standard coverage |

PRO TIP Employer health savings account contributions can reduce taxable income while building medical expense reserves.

Group insurance benefits extend beyond premium savings, offering guaranteed acceptance regardless of pre-existing conditions and comprehensive coverage networks. Large employers negotiate favorable provider contracts, resulting in lower deductibles and broader specialist access compared to individual marketplace plans with restricted networks and higher cost-sharing requirements.

Tax advantages significantly enhance employer plan value, as employee contributions average $1,401 annually for single coverage and $6,575 for family coverage using pre-tax dollars that reduce overall tax liability. This tax treatment effectively provides 22-32% additional savings depending on individual tax brackets and state income tax rates.

Marketplace plans require after-tax premium payments unless qualifying for premium tax credits based on income levels. Subsidy eligibility phases out at 400% of federal poverty levels, creating potential affordability gaps for middle-income households earning too much for assistance but lacking employer coverage options.

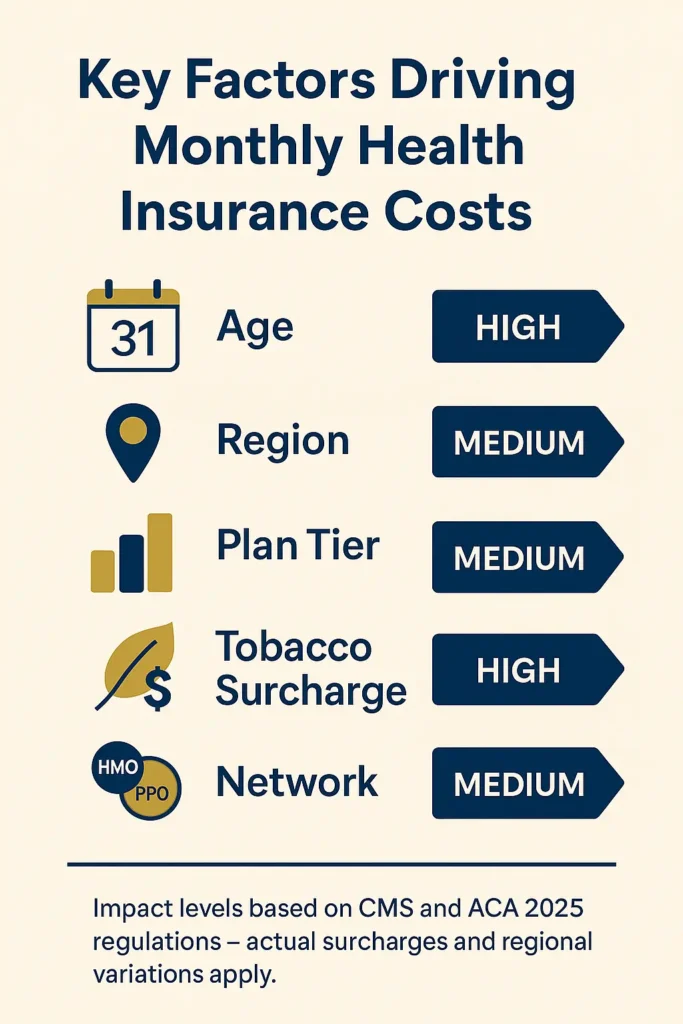

What Factors Drive Monthly Health Insurance Premium Costs

Premium calculation involves multiple risk assessment factors that insurance companies use to determine individual and family healthcare costs. Age represents the primary pricing variable, with federal regulations allowing up to 3:1 premium ratios between oldest and youngest enrollees to reflect increased medical utilization patterns among older populations.

Premium Calculation Factors:

| Factor | Impact Level | Cost Variation |

|---|---|---|

| Age (21 vs 64) | High | 300% increase |

| Geographic Region | High | 200% variation |

| Plan Tier (Bronze vs Platinum) | High | 150% difference |

| Tobacco Use | Medium | 50% surcharge |

| Family Size | Medium | Linear scaling |

WARNING Tobacco users face premium surcharges up to 50% in most states, adding $200-$400 monthly to individual coverage costs.

Geographic location creates substantial premium variations due to local healthcare costs, provider competition, and state regulatory environments. Healthcare costs in northeastern regions exceed southern states by over $100 monthly, reflecting regional differences in medical provider fees, hospital charges, and overall cost of living factors affecting insurance company pricing strategies.

Plan tier selection directly impacts monthly premiums and cost-sharing arrangements, with Bronze plans offering lower premiums but higher deductibles reaching $7,000 annually. Silver plans provide moderate premium costs with enhanced cost-sharing reduction eligibility for households earning 100-250% of federal poverty levels, creating optimal value for subsidy-eligible consumers.

Network type influences both premium costs and provider access, as Health Maintenance Organizations typically offer 15-25% lower premiums compared to Preferred Provider Organizations. HMO plans require primary care physician referrals for specialist visits but provide comprehensive coverage within designated provider networks, while PPO plans allow direct specialist access at higher monthly costs.

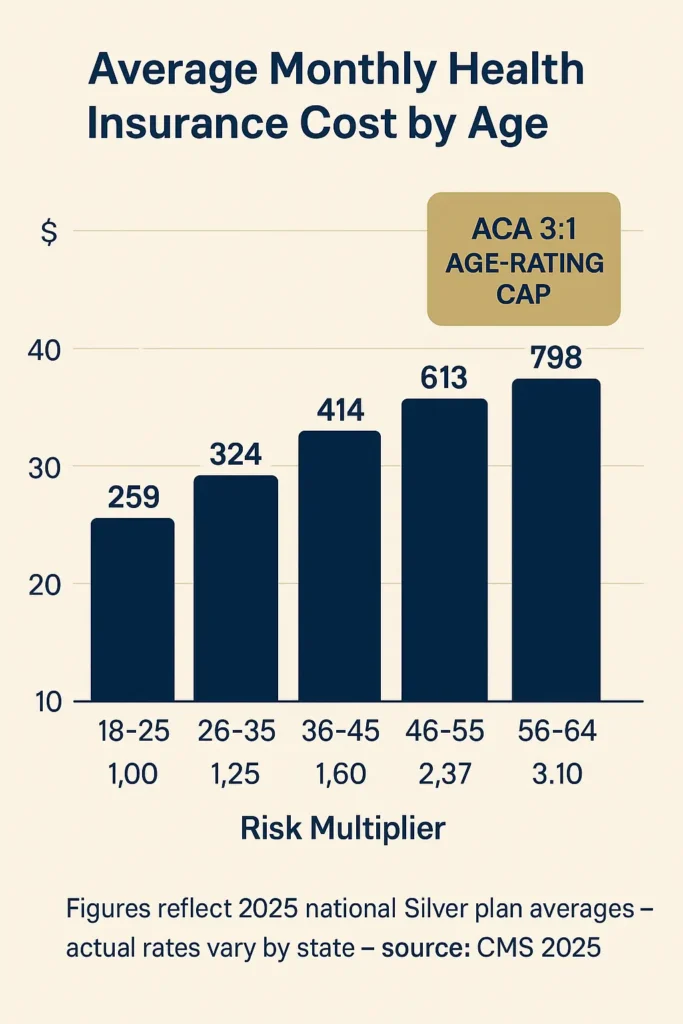

How Do Health Insurance Costs Vary by Age Groups

Age-based premium pricing follows federal actuarial guidelines that reflect statistical healthcare utilization patterns across different life stages. Young adults aged 18-25 pay approximately $396 monthly for Silver coverage, while adults aged 50-64 face premiums reaching $781-$1,187 monthly depending on specific age within the older demographic categories.

Age-Based Premium Schedule:

| Age Range | Average Monthly Premium | Annual Healthcare Spending | Risk Multiplier |

|---|---|---|---|

| 18-25 | $396 | $2,800 | 1.0x |

| 26-35 | $445 | $3,200 | 1.12x |

| 36-45 | $534 | $4,100 | 1.35x |

| 46-55 | $678 | $5,900 | 1.71x |

| 56-64 | $987 | $8,400 | 2.49x |

Young adult coverage benefits from lower risk profiles and reduced medical service utilization, though this demographic often faces affordability challenges due to entry-level employment income levels. Catastrophic health plans remain available exclusively for individuals under age 30, providing emergency coverage with minimal monthly premiums but extremely high deductibles exceeding $8,000 annually.

PRO TIP Adults under 30 can purchase catastrophic plans with premiums 40-50% lower than Bronze coverage while maintaining essential health benefit protections.

Middle-aged adults experience the steepest premium increases due to rising healthcare needs and chronic condition development. Insurance companies adjust pricing to reflect increased diagnostic testing, specialist consultations, and prescription medication requirements typical among 45-55 year old populations facing age-related health changes.

Pre-Medicare adults aged 55-64 encounter the highest premium costs as they approach Medicare eligibility while experiencing peak healthcare utilization. Many individuals in this demographic consider early retirement but face difficult decisions regarding COBRA continuation coverage or marketplace plan purchases with substantially higher monthly costs than employer-sponsored alternatives.

What Are the Costs of Different Health Insurance Plan Types

Plan tier structure creates distinct cost-sharing arrangements that balance monthly premiums against out-of-pocket expenses when medical care becomes necessary. Bronze plans average $488 monthly with high deductibles, while Platinum coverage reaches $913 monthly but provides comprehensive cost protection for individuals requiring frequent medical services or ongoing treatments.

Plan Tier Cost Comparison:

| Plan Tier | Monthly Premium | Annual Deductible | Out-of-Pocket Maximum | Actuarial Value |

|---|---|---|---|---|

| Catastrophic | $361 | $8,700 | $8,700 | 60% |

| Bronze | $488 | $7,050 | $9,100 | 60% |

| Silver | $621 | $4,500 | $8,200 | 70% |

| Gold | $742 | $2,500 | $7,500 | 80% |

| Platinum | $913 | $1,000 | $6,500 | 90% |

Silver plans provide optimal value for most consumers through enhanced cost-sharing reduction benefits available to households earning 100-250% of federal poverty levels. These reductions lower deductibles to $500-$2,500 and decrease coinsurance percentages, creating effective actuarial values reaching 87-94% for eligible families.

IMPORTANT NOTE Cost-sharing reductions apply exclusively to Silver plans, making them the most affordable option for subsidy-eligible households despite higher base premiums.

High-deductible health plans paired with Health Savings Accounts offer tax-advantaged medical expense management for healthy individuals comfortable with higher initial costs. HSA contributions reduce taxable income while building long-term healthcare reserves, with triple tax benefits including deductible contributions, tax-free growth, and qualified withdrawal exemptions.

Network restrictions significantly impact plan costs and provider access, as narrow network plans reduce premiums by 10-20% through limited provider agreements. These plans restrict coverage to essential community providers but may exclude prestigious medical centers or specialized treatment facilities, requiring careful evaluation of individual healthcare needs and preferences.

How Do Subsidies and Tax Credits Reduce Monthly Health Insurance Costs

Premium tax credits provide sliding-scale financial assistance for marketplace health insurance based on household income and family size calculations. The estimated national average cost for a Silver plan after premium tax credit application drops to $66 monthly, demonstrating the substantial impact of federal subsidies on healthcare affordability for eligible households earning 100-400% of federal poverty levels.

Premium Tax Credit Income Thresholds (2025):

| Household Size | 100% FPL | 200% FPL | 300% FPL | 400% FPL |

|---|---|---|---|---|

| Individual | $15,060 | $30,120 | $45,180 | $60,240 |

| Family of 2 | $20,440 | $40,880 | $61,320 | $81,760 |

| Family of 3 | $25,820 | $51,640 | $77,460 | $103,280 |

| Family of 4 | $31,200 | $62,400 | $93,600 | $124,800 |

Cost-sharing reductions exclusively benefit Silver plan enrollees earning 100-250% of federal poverty levels by reducing deductibles, copayments, and coinsurance percentages. These reductions create enhanced Silver plan variants with actuarial values reaching 87% for households earning 150-200% FPL and 94% for those earning 100-150% FPL, providing comprehensive coverage at affordable premium costs.

PRO TIP Advanced premium tax credit payments reduce monthly costs immediately rather than requiring annual tax return reconciliation.

State Medicaid expansion affects subsidy eligibility for individuals earning 100-138% of federal poverty levels in expansion states, while non-expansion states create coverage gaps for low-income adults. Medicaid provides comprehensive healthcare coverage with minimal cost-sharing requirements, making it more affordable than subsidized marketplace plans for eligible populations.

Employer coverage affordability tests determine marketplace subsidy eligibility for workers offered employer-sponsored insurance. Employees become eligible for premium tax credits when employer coverage costs exceed 9.12% of household income for individual coverage, even if family coverage remains unaffordable through the workplace plan.

What Regional Differences Affect Health Insurance Pricing Across States

State-level healthcare markets create dramatic premium variations due to regulatory environments, provider competition, and demographic factors affecting insurance company pricing strategies. Premium costs vary by over 200% between states, with southwestern regions showing 50% cost differences within single states based on local market conditions and regulatory oversight approaches.

State Premium Variation Examples:

| State Category | Average Monthly Premium | Cost Drivers | Market Competition |

|---|---|---|---|

| Low-Cost States | $390-$450 | Rural populations, lower wages | Limited carriers |

| Moderate States | $500-$650 | Balanced markets | 3-5 carriers |

| High-Cost States | $750-$865 | Urban density, high wages | Variable |

| Extreme Markets | $900+ | Limited competition | 1-2 carriers |

Rural healthcare markets often feature limited insurance carrier participation, reducing competition and increasing premium costs despite lower overall healthcare expenses. Single-carrier markets eliminate competitive pressure while creating access challenges for specialized medical services requiring travel to urban medical centers.

IMPORTANT NOTE State insurance department regulations significantly impact premium approval processes and rate increase limitations.

Urban healthcare markets typically offer greater carrier competition but face higher operational costs from expensive real estate, elevated provider fees, and increased administrative overhead. Metropolitan areas provide broader provider networks and specialized treatment access but translate these benefits into higher monthly premium costs for comprehensive coverage options.

Interstate variations in medical malpractice costs, prescription drug pricing, and hospital facility fees directly impact insurance company pricing models. States with tort reform limitations and prescription drug transparency requirements often demonstrate lower premium costs compared to states with extensive litigation environments and limited pharmaceutical pricing oversight.

Understanding premium variations and cost-sharing arrangements enables informed healthcare financial planning across different coverage options. Federal regulatory oversight through CMS rate review processes ensures transparency in premium increases, while Medicare Parts A & B premium guidelines provide benchmarks for age-related coverage transitions.

Comprehensive marketplace data analysis through CMS public use files enables consumer comparison shopping and actuarial evaluation of plan performance across different geographic markets and demographic populations.

Federal regulatory frameworks including marketplace integrity and affordability standards and qualified health plan choice analytics provide essential consumer protection measures and market transparency requirements for informed healthcare coverage decisions.

What Strategies Can Reduce Monthly Health Insurance Expenses

Healthcare cost optimization requires strategic evaluation of coverage options, subsidy eligibility, and alternative insurance arrangements. Employer plan optimization through flexible spending accounts and health savings accounts provides immediate tax advantages while building long-term medical expense reserves for unexpected healthcare costs.

Cost Reduction Strategy Matrix:

| Strategy | Monthly Savings | Implementation | Risk Level |

|---|---|---|---|

| High-Deductible + HSA | $150-$300 | Immediate | Low |

| Narrow Network Plans | $75-$150 | Plan selection | Medium |

| Telemedicine Utilization | $25-$75 | Usage change | Low |

| Preventive Care Focus | $50-$200 | Lifestyle | Low |

| Generic Medications | $30-$150 | Prescription choice | Low |

Health Savings Account maximization provides triple tax benefits through deductible contributions, tax-free investment growth, and qualified withdrawal exemptions for medical expenses. HSA funds roll over annually without expiration, creating long-term healthcare financial planning opportunities while reducing current taxable income by up to $4,150 for individuals or $8,300 for families.

WARNING High-deductible health plans require substantial cash reserves for unexpected medical expenses before insurance coverage begins.

Preventive care utilization maximizes insurance value through comprehensive annual examinations, recommended screenings, and vaccination programs covered at 100% without deductible requirements. Early detection strategies reduce long-term healthcare costs while maintaining optimal health outcomes through regular monitoring and intervention programs.

Prescription drug cost management involves generic medication preferences, prescription assistance programs, and pharmacy benefit optimization. Many insurance plans offer lower copayments for mail-order prescriptions and preferred pharmacy networks, while pharmaceutical manufacturer programs provide significant discounts for brand-name medications.

From understanding business insurance compliance requirements to exploring renters insurance coverage components, comprehensive insurance knowledge enables informed financial planning across all coverage areas.

Marketplace optimization strategies extend beyond health insurance to include coordinated coverage planning with home insurance coverage components and comprehensive workers compensation requirements by state for complete financial protection portfolios.

FAQ

How much should I budget monthly for health insurance?

Budget 8-12% of gross monthly income for health insurance premiums, with additional reserves for deductibles and out-of-pocket expenses. Employer-sponsored plans typically require $100-$200 monthly employee contributions, while individual marketplace plans range $400-$800 monthly before subsidies.

Do health insurance costs increase every year?

Yes, health insurance premiums typically increase 4-8% annually due to medical inflation, prescription drug costs, and administrative expenses. However, subsidy adjustments and plan shopping can offset increases for marketplace enrollees.

Can I change my health insurance plan to reduce costs?

Plan changes occur during annual open enrollment periods (November 1 – January 15) or qualifying life events such as job loss, marriage, or income changes. Compare total annual costs including premiums, deductibles, and expected medical expenses.

What happens if I can’t afford health insurance premiums?

Explore Medicaid eligibility, premium tax credits, or short-term health plans for temporary coverage. Healthcare sharing ministries and direct primary care arrangements provide alternative healthcare financing options for specific situations.

Are employer health insurance costs worth the coverage?

Employer plans typically provide 60-80% premium cost sharing and comprehensive benefits making them more affordable than individual marketplace alternatives. Evaluate total compensation packages including health benefits when considering employment decisions.

How do family health insurance costs compare to individual plans?

Family coverage typically costs 2.5-3 times individual premiums, with employer-sponsored family plans averaging $1,997 monthly total cost versus $703 for individual coverage. Marketplace family plans range $1,500-$2,500 monthly before subsidies.

Conclusion

The average health insurance cost per month USA reflects complex interactions between coverage sources, individual demographics, and geographic market conditions that significantly impact healthcare affordability decisions. Understanding these cost variations enables consumers to optimize healthcare spending through strategic plan selection, subsidy utilization, and cost-sharing arrangements that balance premium affordability with comprehensive medical protection.

Employer-sponsored coverage provides substantial financial advantages through group purchasing power and tax-advantaged premium sharing, while marketplace plans offer greater flexibility with potential subsidy benefits for income-eligible households. Regional premium variations exceeding 200% between states emphasize the importance of location-specific healthcare planning and carrier competition evaluation.

Cost reduction strategies including health savings accounts, preventive care utilization, and prescription drug optimization provide immediate savings opportunities while building long-term healthcare financial security. Successful healthcare cost management requires annual plan evaluation, subsidy optimization, and proactive healthcare engagement to maximize insurance value while minimizing out-of-pocket expenses.

Key Takeaways

Healthcare costs in America create significant financial planning challenges requiring strategic coverage evaluation and optimization. Employer plans offer superior affordability through shared premium costs, while marketplace subsidies provide essential assistance for eligible households. Geographic location dramatically impacts premium costs, making state-specific research essential for accurate budgeting. Age-based pricing creates predictable cost increases requiring long-term financial planning, while plan tier selection balances monthly affordability against potential medical expenses.

Disclaimer

Data freshness: Insurance rates and regulations change frequently. Data accuracy depends on timing of official releases from federal and state agencies.

Geographic variations: Insurance requirements vary significantly by state. Always consult your state’s insurance department for current regulations and marketplace options.

Professional advice: This information is for educational purposes only. Insurance decisions should be made in consultation with licensed insurance professionals and financial advisors.