Emily, a first-time mom in Denver, had just hit her third trimester when she called her insurance to ask a simple question: “Can I really get a breast pump through insurance?” Her OB had mentioned it casually, but no one had explained how. With rising prenatal costs and a $2,500 deductible looming, every dollar counted — and she couldn’t afford to guess.

Yes, under the Affordable Care Act, most health plans must cover a breast pump, but the how, when, and what type can vary wildly. According to the U.S. Department of Health and Human Services (2024), coverage depends on your plan, state, and even your provider’s DME network. And getting it wrong might mean paying $300+ out of pocket.

Here’s what you need to know if you’re trying to secure your breast pump through insurance without stress, surprise costs, or endless phone calls — especially if you’re already juggling appointments and prepping for baby.

On This Page

1. Who Qualifies for a Free Breast Pump Through Insurance?

Navigating insurance benefits during pregnancy can feel like trying to decode a foreign language — especially when you’re juggling prenatal visits, baby gear, and midnight backaches. Take Madison from Tampa: her OB mentioned she’d be eligible for a breast pump through insurance, but when she checked her portal, she was buried in vague policy terms and “subject to plan limitations” disclaimers. So who really qualifies?

Let’s break it down without the jargon — just facts, real steps, and what your insurance won’t tell you up front.

1.1 ACA Rules and What They Actually Mean

The Affordable Care Act (ACA) mandates that most health insurance plans must cover a breast pump through insurance at no cost — but the devil is in the details. The law doesn’t say what kind of pump, when you’ll get it, or how the process works. That’s left to insurers.

To qualify under the ACA:

- You must be pregnant or have recently given birth

- Your plan must be ACA-compliant (not a short-term or grandfathered plan)

- You need a prescription or documentation from your healthcare provider

Here’s the kicker: plans get to choose whether they offer a manual or electric breast pump, and whether it’s rental or purchase. According to the U.S. Department of Health and Human Services, most insurers require you to go through an approved medical supplier — not Amazon, not Target. For comprehensive information about health insurance requirements, see our detailed health insurance analysis.

Pro Tip: Even if your plan is ACA-compliant, request confirmation in writing that your provider is in-network and that the pump is covered in full. Screenshots save arguments.

🧠 Now let’s be real for a second. The ACA created a great baseline, but insurance companies aren’t in the business of making things easy. They use vague wording like “reasonable time after delivery” or “subject to medical necessity,” which leads many moms — like Madison — to assume they missed their window or won’t qualify. And that’s simply not true.

If you’re covered by an ACA plan and your OB signs off, you qualify. Full stop.

The question is whether you’ll get the pump you want, when you actually need it.

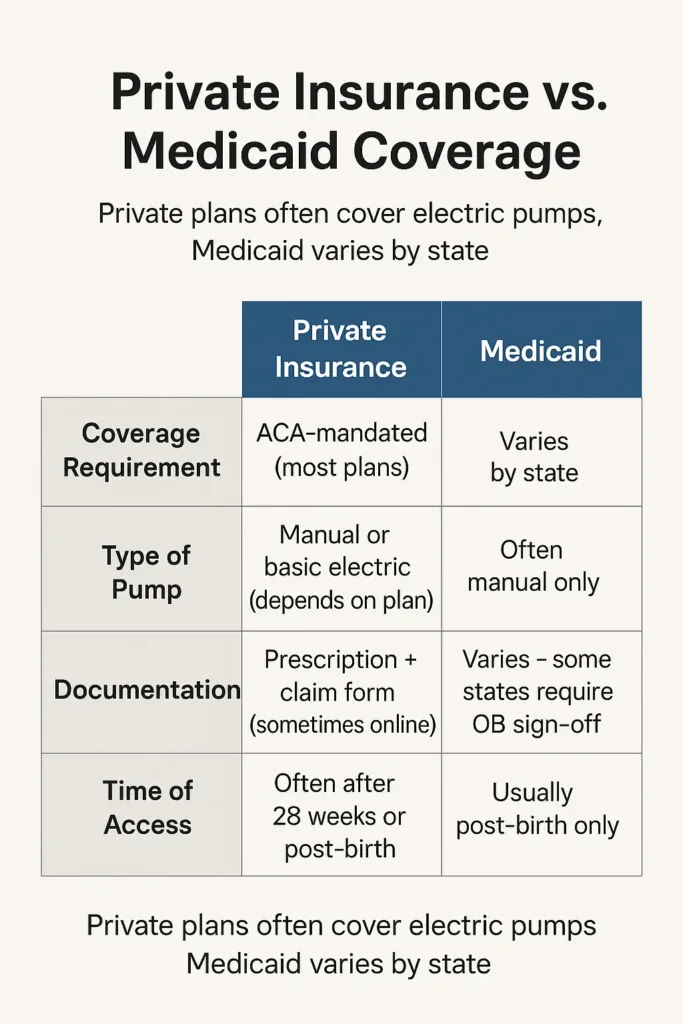

1.2 Private Insurance vs. Medicaid: What’s the Difference?

The experience of getting a breast pump through insurance varies wildly depending on your coverage. Let’s compare the two big buckets most new moms fall into.

| Private Insurance | Medicaid | |

|---|---|---|

| Coverage Requirement | ACA-mandated (most plans) | Varies by state |

| Type of Pump | Manual or basic electric (depends on plan) | Often manual only |

| Supplier | Must use in-network DME | State-approved vendors only |

| Documentation | Prescription + claim form (sometimes online) | Varies – some states require OB sign-off |

| Time of Access | Often after 28 weeks or post-birth | Usually post-birth only |

Under private insurance, you may have more flexibility in choosing your pump brand (e.g. Spectra, Medela, Elvie), but you’ll also face more red tape — in-network suppliers, shipping timelines, and sometimes partial coverage.

Under Medicaid, coverage is less standardized. For example:

- Texas only covers pumps after the baby is born

- New York covers electric pumps, but only for NICU babies

- California offers more generous options but requires OB documentation

Testimonial: “I had Medicaid in Georgia and didn’t know I needed to request my pump right after delivery. By the time I asked, they told me the window had passed.” — Alyssa, 26, Macon GA

Bottom line? Your insurance does impact what you get and when. If you’re on Medicaid, call your local office before 36 weeks. If you’re privately insured, check your member portal and call the DME provider directly. Don’t assume — ask.

Understanding your coverage type is crucial for accessing benefits. Our health insurance for self-employed guide provides additional context for those navigating different plan types.

2. How to Get a Breast Pump Through Insurance (Step-by-Step)

No one wants to be stuck on hold with their insurer at 34 weeks pregnant, trying to figure out whether they qualify for a breast pump — let alone how to get one delivered before labor kicks in. That’s exactly what happened to Jasmine, a teacher from Milwaukee, who spent three afternoons chasing vague answers and missing forms. She had the coverage, but not the roadmap.

So here it is — the real process, in plain English, without the stress.

2.1 What Documents You’ll Need to Get a Breast Pump Through Insurance

To qualify for a breast pump through insurance, most plans will ask you for three things:

- A prescription or written recommendation from your OB or midwife.

- Your insurance member ID number (sometimes on a claim form).

- A DME referral or selection form, depending on your insurer.

These documentation requirements are similar to other prescription drug coverage processes under most health plans.

💡 Contrary to what you might read online, most insurers don’t require the prescription to name a specific brand. Phrases like “breast pump for postpartum use” are typically enough. Still, double-check — some regional Medicaid plans may be more strict.

Now, here’s the hard truth: if any of these documents are missing or incomplete, the supplier can’t submit the claim. And your insurer won’t always tell you — they’ll quietly “pend” the file until you follow up.

Client-Agent Dialogue (Real Case)

— “I faxed my form two days ago. Is it enough?”

— “We received it, but the physician didn’t sign the DME authorization. You’ll need to resend it.”

— “Why wasn’t I notified?”

— “We don’t notify unless the claim is formally denied.”

Lesson? Screenshot everything. Email instead of fax when you can. Ask for confirmation numbers.

2.2 Timeline: When to Apply During Your Pregnancy for a Breast Pump Through Insurance

Timing can be a game-changer when requesting a breast pump through insurance.

Most plans allow requests starting at 28 to 30 weeks of pregnancy. Some, like Blue Cross Blue Shield, approve earlier but delay shipment until 36 weeks. Others (especially Medicaid in states like Florida or Mississippi) don’t allow any requests until after birth.

Here’s a simplified timeline:

| Week of Pregnancy | What You Can Do |

|---|---|

| Week 20 | Ask your OB for the Rx |

| Week 28 | Contact insurance or approved DME supplier |

| Week 30–34 | Submit paperwork + confirm plan requirements |

| Week 36+ | Track shipment and save delivery receipt |

| After Birth | Medicaid-only? Call to request eligibility |

Pro Tip: If you’re having twins or planning a NICU stay, you may qualify for earlier or upgraded coverage. Ask your OB to include medical necessity language.

And remember — if your due date shifts, you may need to update your info. DME vendors sometimes cancel pending shipments if there’s a discrepancy between the Rx and current EDD (expected due date).

2.3 What to Do If Your Breast Pump Through Insurance Claim Is Denied

Let’s say you do everything right — and still get denied. It happens more often than you’d think. Insurers might reject claims for reasons as frustrating as:

- Submitting the request “too early” (before their policy window)

- Using an out-of-network supplier

- Missing a minor field on the claim form

- No Rx on file, even when one was sent

Here’s what to do:

- Call the insurer and ask for the specific denial reason and the denial code.

- Request a written copy of the decision (this helps with appeals).

- Get your OB’s office involved — often, a fax or clarification from the provider clears things up fast.

- Ask about exceptions: if you’re breastfeeding due to NICU admission, adoption, or complications, you may qualify under medical necessity clauses.

🎯 If your plan refuses completely and you’re under ACA coverage, you can file a formal appeal. Each state has its own process via the Department of Insurance.

Stat 2024 – U.S. Breastfeeding Policy Review:

1 in 7 new mothers who tried to claim a breast pump through insurance had to make multiple requests or appeals before final approval. (Source: NAIC, 2024)

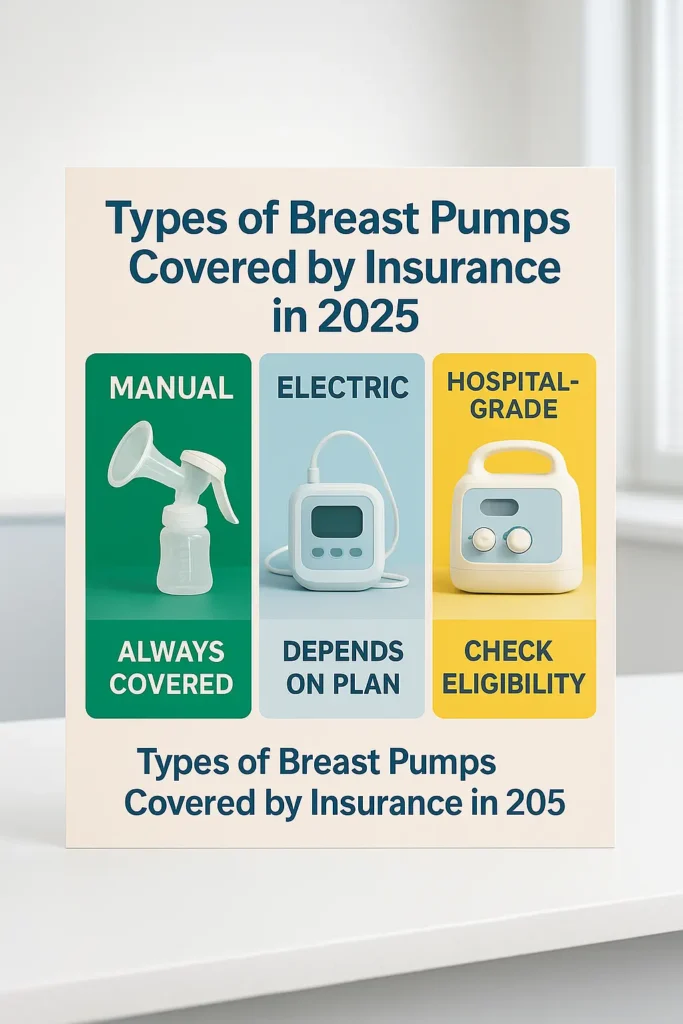

3. Types of Breast Pumps Covered by Insurance in 2025

When Marissa, a first-time mom in Boise, Idaho, opened her insurance dashboard at 32 weeks pregnant, she expected clear choices. Instead, she found unfamiliar terms like “single electric” and “manual,” mixed with models that looked nothing like the sleek wearable pump her coworker used in meetings. Confused and a little panicked, she called her OB — but they couldn’t tell her which one her plan would cover.

This is where many new moms get blindsided. The reality? Not all breast pumps through insurance are the same — and your options depend more on your plan’s paperwork than your pumping needs.

3.1 Manual vs. Electric: What Plans Typically Cover for Breast Pumps Through Insurance

Insurance providers in 2025 typically offer one of two base options: a manual pump or a standard electric model. But the difference in usability is significant — especially if you’re returning to work or plan to pump multiple times a day.

- Manual Pump: Hand-squeezed, portable, best for occasional use – Almost always covered

- Standard Electric: Plug-in or battery-powered, usually double pump – Covered on most plans

- Wearable/Hands-Free: Cordless, bra-insertable (e.g. Elvie, Willow) – Not typically covered

- Premium Electric: Multiple modes, quiet motors, comfort settings – Partial coverage with co-pay

- Hospital-Grade: Heavy-duty, hospital-issued, short-term rentals – Only if medically necessary

The breast pump through insurance you receive will almost always come from an approved supplier, known as a DME (Durable Medical Equipment) provider.

Pro Tip

Planning to pump at work or during commutes? Many standard electric models work fine, but if you want a silent wearable pump, check if your FSA or HSA can be used to offset the upgrade cost.

🧠 Reality check: The internet is full of glowing reviews for $400 wearable pumps — and they’re great. But expecting your insurance to cover one without cost is like expecting a luxury car in a rental contract. Most plans only approve what’s deemed medically “sufficient,” not what’s most convenient.

So before choosing based on aesthetics or social media buzz, get the actual list of covered models from your insurer or DME partner.

3.2 Hospital-Grade Pumps: Are They Covered by Insurance?

Here’s where things get specific. Hospital-grade breast pumps through insurance aren’t typically available to everyone — but they are possible in certain medical cases.

You may qualify for a hospital-grade rental if:

- Your newborn is admitted to the NICU

- You had a premature birth or C-section complications

- You’re inducing lactation due to adoption or surrogacy

- Your baby has oral issues preventing nursing

In those cases, your OB or lactation consultant will need to issue a specific medical necessity note that includes terms like “hospital-grade pump rental required.” Most approvals last 30 to 60 days, with renewals available upon medical review.

2025 Policy Snapshot (State Variants)

- Colorado Medicaid: Covers rentals for NICU or preemie births

- Florida Blue: Allows hospital-grade rental if prescribed postpartum

- Illinois Managed Care: Requires prior authorization + lactation support plan

It’s important to know that not all DME suppliers carry these hospital-grade units, and even when insurance approves them, availability can be limited. Rental pumps are often reused, professionally sanitized, and returned on deadline — so expect contracts, deposits, or usage logs.

Real Case – Marissa, Boise ID

“Once my twins were admitted to the NICU, my OB’s nurse sent in the paperwork the same day. The insurer approved a rental Medela Symphony within 48 hours. Without that push, I wouldn’t have even known it was an option.”

🎯 If your situation qualifies, act quickly. Some insurers set tight windows for approval after birth, and delays can mean you miss out entirely.

4. Common Misconceptions About Breast Pump Insurance Coverage

In theory, getting a breast pump through insurance should be simple — but for many new moms, it feels more like decoding a riddle in a doctor’s waiting room. The confusion doesn’t come from lack of coverage, but from misinformation that circulates online, in hospitals, and even in OB offices.

Let’s clear the air. Here’s what most people get wrong — and what it might cost you if you believe it.

4.1 “It’s Always Free” and Other Myths About Breast Pump Through Insurance

If you ask five moms in a Facebook group whether their breast pump through insurance was totally free, you’ll get five wildly different answers. And that’s the first red flag.

Here are some of the most common myths — and the reality behind them:

| Myth | Reality |

|---|---|

| “All plans cover pumps 100% free.” | Only ACA-compliant plans do — not short-term or grandfathered ones. |

| “You can choose any pump you want.” | Nope — you can only pick from what your DME supplier offers. |

| “Insurance pays for hospital-grade models.” | Only with medical necessity + documentation. |

| “You don’t need a prescription.” | Most insurers still ask for one, even if it’s generic. |

| “Medicaid gives you the same pumps as private.” | State Medicaid coverage varies drastically and is often more limited. |

Pro Tip

If you’re not sure your plan is ACA-compliant, check your Summary of Benefits or call your insurer directly. Just because your premium is high doesn’t mean breast pump coverage is included.

🧠 Let’s be real. Much of the confusion comes from oversimplified brochures or hospital handouts that say “You’re entitled to a free breast pump.” That may be true in theory, but insurers define “free” narrowly: only certain models, only through their vendors, and only within set time frames. Anything outside those conditions? You’re paying.

4.2 The Hidden Costs Most Moms Don’t See Coming with Breast Pump Through Insurance

Samantha in Chattanooga, TN thought she had everything sorted. Her insurer’s portal showed her approved for a pump. But when it arrived, she realized the tubing wasn’t included, and her “free” pump didn’t have a rechargeable battery. Upgrading would cost $185. And she needed it — she was going back to work in three weeks.

Here’s what insurance won’t always tell you:

- Basic kits may not include all accessories — like extra bottles, freezer bags, flanges, or a carrying case.

- Upgrades often look “covered” but require co-pays — especially for wearables or quieter electric models.

- Shipping isn’t always free — some vendors charge for express delivery, which most moms need late in pregnancy.

- You can’t return or swap once ordered — even if it doesn’t suit your needs.

- Late ordering can cost you the benefit — some plans only approve coverage until 30 days after birth.

Snapshot – U.S. Claims Data (2024)

According to a Statista Health study, 36% of new mothers paid out-of-pocket for accessories not included in their insurance-covered breast pump kit.

And there’s the emotional cost. When you’re postpartum, sleep-deprived, and leaking through your hospital gown, the last thing you want to hear is that your pump is on backorder or that the tubing you need is “not a covered item.”

🎯 Solution? Get the full breakdown before you order. Call the DME, request a complete supply list, and ask whether “basic” includes everything you’ll need to start pumping day one.

These unexpected costs highlight why understanding your full health coverage is essential. For those managing healthcare expenses, exploring HSA vs FSA options can help offset additional medical equipment costs.

5. Real Talk: How Emily in Denver Got Her Breast Pump Covered

Emily, a 31-year-old freelance designer in Denver, Colorado, was already managing project deadlines, prenatal yoga, and glucose checks when her OB handed her a pink brochure: “Call your insurance to request your pump by week 30.”

Easy, right?

Not exactly. Between hold music, mismatched info, and a surprisingly short window for approval, Emily’s journey to get a breast pump through insurance became a quiet battle of persistence. Here’s exactly what happened.

5.1 The Call With Her Insurer About Her Breast Pump Through Insurance

Emily dialed the member services number listed on her insurance app. The first rep told her to go directly through a supplier. The second said she needed a prescription. The third transferred her twice before giving her the correct Durable Medical Equipment (DME) link.

Dialogue Transcript (condensed)

— “Hi, I’m 29 weeks pregnant. How do I get my breast pump through insurance?”

— “Have you received a prescription yet?”

— “My OB said they’ll send one once I choose a supplier.”

— “You’ll need to use one of our approved DMEs. Here’s the list.”

— “Do I need to submit anything else?”

— “Not if your OB faxes the Rx directly. But call the DME in two days to confirm.”

She hung up and felt… confused but determined. She picked a supplier from the list — Byram Healthcare — filled out a quick form online, uploaded her insurance ID, and called her OB’s office to request the prescription be sent.

Two days later, she followed up. The DME had the paperwork. Three days after that, her insurance-covered breast pump — a Spectra S2 — arrived at her door.

Pro Tip

Always double-check that the supplier received all required documents. Insurers rarely notify you if something’s missing — and delays can cost you eligibility if you pass their deadline.

5.2 What Surprised Her About the Process of Getting a Breast Pump Through Insurance

Emily assumed the hardest part would be choosing the pump. Instead, the real surprises were buried in the fine print.

Here’s what caught her off guard:

- The supplier choice was mandatory. She couldn’t just order from Amazon or pick her favorite brand — it had to be from a partner DME.

- The models were limited. She hoped for a wearable pump but found only plug-in options under “fully covered.”

- Shipping took longer than expected. Her order was processed on a Friday but shipped the following Wednesday.

- No one proactively followed up. If she hadn’t called twice, her order might have stalled.

Emily’s Insight (Denver, CO)

“I thought it would be one form and done. But I had to coordinate between my OB, the supplier, and my insurance like I was managing a mini project. The pump came, and I’m grateful — but I had to push for every step.”

🧠 And here’s the takeaway: while most insurers technically cover a breast pump through insurance, the actual process is neither instant nor intuitive. You’re responsible for initiating, tracking, and confirming every step — often while juggling third-trimester fatigue or Braxton Hicks contractions.

🎯 Final word? Don’t wait until week 36. Start at 28. Make the calls. Follow up. It’s your benefit — but you’re the project manager.

7. What If You Don’t Have Insurance or Are Between Plans?

Not every new mom has coverage lined up at just the right time. Maybe your job ended mid-pregnancy, maybe you’re switching plans, or maybe you’re uninsured altogether. That doesn’t mean you’re out of options for getting a breast pump through insurance — or through trusted programs that fill the gap.

Let’s look at what’s actually available if you’re navigating this gray zone — and how to avoid last-minute panic at the hospital.

7.1 Medicaid & CHIP Coverage in Your State for Breast Pump Through Insurance

If you’re currently uninsured but pregnant, you may qualify for Medicaid or CHIP (Children’s Health Insurance Program) in your state. Our affordable health insurance options guide covers additional pathways to coverage for expecting mothers. — even if you don’t meet the typical income requirements.

Most states offer pregnancy-related Medicaid that kicks in quickly and retroactively covers up to 3 months of care — including a breast pump through insurance, if state rules allow it.

Here’s a quick snapshot by state:

| State | Breast Pump Coverage via Medicaid |

|---|---|

| California | Yes – electric or manual, after delivery |

| Texas | Yes – manual only, must request post-birth |

| New York | Yes – electric pumps for NICU or medical need |

| Florida | Limited – manual only, prior auth required |

| Illinois | Yes – electric pump, OB documentation required |

Pro Tip

Many states approve pregnancy Medicaid within 10 days — and some hospitals can enroll you on-site during labor. Ask the hospital’s social worker if you’re between plans.

🧠 Real talk? Don’t wait for the perfect plan. If you’re late in pregnancy or postpartum and uninsured, call your state Medicaid office or go through Healthcare.gov to check fast-track eligibility. Even short-term enrollment can open the door to pump access, lactation support, and postpartum care.

7.2 Programs That Offer Free Breast Pumps to Low-Income Families Without Insurance

Even if you don’t qualify for Medicaid or ACA coverage, there are nonprofit programs and local resources that provide breast pumps for free — no insurance needed.

Here are verified, credible sources to turn to:

| Program | What They Offer | Eligibility |

|---|---|---|

| WIC (Women, Infants & Children) | Free manual or electric pumps; hospital-grade for special cases | Income-based; must be WIC participant |

| Loving Hands of Ohio | New or gently used pumps; statewide shipping | Proof of pregnancy or postpartum |

| EveryMother.org | Emergency access to pumps in rural areas | Zip-code based; low-income threshold |

| Hospital-Based Lending Programs | Short-term pump rental (2–6 weeks) | Based on need; ask lactation consultant |

| Baby2Baby (National) | Supplies for newborns; may include pumps by request | Must apply through approved partner orgs |

Testimonial – Kiara, Atlanta GA

“I didn’t have insurance, but WIC gave me a manual pump the same week I applied. When my baby was in NICU, they upgraded me to a hospital-grade rental for 4 weeks — no charge.”

🎯 If you’re between plans, recently unemployed, or simply overwhelmed, don’t assume you’re out of options. These programs exist because the system doesn’t catch everyone — and they’re often faster than formal insurance channels.

For more comprehensive information about navigating health insurance benefits during pregnancy and beyond, explore Insurance Zenith’s complete health coverage resources, including our open enrollment guide and pre-existing conditions coverage analysis.

FAQ

How to get a breast pump through insurance?

Contact your insurance provider or approved DME supplier, obtain a prescription from your OB, submit required documentation, and allow 2-3 weeks for processing and delivery.

What types of breast pumps are covered by insurance?

Most ACA-compliant plans cover manual or standard electric pumps. Hospital-grade models require medical necessity. Wearable pumps typically aren’t covered without upgrade fees.

How long does it take to get a breast pump through insurance?

Processing takes 3-5 business days after complete documentation submission, plus 5-10 business days for shipping. Total timeline: 2-3 weeks.

Can I get a breast pump through insurance before giving birth?

Most plans allow requests starting at 28-30 weeks of pregnancy. Some insurers approve early but delay shipment until 36 weeks. Medicaid typically requires waiting until after birth.

What if my insurance doesn’t cover a breast pump?

Check if your plan is ACA-compliant, verify you’re using an approved DME supplier, or explore Medicaid eligibility. WIC and nonprofit programs like Loving Hands also provide free pumps for qualifying families.

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations.