Experiencing a car accident no insurance scenario represents one of the most financially devastating situations American drivers face today. According to official uninsured motorist statistics, approximately 15.4% of U.S. motorists drive without required coverage, creating millions of potential car accident no insurance incidents annually that expose both uninsured drivers and accident victims to severe financial consequences.

The complexity surrounding car accident no insurance situations stems from varying state laws, enforcement mechanisms, and recovery options available to affected parties. Uninsured motorist coverage costs have increased substantially as insured drivers absorb billions in accident-related expenses caused by drivers lacking proper liability protection under current financial responsibility laws.

When drivers encounter car accident no insurance circumstances, immediate understanding of legal obligations becomes critical for minimizing long-term financial damage. Comprehensive knowledge of automobile insurance fundamentals helps drivers recognize coverage gaps before accidents occur, potentially preventing catastrophic personal liability exposure.

This analysis examines verified data from official sources regarding car accident no insurance consequences, state-specific legal penalties, and practical recovery strategies for both uninsured drivers and accident victims navigating these complex situations.

On This Page

Essential Overview

Car accident no insurance incidents create unlimited personal liability for uninsured drivers while challenging victims’ recovery prospects. State insurance requirements, enforcement penalties, and available protection mechanisms vary significantly, requiring specific knowledge for effective financial protection and legal compliance.

What happens in Florida if you get into an accident without insurance?

Florida’s approach to car accident no insurance enforcement involves immediate civil penalties rather than criminal charges for initial violations. The state mandates minimum $10,000 Personal Injury Protection plus $10,000 Property Damage Liability coverage, with strict electronic monitoring systems tracking compliance status for all registered vehicles through continuous insurance verification protocols.

Florida Penalty Structure for Uninsured Driving:

| Violation Category | First Occurrence | Repeat Violations | Maximum Duration |

|---|---|---|---|

| License Suspension | Immediate upon notification | Immediate | 3 years maximum |

| Registration Suspension | Simultaneous with license | Simultaneous | Until compliance |

| Reinstatement Fees | $150 minimum | $500 escalation | Per violation cycle |

| Administrative Penalties | $150-$500 range | Enhanced amounts | Cumulative |

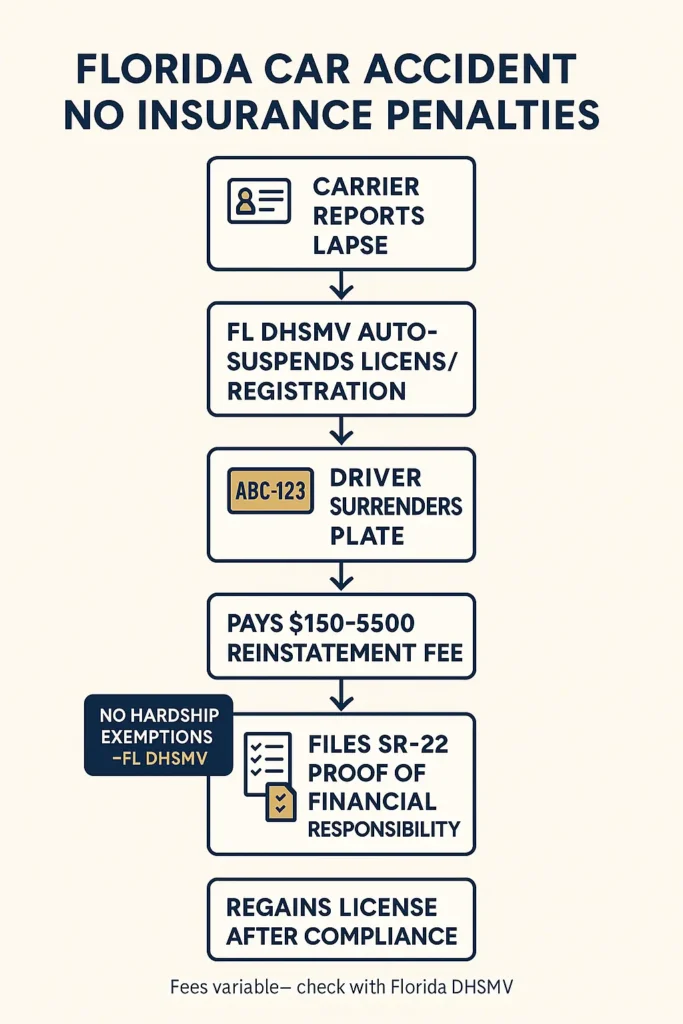

Car accident no insurance situations in Florida trigger automatic suspension procedures once the Department of Highway Safety receives notification from insurance carriers about policy lapses. The state’s Electronic Insurance Verification System operates continuously, making compliance gaps detectable within days of coverage termination.

PRO TIP: Florida requires license plate surrender before insurance cancellation according to Florida insurance requirements. Failing to return plates while uninsured constitutes separate violations with additional penalties.

Personal liability exposure becomes unlimited for drivers involved in car accident no insurance incidents where they bear responsibility for damages. While Florida’s no-fault system provides some protection through mandatory Personal Injury Protection, serious injuries exceeding PIP thresholds allow victims to pursue full damage recovery against uninsured at-fault drivers.

Medical expenses from significant accidents routinely exceed six-figure amounts, while property damage and lost income claims can create overwhelming financial obligations. The state’s financial responsibility laws require demonstrating ability to pay potential damages before license restoration, often necessitating expensive SR-22 high-risk insurance filings for extended periods.

Coverage Enforcement Mechanisms:

- Electronic verification monitoring all active policies

- Automatic suspension triggers upon coverage lapses

- Mandatory proof requirements for reinstatement

- Extended high-risk insurance filing obligations

- No temporary or hardship exemptions available

How to pay for a car accident without insurance?

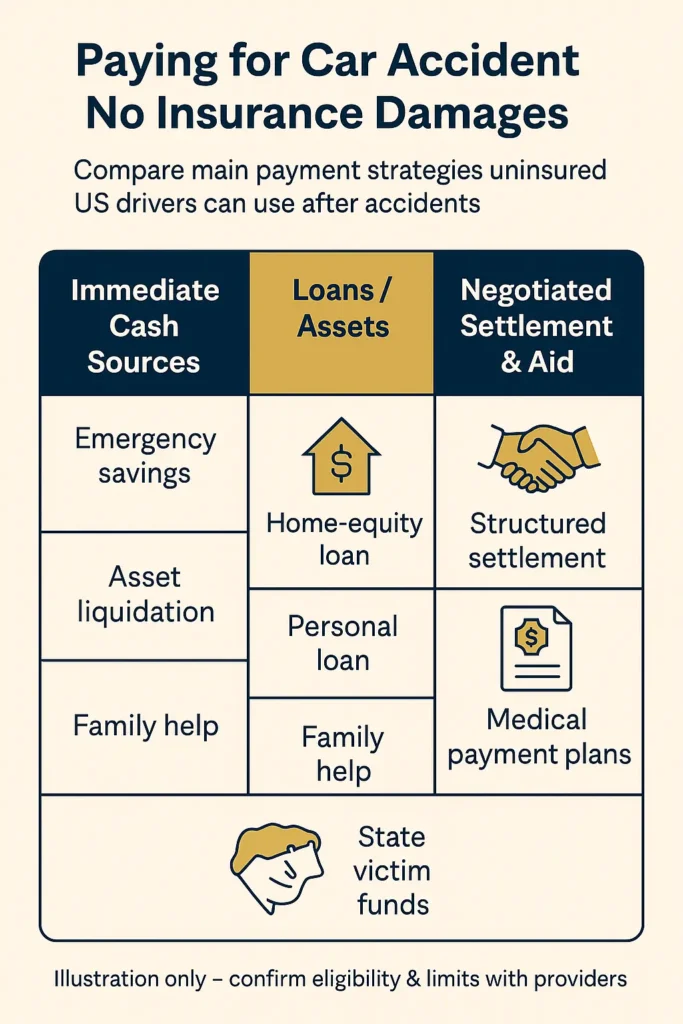

Managing financial obligations from car accident no insurance incidents requires immediate strategic planning and thorough understanding of available payment options. Average claim costs range from $18,000 for minor collisions to over $750,000 for serious injury cases, creating substantial financial burdens that demand careful debt management approaches.

Primary Payment Strategies:

Immediate Liquidity Sources:

- Emergency savings and accessible cash reserves

- Investment liquidation and asset conversion

- Home equity borrowing against property value

- Personal loan applications through financial institutions

- Family assistance and private lending arrangements

Structured settlement negotiations frequently reduce total financial exposure compared to court-imposed judgments. Legal professionals recommend immediate engagement with accident victims to demonstrate good faith and establish reasonable payment schedules that acknowledge financial limitations while satisfying legal obligations.

Financial Management Resources:

| Resource Category | Typical Coverage | Eligibility Requirements | Application Process |

|---|---|---|---|

| State Victim Funds | $15,000-$50,000 | Crime-related accidents | Government application |

| Medical Payment Plans | Variable limits | Credit qualification | Provider negotiation |

| Legal Aid Consultation | Advice only | Income verification | Nonprofit organizations |

| Debt Counseling Services | Planning assistance | Open enrollment | Credit counseling agencies |

Asset protection planning becomes essential when facing substantial car accident no insurance liabilities. Professional financial advisors help identify exempt property under state laws and develop payment structures preserving essential assets like primary residences and necessary transportation.

WARNING: Avoiding payment obligations often results in wage garnishment, asset seizure, and extended collection activities that can continue for decades.

Long-term financial planning must account for ongoing car accident no insurance obligations while maintaining basic living standards. Debt consolidation strategies and structured payment plans help manage multiple obligations while preserving credit ratings and avoiding bankruptcy proceedings.

Understanding comprehensive insurance coverage principles demonstrates how proper planning prevents these devastating financial exposures before accidents occur.

Credit counseling services specializing in accident-related debt provide valuable guidance for developing realistic payment schedules and negotiating favorable settlement terms with multiple creditors and legal representatives.

What happens if you get into a car accident without insurance in VA?

Virginia maintains among the nation’s strictest car accident no insurance enforcement systems, combining criminal penalties with substantial financial obligations for violations. The state eliminated alternative compliance options in July 2024, requiring all drivers to maintain continuous liability coverage without exemptions according to Virginia insurance penalty structure.

Virginia Criminal and Civil Penalties:

| Offense Classification | Legal Category | Monetary Penalties | Additional Consequences |

|---|---|---|---|

| Operating Uninsured Vehicle | Class 3 Misdemeanor | $600 noncompliance fee | License/registration suspension |

| False Insurance Evidence | Class 3 Misdemeanor | $600 plus court costs | SR-22 requirement |

| Subsequent Violations | Enhanced Misdemeanor | $1,000+ escalation | Extended suspension periods |

| Accident-Related Charges | Class 2 Misdemeanor | Variable amounts | Criminal record |

Virginia’s Electronic Insurance Verification Program monitors all registered vehicles continuously, automatically triggering enforcement actions when insurers report policy cancellations or non-renewals. The state requires immediate license plate surrender upon insurance termination, with failure to comply constituting separate criminal violations.

IMPORTANT NOTE: Virginia eliminated the $500 Uninsured Motor Vehicle fee effective July 1, 2024. No alternative compliance methods remain available.

Car accident no insurance situations in Virginia involve unique contributory negligence rules that can eliminate victim recovery rights entirely. Even minimal fault attribution (1% or less) prevents accident victims from recovering damages, creating complex liability scenarios for uninsured drivers.

Criminal consequences escalate significantly with repeat violations or accident involvement. Virginia requires three-year SR-22 financial responsibility filings for convicted offenders, with insurance companies mandating continuous monitoring and immediate violation reporting to state authorities.

Recovery Requirements:

- Payment of $600 statutory noncompliance fee

- Obtaining SR-22 high-risk insurance policy

- Maintaining continuous coverage for three years

- Paying $145 license reinstatement fee

- Satisfying all civil judgment obligations

Financial responsibility minimums include $30,000 per person and $60,000 per accident for bodily injury coverage, plus $20,000 property damage protection. Uninsured drivers must demonstrate financial capacity to meet these requirements before license restoration.

The comprehensive auto insurance regulatory framework provides comparative analysis of different state approaches to coverage enforcement and penalty structures.

Can you go to jail for no insurance in FL?

Car accident no insurance violations in Florida typically constitute civil rather than criminal matters for initial offenses, though related circumstances can escalate to criminal charges carrying potential incarceration. Understanding the distinction between civil and criminal aspects helps drivers recognize when legal representation becomes essential.

Criminal Risk Escalation Scenarios:

Circumstances Triggering Criminal Charges:

- Hit-and-run conduct following car accident no insurance incidents

- Driving with suspended license due to insurance violations

- Providing fraudulent insurance documentation to authorities

- Fleeing accident scenes to avoid liability determination

- Pattern violations demonstrating willful noncompliance

Criminal penalties apply when car accident no insurance situations involve additional violations or demonstrate deliberate law evasion. Florida courts can impose jail sentences for habitual offenders who repeatedly drive without required coverage, particularly when combined with other traffic violations.

Criminal Penalty Progression:

| Violation Stage | Legal Classification | Potential Incarceration | Long-term Consequences |

|---|---|---|---|

| Initial Insurance Lapse | Civil Violation | None | Administrative penalties |

| Suspended License Operation | Misdemeanor | 60 days maximum | Enhanced penalties |

| Repeated Suspension Violations | First-Degree Misdemeanor | 365 days maximum | Mandatory minimums |

| Habitual Offender Status | Felony Potential | 1-5 years | Permanent revocation |

Hit-and-run scenarios involving car accident no insurance create serious criminal exposure beyond insurance violations. Leaving accident scenes while uninsured constitutes separate criminal conduct with mandatory minimum sentences for injury-related incidents.

WARNING: Criminal charges from car accident no insurance incidents can result in permanent criminal records affecting employment, housing, and professional licensing opportunities.

Fraudulent insurance activities carry criminal penalties regardless of accident involvement. Using fake insurance cards or providing false verification constitutes criminal violations with potential incarceration even for first-time offenders.

Enhanced penalties apply progressively with multiple violations, reflecting legislative intent to deter repeated noncompliance. Third-offense driving on suspended license convictions carry mandatory 10-day minimum jail sentences in Florida courts.

Understanding business insurance legal compliance requirements demonstrates similar escalation patterns across different insurance violation categories.

How do insurance companies go after uninsured drivers?

Insurance companies deploy sophisticated recovery operations when pursuing car accident no insurance claims, utilizing specialized departments equipped with extensive legal and investigative resources. According to insurance industry uninsured motorist data, insured drivers collectively pay approximately $16 billion annually for uninsured motorist coverage, creating strong economic incentives for aggressive collection efforts.

Professional Recovery Methods:

Investigation and Asset Location:

- Comprehensive background checks and financial analysis

- Employment verification and income documentation

- Real estate records and property ownership searches

- Bank account identification and asset evaluation

- Business interest discovery and valuation assessment

Insurance recovery specialists maintain relationships with private investigation firms, asset location services, and legal professionals focused exclusively on maximizing collection from car accident no insurance defendants. These professionals employ advanced database searches and surveillance techniques to identify hidden assets.

Collection Timeline and Success Rates:

| Recovery Phase | Duration | Collection Methods | Typical Success |

|---|---|---|---|

| Initial Asset Search | 30-90 days | Database investigation | 85% asset location |

| Settlement Negotiations | 60-180 days | Direct contact attempts | 45% voluntary settlement |

| Legal Action Filing | 120-240 days | Lawsuit initiation | 70% obtain judgment |

| Enforcement Activities | 6 months-10 years | Garnishment/seizure | 35% meaningful recovery |

Sophisticated asset investigation techniques identify property and income sources that car accident no insurance defendants might attempt to conceal. Insurance companies access credit reports, employment records, and financial account information through legal discovery processes during litigation.

IMPORTANT NOTE: Collection activities can continue indefinitely in many states, with judgment renewal extending recovery periods for decades.

Credit reporting consequences from insurance company collection efforts severely impact uninsured drivers’ financial futures. Unpaid judgments remain on credit reports for seven years minimum, affecting employment prospects, housing applications, and loan qualification opportunities.

Settlement negotiations typically favor early resolution over extended litigation costs. Car accident no insurance defendants who engage proactively often achieve 30-50% reductions from original claim amounts through structured payment agreements.

The professional liability insurance framework demonstrates similar risk transfer mechanisms and collection strategies across different insurance sectors.

Debtor Protection Strategies:

- Immediate legal consultation upon accident occurrence

- Proactive settlement engagement before lawsuit filing

- Asset protection planning within legal parameters

- Good faith payment demonstrations

- Professional debt management counseling

Is it worth suing an uninsured driver?

Evaluating lawsuit viability against car accident no insurance defendants requires comprehensive analysis of recovery potential, litigation costs, and practical enforcement challenges. With over 36 million uninsured drivers nationally based on current population estimates, accident victims must carefully assess whether defendants possess sufficient assets to justify legal expenses.

Lawsuit Economic Analysis:

Asset Evaluation Priorities:

- Real estate ownership and available equity

- Employment status and garnishment potential

- Business ownership or partnership interests

- Financial accounts and investment holdings

- Alternative insurance coverage sources

Professional asset investigation services typically cost $750-$2,500 but can reveal substantial hidden wealth justifying litigation investment for significant damage claims exceeding $50,000.

Cost-Benefit Analysis Framework:

| Claim Value Range | Expected Legal Costs | Asset Requirements | Recovery Probability |

|---|---|---|---|

| $15,000-$35,000 | $8,000-$18,000 | Assets 2.5x claim value | 20-35% |

| $35,000-$100,000 | $18,000-$40,000 | Assets 2x claim value | 35-55% |

| Over $100,000 | $40,000-$80,000 | Substantial asset base | 55-70% |

Recovery probability depends heavily on defendant asset availability and state collection law effectiveness. Some states provide extensive debtor protections for primary residences, retirement accounts, and essential property that significantly limit collection potential.

Time limitations substantially affect lawsuit economics. Personal injury statutes of limitations range from one to six years depending on jurisdiction, while collection activities on obtained judgments can extend for decades with proper legal renewal procedures.

WARNING: Many car accident no insurance defendants qualify for bankruptcy protection, potentially eliminating judgment obligations through federal debt relief procedures.

Alternative recovery mechanisms sometimes provide superior results compared to traditional litigation. Structured settlements, payment plans, and asset-based agreements often yield higher net recovery while reducing legal expenses and time investment.

Insurance coverage gaps occasionally provide unexpected recovery opportunities through alternative sources. Car accident no insurance defendants may have homeowner’s policies, employer liability coverage, or family member insurance providing indirect accident protection.

Understanding comprehensive insurance coverage analysis helps identify potential alternative recovery sources beyond direct defendant assets.

Strategic Litigation Considerations:

- Professional asset investigation before lawsuit filing

- Early settlement negotiations minimizing legal costs

- Structured payment preservation of defendant solvency

- Alternative dispute resolution mechanisms

- Comprehensive insurance coverage investigation

Legal fee arrangements significantly impact lawsuit economics. Contingency fee attorneys typically charge 33-40% of recovered amounts, while hourly legal representation may require substantial upfront payments with uncertain recovery prospects.

Collection enforcement often requires ongoing legal proceedings spanning years or decades. Successful judgments necessitate continued monitoring, garnishment actions, and asset seizure proceedings that substantially increase total legal costs.

FAQ

What immediate steps should I take after a car accident if I don’t have insurance?

Remain at the accident scene regardless of insurance status, as leaving constitutes hit-and-run violations with serious criminal penalties. Call police to document the incident, exchange information with other drivers, photograph the scene thoroughly, and seek medical attention if injured. Contact an attorney immediately to understand legal obligations and develop protection strategies. Never admit fault or discuss insurance status with other parties beyond required information exchange.

Can uninsured drivers recover damages when they’re not at fault in accidents?

Recovery rights for car accident no insurance victims vary significantly by state law and specific circumstances. No-fault states like Florida may limit recovery options for uninsured drivers, while traditional tort states generally allow damage recovery against at-fault parties regardless of victim insurance status. States with contributory negligence rules like Virginia may deny recovery entirely if uninsured victims bear any fault percentage. Practical collection challenges often limit actual recovery even when legal rights exist.

How long do insurance-related license suspensions typically last?

Suspension duration depends on state laws and violation severity. Virginia suspensions continue until drivers pay $600 noncompliance fees and maintain SR-22 financial responsibility filings, while Florida imposes suspensions lasting up to three years. Most states require insurance proof, reinstatement fee payment, and ongoing coverage compliance before restoration. Repeat violations typically result in extended suspension periods and enhanced penalties requiring legal consultation.

Will bankruptcy eliminate debts from car accident no insurance incidents?

Bankruptcy protection may discharge or reduce accident-related obligations, though outcomes depend on bankruptcy type, debt classification, and specific circumstances. Chapter 7 bankruptcy can eliminate most car accident no insurance debts, while Chapter 13 creates structured payment plans over three to five years. Debts arising from intentional misconduct, criminal activity, or willful violations may not qualify for discharge. Professional bankruptcy consultation provides case-specific analysis considering procedural requirements and available exemptions.

Do states share uninsured driver violation information across borders?

Most states participate in interstate information sharing systems tracking insurance violations and license suspensions nationwide. The Driver License Compact and National Driver Register enable states to identify drivers with out-of-state violations when processing new license applications or registrations. Attempting to avoid penalties by relocating typically fails due to comprehensive background checks revealing prior violations, often resulting in enhanced penalties for circumvention attempts.

Can I obtain insurance after being caught driving uninsured?

Insurance availability following car accident no insurance violations depends on violation severity and state requirements. Most companies offer high-risk policies for drivers with insurance violations, though premiums typically increase 150-400% above standard rates. States often mandate SR-22 or FR-44 financial responsibility filings for three years, adding administrative costs and monitoring requirements. Comparison shopping among multiple insurers helps identify competitive rates, as companies vary significantly in high-risk driver policies.

Conclusion

Car accident no insurance situations create multifaceted legal and financial challenges demanding immediate attention and strategic planning. This comprehensive analysis reveals significant variations in state enforcement approaches, from Florida’s civil penalty structure to Virginia’s criminal violation framework, emphasizing the importance of understanding jurisdiction-specific requirements.

The verified data demonstrates that 15.4% of American drivers currently operate without required coverage, creating substantial risk exposure for both uninsured motorists and accident victims. Financial consequences range from administrative penalties to unlimited personal liability, while recovery options depend heavily on defendant assets and state collection law effectiveness.

Recovery prospects for accident victims require careful evaluation of lawsuit economics, alternative settlement mechanisms, and enforcement challenges. Professional asset investigation and early legal consultation often provide superior outcomes compared to traditional litigation approaches, particularly when combined with comprehensive insurance coverage analysis.

Key Takeaways

For Uninsured Drivers: Immediate insurance acquisition, professional legal consultation, and proactive settlement engagement provide optimal protection against devastating financial consequences. Asset protection planning and structured payment negotiations preserve essential resources while satisfying legal obligations.

For Accident Victims: Professional asset evaluation, comprehensive insurance investigation, and early legal intervention maximize recovery potential. Understanding state collection laws and enforcement mechanisms helps develop realistic expectations and effective strategies.

For All Drivers: Maintaining adequate insurance coverage including uninsured motorist protection provides essential financial security against substantial risks posed by millions of uninsured drivers nationwide.

Disclaimer

Data Freshness: Insurance rates and regulatory requirements change frequently. Data accuracy depends on timing of official releases from state insurance departments and federal agencies.

Geographic Variations: Insurance requirements, penalty structures, and enforcement mechanisms vary significantly by state jurisdiction. Always consult state insurance departments and legal professionals for current requirements and specific guidance.

Professional Advice: This information serves educational purposes only. Insurance and legal decisions should involve consultation with licensed professionals providing guidance specific to individual circumstances and applicable jurisdiction.