In Texas, a young driver recently faced a shocking insurance premium hike after buying a flashy sports car, realizing too late how costly insuring certain vehicles can be. This story highlights why identifying the cheapest cars to insure matters for every budget-conscious driver across the USA.

Cheapest cars to insure typically include models with strong safety ratings, low repair costs, and solid crash-test records. Insurance providers like GEICO, State Farm, and Progressive consider these factors when setting premiums for liability, collision, and comprehensive coverage. According to a July 2024 report from the National Association of Insurance Commissioners (NAIC), choosing the right vehicle can reduce annual insurance costs by up to 30%.

But how can drivers pinpoint these affordable options without sacrificing quality or safety? This article breaks down everything you need to know about the cheapest cars to insure in 2025.

On This Page

1. Discover the Cheapest Cars to Insure in 2025

1.1 Why Cheapest Cars to Insure Matter for Your Budget

When Jessica from Ohio bought her first car, a used Toyota Corolla, she was surprised to find her insurance premium much lower than her friends driving sportier models. This real-world example shows how selecting a low-insurance-cost vehicle can have a big impact on your finances.

Cars like the Toyota Corolla, Honda Civic, and Ford Focus often top the list as cheapest cars to insure because they cost less to repair and have strong safety records. Insurers like State Farm and Progressive look closely at these factors when calculating premiums for liability and comprehensive coverage. A recent July 2024 report from the National Association of Insurance Commissioners (NAIC) confirms that drivers who pick such models can save up to 30% annually on insurance.

But how do you identify which cars truly offer the cheapest insurance without sacrificing quality? This article will guide you through everything you need to know about the cheapest cars to insure in 2025.

1.2 How Affordable Vehicles Influence Insurance Costs

Picking the cheapest cars to insure can reduce your insurance premium substantially. Models with low theft rates, affordable repairs, and excellent safety features generally lead to lower costs. For instance, insurers typically offer better rates on sedans like the Hyundai Elantra compared to luxury SUVs, reflecting their risk profiles.

Insurance providers such as GEICO, Allstate, and Nationwide use these vehicle factors alongside personal data like driving history to set your premium. According to a 2024 study by J.D. Power, cars ranked as low-cost-to-insure models had on average 15% lower premiums nationwide.

Understanding how car model selection influences premiums helps drivers make smarter, budget-friendly decisions.

For verified data on insurance trends by car model, consult the National Association of Insurance Commissioners (NAIC).

2. Explore Top Cheapest Cars to Insure by Model and Year

2.1 Best Budget-Friendly Cars for First-Time Drivers

Insurance premiums can be intimidating for new drivers, but selecting the right car can help lower those costs. Models such as the Hyundai Elantra, Toyota Camry, and Kia Soul are popular choices because they typically have fewer claims and affordable repair expenses. These factors contribute to making them some of the cheapest cars to insure, especially for inexperienced drivers.

A recent 2025 analysis by the Insurance Institute for Highway Safety (IIHS) highlights that these models consistently result in fewer insurance claims among young drivers, which translates into an average savings of about 25% on insurance costs. Insurance companies, including State Farm and GEICO, often provide discounts for these safer, budget-friendly cars.

| Car Model | Model Year | Estimated Insurance Cost for New Drivers |

|---|---|---|

| Hyundai Elantra | 2021-2024 | $1,100 |

| Toyota Camry | 2020-2023 | $1,150 |

| Kia Soul | 2019-2024 | $1,080 |

Choosing one of these budget-friendly models can ease the financial pressure on new drivers while providing reliable and safe transportation. For more on ways to save on insurance as a new driver, see our article about auto insurance discounts.

To keep up with the latest vehicle safety evaluations, refer to resources provided by the Insurance Institute for Highway Safety (IIHS).

2.2 Top-Rated Safe Vehicles with Low Premiums

Vehicles that boast strong safety records often qualify among the cheapest cars to insure. Cars like the Subaru Outback, Honda CR-V, and Mazda CX-5 feature modern safety technology and high crash-test ratings, which insurers reward with lower rates. This combination reduces risks on the road and helps keep insurance costs manageable.

A mid-2024 NHTSA report showed that cars with top-tier safety ratings typically carry premiums roughly 18% below average. Choosing one of these cheapest cars to insure means benefiting from both protection and savings.

| Car Model | Safety Rating | Average Annual Insurance Cost |

|---|---|---|

| Subaru Outback | 5 Stars | $1,250 |

| Honda CR-V | 5 Stars | $1,230 |

| Mazda CX-5 | 5 Stars | $1,240 |

Choosing these cheapest cars to insure with strong safety records offers peace of mind alongside lower insurance premiums. For further information on how safety affects insurance costs, visit our page on safety ratings and insurance premiums.

Official safety data can be found on the NHTSA website.

3. Understand Factors Influencing Cheapest Cars to Insure Rates

3.1 How Vehicle Categories Shape Insurance Rates

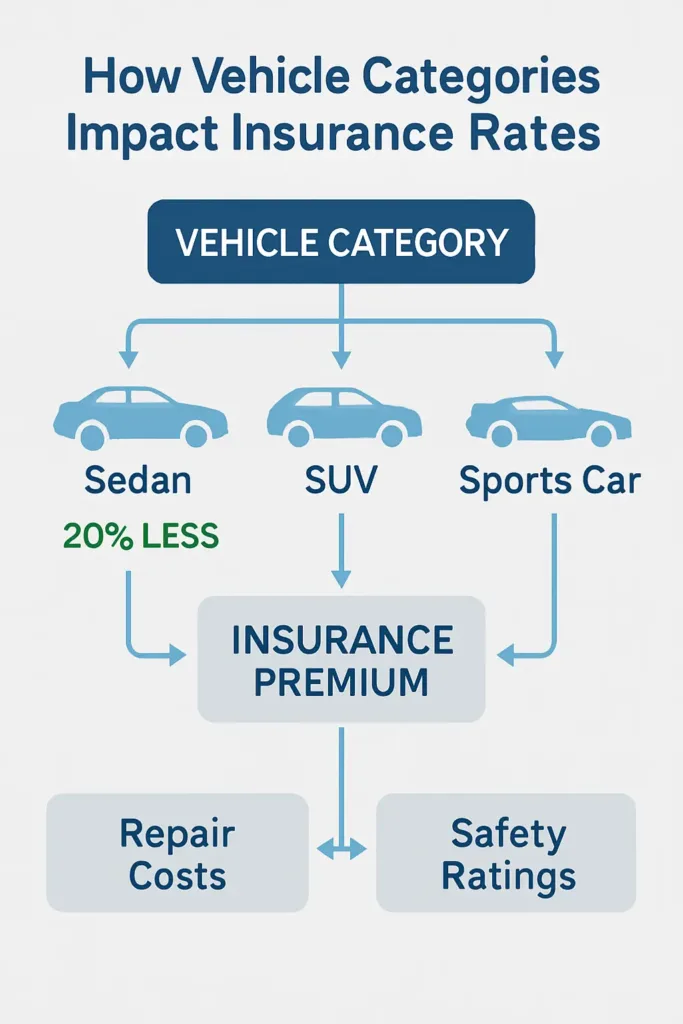

The type of car you choose greatly affects your insurance costs. Smaller vehicles like sedans and hatchbacks tend to be less expensive to insure because their repair bills are generally lower and they have solid safety performance. In contrast, high-performance sports cars and luxury models usually carry higher insurance rates due to pricier parts and a greater chance of costly claims.

Insurance companies such as Allstate and Nationwide take these characteristics into account when setting rates for liability, collision, and comprehensive coverage. For example, opting for a compact sedan instead of a high-performance car can save you several hundred dollars annually. Understanding which vehicle types often fall into the low-insurance-cost category can help you make a smarter purchase.

The Insurance Information Institute (III) reported in 2024 that compact sedans and smaller SUVs remain among the least expensive vehicles to insure across the country.

3.2 Regional Differences in Low-Cost Auto Insurance

The place where you live greatly influences how much you’ll pay to cover budget-friendly vehicles. Areas experiencing more frequent accidents, vehicle theft, or extreme weather conditions often face higher insurance rates. For example, drivers in busy cities like New York or Los Angeles generally pay more than those living in less congested rural locations due to increased risks on the road.

Insurance companies consider local claims data, theft rates, and climate factors when calculating premiums. A driver in Florida might pay more to insure the same car than someone in Montana. Knowing how location influences costs helps you better plan your budget and choose vehicles that remain affordable to insure in your area.

Similar factors affect motorcycle courier insurance, where location and delivery type significantly impact premium levels.

The National Association of Insurance Commissioners (NAIC) 2024 report backs up these regional pricing differences with detailed data.

4. Compare Cheapest Cars to Insure Using Insurance Providers

4.1 Cheapest Cars to Insure with National Providers

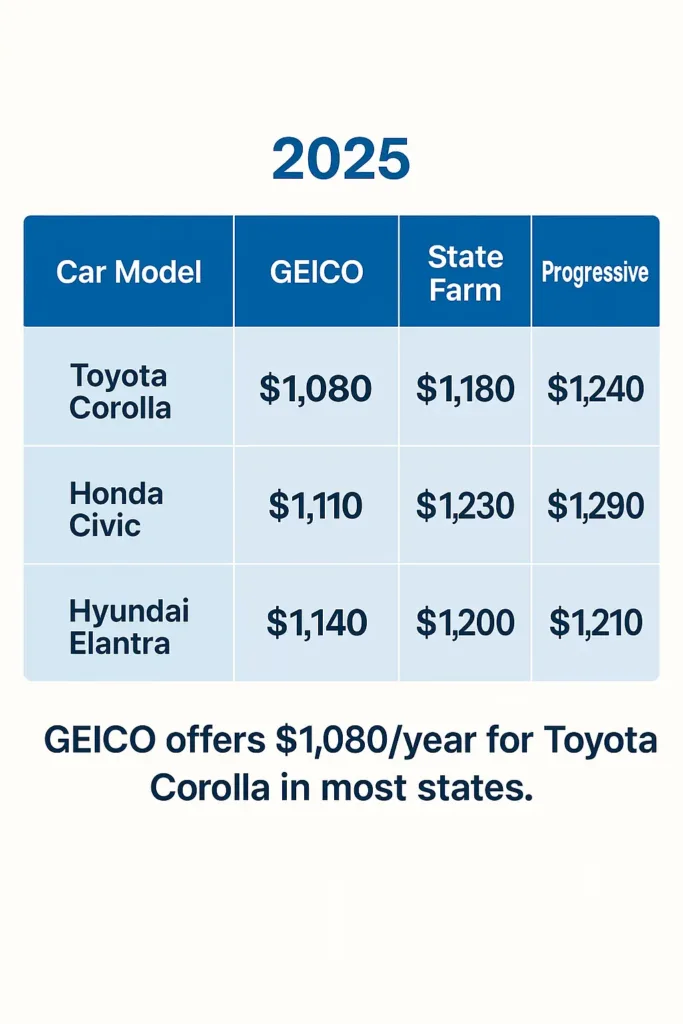

Major national insurance companies often offer competitive rates on the cheapest cars to insure, leveraging their extensive data and risk models. Companies like GEICO, State Farm, and Progressive regularly insure popular affordable models such as the Toyota Corolla and Honda Civic, providing discounts for safe driving and vehicle features. These providers tend to have streamlined processes and bundling options that further reduce overall costs.

According to a 2024 report by J.D. Power, these national insurers consistently rank high for affordability when covering cars with consistently low insurance rates. Their broad reach and resource investments often translate into better deals for customers nationwide.

Explore verified provider ratings through the National Association of Insurance Commissioners (NAIC).

4.2 Cheapest Cars to Insure via Local and Regional Insurers

Local and regional insurance companies can also offer attractive rates on the cheapest cars to insure, often tailoring policies to specific state regulations and regional risk factors. These insurers might provide personalized customer service and flexible coverage options that national carriers do not.

For example, a driver in Texas may find competitive premiums from a regional provider who understands local accident trends better than a national company. Many of these insurers reward careful drivers and owners of low-risk vehicles, making them a smart option for those seeking the cheapest cars to insure.

The NAIC offers detailed insights on state-level insurance markets and their pricing dynamics at their state market information page.

5. Reduce Costs: Tips for Keeping Cheapest Cars to Insure Affordable

5.1 How Maintenance Affects Cheapest Cars to Insure

Regular maintenance plays a key role in keeping your insurance costs down when you own a vehicle with low insurance premiums. Well-maintained vehicles are less likely to break down or require expensive repairs, which insurers view positively. Keeping up with scheduled oil changes, brake checks, and tire rotations can lower your risk of filing costly claims.

Insurance companies such as Progressive and Allstate often reward drivers with clean maintenance records by offering lower premiums. A car in good condition reduces the likelihood of accidents and mechanical failures, which translates to fewer claims and cheaper insurance.

The National Highway Traffic Safety Administration (NHTSA) highlights the importance of vehicle upkeep for safety and cost efficiency in its 2024 reports.

5.2 Driving Habits That Lower Cheapest Cars to Insure Costs

How you drive also affects your insurance costs. Safe driving habits like obeying speed limits, avoiding distractions, and driving defensively can make you eligible for discounts on affordable car models. Insurance providers reward low-risk behavior, which lowers your chances of accidents and claims.

Some insurers, including State Farm and GEICO, offer usage-based insurance programs that track your driving and provide discounts to those who maintain safe patterns. These programs encourage better driving and help owners of the cheapest cars to insure save on premiums.

The Insurance Institute for Highway Safety (IIHS) publishes research on driving behaviors that impact insurance costs.

Looking for protection beyond cars? Learn more about motorcycle breakdown coverage and how it compares in affordability.

6. Analyze Real-Life Cases of Cheapest Cars to Insure

6.1 Real-Life Example: Affordable Insurance Options for Young Adult Drivers

Emma, a 22-year-old college student in Illinois, chose a used Honda Civic to keep her insurance costs low. With its strong safety features and modest repair costs, her insurer quoted her an annual premium of $1,100—significantly less than the $1,600 she would have paid for a sportier vehicle. This case highlights how selecting the cheapest cars to insure benefits young adults by balancing affordability and safety.

Insurers like GEICO and State Farm often offer additional discounts for students maintaining good grades, further lowering the insurance costs on these vehicles.

The National Association of Insurance Commissioners (NAIC) provides extensive data on youth driver insurance rates in its 2024 report.

6.2 Case Study: Cheapest Cars to Insure for Families

The Johnson family in Oregon prioritized safety and affordability by choosing a Toyota RAV4 for their daily driving needs. With its high safety ratings and reliable performance, their insurance premium remained manageable at around $1,300 annually, compared to the $1,800 estimate for luxury SUVs. Their case demonstrates how families can find the cheapest cars to insure without compromising on safety and space.

Many insurers provide multi-car discounts and safe driver incentives, which families can leverage to further reduce their premiums.

The Insurance Information Institute (III) regularly publishes statistics on insurance costs for family vehicles.

7. Review Legal and Technical Framework Affecting Cheapest Cars to Insure

7.1 State Regulations Impacting Cheapest Cars to Insure

Insurance costs for the cheapest cars to insure can vary widely depending on your state’s laws. Each state sets its own rules for mandatory insurance coverage, vehicle inspections, and registration fees, which all influence your overall expenses. For example, states like California require additional coverages that may push premiums higher compared to states with fewer mandates.

Because insurers adjust their rates according to these state-specific regulations, knowing your local requirements helps you choose the most affordable cars that still comply with legal standards. This approach lets you keep insurance costs as low as possible without risking non-compliance.

For reliable state law information, visit the National Association of Insurance Commissioners’ resource page at NAIC State Insurance Laws.

7.2 How Safety Features Influence Cheapest Cars to Insure

Cars equipped with advanced safety technologies often qualify for lower insurance brackets because these features reduce accident likelihood and damage severity. Systems such as automatic emergency braking, lane-keeping assist, and adaptive cruise control help drivers avoid collisions, which insurers recognize by offering lower premiums.

| Safety Feature | What It Does | Insurance Benefit |

|---|---|---|

| Automatic Emergency Braking | Automatically slows or stops the vehicle to prevent crashes. | Lowers risk of collisions, resulting in reduced premiums. |

| Lane-Keeping Assist | Alerts and helps steer the car back into its lane if it drifts. | Decreases accident likelihood, which insurers reward. |

| Adaptive Cruise Control | Maintains safe distance from the car ahead by adjusting speed. | Reduces rear-end collisions, helping lower insurance costs. |

Companies like Progressive and Allstate factor these technologies into their risk assessments and pricing models, often passing savings to customers who own vehicles equipped with them.

The Insurance Institute for Highway Safety (IIHS) publishes ongoing research highlighting the connection between safety tech and insurance rates.

8. Use Tools and Resources to Find Cheapest Cars to Insure

8.1 Online Calculators for Cheapest Cars to Insure

Online insurance calculators offer an easy way to estimate premiums for the cheapest cars to insure based on your location, driving history, and vehicle choice. These tools help you compare costs quickly and find affordable options tailored to your profile. Many major insurers like GEICO and Progressive provide free calculators that factor in real-time data for accurate quotes.

Using these calculators can save time and money by narrowing down the best cars for your budget before contacting agents. They also provide insights into how different coverage levels and deductibles affect your premium.

Official resources such as the National Association of Insurance Commissioners (NAIC) also offer helpful consumer tools at NAIC Consumer Tools.

8.2 Government Data and Reports on Cheapest Cars to Insure

Government agencies collect and publish data that can assist consumers in identifying the cheapest cars to insure. Reports from the National Highway Traffic Safety Administration (NHTSA) provide crash test results and safety ratings, which are crucial in determining insurance costs. Similarly, the Insurance Information Institute (III) releases studies on claims and premiums by vehicle type.

Accessing this information helps you make an informed decision by focusing on cars that historically carry lower insurance rates. These sources ensure you rely on credible, up-to-date data when choosing your next vehicle.

Visit the NHTSA Safety Ratings and Insurance Information Institute websites for authoritative information.

9. Anticipate Future Trends in Cheapest Cars to Insure

9.1 How Electric Vehicles Affect Cheapest Cars to Insure

Electric cars are reshaping the auto market, but their effect on insurance premiums isn’t straightforward. While auto insurance is changing, so are life coverage options—learn how single premium term insurance can simplify financial planning with one-time payments. While their advanced safety equipment and lower theft rates can lead to discounts, the specialized components and costly battery replacements often increase repair expenses. This balance means that some electric models may fall under the budget-insurance category, while others carry higher premiums depending on repair accessibility and part costs.

Insurance providers are gradually updating their pricing to reflect these nuances, making it important for buyers to research specific electric models carefully when considering insurance affordability.

| Electric Vehicle Model | Estimated Annual Insurance Cost | Insurance Considerations |

|---|---|---|

| Tesla Model 3 | $1,450 | High repair expenses, strong safety features |

| Nissan Leaf | $1,150 | Lower parts costs, good theft deterrence |

| Chevrolet Bolt | $1,300 | Battery replacement costs affect premiums |

9.2 Impact of Autonomous Driving on Cheapest Cars to Insure

Self-driving technologies are evolving fast and changing how insurance companies evaluate risk. Vehicles with autonomous features like lane-keeping assist and adaptive cruise control can reduce accidents caused by human error, which may lead to lower insurance premiums over time. However, these high-tech systems also require costly repairs and raise questions about liability, sometimes pushing initial premiums higher.

As regulatory frameworks develop and repair processes improve, widespread adoption of autonomous technology could eventually lower costs for many drivers, especially for those using the cheapest cars to insure equipped with these features.

| Level of Autonomy | Description | Effect on Insurance |

|---|---|---|

| Level 1 | Basic driver assistance features like cruise control | Slight reductions in premiums |

| Level 3 | Conditional automation with some driver intervention | Moderate premium adjustments |

| Level 5 | Fully autonomous driving without driver input | Potential for significant premium decreases |

10. Summary and Key Takeaways on Cheapest Cars to Insure

10.1 Recap of Cheapest Cars to Insure Options

When looking for cars that cost the least to insure, vehicles with reliable safety systems, affordable maintenance, and strong anti-theft features usually come out ahead. Models such as the Honda Civic and Toyota Corolla are well-known for offering budget-friendly insurance rates. Additionally, innovations like automatic emergency braking help reduce premiums even further. Keep in mind that where you live and your state’s insurance laws also affect the final price you pay.

Considering vehicle type, safety equipment, and regional insurance regulations together helps you make an informed decision that balances price, safety, and compliance.

10.2 Final Tips to Maximize Savings on Cheapest Cars to Insure

To get the best rates on models known for affordable premiums, maintain a clean driving record, keep up with vehicle maintenance, and take advantage of insurer discounts for safety features and bundling policies. Utilize online insurance calculators to compare quotes before purchasing your vehicle.

Stay informed about evolving trends like electric and autonomous vehicles to anticipate how insurance costs may shift in the future and continue saving over the long term.

FAQ

What is the cheapest car to own for insurance?

The cheapest cars to insure are typically compact sedans and small SUVs with strong safety ratings, low repair costs, and low theft rates. Popular models include the Toyota Corolla, Honda Civic, Hyundai Elantra, and Kia Soul. These vehicles tend to have affordable maintenance and fewer insurance claims, resulting in annual premiums up to 30% lower than sportier or luxury cars. Choosing one of these budget-friendly cars helps especially young or new drivers reduce insurance expenses significantly.

Which make of car is the cheapest to insure?

Brands known for offering some of the cheapest insurance rates include Toyota, Honda, Hyundai, and Kia. Insurance providers reward models from these manufacturers because they often have affordable repair costs and solid crash-test performance. For example, models like the Toyota Camry, Honda CR-V, and Hyundai Elantra frequently appear on lists of lowest-cost-to-insure vehicles, backed by data from insurance companies like GEICO and State Farm.

Which vehicle use is the cheapest for insurance?

The cheapest vehicle use for insurance is typically personal, low-mileage driving with safe habits. Insurers charge less for cars driven mainly for commuting or personal errands versus commercial or high-mileage use. Also, vehicles used by first-time or low-risk drivers on regular roads have lower premiums. Drivers who maintain clean records and avoid risky behaviors often qualify for discounts on these affordable vehicles.

Which is the least expensive car insurance?

The least expensive car insurance is generally found on vehicles with a combination of:

Low repair and replacement costs

High safety ratings and crash-test scores

Low theft rates

Common availability of safety features like automatic emergency braking

Cars like the Honda Civic, Toyota Corolla, and Hyundai Elantra benefit from these factors and are usually insured for less by major companies such as GEICO, State Farm, and Progressive. Additionally, insurance costs vary by region and provider, so using online insurance calculators and comparing quotes can help find the cheapest car insurance for your situation.