Climate resilience discounts homeowners insurance 2025 programs now offer premium reductions averaging 5-25% for properties with verified mitigation improvements. The Federal Insurance Office reports that insurers across 43 states have implemented climate-related discount structures following $140 billion in weather-related claims during 2023, making these programs more accessible than ever.

Property owners who invest in fortification measures like impact-resistant roofing, reinforced garage doors, or foundation anchoring can now document these improvements to secure substantial annual savings. According to NAIC’s March 2024 Climate Risk & Resilience Strategy, homes with FORTIFIED Home designations receive average discounts of $850 annually compared to standard policies. This guide examines eligibility requirements, qualifying improvements, state-specific programs, and documentation processes to help you maximize available discounts. Understanding climate resilience discounts homeowners insurance 2025 eligibility can significantly reduce your annual premium costs.

Quick Answer: Climate resilience discounts homeowners insurance 2025 programs offer premium reductions of 5-25% for homes with verified mitigation measures like impact-resistant roofing, storm shutters, or foundation reinforcement. (Federal Insurance Office, 2024)

What You Need to Know

- 43 states now mandate or incentivize resilience discounts through insurance department regulations as of September 2024

- Average annual savings range from $200 for basic wind mitigation to $1,200 for comprehensive FORTIFIED designation

- Documentation requirements include professional inspection reports, building permits, and manufacturer certifications dated within 5 years

On This Page

Understanding Resilience Discount Programs

Climate resilience discounts homeowners insurance 2025 programs emerged as regulatory responses to escalating natural catastrophe losses affecting insurance markets nationwide. These initiatives create financial incentives for property owners to implement protective measures that reduce claim likelihood and severity. The Insurance Institute for Business & Home Safety developed the FORTIFIED Home standard in 2010, but widespread insurer adoption accelerated dramatically after 2022 when state insurance departments began requiring discount structures. Today’s programs encompass wind mitigation, wildfire hardening, flood elevation, seismic retrofitting, and comprehensive fortification approaches. Understanding homeowners insurance coverage fundamentals helps property owners recognize how mitigation improvements interact with standard policy terms and premium calculations.

According to the Federal Insurance Office’s 2024 report analyzing homeowners insurance markets from 2018-2022, properties with documented resilience improvements experience 40-60% fewer weather-related claims compared to similar unfortified structures. This claims reduction directly translates to insurer willingness to offer meaningful premium discounts. State insurance departments now review and approve discount schedules annually, ensuring consistency between claimed savings and actual risk reduction. Climate resilience discounts homeowners insurance 2025 represent the most comprehensive iteration of these programs to date.

Michael, 52, Tampa Invested $8,500 in hurricane shutters and impact-resistant garage door after 2022 Hurricane Ian. His insurer approved 18% premium reduction worth $920 annually, recovering improvement costs within 10 years. Lesson: Document all improvements immediately with professional inspection reports to maximize discount eligibility.

How Climate Resilience Discounts Homeowners Insurance 2025 Work

Understanding Tiered Discount Structures

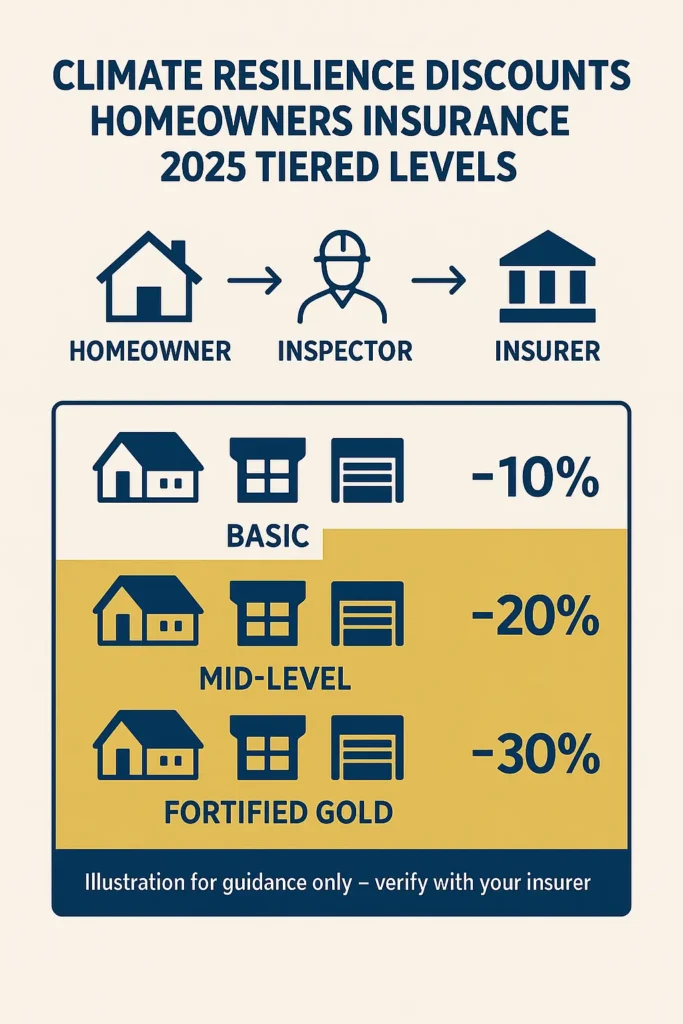

Climate resilience discounts homeowners insurance 2025 operate through tiered discount structures where specific improvements generate predetermined percentage reductions from base premium calculations. Insurers establish these schedules based on actuarial analysis demonstrating reduced loss probability for fortified properties. The process begins when property owners complete eligible mitigation work and submit documentation proving compliance with program standards. Third-party inspectors typically verify major improvements like roof replacements or foundation retrofitting, while manufacturer certifications may suffice for component installations like impact-resistant windows.

The IBHS FORTIFIED Home Program 2025 Standards, updated January 2025, define three designation levels qualifying for progressively larger discounts. Climate resilience discounts homeowners insurance 2025 availability varies by state regulations and insurer filed rating structures. Insurance companies must file discount schedules with state regulators showing percentage reductions for each improvement category. Most programs allow stacking multiple discounts up to maximum thresholds ranging from 25-45% depending on state regulations. Property owners exploring comprehensive strategies should prioritize improvements offering both resilience benefits and insurance recognition. Climate resilience discounts homeowners insurance 2025 programs reward documented mitigation efforts with measurable premium reductions.

Documentation and Discount Calculation

Discount Calculation Example: Base annual premium: $2,400

- Impact-resistant roof: -10% ($240)

- Storm shutters: -8% ($192)

- Reinforced garage door: -5% ($120) Total discount: 23% ($552 annual savings) Adjusted premium: $1,848

Documentation requirements include building permits showing work completion dates, contractor licenses, product certifications meeting specific wind or fire resistance ratings, and professional inspection reports validating proper installation. Most insurers require updates every 3-5 years to maintain discount eligibility, particularly for time-sensitive certifications like roof condition assessments. Climate resilience discounts homeowners insurance 2025 documentation standards ensure verified compliance with program requirements.

| Improvement Category | Typical Discount Range | Documentation Required | Recertification Period |

|---|---|---|---|

| Impact-resistant roofing | 8-15% | Contractor certification, permit | 5 years |

| Storm shutters/impact windows | 5-12% | Product rating, installation photos | 3 years |

| Reinforced garage doors | 3-7% | Wind rating certificate | 5 years |

| Foundation anchoring | 5-10% | Engineer inspection report | 10 years |

| Wildfire hardening | 10-20% | Ignition-resistant materials proof | 5 years |

Federal and State Program Structures

Federal involvement in resilience discounts occurs primarily through FEMA’s Community Rating System program guidance, which provides flood insurance premium reductions for communities implementing comprehensive floodplain management. According to FEMA’s September 2024 guidance, participating communities achieve 5-45% discounts on National Flood Insurance Program policies based on credited activities including building code enforcement, stormwater management, and public education initiatives. Individual property owners benefit automatically when residing in participating CRS communities, with additional discounts available for elevation measures exceeding minimum requirements. Climate resilience discounts homeowners insurance 2025 combine federal CRS benefits with state-specific mitigation programs for maximum savings.

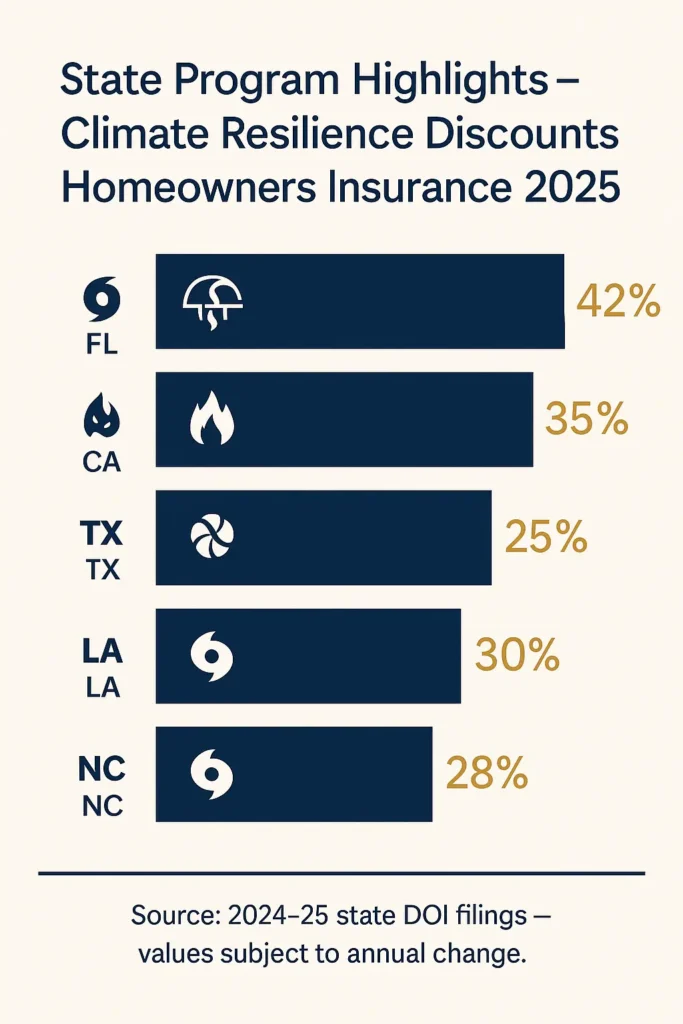

State-level programs demonstrate considerably more variation in structure and generosity. Florida’s Hurricane Loss Mitigation Program, established through statutory requirements, mandates specific discount schedules for nine separate mitigation features including roof-to-wall attachments, roof deck attachments, roof covering type, and opening protections. The Florida Office of Insurance Regulation reviews these annually, with 2024 approved schedules ranging from 2% for basic roof covering upgrades to 42% for homes meeting all nine criteria. Climate resilience discounts homeowners insurance 2025 in Florida represent the nation’s most comprehensive mandatory discount framework. California’s recent wildfire mitigation discount regulations require insurers to recognize Safer from Wildfires assessments, ember-resistant vents, defensible space maintenance, and ignition-resistant construction materials.

State Discount Program Comparison (2024-2025):

| State | Program Type | Maximum Discount | Primary Focus | Mandatory/Voluntary |

|---|---|---|---|---|

| Florida | Wind Mitigation | 42% | Hurricane protection | Mandatory |

| California | Wildfire Hardening | 35% | Ember resistance | Mandatory (2024+) |

| Texas | Hail Resistance | 25% | Impact-rated roofing | Voluntary |

| Louisiana | Storm Fortification | 30% | FORTIFIED designation | Voluntary |

| North Carolina | FORTIFIED Program | 28% | Comprehensive | Voluntary |

The Federal Insurance Office encourages state adoption of resilience discounts through technical assistance and model regulation development, but implementation remains under state authority. Recent federal infrastructure legislation includes $1 billion for state revolving loan funds supporting residential mitigation improvements, making physical upgrades more financially accessible before applying for insurance discounts.

Qualifying Mitigation Improvements by Category

Wind Mitigation Improvements

Wind mitigation improvements constitute the most widespread category of discount-eligible upgrades, particularly relevant for coastal and hurricane-prone regions. These measures address three primary vulnerability points: roof systems, wall openings, and garage doors. Roof improvements include installing continuous ridge venting, upgrading roof-to-wall connections with hurricane straps or clips, using secondary water barriers under roofing materials, and selecting impact-resistant shingles rated for high wind speeds. Wall opening protections encompass impact-resistant windows, permanent storm shutters, or removable panel systems meeting specified design pressure ratings. According to the IBHS FORTIFIED Home Program 2025 Standards, garage doors must meet wind load requirements based on property location and exposure category.

Wildfire Hardening Measures

Wildfire hardening measures focus on reducing ignition vulnerability through ember-resistant construction and defensible space management. Qualifying improvements include Class A fire-rated roofing materials, enclosed eaves preventing ember intrusion, tempered dual-pane windows reducing radiant heat penetration, and non-combustible siding materials. Property owners must also maintain defensible space extending 30-100 feet from structures depending on slope and vegetation density. Many western states now require annual defensible space inspections to maintain discount eligibility, with photographic documentation submitted through insurer portals. Climate resilience discounts homeowners insurance 2025 wildfire programs prioritize ember-resistant construction and vegetation management compliance.

Sarah, 38, Boulder Completed $12,000 wildfire hardening project including ember-resistant vents, dual-pane windows, and extensive vegetation management. Her insurer initially denied the discount request due to insufficient documentation. After obtaining a professional Safer from Wildfires assessment showing compliance, she secured 22% reduction worth $680 annually. Lesson: Obtain third-party verification before completing improvements to ensure work meets specific program standards.

Flood and Seismic Mitigation

Flood mitigation improvements qualifying for premium reductions include elevating living spaces above Base Flood Elevation levels, installing flood vents in foundation walls, relocating mechanical systems to upper floors, and using flood-resistant building materials. The NFIP provides specific discount percentages based on elevation relative to BFE, with homes elevated 3 feet above BFE receiving approximately 30% discounts compared to homes built exactly at BFE. Properties implementing multiple flood protection measures can combine NFIP CRS community discounts with individual elevation credits for maximum savings.

| Mitigation Category | Example Improvements | Average Cost | Average Annual Savings | Payback Period |

|---|---|---|---|---|

| Wind Resistance | Hurricane straps, impact windows | $8,000-$15,000 | $450-$850 | 10-18 years |

| Wildfire Hardening | Ember vents, Class A roof, siding | $10,000-$25,000 | $650-$1,200 | 12-20 years |

| Flood Elevation | Raise structure 2-3 feet | $30,000-$60,000 | $800-$1,500 | 20-40 years |

| Seismic Retrofitting | Foundation bolting, cripple walls | $5,000-$12,000 | $300-$600 | 12-25 years |

| Comprehensive FORTIFIED | Multiple systems, full designation | $15,000-$35,000 | $850-$1,500 | 12-28 years |

State Variation in Climate Resilience Discounts Homeowners Insurance 2025

Coastal State Programs

Geographic location significantly influences both available discount programs and potential savings magnitude. Coastal states experiencing frequent hurricane activity maintain the most mature and comprehensive wind mitigation discount structures. Florida leads nationally with statutorily required discounts, detailed inspection forms standardized statewide, and robust enforcement through the Office of Insurance Regulation. The Florida Hurricane Catastrophe Fund provides reinsurance support enabling private insurers to offer aggressive discounts while managing catastrophic exposure. North Carolina, South Carolina, Louisiana, and Texas have developed similar frameworks with varying mandatory requirements and discount maximums. Climate resilience discounts homeowners insurance 2025 in these states typically range from 15-42% for comprehensive improvements.

Western State Wildfire Programs

Western states affected by wildfire risk have rapidly expanded resilience discount programs following devastating fire seasons between 2017-2023. California’s 2024 regulations require all admitted insurers writing homeowners coverage to offer discounts for wildfire mitigation measures, with minimum discount percentages specified by regulation. Climate resilience discounts homeowners insurance 2025 programs in western states emphasize defensible space and ignition-resistant construction standards. The California Department of Insurance reviews insurer compliance annually and can impose penalties for inadequate discount offerings. Colorado, Oregon, and Washington have adopted similar frameworks emphasizing defensible space maintenance and ignition-resistant construction materials.

James, 45, New Orleans Lives in community participating in FEMA’s CRS program at Class 6 rating, automatically receiving 20% NFIP discount. After elevating his home 2 feet above BFE and installing FORTIFIED Roof designation, he secured additional 15% private insurance discount. Combined savings total $1,120 annually on flood and homeowners policies. Lesson: Stack federal, state, and private insurer discounts by participating in multiple programs simultaneously.

Midwest and Central State Programs

Midwestern and central states focus primarily on severe convective storm mitigation, particularly hail-resistant roofing materials and tornado-safe room construction. Oklahoma, Kansas, and Nebraska offer discounts for impact-resistant roofing products rated Class 3 or Class 4, with some insurers providing enhanced discounts for homes including above-ground safe rooms meeting FEMA specifications. Climate resilience discounts homeowners insurance 2025 in tornado-prone regions focus on hail resistance and structural reinforcement measures. These programs remain largely voluntary rather than regulatory mandates, resulting in wider variation between insurers within the same state.

State Program Alert: Always verify current discount availability with your state insurance department before investing in mitigation improvements. Program structures and qualifying criteria change annually based on regulatory updates and insurer filings.

Property owners considering affordable coverage options across multiple insurers should request detailed discount schedules during quote comparisons, as identical improvements may generate vastly different savings depending on each company’s filed rating structure.

Impact on Premium Costs and Property Values

Climate resilience investments create dual financial benefits through immediate insurance savings and enhanced property marketability. The NAIC’s March 2024 Climate Risk & Resilience Strategy analyzed property transactions in disaster-prone regions, finding that homes with documented FORTIFIED designations sold for 3-7% premiums compared to similar unfortified properties. Climate resilience discounts homeowners insurance 2025 enhance both insurance affordability and property resale values simultaneously. This value increase, averaging $9,000-$24,000 depending on market conditions, supplements the annual insurance savings over the property ownership period. Real estate professionals in coastal markets now routinely highlight mitigation features and associated insurance discounts during listing presentations.

The premium reduction impact varies substantially based on base policy cost, which itself reflects location-specific risk factors. Properties in high-risk areas where base premiums exceed $3,000-$5,000 annually achieve the largest absolute dollar savings from percentage-based discounts. A 20% discount on a $4,500 annual premium generates $900 savings compared to $300 savings on a $1,500 premium, making mitigation investments more financially attractive for high-risk properties. However, lower-risk properties may achieve faster payback periods due to lower improvement costs relative to savings.

Cost-Benefit Analysis Example: Property value: $350,000 Base premium: $3,200/year FORTIFIED Gold investment: $22,000 Annual discount: 28% ($896) Simple payback: 24.6 years Property value increase: 5% ($17,500) Net investment after value gain: $4,500 Adjusted payback: 5.0 years

Long-term financial modeling demonstrates that resilience investments provide cumulative benefits exceeding initial costs for most property owners maintaining ownership beyond 8-12 years. The calculation becomes more favorable when incorporating avoided deductible expenses from prevented claims, reduced repair costs from limited damage during events, and potential elimination of coverage non-renewals in stressed markets. Some coastal regions experiencing insurer withdrawals now see buyers requiring FORTIFIED designation as a financing condition, making these improvements essential for property marketability regardless of insurance savings. Climate resilience discounts homeowners insurance 2025 increasingly influence mortgage lending requirements in high-risk markets.

| Risk Zone | Typical Base Premium | Average Discount % | Annual Savings | Property Value Impact |

|---|---|---|---|---|

| High Wind (Coastal) | $3,500-$6,000 | 18-28% | $630-$1,680 | +4-7% |

| Wildfire Interface | $2,800-$5,500 | 15-25% | $420-$1,375 | +3-6% |

| Flood Hazard Zone | $2,200-$4,500 | 12-30% | $264-$1,350 | +2-5% |

| Moderate Risk (Inland) | $1,200-$2,400 | 8-15% | $96-$360 | +1-3% |

Frequently Asked Questions

What climate resilience discounts homeowners insurance 2025 programs are available in my state?

Availability depends on your state’s regulatory requirements and natural hazard exposure. Contact your state insurance department or visit their website to review approved discount programs. Most coastal states offer wind mitigation discounts, western states provide wildfire hardening programs, and flood-prone regions have elevation-based reductions. The NAIC maintains information on state programs showing current offerings by jurisdiction.

How do I apply for climate resilience discounts homeowners insurance 2025?

Contact your insurance company to request their specific mitigation discount application forms and documentation requirements. Most insurers provide online portals for submitting inspection reports, building permits, product certifications, and photographs. Schedule a professional inspection if required for major improvements like roof systems or foundation work. Submit all documentation within 60 days of improvement completion for fastest processing. Your insurer will review materials and adjust your policy premium at the next renewal period, with some companies offering mid-term adjustments for significant improvements.

Can I combine multiple climate resilience discounts homeowners insurance 2025 on one policy?

Yes, most programs allow stacking multiple improvement discounts up to state-mandated maximum thresholds. Florida permits combining up to nine separate wind mitigation features, while California allows concurrent wildfire hardening and seismic retrofitting discounts. However, total combined discounts typically cannot exceed 40-50% of base premium depending on state regulations. Review your insurer’s filed discount schedule to understand how individual improvements interact and whether any exclusions apply to specific combinations.

Do resilience discounts apply to both dwelling and contents coverage?

Discounts typically apply only to dwelling coverage premiums, which represent 75-85% of total policy costs. Contents, liability, and additional living expense coverages generally receive no direct discount, though reduced overall policy premiums may indirectly affect these components through rate structure. Some insurers offer small additional credits for wildfire-hardened homes on contents coverage due to reduced smoke damage risk. Always request detailed premium breakdowns showing discount application to each coverage component.

How long does the discount approval process take for climate resilience discounts homeowners insurance 2025?

Processing timelines range from 2-8 weeks depending on documentation completeness and improvement complexity. Simple upgrades like impact-resistant roofing with complete manufacturer certifications often process within 10-15 business days. Comprehensive FORTIFIED designations requiring third-party engineer verification may take 6-8 weeks. Submit applications immediately after improvement completion to ensure discount application at your next policy renewal. Some insurers provide provisional discounts pending final verification to avoid delayed savings.

What happens if I sell my home after making mitigation improvements?

Climate resilience improvements transfer with the property and benefit subsequent owners. FORTIFIED designations remain valid for the structure indefinitely, though insurers may require recertification every 5 years to maintain discount eligibility. Include all mitigation documentation in property disclosures and inform buyers about available insurance savings. Many buyers consider existing discounts when evaluating offers, potentially increasing sale prices by $5,000-$20,000 depending on improvement scope. Transfer all inspection reports, certifications, and permits to new owners for seamless discount continuation.

Are there financing options for expensive mitigation improvements?

Several federal and state programs provide financial assistance for resilience investments. FEMA’s Hazard Mitigation Grant Program covers up to 75% of costs for properties in presidentially declared disaster areas. The new federal Resilience Revolving Loan Fund offers low-interest financing up to $50,000 for qualifying improvements through state-administered programs. Some insurers partner with contractors to provide payment plans deducted from annual premiums. Many local governments offer property-assessed clean energy financing allowing repayment through property tax bills over 10-20 years.

Will my climate resilience discounts homeowners insurance 2025 remain if I switch insurance companies?

Discounts based on physical property improvements transfer between insurers, but percentage amounts vary based on each company’s filed discount schedule. When shopping for new coverage, provide documentation of all mitigation improvements to receive applicable discounts from prospective insurers. Some companies offer more generous discounts for identical improvements, making it worthwhile to compare multiple quotes highlighting your specific features. Never assume discount amounts will match your previous insurer without verifying their filed rating structure.

What You Should Do Next

Climate resilience discounts homeowners insurance 2025 represent a critical opportunity to reduce premium costs while protecting your property against intensifying natural hazards. Start by requesting your current insurer’s complete discount schedule to identify which improvements generate the largest savings for your specific policy. Contact your state insurance department to understand mandatory discount programs and available financial assistance for mitigation investments. Obtain quotes from 3-5 insurers to compare how different companies value identical improvements, as discount generosity varies significantly between carriers. Document all existing mitigation features your home already possesses, as many properties qualify for discounts without additional investment once proper certifications are obtained.

Schedule professional inspections for major systems like roofing, foundation, and window installations to identify improvement opportunities with favorable cost-benefit ratios. Prioritize projects offering both resilience benefits and insurance recognition rather than selecting improvements solely for aesthetic purposes. Consider timing major renovations to incorporate mitigation features during planned updates, substantially reducing marginal costs compared to standalone projects. Maintain thorough records of all improvements including permits, contractor licenses, product specifications, inspection reports, and completion photographs to support discount applications and property value documentation.

Key Takeaways:

- Climate resilience discounts homeowners insurance 2025 programs can reduce premiums by $200-$800 annually depending on improvements, with comprehensive FORTIFIED designations achieving up to $1,500 savings

- 43 states now offer regulated discount programs covering wind mitigation, wildfire hardening, flood elevation, or seismic retrofitting based on regional hazard exposure

- Documentation requirements include professional inspection reports, building permits, manufacturer certifications, and photographs proving compliance with program standards

- Property values increase 3-7% for homes with verified resilience improvements, substantially improving investment payback periods beyond insurance savings alone

- Multiple discounts can be stacked up to maximum thresholds of 25-45% depending on state regulations and insurer filing structures

Disclaimers:

This guide provides educational information only and does not constitute professional insurance, legal, or financial advice.

Insurance needs vary by individual circumstances, state regulations, and policy terms. Consult licensed professionals before making coverage decisions.

Information accurate as of October 2025. Insurance regulations and products change frequently. Verify current details with official sources and licensed agents.