Comparative raters auto insurance technology transforms how insurance professionals and consumers access premium calculations across multiple carrier systems simultaneously. According to the NAIC’s 2024 Auto Insurance Database Report, over 2,400 insurance companies write auto coverage in the United States, making efficient rate comparison essential for both agents and consumers seeking competitive pricing. The Insurance Information Institute reports that the average American household spends $1,548 annually on auto insurance premiums, highlighting the importance of accurate rating systems for market analysis.

Insurance professionals increasingly rely on sophisticated rating algorithms to navigate the complex landscape of carrier-specific underwriting systems and policy pricing structures. These technological solutions process vast amounts of actuarial data while maintaining compliance with state regulatory requirements across all 50 jurisdictions. The complexity of modern risk assessment protocols requires advanced insurance technology platforms that can handle multiple variables simultaneously.

Agents and brokers utilize these advanced rate comparison tools to provide comprehensive quote generation services while ensuring accurate premium calculations for their clients. Understanding how car insurance quotes and comparison processes work becomes crucial as the industry continues adopting more sophisticated agent platforms and automated underwriting systems.

This comprehensive analysis examines the technical architecture, regulatory compliance requirements, and practical applications of modern comparative raters auto insurance systems within the auto insurance marketplace.

On This Page

Essential Overview

Comparative raters auto insurance systems are technological platforms that simultaneously access multiple insurance carrier rating engines to generate premium calculations and facilitate efficient rate comparison for agents and consumers across diverse coverage options.

What is a comparative rater in auto insurance?

A comparative raters auto insurance platform represents a sophisticated insurance technology solution that connects with multiple carrier rating engines to generate simultaneous premium calculations across various insurance companies. These systems function as intermediary platforms between insurance agents, consumers, and carrier underwriting systems, processing standardized applicant information through carrier-specific rating algorithms to produce comparable quotes.

Key Components of Comparative Rating Systems:

| Component | Function | Data Processing |

|---|---|---|

| API Integrations | Connect to carrier systems | Real-time data exchange |

| Rating Engine | Process premium calculations | Risk assessment protocols |

| Data Validation | Verify applicant information | Compliance checking |

| Quote Management | Organize and compare results | Policy pricing analysis |

| Regulatory Compliance | Ensure state law adherence | Jurisdiction-specific rules |

The National Association of Insurance Commissioners (NAIC) 2024 Market Conduct Report indicates that over 75% of licensed insurance agencies now utilize some form of comparative rating technology, representing a 23% increase from 2022 data. These platforms process approximately 4.2 million quote requests daily across all participating carriers.

Modern systems integrate with carrier Application Programming Interfaces (APIs) to access real-time rating algorithms while maintaining data security protocols required by state insurance departments. The platforms translate standardized applicant data into carrier-specific formats, ensuring accurate premium calculations despite varying underwriting criteria across different insurance companies.

IMPORTANT NOTE: These platforms function as quote generation tools, not binding coverage platforms. Final policy terms and premiums require direct carrier confirmation and underwriting approval.

Insurance agents benefit from streamlined workflows that reduce manual data entry while providing clients with comprehensive rate comparison options. The technology enables simultaneous processing of multiple carrier quotes, typically reducing quote generation time from hours to minutes for complex coverage scenarios.

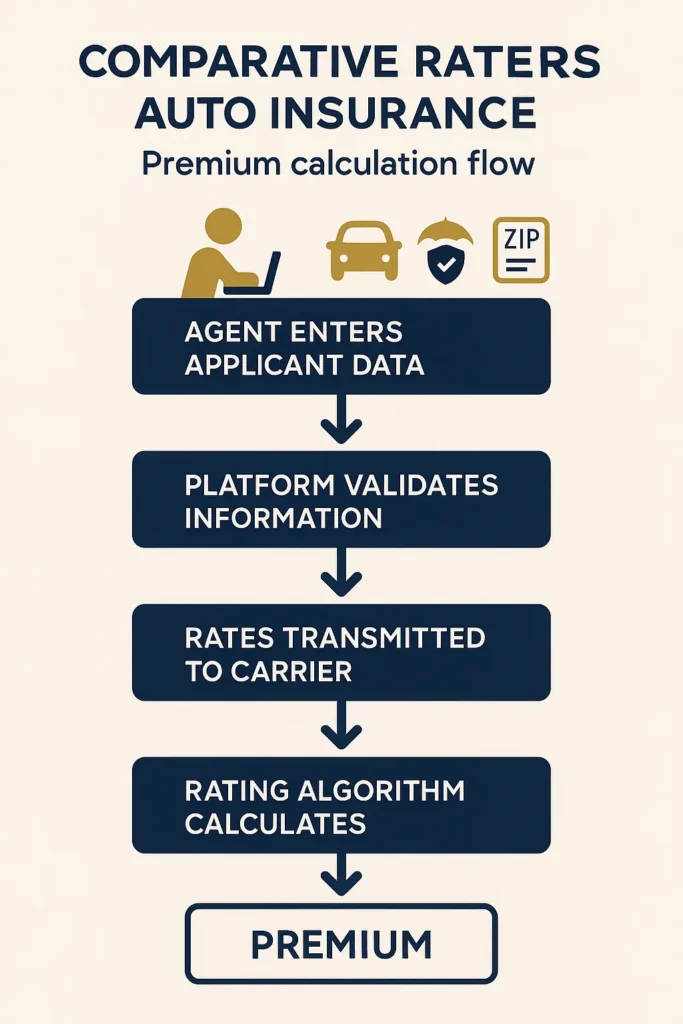

Practical Application Steps:

- Agent inputs standardized applicant information into the platform

- System validates data for completeness and accuracy

- Platform simultaneously transmits requests to connected carrier systems

- Carrier rating engines process information through specific underwriting algorithms

- Results return to the platform for organization and presentation

- Agent reviews quotes and presents options to client

How do comparative raters auto insurance systems calculate premiums?

Comparative raters auto insurance platforms utilize sophisticated premium calculations that mirror individual carrier methodologies while standardizing data input formats across multiple insurance companies. These systems employ complex rating algorithms that process hundreds of variables through carrier-specific underwriting systems to generate accurate policy pricing estimates.

The calculation process begins with data standardization, where platforms translate applicant information into formats compatible with each connected carrier’s rating engine. This standardization ensures consistent data quality while preserving carrier-specific underwriting criteria that influence final premium calculations.

Premium Calculation Variables:

- Driver Factors: Age, gender, marital status, driving record, credit score (where permitted)

- Vehicle Information: Make, model, year, safety features, anti-theft devices

- Coverage Selections: Liability limits, deductibles, optional coverages

- Geographic Factors: ZIP code, garaging location, regional claim frequencies

- Policy Terms: Coverage period, payment frequency, multi-policy discounts

Rating Algorithm Processing Flow:

| Stage | Process | Data Validation |

|---|---|---|

| Input Validation | Verify data completeness | Required field checking |

| Risk Classification | Assign risk categories | Underwriting rule application |

| Base Rate Calculation | Apply territorial factors | Geographic risk assessment |

| Modification Factors | Apply discounts/surcharges | Eligibility verification |

| Final Premium | Calculate total cost | Regulatory compliance check |

According to NAIC’s 2024 Rate Filing Database, insurance companies submit over 12,000 rate filing changes annually, requiring comparative rating platforms to maintain current rating factor databases for accurate premium calculations. These systems update rating tables monthly or quarterly to reflect approved rate changes across all participating carriers.

The Insurance Services Office (ISO) reports that modern rating algorithms consider approximately 300-500 distinct variables when calculating auto insurance premiums, depending on carrier sophistication and state regulatory requirements. These platforms must accommodate this complexity while maintaining processing speed and accuracy.

PRO TIP: These systems typically provide premium estimates within 5-10% accuracy of final carrier quotes, with variations primarily due to carrier-specific underwriting guidelines not captured in standardized data fields.

Risk assessment protocols within these systems evaluate multiple data points simultaneously to replicate carrier underwriting logic. These protocols incorporate actuarial data from loss experience studies, territorial risk factors, and regulatory compliance requirements specific to each jurisdiction.

Insurance companies provide platform vendors with rating specifications that outline how their underwriting systems process applicant information. These specifications include discount eligibility criteria, surcharge applications, and coverage availability rules that affect final premium calculations.

Practical Application: Agents can optimize quote accuracy by ensuring complete and accurate data entry, understanding carrier-specific requirements, and recognizing when manual underwriting may be necessary for complex risk profiles or coverage scenarios not fully supported by automated rating systems.

What data sources do comparative raters auto insurance platforms use for calculations?

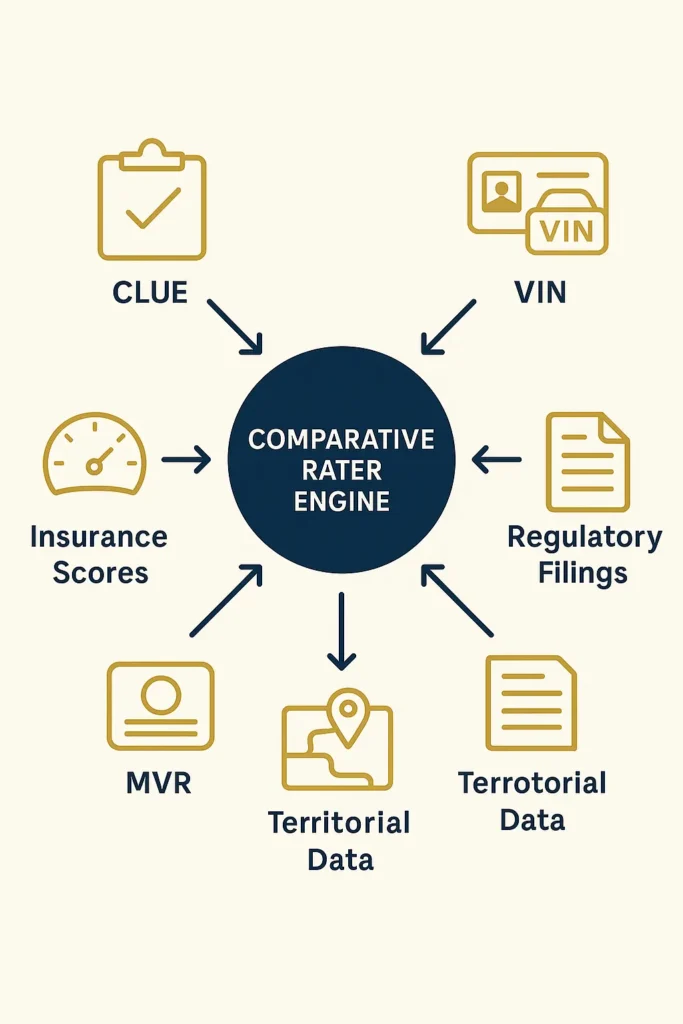

Comparative raters auto insurance systems aggregate information from multiple authoritative data sources to ensure accurate premium calculations and comprehensive risk assessment protocols across participating carrier systems. These platforms maintain connections with industry databases, regulatory agencies, and carrier-specific repositories to access current actuarial data required for precise policy pricing.

Primary data sources include the Comprehensive Loss Underwriting Exchange (CLUE), which provides historical claims information for vehicles and drivers, and the Motor Vehicle Record (MVR) databases maintained by state departments of motor vehicles. These sources supply critical underwriting information that influences rating algorithms and risk classification processes.

Core Data Sources for Comparative Rating:

| Data Source | Information Type | Update Frequency |

|---|---|---|

| CLUE Reports | Claims history, loss data | Real-time |

| MVR Systems | Driving records, violations | Daily |

| Insurance Scores | Credit-based risk factors | Monthly |

| VIN Databases | Vehicle specifications, safety ratings | Quarterly |

| Territorial Data | Geographic risk factors, loss costs | Annually |

| Regulatory Files | Rate approvals, coverage requirements | As filed |

The Property Casualty Insurers Association of America (PCI) 2024 Technology Survey indicates that 89% of these platforms access at least eight distinct data sources during the quote generation process, with larger systems connecting to over 20 specialized databases for comprehensive risk evaluation.

Insurance technology platforms integrate with the National Insurance Crime Bureau (NICB) databases to access vehicle theft rates and anti-theft device effectiveness data that influence comprehensive and collision coverage pricing. These integrations ensure rating algorithms incorporate current loss experience data when calculating premium modifications.

Vehicle identification number (VIN) decoding services provide detailed specifications including safety ratings from the National Highway Traffic Safety Administration (NHTSA) and Insurance Institute for Highway Safety (IIHS). This information affects coverage pricing for physical damage coverages and may trigger available safety discounts in participating carrier systems.

WARNING: Data quality significantly impacts quote accuracy. Incomplete or outdated information can result in premium estimates that vary substantially from final carrier quotes, potentially causing customer dissatisfaction and agent credibility issues.

Geographic risk factors derive from ISO territorial rating databases that analyze historical loss experience by ZIP code and sub-territory classifications. These databases incorporate weather patterns, traffic density, crime statistics, and litigation environments that affect claim frequencies and severities across different locations.

Regulatory compliance data sources include state insurance department rate filings, coverage requirement specifications, and approved policy forms that ensure platforms generate quotes consistent with current legal requirements. The federal insurance regulatory framework provides oversight standards for multi-state rating platforms.

Practical Application Steps:

- Verify data source currency and reliability before quote generation

- Understand carrier-specific data requirements and limitations

- Recognize when additional information may be needed for accurate rating

- Implement data validation protocols to ensure information consistency

- Monitor regulatory changes that may affect data requirements or availability

Third-party vendors specializing in insurance data aggregation provide these platforms with standardized access to multiple carrier systems while maintaining data security and privacy protocols required by state and federal regulations.

How accurate are comparative raters auto insurance systems for consumers?

Comparative raters auto insurance system accuracy varies significantly based on risk complexity, carrier participation levels, and data completeness, with industry studies indicating quote precision ranges from 85-95% for standard risks to 60-75% for complex or high-risk scenarios. The accuracy limitations stem from carrier-specific underwriting guidelines, real-time data availability, and regulatory compliance requirements that may not be fully captured in standardized rating platforms.

According to the 2024 Independent Insurance Agents & Brokers of America (IIABA) Technology Report, 73% of agents report these platform quotes within 10% of final carrier quotes for preferred risk categories, while 45% experience accuracy rates above 90% for standard auto insurance applications. However, accuracy decreases significantly for applicants with complex driving records, non-standard vehicles, or unique coverage requirements.

Accuracy Factors by Risk Category:

| Risk Type | Typical Accuracy Range | Common Variations |

|---|---|---|

| Preferred Risks | 90-95% | Discount application differences |

| Standard Risks | 85-92% | Underwriting guideline variations |

| Non-Standard Risks | 60-75% | Manual underwriting requirements |

| Commercial Auto | 65-80% | Complex coverage structures |

| High-Risk Drivers | 55-70% | Carrier appetite differences |

The accuracy of these systems depends heavily on carrier participation and API sophistication levels. Major insurance companies increasingly provide direct API access with real-time rating capabilities, while smaller carriers may rely on batch processing or manual quote requests that reduce accuracy and timeliness.

Data currency represents another critical accuracy factor, as platforms must maintain current rating tables, discount schedules, and underwriting guidelines for all participating carriers. The NAIC’s 2024 Rate Filing Analysis shows carriers submit an average of 4.2 rate changes annually, requiring constant database updates to maintain quote precision.

Consumer Impact Analysis:

- Budget Planning: Quote variations of 10-15% can significantly affect consumer decision-making for price-sensitive buyers

- Carrier Selection: Inaccurate initial quotes may eliminate viable options or create false expectations

- Time Efficiency: Multiple quote revisions reduce the efficiency benefits of comparative rating systems

Geographic variations in accuracy occur due to state-specific regulatory requirements, territorial rating factors, and carrier market presence. States with complex regulatory environments or unique coverage requirements typically experience lower accuracy rates.

IMPORTANT NOTE: Results should always be verified through direct carrier contacts before making final purchasing decisions, particularly for applicants with complex risk profiles or specific coverage needs.

The Insurance Research Council’s 2024 Consumer Survey indicates that 68% of consumers understand these platforms provide estimates rather than guaranteed quotes, though 32% express confusion about accuracy limitations and the need for carrier verification processes.

Consumer education about accuracy limitations helps manage expectations while maximizing the utility of these platforms. Understanding when quotes require additional verification enables consumers to use these tools effectively while avoiding potential disappointments during the application process.

Practical Consumer Guidelines:

- Use these platforms for initial market exploration and carrier identification

- Verify quotes directly with top carrier choices before making decisions

- Understand that complex situations may require personalized agent consultation

- Request explanation of significant quote variations between preliminary and final rates

- Consider accuracy limitations when budgeting for insurance expenses

Modern insurance technology continues improving accuracy through enhanced API integrations, machine learning algorithms, and real-time data processing capabilities that better replicate carrier underwriting processes.

What role do comparative raters auto insurance systems play in agent operations?

Comparative raters auto insurance platforms serve as essential operational tools that enable insurance agents to efficiently manage multiple carrier relationships while providing comprehensive quote generation services to clients across diverse coverage needs. These systems streamline agent workflows by eliminating manual data entry requirements and reducing the time needed to obtain competitive quotes from multiple insurance companies.

The Independent Insurance Agents & Brokers of America (IIABA) 2024 Operations Survey reveals that agencies utilizing these platforms report 47% faster quote turnaround times and 31% increased productivity in new business acquisition compared to agencies relying solely on individual carrier systems. This efficiency gain allows agents to serve more clients while maintaining service quality standards.

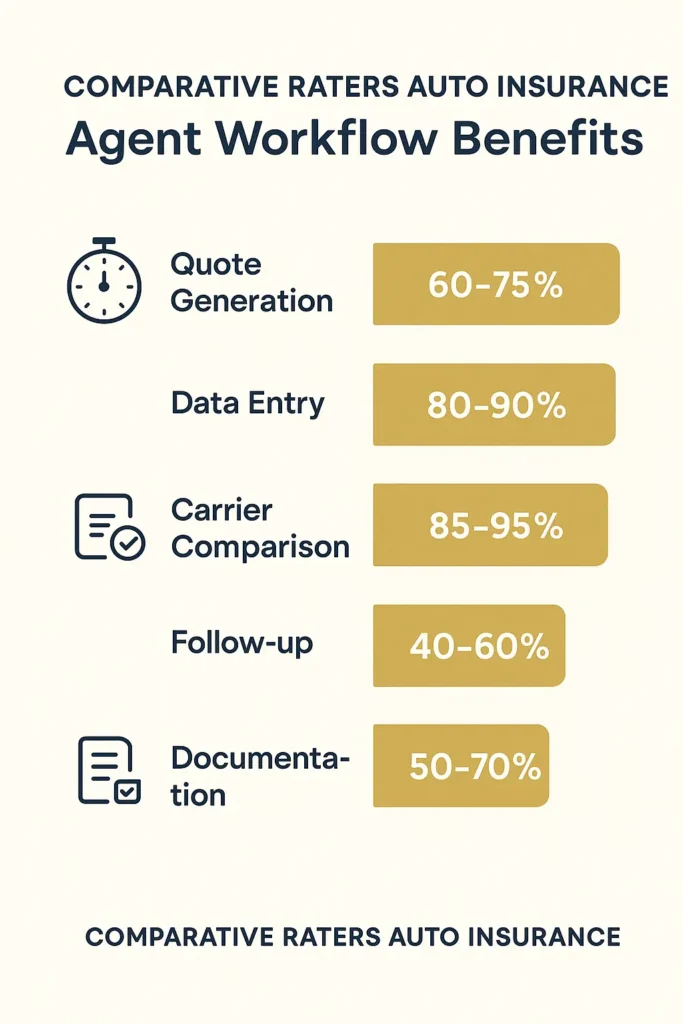

Agent Platform Integration Benefits:

| Operational Area | Efficiency Gain | Time Savings |

|---|---|---|

| Quote Generation | 60-75% | 15-30 minutes per quote |

| Data Entry | 80-90% | 10-20 minutes per application |

| Carrier Comparison | 85-95% | 20-40 minutes per client |

| Follow-up Processes | 40-60% | 5-15 minutes per quote |

| Documentation | 50-70% | 10-25 minutes per policy |

Agency management systems increasingly integrate with these platforms to create seamless workflows from initial quote through policy binding and ongoing service delivery. These integrations enable agents to maintain comprehensive client records while accessing multiple carrier options through single-platform interfaces.

The role extends beyond simple quote generation to include market analysis, carrier performance tracking, and competitive positioning tools that help agents make informed recommendations to clients. Advanced platforms provide historical pricing trends, carrier appetite indicators, and success rate analytics that inform agent strategy development.

Professional liability considerations require agents to understand platform limitations and maintain appropriate documentation of quote accuracy discussions with clients. The professional liability insurance protection principles apply to technology tool usage and client communication responsibilities.

Workflow Enhancement Features:

- Client Presentation Tools: Professional quote comparison formats and carrier information summaries

- Pipeline Management: Tracking systems for quote status and follow-up requirements

- Commission Tracking: Integration with agency management systems for financial reporting

- Regulatory Compliance: Built-in compliance checking for state-specific requirements

Small and mid-sized agencies particularly benefit from these platforms as they provide access to carrier relationships and rating capabilities that might otherwise require significant technology investments or extensive carrier appointments. This democratization of technology enables smaller agencies to compete effectively with larger competitors.

PRO TIP: Successful implementation requires ongoing staff training, regular platform updates, and clear client communication protocols about quote accuracy and verification processes.

Training requirements include understanding platform capabilities, recognizing accuracy limitations, and developing effective client communication strategies about the role of preliminary quotes in the insurance purchasing process. Ongoing education ensures agents maximize platform benefits while maintaining professional standards.

Carrier relationship management becomes more complex with platform usage, as agents must balance platform efficiency with individual carrier requirements for submission protocols, underwriting information, and binding procedures. Successful agents develop hybrid approaches that optimize technology benefits while maintaining strong carrier partnerships.

Practical Implementation Steps:

- Evaluate platform options based on carrier participation and feature sets

- Develop staff training programs for effective platform utilization

- Establish client communication protocols about quote accuracy and limitations

- Create workflow procedures that integrate comparative rating with agency operations

- Monitor platform performance and adjust usage strategies based on results

The future of agent operations increasingly depends on effective platform integration as clients expect faster service delivery and comprehensive market coverage from their insurance professionals.

How do regulatory requirements affect comparative raters auto insurance functionality?

Regulatory compliance requirements significantly influence comparative raters auto insurance design, functionality, and operational protocols, as these platforms must navigate complex state insurance laws, licensing requirements, and consumer protection standards across multiple jurisdictions. Each state maintains distinct regulatory frameworks that affect how systems collect data, present quotes, and interact with consumers and agents.

The National Association of Insurance Commissioners (NAIC) Model Laws provide guidance for multi-state rating platforms, though individual state implementations vary considerably in areas such as rate filing requirements, data privacy standards, and consumer disclosure obligations. The NAIC regulatory oversight framework establishes baseline standards that platforms must meet for market participation.

State Regulatory Variations Affecting Platforms:

| Regulatory Area | Variation Range | Compliance Impact |

|---|---|---|

| Rate Filing Requirements | 30-180 days approval | Data currency challenges |

| Consumer Disclosure Rules | Basic to comprehensive | Platform design requirements |

| Data Privacy Standards | Moderate to strict | Technical architecture needs |

| Agent Licensing Requirements | State-specific | Platform access controls |

| Quote Presentation Rules | Minimal to detailed | Display format standards |

Privacy and data security regulations, particularly state-level adaptations of privacy legislation, require platforms to implement sophisticated data protection protocols. These requirements affect platform architecture, data retention policies, and consumer consent processes that must be incorporated into quote generation workflows.

Consumer protection standards mandate specific disclosures about quote accuracy, carrier participation, and the preliminary nature of results. State insurance departments require platforms to clearly communicate that quotes represent estimates rather than guaranteed coverage offers, with variations in disclosure language and presentation requirements across jurisdictions.

Rate regulation compliance presents ongoing challenges as platforms must maintain current approved rates for all participating carriers across all operational states. The frequency of rate filings—averaging 4.2 changes per carrier annually according to NAIC data—requires sophisticated database management systems to ensure regulatory compliance.

Licensing and Appointment Requirements: Most states require platform operators to maintain appropriate insurance licenses and carrier appointments, though specific requirements vary by jurisdiction and platform functionality. Some states classify these systems as lead generation services, while others treat them as insurance intermediaries subject to full regulatory oversight.

The regulatory landscape continues evolving as state insurance departments adapt oversight frameworks to address emerging insurance technology applications. Recent regulatory developments focus on consumer data protection, quote accuracy standards, and disclosure requirements for technology-assisted insurance transactions.

WARNING: Regulatory non-compliance can result in platform suspension, financial penalties, and loss of carrier relationships, making ongoing compliance monitoring essential for operations.

Federal oversight through agencies such as the Federal Trade Commission (FTC) adds additional compliance layers for platforms operating across state lines, particularly regarding advertising claims, consumer data handling, and unfair trade practice prevention.

Multi-state operations require platforms to implement jurisdiction-specific functionality that accommodates varying regulatory requirements while maintaining operational efficiency. This complexity often necessitates legal consultation and ongoing regulatory monitoring to ensure continued compliance.

Practical Compliance Strategies:

- Implement jurisdiction-specific compliance checking during quote generation

- Maintain current regulatory monitoring for all operational states

- Develop standardized disclosure protocols that meet highest state requirements

- Create documentation systems for regulatory audit requirements

- Establish legal consultation protocols for regulatory interpretation questions

Insurance departments increasingly scrutinize platform operations through market conduct examinations and consumer complaint investigations, requiring platforms to maintain comprehensive documentation of compliance efforts and consumer interaction records.

FAQ

How often do comparative raters auto insurance platforms update rate data?

These systems typically update carrier rate information on monthly or quarterly schedules, though frequency varies based on carrier integration levels and regulatory approval timelines. Major carriers with direct API connections often provide real-time rate updates, while smaller carriers may require manual updates following state approval of rate filings. The NAIC’s 2024 Rate Filing Database indicates carriers submit an average of 4.2 rate changes annually, creating ongoing update requirements for rating platforms.

Update delays can affect quote accuracy, particularly during periods of significant market changes or following natural disasters that trigger rate adjustments. Consumers should verify quote currency with agents, especially for quotes older than 30 days or during periods of known rate changes.

Can these systems access all insurance company rates?

These platforms cannot access all insurance company rates due to carrier participation limitations, technical integration requirements, and competitive considerations that influence carrier API availability. The 2024 Insurance Technology Survey indicates approximately 65% of licensed auto insurance carriers participate in at least one platform, though coverage varies significantly by state and risk category.

Carrier participation depends on factors including market strategy, technology capabilities, distribution preferences, and competitive positioning considerations. Some carriers prefer direct sales channels or exclusive agency relationships that limit platform participation.

Do these systems include all available discounts?

These platforms typically capture major discount categories such as multi-policy, safety features, and good driver discounts, but may not include all carrier-specific discounts or promotional offers available through direct channels. Discount inclusion depends on API sophistication, carrier data sharing policies, and platform programming capabilities.

The comprehensive coverage evaluation process should include verification of discount availability through direct carrier contact, particularly for customers with complex discount eligibility scenarios or specialty programs not captured in standardized rating platforms.

Are these results legally binding quotes?

Results represent preliminary estimates rather than legally binding insurance quotes, requiring carrier verification and formal underwriting approval before coverage becomes effective. State insurance regulations typically require platforms to include clear disclaimers about the preliminary nature of results and the need for carrier confirmation.

Binding coverage requires formal application submission, carrier underwriting review, and policy issuance through authorized channels. Platform results serve as market exploration tools rather than guaranteed coverage offers.

How do these systems handle driver risk factors?

These platforms process driver risk factors through standardized data fields that capture major underwriting variables such as age, driving record, credit score (where permitted), and claims history. However, carrier-specific risk assessment protocols may evaluate these factors differently, leading to variations between platform estimates and final carrier quotes.

Complex risk factors such as recent violations, claims circumstances, or non-standard driver situations may require manual underwriting that platforms cannot fully replicate. Agents should recognize when risk complexity may necessitate direct carrier consultation for accurate pricing.

Conclusion

Comparative raters auto insurance systems represent essential technology platforms that streamline quote generation processes while providing valuable market access for both insurance professionals and consumers. These sophisticated systems process complex rating algorithms across multiple carrier platforms, enabling efficient rate comparison and market exploration capabilities that would otherwise require extensive manual effort.

The effectiveness of these platforms depends significantly on understanding their capabilities and limitations, including accuracy variations based on risk complexity, carrier participation levels, and regulatory compliance requirements that affect functionality across different jurisdictions. Successful utilization requires recognizing that these systems provide valuable preliminary information rather than guaranteed final pricing.

Modern insurance technology continues advancing platform capabilities through enhanced API integrations, improved data processing algorithms, and more sophisticated risk assessment protocols. However, the fundamental role as market exploration tools rather than binding quote systems remains consistent across all implementations.

Insurance professionals and consumers benefit most from these platforms when they understand the technology’s proper role within the broader insurance purchasing process, maintain realistic expectations about accuracy limitations, and utilize results as starting points for more detailed carrier evaluations and negotiations.

Key Takeaways

Technology Benefits: These platforms significantly reduce quote generation time while providing comprehensive market coverage across multiple carrier systems, enabling efficient insurance shopping and market analysis capabilities.

Accuracy Considerations: Quote precision varies from 85-95% for standard risks to 60-75% for complex scenarios, requiring verification through direct carrier contact before making final purchasing decisions.

Regulatory Compliance: Multi-state operations require sophisticated compliance protocols that accommodate varying regulatory requirements while maintaining operational efficiency across different jurisdictions.

Professional Applications: Insurance agents benefit from streamlined workflows, improved productivity, and enhanced client service capabilities when platforms are properly integrated into agency operations.

Consumer Education: Understanding platform limitations and verification requirements enables consumers to effectively utilize comparative rating tools while maintaining realistic expectations about quote accuracy and binding coverage requirements.

Disclaimer

Data Freshness: Insurance rates and regulations change frequently. Data accuracy depends on timing of official releases and carrier rate filing approvals that may not be immediately reflected in comparative rating platforms.

Geographic Variations: Insurance requirements vary significantly by state. Always consult your state’s insurance department for jurisdiction-specific regulations and coverage requirements that may affect platform functionality.

Professional Advice: This information is for educational purposes only. Insurance decisions should be made in consultation with licensed professionals who can provide personalized guidance based on individual circumstances and current market conditions.