At 43, Kevin from Charlotte, North Carolina, thought he had life insurance “figured out.” But after his second child was born, a quick glance at his old term policy left him unsettled. Could it still meet his family’s needs? Like many Americans, Kevin faced a maze of options—term, whole, universal—each with different costs and long-term consequences.

In 2024, the National Association of Insurance Commissioners (NAIC) reports that over 35% of U.S. adults misunderstand what their life policy actually covers. The stakes are high: the wrong choice can leave loved ones financially exposed or underinsured.

This guide breaks down how to compare life insurance policies with clarity. You’ll learn how each policy works, what riders to consider, how to decode quotes, and which plan fits different life stages. Whether you’re buying your first plan or reviewing an old one, this article gives you the knowledge to choose wisely.

On This Page

1. Why Comparing Life Insurance Policies Matters

1.1. The High Stakes of Choosing Wrong

Comparing life insurance policies isn’t just a financial exercise—it’s a crucial decision that can affect your family’s future. A rushed or misinformed choice can lead to gaps in coverage or overpriced premiums for decades. In 2024, the National Association of Insurance Commissioners (NAIC) reported that 42% of policyholders didn’t understand the difference between term and whole life coverage before enrolling.

For example, selecting a term policy that expires before retirement can leave loved ones unprotected. On the flip side, choosing a whole life plan without considering its long-term cost can drain savings. Guessing can lead to financial gaps your family can’t afford—clarity is essential.

Stat 2024: According to the NAIC, nearly half of Americans under 50 who purchased life insurance in the past five years later reported dissatisfaction due to “misaligned policy expectations.”

1.2. How Policies Vary More Than You Think

When comparing life insurance policies, it’s easy to assume they all work the same. But the fine print reveals critical differences—some plans build cash value over time, others don’t. Some include flexible premium options, while others lock you in. Riders, exclusions, surrender charges, and payout structures vary widely.

Comparison Table – Key Features by Policy Type

| Feature | Term Life | Whole Life | Universal Life |

|---|---|---|---|

| Coverage Duration | 10–30 years | Lifetime | Flexible |

| Cash Value | No | Yes | Yes (variable) |

| Premiums | Fixed, low | Fixed, higher | Adjustable |

| Policy Loans | No | Yes | Yes |

| Cost Over 30 Years | $15,000–$25,000 | $60,000–$90,000+ | $50,000–$85,000+ |

1.3. Emotional and Financial Impact on Families

Local Anecdote : Barbara, 59, from Columbus, Ohio, discovered after her husband’s death that his policy had lapsed due to missed payments. “We thought we were covered. It was devastating to realize we weren’t.”

Real-life : A family who selects the wrong policy might face funeral bills, medical debt, or mortgage foreclosure without support. On the other hand, a policy aligned with your needs can secure tax-free support, maintain stability, and ease your family’s burden during difficult times.

Fictional Dialogue :

James (Austin, TX, 38): “I’m healthy now—why should I worry about permanent life insurance?”

Agent: “It’s not about now—it’s about whether your family can rely on a benefit if you’re gone in 30 years. That’s why comparing life insurance policies early is smart.”

Pro Tip – Texas Insurance Code § 1113.002: In Texas, insurers must provide a “policy summary” clearly stating coverage limits, duration, and whether the plan builds cash value. Always request and read this document before signing.

2. Term Life vs. Whole Life: Key Differences

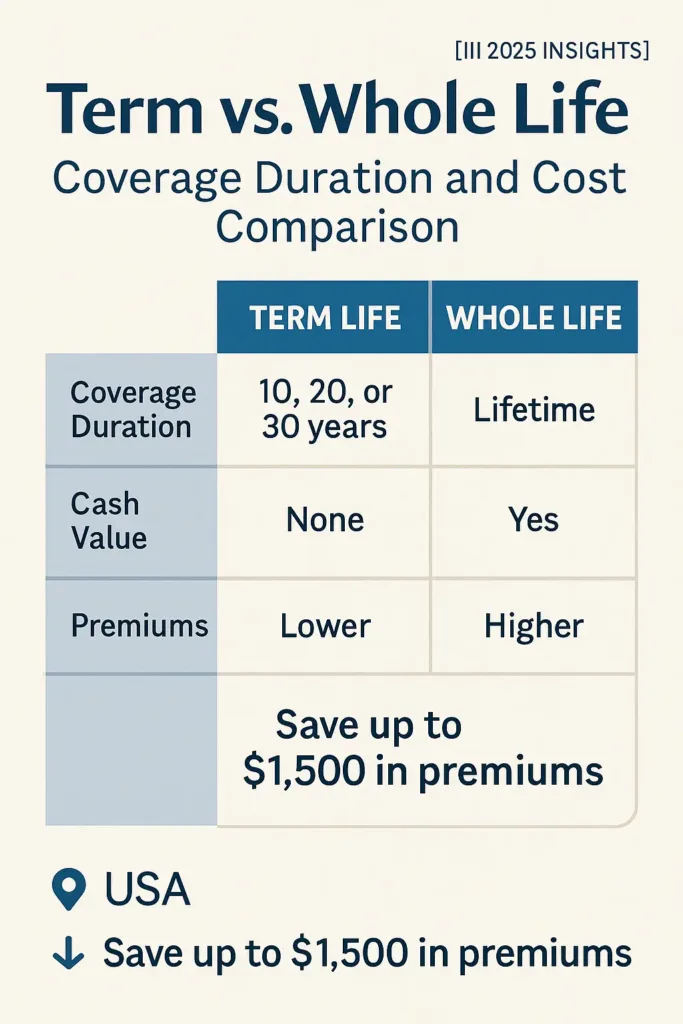

2.1. Coverage Duration and Cost Comparison

When comparing life insurance policies, understanding the difference in coverage duration is essential. Term life offers protection for a set period—typically 10 to 30 years—while whole life extends coverage for your entire life, often at a higher cost. Many Americans choose term policies for affordability, especially during mortgage or child-rearing years. But the long-term cost comparison tells a deeper story.

2024 US Statistic: According to the Insurance Information Institute (III), over 63% of new life insurance purchases in the U.S. in 2024 were term policies, driven by affordability and ease of access.

Real-life: A 35-year-old nonsmoker in Chicago might pay $25/month for a $500,000 20-year term policy, compared to $220/month for the same coverage in whole life—over 700% more.

Comparison Table – Term vs Whole Life (Cost Overview)

| Criteria | Term Life | Whole Life |

|---|---|---|

| Coverage Duration | Fixed (10–30 years) | Lifetime |

| Monthly Premium (Age 35, $500k) | $25–$45 | $200–$300 |

| Cash Value | None | Yes (guaranteed) |

| Policy Expires? | Yes (unless renewed) | No |

| Cost Over 30 Years | $9,000–$16,000 | $72,000–$108,000 |

2.2. Cash Value Accumulation: Yes or No?

One of the most defining contrasts when comparing life insurance policies is whether they build cash value. Whole life and some universal life plans grow tax-deferred savings that can be borrowed against or withdrawn. Term policies, by contrast, provide no savings feature—they’re pure protection.

Denise, 47, from Reno, Nevada, used the cash value from her whole life policy to cover emergency home repairs when a wildfire threatened her property. “That policy gave me access to funds I never expected to use.”

Martin (Baltimore, MD, 41): “If term is cheaper, why pay more for whole life?”

Advisor: “Because you’re not just paying for coverage—you’re building a reserve you can tap into later. That changes how you plan retirement.”

2.3. Which Option Fits Different Life Stages?

As life changes—marriage, kids, retirement—your insurance should evolve too, matching the priorities of each new chapter. Term life often suits younger individuals who want affordable protection while raising children or paying a mortgage. Whole life can serve long-term planners looking to leave a legacy, supplement retirement, or lock in lifetime protection regardless of health changes.

Pro Tip – California Insurance Code § 10113.2: In California, insurers must provide a 60-day grace period on all life insurance policies before termination for non-payment, especially important for whole life holders with long-standing plans.

Real-life: In San Diego, a couple in their early 30s selected a 25-year term plan that aligned with their home loan—ensuring coverage during their highest debt years. Their goal: protect the house as a family asset while raising children. At age 60, they plan to convert part of the policy to permanent coverage without needing a medical exam.

3. Understanding Riders and Optional Benefits

3.1. What Are Riders and Why They Matter

When comparing life insurance policies, riders are often the overlooked extras that can make or break your protection. A rider is an optional add-on that modifies the base coverage to fit personal needs—like covering a critical illness, ensuring children are protected, or waiving premiums if you become disabled. While they come at a cost, they can drastically increase a policy’s usefulness.

2024 US Statistic: According to LIMRA’s 2024 consumer trends report, 58% of new life insurance buyers opted for at least one rider—most commonly the accelerated death benefit or waiver of premium.

Real-life: Nate, a 36-year-old father of two in Kansas City, added a children’s term rider to his policy for just $5/month. When his daughter was diagnosed with leukemia at age 8, the payout helped cover out-of-pocket medical expenses not covered by his health plan.

3.2. Popular Riders: Waiver of Premium, Accelerated Death

The two most frequently selected riders are the **Waiver of Premium** and the **Accelerated Death Benefit**. The first suspends your premiums if you become disabled. The second allows early access to the death benefit if diagnosed with a terminal illness—offering support when it’s needed most.

Tableau – Common Riders and What They Cover

| Rider Type | What It Covers | Typical Cost |

|---|---|---|

| Waiver of Premium | Premiums waived if you become totally disabled | 5–10% of base premium |

| Accelerated Death Benefit | Early payout if terminally ill | Usually free or low cost |

| Children’s Term Rider | Covers dependent children up to age 25 | $5–$15/month |

| Long-Term Care Rider | Uses death benefit to pay for long-term care | High; varies by age & health |

| Return of Premium | Refunds all premiums if you outlive the term | 30–50% more than base policy |

3.3. Hidden Costs and Exclusions

Riders aren’t always the safety net they seem. Some come with waiting periods, exclusions, or narrow definitions of eligibility. For instance, a waiver of premium rider may not apply if the disability is due to a pre-existing condition or mental illness.

Carla, 52, from Tampa, Florida, added a long-term care rider thinking it would protect her if hospitalized later in life. But when she needed extended rehab after a stroke, she learned her rider excluded temporary stays under 90 days. “I didn’t read the fine print,” she admitted.

Rachel (Seattle, WA, 45): “My agent said I could get my money back if I outlive the term—is that real?”

Advisor: “It’s called a return of premium rider. You pay more now, but yes—if you reach the end of the term, you get your premiums refunded. Just be sure to check the conditions.”

Pro Tip – Florida Statutes § 627.4554: In Florida, life insurance riders must disclose any limitation on benefits or exclusions prominently in the Summary of Coverage. Always request this document before finalizing your contract.

4. How to Read and Compare Policy Quotes

4.1. Breaking Down the Summary of Benefits

Comparing life insurance policies starts with understanding the quote—or more precisely, the Summary of Benefits.

Don’t confuse this with a certificate of insurance, which serves a different purpose in proving coverage to third parties.

This document outlines coverage type, term length, premium amount, death benefit, cash value (if any), and riders included. But the fine print matters as much as the numbers.

Real-life: In Atlanta, a 40-year-old applicant received quotes for two $250,000 policies. The term plan listed a 20-year duration at $32/month. The whole life quote was $198/month—but also included cash value and a paid-up option after age 65. Without understanding those features, the cost difference would seem unjustified.

2024 US Statistic: A 2024 NAIC report found that 54% of consumers misinterpret life insurance quotes due to unfamiliar terms or incomplete summaries—often overlooking exclusions or hidden fees.

4.2. Common Red Flags in Life Insurance Quotes

Quotes often look simple, but there are red flags to watch for. These include low teaser premiums that rise sharply after the first term, vague rider names, unclear renewal terms, and missing disclosure of surrender fees. If a quote seems too good to be true, check the assumptions behind the numbers.

Trevor, 33, from Portland, Oregon, chose a policy with an attractive $21/month premium. He later discovered the rate was only valid for 10 years, after which premiums would triple. “I didn’t realize the renewal wasn’t guaranteed,” he said.

Lena (Chicago, IL, 37): “My quote looks great—$27 a month for $500k. Why not just go with it?”

Advisor: “Look at the footnotes. That plan may have rising premiums after year 10 or limited payout options. Let’s dig into the summary details first.”

4.3. Pro Tip: What Must Be Disclosed by Law

Pro Tip – California Insurance Code § 10509.4: California law requires all life insurance quotes to include a written Summary of Benefits and a Buyer’s Guide, both clearly outlining coverage terms, exclusions, and renewal options. If your insurer doesn’t provide these documents, it may be violating disclosure rules.

Calculator Tool : Compare Your Policy Quote

| Policy Type | Coverage | Monthly Premium | Cash Value? | Renewable? |

|---|---|---|---|---|

| Term Life | $500,000 / 20 years | $28 | No | Optional (rate increase) |

| Whole Life | $250,000 / Lifetime | $185 | Yes | Not applicable |

| Return-of-Premium Term | $300,000 / 30 years | $72 | Yes (premium refund) | Limited |

5. Comparing Costs: Premiums, Fees, and Long-Term Value

5.1. Monthly vs Annual Premium Breakdown

When comparing life insurance policies, premiums are usually the first number people notice—but the billing frequency can hide surprising differences. Monthly payments are convenient, but they often cost more annually than a lump-sum premium. Some providers charge processing fees, which accumulate over time.

2024 US Statistic: According to the 2024 Life Insurance Market Trends report by NAIC, policyholders who chose annual payments saved an average of 5–8% compared to monthly billing on the same plan.

Real-life: In Minneapolis, Amy, 42, saved $96 per year by switching her $600,000 term policy from monthly ($39/month) to annual billing ($432/year). “It didn’t seem like much at first—but it added up fast over the years.”

Tableau – Monthly vs Annual Cost Comparison

| Policy Type | Monthly Premium | Annual Premium | Annual Savings |

|---|---|---|---|

| Term Life – $500k / 20 yrs | $34 | $384 | $24 |

| Whole Life – $250k Lifetime | $210 | $2,376 | $144 |

| ROP Term – $300k / 30 yrs | $76 | $864 | $48 |

5.2. Real Cost Over 20 Years by Policy Type

The sticker price doesn’t always reflect long-term cost. A policy with lower premiums may offer no cash value, while another more expensive one might refund premiums or accumulate savings. Evaluating value means looking beyond the price tag to total out-of-pocket cost and benefits received.

Clarence, 50, from Boise, Idaho, paid $29/month for a 20-year term policy. After 12 years, he wanted to upgrade, but rising health issues disqualified him from switching to whole life. “I wish I’d thought long-term from the start,” he shared.

For business owners, understanding how insurance costs affect long-term planning can be just as important when selecting the right life coverage.

Pro Tip – Texas Insurance Code § 1101.006: Texas law requires life insurance policy disclosures to include long-term cost projections in writing. Always compare those figures before choosing a plan, especially if considering riders or conversion options.

5.3. Value Beyond Price: What Are You Really Paying For?

A lower premium doesn’t always mean a better value. Some policies cost more upfront but include lifetime coverage, loan options, or built-in savings. Others may offer low entry costs but expire when you may need them most. Matching policy cost with goals is key to long-term financial security.

Jasmine (Denver, CO, 35): “This policy is $15 cheaper a month. Isn’t that better?”

Agent: “That depends—does it cover you for life? Does it build any savings? The cheaper one might leave your family with nothing after a certain point.”

6. Choosing a Policy Based on Your Life Goals

6.1. Protecting Your Family

Many people buy life insurance to ensure their loved ones aren’t left with debt, unpaid mortgage balances, or lost income. In this case, term life often provides the most affordable, targeted coverage during high-responsibility years.

Real-life: Anthony, 39, from Charlotte, NC, bought a $750,000 term policy after the birth of his second child. “It gave me peace of mind knowing the mortgage and daycare would be covered if something happened to me.”

2024 US Statistic: A 2024 LIMRA report found that 68% of term life purchasers cited “protecting family income” as their main motivation, especially among those aged 30–49.

6.2. Building Cash Value for Retirement

Whole life and universal life insurance policies can serve as long-term financial tools. In addition to coverage, they build cash value that grows over time and can be used to supplement retirement income, fund emergencies, or act as collateral for loans.

Carla, 58, in Phoenix, AZ, used a policy loan from her whole life insurance to help cover her daughter’s college tuition after a job layoff. “It wasn’t my plan, but it saved us when we needed it.”

Pro Tip – Arizona Revised Statutes § 20-2632: In Arizona, insurers must clearly disclose policy loan interest rates and repayment rules for all permanent life insurance products. Review this section of your contract carefully if you plan to use cash value later in life.

6.3. Covering End-of-Life Expenses

Final expense policies—also called burial or funeral insurance—are typically small whole life policies designed to cover costs like cremation, services, and outstanding medical bills. Similar to how mobile home insurance requires tailored protection, final expense coverage must match specific needs in later life. They’re ideal for those with no dependents but who want to avoid burdening their family financially.

Frank (Tulsa, OK, 66): “I don’t need a big policy—I just want to cover funeral costs.”

Advisor: “That’s what final expense insurance is for. It’s affordable, and it ensures your family won’t face surprise bills during a difficult time.”

Tableau – Matching Life Goals to Policy Type

| Life Goal | Recommended Policy | Why It Fits |

|---|---|---|

| Pay off mortgage if I die young | Term Life | Affordable, time-limited protection |

| Build savings for retirement | Whole or Universal Life | Accumulates cash value over time |

| Ensure funeral costs are covered | Final Expense Life | Low benefit, easy approval, lifelong coverage |

| Leave a legacy for children | Whole Life with riders | Lifetime payout + flexible additions |

7. Real-Life Scenarios: What Policy Works Best When?

7.1. Young Single Adult in Debt

For young adults juggling student loans and low income, affordability is key. A simple term policy—often under $20/month—can provide essential protection while building financial stability.

Real-life: Malik, 27, from Atlanta, took out a $250,000 term life policy to cover private student loans co-signed by his parents. “If anything happened to me, I didn’t want my mom stuck with my debt.”

2024 US Statistic: According to the 2024 Federal Student Aid Data Center, 17% of private student loans held by borrowers under 30 are co-signed by a parent or guardian, making term life coverage relevant for many.

7.2. Married Parent with Mortgage

Parents with young children and home loans often need the highest level of temporary protection. A 20- or 30-year term policy large enough to replace income and pay off the mortgage is typically the smartest fit.

David and Sara, a couple in Cincinnati, Ohio, each bought $500,000 term policies shortly after buying their home and welcoming their first child. “It was one of the few things we agreed on instantly,” Sara joked.

Nick (Raleigh, NC, 34): “Do we really both need policies? Isn’t one enough?”

Agent: “If either of you passed away, the surviving partner would need to handle daycare, mortgage, and bills alone. Two policies = full protection.”

7.3. Retiree Thinking of Final Expenses

For retirees with no dependents, the goal is often simplicity. A final expense policy or small whole life plan offers permanent coverage for a flat monthly rate, with easy approval even for those with health conditions.

Real-life: Helen, 71, from Tampa, FL, lives on Social Security and a modest pension. She purchased a $15,000 final expense policy to cover her cremation and medical bills. “At least now, my daughter won’t have to deal with the financial side while grieving.”

Pro Tip – Florida Statutes § 626.9541(1)(a): In Florida, insurers cannot deny final expense life insurance solely based on age or minor pre-existing conditions, but rates may vary. Always compare guaranteed issue vs simplified issue plans.

Tableau – Policy Fit by Life Stage

| Profile | Best Policy Type | Coverage Goal | Monthly Cost (Est.) |

|---|---|---|---|

| Single, under 30, student loans | 10–20 Year Term | Debt protection | $12–$20 |

| Married with kids and mortgage | 25–30 Year Term | Income replacement, mortgage | $35–$65 |

| Retired, no dependents | Final Expense Whole Life | Funeral + medical bills | $30–$55 |

8. Tips for a Smarter Insurance Comparison

8.1. Ask the Right Questions Before You Sign

Comparing life insurance policies effectively means asking deeper questions than just “How much does it cost?” Dig into renewal terms, exclusions, living benefits, and how long the quote is locked in. This due diligence helps avoid surprises later.

Shawn (Buffalo, NY, 38): “The quote looks good—can I just sign it?”

Advisor: “Not so fast. Ask how long that rate is guaranteed, and if your premiums can rise after year ten. Those details are deal-breakers.”

8.2. Don’t Compare Monthly Premiums Alone

Low monthly premiums can be misleading. Two quotes with the same face value might differ in duration, renewability, rider quality, or cash value. A $20/month term policy may not be a better deal than a $30/month return-of-premium plan if one offers refund value at the end.

2024 US Statistic: According to a 2024 NAIC consumer bulletin, 47% of Americans who switched policies said they chose their first plan based solely on monthly cost—without understanding policy structure or exclusions.

In Albuquerque, New Mexico, Lisa, 44, picked a budget-friendly term policy. Years later, she learned it excluded death by illness within the first 24 months. “No one ever explained that clause—it was in the fine print.”

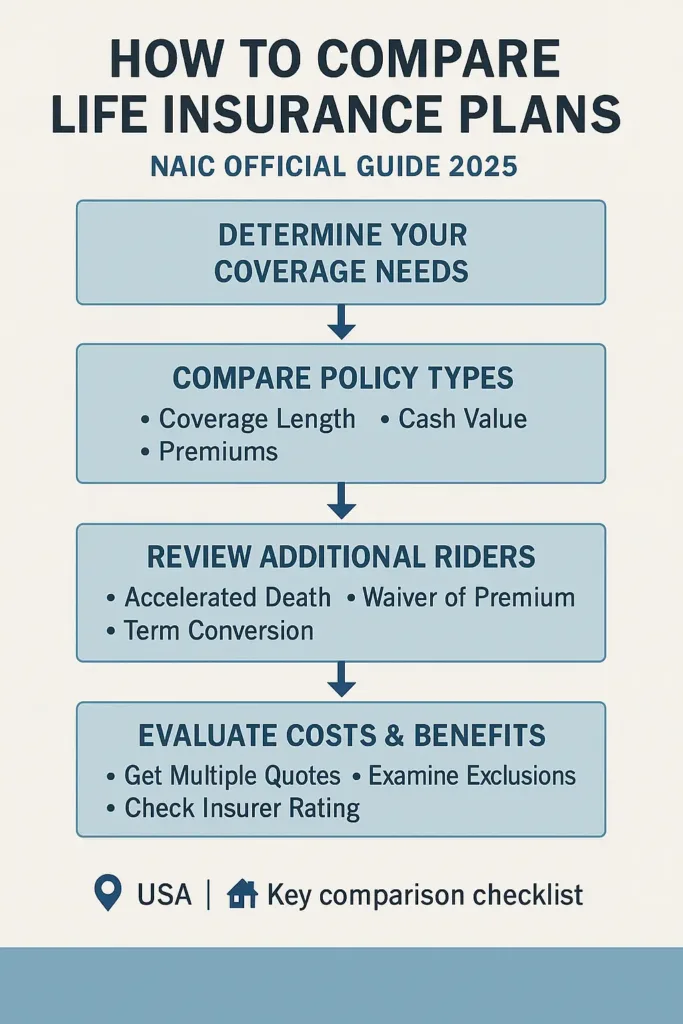

8.3. Use a Checklist to Compare Features Side-by-Side

Pro Tip – NAIC Model Regulation #640: The NAIC recommends using a standardized comparison form when reviewing life insurance quotes. Many state insurance departments offer downloadable checklists to help consumers evaluate side-by-side features like guaranteed renewals, benefit payouts, and loan options.

Real-life: Jordan, 31, from Austin, TX, used a checklist from the Texas Department of Insurance to compare three different quotes. “Once I saw them side-by-side, the gaps jumped out—one had no living benefits, another had hidden surrender fees.”

Tableau – Life Insurance Comparison Checklist

| Feature to Compare | Policy A | Policy B | Policy C |

|---|---|---|---|

| Guaranteed Level Premium? | ✔️ | ✔️ | ❌ (rate increases) |

| Renewable After Term? | ✔️ | ❌ | ✔️ |

| Includes Living Benefits? | ✔️ (accelerated death) | ❌ | ✔️ (chronic illness) |

| Cash Value Option? | ❌ | ✔️ | ❌ |

| Surrender Charges? | No | Yes (first 5 yrs) | No |

9. Mistakes to Avoid When Comparing Life Insurance

9.1. Ignoring Policy Exclusions

Many people focus on premiums and coverage limits, but overlook the exclusions—those hidden clauses that can void your protection when you need it most. These may include suicide clauses, contestability periods, or limitations on pre-existing conditions.

Real-life: In Columbus, Georgia, Darren bought a low-cost policy but didn’t realize it excluded death by pre-existing heart conditions during the first two years. His family was later denied a payout after a fatal cardiac event.

Pro Tip – Georgia Code § 33-25-6: Georgia law permits life insurers to deny benefits if death occurs from undisclosed health issues within the first two years. Always review the contestability clause before signing.

9.2. Underestimating Future Needs

It’s easy to base coverage on current expenses—mortgage, daycare, loans—but that may not reflect your long-term responsibilities. A policy that seems sufficient now might fall short as your income grows or dependents increase.

Katrina, 31, from Reno, NV, purchased a $100,000 policy when she was single. After marriage and two kids, she realized the benefit wouldn’t even cover five years of lost income. “I didn’t think ahead—I just wanted to check the box.”

Brian (Houston, TX, 36): “My current $150k policy feels safe.”

Advisor: “Would it still feel safe if you had a second child, or your spouse took time off work? Future-proofing your policy protects against life changes.”

9.3. Skipping the Fine Print in Riders

Riders can be valuable—but they’re only helpful if their terms actually apply. Many have strict activation requirements, expiration ages, or only apply to specific diagnoses. Overlooking this fine print can create a false sense of security.

2024 US Statistic: In a 2024 NAIC survey, 39% of policyholders said they misunderstood how their riders worked, with over half assuming benefits would trigger automatically.

Tableau – Common Mistakes vs What to Do Instead

| Common Mistake | Impact | Smarter Alternative |

|---|---|---|

| Choosing the cheapest quote | Hidden limits or rising premiums | Compare cost + coverage details |

| Ignoring exclusions | Denied claim after death | Ask for the exclusions summary |

| Underinsuring future obligations | Coverage gap later in life | Factor in future dependents/income |

| Misunderstanding riders | No payout when needed | Confirm rider activation rules |

Final Thoughts: Making the Right Insurance Choice

Comparing life insurance policies isn’t just about finding the cheapest plan—it’s about aligning your coverage with your life, your values, and the people who count on you. Whether you’re a new parent, planning retirement, or simply trying to leave things in order, the right policy can bring peace of mind and financial security when it matters most.

No single policy fits everyone. What works for your neighbor or coworker may fall short for you. Take time to review the fine print, ask tough questions, and consider how your needs might evolve over the next 10, 20, or 30 years.

As you evaluate life insurance options, steer clear of industry buzzwords or panic-driven choices—let your needs, not noise, lead the way. Let facts, transparency, and thoughtful planning guide you toward coverage that truly fits your life goals. A well-matched policy isn’t just a contract—it’s a long-term promise to those you care about.

FAQ

How do I compare life insurance policies?

To compare life insurance policies effectively, start by examining coverage type (term vs whole life), duration, premiums, and whether the plan builds cash value. Look closely at riders, exclusions, renewal terms, and policy fees. Using a checklist or side-by-side comparison form can help reveal differences beyond price, such as living benefits and payout structures. Always review the Summary of Benefits and disclosures before deciding.

How much does a $1,000,000 life insurance policy cost per month?

The monthly cost of a $1,000,000 life insurance policy varies widely based on age, health, policy type, and coverage length. For example, a healthy 35-year-old nonsmoker might pay around $80–$150 per month for a 20-year term policy, whereas a whole life policy with the same death benefit could cost $600 or more monthly. Older applicants or those with health conditions typically face higher premiums.

What is the most recommended life insurance?

Term life insurance is most recommended for those seeking affordable, straightforward protection during key financial responsibility years—like raising children or paying a mortgage. Whole life or universal life insurance suits people wanting lifetime coverage and cash value accumulation for retirement or legacy planning. The best choice depends on your financial goals, budget, and family needs.

What not to say when applying for life insurance?

Avoid providing inaccurate or incomplete information, especially about your health, lifestyle, or hazardous activities, as misrepresentations can lead to denied claims. Don’t mention plans to engage in risky hobbies without disclosure. Also, avoid vague answers; be honest and thorough when answering medical and lifestyle questions to ensure your coverage isn’t voided later.