Annual cost legal malpractice insurance premiums range from $500 to $6,500, with 4-5% of practicing lawyers facing claims each year according to industry data. Understanding cost legal malpractice insurance factors becomes crucial as defense expenses alone average $80,000 per claim, making adequate coverage essential for financial protection. The complexity of determining cost legal malpractice insurance stems from multiple variables including practice area risk levels, firm size, geographic location, and coverage limits that significantly impact annual premiums.

Legal professionals face mounting pressure to secure comprehensive protection while managing operational expenses effectively. Current market conditions show increased claim frequency and severity, particularly in high-risk practice areas like securities law, medical malpractice defense, and intellectual property. The evolving legal landscape requires attorneys to balance cost considerations with adequate protection against potentially devastating financial exposure.

Professional liability protection serves as a critical business expense rather than optional coverage, especially given recent trends showing multimillion-dollar settlements becoming increasingly common. Our analysis reveals that comprehensive business insurance compliance requirements directly correlate with reduced claim frequencies and lower long-term premium costs through proactive risk management strategies.

This comprehensive guide examines current pricing structures, coverage options, and practical strategies for optimizing cost legal malpractice insurance while maintaining essential protection levels. We’ll explore industry data, carrier selection criteria, and proven methods for reducing premiums without compromising coverage quality. Effective cost legal malpractice insurance management requires understanding market dynamics and strategic planning approaches.

On This Page

Essential Overview

Cost legal malpractice insurance varies significantly based on practice area, firm size, and location, with comprehensive policies typically ranging $2,500-$3,500 annually for established practitioners while newer attorneys may pay $500-$1,000 for basic coverage.

How Much Does Legal Malpractice Insurance Cost in 2025?

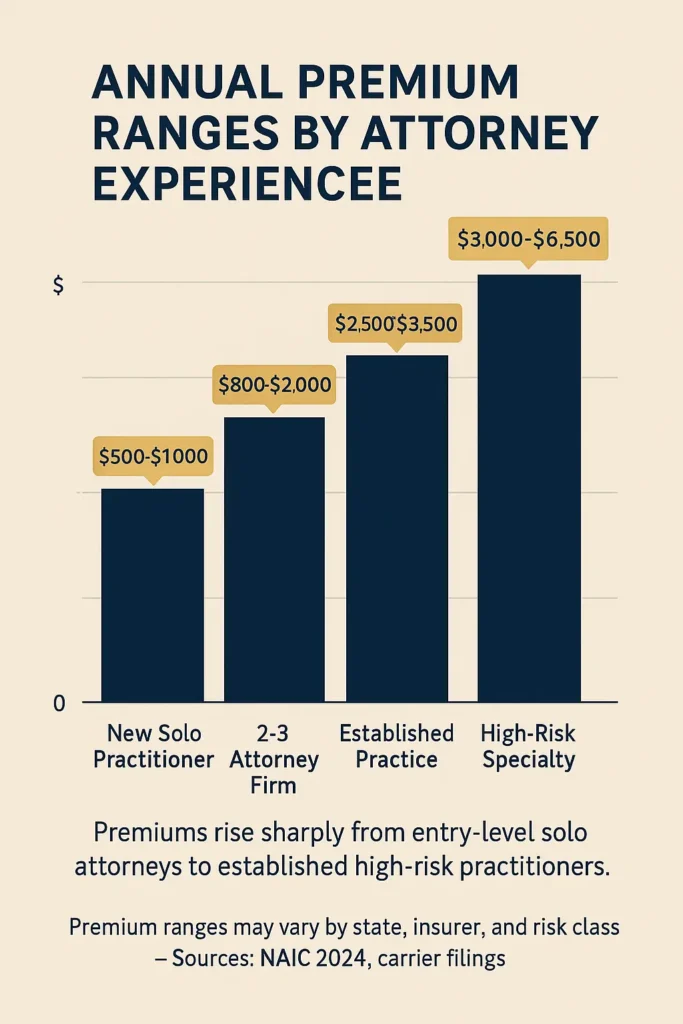

Legal malpractice insurance premiums in 2025 reflect significant market variations based on multiple risk factors and coverage requirements. Industry data shows cost legal malpractice insurance ranges from $500 for new attorneys in low-risk practice areas to $6,500 for experienced lawyers in high-risk specialties with extensive coverage limits. Analyzing cost legal malpractice insurance trends reveals substantial premium increases across most jurisdictions, making cost comparison essential for budget planning.

Premium Range by Attorney Experience:

| Attorney Profile | Annual Premium Range | Coverage Limits | Key Factors |

|---|---|---|---|

| New Solo Practitioner | $500 – $1,000 | $100K/$300K | No prior acts, limited practice |

| 2-3 Attorney Firm | $800 – $2,000 | $250K/$500K | Step-rating applies |

| Established Practice | $2,500 – $3,500 | $1M/$1M | Full maturity rating |

| High-Risk Specialty | $3,000 – $6,500 | $1M/$2M+ | Securities, IP, class action |

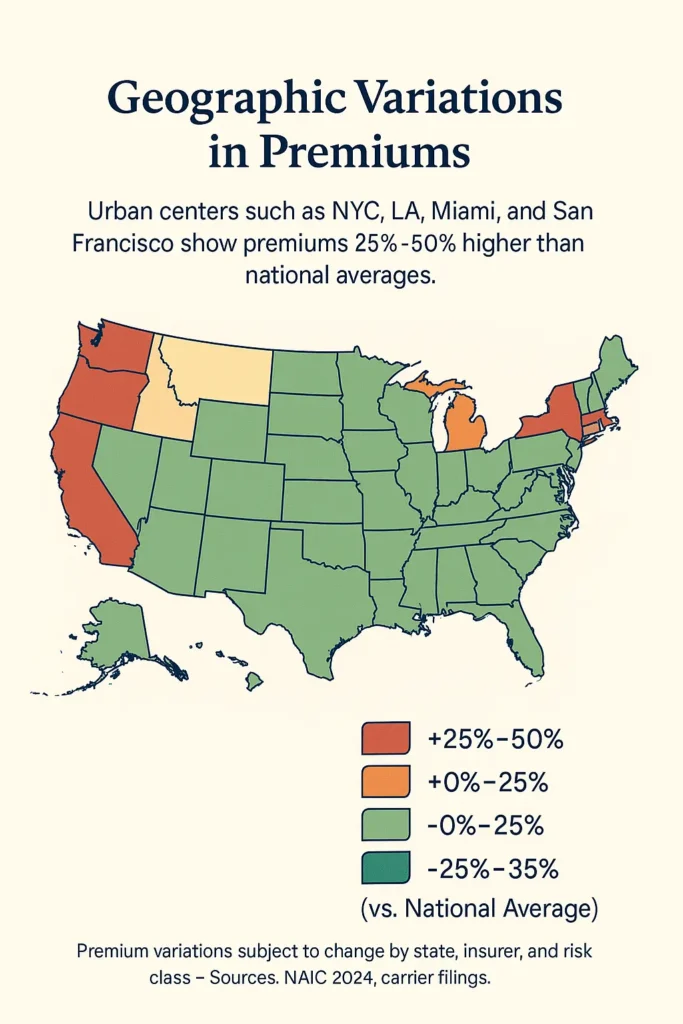

Geographic location creates substantial premium variations, with metropolitan areas commanding 25-50% higher rates than rural jurisdictions. New York City, Los Angeles, Miami, and San Francisco represent the highest-cost markets, while rural areas may see premiums 35% below national averages. Understanding regional variations in cost legal malpractice insurance helps attorneys budget effectively and consider relocation impacts on professional liability expenses.

The step-rating system significantly impacts cost legal malpractice insurance during the first five to seven years of practice. New lawyers start at step one with reduced premiums, reflecting lower caseloads and claim exposure. Each subsequent year increases the rating step as case volumes grow and potential claims develop, creating a graduated premium structure until reaching mature practitioner status.

PRO TIP: Most carriers offer payment plan options that allow quarterly or monthly premium payments, helping solo practitioners manage cash flow while maintaining continuous coverage.

Defense costs represent a critical component often overlooked when evaluating cost legal malpractice insurance. Even unsuccessful claims average $80,000 in defense expenses, with complex cases reaching $200,000 or more. This reality makes adequate coverage limits essential regardless of premium considerations. Attorneys must factor defense cost exposure when determining appropriate cost legal malpractice insurance budgets and coverage selections.

What Factors Determine Legal Malpractice Insurance Premiums?

Practice area specialization creates the most significant impact on cost legal malpractice insurance, with risk levels varying dramatically across different legal disciplines. Insurance carriers maintain detailed claims data showing clear patterns of exposure that directly influence premium calculations. Attorneys switching practice areas must reassess cost legal malpractice insurance implications and potential premium changes before making transitions.

Practice Area Risk Classifications:

| Risk Level | Practice Areas | Premium Impact | Claims Frequency |

|---|---|---|---|

| Low Risk | Criminal defense, immigration, insurance defense | -30% to -50% | 1-2% annually |

| Moderate Risk | Family law, business transactions, bankruptcy | Standard rates | 3-4% annually |

| High Risk | Personal injury plaintiff, real estate, trusts/estates | +25% to +50% | 5-7% annually |

| Highest Risk | Securities law, medical malpractice, intellectual property | +100% to +300% | 8-12% annually |

Firm size and attorney count influence cost legal malpractice insurance through economies of scale and shared risk distribution. Two-attorney firms typically pay slightly less than double solo practitioner rates, while larger firms benefit from improved risk spreading across multiple professionals. Growth planning should incorporate cost legal malpractice insurance scaling to ensure budget accuracy and adequate protection levels.

Coverage limits selection directly correlates with premium costs, following a predictable scaling pattern. The minimum $100,000/$300,000 limits serve as the baseline, with $250,000/$500,000 coverage costing approximately 35% more. Each subsequent limit increase typically adds 10-15% to the annual premium.

IMPORTANT NOTE: Claims-made policies require careful consideration of retroactive dates and extended reporting periods, as gaps in coverage can create significant exposure for prior acts.

Geographic jurisdiction affects cost legal malpractice insurance through state-specific legal environments, jury award patterns, and regulatory frameworks. Professional liability insurance protection varies significantly based on local court systems and damage award histories. Multi-state practices must evaluate cost legal malpractice insurance variations across jurisdictions to optimize coverage and premium allocation strategies.

Claims history represents the most critical underwriting factor, with even minor settlements creating long-term premium impacts. Most carriers apply surcharges for three to five years following any paid claim, regardless of the settlement amount or fault determination.

How Do Coverage Limits Affect Insurance Costs?

Coverage limit selection represents a critical decision point affecting both cost legal malpractice insurance and adequate protection levels. Industry standard limits begin at $100,000 per claim with $300,000 annual aggregate, though many legal professionals find these minimums insufficient for meaningful protection.

The relationship between limits and premiums follows a predictable but non-linear progression. While doubling coverage limits doesn’t double premiums, significant cost increases occur at each major threshold. Understanding this pricing structure helps attorneys make informed decisions about optimal coverage levels.

Coverage Limits Pricing Structure:

| Per Claim Limit | Annual Aggregate | Premium Increase | Recommended For |

|---|---|---|---|

| $100,000 | $300,000 | Baseline | New solos only |

| $250,000 | $500,000 | +35% | Small firms |

| $500,000 | $1,000,000 | +65% | Established practices |

| $1,000,000 | $2,000,000 | +90% | High-risk practices |

| $2,000,000 | $4,000,000 | +150% | Major firm exposure |

Higher limits provide essential protection against catastrophic claims while offering additional benefits beyond basic coverage. Increased limits typically include enhanced defense coverage, broader policy definitions, and additional protections for regulatory proceedings.

WARNING: Inadequate limits can result in personal asset exposure, as legal malpractice claims frequently exceed minimum coverage amounts, particularly in complex commercial transactions or high-value personal injury cases.

The aggregate limit consideration becomes crucial for busy practices handling numerous matters simultaneously. Multiple smaller claims within a single policy year can quickly exhaust annual aggregate limits, leaving attorneys exposed for subsequent claims until policy renewal.

Cost legal malpractice insurance evaluation must balance premium affordability with realistic exposure assessment. How much is business insurance analysis reveals that adequate professional liability limits typically represent 1-3% of annual firm revenue, providing a useful benchmark for coverage decisions.

What Practice Areas Have the Highest Insurance Costs?

Securities law and intellectual property practices command the highest cost legal malpractice insurance premiums due to extraordinary claim exposure and potential damages. These specialized practice areas involve complex transactions with significant financial consequences, creating elevated risk profiles that carriers reflect in premium pricing. Attorneys entering these fields must budget substantially higher cost legal malpractice insurance amounts compared to general practice areas.

Securities work presents unique challenges as claims often involve substantial financial losses affecting multiple parties. Patent and trademark work carries similar risks due to the specialized knowledge required and potential for costly mistakes with long-term business implications. These factors combine to create premium surcharges of 100-300% above standard rates.

High-Risk Practice Area Analysis:

| Practice Area | Risk Multiplier | Average Claim Size | Common Issues |

|---|---|---|---|

| Securities Placement | 3-4x standard | $500K – $5M | Disclosure failures, regulatory violations |

| Patent Law | 2-3x standard | $200K – $2M | Prior art issues, prosecution errors |

| Class Action Work | 3-5x standard | $1M – $10M+ | Settlement complications, conflict issues |

| Medical Malpractice Defense | 2-3x standard | $300K – $3M | Missed deadlines, inadequate investigation |

Trust and estate planning presents moderate to high risk levels due to the long-term nature of potential claims and the involvement of non-client beneficiaries. These cases often involve substantial assets and complex family dynamics, creating multiple exposure points for practitioners.

Real estate transactions carry elevated risk due to the high-value nature of property deals and the potential for title issues, financing complications, and regulatory compliance problems. The interconnected nature of real estate transactions means errors can affect multiple parties and create cascading liability exposure.

PRO TIP: Attorneys practicing in multiple areas should disclose all practice concentrations to ensure proper underwriting and avoid coverage gaps that could void claims in excluded practice areas.

Conversely, criminal defense and immigration law typically command the lowest cost legal malpractice insurance due to limited civil liability exposure. These practice areas focus primarily on constitutional and statutory interpretation rather than financial transactions, reducing the potential for large monetary damages. Attorneys in these specialties often achieve the most favorable cost legal malpractice insurance rates while maintaining adequate protection levels.

The emergence of new practice areas creates additional underwriting challenges as carriers lack historical claims data. Areas like cryptocurrency law, artificial intelligence regulation, and data privacy compliance may face higher initial premiums due to unknown risk profiles. Early adopters in emerging fields should expect elevated cost legal malpractice insurance until sufficient claims experience develops for accurate risk assessment.

How Can Law Firms Reduce Malpractice Insurance Costs?

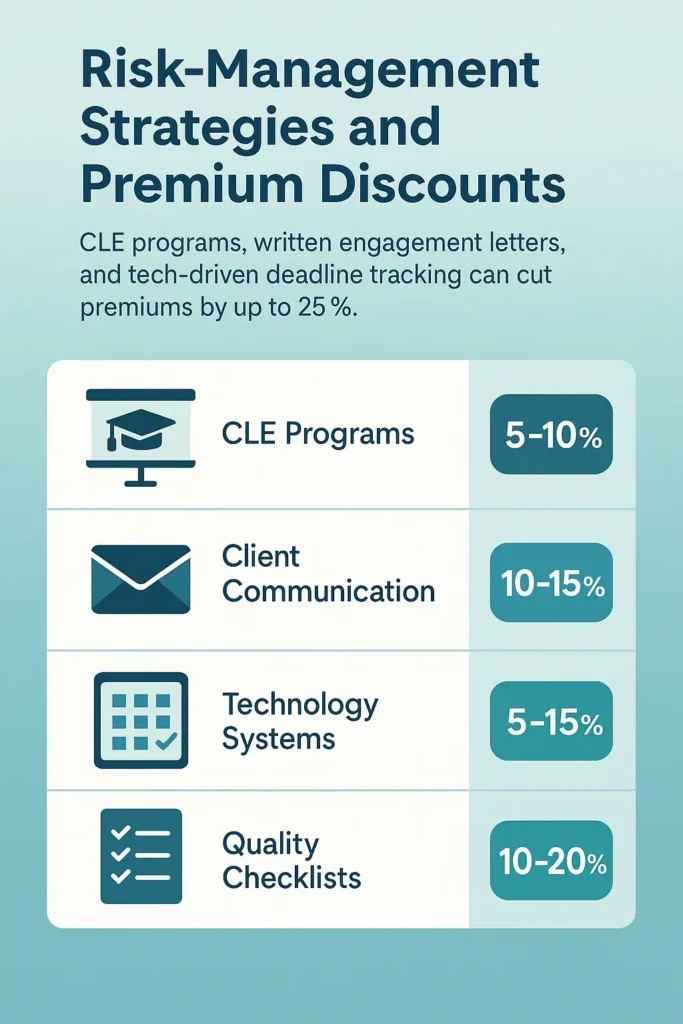

Risk management programs represent the most effective long-term strategy for reducing cost legal malpractice insurance while improving practice quality. Carriers increasingly offer premium discounts for firms implementing comprehensive risk management protocols, recognizing the correlation between proactive measures and reduced claim frequency. Strategic investment in risk management often produces measurable reductions in cost legal malpractice insurance over time.

Systematic practice management reduces exposure through standardized procedures, client communication protocols, and deadline tracking systems. Many successful firms adopt manufacturing-style quality control processes adapted for legal services, creating measurable improvements in risk profiles that carriers recognize through reduced premiums.

Effective Risk Management Strategies:

| Strategy | Implementation | Premium Impact | Additional Benefits |

|---|---|---|---|

| CLE Programs | Annual risk management training | 5-10% discount | Improved practice quality |

| Client Communication | Written engagement letters, regular updates | 10-15% reduction | Fewer misunderstandings |

| Technology Systems | Calendar management, conflict checking | 5-15% discount | Operational efficiency |

| Quality Checklists | Standardized procedures for common tasks | 10-20% reduction | Consistent service delivery |

Deductible selection provides immediate premium savings opportunities for firms willing to retain more risk. Higher deductibles can reduce premiums by 10-25%, though careful consideration of cash flow implications remains essential. Self-insured retentions work similarly but require more substantial financial resources.

Claims-free discounts reward attorneys maintaining clean records over extended periods. Many carriers offer graduated discounts increasing over time, creating incentives for consistent risk management. These discounts can reach 15-25% for attorneys with five or more years without claims.

IMPORTANT NOTE: Comparing carriers annually ensures competitive pricing, as different insurers may view specific risk profiles more favorably, leading to significant premium variations for identical coverage.

Group purchasing through bar associations or professional organizations can provide access to specialized programs designed for legal professionals. These arrangements often feature competitive pricing, enhanced coverage features, and simplified underwriting processes. Complete workers comp requirements by state coordination with malpractice coverage can create additional efficiencies and cost savings.

Early career attorneys should consider carriers offering new lawyer programs with extended payment terms and reduced initial premiums. These programs recognize the financial challenges facing new practitioners while ensuring adequate protection during the critical early practice years. Specialized new attorney programs often provide the most affordable cost legal malpractice insurance options for recent law school graduates.

Should You Buy Legal Malpractice Insurance?

Legal malpractice insurance serves as essential protection for practicing attorneys, with the question shifting from whether to buy coverage to determining optimal coverage levels. The financial consequences of defending even frivolous claims make cost legal malpractice insurance a necessary business expense rather than an optional consideration.

Professional liability exposure begins immediately upon client representation, regardless of experience level or practice area. Even criminal defense attorneys face potential civil liability for ineffective assistance of counsel claims, while transactional lawyers risk substantial exposure for missed deadlines, inadequate due diligence, or conflict of interest violations. All practicing attorneys must evaluate cost legal malpractice insurance needs from the moment they begin client representation.

State requirements vary significantly regarding mandatory malpractice insurance. While most states don’t require coverage, some mandate disclosure to clients when attorneys practice without insurance. Oregon requires all attorneys to carry minimum coverage or obtain client consent, while several other states consider similar mandates.

Coverage Decision Factors:

| Consideration | Impact on Decision | Risk Assessment | Financial Implications |

|---|---|---|---|

| Personal Assets | High exposure requires coverage | Evaluate net worth protection | Potential bankruptcy risk |

| Practice Area | High-risk areas need enhanced limits | Claims frequency analysis | Catastrophic loss potential |

| Client Base | Sophisticated clients expect coverage | Professional credibility | Competitive positioning |

| Firm Structure | Partnership creates shared liability | Joint and several exposure | Cross-indemnification issues |

The “going bare” decision creates substantial personal financial risk that few attorneys can adequately self-insure. Average legal malpractice settlements exceed $300,000, while defense costs alone typically range from $50,000 to $100,000 per claim. These figures far exceed the annual premium costs for adequate coverage. Comparing potential liability exposure to annual cost legal malpractice insurance premiums clearly demonstrates the value proposition of maintaining coverage.

Professional reputation protection represents an often-overlooked benefit of malpractice insurance. Carriers provide access to experienced defense counsel specializing in legal malpractice, ensuring competent representation during claims proceedings. The insurance company’s financial resources and legal expertise often prove invaluable during stressful claim situations.

WARNING: Attempting to self-insure legal malpractice exposure rarely proves cost-effective, as the capital requirements for adequate reserves typically exceed decades of insurance premiums while providing no guaranteed protection.

Client confidence increases significantly when attorneys maintain professional liability coverage. Many sophisticated clients specifically request proof of insurance before engaging counsel, particularly for complex transactions or high-stakes litigation matters.

FAQ

How much does legal malpractice insurance cost for solo practitioners?

Solo practitioners typically pay $500-$1,000 annually for their first legal malpractice insurance policy, depending on practice area and coverage limits. New attorneys without prior acts coverage and practicing in low-risk areas like criminal defense or immigration may secure basic coverage for $500, while those in moderate-risk practices might pay $800-$1,000. Premiums increase through step-rating over the first five years as caseloads and exposure develop. Business insurance compliance requirements often integrate with malpractice coverage for comprehensive protection. Understanding entry-level cost legal malpractice insurance helps new attorneys budget appropriately for essential protection.

How long does it take to get legal malpractice insurance?

Legal malpractice insurance applications can be completed and approved within 24-48 hours for straightforward cases, with some carriers offering online applications that provide immediate coverage. Solo practitioners with clean records and standard practice areas can often secure coverage in as little as 10 minutes through streamlined online platforms. More complex applications involving multiple attorneys, high-risk practice areas, or prior claims may require 1-2 weeks for underwriting review. Federal insurance oversight ensures carrier solvency and claims-paying ability.

What is the average legal malpractice settlement amount?

Legal malpractice settlements average approximately $300,000 across all practice areas, though amounts vary significantly based on case specifics and damages involved. High-risk practice areas like securities law or complex business transactions often see settlements exceeding $1 million, while routine matters may settle for $50,000-$150,000. Recent industry data shows 70% of insurers paid claims exceeding $50 million in 2023, with some reaching $300 million for catastrophic cases. Defense costs alone typically range $50,000-$100,000 regardless of settlement amounts.

Can law firms get group discounts on malpractice insurance?

Law firms can secure group discounts through bar association programs, professional liability groups, and carrier-specific multi-attorney policies. Group purchasing arrangements often provide 5-15% premium savings compared to individual policies, along with enhanced coverage features and simplified administration. Larger firms benefit from economies of scale and risk distribution across multiple attorneys. Professional associations frequently negotiate specialized programs offering competitive pricing and tailored coverage for members practicing in specific areas.

How do claims-made policies affect insurance costs?

Claims-made policies typically cost 10-20% less than occurrence-based coverage due to more predictable loss development for insurers. However, these policies require continuous renewal to maintain protection for prior acts, and attorneys changing carriers must purchase expensive tail coverage or secure prior acts coverage from new insurers. Extended reporting periods can cost 150-300% of annual premiums. Professional liability insurance protection analysis helps determine optimal policy structure based on career planning and risk tolerance.

What happens if I practice without malpractice insurance?

Practicing without legal malpractice insurance exposes attorneys to unlimited personal liability for professional errors, potentially resulting in personal bankruptcy or asset seizure. While most states don’t mandate coverage, some require disclosure to clients when attorneys practice “bare.” Without insurance, attorneys must personally fund defense costs averaging $80,000 per claim and any settlements or judgments. Professional credibility may suffer as sophisticated clients increasingly expect attorneys to maintain adequate coverage. The personal financial risk of practicing without protection far exceeds reasonable cost legal malpractice insurance premiums.

Conclusion

Cost legal malpractice insurance represents a critical investment in professional protection that no practicing attorney should overlook. With annual premiums ranging from $500 for new practitioners to $6,500 for high-risk specialties, the cost remains modest compared to potential claim exposure averaging $300,000 in settlements plus substantial defense expenses.

The key to optimizing cost legal malpractice insurance lies in understanding the factors driving premium calculations and implementing strategic risk management practices. Practice area selection, coverage limits, geographic location, and claims history create the primary variables affecting annual costs, while proactive risk management can generate meaningful premium discounts over time.

Professional liability protection serves multiple purposes beyond basic claim coverage, including access to specialized defense counsel, regulatory proceeding coverage, and enhanced professional credibility with sophisticated clients. The financial and reputational consequences of practicing without adequate coverage far outweigh the annual premium investment required for comprehensive protection.

Key Takeaways

Essential Cost Ranges: Legal malpractice insurance costs vary from $500-$6,500 annually based on experience, practice area, and coverage limits, with comprehensive policies typically ranging $2,500-$3,500 for established practitioners. Understanding cost legal malpractice insurance ranges helps attorneys plan budgets appropriately.

Practice Area Impact: High-risk specialties like securities law and intellectual property command premiums 2-4 times higher than low-risk areas like criminal defense, reflecting significant differences in claim frequency and severity.

Risk Management Benefits: Implementing systematic quality control procedures, continuing education programs, and effective client communication protocols can reduce premiums by 10-25% while improving practice quality.

Coverage Adequacy: Minimum policy limits of $100,000/$300,000 provide insufficient protection for most practices, with recommended coverage of $1,000,000/$2,000,000 or higher for adequate protection against catastrophic claims.

Professional Necessity: The average defense cost of $80,000 per claim and settlement amounts averaging $300,000 make malpractice insurance essential for protecting personal assets and maintaining professional credibility.

Disclaimer

Data Freshness: Insurance rates and regulations change frequently. Data accuracy depends on timing of official releases and may vary from current market conditions.

Geographic Variations: Insurance requirements vary significantly by state. Always consult your state’s insurance department and bar association for specific requirements and recommendations.

Professional Advice: This information is for educational purposes only. Insurance decisions should be made in consultation with licensed professionals familiar with your specific practice circumstances and risk profile.