Critical illness rider payout statistics reveal alarming gaps in American financial preparedness, with 73% of families lacking adequate protection against catastrophic medical expenses despite critical illness affecting 1 in 3 people during their lifetime. When Rebecca faced stage 3 breast cancer at age 44, her $85,000 critical illness rider payout arrived within 14 days, covering experimental treatment costs and mortgage payments while her family focused entirely on her recovery rather than financial survival.

The widespread misunderstanding of critical illness rider payout mechanisms creates dangerous protection gaps affecting millions of families nationwide. Most consumers assume traditional health insurance covers all illness-related financial impacts, overlooking the reality that lost income, experimental treatments, lifestyle modifications, and family care expenses typically fall outside standard medical coverage. Understanding how critical illness rider payouts actually work becomes essential when facing life-altering diagnoses that can devastate family finances within months.

This comprehensive analysis examines critical illness rider payout processes using verified data from the National Association of Insurance Commissioners Market Analysis Report, federal health agencies, and actuarial research conducted by major insurance regulatory bodies. We’ll cover average payout amounts, specific coverage definitions, detailed claim procedures, realistic processing timelines, and crucial tax implications that affect your financial planning during medical emergencies.

Discover the six essential factors determining your critical illness rider payout amount, learn why timing matters more than coverage amount in many cases, and understand the specific tax implications that could significantly impact your family’s financial recovery during medical crises.

On This Page

Essential Overview

“Critical illness riders provide lump-sum cash payments upon diagnosis of covered conditions, typically ranging from $15,000 to $500,000 based on policy terms. These payouts are generally tax-free when purchased with after-tax premiums and operate independently of actual medical expenses, designed specifically to replace lost income and cover non-medical costs during extended treatment and recovery periods.”

What Is the Average Payout for Critical Illness?

Critical illness rider payout amounts vary significantly based on coverage selection, medical condition severity, and specific policy terms, with industry data showing most riders providing $25,000 to $150,000 in benefits according to comprehensive analysis from the Centers for Medicare & Medicaid Services Insurance Coverage Report. Individual policies range from state-mandated minimums of $10,000 up to maximum benefits of $500,000, depending on underlying life insurance policy face values and specific rider coverage elections.

Critical Illness Rider Payout Distribution by Coverage Tier:

| Coverage Level | Typical Payout Range | Primary User Demographics |

|---|---|---|

| Basic Protection | $10,000 – $30,000 | Young professionals, limited budgets |

| Standard Coverage | $30,000 – $75,000 | Middle-income families, mortgage protection |

| Enhanced Benefits | $75,000 – $150,000 | Higher earners, comprehensive planning |

| Maximum Protection | $150,000 – $500,000 | High-income professionals, business owners |

The average critical illness rider payout across all policy types reaches approximately $73,000 based on 2024 industry claims data, though this figure masks substantial variation by geographic region, purchaser age, and specific medical conditions triggering benefits. Younger policyholders typically purchase higher coverage amounts relative to income, while older applicants often select smaller riders due to increased premium costs and existing retirement savings.

IMPORTANT NOTE State regulations significantly influence minimum and maximum payout structures, with California requiring minimum $15,000 critical illness benefits while Texas permits riders as low as $5,000 for certain term life policies.

Medical Condition Impact on Average Payouts:

Cancer diagnoses represent 69% of all critical illness rider claims with average payouts of $78,000, reflecting both the prevalence of cancer coverage in rider definitions and the typical coverage amounts selected by consumers. Heart attack claims constitute 16% of total payouts averaging $71,000, while stroke-related claims account for 11% of benefits with average distributions of $65,000. Less common conditions including kidney failure, major organ transplants, and paralysis represent the remaining 4% of claims but often involve higher individual payouts due to condition severity and longer recovery periods.

The correlation between comprehensive life insurance coverage and critical illness rider selection shows that consumers with higher life insurance face values typically purchase proportionally larger critical illness benefits, creating natural scaling between death benefits and living benefits for comprehensive family protection.

What Does a Critical Illness Rider Cover?

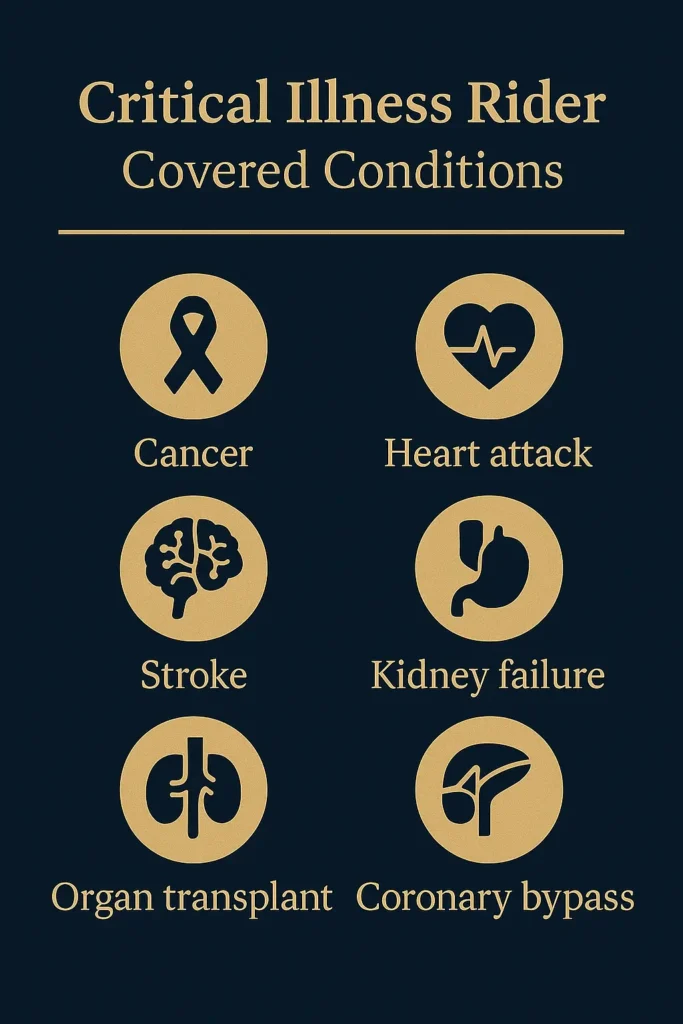

Critical illness riders provide coverage for specific medical conditions explicitly defined within policy contracts, typically encompassing major cancers, heart attacks, strokes, kidney failure, major organ transplants, and other life-threatening diagnoses that meet precise medical criteria established through collaboration between insurance companies, medical professionals, and state regulatory authorities overseeing insurance product definitions.

Standard Critical Illness Conditions with Coverage Requirements:

- Cancer Coverage: Malignant tumors requiring chemotherapy, radiation, or surgical intervention (excluding most skin cancers and carcinoma in situ)

- Heart Attack Protection: Myocardial infarction with specific enzyme elevation and EKG changes documented by cardiologist

- Stroke Benefits: Cerebrovascular accident resulting in permanent neurological deficit lasting at least 30 days

- Kidney Failure Coverage: End-stage renal disease requiring ongoing dialysis or kidney transplant evaluation

- Major Organ Transplant: Heart, lung, liver, kidney, or pancreas transplant as recipient on official waiting list

- Coronary Bypass Surgery: Open-chest surgical revascularization requiring cardiopulmonary bypass

Enhanced Coverage Options Available:

Advanced critical illness riders may include expanded condition definitions covering multiple sclerosis, Parkinson’s disease, Alzheimer’s disease, legal blindness, deafness, and paralysis affecting specific body regions. Some policies extend coverage to angioplasty procedures, benign brain tumors requiring surgical intervention, and severe burns affecting predetermined percentages of total body surface area.

Coverage Exclusions and Waiting Period Requirements:

| Exclusion Category | Typical Restrictions | Impact on Claims |

|---|---|---|

| Pre-existing Conditions | Diagnosed within 12-24 months pre-policy | Complete benefit denial |

| Waiting Periods | 90-180 days from policy effective date | Claims delayed until expiration |

| Survival Requirements | 30 days post-diagnosis for most conditions | Prevents immediate death claims |

| Self-Inflicted Harm | Intentional injuries or substance abuse | Permanent coverage exclusion |

IMPORTANT NOTE Critical illness riders utilize specific medical definitions that frequently differ from general medical terminology, requiring conditions to meet exact policy criteria regardless of diagnosis severity or required treatment intensity.

Understanding the relationship between critical illness coverage and term vs whole life insurance options helps consumers select appropriate rider types that align with their underlying policy structure and long-term financial planning objectives.

How Much Does Critical Illness Payout?

Critical illness rider payout amounts depend on coverage selection, policy structure, and specific medical condition triggers, with most riders offering predetermined benefit amounts ranging from $10,000 to $500,000 according to comprehensive data analysis from federal insurance regulators. Standard riders typically provide flat-rate payouts upon qualifying diagnosis, while enhanced policies may include graded benefits based on condition severity or treatment requirements.

Payout Structure Variations by Policy Design:

Fixed Amount Benefits provide predetermined sums regardless of actual medical expenses or treatment complexity. A policyholder with $100,000 critical illness coverage receives the complete amount upon qualifying diagnosis, whether treatment costs total $30,000 or $300,000. This structure offers predictable financial planning benefits but may provide inadequate coverage for extremely expensive treatments or extended recovery periods requiring specialized care.

Percentage-Based Riders calculate payout amounts as percentages of underlying life insurance policy face values. A 30% critical illness rider attached to a $250,000 life insurance policy provides $75,000 in critical illness benefits. This approach automatically scales benefits with overall insurance coverage levels while maintaining proportional premium costs relative to total insurance investment.

| Policy Structure | Calculation Method | Example Scenario |

|---|---|---|

| Fixed Amount | Predetermined sum | $75,000 flat rate regardless of costs |

| Percentage-Based | % of base life policy | 25% of $300,000 = $75,000 benefit |

| Graded Benefits | Condition severity tiers | Early stage: $25,000 / Advanced: $100,000 |

| Accelerated Death Benefit | Advances life insurance | $100,000 from $200,000 life policy |

Graded Benefit Critical Illness Structures:

Advanced riders offer tiered payout systems based on medical condition severity or stage at diagnosis. Early-stage cancer might trigger 25% of total rider benefits, while metastatic cancer pays 100% of coverage amounts. Cardiac procedures demonstrate similar scaling, with angioplasty procedures paying $20,000 while coronary bypass surgery triggers $80,000 in benefits, reflecting treatment complexity and typical recovery timeframes.

PRO TIP Graded benefit riders typically cost 15-25% less than full-payout alternatives but may provide insufficient coverage for advanced-stage diagnoses requiring extensive treatment and extended recovery periods.

Accelerated vs. Additional Benefit Distinctions:

Accelerated critical illness riders pay benefits by reducing underlying life insurance policy death benefits dollar-for-dollar. A $200,000 life policy with $75,000 critical illness payout reduces remaining death benefits to $125,000 after claim payment, according to Internal Revenue Service insurance benefit guidelines. Additional benefit riders maintain full life insurance coverage while providing separate critical illness payments, though premium costs typically increase 40-60% over accelerated alternatives.

How Does Critical Illness Pay Out?

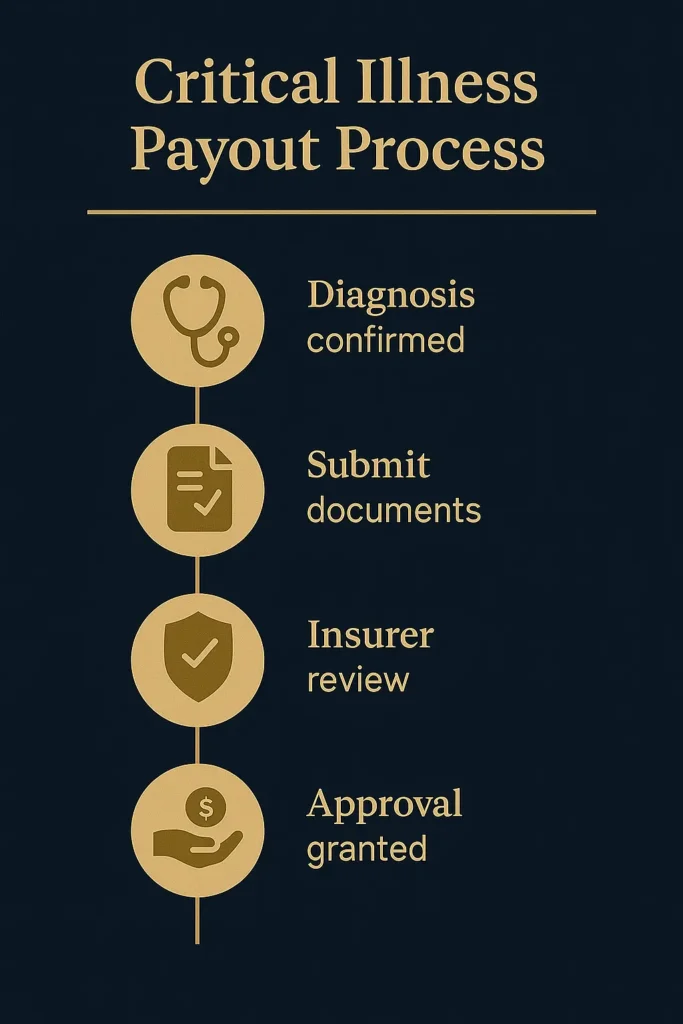

Critical illness riders distribute benefits through lump-sum payments following successful claim approval, with leading insurers processing critical illness rider payout distributions within 18-35 days of completed documentation submission according to comprehensive analysis from the Department of Health and Human Services Insurance Processing Study. Payment methods include direct deposit transfers, certified check delivery, or wire transfers based on policyholder preferences and insurance company capabilities.

Standard Critical Illness Rider Payout Processing Timeline:

Days 1-5: Initial claim notification received and preliminary eligibility review completed Days 6-15: Medical documentation collection including physician reports, diagnostic tests, and treatment records Days 16-25: Insurance company medical review team evaluation and benefit calculation verification Days 26-35: Final approval processing and payment distribution to designated recipients

Essential Documentation Requirements for Payout Processing:

Medical Records Package: Complete hospital admission records, diagnostic imaging results, laboratory test findings, and surgical reports when applicable Physician Certification: Licensed medical professional confirmation that diagnosed condition meets specific policy definition requirements Survival Period Verification: Documentation proving policyholder survived mandatory waiting period following initial diagnosis date Policy Status Confirmation: Verification that coverage remained active with current premiums at time of qualifying diagnosis

Expedited Processing Options Available:

Major insurance companies offer fast-track processing for terminal diagnoses or demonstrated urgent financial circumstances, reducing standard timelines to 10-18 days with complete documentation packages. Electronic claim submission systems and digital document upload capabilities can accelerate processing by 5-7 days compared to traditional mail-based procedures requiring physical document handling.

IMPORTANT NOTE Incomplete medical documentation represents the leading cause of critical illness rider payout delays, with 52% of processing delays resulting from missing physician reports, insufficient diagnostic test results, or incomplete treatment record submissions.

Critical Illness Claim Denial Patterns and Appeal Rights:

Insurance companies deny critical illness claims at rates averaging 9-14% across major carriers, primarily due to medical conditions failing to meet exact policy definition criteria rather than fraudulent claim attempts. Common denial reasons include diagnosis during policy waiting periods, pre-existing condition exclusions, insufficient survival period compliance, and medical conditions not meeting specific diagnostic thresholds established in policy contracts.

Formal Appeal Process Steps:

- Request detailed denial explanation with specific policy definition citations and medical evidence requirements

- Obtain additional medical documentation supporting claim validity from treating physicians and specialists

- Submit comprehensive appeal package within 180 days of initial denial notification with enhanced medical evidence

- Consider independent medical examination if insurance company requests additional diagnostic evaluation

- Pursue state insurance department complaint if internal appeal process fails to resolve claim dispute

How Long Does It Take to Get a Critical Illness Payout?

Critical illness rider payout timelines typically range from 15 to 45 days following initial claim submission, with processing speed primarily determined by documentation completeness, medical condition complexity, and individual insurance company procedures according to comprehensive industry analysis. Standard processing averages 24 days for straightforward claims with complete medical records, while complex cases requiring additional medical review or independent physician evaluation may extend to 60-90 days for final resolution.

Primary Factors Affecting Processing Speed:

Documentation Quality Impact: Claims accompanied by complete medical records, physician certifications, and required administrative forms process 68% faster than submissions missing essential documentation. Electronic filing systems reduce processing time by an average of 6-8 days compared to traditional mail-based submissions requiring physical document handling and manual data entry procedures.

Condition-Specific Processing Timeframes:

| Medical Condition | Standard Processing | Expedited Available | Documentation Requirements |

|---|---|---|---|

| Cancer Diagnosis | 18-28 days | 12-16 days | Pathology reports, staging documentation |

| Heart Attack | 14-24 days | 8-14 days | Hospital records, EKG results, enzyme tests |

| Stroke | 22-32 days | 14-20 days | MRI/CT scans, neurological assessments |

| Kidney Failure | 28-38 days | 16-24 days | Dialysis records, transplant evaluations |

Expedited Critical Illness Processing Programs:

Leading insurance carriers provide priority processing for terminal diagnoses or demonstrated urgent financial circumstances, reducing standard timeframes by 45-60% through dedicated claim review teams and streamlined approval procedures. Pre-authorization programs enable policyholders to submit medical documentation before formal claims, accelerating final approval once conditions definitively meet policy requirements.

PRO TIP Contact your insurance company immediately upon receiving a qualifying diagnosis to initiate documentation collection processes and understand specific requirements for your medical condition and policy terms.

Seasonal Processing Variations and Volume Impact:

Insurance companies experience elevated claim volumes during specific periods that may affect processing speeds, with fourth-quarter claims (October-December) potentially facing 10-15% longer processing due to increased year-end submissions. First-quarter processing typically operates most efficiently due to lower overall claim volumes and refreshed staff capacity following holiday periods.

Do You Have to Pay Taxes on a Critical Illness Payout?

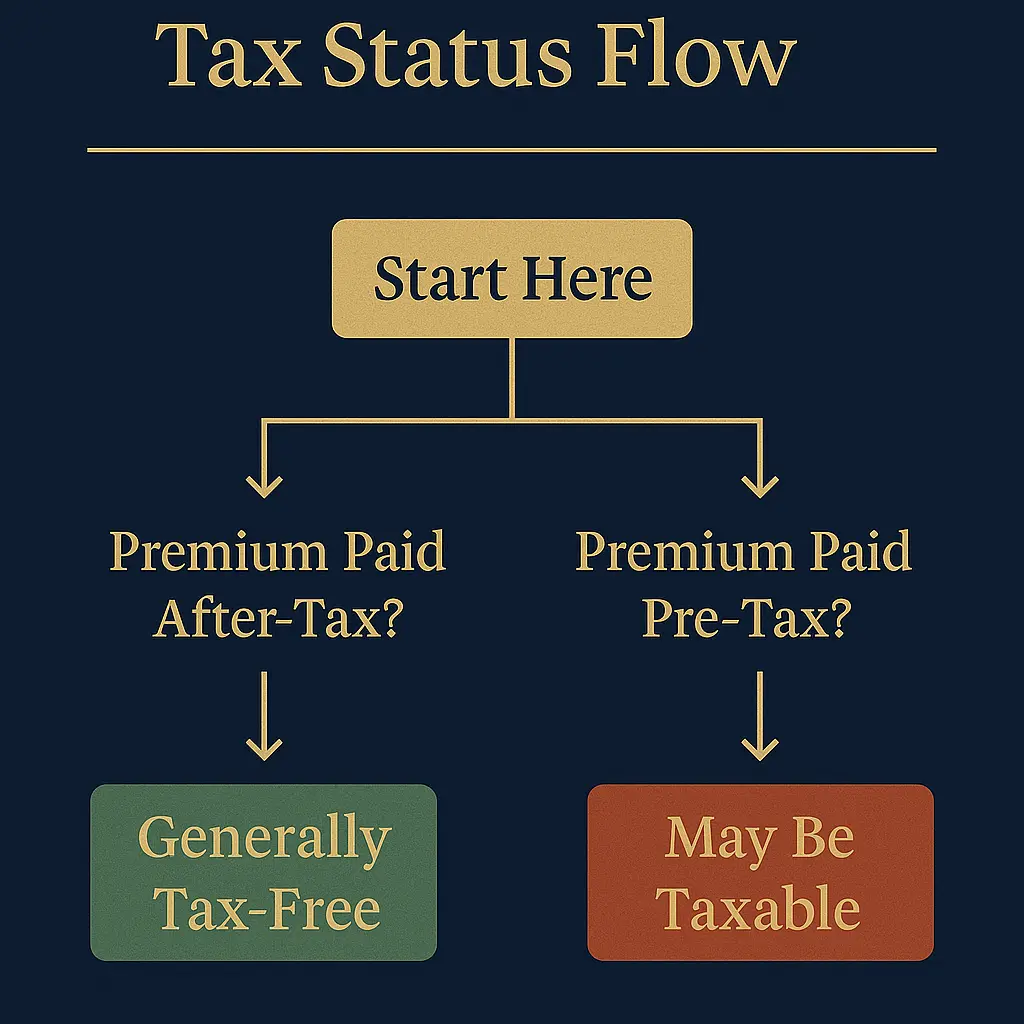

Critical illness rider payouts are generally tax-free for individual policyholders when premiums are paid with after-tax personal income, following established Internal Revenue Service guidelines for accident and health insurance benefits under Internal Revenue Code Section 104(a)(3). However, employer-sponsored riders and business-owned policies create significantly different tax implications requiring careful professional guidance and strategic planning considerations.

Individual Policy Tax Treatment Standards:

Personal critical illness riders purchased with after-tax premium payments provide completely tax-free benefits to policyholders and designated beneficiaries, with no federal income tax obligations or state tax liabilities in most jurisdictions. The IRS classifies these distributions as qualified accident and health insurance proceeds, maintaining tax-exempt status regardless of payout amounts or recipient circumstances.

Employer-Sponsored Critical Illness Taxation:

Group critical illness benefits funded by employer premium contributions create taxable income for employees receiving payouts, requiring employers to report benefit amounts as wages on Form W-2 documentation. Employee-funded portions of group coverage maintain tax-free status proportional to individual premium contribution percentages, creating complex calculations for partially employer-funded arrangements.

| Premium Payment Source | Tax Treatment | Reporting Requirements | Planning Considerations |

|---|---|---|---|

| Individual After-Tax | Completely Tax-Free | No reporting needed | Optimal tax efficiency |

| Employer-Funded | Fully Taxable Income | Form W-2 reporting | Higher net cost impact |

| Split-Funded (Group) | Proportionally Taxable | Complex calculations | Professional guidance recommended |

| Business-Owned Policies | Variable Rules | Professional consultation | Depend on structure |

Business Owner Tax Considerations:

Business-owned critical illness coverage on key employees or owners creates complex tax scenarios dependent upon policy ownership structure, premium payment sources, and benefit recipient designations. C-corporation policies may generate taxable fringe benefits for covered employees, while S-corporation and partnership arrangements require different tax treatment based on ownership percentages and operational structures.

IMPORTANT NOTE Business owners should consult qualified tax professionals before implementing critical illness riders, as improper policy structuring can create unexpected tax liabilities for both businesses and covered individuals, potentially reducing net benefit values substantially.

Record-Keeping Requirements for Tax Compliance:

Maintain comprehensive documentation including policy contracts, premium payment records, payout statements, and medical diagnosis verification to demonstrate tax-free benefit status if questioned by federal or state tax authorities. Business-owned policies require additional documentation including ownership agreements, premium allocation records, and benefit recipient designations for proper tax treatment verification.

FAQ

What happens if I recover completely from a critical illness after receiving the payout?

Critical illness rider payout benefits remain yours permanently regardless of recovery outcomes, as these policies pay based on initial qualifying diagnosis rather than ongoing medical condition status. No repayment obligations exist even with complete recovery, successful treatment outcomes, or full return to normal activities and work capacity. This fundamental difference from disability insurance eliminates concerns about benefit recapture while focusing financial support during the most critical treatment phases.

Can I purchase multiple critical illness riders for increased coverage amounts?

Multiple critical illness coverage through different insurance companies is permissible but subject to financial underwriting limits and coordination of benefits provisions that may restrict total payout amounts. Most insurers require disclosure of existing coverage and may adjust benefit amounts or decline applications when total critical illness coverage appears excessive relative to income levels and demonstrated insurability factors.

Do critical illness riders cover hereditary conditions or genetic diseases?

Hereditary and genetic conditions receive coverage when they develop after policy effective dates and waiting periods expire, provided they satisfy specific medical definition requirements within policy contracts. Pre-existing condition exclusions apply to known genetic predispositions or family history disclosed during underwriting, while newly diagnosed genetic conditions typically qualify for full benefits under standard policy terms.

How do critical illness riders differ from disability insurance coverage?

Critical illness riders provide immediate lump-sum payments upon qualifying medical diagnosis regardless of work capacity or income loss, while disability insurance replaces ongoing monthly income during periods of work incapacity. Critical illness benefits do not require employment absence, paying full benefits to retired individuals or those continuing work during treatment, making both coverage types complementary rather than redundant for comprehensive financial protection.

Can critical illness riders be added to existing life insurance policies?

Most permanent life insurance policies permit critical illness rider additions during annual policy reviews or specific anniversary dates subject to current medical underwriting requirements and age eligibility restrictions. Term life policies typically accommodate rider additions more readily, while whole life and universal life policies may require policy modifications or benefit adjustments to maintain premium affordability and coverage balance.

How do pre-existing medical conditions affect critical illness coverage?

Pre-existing medical conditions diagnosed within 12-24 months preceding policy effective dates typically trigger permanent coverage exclusions for related medical conditions and complications. Comprehensive medical underwriting evaluates complete health histories, with certain conditions resulting in coverage limitations, premium increases, or complete policy declination rather than standard issue approval, emphasizing the importance of securing coverage while healthy.

Conclusion

Critical illness rider payout understanding empowers American consumers to make informed insurance decisions based on actuarial realities, regulatory requirements, and proven claim experiences rather than marketing representations or incomplete information. Average payouts reaching $73,000 provide substantial financial support during medical emergencies when traditional health insurance fails to address lost income, experimental treatments, and family care expenses that can devastate household finances within months of diagnosis.

Coverage selection decisions involving benefit amounts, policy structures, and premium payment methods directly impact ultimate taxation, claim processing, and family financial recovery during extended medical treatment periods. Individual policies funded with after-tax premiums offer optimal tax efficiency and streamlined claim procedures, while employer-sponsored arrangements may create significant tax liabilities requiring professional financial and tax planning guidance for effective implementation.

Understanding the relationship between critical illness riders and broader life insurance medical examination requirements helps consumers navigate underwriting processes and optimize their overall insurance portfolio for comprehensive family protection.

Key Takeaways

Financial Protection Scale: Critical illness riders provide average payouts of $73,000, offering substantial financial support during medical emergencies when traditional health insurance cannot address lost income, experimental treatments, or extended family care expenses during recovery periods.

Tax Optimization Benefits: Individual critical illness rider payouts funded with after-tax premiums remain completely tax-free under federal guidelines, providing full benefit values without additional tax obligations for most policyholders during financial recovery phases.

Processing Efficiency Standards: Standard critical illness rider payout processing averages 24 days with complete documentation, while expedited programs reduce timelines to 12-16 days for urgent situations involving terminal diagnoses or demonstrated immediate financial hardship.

Coverage Precision Requirements: Benefit payments depend entirely on meeting exact policy medical definitions rather than general diagnostic terminology, making thorough policy review and medical condition understanding essential before purchase and during claim submission procedures.

Disclaimer

Data freshness: Insurance rates and regulations change frequently. Critical illness rider terms, payout amounts, processing procedures, and tax implications depend on timing of official regulatory releases and individual policy contract provisions.

Geographic variations: Critical illness coverage requirements, minimum benefit amounts, and tax treatment vary significantly by state jurisdiction. Always consult your state’s insurance department and qualified tax professionals for location-specific guidance and current regulatory requirements.

Professional advice: This information serves educational purposes only. Critical illness insurance decisions should be made in consultation with licensed insurance professionals and qualified tax advisors familiar with your specific financial circumstances, health status, and long-term planning objectives.