Dental insurance for seniors can become essential in retirement—especially when unexpected costs arise. At 68, Linda from Tempe, Arizona, thought retirement would bring peace of mind—until a cracked molar sent her to an emergency dental visit. Without insurance, the $1,200 bill shook her fixed income. She’s not alone: in 2024, over 70% of seniors in the U.S. lack dental insurance, according to the National Association of Insurance Commissioners (NAIC).

Many retirees assume Medicare will cover their dental needs. It doesn’t. From preventive cleanings to dentures and implants, the costs add up fast. The good news? There are affordable dental insurance options tailored for older adults—if you know what to look for.

This guide breaks down everything seniors need to understand about dental insurance—from coverage types to hidden costs, Medicare limits, and real-world plan comparisons. Whether you’re 60 or 80, you’ll find clear, practical answers to help protect your health—and your wallet.

This comprehensive guide will help you navigate the best dental insurance for seniors to protect both your oral health and finances.

On This Page

1. Why Dental Insurance for Seniors Matters

1.1. Common Dental Issues After Age 60

As the body ages, so does oral health. Seniors commonly face a range of dental challenges that go beyond simple cavities. Gum disease, tooth loss, and dry mouth—often caused by medications—are widespread. Even more serious conditions, like oral cancer, see a spike in adults over 60.

CDC data from 2024 shows that close to 7 in 10 Americans aged 65+ are affected by gum disease in some form.

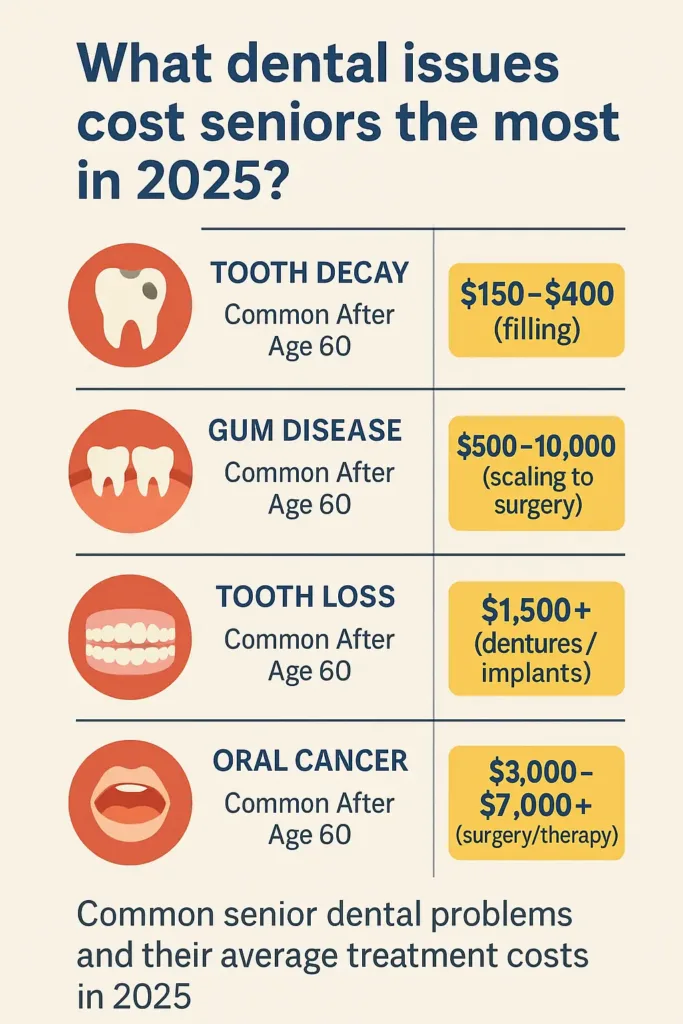

To better understand how costly dental neglect can become after 60, here’s a comparison of typical dental problems and their out-of-pocket costs without insurance:

1.1.1. Average Cost of Common Senior Dental Issues (Without Insurance)

| Dental Issue | Common After Age 60? | Average Treatment Cost (Without Insurance) |

|---|---|---|

| Tooth Decay | Yes | $150–$400 (filling) |

| Gum Disease (Periodontitis) | Yes | $500–$10,000 (scaling to surgery) |

| Tooth Loss | Yes | $1,500+ (dentures/implants) |

| Dry Mouth (Xerostomia) | Yes | $200–$600/year (treatment/medication) |

| Oral Cancer | Yes | $3,000–$7,000+ (surgery/therapy) |

Local Anecdote : Gerald, 74, from Louisville, Kentucky, lost three molars in a year due to untreated gum recession. He admitted, “I didn’t think it was serious—until eating became painful.”

Real-Life Example : Without insurance, older adults must personally cover every dental expense, from cleanings to surgeries.

Fictional Dialogue :

Martha (Temecula, CA, 66): “Why does my dentist keep talking about bone loss?”

Dr. Nguyen: “It’s common after 60. That’s why preventive visits and cleanings are more important than ever.”

That’s why having dental insurance for seniors in place is a key preventive measure.

1.2. Costs Without Insurance: What to Expect

Without dental insurance, seniors face full responsibility for costs that can be both sudden and significant. A routine cleaning may be affordable, but major procedures—root canals, crowns, or dentures—can deplete retirement savings quickly.

According to 2024 data from the American Dental Association (ADA), seniors can expect to pay more than $1,100 out of pocket for a single dental crown.

Pro Tip (California Health Code § 1374.13): In California, dental insurance must clearly disclose annual benefit caps and waiting periods in writing before enrollment. Always review these terms in your plan summary.

2024 US Statistic : According to the National Association of Insurance Commissioners (NAIC), 58% of seniors delay or skip dental care due to cost—leading to long-term health complications.

1.3. Health Risks Tied to Dental Neglect in Seniors

Oral health isn’t just cosmetic. Untreated dental issues have been linked to heart disease, diabetes complications, and even dementia. Seniors are particularly vulnerable due to weakened immunity and reduced healing capacity. That’s why it’s equally important to consider coverage for situations like income loss if a long-term disability arises, not just dental care.The U.S. Department of Health and Human Services (HHS) reports a growing link between oral inflammation and cognitive decline in older adults.

For example, skipping cleanings can lead to gum infection, which may allow bacteria to enter the bloodstream—potentially contributing to cardiovascular issues. Proper dental care isn’t optional. It’s essential preventive health.

2. Understanding Dental Insurance Plan Structures

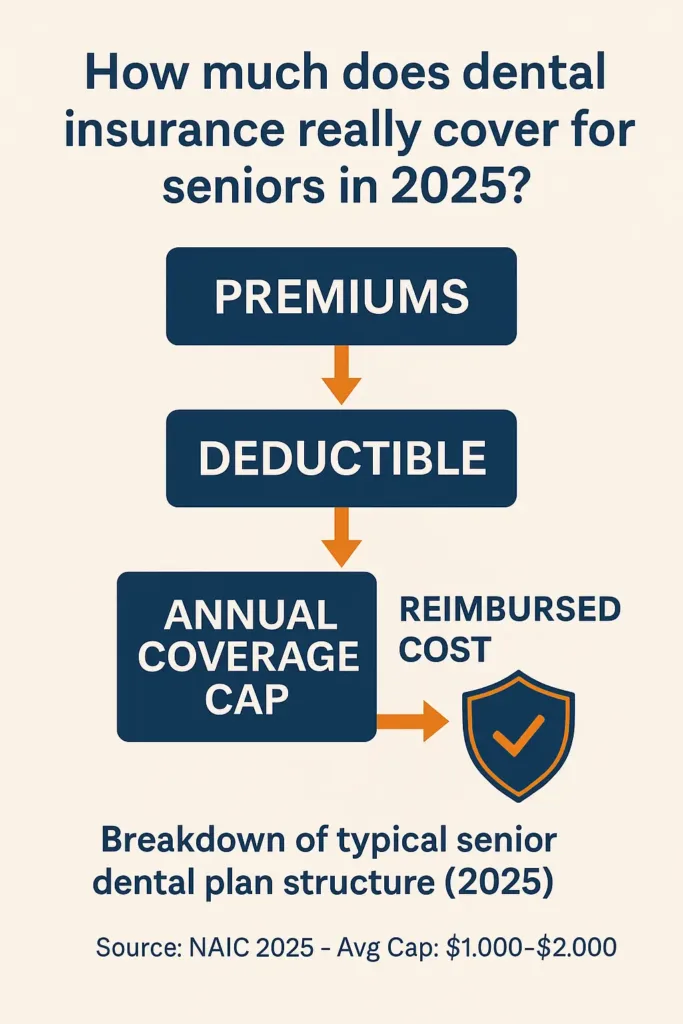

2.1. Premiums, Deductibles, and Coverage Caps

Dental insurance plans designed for seniors often follow a structure that includes a monthly premium, an annual deductible, and a coverage maximum. Most plans require you to pay out of pocket for services until the deductible is met, after which insurance pays a percentage of covered services.

2024 US Statistic : According to the NAIC, the average senior dental plan premium in 2024 is $38/month, with coverage caps typically ranging between $1,000 and $2,000 annually.

Local Anecdote : Harold, 69, from Spokane, Washington, opted for a low-premium plan at $22/month, but didn’t realize the $1,200 cap would barely cover his two crowns. “I thought I was covered—until I saw the bill,” he recalls.

Real-Life Example : A senior undergoes a root canal and crown costing $2,000. Their plan covers 50% after a $100 deductible. The insurance pays $950, and the senior is responsible for the remaining $1,050—nearly hitting the cap.

2.2. Networks: PPO, HMO, and Indemnity Plans Explained

Dental insurance plans differ widely in how they manage provider networks. Seniors may choose among PPO, HMO, and Indemnity plans—each with its own trade-offs in flexibility and cost.

Fictional Dialogue :

Leo (72, Denver): “Can I still see my dentist if I switch plans?”

Agent: “It depends. PPOs often let you see out-of-network providers, but HMOs are stricter. Indemnity plans offer total freedom, but cost more.”

2.2.1. Dental Plan Type Comparison

| Plan Type | Choice of Dentists | Referrals Needed | Monthly Premiums | Typical Out-of-Pocket Costs |

|---|---|---|---|---|

| PPO | Wide network, out-of-network allowed | No | Moderate to High | Moderate |

| HMO | Restricted to in-network | Yes, for specialists | Low | Low |

| Indemnity | Any licensed dentist | No | High | High |

Pro Tip (FL Stat § 627.64731): In Florida, insurers offering PPO dental plans must clearly state whether out-of-network providers will result in balance billing, which can significantly affect seniors’ final costs.

2.3. Waiting Periods and Enrollment Limits

Many senior dental plans come with waiting periods—typically 6 to 12 months—before major procedures like crowns or dentures are covered. This protects insurers from large immediate claims, but can delay care for new enrollees.

2024 U.S. Statistic : A CMS 2024 report notes that 44% of new Medicare Advantage enrollees experience delays in dental procedures due to waiting period rules in supplemental plans.

Local Anecdote : Darlene, 67, from Scranton, Pennsylvania, needed a denture realignment shortly after switching plans. “They told me I had to wait nine months,” she says. “By then, I’d already paid for it myself.”

Real-Life Example : A senior signs up for a new plan in January. They’re scheduled for implant surgery in March, but the plan won’t cover it until August. That delay costs them over $2,000 in upfront care.

3. Does Medicare Cover Dental Insurance for Seniors?

3.1. What Original Medicare Includes (and Doesn’t)

It often comes as a surprise that Original Medicare (Parts A and B) excludes nearly all routine dental care. Routine exams, cleanings, fillings, and dentures are excluded. Coverage is limited to dental services that are directly related to a covered medical procedure, such as jaw reconstruction after an accident. According to the Centers for Medicare & Medicaid Services (CMS), less than 1% of dental claims were reimbursed under Original Medicare in 2024.

Local Anecdote : Harold, 72, from Boise, Idaho, thought his Medicare plan would cover his dentures. “I went in for impressions and came out with a $1,800 bill,” he said. “That’s when I understood Medicare wouldn’t help me with basic dental needs.”

Real-Life Example : Original Medicare paid for Harold’s jaw surgery after a fall, but didn’t cover the follow-up dental work. He later had to enroll in a separate dental policy to afford the needed implants.

3.2. Medicare Advantage Dental Benefits

Part C Medicare plans—also known as Medicare Advantage—are administered by private insurance companies and frequently add dental coverage. These can cover cleanings, exams, and sometimes more advanced procedures like crowns or dentures. However, benefits vary widely by provider, and many plans impose caps around $1,000–$2,000 annually.

CMS figures from 2024 show that nearly two-thirds of people on Medicare Advantage plans receive dental-related benefits.

Fictional Dialogue :

Ella (Tampa, FL, 67): “My neighbor gets free dental cleanings. Why don’t I?”

Agent: “She’s probably on a Medicare Advantage plan. Original Medicare doesn’t cover cleanings.”

3.2.1. Medicare vs Medicare Advantage Dental Benefits

| Feature | Original Medicare | Medicare Advantage |

|---|---|---|

| Routine Exams | Not Covered | Often Covered |

| Cleanings | Not Covered | Often Covered |

| Fillings | Not Covered | Sometimes Covered |

| Crowns & Bridges | Not Covered | Limited Coverage |

| Dentures | Not Covered | Limited Coverage |

| Out-of-Network Coverage | N/A | Plan Dependent |

3.3. Medicaid Dental Coverage for Seniors

Medicaid provides dental benefits in some states, but the scope of coverage varies significantly. States such as New York and California provide expanded Medicaid dental services, including cleanings, exams, and restorative procedures. Others may limit coverage to emergency procedures only. The Kaiser Family Foundation (KFF) reports that as of 2024, 36 states offer at least limited adult dental benefits under Medicaid.

Pro Tip (NY Soc. Serv. Law § 365-a): In New York, Medicaid must cover medically necessary dental care, including dentures and periodontal treatment, for enrolled seniors.

4. Types of Dental Insurance Options for Seniors

4.1. Standalone Dental Insurance Policies

Standalone dental insurance for seniors is one of the most popular choices among retirees looking for flexible and predictable dental care.

Standalone dental insurance is the most common option for seniors who want full coverage for preventive and restorative care. These plans are offered by private insurers and usually include cleanings, exams, X-rays, fillings, and sometimes dentures or implants. However, premiums vary based on age, location, and benefits selected. According to the NAIC 2024 data, the national average monthly premium for a basic senior dental plan is around $35.

Local Anecdote : Loretta, 68, from Albany, New York, pays $32 per month for a standalone dental plan that covers her cleanings, one filling a year, and 50% off major procedures.

4.2. Bundled Vision + Dental Plans

Some insurers offer bundled plans that include both dental and vision benefits. Some seniors also explore how combined insurance can streamline your coverage and reduce paperwork and premium overlap.These packages often appeal to seniors seeking convenience and combined service under one premium. Coverage might include annual dental cleanings, exams, plus eye exams and discounts on glasses or contacts. While convenient, these plans may have lower dental benefit caps than standalone options.

Fictional Dialogue :

Tom (Las Vegas, NV, 70): “I liked having one plan that covered both my dentist and eye doctor. But it didn’t help much with my crown.”

Agent: “Bundled plans tend to focus on preventive care, not major dental work.”

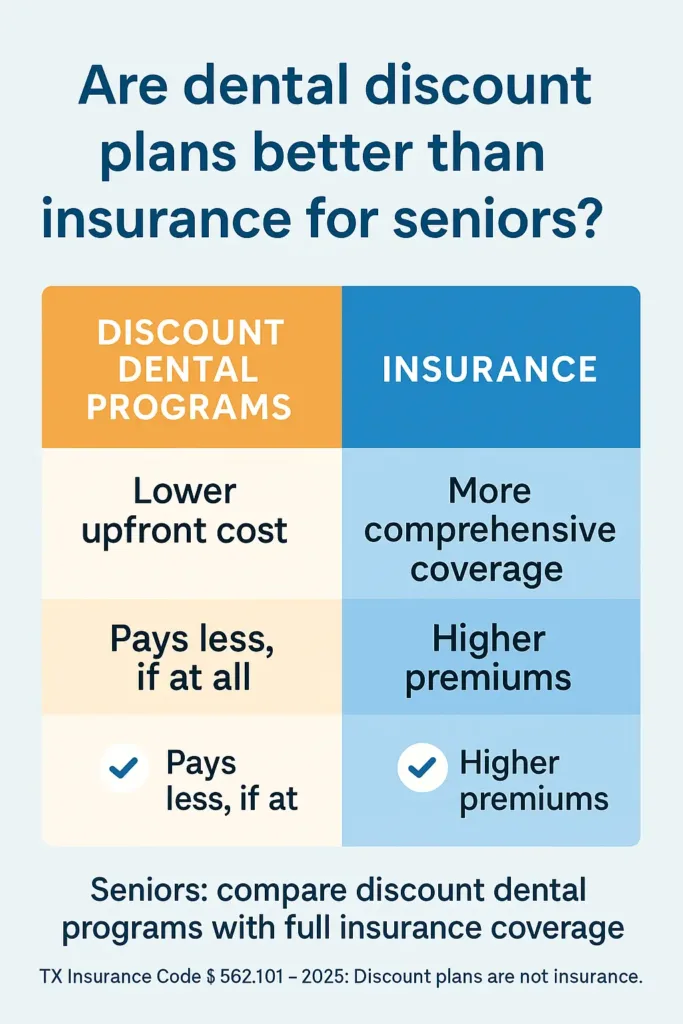

4.3. Discount Dental Programs vs. Insurance

Dental discount programs are not insurance. Instead, they offer reduced rates on services through a network of participating providers. Seniors pay a membership fee—often around $10 to $20 monthly—and receive discounted rates on procedures like cleanings, fillings, and even dentures. There are no claims or reimbursements involved. These programs can be helpful for seniors with limited budgets who still want access to basic care.

Pro Tip (TX Insurance Code § 562.101): In Texas, all dental discount plans must clearly disclose that they are not insurance and provide a list of participating providers at enrollment.

4.3.1. Types of Senior Dental Insurance Plans

| Plan Type | Monthly Cost Range | Coverage Includes | Ideal For |

|---|---|---|---|

| Standalone Dental Insurance | $20–$50 | Preventive, basic, and sometimes major procedures | Seniors needing full dental benefits |

| Bundled Vision + Dental Plans | $40–$80 | Dental and vision exams, cleanings, eyeglasses, some restorative care | Retirees looking for convenience and combined care |

| Dental Discount Programs | $10–$20 | Discounted rates on services; no coverage or reimbursement | Low-income seniors or those without major dental needs |

5. What Does Dental Insurance for Seniors Typically Cover?

5.1. Preventive Services

Preventive care is the cornerstone of most senior dental insurance plans. These services usually include semi-annual cleanings, exams, and diagnostic X-rays. Many dental plans reimburse preventive services like cleanings and exams at rates between 80% and 100%, and typically waive waiting periods for these treatments. According to the Centers for Medicare & Medicaid Services (CMS), preventive services represent the highest utilization category among seniors with private dental insurance in 2024.

Local Anecdote : Ron, 69, from Raleigh, North Carolina, shared: “I never used to go unless something hurt. Now my plan gives me two free cleanings a year, and I haven’t had a cavity in two years.”

5.2. Basic and Major Restorative Services

Basic services include treatments like fillings, simple extractions, and non-surgical root canals. These are generally covered at 50% to 80%, with waiting periods of 3 to 6 months depending on the plan. Major services—such as crowns, bridges, dentures, and oral surgery—usually have lower coverage percentages (30% to 50%) and longer waiting periods, sometimes up to 12 months.

Real-Life Example : Sandra, 71, needed a crown two months after enrolling in her dental plan. Because it was a major service and still under the waiting period, she had to cover the full $1,200 cost herself.

5.3. Dentures, Implants, and Periodontal Treatments

Dentures and implants are typically considered major services, and not all senior dental insurance plans cover them. Some offer partial coverage with limits such as one denture per jaw every five years. Periodontal care—like deep cleanings and gum surgery—is often partially covered but may require preauthorization. According to a 2024 report from the American Dental Association (ADA), nearly 26% of seniors aged 65+ require some form of periodontal treatment annually.

Fictional Dialogue :

Janet (Tucson, AZ, 73): “I didn’t know my insurance didn’t cover implants until the bill came.”

Dentist: “Many plans treat implants as optional. Dentures are more commonly included.”

5.3.1. Typical Coverage in Senior Dental Insurance

| Service Type | Examples | Coverage Percentage (Typical) | Waiting Period (Common) |

|---|---|---|---|

| Preventive Care | Cleanings, exams, X-rays | 80%–100% | None |

| Basic Procedures | Fillings, extractions, simple root canals | 50%–80% | 3–6 months |

| Major Procedures | Crowns, dentures, implants, oral surgery | 30%–50% | 6–12 months |

Pro Tip (FL Admin Code 69O-149.005): Florida law requires dental insurers to outline all benefit caps and waiting periods in writing before plan selection.

6. Comparing Costs: Premiums, Copays, and Out-of-Pocket

6.1. Average Premiums by State (2024)

What seniors pay for dental insurance can shift significantly from one state to another. In 2024, the national average monthly premium for a basic dental plan ranges from $32 to $40, according to NAIC data. Factors like provider competition, plan type, and local cost of living all play a role.

Local Anecdote : Carl, 70, from Houston, TX, pays $34 per month for his PPO plan. “It’s cheaper than I expected, and it covers two cleanings and one filling per year,” he said.

6.1.1. State-by-State Dental Cost Comparison (2024)

| State | Average Monthly Premium | Typical Copay (Cleaning) | Out-of-Pocket for Crown |

|---|---|---|---|

| California | $38 | $20 | $700 |

| Texas | $34 | $15 | $650 |

| Florida | $36 | $18 | $675 |

| New York | $40 | $25 | $720 |

| Illinois | $32 | $20 | $680 |

6.2. Hidden Costs Seniors Should Watch For

Beyond premiums and basic copays, many plans include exclusions or limits that can catch seniors off guard. Common hidden costs include missing tooth clauses, annual benefit caps, out-of-network charges, and non-covered services like implants or sedation. According to CMS 2024 data, nearly 40% of dental plan holders encountered a cost not listed in their plan’s benefit summary.

Fictional Dialogue :

Betty (Milwaukee, WI, 72): “They didn’t tell me the crown wasn’t covered until after the prep. That’s when I got the $900 bill.”

Office staff: “It’s in the fine print. Major services aren’t always covered in the first year.”

To avoid surprise medical bills, some seniors also consider hospital indemnity insurance to help cover unexpected hospitalization costs.

6.3. Sample Cost Calculator by Treatment Type

Here’s an example of what typical dental procedures might cost with and without insurance for a senior in 2024:

- Routine cleaning: $100 uninsured vs. $20 insured copay

- Filling (1 surface): $150 uninsured vs. $40 with 70% coverage

- Crown (porcelain): $1,200 uninsured vs. $650 out-of-pocket with 50% coverage

Real-Life Example : Marvin, 67, used his plan’s online calculator before scheduling a crown. “The estimator showed an estimate near $650—and that’s exactly what the final bill came to. Everything matched.”

Pro Tip (CA Health & Safety Code § 1363): In California, dental plans must disclose all cost-sharing rules—including coinsurance and copayment ranges—before the plan is issued.

7. How to Choose the Best Dental Insurance for Seniors

7.1. Key Factors Seniors Should Consider

Selecting the right dental insurance as a senior involves more than just looking at premiums. It requires evaluating your current and expected dental needs, your budget, and the flexibility you need in choosing providers. For many older adults, procedures like crowns, dentures, and implants are on the horizon, making benefit caps and coverage details critical.

Real-Life Example : Elena, 69, from Tampa, FL, compared two plans. One had a $20 lower premium but didn’t cover implants. “I realized saving $240 a year didn’t help when I needed $1,800 worth of dental work,” she explained.

7.1.1. Dental Plan Decision Criteria for Seniors

| Decision Criteria | Why It Matters |

|---|---|

| Monthly Premium Affordability | Fits within a retiree’s fixed income |

| Waiting Period for Major Services | Delays could postpone needed treatment |

| Provider Network Size | More dentists = more flexibility and access |

| Coverage for Dentures/Implants | Important for seniors needing full replacements |

| Annual Maximum Benefit | Limits total annual reimbursement potential |

7.2. Avoiding Common Mistakes

One of the biggest mistakes seniors make is assuming all plans cover major dental work equally. Many policies include waiting periods, exclude pre-existing conditions, or don’t cover replacement teeth at all. Always read the summary of benefits before enrolling, and ask questions about exclusions and network access.

Pro Tip (TX Insurance Code § 1501.105): In Texas, insurers must provide a written summary of dental coverage details before enrollment—especially for plans marketed to Medicare-eligible individuals.

7.3. Questions to Ask Before You Sign Up

- Is there a waiting period for crowns or dentures?

- Are your preferred dentists in the network?

- What is the annual benefit cap?

- Does the plan offer preventive services without cost-sharing?

- Are pre-existing missing teeth covered?

Dialogue réaliste :

Susan (Reno, NV, 73): “I was so focused on the monthly cost that I didn’t ask if my periodontist was in the network.”

Insurance agent: “That’s a common oversight. Networks are crucial if you want to keep your current providers.”

8. Understanding Waiting Periods and Exclusions

8.1. What Are Waiting Periods and Why Do They Exist?

Most senior dental insurance plans include waiting periods, especially for major services. This means you may need to wait several months—typically 6 to 12—before certain procedures like crowns, bridges, or dentures are covered. Insurers use waiting periods to discourage people from buying insurance only when they need expensive treatments.

Local Anecdote : Marlene, 71, from Sacramento, CA, enrolled in a plan in January and scheduled a crown for March. “I was shocked to learn it wasn’t covered until July,” she said.

Real-Life Example : A plan with a 6-month waiting period for major work may still offer full preventive care from day one. Seniors should check which services are available immediately versus those delayed by the policy.

8.2. Common Exclusions in Senior Dental Insurance

Exclusions are services or conditions that your plan doesn’t cover. These are often found in the fine print and can lead to surprise bills. Common exclusions include missing tooth clauses (where prior loss of a tooth disqualifies you from getting it replaced), cosmetic dentistry like veneers, and services received outside the provider network.

Fictional Dialogue :

Ken (Denver, CO, 68): “I didn’t realize my plan wouldn’t pay for the bridge because I lost the tooth years ago.”

Benefits rep: “That’s called a missing tooth clause. Some plans exclude those situations unless you pay extra.”

8.2.1. Common Senior Dental Plan Exclusions

| Exclusion Type | Typical Impact |

|---|---|

| Missing Tooth Clause | No coverage for replacing teeth missing before enrollment |

| Major Work Waiting Period | No coverage for crowns/dentures during first 6–12 months |

| Cosmetic Procedures | Whitening and veneers often excluded entirely |

| Pre-existing Conditions | Limited or no coverage for previously untreated problems |

| Out-of-Network Services | Higher costs or full responsibility outside network |

Pro Tip (NY Comp Codes R. & Regs. Title 11 § 52.16): In New York, all dental insurers must clearly define waiting periods and exclusions in the Evidence of Coverage before enrollment is finalized.

9. Alternatives to Dental Insurance for Seniors

9.1. Options Outside the Insurance Market

For seniors who can’t afford monthly premiums or don’t qualify for standard dental plans, several alternative options exist. These include dental schools, community clinics, veteran services, and private discount programs. While they don’t offer the same level of coverage, they can significantly reduce out-of-pocket costs for preventive or emergency care.

Local Anecdote : Robert, 74, from Dayton, OH, received a cleaning and X-ray for just $25 at a local dental school. “It took longer than usual, but the care was excellent and supervised by a licensed dentist,” he said.

9.1.1. Dental Insurance Alternatives for Seniors

| Alternative Option | Pros | Limitations |

|---|---|---|

| Dental Schools | Low-cost care, supervised by professionals | Limited availability, longer appointments |

| Community Health Clinics | Income-based fees, preventive and urgent care | Restricted service types and appointment times |

| Veterans Affairs Dental | Free or reduced cost for eligible veterans | Eligibility restrictions, limited coverage |

| Dental Savings Plans | Discounted rates without insurance barriers | No reimbursements, limited networks |

| Direct Pay Subscription Services | Flat monthly fee, includes preventive care | Not available in all areas, may exclude major work |

9.2. When an Alternative May Be the Better Fit

Alternatives to dental insurance may suit seniors with minimal dental needs, irregular incomes, or gaps in insurance eligibility. Some seniors turn to dental savings programs, which grant reduced rates up front and typically skip the delays of traditional coverage. Community health clinics and federally qualified health centers (FQHCs) can also provide crucial access for those on tight budgets.

Fictional Dialogue :

Linda (El Paso, TX, 70): “Paying for private coverage was out of reach, so I went to the local clinic—they did my filling for $35,” said Linda.

Clinic staff: “We adjust fees based on income. Most seniors pay far less than they’d expect from a private practice.”

Real-Life Example : A senior needing only two cleanings and one filling a year may save more using a $99/year dental discount card than paying $480 annually for a full insurance plan with deductibles and limitations.

Pro Tip (U.S. Health Resources & Services Administration – HRSA): Federally funded dental clinics must offer income-based services and cannot deny care based on the inability to pay.

Conclusion

For many seniors, dental insurance is more than a policy—it’s a tool to preserve quality of life, avoid painful delays in care, and control health-related costs. From traditional plans to community-based alternatives, the choices can seem overwhelming. Yet, understanding what’s covered, what’s not, and what fits your budget makes all the difference. If you’re uncertain about your options or eligibility, don’t hesitate to seek guidance from a licensed advisor familiar with local regulations. A well-informed decision today can help ensure peace of mind tomorrow.

With the right dental insurance for seniors, you can enjoy peace of mind and better long-term oral health.

FAQ

What is the best dental insurance to have for seniors?

The best dental insurance for seniors depends on individual needs, but generally:

Plans with broad coverage for preventive, basic, and major services (including dentures and implants) are ideal.

PPO plans offer flexibility with a wide network and out-of-network options, but cost more.

HMO plans cost less but limit provider choices.

Look for plans with reasonable premiums, manageable waiting periods, and adequate annual benefit caps (often $1,000–$2,000).

Avoid plans that exclude major procedures seniors are likely to need, such as crowns and implants.

Is there really free dental care for seniors?

Original Medicare does NOT cover routine dental care such as cleanings, fillings, or dentures.

Some Medicare Advantage (Part C) plans include dental benefits, but coverage varies and often has limits.

Medicaid offers dental benefits in some states, especially for emergency or medically necessary services, but varies widely by state.

For low-income seniors, community clinics, dental schools, and veterans’ programs may offer free or low-cost care, but this is not universal.

Is AARP dental insurance worth it for seniors?

While not detailed in the article, AARP dental plans are typically standalone insurance or discount programs tailored for seniors, often with good network access and reasonable premiums.

Worth depends on individual needs: If you need comprehensive coverage with predictable costs, AARP’s plans can be competitive and convenient.

Always compare coverage details, premiums, and waiting periods before deciding.

Are dental discount plans worth it for seniors?

Dental discount plans are NOT insurance, but provide reduced fees at participating dentists for a monthly membership fee (often $10–$20).

They can be a cost-effective option for seniors with limited dental needs or budgets.

However, they offer no reimbursement or coverage—only discounts, and networks may be limited.

For seniors needing major dental work or regular care, insurance might provide better financial protection.