Does insurance cover vasectomy procedures remains a critical question for millions of American men, particularly since there are no federal rules requiring health plans to cover vasectomies under the Affordable Care Act, unlike female contraceptive coverage. This coverage gap creates significant financial barriers, with vasectomy costs averaging $1,730 nationally when men must pay out-of-pocket for this highly effective permanent birth control method.

The current insurance landscape for male sterilization procedures creates confusion and financial uncertainty for families planning their reproductive future. Most privately insured women have coverage for contraception without any out-of-pocket costs, such as copayments, co-insurance, or deductibles, while these protections do not extend to privately insured men for vasectomy. This disparity affects contraceptive coverage decisions and places the financial burden of family planning disproportionately on women or forces couples to choose more expensive long-term birth control options.

Understanding your insurance options for vasectomy coverage requires navigating complex federal regulations, state mandates, and individual plan provisions. While the ACA mandates comprehensive coverage for female contraceptives as preventive services, male sterilization falls outside these federal requirements, creating a patchwork of coverage that varies significantly by location, insurance type, and individual circumstances. This regulatory complexity mirrors broader business insurance compliance requirements where coverage mandates differ across jurisdictions and plan types.

This comprehensive guide examines current vasectomy insurance coverage policies, state-by-state variations, Medicare and Medicaid provisions, and practical steps for determining your coverage options and managing costs effectively.

On This Page

Essential Overview

Federal law does not require health plans to cover vasectomies, but many insurance plans voluntarily provide coverage. Nine states mandate coverage for state-regulated plans, while Medicaid covers vasectomies in most states.

What Are Typical Vasectomy Costs With and Without Insurance?

The average cost of a vasectomy is $1,730 before insurance, though expenses can range significantly based on multiple factors. Understanding these cost variations helps men plan financially and evaluate insurance benefits effectively.

Cost Range by Setting:

| Procedure Location | Typical Cost Range | Average Cost |

|---|---|---|

| Doctor’s Office | $500 – $1,200 | $800 |

| Outpatient Surgery Center | $800 – $1,500 | $1,100 |

| Hospital Outpatient | $1,200 – $3,000 | $1,900 |

| Planned Parenthood | $0 – $1,000 | $600 |

Getting a vasectomy can cost anywhere between $0 and $1,000, including follow-up visits, with costs varying based on where you get it, what kind you get, and whether or not you have health insurance coverage. The substantial cost range reflects geographic variations, facility overhead differences, and procedural complexity.

Additional Cost Considerations:

- Consultation fees: $150 – $300 for initial urologist visits

- Follow-up appointments: $100 – $200 per visit for post-procedure care

- Semen analysis testing: $50 – $150 to confirm sterility

- Pain medication: $20 – $100 for prescribed post-operative medications

PRO TIP: Many health insurance companies cover all or most of the cost of a vasectomy, so checking with your plan provider before scheduling can reveal significant savings opportunities.

Insurance Impact on Costs:

With insurance coverage, patient responsibility typically ranges from $0 to $500, depending on plan specifics. With insurance, vasectomy costs between $0 and $1,000, with the type of insurance you have and the location where you get the procedure affecting the final fee.

Long-term Financial Comparison:

Annual out-of-pocket costs for birth control can be more than $2,000 a year, depending on the method used and insurance status, making vasectomy cost-effective over time. The one-time vasectomy expense often proves more economical than decades of alternative contraceptive costs, particularly when insurance provides partial or complete coverage.

What Vasectomy Coverage Do Different Insurance Plans Provide?

Insurance coverage for vasectomy varies dramatically across plan types, with significant disparities between federal requirements and actual coverage provisions. Understanding these differences helps men navigate their options effectively.

Federal Coverage Framework:

The Affordable Care Act requires most private health plans to cover birth control, including sterilization, for women, but they are not required to cover sterilization (vasectomies) for men. This federal policy, detailed in official ACA contraceptive coverage requirements, creates the foundation for current coverage disparities.

Coverage by Insurance Type:

| Insurance Type | Coverage Status | Typical Patient Cost |

|---|---|---|

| Employer-Sponsored Plans | Varies by plan | $0 – $800 |

| ACA Marketplace Plans | Optional coverage | $200 – $1,200 |

| Medicaid | Covered in most states | $0 – $50 |

| Original Medicare | Not covered | Full cost |

| Medicare Advantage | Plan-dependent | Varies |

Employer-Sponsored Insurance:

Many employer-sponsored insurance plans do provide some coverage for a vasectomy, though coverage specifics depend on plan design and employer decisions. Large employers often include vasectomy benefits as part of comprehensive reproductive health coverage, while smaller employers may exclude these benefits to control premium costs. Understanding does insurance cover vasectomy questions requires examining your specific employer plan documents and benefits summaries.

State Marketplace Plans:

Some states require state-regulated health plans to cover vasectomies, but state laws do not apply to self-insured health plans, which account for the majority of employer-sponsored health plans. This limitation significantly reduces the impact of state mandates on overall coverage availability. Professional liability considerations also influence how professional liability insurance protection addresses medical procedure coverage decisions.

Key Coverage Variables:

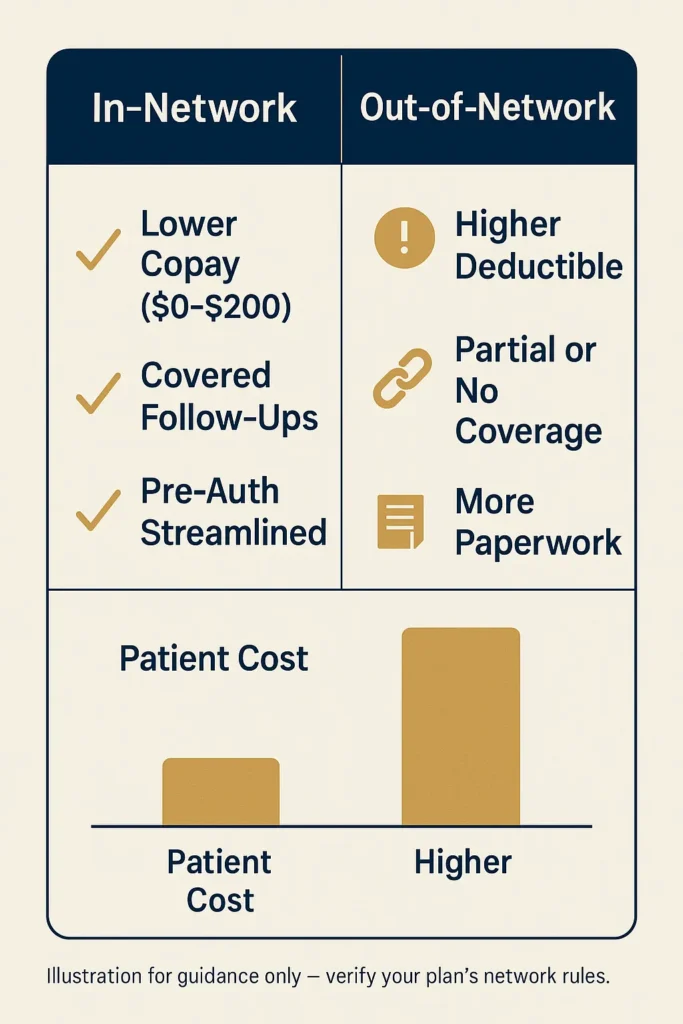

- Deductible requirements: Some plans require meeting annual deductibles before coverage begins

- Copayment structures: Fixed fees ranging from $25 to $200 per visit

- Network restrictions: Coverage limited to in-network urologists and facilities

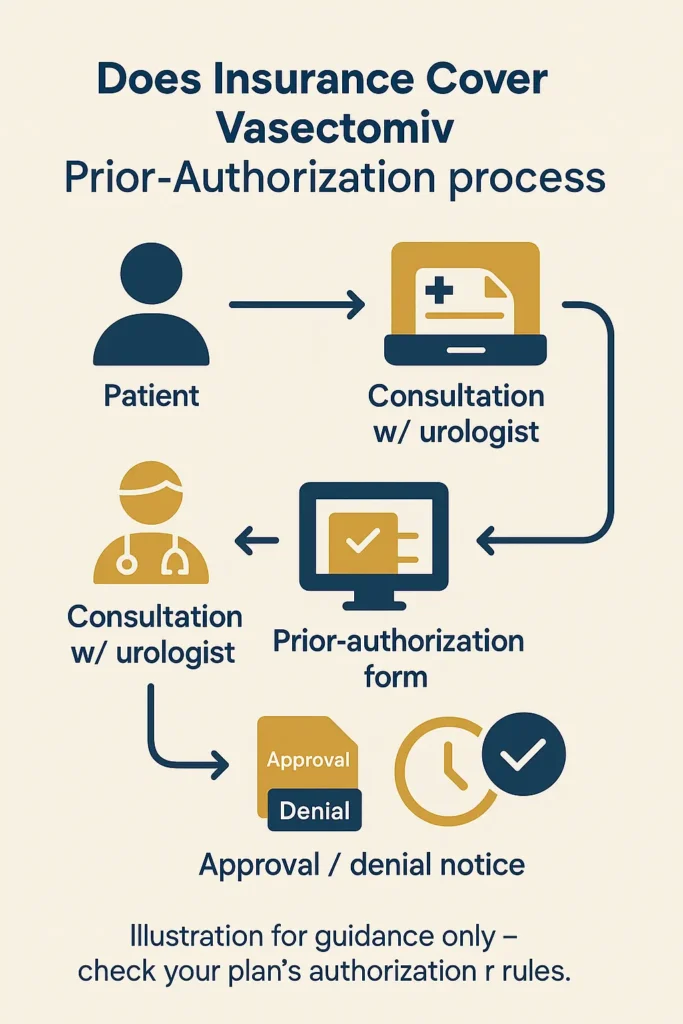

- Prior authorization: Some plans require pre-approval for coverage

IMPORTANT NOTE: Even when it’s not required, some health plans voluntarily cover all or part of the cost of a vasectomy, so you should check with your plan to see whether you have vasectomy coverage.

How Does Age Affect Vasectomy Insurance Coverage Decisions?

Age considerations play a complex role in vasectomy insurance coverage, influencing both coverage decisions and medical necessity determinations. Understanding these factors helps men navigate coverage requirements across different life stages.

Age-Related Coverage Patterns:

Insurance companies typically do not impose age restrictions for vasectomy coverage, but age-related factors influence coverage decisions and medical evaluations. Younger patients may face additional counseling requirements, while older patients might encounter medical complexity considerations.

Coverage Considerations by Age Group:

| Age Range | Coverage Considerations | Common Requirements |

|---|---|---|

| 18-25 | Enhanced counseling | Waiting periods, multiple consultations |

| 26-35 | Standard coverage | Standard evaluation process |

| 36-45 | Routine approval | Minimal additional requirements |

| 46+ | Medical screening | Age-related health assessments |

Younger Patient Considerations:

Insurance plans and medical providers often implement additional safeguards for younger patients seeking vasectomy. These may include mandatory waiting periods, multiple consultations, and enhanced informed consent processes. However, these requirements focus on ensuring informed decision-making rather than restricting coverage based on age alone.

Medical Necessity Evaluations:

Medicare does not consider a vasectomy a medically necessary procedure, so Original Medicare will not cover the cost. This classification affects older patients who rely on Medicare coverage, as age-related transition to Medicare eliminates vasectomy coverage for most seniors. State insurance regulators follow comprehensive insurance market conduct guidelines when evaluating coverage disputes and medical necessity determinations.

Age-Related Medical Factors:

- Surgical risk assessment: Older patients may require additional pre-operative evaluations

- Recovery considerations: Age-related healing factors influence post-procedure care costs

- Fertility preservation: Younger patients might consider sperm banking, adding insurance coverage questions

- Reversal likelihood: Insurance companies consider age-related reversal probability in coverage decisions

When patients ask does insurance cover vasectomy for different age groups, the answer typically depends more on plan design than patient age, though medical complexity may increase costs for older patients seeking the procedure.

Special Considerations for Medicare-Eligible Patients:

Original Medicare doesn’t cover vasectomies or other elective procedures, as Medicare only pays for services it considers to be medically necessary. This creates coverage gaps for men transitioning from employer-sponsored insurance to Medicare.

PRO TIP: Men approaching Medicare eligibility should consider timing vasectomy procedures while still covered by employer-sponsored insurance to avoid complete out-of-pocket costs.

What Vasectomy-Related Costs Does Insurance Typically Cover?

Insurance coverage for vasectomy encompasses multiple cost components, with coverage varying significantly across different plan types and specific benefit structures. Understanding covered services helps patients anticipate out-of-pocket expenses accurately.

Comprehensive Coverage Components:

| Service Category | Coverage Likelihood | Typical Insurance Payment |

|---|---|---|

| Surgical Procedure | 60-80% of plans | 70-100% of allowed amount |

| Consultation Visits | 80-90% of plans | Subject to office visit copay |

| Laboratory Tests | 70-85% of plans | 80-100% of allowed amount |

| Follow-up Care | 75-85% of plans | Subject to office visit copay |

| Complications | 90-95% of plans | Standard medical coverage applies |

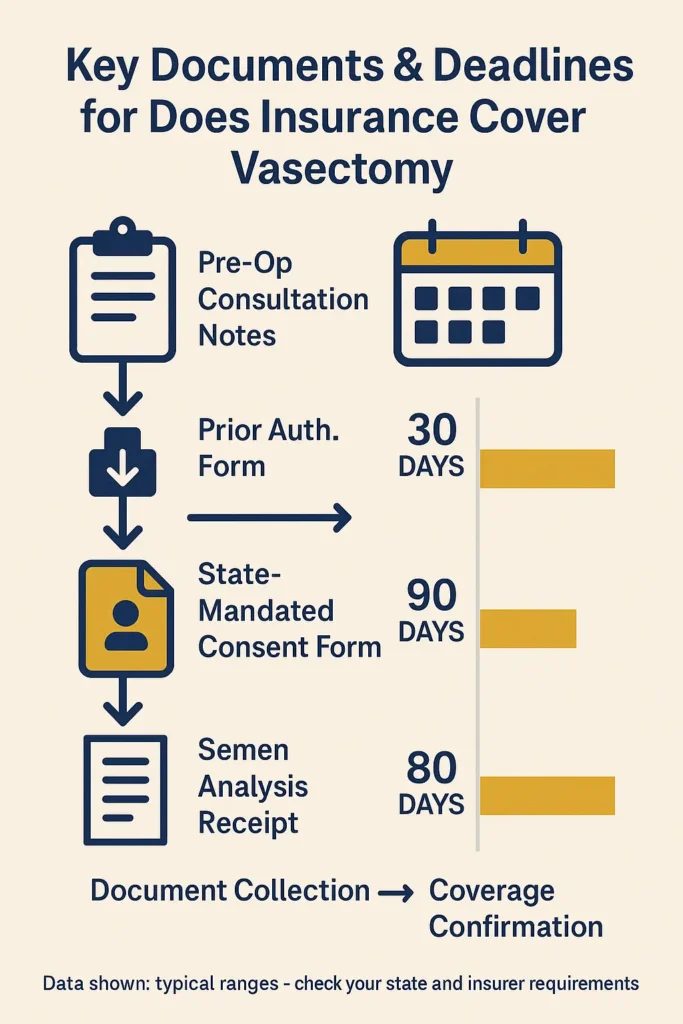

Pre-Procedure Coverage:

Most insurance plans that cover vasectomy include pre-operative consultations, required laboratory work, and medical clearance evaluations. These services typically fall under standard medical coverage provisions, subject to applicable copayments and deductibles.

Surgical Procedure Coverage:

When plans include vasectomy benefits, they typically cover the surgical procedure as an outpatient surgery benefit. Many private insurance plans, most Medicaid programs, and some Medicare Advantage plans cover vasectomy, though specific coverage percentages vary based on plan design.

Post-Procedure Coverage:

- Recovery visits: Standard office visit coverage applies

- Complication management: Covered under medical treatment provisions

- Semen analysis: Often covered as diagnostic testing

- Pain management: Prescription coverage subject to pharmacy benefits

Coverage Exclusions:

IMPORTANT NOTE: Insurance plans consistently exclude certain vasectomy-related costs:

- Reversal procedures: Health insurance plans don’t usually cover vasectomy reversals because they’re considered an optional procedure

- Fertility preservation: Sperm banking and storage typically excluded

- Elective enhancements: Premium procedure options may not be covered

- Travel costs: Transportation to specialized providers not covered

HSA and FSA Eligibility:

If you have a Health Savings Account (HSA) or a Flexible Spending Account (FSA), your saved funds can be used to foot a vasectomy bill. These tax-advantaged accounts provide coverage alternatives when insurance benefits are limited.

Network Provider Requirements:

Insurance coverage typically requires using in-network providers to receive maximum benefits. Out-of-network providers may result in significantly higher patient costs or complete coverage exclusions, depending on plan structure.

How Do Insurance Plans Evaluate Vasectomy Medical Necessity?

Medical necessity determinations form the foundation of insurance coverage decisions for vasectomy procedures. Understanding these evaluation criteria helps patients navigate coverage requirements and appeal processes effectively.

Federal Medical Necessity Standards:

Generally, Medicare will not cover a vasectomy as health experts do not consider it to be medically necessary, instead categorizing the vasectomy procedure as an elective surgery. This federal classification influences private insurance policies and establishes the baseline for medical necessity evaluations.

Standard Evaluation Criteria:

| Evaluation Factor | Insurance Consideration | Documentation Requirements |

|---|---|---|

| Family Planning Goals | Primary consideration | Patient consultation notes |

| Alternative Methods | Contraindication assessment | Medical history review |

| Surgical Candidacy | Health status evaluation | Physical examination |

| Informed Consent | Decision-making capacity | Counseling documentation |

Medical Necessity Documentation:

Insurance plans typically require comprehensive documentation supporting medical necessity, even when coverage is mandated. This documentation ensures appropriate utilization and protects both patients and insurers from unnecessary procedures, following federal Medicare sterilization coverage guidelines that establish baseline evaluation standards.

Required Medical Evaluations:

- Comprehensive medical history: Assessment of contraceptive needs and alternatives

- Physical examination: Evaluation of surgical candidacy and anatomical considerations

- Counseling documentation: Evidence of informed consent and decision-making counseling

- Risk assessment: Evaluation of surgical risks and contraindications

Coverage Approval Processes:

Most insurance plans with vasectomy coverage use streamlined approval processes, recognizing the elective nature of the procedure. However, some plans implement prior authorization requirements to ensure medical appropriateness.

Appeal Processes for Denied Claims:

When insurance companies deny vasectomy coverage, patients can appeal decisions through established processes. Patients can appeal their insurers’ decisions, but that’s not easy, and if a patient’s appeals fail, litigation is generally the only option.

State-Mandated Coverage Impact:

Nine states (CA, IL, MD, NJ, NM, NY, OR, VT, and WA) require certain health plans in those states to cover vasectomies, at no cost to the patient. These mandates eliminate medical necessity requirements for covered plans, ensuring access regardless of traditional medical necessity criteria.

Special Medical Circumstances:

In rare cases, vasectomy may be considered medically necessary for treatment of underlying conditions. However, if a vasectomy is recommended to treat an illness or injury, original Medicare may cover the procedure. These circumstances require extensive documentation and specialist consultation.

WARNING: Medical necessity appeals require comprehensive documentation and often involve lengthy review processes. Patients should maintain detailed records of all medical consultations and coverage communications.

What Factors Affect Vasectomy Insurance Approval and Coverage?

Multiple interconnected factors influence vasectomy insurance approval and coverage levels, creating a complex landscape that varies significantly across insurance types, geographic locations, and individual circumstances.

Primary Coverage Determinants:

| Factor Category | Impact Level | Coverage Variation |

|---|---|---|

| Geographic Location | High | 0-100% coverage difference |

| Insurance Plan Type | High | Complete coverage to exclusion |

| State Regulations | Medium | Mandated vs. optional coverage |

| Provider Network | Medium | 0-40% cost difference |

| Procedure Complexity | Low | 5-15% cost variation |

Geographic Coverage Variations:

As of 2024, at least eight states specifically require state-regulated insurance plans to cover male sterilization without cost-sharing: California, Illinois, Maryland, New Jersey, New Mexico, Oregon, Vermont, and Washington. These state mandates create significant coverage advantages for residents with qualifying insurance plans.

State Coverage Map:

States with Mandated Coverage:

- California, Illinois, Maryland, New Jersey, New Mexico, New York, Oregon, Vermont, Washington

States with Medicaid Coverage:

- Medicaid covers vasectomies in nearly all states, with a 2021 KFF survey showing 41 states and DC confirmed coverage

Federal Plan Limitations:

State-level requirements have several major limitations, as states only have the authority to regulate fully insured private health plans and cannot regulate so-called self-funded health plans. This limitation affects approximately 60% of employer-sponsored insurance plans, significantly reducing the impact of state mandates.

Plan-Specific Coverage Factors:

- Benefit design: Comprehensive vs. basic coverage levels

- Deductible structures: High-deductible plans may require significant out-of-pocket costs

- Network arrangements: Provider availability and cost-sharing variations

- Prior authorization: Administrative requirements affecting access timing

Provider Selection Impact:

Insurance coverage optimization requires strategic provider selection. If you have insurance, try to find a doctor in your network to avoid paying high costs when you get care. Network status can create substantial cost differences, often ranging from minimal copayments to complete out-of-pocket responsibility.

Medicaid Coverage Advantages:

Medicaid covers vasectomies in all 41 states that responded to a survey from KFF, with Washington, D.C., residents also having vasectomy coverage under Medicaid. According to comprehensive Medicaid coverage analysis, this coverage provides the most comprehensive access for eligible low-income patients.

Medicare Coverage Limitations:

Original Medicare doesn’t cover vasectomies because Medicare considers them elective procedures and never pays for elective procedures, including both vasectomies and vasectomy reversals. However, Medicare Advantage plans may offer coverage, though it’s not a commonly offered service. Patients frequently ask does insurance cover vasectomy under Medicare, but the answer remains consistently negative for traditional Medicare coverage. State insurance departments can provide guidance on coverage appeals, following official state insurance regulatory frameworks for disputed coverage decisions.

IMPORTANT NOTE: States that require pre-deductible vasectomy coverage must have an exception for HSA-qualified high-deductible health plans if they want HDHPs to continue to be available, creating coverage gaps even in states with mandates. Workers’ compensation requirements follow similar state-by-state variation patterns, as detailed in complete workers’ compensation requirements by state analysis.

FAQ

Does the Affordable Care Act require vasectomy coverage?

The ACA requires most private health plans to cover birth control, including sterilization, for women, but they are not required to cover sterilization (vasectomies) for men. This creates a coverage disparity where female contraceptive services receive comprehensive federal protection while male sterilization procedures depend on individual plan provisions or state mandates.

Which states require insurance companies to cover vasectomies?

Nine states (CA, IL, MD, NJ, NM, NY, OR, VT, and WA) require certain health plans in those states to cover vasectomies, at no cost to the patient. However, these mandates apply only to state-regulated insurance plans and do not affect self-insured employer plans, which represent the majority of employer-sponsored coverage.

Does Medicaid cover vasectomy procedures?

Medicaid covers vasectomies in nearly all states, with a 2021 KFF survey receiving responses from 41 states and DC, all of which reported that their Medicaid programs covered vasectomies. This makes Medicaid one of the most reliable coverage sources for eligible patients seeking vasectomy procedures.

Will Medicare pay for vasectomy surgery?

Original Medicare does not generally cover vasectomies or other elective surgeries unless doctors consider them medically necessary. However, Medicare Advantage plans may offer coverage, though vasectomy coverage is not a commonly offered service.

How much does a vasectomy cost without insurance?

A vasectomy costs an average of $1,730 before insurance, with costs ranging from $500 to $3,000 depending on the procedure location, complexity, and geographic region. The cost varies and depends on where you get it, what kind you get, and whether or not you have health insurance coverage.

Can I use my HSA or FSA for vasectomy costs?

If you have a Health Savings Account (HSA) or a Flexible Spending Account (FSA), your saved funds can be used to foot a vasectomy bill. These tax-advantaged accounts provide an alternative funding source when insurance coverage is limited or unavailable.

Conclusion

Vasectomy insurance coverage remains a complex patchwork of federal regulations, state mandates, and individual plan provisions that creates significant variation in patient access and costs. While there are no federal rules requiring health plans to cover vasectomies, many insurance plans voluntarily provide coverage, and nine states mandate coverage for qualifying plans.

The coverage landscape continues evolving as states recognize the importance of comprehensive reproductive health coverage for men. Medicaid covers vasectomies in nearly all states, providing the most consistent coverage source, while private insurance coverage depends heavily on plan design, geographic location, and state regulations.

For men considering vasectomy, the most critical step involves directly verifying coverage with their insurance provider before scheduling procedures. Understanding plan-specific benefits, network requirements, and cost-sharing provisions enables informed decision-making and optimal financial planning for this important reproductive health choice.

Key Takeaways

Coverage varies significantly across insurance types, with Medicaid providing the most comprehensive coverage and Original Medicare offering no coverage for elective vasectomy procedures.

Nine states mandate coverage for state-regulated insurance plans, creating substantial cost advantages for residents with qualifying coverage in California, Illinois, Maryland, New Jersey, New Mexico, New York, Oregon, Vermont, and Washington.

Average costs range from $500 to $3,000 without insurance, making coverage verification essential for financial planning, particularly since vasectomy proves cost-effective compared to long-term alternative contraceptive expenses.

Alternative funding sources including HSAs, FSAs, and payment plans provide options when insurance coverage is limited, ensuring access regardless of coverage limitations.

Disclaimer

Data freshness: Insurance rates and regulations change frequently. Vasectomy coverage policies and state mandates may be updated between publication and reading. Data accuracy depends on timing of official releases from insurance departments and federal agencies.

Geographic variations: Insurance requirements and vasectomy coverage vary significantly by state. Always consult your state’s insurance department and individual plan providers for current coverage information specific to your location and circumstances.

Professional advice: This information is for educational purposes only. Vasectomy coverage decisions should be made in consultation with licensed insurance professionals and healthcare providers who can assess individual circumstances and current plan provisions.