In 2024, a licensed esthetician in Texas faced a costly lawsuit after a client suffered an allergic reaction to a facial treatment. Without proper esthetician insurance, she was left covering thousands of dollars in medical bills out of pocket. This real case highlights the hidden risks beauty professionals face every day.

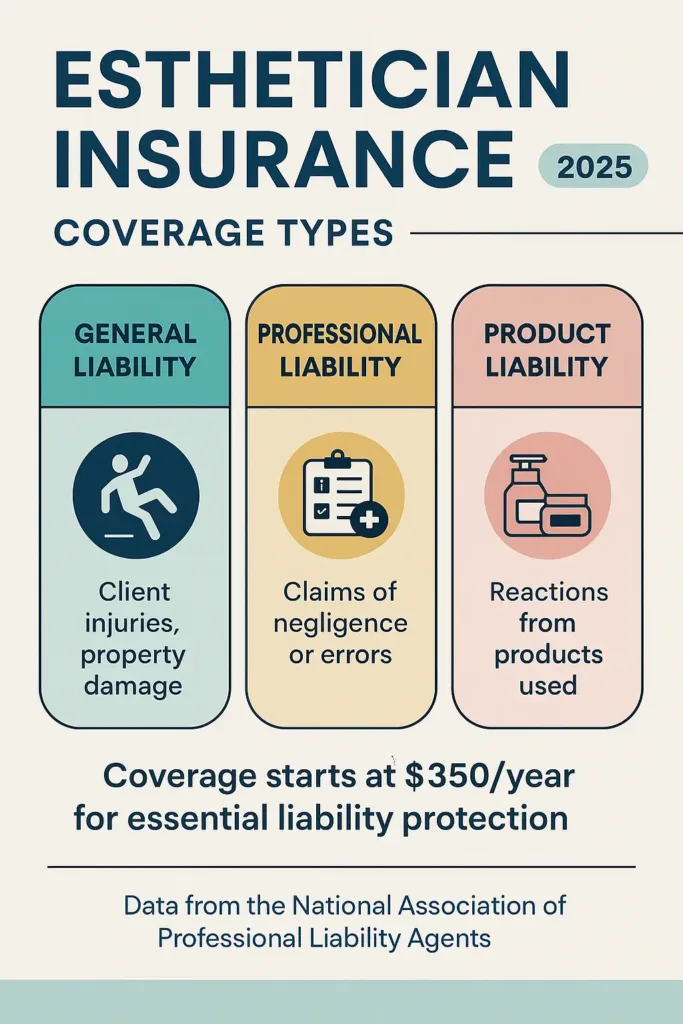

Esthetician insurance provides essential protection by covering liability, property damage, and sometimes professional errors, helping beauty specialists navigate claims confidently. Policies often include general liability, professional liability, and product liability, tailored for estheticians operating solo or within salons.

But how can estheticians secure the right coverage to avoid financial pitfalls and ensure peace of mind? This article breaks down everything you need to know about esthetician insurance in 2025, including costs, coverage types, and expert tips to protect your career and clients alike.

“According to the Beauty Industry Report (June 2024), 35% of estheticians reported facing liability claims in the past year.”

On This Page

1. Understanding Esthetician Insurance: Definition and Scope

1.1 What Exactly is Esthetician Insurance? (Legal and Industry Perspective)

Esthetician insurance is a specialized form of professional liability coverage designed to protect beauty practitioners from financial loss due to claims arising from their services. This insurance typically covers bodily injury, property damage, and errors related to esthetic procedures such as facials, waxing, and chemical peels. In states like California and New York, where regulations for esthetic services are strict, having this insurance is often mandatory for licensure.

| Type of Coverage | What It Covers | Typical Annual Cost (2024) |

|---|---|---|

| General Liability | Client injuries, property damage | $350 – $700 |

| Professional Liability | Errors or negligence during services | $400 – $900 |

| Product Liability | Claims from product usage | $200 – $500 |

According to the National Association of Professional Liability Agents, esthetician insurance policies vary widely, depending on the scope of services and location, making it crucial to understand your specific coverage needs.

1.2 Types of Coverage Included in Esthetician Insurance Policies

Esthetician insurance typically combines multiple protections to cover the specific hazards of the skincare and beauty profession.

Similarly, professionals in high-risk industries can benefit from tailored protection—explore our full commercial dump truck insurance guide for 2025 to see how coverage adapts to unique operational risks.

These usually encompass general liability, which safeguards against bodily injuries or property damage during client visits; professional liability, protecting estheticians from claims of errors or negligence during treatments; product liability, addressing adverse effects caused by products used; and occasionally property insurance to cover salon tools and equipment.

Each coverage type plays a distinct role in shielding your business from financial loss, making it essential to select a policy that matches the services you offer and the risks involved.

Refer to the Insurance Information Institute’s overview on business insurance basics for more on essential coverage types.

2. Esthetician Insurance Costs & Influencing Factors

2.1 2024 Price Ranges for Esthetician Insurance (State-by-State Comparison)

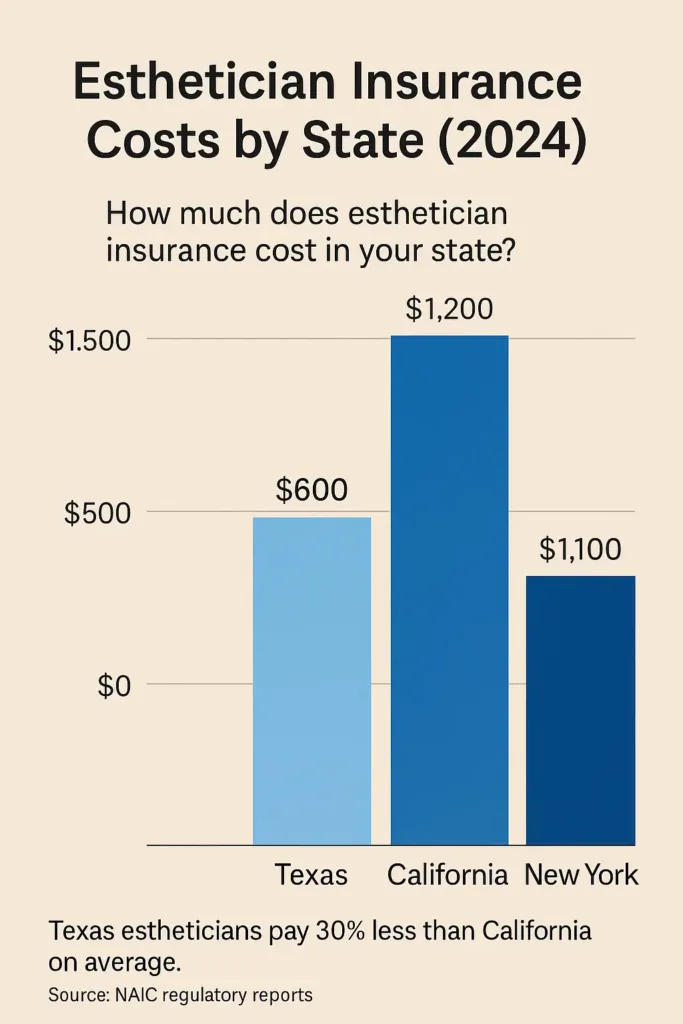

The cost of esthetician insurance varies significantly across the United States, influenced by state regulations, coverage limits, and risk levels. In 2024, average premiums ranged from $300 in less regulated states like Idaho to upwards of $1,200 in high-risk or highly regulated states such as California and New York. These price differences reflect local market conditions and state-mandated coverage requirements.

| State | Average Annual Cost | Required Minimum Coverage |

|---|---|---|

| California | $1,000 – $1,200 | $1 million per occurrence |

| New York | $900 – $1,100 | $1 million per occurrence |

| Texas | $600 – $800 | Varies by city |

| Florida | $500 – $700 | $500,000 per occurrence |

| Idaho | $300 – $450 | No minimum required |

For official state insurance requirements, visit the National Association of Insurance Commissioners (NAIC). Understanding your state’s specific insurance mandates can save you from costly fines and ensure proper protection.

2.2 5 Hidden Factors That Can Increase Your Esthetician Insurance Premiums

Several lesser-known factors can unexpectedly raise your esthetician insurance costs. These include your claims history, the types of products you use, your years of experience, salon location, and the number of employees. For example, estheticians using advanced chemical peels or laser treatments often face higher premiums due to increased liability risks.

Moreover, operating in urban centers with high litigation rates, such as Chicago or Miami, can push insurance costs up by 15-20%. Maintaining a clean claims record and proper certification can help keep premiums manageable.

Explore these insights in detail with the Insurance Information Institute’s breakdown on premium factors.

3. How to Get Esthetician Insurance: Step-by-Step Process

3.1 The 7 Essential Steps to Secure Esthetician Insurance Coverage

To begin, clearly outline all the beauty services you provide and identify any risks linked to each treatment. Next, search for insurers who focus on coverage tailored to estheticians and the wellness industry. Prepare important documents like your professional license and proof of your workspace—whether rented or owned. Reach out to several insurance companies to obtain quotes and compare both the coverage details and pricing. Carefully examine each policy’s terms, including any exclusions or limits. When you find the right fit, complete the application accurately. Make sure to renew your insurance on time and update your policy whenever your business expands or changes.

| Step | Action | Helpful Tip |

|---|---|---|

| 1 | Identify offered services and risks | Be thorough in listing treatments |

| 2 | Find insurers specializing in esthetician coverage | Check for industry expertise |

| 3 | Gather licensing and workspace documents | Prepare recent licenses and leases |

| 4 | Request and compare multiple quotes | Look for comprehensive coverage |

| 5 | Carefully review policy terms and exclusions | Ask questions if unclear |

| 6 | Submit your application with accurate info | Double-check all entries |

| 7 | Keep your insurance active and updated | Adjust for new services or changes |

The National Association of Insurance Commissioners highlights that following a structured approach reduces coverage gaps and ensures proper protection for estheticians.

3.2 How to File a Claim Under Your Esthetician Insurance Policy (Real Examples)

When an incident happens, report it to your insurer right away and collect all pertinent evidence such as client statements, photos of the issue, and any related receipts. Fill out your claim form completely and submit any documents requested by the insurance company without delay. Staying in close contact with your claims adjuster can help speed the resolution. Knowing the limits of your coverage before filing can also prepare you for any costs you might have to cover personally.

For example, an esthetician based in Illinois successfully submitted a claim after a chemical peel caused a reaction. By promptly providing thorough documentation, the esthetician was able to have medical expenses and legal fees covered by the insurer.

For older practitioners or clients, it’s also worth reviewing your legal options through the Senior Courts Act guide for 2025 seniors.

4. Real Case Studies & Success Stories in Esthetician Insurance

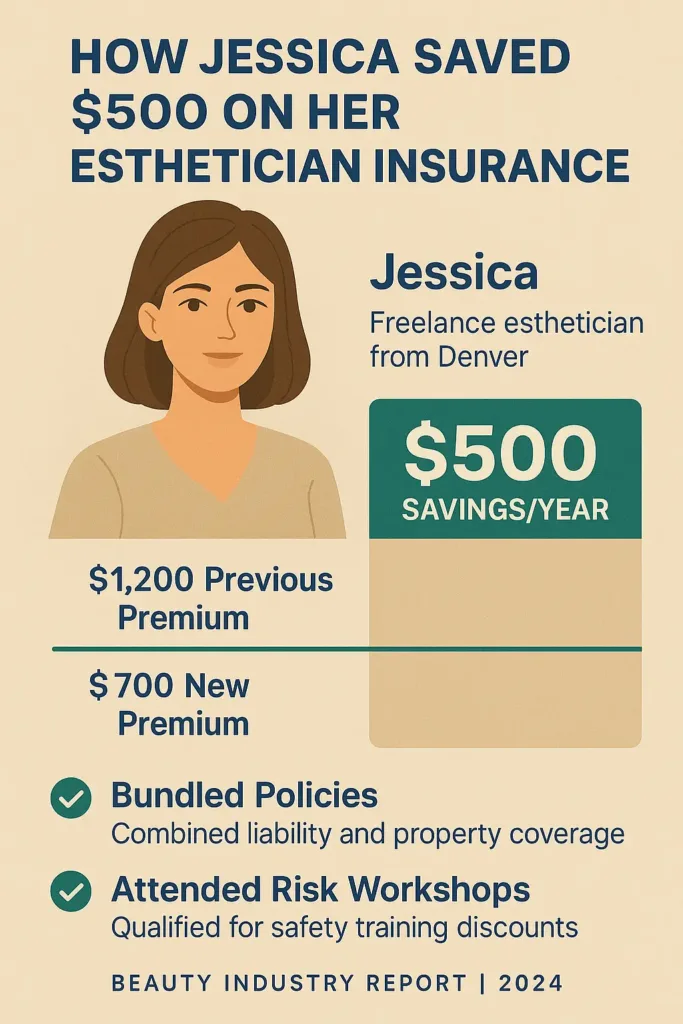

4.1 How One Esthetician Saved $500 Annually on Insurance (2024 Case)

In 2024, Jessica, a freelance esthetician from Denver, Colorado, managed to reduce her insurance premium by $500 annually. By bundling her general liability and professional liability policies and demonstrating a clean claims history, she negotiated lower rates with her insurer. Jessica’s proactive approach included attending risk management workshops, which insurers rewarded with additional discounts.

This case exemplifies how informed estheticians can significantly lower costs without sacrificing coverage quality.

4.2 The California Health Spa Incident That Changed Esthetician Insurance Practices

After a high-profile lawsuit in a Los Angeles spa in 2023, where a series of chemical peel treatments caused widespread client injuries, insurers tightened underwriting standards for esthetician insurance in California. This incident led to increased premiums and more stringent proof of certification requirements. As a result, many estheticians revamped their insurance policies to include expanded professional liability and product liability coverage.

This event underscores the importance of staying updated on industry developments and adjusting insurance accordingly.

| Case | Location | Outcome | Key Lesson |

|---|---|---|---|

| Jessica’s Discount | Denver, CO | $500 Annual Savings | Bundle policies & maintain clean claims |

| LA Spa Lawsuit | Los Angeles, CA | Increased premiums & stricter rules | Keep certifications updated & review coverage |

5. Expert Secrets & Insider Tips for Esthetician Insurance

5.1 3 Little-Known Loopholes in Esthetician Insurance Policies

Many estheticians are unaware of certain policy details that can significantly impact their coverage and costs. First, some insurers offer “claims-made” policies that require continuous coverage to protect against past incidents—a gap here can leave you vulnerable. Second, bundling your esthetician insurance with your salon’s commercial property insurance often unlocks discounts not advertised openly. Third, some policies exclude certain high-risk treatments like microdermabrasion unless specifically added, so reviewing exclusions carefully is essential to avoid surprise denials.

These loopholes can either expose your business to risk or, when navigated well, save you money and provide stronger protection.

5.2 What Insurance Companies Don’t Tell You About Esthetician Insurance

Insurance providers often emphasize low premiums but may understate the importance of adequate coverage limits and detailed policy terms. For instance, a policy with a lower premium but a $500,000 liability cap might seem attractive but can be insufficient if multiple claims arise. Additionally, many estheticians don’t realize that maintaining a spotless claims record can qualify them for loyalty rewards or reduced premiums over time.

Understanding these hidden aspects allows estheticians to choose policies that truly safeguard their practice and clients.

| Insider Tip | Impact | Action |

|---|---|---|

| Understand “claims-made” vs “occurrence” policies | Prevents coverage gaps | Confirm continuous coverage |

| Bundle insurance policies | Unlocks discounts | Ask providers about bundles |

| Review exclusions carefully | Avoid denied claims | Add high-risk treatments explicitly |

Check the Insurance Information Institute’s guide to better grasp insurance terms and coverage nuances.

6. Future-Proofing Your Esthetician Insurance

6.1 Emerging Trends in Esthetician Insurance (2025-2030 Outlook)

The esthetician insurance landscape is evolving rapidly, driven by new beauty technologies and shifting regulations. Between 2025 and 2030, insurers are expected to introduce more customized policies that address emerging risks from advanced treatments like microneedling and laser therapies. Additionally, sustainability concerns are prompting policies that cover eco-friendly product liabilities. Increasing demand for tele-beauty services will also lead to specialized coverage options for virtual consultations and remote skincare advice.

Staying ahead means regularly reviewing your policy to incorporate these innovations and protect your practice from novel liabilities.

7.2 How Artificial Intelligence is Transforming Esthetician Insurance

AI technology is reshaping insurance underwriting and claims management in the beauty sector. Automated risk assessments now analyze client data and treatment histories to offer personalized premiums. AI-driven claim processing reduces turnaround times and improves accuracy in evaluating esthetician claims. Additionally, predictive analytics help insurers identify emerging risks, allowing estheticians to proactively adjust coverage.

Embracing AI tools can help estheticians secure better rates and more precise insurance solutions tailored to their unique business needs.

| Trend | Impact on Esthetician Insurance | Recommended Action |

|---|---|---|

| Advanced treatment coverage | More tailored policies for new procedures | Update policy regularly |

| Eco-friendly product liability | Coverage for sustainable beauty products | Check for green endorsements |

| Tele-beauty insurance | Protection for virtual services | Include tele-services in policy |

| AI-powered underwriting | Personalized pricing and risk analysis | Use AI-enabled brokers |

For more insights on insurance trends and technology, visit the National Association of Insurance Commissioners.

Conclusion and Action Plan for Esthetician Insurance

Your 5-Point Esthetician Insurance Action Plan

- Assess the specific risks related to your esthetician services and treatments.

- Research insurance providers with expertise in beauty professional coverage.

- Compare multiple quotes to find comprehensive policies at competitive prices.

- Regularly review and update your insurance as your business evolves.

- Maintain detailed records and promptly file claims to ensure smooth processing.

Next Steps to Protect Your Esthetician Business

Protecting your esthetician career with the right insurance is essential for peace of mind and long-term success. Start by consulting trusted insurance experts, and make sure your coverage aligns with your evolving services. Stay informed about legal requirements in your state and keep your policy current to avoid unexpected gaps. With the right preparation, you can focus on delivering exceptional beauty treatments while safeguarding your business against unforeseen risks.

Official Resources and Expert Advice

Government and Professional Organizations

- National Association of Insurance Commissioners (NAIC) – Offers regulatory guidelines and consumer protection information for insurance across the United States.

- New York State Office of the Professions – Governs cosmetology and esthetician licensing and insurance laws in New York.

Free Tools to Check Your Esthetician Insurance

- Insureon Esthetician Insurance Quotes – Compare customized insurance quotes from multiple providers for beauty professionals.

For vehicle-based beauty businesses, don’t miss our guide on box truck insurance costs in 2025 to avoid overpaying. - State Insurance Department Map – Find your state’s insurance regulator to get help and file complaints if needed.

FAQ

What insurance does an esthetician need?

Estheticians typically need a combination of general liability insurance (for client injuries or property damage), professional liability insurance (to cover errors or negligence during treatments), and product liability insurance (for adverse reactions caused by products used). These coverages protect against financial losses from lawsuits or claims related to their beauty services.

How much is professional liability insurance for estheticians?

Professional liability insurance for estheticians usually costs between $400 and $900 annually, depending on the state, scope of services, and risk factors. More advanced or higher-risk treatments can increase premiums.

How much does $1,000,000 general liability insurance cost?

A $1,000,000 general liability policy for estheticians typically ranges from $350 to $700 per year, influenced by location and claims history. States with stricter regulations or higher litigation rates tend to have higher premiums.

How much is $100,000 in liability insurance?

Liability insurance with a $100,000 limit is generally less expensive, often available at significantly lower rates than higher limits. While exact prices vary, it might cost a few hundred dollars annually, but it’s important to verify coverage adequacy as many states and clients require higher limits for proper protection.