Introduction

EV insurance cost 2025 is under the spotlight as electric‑vehicle owners face higher premiums driven by increased repair expenses, new underwriting trends, and regional labor‑rate spikes. A recent Mitchell EV Collision Insights Q2 2025 report shows that EV claim severity rose 16–49 % compared to gasoline vehicles due to battery‑pack repairs, calibration of advanced driver‑assistance sensors, and parts delays. Buzz on Reddit EV forums and Tesla owner threads reflects growing concern about rising renewal rates, with many drivers seeking more affordable coverage.

This comprehensive guide breaks down why EV policies cost more, which factors drive pricing, practical ways to save, and what market changes lie ahead.

On This Page

Why EV insurance cost 2025 is higher than gas cars

Premiums for electric vehicles remain elevated for several reasons:

- Repair complexity: EVs use high‑voltage lithium‑ion batteries, ADAS sensors, and specialized components that require OEM‑certified technicians and additional safety protocols.

- Higher parts & labor costs: According to Mitchell, EV collision‑repair severity is 16–49 % higher than for internal‑combustion vehicles. Battery diagnostic tests, sensor recalibration, and limited repair networks all add cost.

- Safety tech adds expense: A seemingly minor fender‑bender can require costly replacements of radar units, cameras, and LiDAR sensors embedded in bumpers.

- Total‑loss thresholds: Because battery replacement can exceed 50 % of a car’s value, insurers often declare EVs a total loss more quickly, pushing up comprehensive coverage rates.

- Regional variation: States like California and New York with higher labor rates or strict EV repair‑shop certification often see premiums above the national average.

For background on standard auto‑policy structures and coverage types, see our car insurance guide.

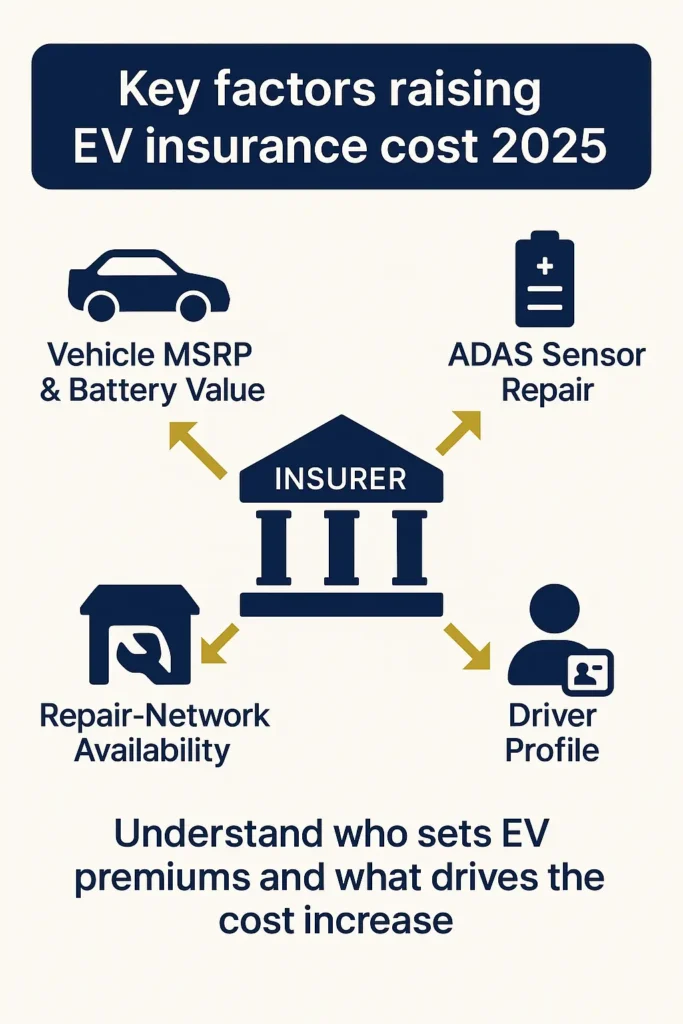

How insurers set EV premiums in 2025

Insurance companies use a combination of traditional and EV‑specific risk factors:

- Vehicle MSRP & battery value: Higher replacement costs increase comprehensive and collision premiums.

- ADAS repairability: Vehicles with advanced sensors require costly calibration after accidents, affecting rates.

- Driver profile & driving data: Age, credit score (where permitted), driving history, and telematics mileage all impact pricing.

- ZIP‑code crash and theft statistics: Urban ZIP codes with higher collision or theft incidents carry higher base rates.

- Repair‑network availability: In regions lacking EV‑certified shops, insurers account for transport costs and longer repair times, which raise premiums.

- Regulatory compliance & incentives: Some states cap certain surcharges or offer credits for EV adoption.

Policyholders who bundle auto with home coverage can save up to 15–25 % on premiums depending on the carrier. Learn more in our auto and renters insurance bundle guide.

5 Ways to Lower EV Insurance Costs in 2025

Below are practical steps with typical savings ranges reported by major carriers:

- Compare EV‑friendly carriers: Companies like Tesla Insurance, Travelers, and Progressive EV programs often provide 5–10 % lower rates for EVs due to tailored repair‑cost models.

- Increase deductibles cautiously: Raising deductibles from $500 to $1,000 can cut premiums by 6–12 %, but keep cash reserves for claims.

- Bundle home/auto policies: Multi‑policy discounts can save 10–20 % depending on state regulations.

- Install safety & anti‑theft tech: OEM‑approved charging‑station safety devices, GPS trackers, and dashcams may qualify for 3–8 % discounts.

- Drive fewer miles / usage‑based plans: Low‑mileage EV drivers benefit from pay‑per‑mile or telematics‑based programs that can reduce premiums by up to 15 % for under‑8,000‑mile drivers.

For shoppers seeking good‑value models, visit our cheapest cars to insure — several compact EVs rank competitively in premium cost.

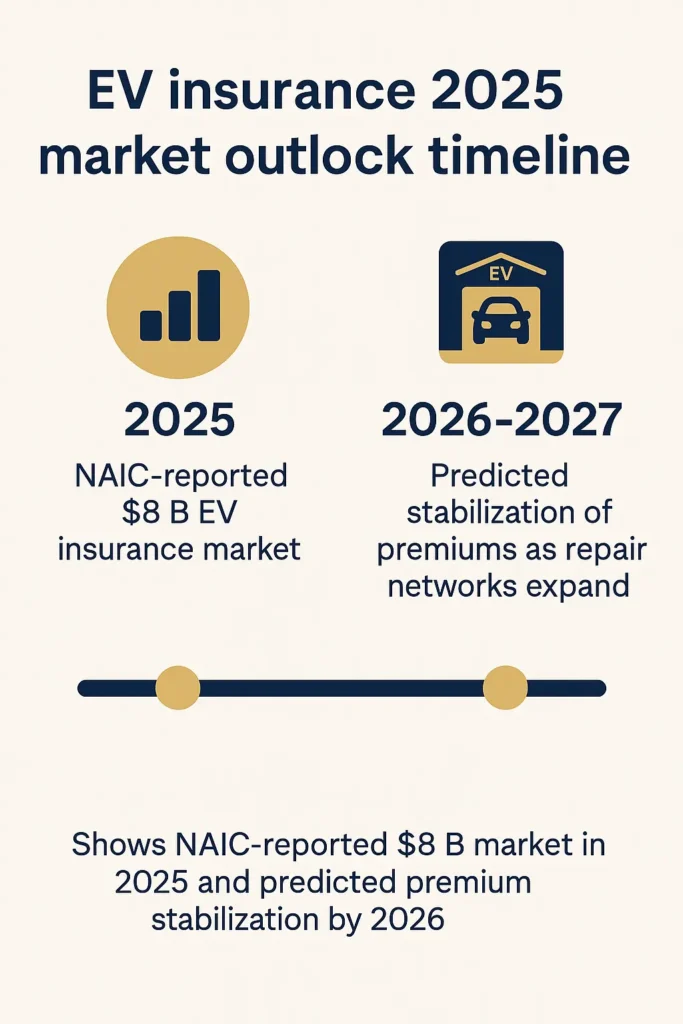

EV incentives & market outlook 2025

- Insurance incentives: Some state clean‑energy programs offer $50–$150 premium credits for EV owners who install certified home chargers or meet safety standards.

- Market growth: NAIC EV Insurance Rates data shows the EV‑specific auto‑insurance sector in the U.S. exceeded $8 billion in written premiums in 2025, driven by rising EV sales and specialty carriers.

- Stabilization outlook: Analysts project premium growth to slow after 2026 as repair‑network capacity expands, battery‑pack prices decline, and more carriers compete for EV policies.

For more information on available incentives nationwide, visit the U.S. DOE Alternative Fuels Data Center – EV Incentives directory for state‑by‑state programs.

EV insurance cost 2025 – FAQs

Is car insurance more expensive in 2025?

Yes. Across the U.S., average auto‑insurance premiums rose about 8–12 % in 2025 due to parts inflation and climate‑related losses. EV premiums climbed even more because of battery repair costs.

Are EV vehicles more expensive to insure?

Generally yes. The Mitchell study reports 16–49 % higher claim severity for EVs, which drives higher comprehensive and collision rates compared to gas cars of similar value.

What is the most affordable EV insurance?

Usage‑based telematics policies and EV‑focused carriers like Tesla Insurance often quote the lowest rates for low‑mileage drivers with good records.

How big is the electric vehicle insurance market?

Industry estimates show the EV‑insurance market reached $8 billion in 2025, according to NAIC, growing in tandem with EV adoption and specialized underwriting models.

What is the insurance incentive 2025?

Certain states offer insurance‑premium credits or rebates tied to EV adoption or safe‑charging equipment. Check your state’s department of insurance or the U.S. DOE EV Incentives site for eligibility.

What car is cheapest to insure?

Smaller EV hatchbacks and sedans with modest MSRP and inexpensive battery modules generally cost less to insure. See our cheapest cars to insure for rankings.

Why is EV insurance cost 2025 trending online?

Social‑media conversations, particularly in Reddit EV and Tesla forums, highlighted renewal hikes linked to the 16–49 % higher claim costs, sparking mainstream attention.

How will EV repair‑network expansion influence premiums after 2025?

As more OEM‑certified repair centers open nationwide and independent shops gain EV credentials, carriers expect repair timelines to shorten and costs to drop, which could help stabilize or reduce premiums by 2026–2027.

Future regulations & transparency efforts

The National Association of Insurance Commissioners – NAIC is exploring risk‑based pricing transparency guidelines for EVs. Proposed 2025–2026 measures include standardized reporting on how ADAS features, battery‑replacement costs, and repair‑network factors influence premium calculations. These initiatives aim to help consumers understand rate changes and encourage competitive pricing.

Key Takeaways

- EV insurance cost 2025 remains higher than average due to battery‑related repair severity, specialized labor, and sensor recalibration.

- Drivers can save by shopping EV‑friendly carriers, bundling policies, leveraging telematics, and installing approved safety devices.

- Future premiums may moderate as repair‑network capacity improves and regulatory transparency increases.

Helpful Resources

- Car insurance guide for basics of coverage.

- Cheapest cars to insure for models that often cost less to insure.

- Auto and renters insurance bundle to maximize multi‑policy discounts.

Conclusion

The EV insurance cost 2025 surge underscores how emerging vehicle technology reshapes risk and premiums. By understanding cost drivers, leveraging U.S. DOE EV Incentives, and comparing Tesla Insurance with other EV‑friendly carriers, electric‑vehicle owners can better manage rising premiums and prepare for a more stable market as repair networks expand.

Regulatory Disclaimers

- This article is for informational purposes only and does not constitute legal or financial advice.

- Premium estimates vary by driver profile, ZIP code, vehicle model, and insurer.

- For specific rates or incentives, consult a licensed insurance agent or your state’s department of insurance.