Lisa had just moved into her first home in Tampa, Florida—barely three miles from the bay. Two months later, a late-summer storm pushed six inches of water through her back door. Her homeowner’s policy? It didn’t cover a dime. She found herself Googling in panic: “Do I need flood insurance if I don’t live in a flood zone?”

Flood insurance protects homeowners and renters from devastating water damage that regular policies often exclude. On average, premiums range from $700 to $1,400 per year depending on your FEMA zone and coverage type (NAIC, 2024).

If you live anywhere water can reach—coastal, inland, or even “low-risk” areas—you could be at financial risk. Here’s what you need to know if you’re unsure whether your current insurance would protect you after the next big storm.

On This Page

1. Understanding Flood Insurance in the U.S.

1.1 What Flood Insurance Actually Covers

When Mike’s basement in Houston flooded after just four hours of rainfall, his home insurance denied the claim—”flooding isn’t covered.” What saved him? A separate flood insurance policy he barely remembered buying the year before.

Flood insurance protects against physical damage caused by rising water that enters from outside your home—something your standard policy almost never includes. Many policies help pay for structural repairs after water intrusion, including damage to walls, electrical wiring, plumbing, flooring, and even permanently installed cabinets or shelving—elements often overlooked until it’s too late.

Policies may also include or allow you to add contents coverage to protect personal belongings like clothing, furniture, and electronics. That said, items like vehicles, temporary housing, or losses from sewer backups typically fall outside this coverage unless specifically added.

According to FEMA’s 2024 data, the average flood insurance payout in the U.S. reached $42,800—a figure that highlights just how financially crippling even a moderate flood can be.

Pro Tip: Don’t assume everything is covered. Make sure you understand what’s included in building vs contents coverage, and ask your agent to clarify exclusions.

1.2 Who Really Needs It—Even Outside High-Risk Zones

Lisa lives in Columbus, Ohio—nowhere near the ocean. She never imagined a heavy spring thaw would turn her street into a shallow river. The cleanup cost her $17,000. Her mistake? Believing that flood insurance was only for coastal homes.

According to NAIC (2024), nearly a quarter of all flood insurance claims originate from areas not officially labeled “high-risk.” That means millions of homes across the U.S. face real flood threats—despite what the maps might suggest.

Floods aren’t just coastal events. They can result from intense rainfall, overflowing storm drains, rapid snowmelt, or poor urban drainage. These conditions increasingly affect areas once considered “safe.”

Flood insurance is especially worth considering if you:

- Live near rivers, lakes, creeks, or retention ponds

- Reside in older neighborhoods with poor drainage systems

- Rent a basement or ground-floor unit

- Own property in cities with frequent flash flooding

Stat to Know: Over 3.5 million properties in so-called “low-risk” zones have reported flood losses in the past 15 years (FEMA & U.S. Census, 2025).

1.3 Why Standard Home Insurance Isn’t Enough

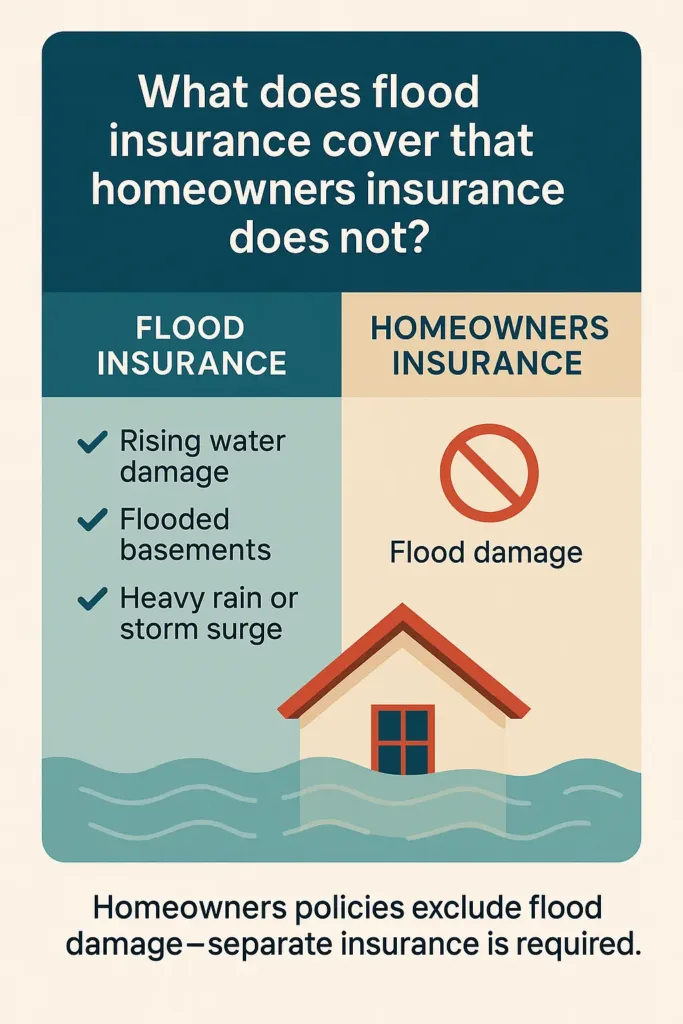

One of the most dangerous myths in U.S. insurance? Assuming your homeowners policy includes flood insurance. It doesn’t. Not even a little.

Home insurance typically only covers water damage from internal events—like burst pipes or a leaking roof. It does not cover water that comes from outside your home, like rainwater overflowing into your basement or flash flooding from the street.

That’s why protection against floods isn’t bundled with your standard homeowners insurance—you’ll need to get a separate policy, either through the NFIP or from a private company offering similar coverage.

Comparison Table: NFIP vs Private Flood Insurance

| Feature | NFIP | Private Insurers |

|---|---|---|

| Max Building Coverage | $250,000 | Up to $2 million+ |

| Contents Coverage Optional | Yes | Yes |

| Waiting Period | 30 days | Often 10–15 days |

| Basement Coverage | Limited | More flexible |

| Availability | Nationwide | Varies by state and provider |

FEMA estimates that just one inch of flooding can lead to over $25,000 in home repairs—a figure that puts into perspective how risky it is to count on a standard homeowners policy that excludes flood events entirely.

2. How Much Is Flood Insurance and What Affects the Cost?

2.1 National and State Averages (Updated 2025 Data)

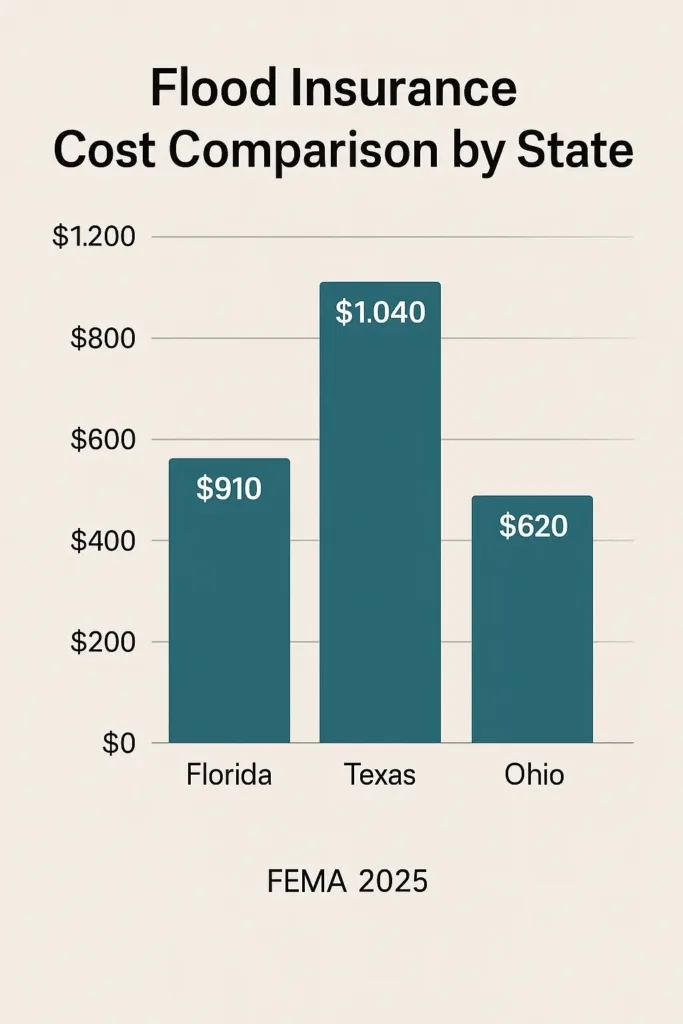

Flood insurance isn’t a one-size-fits-all product. While the national average premium sits around $888/year in 2025, the actual amount you’ll pay can vary wildly depending on where you live, what your home is made of, and how FEMA or your private carrier views your risk.

Here’s a quick snapshot of average annual premiums in five diverse states:

| State | Estimated Annual Premium (2025) |

|---|---|

| Florida | $910 |

| Texas | $1,040 |

| California | $881 |

| New York | $1,270 |

| Ohio | $620 |

📊 Source: Compiled from 2024–2025 regional NFIP and private market data sets (FEMA, NAIC).

But averages don’t tell the full story. Let’s look at what really determines your price—and why your neighbor might pay hundreds more (or less) than you do.

2.2 What Drives Your Rate: Zone, Property, Risk, NFIP

Ariana, a renter in a modest duplex outside Denver, never imagined she’d need flood insurance. Her street was nowhere near a coastline. But after FEMA updated its flood maps and reclassified her block due to runoff patterns from nearby foothills, her premium nearly doubled.

What changed? Just a few factors that can drastically impact your flood insurance cost:

- Flood Zone Designation: Homes in high-risk zones (like AE, VE) are significantly more expensive to insure than those in moderate (Zone B or C) or minimal-risk areas (Zone X).

- Elevation Certificate: Homes with higher base elevation can save hundreds annually.

- Construction Features: Flood-resistant building techniques like raised foundations or vents often reduce risk scores.

- Coverage Choices: The more coverage you choose—especially for contents—the higher the cost. A $250K structure-only plan costs far less than a bundled $350K structure + contents package.

- Insurer Type: NFIP premiums are standardized, but private insurers may offer custom quotes with faster activation—though their prices can swing based on your zip code or claims history.

💡 Pro Tip: If you believe your home was misclassified into a higher-risk zone, you can request a Letter of Map Amendment (LOMA). It could lower your premium by hundreds—if your elevation or updated survey data supports it.

2.3 Real Examples: Premiums in Florida, Texas, and Ohio

Let’s bring this to life with real-world quotes based on current filings and FEMA data.

Miami, FL – Coastal Property (Zone AE)

- Home Type: Single-family

- Coverage: $250,000 structure / $100,000 contents

- Annual Premium: ~$1,710 (NFIP), ~$2,030 (Private)

Austin, TX – Mid-Elevation Home (Zone X)

- Home Type: Townhome

- Coverage: $200,000 structure only

- Annual Premium: ~$612 (NFIP), ~$595 (Private)

Columbus, OH – Older Home with Basement (Zone B)

- Home Type: Colonial-style

- Coverage: $150,000 structure + contents

- Annual Premium: ~$545 (NFIP), ~$630 (Private)

🗨️ Agent: “Did you know that covering your contents—like furniture, electronics, and kitchen appliances—can raise your premium by up to 30%?”

Client: “I thought that was included!”

Agent: “It’s optional in most policies. And worth every penny if you have a finished basement or valuable gear downstairs.”

✅ Summary Snapshot (UX Synthesis)

| Factor | Effect on Cost |

|---|---|

| High-Risk Zone (AE/VE) | +50% to +150% premium |

| Elevation Certificate | -10% to -40% reduction |

| Private vs NFIP | Custom pricing, faster payouts, more fluctuation |

| Contents Coverage Added | +$70 to $300/year |

| LOMA Approved | -$200 to -$600/year (depending on zone) |

3. How to Get Flood Insurance: Your 2025 Step-by-Step Guide

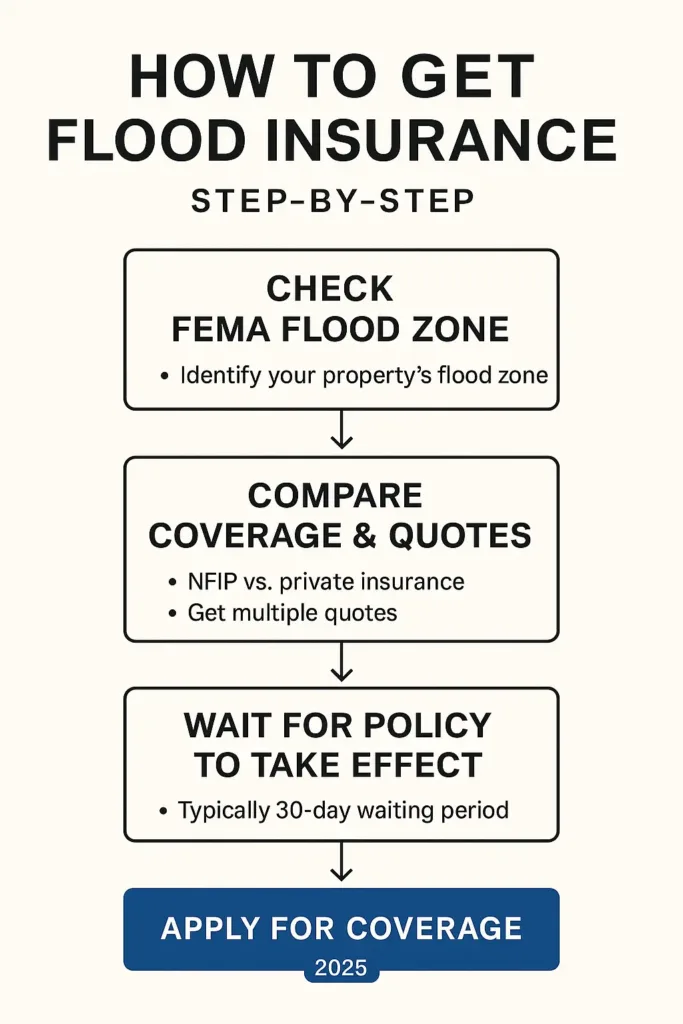

Flood insurance isn’t something you can tack onto your regular home insurance—it’s a separate policy with its own application, pricing model, and start dates. Whether you’re buying a beach cottage in Biloxi or managing a duplex in inland Georgia, the process is more accessible than most people assume.

We’ll walk you through each step so you don’t miss coverage when it matters most.

3.1 NFIP vs Private Flood Insurance: Which One to Choose?

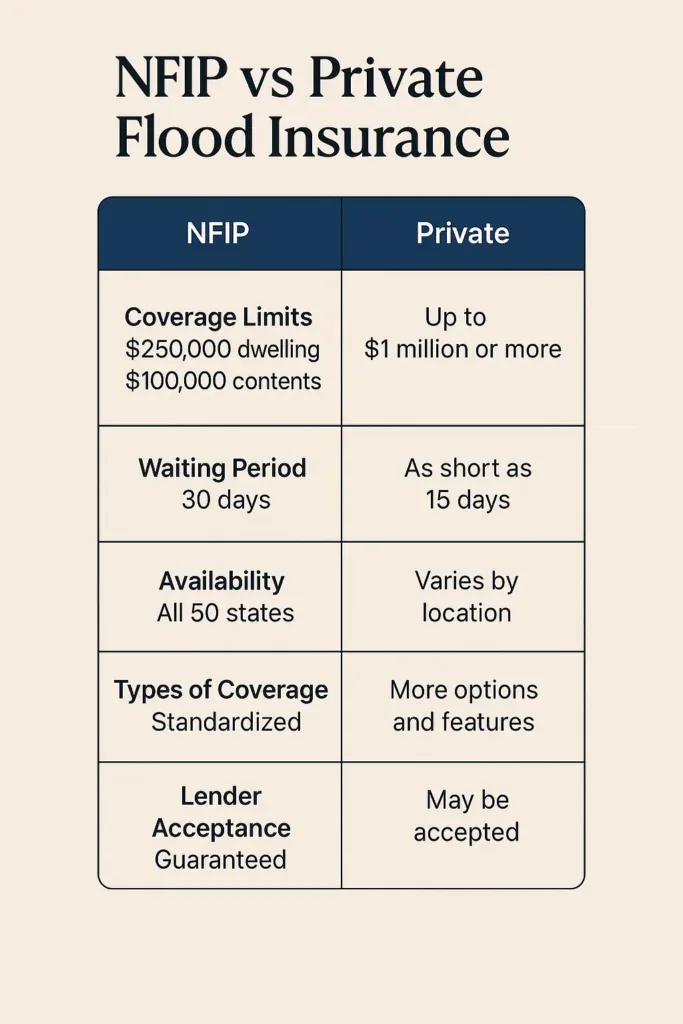

When you start looking into how to get flood insurance, you’ll likely encounter two main paths: a federally backed NFIP policy or a private flood insurance plan. Understanding which fits your situation is the first real decision you’ll need to make.

Let’s break it down by key factors:

NFIP (National Flood Insurance Program)

- Backed by FEMA, widely accepted by mortgage lenders

- Max structure coverage: $250,000

- Max contents coverage: $100,000

- Available in over 22,000 communities nationwide

- Mandatory 30-day waiting period (unless tied to a mortgage closing)

- Limited flexibility: doesn’t cover loss of use or basement contents

Private Flood Insurance

- Offered by licensed insurers across the U.S.

- Higher limits (often up to $1M+), more add-ons available

- Shorter waiting periods (some as low as 7–10 days)

- May include living expenses, finished basements, replacement cost

- May not be accepted by every lender

🧭 Pro Tip: If your home has high-value contents or sits in a low-risk zone, private flood insurance can offer more protection at a similar price.

Comparison Snapshot

| Feature | NFIP (FEMA) | Private Insurers |

|---|---|---|

| Coverage Limit | $250K / $100K | Up to $1M or more |

| Waiting Period | 30 days | 7–15 days |

| Replacement Cost Option | Not available | Often included |

| Loss of Use | Not covered | Frequently covered |

| Mortgage Lender Approval | Universally accepted | Varies by lender |

3.2 How to Get a Flood Insurance Quote Today

Getting a flood insurance quote isn’t as complicated as it sounds. In fact, it’s often faster than a regular homeowners policy if you’re prepared.

Here’s what the process usually looks like:

- Know Your Flood Zone

Use FEMA’s Flood Map Service Center to check your flood zone. Whether you’re in Zone AE or Zone X, this will influence pricing and availability. - List What You Want Covered

Think about the structure, contents, or both. For renters, contents-only policies are available. For homeowners, you may want to cover finished basements, major appliances, and personal belongings. - Reach Out to an Agent or Compare Online

You can contact a local independent agent or use national platforms that compare NFIP and private options side-by-side. Just be sure the platform is licensed in your state. - Review Quote Details Carefully

Check waiting periods, deductible amounts, exclusions, and if you’re eligible for optional riders like replacement cost coverage or sewer backup.

3.3 Timeline, Waiting Periods, and Effective Coverage Start

Many people think flood insurance kicks in as soon as you pay—but that’s rarely the case.

Here’s how it actually works:

- NFIP Policies: Have a mandatory 30-day waiting period unless you’re buying the coverage in conjunction with a loan closing. That means if a storm is forecasted next week, it’s already too late to get protected.

- Private Flood Insurance: Often provides faster activation, typically within 7–15 days. Some carriers offer next-day coverage if certain conditions are met (like a home inspection or low-risk zone).

👤 Case Example:

In late April, Andrea in Baton Rouge secured a private flood policy with a 10-day wait. By early May, heavy rainfall caused flash flooding. Because her policy had already activated, her damage—over $45K—was fully covered.

💬 Agent–Client Exchange:

— “Can I get coverage immediately? There’s a storm coming this weekend.”

— “Unfortunately, both NFIP and private policies have built-in waiting periods. But if your lender is involved, we may be able to waive it. Let’s check.”

Checklist: When Will My Coverage Start?

| Scenario | Estimated Start Date |

|---|---|

| Buying through NFIP without a loan | 30 days after payment |

| Tied to mortgage or loan closing | Same day as closing |

| Private policy with low-risk property | 7 to 10 days (varies) |

| Private policy with inspection or riders | May take up to 15 days |

4. What Is the National Flood Insurance Program (NFIP)?

At first glance, the National Flood Insurance Program (NFIP) may seem like just another federal acronym—but for millions of homeowners and renters, it’s a lifeline. If you’re wondering how flood coverage actually works, where it comes from, or why it’s handled differently than regular home insurance, this section breaks it all down clearly.

4.1 Who Runs NFIP and What It Offers

The National Flood Insurance Program is managed by the Federal Emergency Management Agency (FEMA), but the policies themselves are sold through over 50 private insurers. That means you’re not buying insurance from the government directly—you’re just getting federally backed coverage through familiar carriers like Allstate, Liberty Mutual, or independent agents.

The program was created in 1968 to reduce the federal burden of disaster relief after floods, and it’s grown to cover more than 4.7 million properties nationwide (FEMA, 2024). Its goal? To make flood protection accessible and standardized, especially in high-risk flood zones.

NFIP Coverage Includes:

- Structural protection up to $250,000

- Personal belongings up to $100,000

- Water damage from flash floods, hurricanes, storm surges, and overflowing rivers

- Coverage in all 50 states + D.C. + U.S. territories

💬 Client Quote:

“I had no idea FEMA wasn’t the insurer. My agent explained NFIP policies work like any other coverage—but come with strict caps and limits.” — Lydia, homeowner in Tampa, FL

The catch? Coverage through NFIP is limited, standardized, and comes with a 30-day waiting period, which can leave homeowners exposed if they wait too long.

4.2 NFIP Eligibility, Coverage Limits, and Cost

Can anyone buy an NFIP policy? Not exactly. You can only purchase it if your community participates in FEMA’s Community Rating System (CRS). Luckily, over 22,000 communities do.

You’re eligible if:

- Your home is in a participating community

- You live in a flood zone (Zones AE, V, A…)

- You’re insuring a primary home, secondary home, or rental property

Coverage Limits:

| Category | Coverage Amount |

|---|---|

| Dwelling (Structure) | Up to $250,000 |

| Contents (Personal Property) | Up to $100,000 |

| Deductibles | $1,000 to $10,000 (varies) |

⚠️ Important: NFIP does not cover loss of use, temporary housing, or finished basements. You’ll need private flood insurance for those.

How Much Does NFIP Cost in 2025?

According to FEMA’s latest data (2024), the average premium for NFIP coverage is $935/year, but this varies based on:

- Your flood zone (Zone AE will cost more than Zone X)

- Elevation and foundation type

- Type of property (single-family vs. condo vs. rental)

- Community discounts (via FEMA’s CRS program)

🧠 Real-Life Example:

Lisa in New Orleans pays $1,210/year for NFIP on her raised single-story home in Zone AE. Meanwhile, Raj in Phoenix pays just $402/year—because he’s in Zone X and qualifies for a preferred risk policy.

💡 Pro Tip: Some states offer policy subsidies or discounts through local mitigation efforts. Ask your agent about FEMA’s Elevation Certificate or CRS score rebates.

4.3 Why FEMA Is Not the Insurer (and Why That Matters)

Here’s where many people get confused: FEMA manages the NFIP, but it does not underwrite the policies. Instead, the coverage is administered by private insurers through the Write Your Own (WYO) program.

This setup has pros and cons:

✅ Pros

- Familiar insurers handle your paperwork, billing, and customer service

- Claims processing is streamlined through standard systems

- Easier access for most Americans—your local agent can help

⚠️ Cons

- Coverage is limited by FEMA’s caps, no matter the insurer

- Rates are set by FEMA—no price shopping

- Delays and strict eligibility rules can limit responsiveness during disasters

📞 Agent–Client Conversation

— “Why can’t I just increase my coverage limit?”

— “NFIP maxes out at $250K for structure, no matter what. If your home is worth more, we’d need to look into private options.”

And here’s the big picture: when a major flood hits, FEMA steps in with disaster aid—but only if you’re uninsured or underinsured. Having NFIP protection helps you avoid relying on limited federal relief, which often comes in the form of low-interest loans, not grants.

5. Does Renters Insurance Cover Flood Damage?

5.1 Renters vs Homeowners: What’s the Difference in Coverage?

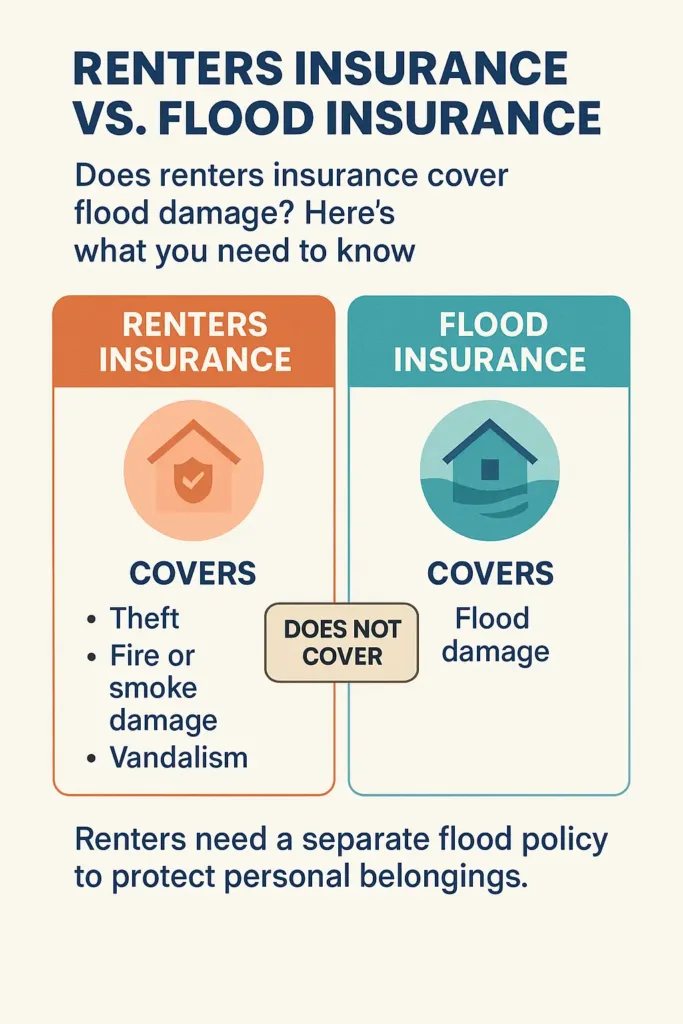

Let’s get one thing straight: standard renters insurance doesn’t protect you from flood damage. Not even a little. While it typically covers your belongings in the event of fire, theft, or even some types of water damage (like burst pipes), it stops cold when floodwaters start rising.

Now, here’s where confusion often kicks in. Homeowners can purchase flood insurance for both the structure and its contents. Renters? They only need to worry about what’s inside—their furniture, electronics, clothes, and cherished personal items. But unless they actively buy a contents-only flood policy, they’re completely unprotected.

🔎 Case in Point

After Hurricane Ian, Tasha, a renter in Cape Coral, lost nearly $9,000 in electronics and irreplaceable keepsakes when floodwater surged into her first-floor apartment. Her landlord had insurance for the building, but Tasha’s policy didn’t cover floods—and her claim was denied. She later learned a contents-only flood policy would have cost her around $160 a year.

🗨️ Agent–Tenant Dialogue

— “So if my apartment floods, my renters insurance won’t help?”

— “Not unless you have a separate flood policy. The landlord’s insurance covers the building, not your stuff.”

— “And how do I get one just for my belongings?”

— “You can apply through NFIP or private insurers for a contents-only policy.”

5.2 What to Do If You’re a Renter in a Flood-Prone Area

Don’t wait until the next hurricane warning to think about insurance. If you’re renting in a coastal city, near a river, or in a basement unit—even in a “moderate” risk zone—you’re still exposed. And here’s the kicker: more than 25% of flood insurance claims come from outside high-risk zones.

Here’s a practical checklist to follow today:

📌 Flood Preparedness Checklist for Renters

- 🔍 Check your address on FEMA’s Flood Map Service Center

- 🏢 Ask your landlord whether the property has experienced flooding in the past

- 🗂️ Inventory your personal belongings (photos + receipts = smoother claims)

- 📦 Consider a contents-only flood insurance policy (via NFIP or private provider)

- ⬆️ Store valuables off the floor or in waterproof bins

💡 Pro Tip: If you live in a basement or garden-level unit, ask if your building is in an AE or VE flood zone. Those zones often require elevation certificates, and flood risk is significantly higher.

5.3 Is It Worth It to Get Standalone Flood Insurance?

It’s a fair question—especially if you’re juggling rent, utilities, groceries, and now possibly another policy. But let’s break it down:

💸 Average annual premium for renters flood insurance:

- Low-risk zone (Zone X): $130–$200/year

- High-risk zone (AE or VE): $220–$450/year

Compare that to the average cost of replacing flood-damaged belongings, which FEMA estimates at $25,000+ for 1 foot of water in a small apartment.

🎯 Why It’s Worth It

- You don’t need to cover the structure—just your stuff

- NFIP contents-only policies are widely available, often with no elevation certificate

- Private flood insurers may offer bundled deals or discounts if you pair it with renters or auto insurance

🧠 Final Takeaway: If your furniture, laptop, and memories matter to you, flood insurance isn’t a luxury—it’s a line of defense most renters don’t realize they need until it’s too late.

6. Common Misconceptions About Flood Insurance

6.1 “Flood Insurance Is Only for Coastal Homes”

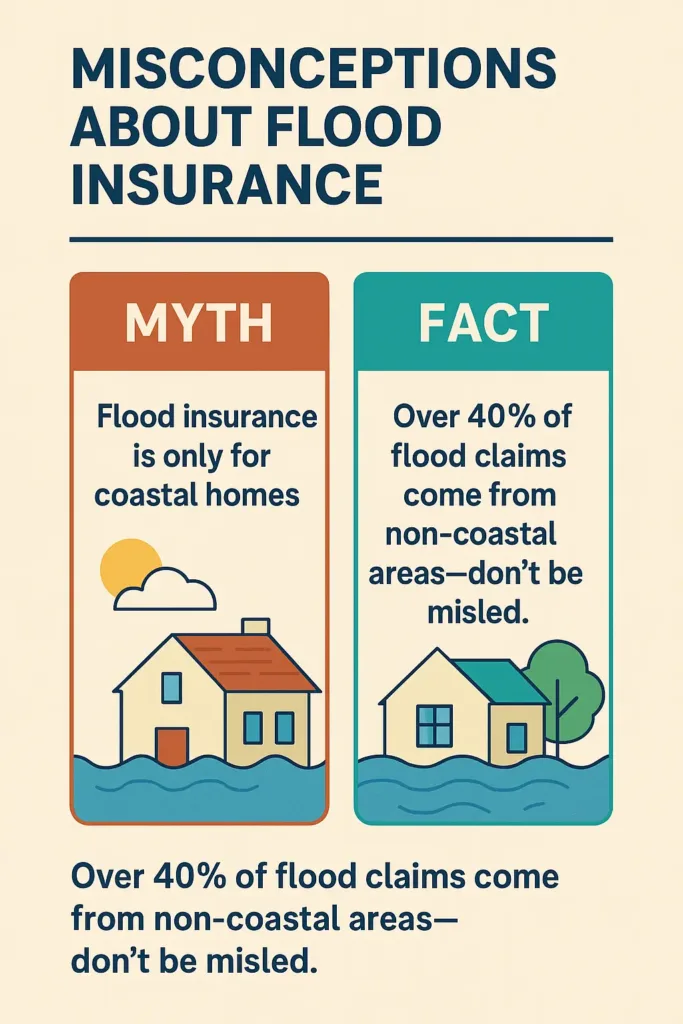

This is, hands down, the most common—and dangerous—myth about flood insurance. While hurricanes and storm surges do hammer coastal towns, over 40% of NFIP claims come from inland areas, according to FEMA. Flash floods, overflowing rivers, and intense rainfall can cause just as much damage hundreds of miles from the nearest beach.

Take Cameron, for example—a homeowner in Louisville, Kentucky. After heavy spring storms, a nearby creek jumped its banks and poured two feet of muddy water into his basement. No coastal hurricane. No warning. Just torrential rain, an aging drainage system, and no flood policy. Cameron ended up draining his emergency fund and maxing out a credit card to recover.

🧠 Writer’s Fingerprint

If we continue thinking “I don’t live near an ocean, so I’m safe,” we’re ignoring how water actually moves. It doesn’t care about coastlines. It cares about elevation, drainage, concrete, rainfall intensity. Flood insurance isn’t about geography—it’s about probability.

📊 Enrichment: Flood Claims by Region (FEMA, 2024)

| Region | % of NFIP Claims | Coastal? |

|---|---|---|

| Texas | 16% | Mixed |

| Illinois | 6% | No |

| Pennsylvania | 5% | No |

| Florida | 12% | Yes |

| Missouri | 4% | No |

As you can see, non-coastal states still account for more than a quarter of claims.

6.2 “Federal Disaster Aid Will Cover Me Anyway”

Many Americans assume that if their home floods, Uncle Sam will bail them out. But here’s what the fine print really says: federal disaster aid is only available when the President formally declares a major disaster—which happens in less than 50% of flood events.

And even when aid is granted, it’s often in the form of low-interest loans, not free money.

📍 Real-Life Example

After flooding struck parts of Vermont in 2023, residents who lacked flood insurance received up to $5,000 in grants. Those with policies received $30,000 to $80,000 depending on the damage.

💡 Pro Tip: FEMA explicitly states that flood insurance provides broader and faster protection than federal disaster assistance. You can’t rely on a presidential declaration to rebuild your life.

🧩 Key Difference Table: FEMA Aid vs. Flood Insurance

| Feature | FEMA Disaster Aid | Flood Insurance (NFIP) |

|---|---|---|

| Eligibility | Only after disaster is declared | Anytime, if insured |

| Average payout | $3,000 – $5,000 | Up to $250,000 for structure + $100,000 for contents |

| Time to receive funds | Weeks to months | Within days to weeks |

| Repayment required? | Often yes (loan) | No |

6.3 “It’s Too Expensive—Not Worth It”

This myth might have been true in the past—but today’s numbers tell a different story. Flood insurance has become significantly more affordable, especially for renters and homeowners in moderate-risk zones.

📈 According to the National Flood Insurance Program’s 2025 data:

- 🏘️ Low-risk zones (Zone X): Policies start at $146/year

- 🌧️ High-risk zones (Zone AE/VE): Range from $420 to $800/year

- 📦 Contents-only coverage for renters: Often under $180/year

Let’s put that in perspective: for many families, a single iPhone costs more than an annual flood policy. And yet, it can protect tens of thousands of dollars in damages.

🎯 Mindset Shift

We insure our phones, our cars, our pets. But not the floodwaters that could wipe out everything in one afternoon? That’s not about price—it’s about priority.

💬 Lisa in Tampa:

“I used to think it was a waste of money—until a summer storm flooded our street, and my neighbor lost her entire downstairs. She had no coverage and had to move out. That’s when I got flood insurance. Now it’s just part of my peace of mind.”

7. State-Specific Flood Insurance Laws and FEMA Zones (2025)

7.1 What FEMA Flood Zones Mean for Your Policy

Not all flood zones are created equal—and FEMA’s zoning system directly impacts what kind of flood insurance you need, how much it costs, and whether it’s mandatory.

Let’s break it down simply. FEMA flood zones are classified by risk:

- High-risk (Zones A, AE, V, VE): Mandatory flood insurance if you have a federally backed mortgage.

- Moderate- to low-risk (Zone X): Insurance is optional—but flood claims still happen here.

- Undetermined risk (Zone D): No detailed analysis available—coverage highly recommended.

📍 Case in Point: Mike in Houston

Mike bought a bungalow in Zone X, thinking he was safe. When Tropical Storm Harold dumped 12 inches of rain, the bayou behind his house overflowed. FEMA maps didn’t require coverage—but his basement filled with water anyway. His takeaway? “Just because it’s not mandatory doesn’t mean it’s not necessary.”

💡 Pro Tip: Use FEMA’s Flood Map Service Center to find your exact zone. Then ask your insurer to walk you through how it affects your flood policy options.

📊 Enrichment: FEMA Flood Zone Comparison

| Zone | Risk Level | Insurance Required? | Notes |

|---|---|---|---|

| A/AE | High | Yes | Common in riverside & low-lying areas |

| V/VE | Coastal High | Yes | Wave hazards + storm surge zones |

| X | Moderate/Low | No | 25% of NFIP claims come from here |

| D | Unknown | No (but advised) | Often found in newly developed zones |

7.2 2025 Flood Insurance Regulations in Florida, California, and Louisiana

Flood insurance isn’t federally uniform—some states go further to regulate it. Here’s what changed in 2025 across the top flood-prone states:

🐊 Florida

- New Requirement (2025): All new home sales in Special Flood Hazard Areas must disclose flood history and insurance costs.

- Citizen Property Insurance now requires flood coverage for certain coastal homeowners before issuing windstorm policies.

- Private flood insurers expanding fast due to NFIP pricing hikes.

👤 Lisa in Tampa: “We almost bought a house without knowing it had flooded three times. The new disclosure law saved us from a huge mistake.”

🌉 California

- No state-level mandate yet—but state lawmakers are debating a new bill (AB 1064) to incentivize flood insurance in post-wildfire zones.

- FEMA now flags mudslide zones in burn scar areas as eligible for flood policies.

📌 Pro Tip: If your home is downhill from a recent wildfire area, ask your insurer about post-burn flood risk and special eligibility.

🐊 Louisiana

- Community Rating System (CRS) discounts expanded in 2025: over 60 municipalities now qualify.

- Grant funding available to elevate homes in Zones A and AE through the state’s Hazard Mitigation Program.

📊 2025 Update: Flood Regulation Snapshot

| State | 2025 Key Regulation | Notes |

|---|---|---|

| Florida | Mandatory disclosure in SFHA zones | Affects buyers, realtors, lenders |

| California | Wildfire-related flood risk added to eligibility | Targets burn zones and mudflow risk |

| Louisiana | Expanded CRS participation & elevation grants | Lower premiums, especially in rural areas |

7.3 Local Discounts, Incentives, and Community Ratings

Flood insurance doesn’t always have to break the bank. In fact, many communities unlock discounts through FEMA’s Community Rating System (CRS), which rewards flood mitigation efforts.

Here’s how it works:

- Communities that invest in drainage upgrades, zoning, and public education earn points.

- These points translate into policy discounts of 5% to 45% for local residents.

- Over 1,500 municipalities now participate—including dozens added in 2025.

🧩 UX Enrichment: Top 2025 CRS Communities (Discount Tier)

| City/Town | State | Discount (%) | CRS Class |

|---|---|---|---|

| Roseville | CA | 45% | Class 1 |

| Fort Lauderdale | FL | 25% | Class 5 |

| Houma | LA | 30% | Class 4 |

| Charleston | SC | 20% | Class 6 |

| Jefferson Parish | LA | 35% | Class 3 |

🗣️ Real-World Tip from Agent Sarah in Baton Rouge

“Ask your local floodplain manager or county clerk if your area participates in CRS. Many homeowners don’t realize they could be getting discounts just for living in a well-managed zone.”

💬 Checklist: 3 Questions to Ask Your Local Agent Today

- What FEMA zone is my property in, and what does that mean for my premiums?

- Does my community participate in the CRS program?

- Are there state-level incentives or disclosure rules that apply to my property?

8. What to Do After a Flood: Filing Your Claim and Recovering

8.1 What Counts as Proof of Flood Damage?

When floodwaters recede, the first instinct is to start cleaning up. But before touching anything, stop—and document. In the eyes of an insurance adjuster, proof of flood damage isn’t what’s lost, it’s what you can prove was lost.

Let’s say your living room carpet is soaked and the drywall is buckling. Snap wide-angle photos of the room, then close-ups of damaged items. Include a ruler or tape measure to show water levels. If you have before-and-after pictures, even better.

In Biloxi, Mississippi, Jamie returned from evacuation to find 18 inches of standing water in her kitchen. Instead of throwing anything out, she filmed a slow walkthrough on her phone, narrated what was damaged, and saved receipts from Home Depot showing replacement costs. Her claim was approved within three weeks.

🧩 UX Enrichment: Actionable Proof Checklist

- 📸 Photos of each affected room (wide + detail shots)

- 📹 Video footage showing water source or extent

- 🧾 Receipts or original invoices for high-value items

- 🗂️ Home inventory or content list (can be handwritten)

- 📅 Timestamped documents (email backups, cloud photos)

Pro Tip: Label your media clearly—“Bedroom_Floor_7-15-2025” goes further than “IMG_4322.”

8.2 Timeline and Payout Expectations

Let’s be honest: filing a flood insurance claim rarely feels fast. But knowing what to expect can reduce stress—and help you push for timely results.

Typically, the claim process starts once you notify your insurer. An adjuster is assigned, a home inspection is scheduled, and then you submit your documentation. But here’s where it diverges:

- With NFIP policies, payout limits are capped at $250,000 for the building and $100,000 for contents, no matter your home’s actual value.

- With private insurers, caps may be higher, timelines shorter, and flexibility greater—especially for policyholders with coverage add-ons like temporary housing or debris removal.

🔍 Case Snapshot – Rebuilding Timeframe

Michael, a homeowner in Galveston, Texas, filed a private flood insurance claim after Hurricane Beryl in 2025. His adjuster visited within 72 hours, and the first disbursement hit his account in 10 business days. In contrast, his neighbor with NFIP coverage waited nearly 5 weeks just for inspection.

📊 UX Table – Payout Expectation Comparison (2025)

| Feature | NFIP Policy | Private Flood Insurance |

|---|---|---|

| Max Building Coverage | $250,000 | $500K–$2M |

| Contents Limit | $100,000 | $250K+ |

| Average Time to Inspection | 5–10 business days | 2–5 business days |

| Average Payout Time | 30–45 days | 7–15 days |

| Temporary Housing Covered | ❌ No | ✅ Often included |

Important: The faster you submit a complete claim file, the sooner the clock starts.

8.3 How to Appeal or Push Back If Denied

Let’s say you get the dreaded denial letter—or worse, an insultingly low settlement offer. It happens more often than you’d expect. But here’s the thing: flood insurance claims can be appealed—and many are successfully overturned.

Start by understanding the why. Was it “insufficient documentation”? A dispute over cause of damage? Or a technical issue like “flood zone misclassification”? Each has a different fix.

🛠 Step-by-Step: How to Push Back

- Re-read the denial and highlight the exact reason cited.

- Gather supporting evidence: updated photos, written contractor estimates, third-party inspections, or even a plumber’s note confirming water source.

- Write a clear, dated appeal letter, addressing the points raised.

- Submit to the correct address (NFIP appeals go to FEMA; private insurers have their own process).

- Mind the clock: NFIP appeals must be filed within 60 days from the denial date.

💬 Agent–Client Roleplay Example

— “They denied it saying the water came from outside, not rising floodwater.”

— “Did you show where it entered?”

— “Yes. It seeped under the door during the storm surge. I have video.”

— “Perfect. You’ve got grounds to appeal.”

✅ Appeal Survival Kit

- A calm, professional tone

- Dates and policy number in every document

- Photos or video proving timeline of damage

- Expert letters (contractor, appraiser, restoration crew)

- Copy of original claim + denial letter

🧠 Quote from FEMA (2024 Claims Report):

“Roughly 30% of flood claim denials that go through the formal appeal process result in partial or full payment when additional documentation is provided.”

9. How to Lower Your Flood Insurance Costs

Flood insurance premiums don’t have to be set in stone. While risk level and location play a major role, there are several ways homeowners and renters can take control—and save. From elevating your property to tapping into FEMA-backed incentives, the following strategies can help shrink your premium without sacrificing protection.

9.1 Home Elevation, Barriers, and Building Materials

If your home sits below base flood elevation (BFE), you’re likely paying a higher rate than someone with similar coverage just a few feet higher. Maybe it’s time to ask: could a few smart upgrades flip the balance—and bring your rate down to match your neighbor’s?

According to FEMA’s 2024 Flood Insurance Manual, raising your structure just one foot above BFE can slash your flood insurance cost by as much as 30%. This doesn’t just apply to new construction. Retrofitting older homes—especially in states like Louisiana or South Carolina—can deliver major savings.

📌 Cost-Saving Structural Changes (Checklist):

- Elevate HVAC systems, circuit breakers, and water heaters above projected flood levels.

- Add engineered flood vents to your foundation to reduce hydrostatic pressure.

- Choose moisture-resistant insulation and drywall for all ground-floor walls.

- Use waterproof coatings around your crawlspace or basement walls to reduce seepage.

- Reinforce entrances with flood-resistant doors and backflow valves.

🧠 Pro Tip:

Check your local building code or consult a floodplain manager. Some communities offer additional tax rebates or permit incentives for flood-mitigation upgrades.

9.2 FEMA Incentives and Community Rating System (CRS)

Many homeowners don’t realize their flood insurance rate is also influenced by how flood-prepared their city is. FEMA’s Community Rating System (CRS) ranks participating municipalities on a 1 to 10 scale based on risk-reduction measures. The better your community scores, the bigger your potential discount.

For example, in Miami-Dade County (CRS Class 5), residents may receive up to 25% off their NFIP policy. By contrast, a neighboring non-participating area gets no discount—despite having similar flood exposure.

📊 NFIP Discount Potential by CRS Class:

| CRS Class | Discount on NFIP Policy |

|---|---|

| Class 1 | Up to 45% |

| Class 5 | 25% |

| Class 9 | 5% |

| Class 10 | 0% |

🧭 To find your community’s CRS score, use FEMA’s official lookup tool: https://www.fema.gov/flood-insurance/crs

9.3 Expert Tips to Reduce Your Risk—and Your Premium

Reducing your flood insurance cost often comes down to knowing where you have leverage. Some tips involve physical upgrades, others are about strategy and timing.

💬 Expert Insight — John Ellis, Flood Risk Assessor (Florida, 2025):

“Homeowners often underestimate how much influence they actually have. I’ve seen premiums drop drastically—sometimes by thousands—just by making strategic improvements and being proactive.”

🛠️ Smart Premium-Lowering Moves:

- Combine your flood policy with home or auto insurance—bundle discounts from private carriers can be substantial.

- Re-evaluate your flood zone classification if FEMA maps have changed recently.

- Avoid filing multiple small claims; too many can label you as high-risk.

- Choose a higher deductible if you can afford the upfront cost—it typically lowers your annual premium.

📌 Lisa’s Story – Tampa, FL:

Lisa bought a home in a moderate-risk zone and was quoted $2,400/year. After elevating her HVAC system and switching to a $5,000 deductible, her premium dropped to $1,280. “The savings made the upgrades pay for themselves within two years,” she says.

10. Flood Insurance vs. Other Types of Insurance: Key Differences

It’s easy to assume your standard policy has you covered—until water pours into your living room and your claim gets denied. The truth? Flood insurance is a completely separate policy, and understanding where it fits among homeowners, renters, and other types of coverage can prevent devastating surprises.

Let’s break it down clearly—no jargon, no fine print.

10.1 Homeowners, Renters, Earthquake, and Water Backup

Many Americans believe flood damage is included in their regular insurance plan. It’s not. Neither homeowners nor renters insurance will cover rising water from a flood event. Here’s how different policies stack up:

📊 What’s Covered? Quick Comparison

| Event Type | Homeowners Insurance | Renters Insurance | Flood Insurance | Earthquake Insurance | Water Backup Rider |

|---|---|---|---|---|---|

| Flash Flood from Rain | ❌ | ❌ | ✅ | ❌ | ❌ |

| Water Seepage from Below | ❌ | ❌ | ✅ | ❌ | ✅* (if added) |

| Pipe Burst (Inside Home) | ✅ | ✅ | ❌ | ❌ | ❌ |

| Earthquake-Related Flood | ❌ | ❌ | ❌ | ✅ | ❌ |

🧠 Pro Tip:

Water damage ≠ flood damage in the eyes of insurers. Even if your carpet is soaked in both cases, the cause changes everything.

📍 Case in Point: Mike in Houston

Mike’s basement flooded after a hurricane surge. He filed a claim through his homeowners policy—denied. Only after adding flood insurance through NFIP did he realize the difference. “No one explained this to me when I bought the house,” he says. “Now I make sure my clients understand exactly what they’re paying for.”

10.2 When You Need Separate Policies (and Why It Matters)

Here’s the kicker: even if you have the best homeowners or renters coverage on the market, you still need flood insurance if you live in a flood-prone area—or even a moderate-risk one.

Why? Because FEMA classifies floods as “excluded perils” under standard property policies. Mortgage lenders know this, which is why they require flood coverage in high-risk zones. But even if you’re not legally required to buy it, your risk may still be real.

🧭 Situations Where Flood Insurance Is Essential:

- You live near a river, lake, or coastline—even if it hasn’t flooded in years.

- Your neighborhood has poor drainage or flood history.

- Your mortgage lender mandates it due to FEMA’s flood zone mapping.

- You rent a basement-level apartment in a floodplain.

- You want protection from hurricanes or storm surge not covered elsewhere.

💬 Dialogue: Agent vs. First-Time Buyer

Buyer: “But my homeowners insurance already costs $1,800/year. Do I really need a separate policy?”

Agent: “Yes. Think of flood insurance as a seatbelt. It’s not about how often you crash—it’s about what happens if you do. And in most places, flood is the most expensive ‘crash’ you could face.”

📌 Key Differences to Remember:

- Homeowners = fire, theft, pipe burst

- Flood insurance = outside-in water (rising water)

- Earthquake = ground movement only

- Water backup = add-on for sewer/drain issues

🧠 Stat to Know:

According to FEMA (2025), over 25% of flood claims come from homes located outside high-risk zones—places where coverage is often optional but consequences are severe.

FAQ

What is the average cost for flood insurance?

Flood insurance premiums vary widely. Nationally, the average NFIP policy costs around $900 per year—but that’s just a ballpark. In low-risk inland states like Iowa, you might pay under $400. Near the coast in Louisiana or Florida? Easily over $2,500. The final price depends on your flood zone, property elevation, foundation type, and whether you’re in a FEMA-designated Special Flood Hazard Area. Bottom line: flood insurance isn’t one-size-fits-all.

What exactly does flood insurance cover?

Flood insurance covers damage caused by rising water from natural sources—overflowing rivers, heavy rain, storm surge, even melting snow. A standard NFIP policy protects the building itself: walls, floors, electrical systems, water heaters, and major appliances. Add-on content coverage includes furniture, clothing, electronics, and more. But it won’t cover basement improvements, temporary housing, or cars. Also, water damage from plumbing issues? That’s another policy.

Is it worth it to have flood insurance?

It depends on your risk tolerance—but for most, the answer is yes. A single inch of floodwater can cause over $25,000 in damage. Even if you’re outside high-risk zones, you’re not off the hook: nearly 20% of NFIP claims come from moderate- to low-risk areas. Think of it this way—flood insurance is like a seatbelt: you hope you’ll never need it, but when disaster hits, you’re thankful it’s there.

What type of insurance do you need for a flood?

Only flood insurance specifically covers flood damage. Standard homeowners or renters policies don’t include this risk. You can get a policy through the National Flood Insurance Program (NFIP) or a private insurer. Each covers different things at different price points. For example, NFIP caps coverage at $250,000 for homes and $100,000 for contents, while private carriers may go higher—but may also charge more based on risk.

Does renters insurance cover flood?

No, standard renters insurance does not cover flood damage. If a flash flood sweeps through your apartment, your furniture, clothing, and electronics won’t be protected unless you have a separate flood insurance policy. Many renters wrongly assume they’re covered—it’s a costly mistake. The NFIP offers contents-only coverage for tenants, which is both affordable and vital in flood-prone areas.

Does renters insurance cover flood damage?

Same answer here—it doesn’t. Whether the water came in from a hurricane surge or a swollen creek, traditional renters insurance excludes flood damage. That means you’ll be on your own to replace belongings. Renters in high-risk areas should strongly consider flood insurance, especially since NFIP premiums for contents-only policies can start under $100 annually.

How much is flood insurance?

Flood insurance costs vary by location, property type, and insurer. NFIP policies average $700–$1,200 per year for homeowners. Renters often pay less—sometimes under $150. Private flood insurance can be more flexible but also pricier, especially in coastal or high-risk areas. Want a precise quote? Use FEMA’s premium estimator or talk to an agent who knows your ZIP code inside and out.

Why doesn’t renters insurance cover flooding?

Because renters insurance is designed for internal risks: fire, theft, smoke damage, burst pipes. It wasn’t built to handle floods from natural disasters. That’s a different category of risk, and it requires a standalone policy. This separation helps insurers price risk more accurately—but it also leaves a coverage gap many tenants don’t discover until after a storm. Don’t wait until your apartment’s underwater to learn this the hard way.