Flower shop insurance protects florists from liability claims, property damage, and business interruptions that could devastate your retail operation. Small floral businesses face unique risks—from delivery vehicle accidents to refrigeration failures destroying inventory worth thousands of dollars. According to recent industry analysis, nearly 60% of small retail businesses experience at least one insurable incident within their first five years of operation, making proper florist insurance coverage essential for long-term viability.

We analyzed current commercial insurance data from multiple regulatory sources and industry reports to identify the most cost-effective coverage strategies for florists. You’ll discover which policy combinations provide optimal protection for your floral business, understand typical premium ranges for different shop sizes, and get actionable steps to reduce your flower shop insurance costs without sacrificing essential coverage.

Quick Answer: Flower shop insurance combines general liability, property, and business interruption coverage. Average annual premiums range from $1,200-$3,500 depending on shop size and location. (NAIC, 2024)

Here’s everything you need to know about securing flower shop insurance for your business.

On This Page

What You Need to Know

• General liability coverage protects against customer injury claims averaging $15,000-$50,000 per incident

• Property insurance covers inventory losses from refrigeration failures, typically costing $800-$1,500 annually

• Business interruption insurance replaces lost income during temporary closures, with 30-90 day coverage periods standard

Essential Flower Shop Insurance Coverage Types

Running a floral business requires multiple insurance layers to address distinct risk categories. General liability forms your foundation, protecting against customer injuries in your shop or during deliveries. A slip on wet floors during peak wedding season or a delivery driver’s accident can generate claims exceeding $30,000. Property coverage protects your physical assets—refrigeration units, display equipment, and perishable inventory that define your flower shop operations. Business interruption insurance replaces lost revenue when covered events force temporary closure of your florist business.

Data from the Small Business Administration’s January 2025 Business Insurance Guide indicates that florists typically need coverage limits of $1 million per occurrence for liability and $50,000-$150,000 for property, depending on inventory value and equipment investment. Most florists benefit from Business Owners Policies that bundle these coverages at reduced premiums compared to purchasing separately. Commercial auto insurance becomes mandatory if you operate delivery vehicles for your floral retail operations. Professional liability protects against claims related to wedding flower mishaps or event failures. Workers compensation coverage is legally required in most states once you hire employees—a critical component of comprehensive business insurance for flower shops.

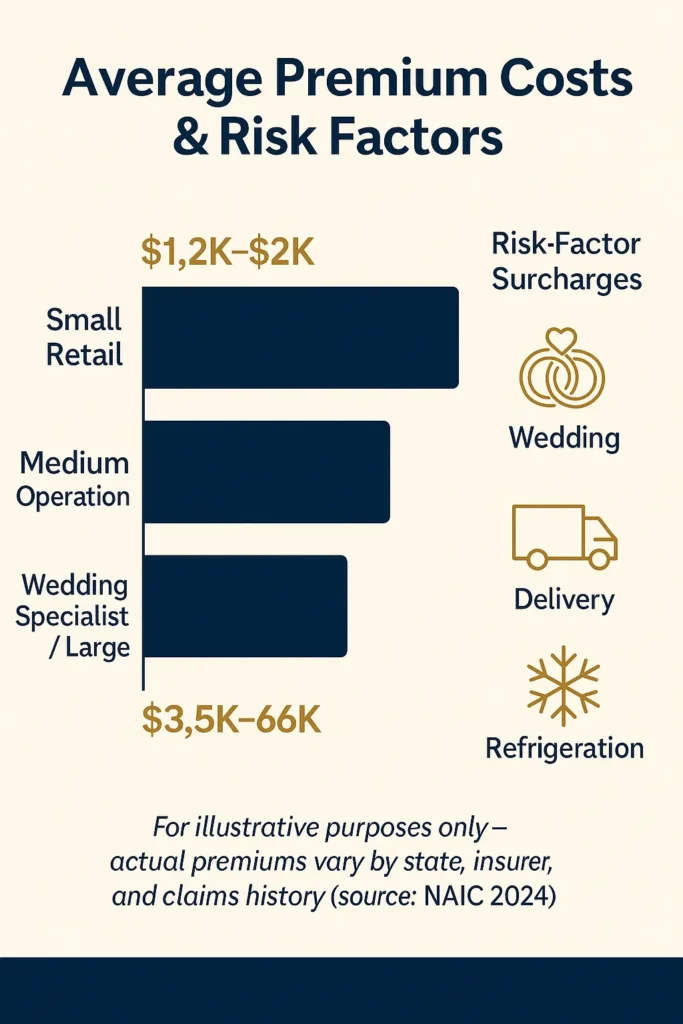

Average Premium Costs for Florists

Premium expenses for flower shop insurance vary significantly based on shop characteristics and location factors. Small retail florists with annual revenue under $250,000 typically pay between $1,200-$2,000 annually for basic BOP coverage. Medium-sized operations generating $250,000-$500,000 in revenue usually face florist insurance premiums of $2,000-$3,500. Wedding specialists and event florists often pay premium surcharges of 15-25% due to higher liability exposure from high-value contracts and tight delivery deadlines.

Geographic location substantially impacts flower shop insurance costs—urban shops in high-rent districts pay more than rural operations. According to the National Association of Insurance Commissioners’ March 2024 Small Business Insurance Market Report, California florists average $2,850 annually while Montana florists average $1,450 for comparable coverage. Your claims history dramatically affects renewal rates for florist business insurance, with claim-free businesses qualifying for discounts of 10-20%. Adding commercial auto coverage for delivery vehicles increases total premiums by $1,200-$2,400 per vehicle annually depending on driver records and coverage limits selected for your floral business operations.

| Shop Size | Annual Revenue | Average Premium |

|---|---|---|

| Small retail | Under $250K | $1,200-$2,000 |

| Medium operation | $250K-$500K | $2,000-$3,500 |

| Large/specialist | Over $500K | $3,500-$6,000 |

Risk Factors That Increase Insurance Costs

Specific operational characteristics elevate your flower shop insurance premium calculations substantially. Wedding and special event work carries heightened risk due to contract values often exceeding $5,000 and zero-tolerance delivery windows. Insurers view late deliveries or quality failures at weddings as high-severity claims that impact florist insurance rates. Delivery operations introduce vehicle accident exposure and product damage risks during transport of floral arrangements. Shops located in older buildings with outdated electrical systems or inadequate sprinkler protection face property insurance surcharges for their retail flower operations.

Refrigeration dependency creates unique exposure for flower shop insurance—equipment failure can destroy entire inventory within hours. Research from the Insurance Information Institute’s February 2025 Commercial Insurance Trends report shows that temperature-controlled inventory losses account for approximately 23% of florist property claims. Employee count directly impacts workers compensation premiums, with rates calculated per $100 of payroll for your floral business. Shops handling exotic plants or maintaining greenhouses face additional liability from potential customer allergic reactions. Previous insurance claims, especially liability settlements or property losses exceeding $10,000, can increase flower shop insurance premiums by 25-40% at renewal.

Maria, 42, Portland Accepted a high-profile wedding contract worth $18,500 without adequate professional liability coverage for her florist business. When a supplier delivered wrong flowers two days before the event, she scrambled for replacements but missed key bouquet specifications. The bride sued for breach of contract and emotional distress, resulting in a $18,500 settlement paid from personal assets. Lesson: Professional liability coverage specifically for event work protects against contract disputes and performance failures in the floral industry.

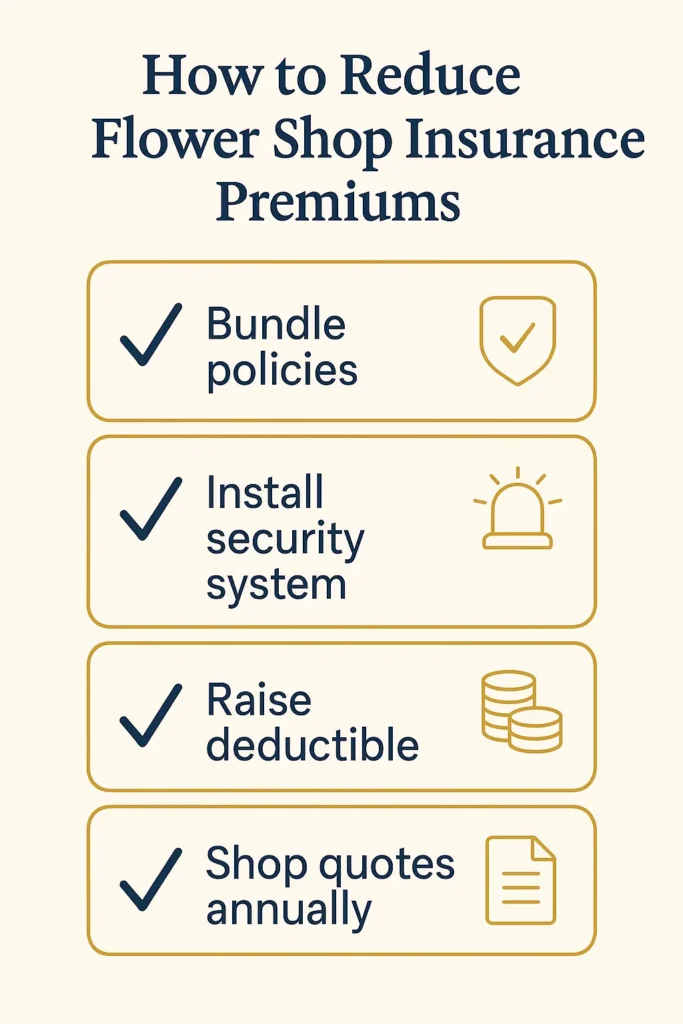

How to Reduce Flower Shop Insurance Premiums

Strategic risk management significantly lowers your florist insurance expenses without compromising protection. Bundling multiple policies with one carrier typically generates discounts of 15-25% on flower shop insurance compared to purchasing coverage from separate insurers. Installing monitored security systems, commercial-grade fire suppression equipment, and backup refrigeration alerts can reduce property premiums by 10-15% for your floral retail business. Implementing documented employee safety training programs and maintaining spotless safety records qualifies you for workers compensation discounts.

Increasing your deductible from $500 to $2,500 can reduce flower shop insurance premiums by 20-30%, though this requires maintaining adequate emergency cash reserves. Many florists find understanding how much business insurance costs helpful for budgeting coverage options and cost reduction strategies. Shopping florist insurance coverage annually with multiple carriers ensures competitive pricing—loyalty rarely rewards you with lower premiums in commercial insurance markets. Consider exploring professional liability insurance options if you specialize in weddings or corporate events. Maintaining detailed inventory records and photographic documentation accelerates claims processing and prevents valuation disputes for your flower shop operations.

James, 55, Austin Operated his flower shop for 12 years without reviewing florist insurance coverage or comparing carriers. When his policy renewed at $3,200 annually, he obtained quotes from three competitors and discovered comparable flower shop insurance available for $2,400—a savings of $800. Lesson: Annual insurance reviews and competitive shopping prevent overpaying for floral business coverage as your business circumstances and market rates change.

Coverage Requirements for Wedding Florists

Wedding and event specialists face distinct florist insurance needs beyond standard retail florists. Contracts frequently require certificate of insurance documentation showing minimum $2 million aggregate liability limits before venue coordinators permit setup. Professional liability coverage becomes essential for flower shop insurance—it protects against claims when flower deliveries arrive late, arrangements don’t match samples, or quality issues disappoint clients. Many wedding venues now mandate additional insured endorsements naming the venue on your liability policy.

High-value wedding contracts often exceed your general inventory value, requiring scheduled coverage for specific events. Event cancellation insurance protects your floral business when weddings postpone or cancel after you’ve purchased perishable inventory. Hired and non-owned auto coverage becomes critical if employees use personal vehicles for deliveries. Consider umbrella liability policies providing additional coverage layers above your primary limits—these typically cost $300-$600 annually for an additional $1-2 million in protection for your flower shop operations. Wedding season concentration intensifies your risk exposure, making adequate limits particularly important from April through October when most ceremonies occur.

Warning: Coverage Gaps Standard Business Owners Policies often exclude spoilage from mechanical breakdown unless you specifically purchase equipment breakdown coverage. This endorsement typically costs $150-$300 annually but covers refrigeration failures that could destroy $10,000+ in inventory overnight.

Claims Process for Florists

Understanding claims procedures accelerates recovery after losses and ensures proper compensation for your flower shop insurance. Document incidents immediately with photographs and detailed written descriptions—smartphone photos of damaged property or accident scenes provide crucial evidence for florist insurance claims. Contact your insurance agent within 24 hours of discovering property damage or receiving notification of liability claims. Many flower shop insurance policies require written notice within specific timeframes, and delays can jeopardize coverage.

Maintain detailed business records including purchase receipts, vendor invoices, and revenue documentation—these substantiate your florist insurance claims for property losses and business interruption. For liability claims, never admit fault or discuss settlement amounts with claimants before consulting your insurer. Your carrier assigns adjusters who investigate claims, evaluate damages, and determine coverage applicability for your floral business. Property claims usually resolve within 30-60 days for straightforward losses. Liability claims involving injuries or legal disputes often take 6-12 months or longer to settle. Business interruption claims require proving lost income with financial records comparing current revenue to historical averages for your flower shop operations.

Linda, 38, Boston Experienced refrigeration failure on Friday evening that destroyed $8,400 in wedding inventory. She immediately photographed the damage, documented temperatures, and contacted her florist insurance agent Saturday morning. Because she had equipment breakdown coverage and maintained detailed inventory records with purchase receipts, her flower shop insurance claim settled within 18 days for full replacement cost. Lesson: Immediate documentation and proper coverage endorsements enable fast claims resolution when equipment failures threaten inventory.

Frequently Asked Questions

What does flower shop insurance typically cost per year?

Annual premiums for flower shop insurance range from $1,200-$3,500 for most small to medium-sized operations. Costs depend on your annual revenue, coverage limits selected, location, claims history, and specialized services like wedding work. Basic retail florists with under $200,000 in revenue typically pay toward the lower end, while wedding specialists or shops with delivery vehicles pay premium amounts toward the higher range or beyond for comprehensive florist insurance.

Is workers compensation insurance required for flower shops?

Workers compensation requirements vary by state, but most jurisdictions mandate coverage once you hire your first employee. Some states like California require it immediately, while others allow sole proprietors to operate without it. Penalties for non-compliance include substantial fines, legal liability for employee injuries, and potential business closure. Premiums calculate based on payroll amounts and typically cost $0.50-$2.00 per $100 of wages for florist shop employees.

Does standard business insurance cover spoiled inventory?

Standard Business Owners Policies typically exclude spoilage from mechanical or electrical breakdown unless you purchase equipment breakdown coverage as an endorsement to your flower shop insurance. This additional coverage usually costs $150-$300 annually but protects against refrigeration failures that could destroy thousands in perishable inventory overnight. Without this endorsement, you’d bear the full replacement cost of spoiled flowers and plants.

What liability limits should florists carry?

Most florists need general liability coverage of at least $1 million per occurrence and $2 million aggregate annually. Wedding and event specialists should consider $2 million per occurrence minimums since many venues require these limits for florist insurance. High-value wedding contracts or corporate accounts may necessitate umbrella policies providing additional coverage layers. Your specific needs depend on contract values, client requirements, and risk tolerance for potential legal defense costs.

Can I insure just my delivery vehicle under personal auto insurance?

Personal auto insurance policies specifically exclude business use and will deny claims if you’re using your vehicle for commercial deliveries when accidents occur. You need commercial auto insurance for any vehicles used in flower shop operations. Alternatively, hired and non-owned auto coverage protects your floral business when employees use personal vehicles for work-related driving—this typically costs $300-$600 annually and provides essential liability protection.

How does business interruption insurance work for florists?

Business interruption coverage replaces lost income when covered perils like fires or storm damage force temporary closure of your flower shop. It typically activates after a waiting period of 48-72 hours and continues for periods ranging from 30-180 days depending on your florist insurance policy limits. You’ll need financial records proving your typical revenue to substantiate claims. This coverage pays ongoing expenses like rent and utilities plus compensates for lost profits during closure periods.

Do I need professional liability insurance as a florist?

Professional liability coverage isn’t mandatory but becomes highly valuable if you handle weddings, corporate events, or other high-stakes contracts. This flower shop insurance protects against claims alleging your professional services failed to meet contractual obligations—like wrong flowers, late deliveries, or arrangements not matching samples. Wedding florists particularly benefit since contract disputes in this market can generate claims exceeding $20,000 for perceived failures during irreplaceable events.

What You Should Do Next

Securing appropriate flower shop insurance protects your floral business from financial risks that could force closure after a single significant claim. Start by requesting quotes from at least three carriers specializing in small business coverage—this comparison reveals market rates and coverage options specific to florist operations. Schedule consultations with independent insurance agents who can explain policy differences and identify coverage gaps in your current protection.

Key Takeaways: • Compare flower shop insurance quotes from multiple carriers to find optimal coverage and competitive premiums for your specific operation • Maintain detailed inventory records with photographs and purchase receipts to accelerate claims processing and prevent valuation disputes • Review coverage annually before renewal and reassess limits as your business grows or services expand into new areas like wedding specialization • Consider equipment breakdown endorsements protecting against refrigeration failures that could destroy thousands in perishable inventory overnight

Disclaimers:

This guide provides educational information only and does not constitute professional insurance, legal, or financial advice.

Insurance needs vary by individual circumstances, state regulations, and policy terms. Consult licensed professionals before making coverage decisions.

Information accurate as of September 2025. Insurance regulations and products change frequently. Verify current details with official sources and licensed agents.