Marcus Thompson, a construction foreman from Charlotte, discovered the harsh reality of medical costs when his teenager broke her leg during soccer practice. The orthopedic surgery, rehabilitation, and follow-up appointments generated $28,600 in bills that his limited health insurance plan barely covered, leaving his family responsible for $11,400 in unexpected expenses.

Health insurance operates as a financial contract between individuals and insurance companies, where monthly premium payments provide access to medical services at predetermined costs. Plans vary significantly in coverage scope, provider networks, and cost-sharing requirements that affect total healthcare expenses throughout the year.

The American health insurance system has experienced significant shifts since marketplace establishment. Enhanced premium tax credits now support families earning up to 400% of federal poverty levels, while short-term medical plans gained expanded availability in certain states. Current data from the Centers for Medicare & Medicaid Services indicates 21.3 million Americans enrolled in marketplace coverage during 2024.

Coverage Options Explained

Health Insurance Market Landscape

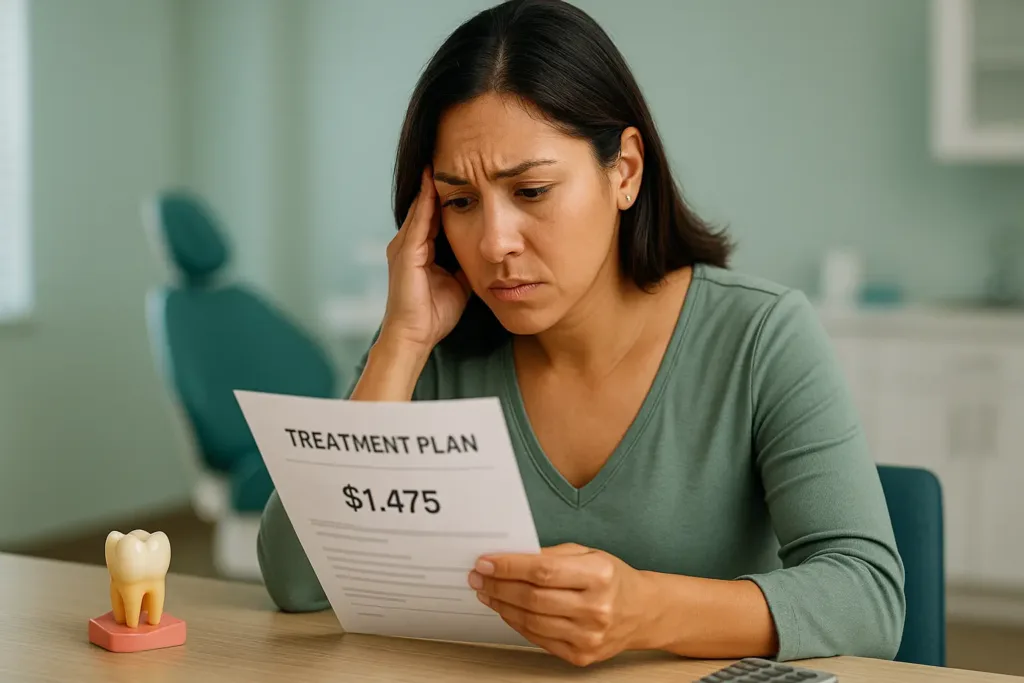

Medical expense inflation continues outpacing general economic growth, creating affordability challenges across demographic groups. Inpatient hospital services now average $3,149 per day nationwide, while specialist physician consultations typically range from $300 to $600 per visit. These costs vary considerably by geographic region and provider network participation.

Healthcare expenditure represents an increasing share of household budgets, with the average American family spending $5,177 annually on medical care according to Bureau of Labor Statistics consumer expenditure data. This figure includes insurance premiums, deductibles, copayments, and services not covered by insurance plans.

Current healthcare cost trends demonstrate concerning patterns:

- Generic prescription drug prices rose 37% between 2019-2024

- Emergency department visits average $2,168 per incident without insurance

- Specialty medications account for 61% of total drug spending despite 3% prescription volume

- 41% of American adults report delaying medical care due to cost considerations

- Medical debt collections appear on 43 million credit reports nationwide

Insurance enrollment patterns reflect growing cost awareness. Marketplace plan selections increasingly favor high-deductible options paired with Health Savings Accounts, representing 47% of individual market enrollment in 2024 compared to 31% in 2020.

Health Insurance Coverage Analysis

Open Enrollment Period Guidance

Health insurance enrollment occurs during specific annual timeframes established by federal and state regulations. The federal marketplace typically operates from November 1st through January 15th, though states with their own marketplaces may establish different dates. Missing enrollment periods generally requires qualifying life events such as job loss, marriage, or relocation to trigger special enrollment opportunities.

Prescription Drug Coverage Options

Health insurance plans manage prescription medication costs through formulary structures that categorize drugs into coverage tiers. Tier 1 typically includes generic medications with lowest copayments, while Tier 4 specialty drugs often require coinsurance payments of 25-40% of total costs. Prior authorization requirements may apply to certain medications.

Pre-existing Medical Condition Protection

The Affordable Care Act prohibits health insurance companies from denying coverage or charging higher premiums based on pre-existing medical conditions. This protection applies to all individual and group health insurance plans, ensuring people with diabetes, heart disease, cancer history, and other conditions can obtain coverage at standard rates.

State-Specific Health Insurance Requirements

Health insurance regulations vary significantly between states, affecting plan availability, coverage requirements, and consumer protections. Some states operate their own insurance marketplaces with unique enrollment rules, while others use the federal platform. State Medicaid expansion decisions also influence coverage options for low-income residents.

Affordable Health Insurance Strategies

Health insurance affordability depends on income levels, family size, and geographic location. Premium tax credits reduce monthly costs for families earning 100-400% of federal poverty levels, while cost-sharing reductions lower deductibles and copayments for those earning up to 250% of poverty thresholds. Medicaid eligibility provides comprehensive coverage at minimal cost in expansion states.

Health Insurance Claims and Reimbursement

Health insurance claims processing involves coordination between healthcare providers, insurance companies, and patients to determine coverage and payment responsibilities. Understanding explanation of benefits statements, prior authorization requirements, and appeal processes helps maximize coverage benefits while minimizing out-of-pocket expenses.

Health Plan Structure Variations

Health insurance plans organize provider networks and cost-sharing arrangements through different structural models that affect patient access and expenses. Health Maintenance Organizations require members to select primary care physicians who coordinate all healthcare services and provide specialist referrals when medically necessary.

Preferred Provider Organizations allow direct access to specialists without referrals while offering cost advantages for using in-network providers. Out-of-network services typically involve higher deductibles and coinsurance rates, though coverage remains available for emergency situations.

High-Deductible Health Plans combine lower monthly premiums with higher annual deductibles, often exceeding $1,500 for individuals or $3,000 for families. These plans frequently qualify for Health Savings Account contributions that provide triple tax advantages for medical expenses.

Exclusive Provider Organizations require all non-emergency services to come from in-network providers, offering no coverage for out-of-network care except in emergencies. This restriction typically results in lower premiums compared to PPO plans with similar benefits.

Point-of-Service plans blend HMO and PPO features by allowing members to choose their level of coverage at the time services are received. In-network services with referrals receive full coverage, while out-of-network services involve higher cost-sharing.

Health insurance marketplace plans categorize coverage levels as Bronze, Silver, Gold, and Platinum based on actuarial values representing the percentage of medical costs covered by insurance rather than patient cost-sharing. Bronze plans cover approximately 60% of costs while Platinum plans cover around 90%.

This information describes general health insurance concepts and market conditions. Healthcare needs and insurance options vary significantly between individuals and geographic areas. Readers should examine specific plan documents and consult appropriate professionals when evaluating coverage decisions.

Recent Insurance Guides

Health Insurance Tax Credits 2026 – 5 Key IRS Updates You Must Know

Health Insurance When Changing Jobs: Complete 2025 Guide

Colorado Health Premiums 2026: Essential Rate Changes Guide

Essential Guide to Anthem Exits Colorado Counties Health Plans 2026

Essential Guide to AI Tool Appeal Health Insurance Denials 2025

Essential Guide to Embedded Insurance Health Benefits 2025

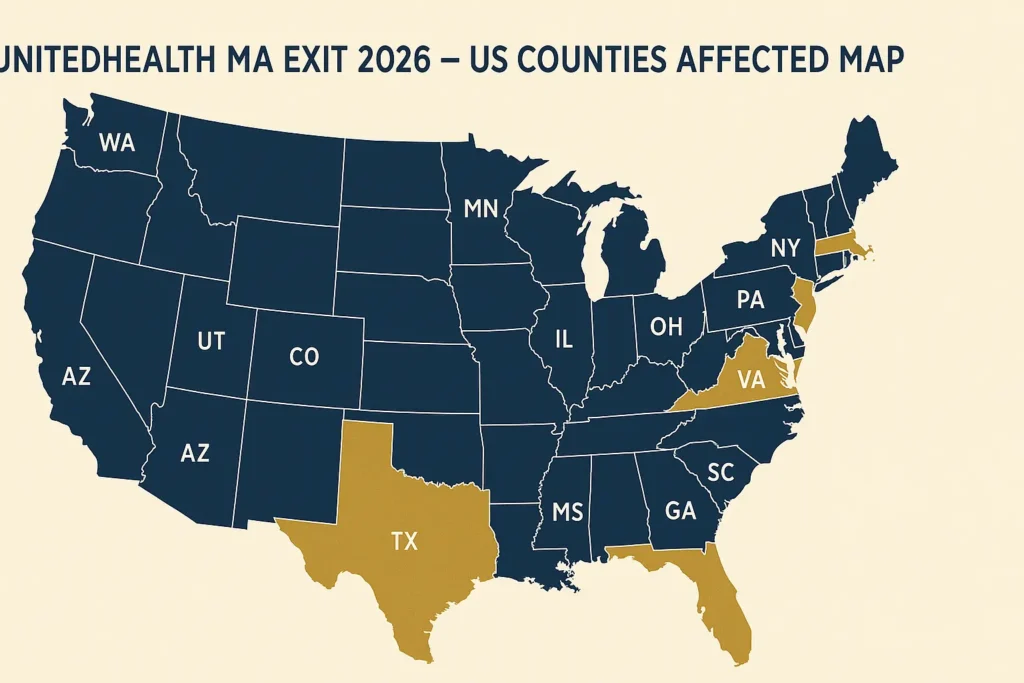

Essential Guide to UnitedHealth Leaving Medicare Advantage 2026 Counties

How Much Does Braces Cost With Insurance – Complete Guide 2025

Does Insurance Cover Vasectomy – Complete Guide 2025

Health Insurance Attorney – Complete Guide 2025

How Much Is an Ultrasound Without Insurance – Complete Guide 2025

How Much Do Braces Cost Without Insurance – Complete Guide 2025

Premium Deficiency Reserve – Complete Guide 2025

What Is a Good Deductible for Health Insurance Complete Guide 2025

Average Health Insurance Cost Per Month USA – Complete Guide 2025

Health Insurance Payout Ratio – Complete Guide 2025

Orthodontic Insurance Coverage – Complete Guide 2025

Critical Illness Rider Payout – Complete Guide 2025

Veterinary Professional Liability Insurance – Complete Guide 2025

Medicare Claims Processing Manual – Complete Guide 2025

Breast Pump Through Insurance

Health Insurance for Self Employed

Long Term Care Insurance Guide 2025

How Much Is a Crown Without Insurance?

Senior Citizen Age

Travel Insurance for Seniors

Affordable Health Insurance

Long Term Disability Insurance

Combined Insurance: Streamlined Protection for Your Income

Hospital Indemnity Insurance