When Sarah discovered missing shingles scattered across her lawn after last spring’s hailstorm, she wondered whether her home insurance payout for roof damage would actually cover the replacement costs her contractor quoted. Like thousands of homeowners facing their first major weather claim, she quickly learned that understanding home insurance payout for roof damage calculations determines the difference between adequate compensation and devastating out-of-pocket expenses that can drain family savings accounts.

The harsh reality becomes apparent when initial settlement offers fall thousands of dollars short of actual repair estimates. Most property owners discover coverage limitations, depreciation deductions, and complex adjuster assessments only after filing their claim and realizing their home insurance payout for roof damage falls short of expectations. Your roof represents one of your home’s most expensive structural components, yet countless homeowners remain unprepared for the intricate process required to secure adequate home insurance payout for roof damage compensation.

Recent industry data shows that weather-related roof claims have increased 35% over the past five years, with average settlement amounts varying dramatically based on homeowner knowledge and preparation. Storm damage from hail, wind, and fallen trees tests both policy coverage and your ability to navigate insurance company procedures effectively to maximize your home insurance payout for roof damage. Smart property owners who understand adjuster assessment methods consistently secure higher compensation than those who passively accept initial home insurance payout for roof damage offers.

This comprehensive guide reveals how insurance companies calculate settlements, examines proven strategies for maximizing your home insurance payout for roof damage, and provides actionable steps for homeowners facing weather-related claims. Whether you’re dealing with recent storm damage or preparing for future severe weather events, mastering these processes protects your financial interests and ensures proper roof restoration. Understanding every aspect of home insurance payout for roof damage empowers homeowners to navigate complex claim procedures and secure fair compensation that covers complete restoration costs.

On This Page

Essential Overview

Insurance companies determine home insurance payout for roof damage amounts by calculating current replacement costs, applying age-based depreciation deductions, subtracting policy deductibles, and considering coverage limits, with final settlement amounts varying significantly based on documentation quality and negotiation effectiveness.

How Insurance Companies Calculate Your Home Insurance Payout for Roof Damage

Insurance adjusters follow industry-standard methodologies when evaluating roof damage claims, beginning with comprehensive property inspections that document damage patterns, measure affected areas, and estimate current repair costs using specialized software programs. The settlement calculation process for your home insurance payout for roof damage involves multiple factors including regional material prices, local labor rates, and depreciation schedules that directly impact your final compensation amount.

Most major insurers employ sophisticated estimation software that generates cost calculations using databases of local contractor pricing, current material costs, and regional wage rates. These automated systems consider factors like roof complexity, accessibility challenges, and material specifications when establishing baseline settlement figures for your home insurance payout for roof damage evaluation.

Primary Settlement Components Analysis:

| Calculation Factor | Typical Impact Range | Average Amount |

|---|---|---|

| Current Replacement Cost | Base calculation | $15,000-$40,000 |

| Age-Related Depreciation | 20-50% reduction | $3,000-$20,000 |

| Policy Deductible Amount | Direct subtraction | $1,000-$5,000 |

| Coverage Ceiling Limits | Maximum restriction | Varies by policy |

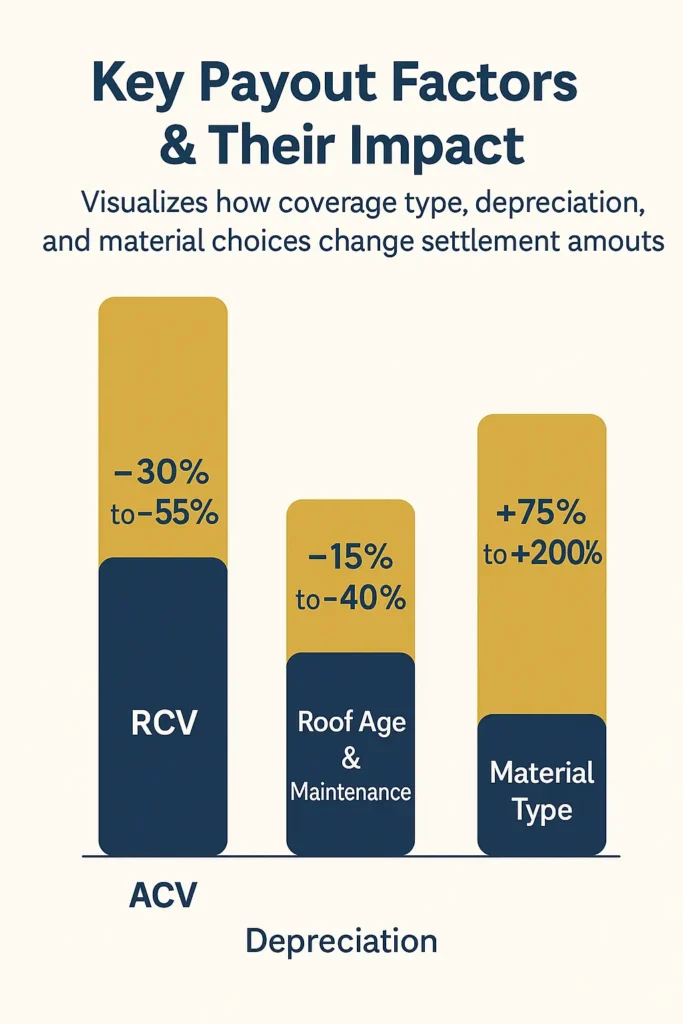

Replacement cost value calculations represent current market pricing for identical roofing materials and professional installation, while actual cash value policies subtract depreciation based on your roof’s age, condition, and expected lifespan. Understanding this critical distinction determines whether your home insurance payout for roof damage provides sufficient funds to restore your roof to its original condition or leaves you facing significant out-of-pocket expenses for full replacement.

Consider this realistic scenario: A homeowner’s 8-year-old architectural shingle roof suffers extensive hail damage requiring complete replacement. The contractor estimates $28,000 for current replacement costs, but the insurance company applies 32% depreciation reflecting the roof’s age, resulting in an initial home insurance payout for roof damage of approximately $19,040 before deductible subtraction. This calculation demonstrates why understanding depreciation impacts your total home insurance payout for roof damage recovery potential and planning requirements.

IMPORTANT NOTE: Many policies include “recoverable depreciation” provisions allowing homeowners to collect withheld depreciation amounts after completing repairs and submitting proper completion documentation to their insurance company within specified timeframes, effectively increasing your total home insurance payout for roof damage.

Regional market variations create substantial differences in settlement calculations, with metropolitan areas typically commanding 25-40% higher labor rates and material costs compared to rural markets. According to comprehensive federal oversight guidelines, experienced homeowners obtain multiple local contractor estimates to validate adjuster pricing assumptions and identify potential discrepancies that could justify higher home insurance payout for roof damage settlement amounts.

Smart policyholders also investigate code upgrade requirements, permit costs, and debris disposal fees that may increase total project costs beyond basic replacement estimates. However, these additional expenses often require specific policy endorsements or fall under separate coverage limits that homeowners should verify before authorizing contractor work that affects their home insurance payout for roof damage budget.

Understanding Professional Adjuster Assessment Methods That Determine Your Home Insurance Payout for Roof Damage

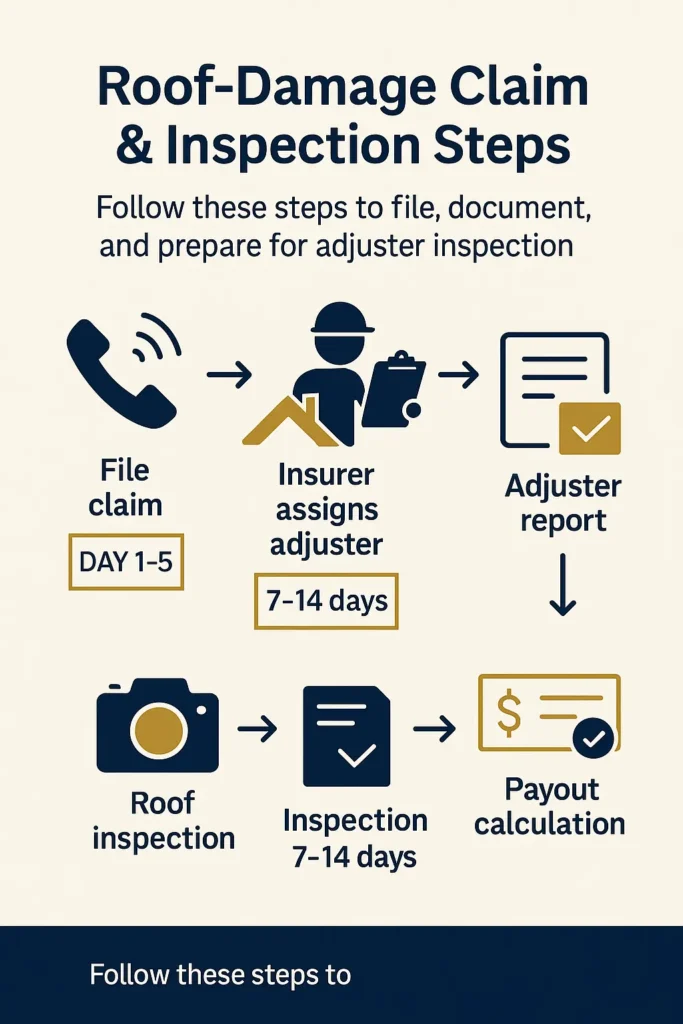

Professional insurance adjusters conduct detailed roof inspections within 7-14 days of claim filing, examining multiple structural components to distinguish legitimate storm damage from normal wear, pre-existing conditions, and maintenance-related issues. Their comprehensive findings directly influence whether you receive compensation for repairs, qualify for full replacement coverage, or face potential claim denial based on policy exclusions and damage causation determinations that affect your home insurance payout for roof damage eligibility.

The typical inspection process spans 60-120 minutes, during which adjusters photograph damage areas from multiple angles, measure affected sections precisely, and document their findings in detailed reports that form the foundation for home insurance payout for roof damage calculations. Understanding adjuster evaluation criteria helps homeowners prepare effectively for these critical assessments and ensure comprehensive damage documentation that supports maximum home insurance payout for roof damage compensation.

Critical Inspection Focus Areas:

| Roof Component Category | Assessment Priority Level | Settlement Impact Potential |

|---|---|---|

| Shingle Surface Integrity | Primary evaluation focus | Very High Impact |

| Flashing System Condition | Secondary review priority | Medium to High Impact |

| Structural Element Damage | Critical safety assessment | Extremely High Impact |

| Gutter and Drainage Systems | Tertiary evaluation area | Low to Medium Impact |

Experienced adjusters examine shingle surfaces systematically for impact marks, granule loss patterns, and crack formations that clearly indicate recent storm damage versus gradual aging deterioration. They also inspect flashing systems around chimneys, vent penetrations, and roof valleys where improper sealing frequently leads to water intrusion damage that may not become immediately apparent during surface inspections but significantly impacts your home insurance payout for roof damage calculations.

PRO TIP: Homeowners should always accompany adjusters during property inspections to highlight damage areas, provide relevant storm documentation including meteorological reports, and ensure thorough evaluation of all potentially affected roof sections that could increase your home insurance payout for roof damage settlement.

Adjuster reports include technical damage descriptions, classification codes, and detailed repair recommendations that insurance companies use to determine coverage eligibility and calculate appropriate settlement amounts for your home insurance payout for roof damage. These reports often contain specialized industry terminology and assessment abbreviations that may confuse homeowners, making careful review and clarification requests essential for protecting your financial interests throughout the claims process.

Common assessment challenges arise when adjusters underestimate damage severity, particularly subtle structural issues like hairline cracks, minor displacement, or early-stage deterioration that could worsen significantly over time without proper attention. Homeowners retain the right to request re-inspections if additional damage becomes apparent or if they fundamentally disagree with initial assessment conclusions that affect their home insurance payout for roof damage amount.

The timing of adjuster visits significantly affects damage visibility, especially for issues that weather conditions, temporary repairs, or natural settling may obscure over time. Scheduling prompt inspections while storm damage remains clearly evident helps ensure thorough documentation and accurate assessment of all affected areas requiring professional attention that impacts your final home insurance payout for roof damage compensation.

Critical Factors That Determine Your Final Home Insurance Payout for Roof Damage Amount

Multiple interconnected variables significantly influence final compensation levels, with policy type selections, coverage limit specifications, and documented damage severity creating substantial variations in settlement amounts across seemingly similar claims. Informed homeowners who understand these determining factors can better evaluate whether proposed settlements adequately address their complete roof restoration needs and maximize their home insurance payout for roof damage potential.

Roofing material specifications substantially impact settlement calculations, as premium options like slate tiles, architectural shingles, or metal roofing systems command significantly higher replacement costs compared to basic three-tab asphalt shingles. Insurance company databases maintain current pricing for various material categories, though these standardized figures may not always reflect local market rates, specialty installation requirements, or material availability constraints in your specific geographic area that affect your home insurance payout for roof damage calculations.

Your roof’s chronological age plays a crucial role in depreciation calculations, with newer installations receiving more favorable treatment than older systems approaching their manufacturer-specified lifespan expectations. Well-maintained roofs with documented service histories often qualify for reduced depreciation rates, while neglected properties showing signs of deferred maintenance may face higher deductions that significantly impact total home insurance payout for roof damage compensation amounts.

Settlement Influencing Variables Analysis:

| Primary Impact Factor | Influence Significance Level | Typical Variation Range |

|---|---|---|

| Coverage Type Selection (RCV vs ACV) | Very High Impact | 30-55% settlement difference |

| Roof Age and Maintenance Condition | High Impact | 15-40% depreciation reduction |

| Material Type and Quality Specifications | High Impact | 75-200% cost variation |

| Regional Market Rate Differences | Medium Impact | 20-35% geographic variation |

Storm severity classifications and documented damage patterns determine whether insurance companies authorize comprehensive repairs or complete roof replacement, with extensive damage often justifying full system replacement despite significantly higher associated costs. Wind damage, hail impact patterns, and fallen tree damage each require different assessment approaches and may be subject to varying coverage provisions under standard homeowner policy language that affects your home insurance payout for roof damage eligibility and amount.

Coverage Considerations Affecting Final Payouts:

- Dwelling coverage limits establish absolute maximum compensation ceilings for your home insurance payout for roof damage

- Special percentage limits may apply specifically to roof damage in high-risk geographic areas

- Code upgrade coverage addresses mandatory improvements required during repair work

- Additional living expense provisions provide temporary housing during extensive reconstruction periods

Local building code requirements and permit obligations can increase settlement amounts when repairs must meet current construction standards that differ from original installation specifications. However, these mandatory upgrades often require specific policy endorsements that many homeowners may not have purchased with their standard coverage packages, creating potential gaps in protection that limit your home insurance payout for roof damage coverage.

Understanding these interconnected variables helps homeowners establish realistic settlement expectations and identify strategic opportunities to maximize their home insurance payout for roof damage outcomes through proper documentation, policy review, and effective claim management throughout the entire process from initial filing to final settlement completion.

Proven Strategies for Maximizing Your Home Insurance Payout for Roof Damage Compensation

Proactive homeowners who thoroughly understand the claims process and implement strategic approaches consistently secure 25-45% higher settlements compared to passive claimants who accept initial offers without comprehensive evaluation or professional challenge. Effective compensation maximization requires meticulous preparation, detailed documentation, and understanding of insurance company evaluation methods that influence your final home insurance payout for roof damage settlement.

Comprehensive damage documentation forms the absolute foundation of successful settlement negotiations, with professional-quality photographs, detailed contractor evaluations, and supporting meteorological evidence creating compelling cases for higher compensation amounts. The quality, thoroughness, and professional presentation of your documentation directly correlates with your ability to challenge inadequate initial offers and secure settlements that truly reflect current replacement costs for maximizing your home insurance payout for roof damage.

Multiple contractor estimates provide essential pricing validation and demonstrate current local market rates that may significantly exceed adjuster calculations based on generic databases or outdated pricing information. Obtaining four to six quotes from licensed roofing professionals creates substantial negotiation leverage and supports compelling requests for settlement increases when adjuster estimates appear inadequate or artificially conservative for your home insurance payout for roof damage calculations.

Compensation Maximization Strategy Framework:

| Strategic Approach Category | Implementation Methodology | Potential Settlement Impact |

|---|---|---|

| Professional Documentation Package | Detailed photos, expert assessments, meteorological data | 20-35% increase potential |

| Multiple Contractor Quote Validation | 4-6 licensed professional estimates | 15-30% increase potential |

| Policy Provision Analysis and Enforcement | Comprehensive coverage review and application | 10-25% increase potential |

| Strategic Timing and Process Management | Prompt action, proper sequencing, deadline management | 15-35% increase potential |

Engaging public adjusters or roofing contractors with extensive insurance claim experience provides professional advocacy that frequently results in substantially higher settlements through expert knowledge of insurance company tactics, policy interpretation nuances, and proven negotiation strategies. These professionals understand adjuster assessment methods, settlement calculation procedures, and dispute resolution processes that maximize recovery outcomes for complex claims and increase your home insurance payout for roof damage significantly.

Effective Documentation Strategy Components:

- High-resolution photographs from multiple angles showing damage progression and severity

- Detailed written damage inventories with precise measurements and location descriptions

- Professional contractor assessments with itemized repair recommendations and cost breakdowns

- Meteorological reports and weather service data confirming storm activity and timing

- Comprehensive maintenance records demonstrating proper roof care and condition history

Understanding your policy’s “matching” provisions becomes crucial when partial roof replacement becomes necessary, as many insurers must legally pay for complete roof sections or entire roof replacement when new materials cannot reasonably match existing materials due to age-related weathering, color changes, or manufacturer discontinuation of specific product lines that affects your total home insurance payout for roof damage eligibility.

PRO TIP: Carefully review your policy’s ordinance and law coverage provisions, which may provide substantial additional funds for mandatory code upgrades required during repair work, potentially adding $5,000-$15,000 to your total home insurance payout for roof damage settlement amount.

Strategic timing considerations significantly impact settlement outcomes, with prompt claim filing, immediate contractor consultation, and carefully planned repair scheduling helping maximize compensation while minimizing out-of-pocket expenses and temporary living disruptions. Some policies include specific time limitations for certain benefit categories that homeowners must understand and manage effectively to preserve their rights and maximize their home insurance payout for roof damage potential.

Navigating Settlement Disputes and Challenges That Affect Your Home Insurance Payout for Roof Damage

Roof damage claim disputes occur frequently due to coverage interpretation disagreements, damage assessment conflicts, and settlement calculation discrepancies that can potentially cost homeowners thousands of dollars in reduced compensation if not properly addressed through systematic resolution approaches. Understanding common dispute patterns, resolution strategies, and available escalation procedures helps property owners protect their financial interests and secure appropriate settlements that reflect their true home insurance payout for roof damage needs.

Settlement underpayment represents the most frequent challenge homeowners encounter, with insurance companies often employing conservative estimates, outdated pricing databases, or incomplete damage assessments that result in inadequate compensation offers requiring professional challenge and negotiation. Successful dispute resolution demands systematic approaches that effectively challenge these shortcomings with documented evidence, professional support, and persistence throughout the process to increase your home insurance payout for roof damage.

Coverage denial disputes frequently center on storm damage versus normal wear distinctions, with insurers attempting to attribute obvious weather-related damage to maintenance issues, pre-existing conditions, or policy exclusions that reduce their financial liability. Homeowners must effectively distinguish between these damage categories through proper documentation, expert professional testimony, and comprehensive evidence presentation when necessary to protect their coverage rights and secure fair home insurance payout for roof damage compensation.

Common Dispute Categories and Strategic Resolution Methods:

| Dispute Type Category | Typical Occurrence Rate | Primary Resolution Strategy Approach |

|---|---|---|

| Settlement Amount Underpayment | 55% of disputed claims | Multiple contractor estimate validation and market pricing evidence |

| Coverage Denial or Limitation Claims | 25% of disputed claims | Expert damage causation analysis and policy provision enforcement |

| Depreciation Calculation Disagreements | 15% of disputed claims | Maintenance documentation review and professional condition assessment |

| Policy Interpretation and Language Issues | 5% of disputed claims | Legal consultation and regulatory compliance verification |

Effective dispute resolution begins with thorough policy review and comprehensive understanding of coverage provisions, exclusion limitations, and specific claim handling requirements that insurance companies must follow under state regulatory frameworks. Many homeowners discover additional coverage options, procedural violations, or overlooked policy benefits that significantly strengthen their negotiating position during settlement discussions and increase their home insurance payout for roof damage potential.

The insurance company supervisory escalation process allows homeowners to request comprehensive reviews by senior adjusters, claims managers, or specialized customer service representatives when initial settlements appear inadequate or adjusters seem unresponsive to legitimate concerns and documented evidence. Most major insurance companies maintain dedicated customer service departments specifically designed to handle claim disputes and provide resolution alternatives before formal legal proceedings become necessary, which can significantly impact your final home insurance payout for roof damage amount.

IMPORTANT NOTE: Many insurance policies include specific appraisal clause provisions that offer binding dispute resolution alternatives to expensive litigation, though these processes have detailed procedural requirements, cost implications, and decision limitations that homeowners should thoroughly understand before initiating formal proceedings that could affect their home insurance payout for roof damage recovery.

Professional representation through experienced public adjusters, roofing contractors with specialized insurance expertise, or attorneys focusing on insurance law can provide valuable advocacy, technical knowledge, and negotiation skills that substantially improve dispute resolution outcomes and final home insurance payout for roof damage settlements. However, homeowners should carefully evaluate professional fees, service agreements, and potential cost-benefit relationships before engaging additional specialized services.

Timeline Expectations and Payment Processing for Your Home Insurance Payout for Roof Damage

Understanding realistic timelines for processing comprehensive roof damage claims helps homeowners manage expectations effectively and plan accordingly, with most standard settlements spanning 60-150 days from initial filing to final payment completion depending on damage complexity, coverage disputes, and contractor coordination requirements. Complex cases involving extensive structural damage, coverage interpretation disputes, or specialized material requirements may extend processing timelines significantly beyond typical industry standards, potentially delaying your home insurance payout for roof damage.

Initial claim processing typically moves efficiently in most cases, with insurance companies legally required to acknowledge receipt within 24-72 hours and assign qualified adjusters within one week of proper filing. However, severe weather events affecting large geographic areas can create substantial backlogs that delay initial responses, extend overall processing times, and complicate contractor availability for both assessment and repair phases that impact your home insurance payout for roof damage timeline.

The inspection and damage assessment phase generally requires 10-28 days depending on adjuster availability, weather conditions, property accessibility, and scheduling coordination between multiple parties. Following inspection completion, insurance companies typically have 15-45 days to complete detailed settlement calculations and provide formal payment offers to policyholders under state regulatory requirements for your home insurance payout for roof damage processing.

Comprehensive Claim Processing Timeline Framework:

| Processing Phase | Standard Duration Range | Primary Activities and Milestones |

|---|---|---|

| Initial Claim Filing and Documentation | Days 1-5 | Claim reporting, preliminary documentation, adjuster assignment |

| Property Inspection and Assessment | Days 7-21 | Comprehensive damage evaluation, measurement, photographic documentation |

| Settlement Calculation and Review | Days 21-42 | Estimate preparation, coverage analysis, management approval |

| Initial Payment Processing | Days 42-60 | Depreciated amount calculation and disbursement |

| Repair Completion and Documentation | 60-120 days | Contractor work, progress inspections, quality verification |

| Final Payment and Depreciation Recovery | Upon verified completion | Recoverable depreciation release and case closure |

Emergency repair authorization receives expedited processing priority, with most reputable insurers providing immediate approval for temporary protective measures necessary to prevent additional water damage, structural deterioration, or security compromises. According to official disaster preparedness guidelines, homeowners should obtain specific pre-approval for emergency work and maintain detailed receipts for all protective measures undertaken to ensure proper reimbursement under policy provisions that affect your total home insurance payout for roof damage recovery.

Payment processing occurs in carefully structured phases for most policy types, with initial settlements covering calculated replacement costs minus applicable depreciation and policy deductible amounts. The remaining recoverable depreciation becomes available after verified repair completion and proper documentation submission to the insurance company within specified policy timeframes, completing your total home insurance payout for roof damage compensation.

State insurance regulations mandate specific timeframes for various claim processing steps, with significant penalties for insurers who fail to meet established regulatory deadlines without legitimate justification or proper notification procedures. The federal regulatory oversight framework provides additional consumer protections, while homeowners experiencing unreasonable processing delays should contact their state insurance department for assistance and potential regulatory intervention when companies fail to comply with mandated timeframes for home insurance payout for roof damage processing.

FAQ

How much can I expect from my roof damage insurance settlement?

Settlement amounts for your home insurance payout for roof damage vary significantly based on your roof’s replacement cost, age-related depreciation, and policy deductible amounts. A typical home insurance payout for roof damage ranges from $8,000-$35,000, with newer roofs receiving higher compensation due to lower depreciation deductions. According to authoritative federal consumer guidance, replacement cost policies generally provide 30-50% higher settlements than actual cash value coverage, making policy selection crucial for maximizing your home insurance payout for roof damage potential.

What documentation do I need to maximize my settlement amount?

Essential documentation for maximizing your home insurance payout for roof damage includes high-resolution damage photographs from multiple angles, official weather reports confirming storm activity, multiple contractor estimates with detailed specifications, and maintenance records showing proper roof care. Professional damage assessments and meteorological data supporting storm causation significantly strengthen your claim and negotiation position for achieving optimal compensation that reflects your true home insurance payout for roof damage needs.

Can I choose my own contractor for insurance-covered roof repairs?

Yes, homeowners typically retain the right to select their preferred licensed roofing contractor for insurance-covered work, despite insurer preferences for approved vendor networks. Your chosen contractor must meet state licensing requirements, provide appropriate warranties, and coordinate effectively with insurance adjusters throughout inspection and payment processes that affect your home insurance payout for roof damage timeline and final settlement amount.

How long does the claims process take from filing to final payment?

Most roof damage claims require 60-150 days from initial filing to complete resolution, including repair work and final payment completion. Emergency situations may qualify for expedited processing, while complex cases involving extensive damage, coverage disputes, or specialty materials may extend timelines significantly beyond standard industry expectations. Understanding these timeframes helps homeowners plan effectively for their home insurance payout for roof damage processing and coordinate with contractors accordingly.

What if my contractor’s estimate exceeds the insurance settlement offer?

You can challenge inadequate settlements by providing multiple contractor estimates, requesting adjuster re-inspection, or engaging professional public adjusters for specialized advocacy. Many homeowners successfully negotiate higher amounts when presenting compelling evidence that adjuster estimates don’t reflect current local market rates or complete damage assessment. Professional federal trade commission guidance on insurance supports homeowner rights to fair settlement evaluation and professional representation throughout the claims process to maximize your home insurance payout for roof damage compensation.

Should I accept the first settlement offer from my insurance company?

Initial settlement offers frequently undervalue actual repair costs and may not include all available coverage benefits. Review settlement calculations carefully, obtain independent contractor estimates for comparison, and consider professional consultation before accepting offers that seem inadequate for complete roof restoration to pre-damage condition. Many homeowners who challenge initial offers successfully increase their home insurance payout for roof damage by 15-30% through proper documentation, negotiation, and understanding of their policy provisions and coverage rights.

Conclusion

Successfully securing fair compensation through home insurance payout for roof damage requires comprehensive understanding of settlement calculations, strategic claim management, and proactive advocacy throughout the complex process from initial filing to final payment completion. Homeowners who educate themselves thoroughly about policy provisions, document damage meticulously, and challenge inadequate offers systematically achieve substantially better outcomes than those who passively accept initial settlement proposals without understanding their rights to fair home insurance payout for roof damage compensation.

The intricate nature of modern insurance policies and claim processing procedures creates numerous opportunities for both success and failure in settlement negotiations. Property owners who understand adjuster assessment methodologies, depreciation calculations, and available dispute resolution processes position themselves strategically to maximize compensation while avoiding common pitfalls that significantly reduce final settlement amounts and leave homeowners with substantial out-of-pocket expenses that could have been covered through proper home insurance payout for roof damage management.

Effective preparation before damage occurs, including comprehensive policy review, documentation strategy development, and relationship building with quality local contractors, creates substantial advantages that benefit homeowners throughout the entire claims process. Maintaining detailed maintenance records, understanding specific coverage provisions, and developing emergency response plans ensures optimal outcomes when severe weather inevitably affects your property and you need to pursue home insurance payout for roof damage compensation.

Professional guidance through experienced public adjusters, knowledgeable contractors, or specialized legal consultation may prove invaluable for complex claims involving significant damage amounts or coverage disputes. However, well-informed homeowners can successfully navigate most roof damage claims independently by applying proven strategies and comprehensive knowledge outlined in this guide to securing fair settlements and complete property restoration through maximizing their home insurance payout for roof damage potential.

Key Takeaways

Documentation quality directly correlates with settlement success, making comprehensive damage photography, multiple contractor estimates, and supporting meteorological evidence essential for maximizing your home insurance payout for roof damage compensation. Professional presentation of evidence and systematic challenge of inadequate offers often results in settlement increases of 15-30% compared to initial proposals, demonstrating the importance of active participation in the claims process to secure fair home insurance payout for roof damage amounts.

Understanding depreciation calculations and recoverable depreciation provisions helps homeowners plan repair timelines strategically and maximize total compensation recovery potential. Many policies provide opportunities to collect full replacement costs after completing qualified repairs, though specific documentation requirements and deadline compliance remain essential for securing these additional payments that complete your total home insurance payout for roof damage recovery.

Active participation in adjuster inspections and comprehensive claim process management protects homeowner interests while ensuring thorough damage assessment and accurate settlement calculations. Property owners should systematically challenge inadequate settlements through established dispute resolution processes while maintaining detailed communication records throughout the entire claims experience for maximum protection of their home insurance payout for roof damage rights.

State insurance regulations provide valuable consumer protections and assistance resources that homeowners can leverage effectively when experiencing claim handling problems or disputes. Professional representation may prove beneficial for complex cases involving significant amounts, though educated homeowners can successfully manage most roof damage claims by understanding key home insurance coverage components and applying proven negotiation strategies consistently to maximize their home insurance payout for roof damage outcomes.

Regional market knowledge and understanding affordable homeowners insurance options help homeowners make informed decisions about coverage levels and deductible amounts that balance premium costs with potential settlement outcomes during major weather events affecting their properties and their need for adequate home insurance payout for roof damage protection.

Disclaimer

Data freshness: Insurance rates and regulations change frequently. Data accuracy depends on timing of official releases.

Geographic variations: Insurance requirements vary significantly by state. Always consult your state’s insurance department for specific requirements.

Professional advice: This information is for educational purposes only. Insurance decisions should be made in consultation with licensed professionals familiar with your specific circumstances and local regulations.