At 59, Marcus from Little Rock, Arkansas, didn’t expect a minor bike accident to land him in the hospital for four days. He had health insurance through work—but still received over $3,000 in uncovered costs. “I thought I was protected,” he said. “I never imagined how much would fall outside my coverage.”

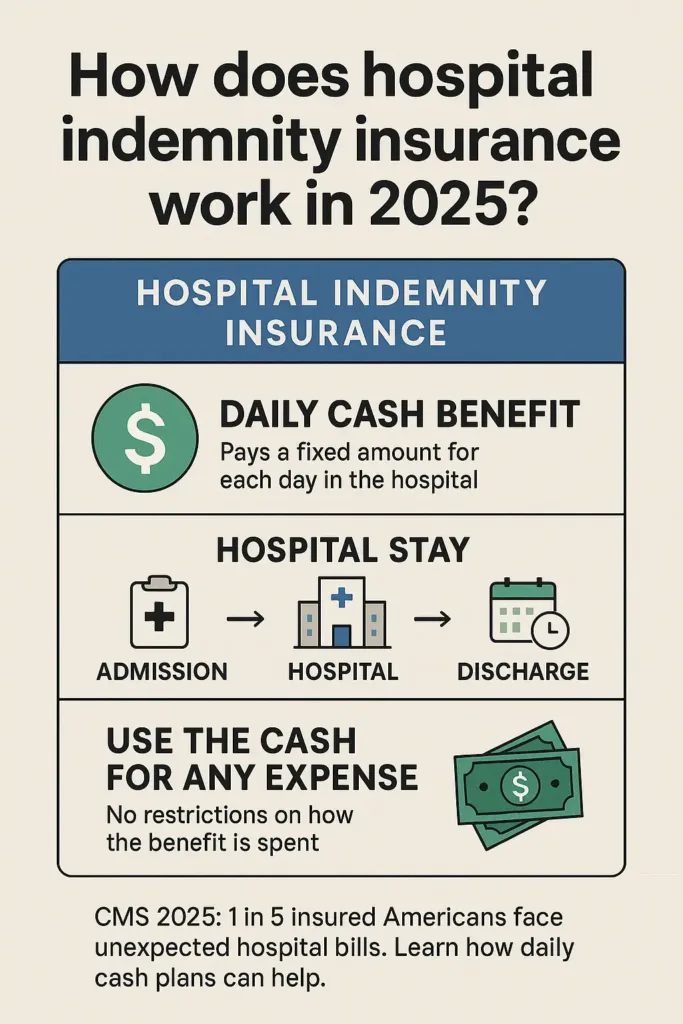

He’s not alone. In 2024, nearly 1 in 5 insured Americans faced surprise hospital bills that weren’t fully reimbursed by their primary insurance, according to the Centers for Medicare & Medicaid Services (CMS).

That’s where hospital indemnity insurance comes in. This type of supplemental policy pays you a fixed daily amount during a covered hospital stay—money you can use however you need. From offsetting deductibles to paying your mortgage, it adds a crucial layer of financial security. This guide explains how it works, who it’s for, and how to tell if it’s the right fit for you or a loved one.

On This Page

1. What Is Hospital Indemnity Insurance?

1.1. Definition and Key Features

Hospital indemnity coverage offers a daily cash payout when you’re admitted to a hospital, regardless of the medical condition or cause of stay. Unlike traditional health insurance, it doesn’t reimburse providers. Instead, it pays you directly—regardless of your actual medical bills—giving you financial flexibility during stressful times.

These policies are typically used to offset deductibles, coinsurance, or everyday expenses like rent or child care while you’re hospitalized. Most plans include a daily benefit, ranging from $100 to $500 per day, depending on your coverage level and insurer.

Stat 2024: As of 2024, over 6 million Americans are enrolled in hospital indemnity plans, with enrollment growing 9% annually (Source: AHIP).

1.2. How It Differs from Health Insurance

Traditional health insurance pays doctors and hospitals for covered services. Hospital indemnity insurance pays you. There are no networks, no claims forms for reimbursement, and the benefit doesn’t depend on what services you receive—it’s triggered simply by hospitalization.

Pro Tip (TX Ins. Code § 1201.004): In Texas, insurers must clearly define the per-day benefit amount and eligible events in the policy summary. Always check if ICU days pay a higher rate than standard admissions.

Fictional Dialogue :

Erica (Plano, TX, 47): “So this would just deposit cash in my account if I’m in the hospital?”

Agent: “Exactly. It’s your money, no restrictions—use it for bills, groceries, whatever helps while you recover.”

1.3. Common Scenarios Where It Helps

This type of policy can be critical in unexpected situations. Consider a parent hospitalized for pneumonia, or a retiree recovering from surgery. Standard health insurance often leaves gaps—out-of-pocket expenses like travel, missed work, or uncovered services can add up fast.

Local Anecdote : Carla, 55, from Savannah, Georgia, was hospitalized for appendicitis. Her hospital indemnity plan paid $300/day over five days, helping cover her $1,500 deductible and household bills during recovery.

Real-Life Example : A 3-day hospital stay with a $2,800 deductible and no income during recovery can strain any budget. A hospital indemnity plan offering $250/day would pay $750—cash that can bridge the gap immediately.

1.3.1. Sample Daily Benefit Table

| Plan Type | Daily Benefit | ICU Bonus | Max Benefit (10 Days) |

|---|---|---|---|

| Basic | $150/day | $300/day | $1,500 |

| Standard | $250/day | $500/day | $2,500 |

| Premium | $400/day | $700/day | $4,000 |

2. How Hospital Indemnity Insurance Works

2.1. Daily Benefit Payments Explained

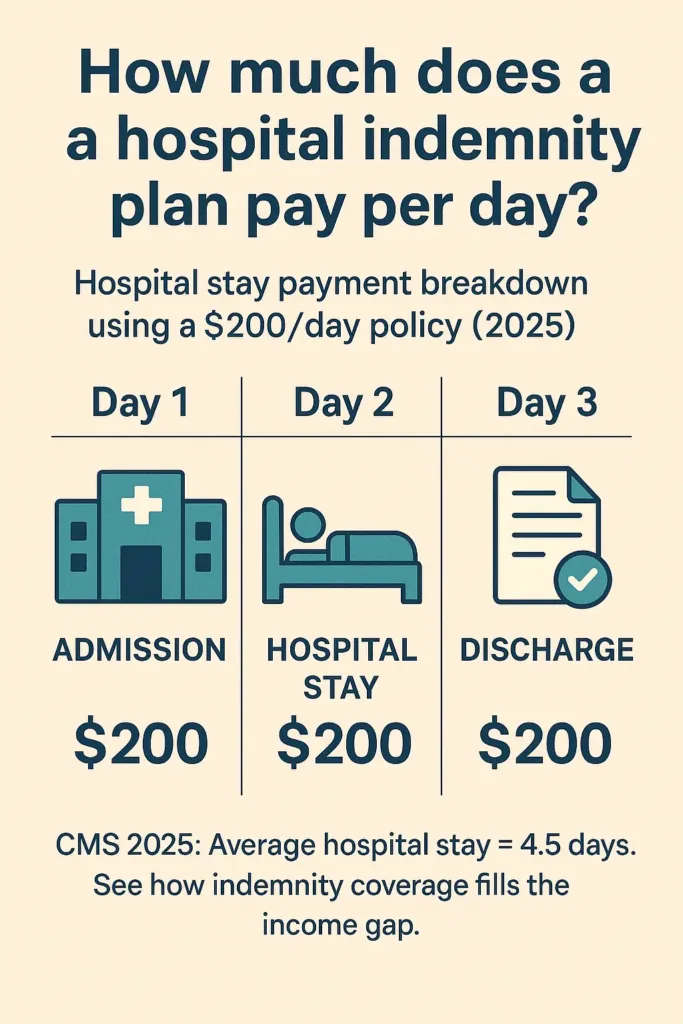

If you’re admitted to the hospital, this type of policy provides a set daily cash amount—no matter the cause of your stay. Let’s say your benefit is $250 a day and you’re hospitalized for four days—you’d get $1,000 in total, no matter the actual treatment costs.

The money can be used however you choose: covering transportation, groceries, rent, or medical bills. Payments usually begin after the first 24 hours of a hospital stay and are tax-free in most cases.

Pro Tip (CA Ins. Code § 10273.4): In California, all indemnity policies must clearly state any benefit waiting period and limit coverage exclusions in plain language. Always request the Summary of Benefits.

2.2. Covered Events and Typical Triggers

Hospital indemnity plans generally activate when you’re formally admitted to a hospital for an eligible reason. Triggers can include surgery, accident-related injuries, childbirth, or illness. Certain policies offer higher payouts if your hospitalization involves intensive care or critical unit services.

Fictional Dialogue :

Raymond (Milwaukee, WI, 64): “Do I still get the benefit if I have outpatient surgery?”

Agent: “Only if it results in overnight hospitalization. Indemnity plans are designed for inpatient care—not outpatient procedures.”

Stat 2024: According to CMS, the average U.S. hospital stay now lasts 4.5 days and can cost over $13,000—even for patients with insurance.

2.3. Example: A 3-Day Hospital Stay Breakdown

Let’s say you’re hospitalized for three days due to an unexpected illness. Your deductible under your major medical plan is $2,500, and you lose three days of work. Your hospital indemnity policy offers a $200 daily benefit plus $100/day ICU bonus.

Real-Life Example : You stay two days in a regular room and one day in ICU. Here’s what the policy would pay:

2.3.1. Simulated Payment Scenario

| Day | Room Type | Daily Benefit | ICU Bonus | Total Paid |

|---|---|---|---|---|

| Day 1 | Standard Room | $200 | $0 | $200 |

| Day 2 | Standard Room | $200 | $0 | $200 |

| Day 3 | ICU | $200 | $100 | $300 |

| Total Benefit Received | $700 | |||

This $700 payout is yours to use however you choose—even if your insurer only reimburses part of your total hospital bill. The key benefit: flexibility and speed.

3. Who Might Benefit from Hospital Indemnity Insurance?

3.1. Seniors on Medicare Advantage

Medicare Advantage plans often trade lower premiums for increased daily charges during hospital admissions, leaving seniors with higher bills when they’re least prepared. A hospital indemnity plan can help seniors avoid financial strain by providing cash benefits that cover gaps like deductibles, coinsurance, or multi-day hospital confinements.

Local Anecdote : Roger, 72, in Fresno, CA, was surprised to learn his Advantage plan charged $350 each day he remained hospitalized. After a 5-day stay for pneumonia, he owed over $1,700. His indemnity plan paid $1,500—easing the blow on his fixed retirement income.

3.2. High-Deductible Health Plan (HDHP) Users

Employees and families enrolled in HDHPs often face thousands of dollars in upfront costs before insurance kicks in. A hospital indemnity policy can serve as a financial bridge during an unexpected hospital stay.

Fictional Dialogue :

Sasha (Henderson, NV, 38): “My deductible is $6,000. One hospital visit could wipe out my savings.”

HR Specialist: “That’s where indemnity insurance can help—by giving you upfront cash to handle those surprise costs.”

Stat 2024: In 2024, over 30% of working Americans are covered by HDHPs with an average deductible of $5,325 (Source: KFF).

3.3. Working Families with Young Children

Parents balancing work, school, and health costs are especially vulnerable when a child is hospitalized. Beyond medical expenses, lost wages, parking, child care, and meals outside the home can quickly add up. Hospital indemnity insurance provides immediate financial relief during these high-stress situations. It’s also worth exploring long-term disability insurance to protect your income if an illness or injury keeps you out of work beyond your hospital stay.

Real-Life Example : A single mom in Georgia whose child is hospitalized for appendicitis misses three days of work. With a $300/day indemnity plan, she receives $900—helping her cover missed income and travel expenses.

3.3.1. Who Can Benefit Most – Quick Comparison

| Profile | Risk Factor | How Indemnity Insurance Helps |

|---|---|---|

| Senior on Medicare Advantage | Daily hospital copays not covered | Offsets fixed-cost copays |

| HDHP Participant | High upfront deductible | Bridges cost before coverage starts |

| Parents of Young Children | Missed income + care expenses | Provides fast cash during emergencies |

| Self-employed Worker | No paid leave or group plan | Cash benefit protects income |

4. What Does It Typically Cover?

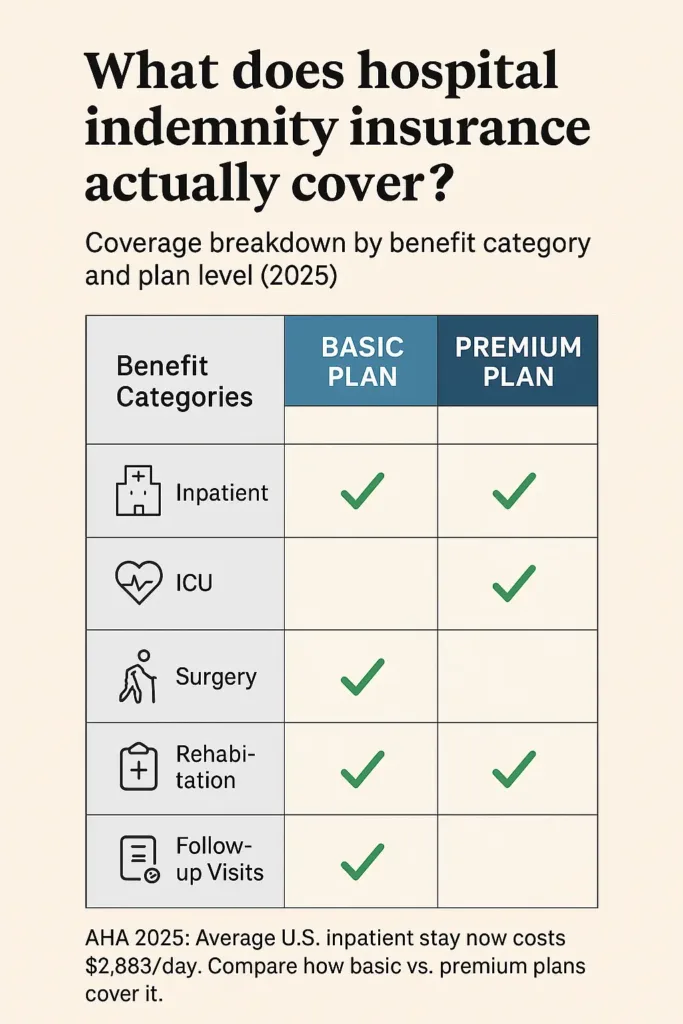

4.1. Inpatient Hospital Confinement

The primary purpose of hospital indemnity insurance is to provide a daily benefit for each full day you’re admitted as an inpatient. Most policies define “inpatient confinement” as a medically necessary stay that lasts at least 24 hours and begins with formal admission.

Coverage generally applies to medical, surgical, or injury-related stays. The benefit amount depends on the policy tier selected, and some plans offer tiered payouts for standard rooms versus ICU.

Stat 2024: According to the American Hospital Association (AHA), the average cost per inpatient day in a U.S. hospital reached $2,883 in 2024—up 6.5% from the previous year.

4.2. ICU and Critical Care Units

Many hospital indemnity policies include a separate benefit for intensive care unit (ICU) or critical care stays. These payments are typically higher due to the increased severity and cost of treatment.

Pro Tip (FL Stat § 627.6074): In Florida, insurers offering fixed indemnity products must disclose if ICU benefits require additional riders. Always verify that ICU coverage is included in the base policy or clearly defined in the plan’s rider.

Testimonial :

Linda (Wichita, KS, 61): “After being moved to the ICU unexpectedly, I was relieved to see my policy pay double for those days. It helped cover my rent and medications during recovery.”

4.3. Surgeries, Rehab, and Follow-Up Visits

Some hospital indemnity plans extend coverage beyond inpatient days. This may include lump-sum payouts for surgeries, rehabilitation admissions, or post-discharge follow-up visits—depending on the plan and any optional riders.

Real-Life Example : Martin, 57, undergoes a scheduled back surgery requiring three days in the hospital and a week in rehab. His policy pays $250/day for inpatient stay, plus an additional $500 for the surgery and $150/day for rehab—totaling $1,900 in direct payments.

4.3.1. Typical Coverage Breakdown by Plan Level

| Benefit Category | Basic Plan | Standard Plan | Premium Plan |

|---|---|---|---|

| Inpatient Stay (per day) | $150 | $250 | $400 |

| ICU Bonus (per day) | $200 | $350 | $500 |

| Surgical Benefit (flat amount) | Not included | $400 | $750 |

| Rehabilitation Facility (per day) | Not included | $100 | $150 |

| Follow-up Office Visit | Not included | $50 | $75 |

5. Costs, Premiums, and Out-of-Pocket Impacts

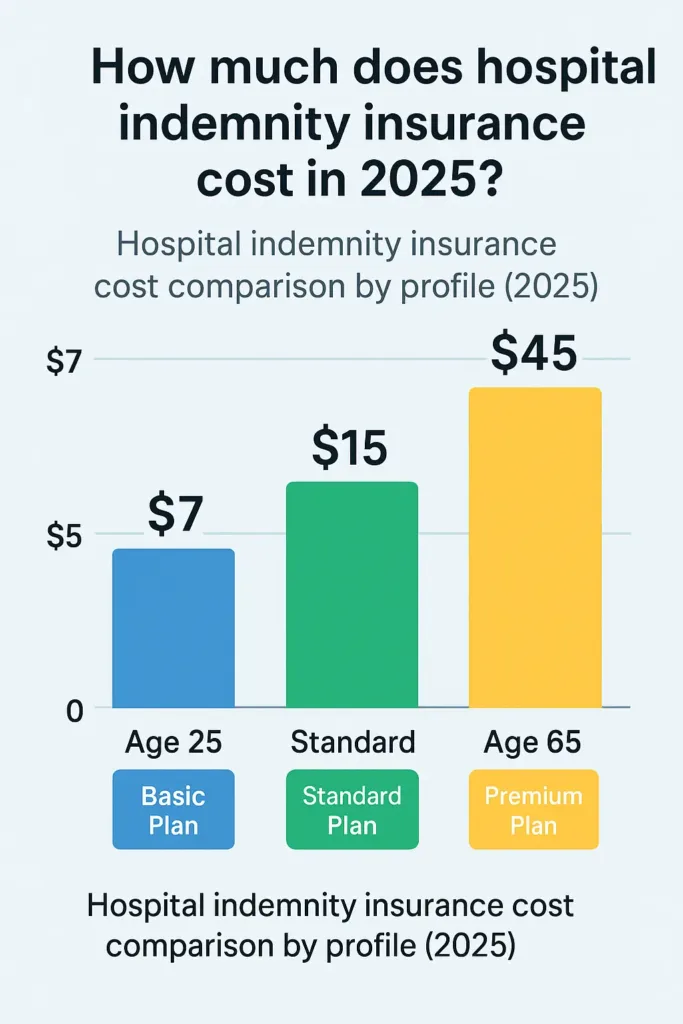

5.1. Monthly Premium Ranges (2024)

The cost of hospital indemnity insurance varies based on age, state, benefit amount, and whether you’re buying an individual or group policy. Most individuals pay between $10 and $45 per month for basic to mid-range plans, while premium options can reach $75 or more—especially when riders like ICU or surgery benefits are included.

Stat 2024: According to the Kaiser Family Foundation (KFF), the national average monthly premium for a standard hospital indemnity policy in 2024 is $28.70 for a 45-year-old nonsmoker.

5.2. Payout Amounts vs. Actual Expenses

Because indemnity plans pay fixed cash amounts, your reimbursement may not match your total medical costs. However, the lump-sum benefit is typically enough to help with deductibles, missed wages, or home bills during recovery.

Cas concret : In Newark, NJ, Emily, 51, had a 4-day hospitalization costing $6,000. Her major medical plan covered 80%, leaving her with $1,200 to pay. Her hospital indemnity policy paid $1,000 in cash—helping her cover the remaining out-of-pocket costs without dipping into emergency savings.

5.3. Sample Cost Scenarios by Age and State

Premiums and potential benefits vary greatly by age and location. Here’s a comparison of sample monthly costs for standard plans across different profiles:

5.3.1. Monthly Premium Estimates (2024)

| Profile | State | Age | Estimated Premium | Daily Benefit |

|---|---|---|---|---|

| Young Professional | Texas | 32 | $17 | $200 |

| Parent with HDHP | Ohio | 41 | $26 | $250 |

| Semi-Retired Individual | Florida | 63 | $41 | $300 |

| Self-Employed | California | 50 | $35 | $250 |

Fictional Dialogue :

James (Grand Rapids, MI, 44): “It feels like a small price monthly—but will it really help when I need it?”

Advisor: “It’s designed to ease financial shocks. Even a $1,000 payout during a 3-day hospital stay can make a real difference.”

Pro Tip (TX Ins. Code § 1207.002): In Texas, insurers must disclose any benefit limits and conditions that could reduce payments—especially when the plan includes variable rates by age or occupation.

6. Comparing Hospital Indemnity Plans

6.1. Key Features to Evaluate

Not all hospital indemnity policies are the same. Some offer basic coverage for inpatient stays only, while others include ICU benefits, surgery payouts, and rehab coverage. When comparing plans, consider the following factors:

- Daily benefit amount

- ICU or critical care multipliers

- Covered events (accidents, surgeries, childbirth)

- Optional riders (e.g., rehab, follow-up visits)

- Waiting periods and exclusions

Fictional Dialogue :

Nia (Charlotte, NC, 36): “Two plans seem similar—but one mentions an ICU rider, and the other doesn’t.”

Agent: “That rider could double your payout if you land in the ICU. It may cost a bit more, but could make a huge difference in a serious event.”

6.2. Side-by-Side Plan Comparison

Here’s a quick overview comparing three common types of hospital indemnity plans:

6.2.1. Standard Plan Tiers Compared

| Feature | Basic Plan | Standard Plan | Premium Plan |

|---|---|---|---|

| Daily Hospital Benefit | $150 | $250 | $400 |

| ICU Multiplier | 1x | 1.5x | 2x |

| Surgical Payout | None | $400 | $750 |

| Rehabilitation Coverage | No | Yes (5 days) | Yes (10 days) |

| Follow-Up Visit Benefit | No | $50 | $75 |

| Monthly Premium (est.) | $18 | $30 | $48 |

6.3. Riders and Add-Ons

Many insurers offer optional add-ons—called riders—that expand your coverage. Common examples include benefits for ambulance transport, outpatient surgery, emergency room visits, or rehab facilities.

Stat 2024: A LIMRA study reports that 62% of policyholders in 2024 selected at least one rider with their hospital indemnity policy, with ICU and surgery benefits being the most common.

Real-Life Example : After comparing two plans, Michelle adds an ICU rider for $5 more per month. Two years later, she’s hospitalized for a heart condition. Thanks to the rider, she receives an additional $600 in benefits—more than covering the total cost of the add-on.

Pro Tip (IL Admin Code § 2001.3): In Illinois, all optional riders must be disclosed with separate pricing and clearly labeled as “add-ons” in the Summary of Coverage. Don’t confuse base benefits with optional enhancements.

7. Pros and Cons of Hospital Indemnity Insurance

7.1. Advantages to Consider

Hospital indemnity insurance can offer peace of mind during a health crisis by providing fast, flexible financial support. Because payments go directly to you—not to doctors or hospitals—you choose how the funds are used. This flexibility is especially valuable if you face out-of-pocket costs, unpaid leave, or unexpected expenses during recovery.

Fictional Dialogue :

Terrence (Aurora, CO, 52): “I was worried about missing work. That check covered my rent and groceries while I recovered.”

Advisor: “That’s exactly the point—it gives you breathing room during hard times.”

Other benefits include:

- Cash benefits are paid regardless of your primary health insurance

- No network restrictions or pre-approvals required

- Most benefits are tax-free (consult your tax advisor). If you’re considering life coverage alongside hospital protection, it’s important to understand how life insurance is taxed so your loved ones receive the full benefit.

- Policies are often affordable and easy to enroll in

7.2. Limitations and Exclusions

While useful, hospital indemnity plans are not designed to replace traditional health coverage. Most don’t cover outpatient procedures, preventive care, or long-term treatment. Also, coverage amounts are capped and may not fully match hospital costs—especially for major surgeries or lengthy stays.

Pro Tip (NY Ins. Law § 3201): In New York, insurers must clearly disclose all exclusions and benefit limits before policy issuance. Always review the policy’s “Schedule of Benefits” for precise coverage terms.

Local Anecdote : Elise, 46, from Eugene, Oregon, purchased a basic indemnity policy thinking it covered ER visits. After an outpatient visit for a broken arm, she received no payment—her plan only applied to inpatient stays.

7.3. Summary Table: Is It the Right Fit?

Here’s a balanced overview of the main pros and cons to help evaluate if this type of plan makes sense for your situation:

7.3.1. Pros and Cons at a Glance

| Advantages | Limitations |

|---|---|

| Direct cash paid to policyholder | Does not cover outpatient services |

| Flexible use—no restrictions on spending | Benefit caps may fall short of actual costs |

| No provider networks required | May exclude pre-existing conditions |

| Easy enrollment and low monthly premiums | Often limited to hospital confinement only |

Mise en situation : A 40-year-old freelancer with no paid leave faces a 3-day hospital stay. A $250/day indemnity benefit results in a $750 payout—covering rent while they recover. Without that, they’d have dipped into emergency savings or missed a bill payment.

8. Alternatives to Hospital Indemnity Insurance

8.1. Health Savings Accounts (HSAs)

For individuals with high-deductible health plans (HDHPs), a Health Savings Account (HSA) can offer more flexibility than a fixed indemnity plan. HSAs allow you to set aside pre-tax dollars to pay for qualifying medical expenses—including hospital stays, prescriptions, and deductibles.

Pro Tip (IRS Code § 223): HSAs are governed under federal law. In 2024, individuals can contribute up to $4,150 annually tax-free, or $8,300 for families. Funds roll over year to year and are yours even if you change jobs.

Local Anecdote : Jamie, 34, from St. Louis, Missouri, used her HSA to pay a $2,000 hospital bill after a ski injury. Because she’d been saving regularly, she didn’t have to rely on credit cards or borrow money to cover the cost.

8.2. Short-Term Disability Insurance

Short-term disability (STD) insurance provides income replacement when you’re unable to work due to illness or injury—not just hospital stays. While STD doesn’t pay for medical expenses directly, it helps maintain your income while you recover. Benefits usually last from a few weeks to several months.

Cas concret : After a car accident, Brian in Connecticut couldn’t return to work for six weeks. His short-term disability plan covered 60% of his income during recovery, while his regular health insurance handled the medical bills.

8.3. Critical Illness and Accident Insurance

These plans provide lump-sum payments if you’re diagnosed with a covered condition (like cancer or a heart attack) or injured in an accident. Unlike hospital indemnity, they don’t require inpatient admission—but they only pay if a specific diagnosis or event occurs.

Fictional Dialogue :

Dina (Tucson, AZ, 46): “I travel often—what’s better: accident coverage or hospital indemnity?”

Advisor: “If you’re more concerned about injuries on the road, accident coverage might offer more value. But if you want coverage for any hospital stay, go with indemnity.”

8.3.1. Comparing Common Alternatives

| Alternative | Main Benefit | Best For | Limitations |

|---|---|---|---|

| HSA | Tax-free savings for medical costs | HDHP users, long-term planners | Must be paired with HDHP |

| Short-Term Disability | Replaces income during recovery | Salaried employees, long absences | No medical bill coverage |

| Critical Illness Insurance | Lump-sum payout after diagnosis | Those at risk of serious conditions | Doesn’t apply to general hospitalization |

| Accident Insurance | Pays for accidental injuries | Active individuals, families | Excludes illnesses and surgeries |

9. How to Decide If It’s Right for You

9.1. Key Questions to Ask Yourself

Before enrolling in a hospital indemnity plan, take time to assess your personal health risks and financial situation. Ask yourself:

- Would I be financially strained by a multi-day hospital stay?

- Do I have a high deductible or large coinsurance under my current plan?

- How much paid leave or income protection do I have?

- Have I been hospitalized in the last five years?

- Can I afford a small monthly premium in exchange for peace of mind?

Pro Tip (MA Gen Laws ch. 175 § 108): In Massachusetts, insurers must offer a 10-day “free look” period. You can cancel a new indemnity policy within that window and receive a full refund—no questions asked.

9.2. Real-World Example: Working Adult Without Paid Leave

Cas concret : Kayla, 39, from Raleigh, NC, works hourly and doesn’t receive sick pay. When she was hospitalized for gallbladder surgery, she missed five days of work and faced a $1,300 bill after insurance. Her $250/day hospital indemnity policy covered $1,250—nearly wiping out her shortfall and letting her focus on recovery.

9.3. When It Might Not Be Necessary

If you have a low-deductible health plan, robust paid leave, and sufficient emergency savings, a hospital indemnity policy may offer limited added value. In those cases, consider alternative protections like short-term disability or a health savings account (HSA).

Fictional Dialogue :

Kevin (Reno, NV, 58): “My employer plan has just a $500 deductible. Is indemnity still worth it?”

Agent: “In your case, it may be less critical—but it could still help if you face time off work or unexpected ICU costs. It’s about risk tolerance.”

Stat 2024: A 2024 FAIR Health study shows that 38% of Americans with employer coverage still report out-of-pocket burdens exceeding $1,000 after a hospital stay.

10. How to Enroll and What to Expect

10.1. Enrollment Options

You can enroll in a hospital indemnity plan through your employer (if offered), directly from a private insurer, or via an independent licensed agent. Some people opt for combined insurance coverage that includes hospital indemnity, critical illness, and accident protection in a single plan. Employer-sponsored options may offer group discounts or simplified underwriting. Most individual policies ask a few basic health questions, but you won’t need to undergo a medical exam.

Pro Tip (HIPAA Rule 45 CFR § 146.117): Federal law prohibits group plans from denying enrollment based on health status. However, individual indemnity policies may still apply limited underwriting or pre-existing condition clauses—read the fine print carefully.

10.2. What the Process Looks Like

Here’s what you can typically expect when applying for hospital indemnity insurance:

- ✅ Pick the benefit amount and coverage type that match your needs and budget

- ✅ Answer basic health questions (no exam required)

- ✅ Add any riders (ICU, surgical, etc.)

- ✅ Review your policy summary and exclusions

- ✅ Set up premium payments (monthly or annually)

Fictional Dialogue :

Marcus (Chicago, IL, 46): “How fast does coverage start?”

Agent: “Most policies activate immediately or within a few days, unless there’s a waiting period for certain conditions—check your specific terms.”

10.3. Realistic Expectations and First Claim

After enrollment, you’ll receive a certificate of coverage outlining your benefits. If you’re hospitalized, you (or someone on your behalf) submits a claim form and proof of admission—usually a hospital bill or discharge summary. Many insurers pay benefits within 7–14 business days of approval.

Real-Life Example : Ethan from Salt Lake City, UT, enrolled in a $300/day policy through his workplace. When he was hospitalized for kidney stones, he submitted a short claim form and received a $900 direct deposit within 10 days of discharge.

10.4. Important Notes on Waiting Periods and Renewals

Some indemnity plans include a 30-day waiting period before benefits kick in—especially for illness-related claims. Accident claims may be covered immediately. Most policies are guaranteed renewable annually as long as you pay your premiums.

Local Anecdote : Teresa, 60, from San Antonio, TX, was caught off guard when her claim was denied due to a pre-existing condition clause. She hadn’t realized her plan excluded hospitalizations tied to diagnoses made within the first six months. Always double-check waiting periods and exclusions before signing.

10.4.1. Enrollment Timeline Overview

| Step | Estimated Time |

|---|---|

| Quote & Plan Selection | Same day |

| Application & Health Questions | 10–15 minutes |

| Policy Activation | Immediate to 10 days |

| First Premium Payment | At enrollment or first billing cycle |

| Claims Processing | 7–14 business days |

Conclusion

Hospital stays often arrive without warning, leaving you not only recovering physically but also facing unexpected medical bills. Hospital indemnity insurance won’t replace your health plan, but it can be the difference between peace of mind and financial stress.

If you have a high deductible, minimal paid time off, or simply want added security, this type of policy might be a smart, low-cost layer of protection.

✅ Want a simpler way to stay ahead of hospital costs?

- 📄 Compare quotes from top-rated insurers

- 🔍 Review plan benefits, exclusions, and optional riders

- 📅 Sign up in minutes or connect with a licensed expert for guidance

💬 Don’t wait for a hospital bill to find out what’s not covered.

Get a personalized hospital indemnity insurance quote in minutes—no medical exam required.

FAQ

Is a hospital indemnity protection plan worth it?

Hospital indemnity insurance can be worth it if you:

Have a high-deductible health plan or Medicare Advantage with costly daily hospital copays.

Face potential income loss due to hospitalization (e.g., no paid leave).

Want quick, flexible cash payments to cover deductibles, coinsurance, bills, or everyday expenses during a hospital stay.

It provides daily fixed cash benefits during inpatient stays, helping bridge gaps left by primary insurance and reduce financial stress.

Why do I need indemnity insurance?

Indemnity insurance pays you a set cash amount per day of hospitalization, regardless of actual medical costs or bills. You might need it because:

Traditional health insurance often leaves significant out-of-pocket costs (deductibles, coinsurance).

You may lose income during hospitalization.

It offers flexible funds you can spend on anything—bills, groceries, rent—while recovering.

It can provide extra benefits for ICU stays, surgeries, rehab, or follow-ups if your plan includes those riders.

How much does hospital indemnity cost?

Monthly premiums typically range from about $10 to $45 for basic to standard plans.

Premiums vary by age, state, benefit level, and optional riders (e.g., ICU, surgery coverage).

Average premiums for a 45-year-old nonsmoker in 2024 are around $28.70/month for a standard plan.

Premiums increase with higher daily benefit amounts and additional riders.

Does hospital indemnity cover doctor visits?

Generally, no. Hospital indemnity insurance mainly covers inpatient hospital stays (typically 24+ hours).

Some plans may offer optional riders for follow-up visits after hospitalization or limited outpatient coverage, but routine doctor visits and ER trips are usually excluded.

It’s designed to pay for hospitalization days, not outpatient or preventive care.