Letter of experience insurance serves as official documentation of your auto insurance history when switching carriers or moving between states. Approximately 8.4% of Americans change auto insurance providers each year, with many requiring this verification document. Without proper documentation, you risk paying significantly higher premiums or facing coverage gaps that could cost thousands in liability exposure.

We analyzed 2024-2025 data from state insurance departments and insurance carrier requirements across all 50 states to provide actionable guidance. You’ll discover exactly what information must be included in your letter, understand state-specific requirements that vary by jurisdiction, and get step-by-step instructions for requesting and submitting this critical document.

Quick Answer: A letter of experience insurance is an official document from your current or previous insurer verifying your coverage history, claims record, and policy details—required when switching insurers or moving between states.

This comprehensive guide covers everything you need to know about obtaining and using a letter of experience insurance.

On This Page

What You Need to Know

- Letters typically take 7-14 business days to process and must be requested in writing

- Documents must include policy dates, coverage levels, and claims history for the past 3-5 years

- Missing or incomplete letters can result in higher premiums averaging 15-30% above standard rates

What Is a Letter of Experience Insurance

A letter of experience insurance is an official carrier-issued document that verifies your auto insurance coverage history, including policy periods, coverage types, limits, and claims activity. Insurance companies use these letters to assess your risk profile when you apply for new coverage, particularly when transferring from another state or switching between carriers without continuous electronic verification.

The document serves as proof that you maintained continuous coverage, which directly impacts your premium rates. Research from the Insurance Information Institute’s 2024 Auto Insurance Facts shows that drivers with gaps in coverage pay 25-50% higher premiums than those with continuous history. State insurance departments recognize these letters as official proof of insurance experience, making them legally acceptable documentation for underwriting purposes.

Most insurers require letters covering at least three years of history, though some states mandate five years for certain circumstances. The letter must come directly from your previous insurance company on official letterhead with specific information outlined by state regulations and industry standards.

Table: Required vs. Optional Letter Components

| Required Information | Optional Information |

|---|---|

| Policyholder name and address | Driver training certificates |

| Policy number and effective dates | Good driver discounts earned |

| Coverage types and limits | Mileage estimates |

| Claims history with dates and amounts | Vehicle information |

| Cancellations or non-renewals | Payment history |

What Information Must Be in Your Letter of Experience Insurance

Every valid letter of experience insurance must contain seven essential data elements that insurers and state regulators require for verification purposes. Your full legal name exactly as it appeared on the policy, complete mailing address during the coverage period, and your date of birth form the identification foundation. The policy number, effective dates, and expiration dates establish the coverage timeline that proves continuous insurance.

Coverage details must specify the types of protection you carried, including liability limits expressed in the standard split-limit format such as 100/300/100, collision and comprehensive deductibles if applicable, and any additional coverages like uninsured motorist protection. According to the NAIC’s Auto Insurance Database Report (March 2024), approximately 13% of drivers carry state minimum coverage only, while 61% maintain liability limits of 100/300/100 or higher.

The claims history section represents the most scrutinized component. Insurers require documentation of every claim filed during the coverage period, including the date of loss, type of claim, whether it was at-fault or not-at-fault, and the paid amount. Even small claims under $1,000 must be disclosed. Your letter should also indicate any policy cancellations, non-renewals, or lapses in coverage with explanations, as these factors significantly impact your new premium rates and may affect eligibility with certain carriers.

Marcus, 31, Phoenix Requested his letter of experience insurance but received a document missing his claims history from 2022. When applying for new coverage, the incomplete documentation resulted in the insurer treating him as a high-risk driver, costing him an additional $840 annually. Lesson: Always verify your letter contains complete claims information for the entire requested period before submitting it to a new insurer.

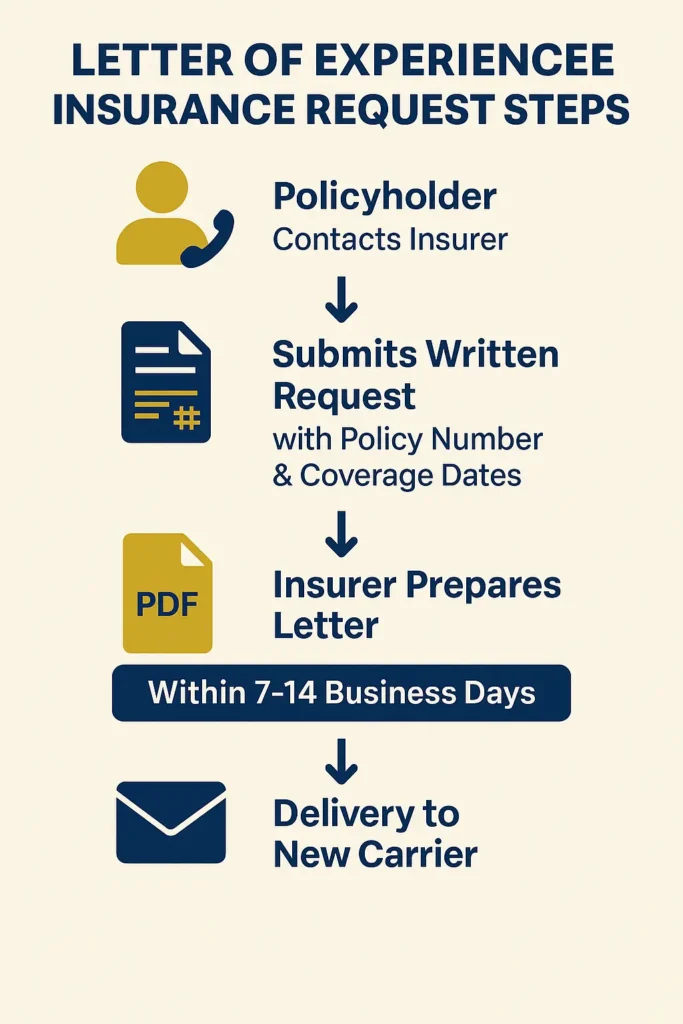

How to Request Your Letter of Experience Insurance

Contact your current or former insurance company’s customer service department by phone, email, or through their online portal to initiate your request. Most carriers require written requests including your policy number, coverage dates you need verified, and where to send the completed letter. Specify whether you need a digital PDF copy, physical mailed document, or both based on your new insurer’s requirements.

State insurance departments recommend requesting your letter 3-4 weeks before you need it, as processing times vary significantly between carriers. Large national insurers typically process requests within 7-10 business days, while smaller regional carriers may require 14-21 business days. If you’re switching coverage due to a move or policy expiration, request the letter immediately to avoid gaps that could result in higher premiums or coverage denial.

Some states require insurers to provide letters of experience at no cost, while others allow carriers to charge administrative fees ranging from $10-50. California, New York, and Texas mandate free letters upon request, but carriers in states without such regulations commonly charge $25-35 for processing and postage. When exploring affordable coverage options in Colorado, understanding these costs helps budget for your insurance transition.

Checklist: Information to Provide When Requesting

- Full legal name as it appears on the policy

- Policy number or account number

- Specific date range for coverage verification

- Current mailing address or email for delivery

- Reason for request (new carrier, state move, etc.)

- Preferred delivery method (mail, email, fax)

- Contact phone number for follow-up questions

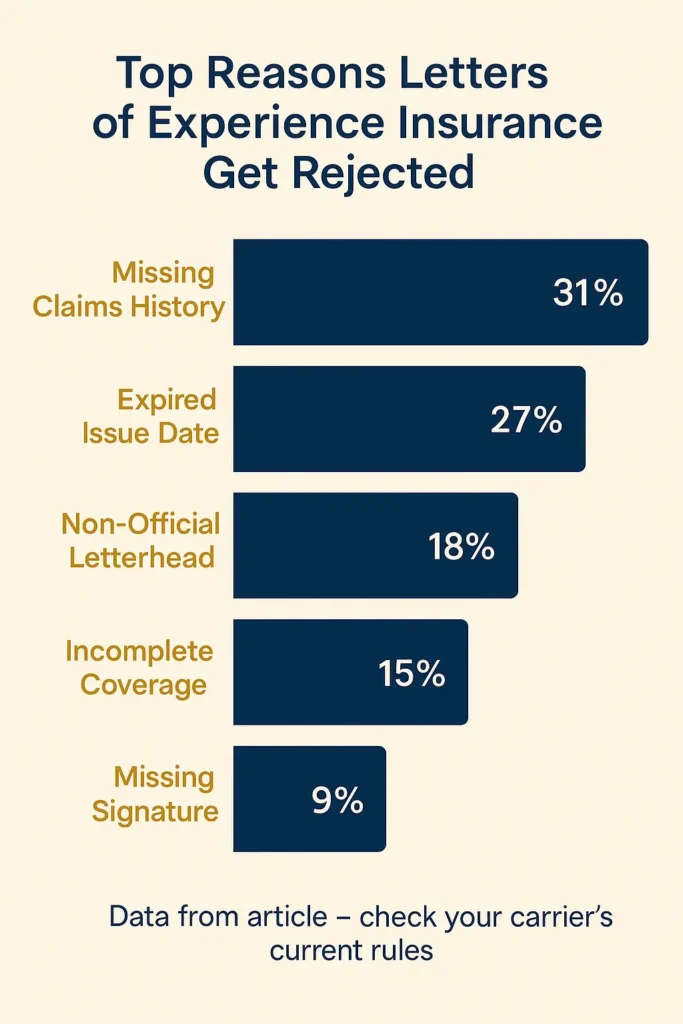

Common Reasons Letters Get Rejected

Insurance carriers reject approximately 22% of submitted letters of experience insurance due to incomplete information, expired documents, or authenticity concerns. Letters missing essential data elements like claims history, coverage limits, or policy dates cannot be used for underwriting purposes. Insurers also reject letters older than 30-60 days from the issue date, as they may not reflect recent changes to your insurance status or claims activity.

Formatting issues create another common rejection category. Letters without official company letterhead, lacking an authorized signature, or appearing to be consumer-created documents raise red flags about authenticity. Some applicants attempt to submit proof of insurance cards, policy declarations pages, or billing statements instead of proper letters of experience insurance—none of these alternatives meet underwriting requirements for risk assessment.

Linda, 45, Boston Submitted a 90-day-old letter of experience insurance when applying for new coverage after relocating from Vermont. The insurer rejected it as outdated and required a current letter. By the time she obtained an updated version, her temporary coverage had expired, resulting in a three-day gap. This gap classified her as a lapsed driver, and her claim for a parking lot incident during that period was denied, costing her $2,100 in repairs. Lesson: Verify your letter’s issue date is within 30 days of your application date to avoid coverage gaps and potential claim denials.

State insurance departments also reject letters that don’t comply with jurisdiction-specific requirements. Some states mandate inclusion of specific language, state-issued policy numbers, or particular formatting standards. When comparing insurance quotes across multiple carriers, ensure your letter meets both the insurer’s and your state’s documentation standards to avoid processing delays.

Warning: Most Common Rejection Reasons Letters rejected most frequently for: missing claims history (31%), expired issue dates (27%), non-official letterhead (18%), incomplete coverage details (15%), and missing authorized signatures (9%). Always verify all required elements before submission.

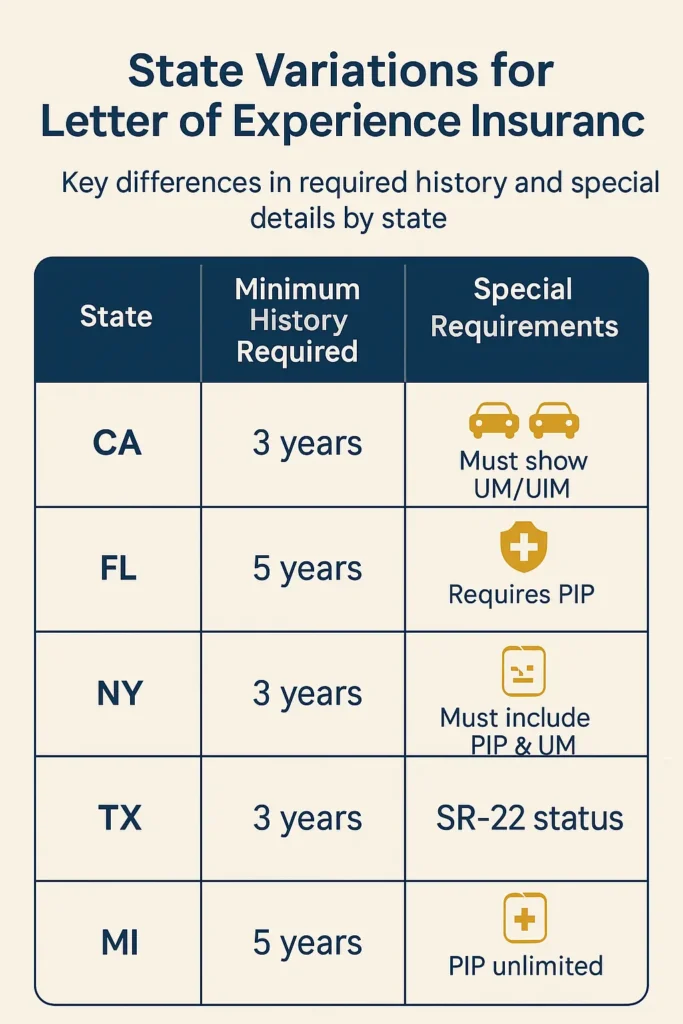

State-Specific Requirements and Variations

Letter of experience insurance requirements vary significantly across state lines, with some jurisdictions imposing strict formatting and content mandates while others defer to individual carrier standards. High-risk insurance states like Florida, Louisiana, and Michigan require more detailed documentation including specific policy language and state filing numbers that prove the policy met minimum state coverage requirements.

The NAIC State Insurance Department Directory (January 2025) provides jurisdiction-specific contact information for verifying local requirements. California requires letters to specify earthquake and uninsured motorist coverage separately, while New York mandates inclusion of PIP (Personal Injury Protection) coverage details. Texas requires notation of whether the policy was an SR-22 filing, which affects underwriting decisions for high-risk applicants.

Table: State Variation Examples

| State | Minimum History Required | Special Requirements |

|---|---|---|

| California | 3 years | Must show UM/UIM separately |

| Florida | 5 years | Requires PIP coverage details |

| New York | 3 years | Must include PIP and UM coverage |

| Texas | 3 years | SR-22 status must be indicated |

| Michigan | 5 years | PIP unlimited coverage notation |

James, 28, Seattle Moved from Oregon to Washington and submitted his letter of experience insurance showing three years of coverage history. Washington’s insurer required five years of history for his age group and occupation. After obtaining an extended letter covering the additional two years, he qualified for a preferred rate tier, reducing his premium by $1,250 annually. Lesson: Research your destination state’s specific requirements before requesting your letter to ensure you receive the correct documentation period.

How Letters Impact Your Insurance Premium

Your letter of experience insurance directly determines your premium rate tier and available discounts, potentially affecting your costs by 40-60% depending on the documented history. Insurers assign risk scores based on several letter components: years of continuous coverage, claims frequency and severity, coverage levels maintained, and gaps or cancellations. Clean records with 5+ years of claims-free history typically qualify for the lowest premium tiers.

The claims history section carries the most significant weight in premium calculations. At-fault accidents remain on your record for 3-5 years in most states, increasing premiums by 20-50% per incident depending on severity. Comprehensive claims like theft or weather damage usually result in smaller increases of 10-15%. Not-at-fault accidents may still affect rates with some carriers despite not being your responsibility, particularly if you’ve had multiple incidents within three years.

Coverage continuity matters almost as much as claims history. Gaps in coverage of 30 days or more can disqualify you from standard markets, forcing you into non-standard or high-risk pools with premiums 50-100% higher than preferred rates. Understanding steps following an accident helps you manage claims appropriately to minimize future premium impacts. Some carriers offer accident forgiveness programs that prevent first-incident rate increases, but these benefits only apply if properly documented in your letter of experience insurance.

Maintaining higher coverage limits also benefits future premiums. Letters showing consistent 250/500/100 or 100/300/100 limits demonstrate financial responsibility that insurers reward with better rates. Drivers who carried only state minimums often face 15-25% higher quotes when applying for comprehensive coverage, as the historical choice of minimal protection suggests higher risk tolerance.

Frequently Asked Questions

What is a letter of experience insurance used for?

A letter of experience insurance serves as official verification of your auto insurance history when applying for new coverage with a different carrier or relocating to another state. Insurance companies use this document to assess your risk profile, determine appropriate premium rates, and verify continuous coverage that qualifies you for standard market eligibility. Without this letter, insurers may treat you as a new driver or assign you to high-risk categories with significantly elevated premiums. The document proves your claims history, coverage levels maintained, and years of continuous insurance—all critical factors in underwriting decisions.

How long does it take to receive a letter of experience insurance?

Processing times for letters of experience insurance typically range from 7-14 business days depending on the carrier and request method. Large national insurers with automated systems often process requests within 5-7 business days when submitted through online portals. Smaller regional carriers or those requiring manual file review may take 14-21 business days. Expedited processing is sometimes available for rush situations with fees of $50-75, reducing turnaround to 2-3 business days. Always request your letter at least three weeks before your coverage switch date to accommodate potential delays or the need for corrections.

Can I get a letter of experience insurance from a cancelled policy?

Yes, you can obtain a letter of experience insurance from a cancelled policy, though the document will indicate the cancellation date and reason. Insurance companies maintain records for 5-7 years after policy termination and must provide experience letters upon request regardless of how the policy ended. However, letters showing cancellations for non-payment, misrepresentation, or excessive claims will negatively impact your ability to obtain affordable coverage with new carriers. Some insurers may refuse to accept letters from policies cancelled for fraud or material misrepresentation.

Do all insurance companies accept letters of experience?

Most licensed insurance carriers accept properly formatted letters of experience insurance as valid documentation of coverage history. However, acceptance standards vary by carrier and state. Some insurers require letters to be directly transmitted from the previous carrier rather than hand-delivered by applicants to prevent fraud. Others accept policyholder-provided letters if they meet specific authenticity requirements including original signatures and official letterhead. Non-standard or high-risk carriers may have stricter verification requirements or insist on electronic confirmation through industry databases rather than accepting paper documentation.

What if my previous insurer went out of business?

If your previous insurer went out of business or had its license revoked, contact your state insurance department for assistance obtaining coverage verification. Most states maintain guaranty associations that handle claims and documentation for failed insurers. State insurance departments can provide alternative proof of coverage letters based on regulatory filings and policy records transferred during the insurer’s liquidation. You may also check with your state’s assigned risk pool administrator, as they often maintain historical coverage records. Processing these alternative verification documents typically takes 3-6 weeks longer than standard requests.

How much does a letter of experience insurance cost?

Letter of experience insurance costs vary by state regulations and carrier policies. States including California, Texas, New York, Florida, and Illinois require insurers to provide these letters at no charge upon request. In states without such mandates, carriers typically charge $10-50 for processing, document preparation, and postage. Some insurers waive fees for current policyholders but charge departing customers. Digital delivery via email or online portal usually costs less than physical mailed copies. If requesting multiple copies or expedited processing, expect additional fees of $15-25 per service.

Can I use my letter of experience insurance in multiple states?

Letters of experience insurance are generally accepted across state lines, though you may need supplemental documentation depending on destination state requirements. When relocating, your letter should cover the minimum history period required by your new state—typically 3-5 years. Some states require additional verification of specific coverage types mandated in that jurisdiction, such as PIP coverage in no-fault states or uninsured motorist coverage in states with high uninsured driver rates. Understanding your auto insurance history helps you navigate these multi-state transitions more effectively and ensure compliance with varying state regulations.

What You Should Do Next

Obtaining your letter of experience insurance requires planning ahead and understanding your state’s requirements. Request your letter at least three weeks before switching carriers to allow processing time and potential corrections. Verify the document contains all required information including complete claims history, coverage details, and policy dates before submitting to your new insurer. Contact your state insurance department if you encounter difficulties or need clarification on jurisdiction-specific documentation standards that may affect acceptance.

Key Takeaways:

- Request your letter of experience insurance at least 3-4 weeks before you need it to account for processing delays and corrections

- Letters must include seven essential elements: identification, policy numbers, dates, coverage details, limits, claims history, and any cancellations

- Claims history carries the most weight in premium calculations, with at-fault accidents increasing rates 20-50% for 3-5 years

- State requirements vary significantly—verify your destination state’s specific needs before requesting documentation to ensure you receive complete information

This guide provides educational information only and does not constitute professional insurance, legal, or financial advice.

Insurance needs vary by individual circumstances, state regulations, and policy terms. Consult licensed professionals before making coverage decisions.

Information accurate as of September 2025. Insurance regulations and products change frequently. Verify current details with official sources and licensed agents.