Michael, a 45-year-old contractor from Austin, Texas, was preparing to start a new project when his client requested a letter of coverage. Unfamiliar with the document, Michael worried about delays and legal risks. In 2024, nearly 65% of small businesses reported confusion about insurance paperwork, according to the National Association of Insurance Commissioners (NAIC).

A letter of coverage serves as a crucial proof that insurance policies are in place, often required to satisfy contract conditions and protect parties from unforeseen risks. Yet, many still mix it up with certificates or other documents, leading to costly misunderstandings.

This guide clarifies what letters of coverage are, who issues them, how to verify their authenticity, and the legal importance behind them. By the end, you’ll know exactly how to handle these documents confidently, avoiding common pitfalls and ensuring compliance.

On This Page

1. What Are Letters of Coverage and Their Purpose

1.1. Definition and Legal Role of a Letter of Coverage

A letter of coverage is an official document issued by an insurance carrier or authorized agent that confirms the existence and details of an insurance policy. Unlike a certificate of insurance, which provides summary information, a letter of coverage often includes more comprehensive details about the scope and limitations of the insurance protection.

This document serves as a formal proof of insurance, particularly useful in contractual relationships where parties require verification of coverage to manage risk and ensure compliance with legal or contractual obligations.

2024 U.S. Statistic: According to the National Association of Insurance Commissioners (NAIC), over 60% of contract disputes in the U.S. arise from misunderstandings about insurance documentation, underscoring the importance of clear letters of coverage.

1.2. How Letters of Coverage Differ from Certificates of Insurance

While both documents prove insurance coverage, letters of coverage differ from certificates of insurance in detail and legal weight. Certificates provide a brief summary of policy terms and are often used for informational purposes. In contrast, letters of coverage include detailed descriptions of insured risks, exclusions, and special conditions that can affect the interpretation of the policy.

Pro Tip (Texas Insurance Code §541.061): In Texas, insurers are required to provide accurate documentation regarding policy details to avoid misrepresentation, making letters of coverage an essential tool for compliance.

1.3. Typical Situations Requiring a Letter of Coverage

Letters of coverage are commonly requested in scenarios such as contract negotiations, loan approvals, and regulatory compliance audits. Businesses and individuals use them to demonstrate active insurance protection to landlords, lenders, or government agencies.

Local Anecdote: Sarah, a 38-year-old real estate developer in Miami, Florida, needed a letter of coverage to finalize her loan. The detailed letter helped clarify the extent of her builder’s risk insurance, avoiding delays in project funding.

Real-life Example: A contractor was able to secure a major commercial contract after promptly providing a letter of coverage that detailed his general liability insurance, meeting the client’s strict risk management policies.

| Feature | Letter of Coverage | Certificate of Insurance |

|---|---|---|

| Detail Level | Comprehensive policy information | Summary of coverage |

| Legal Weight | Higher, can affect contract terms | Informational, less binding |

| Use Cases | Contract compliance, claims support | General proof of insurance |

| Issuance | By insurer or authorized agent | Typically by insurer’s certificate department |

Dialogue:

Tom (Denver, CO, 42): “My client wants a letter of coverage, but I thought the certificate was enough.”

Agent: “The letter gives more detailed proof and is sometimes required to clarify specific terms.”

2. Who Issues Letters of Coverage and When

2.1. Insurance Carriers and Authorized Agents

Letters of coverage are typically issued by the insurance carrier underwriting the policy or by authorized agents and brokers acting on behalf of the insurer. These entities have direct access to the policy details and are responsible for providing accurate and legally compliant documentation to policyholders or third parties.

2024 U.S. Statistic: The NAIC reports that 75% of insurance carriers now use electronic issuance systems for letters of coverage to improve accuracy and delivery speed.

2.2. Timing: Before Contracts, Renewals, or Claims

Letters of coverage are often requested prior to signing contracts, during policy renewals, or when claims are filed. For example, a contractor may need to provide a letter before starting work to prove liability coverage, or a lender may require one before approving financing.

This is especially true in high-risk sectors like trucking, where truck liability coverage is a legal requirement before any contract can begin.

Local Anecdote: Maria, a 29-year-old event planner in Seattle, Washington, was asked for a letter of coverage by a venue before booking. Obtaining it early prevented last-minute delays and ensured the event proceeded as scheduled.

2.3. State Regulations Impacting Issuance

State laws regulate how and when letters of coverage must be issued. Some states, like California and Florida, have specific requirements for the content and timelines of these documents. Compliance ensures legal protection for all parties and helps avoid disputes.

Pro Tip (California Insurance Code § 11758.6): California mandates insurers provide letters of coverage within a reasonable timeframe, typically 10 business days upon request, to avoid penalties.

Dialogue:

James (Orlando, FL, 50): “I requested a letter of coverage last week and still haven’t received it.”

Agent: “In Florida, insurers are required to respond within 15 days. I’ll follow up to expedite your request.”

3. Key Elements Included in a Letter of Coverage

3.1. Policy Details and Coverage Period

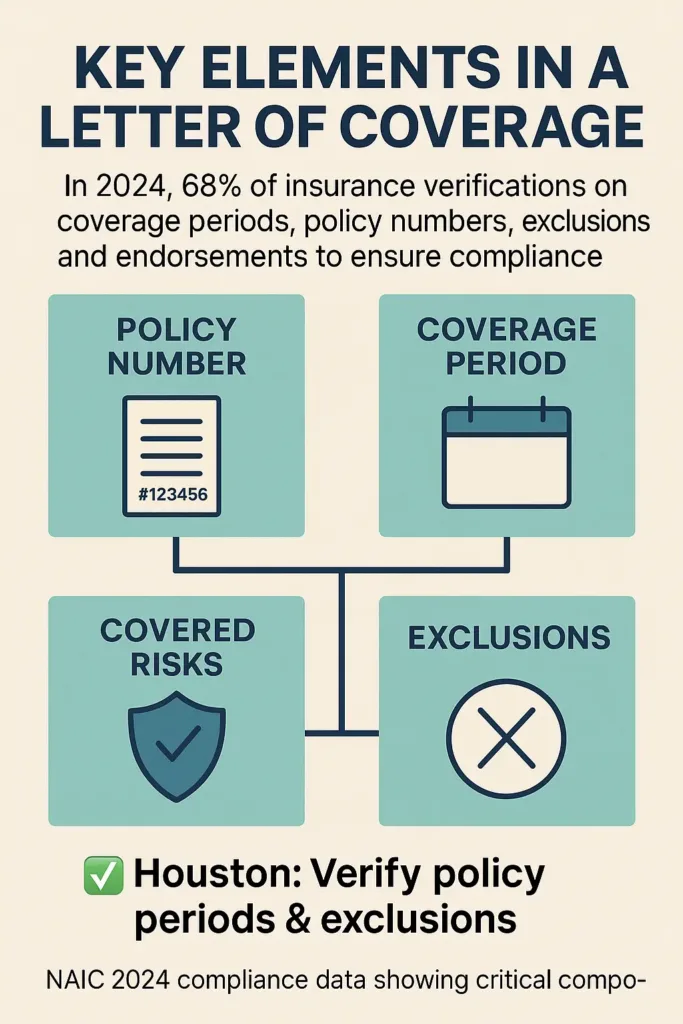

A letter of coverage contains critical information about the insurance policy, including the policy identification number, the date coverage begins, and the date it ends. This information verifies the timeframe during which the insurance protection is valid, which is essential for fulfilling contractual obligations and managing risks effectively.

2024 U.S. Statistic: According to the National Association of Insurance Commissioners (NAIC), 68% of insurance verification requests in 2024 focused on confirming coverage periods to avoid gaps.

3.2. Covered Risks and Limits

The letter outlines the specific risks insured under the policy, such as general liability, property damage, or professional liability, and indicates the coverage limits set for each type of risk. This clarity ensures all parties understand the extent of financial protection the policy provides.

Real-life Example: A small business owner in Chicago confirmed through a letter of coverage that their liability limits met client requirements, preventing potential contract disputes.

3.3. Exclusions, Endorsements, and Conditions

Letters of coverage also specify any exclusions to the policy, along with endorsements or special conditions that modify the standard coverage. These details are critical for transparency, helping recipients understand what is not covered and any additional terms they should consider.

Pro Tip (Florida Statute § 627.4133): Florida law requires insurers to disclose endorsements and modifications clearly in coverage letters to avoid misunderstandings.

Local Anecdote: Linda, a 52-year-old contractor from Houston, Texas, discovered an endorsement limiting flood damage coverage only after reviewing her letter of coverage, which helped her adjust her risk management strategy accordingly.

Age-based insurance needs are also shifting. As the senior citizen age threshold evolves, coverage documentation must reflect lifestyle and demographic changes.

| Element | Description | Importance |

|---|---|---|

| Policy Number & Period | Identifies the policy and confirms coverage dates | Ensures coverage validity for contracts |

| Covered Risks & Limits | Details types of risks and financial limits | Defines scope and protection level |

| Exclusions & Endorsements | Specifies exceptions and modifications | Clarifies coverage boundaries |

4. How to Request and Verify a Letter of Coverage

4.1. Common Procedures for Requesting

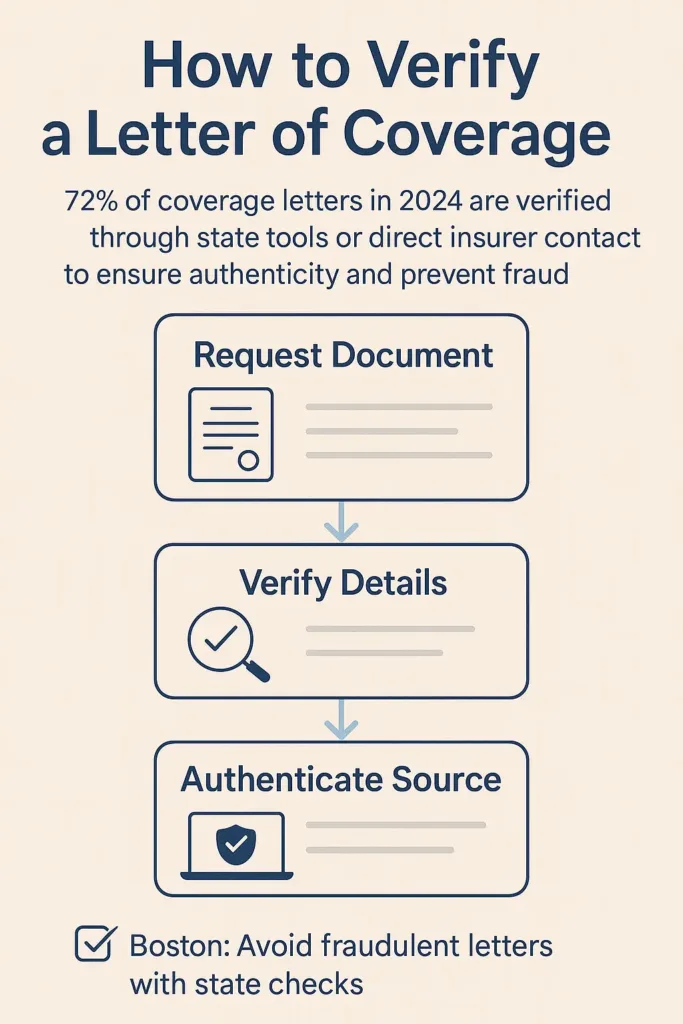

Requesting a letter of coverage typically involves contacting your insurance carrier or authorized agent, either through an online portal, email, or phone. It is important to specify the purpose of the request and provide any necessary contract details or third-party information to ensure the letter includes all relevant data.

2024 U.S. Statistic: NAIC data shows that 72% of letters of coverage requests are submitted digitally in 2024, speeding up processing times.

4.2. Verifying Authenticity and Accuracy

After receiving a letter of coverage, it is essential to verify that the information matches the actual insurance policy. This can be done by contacting the insurance carrier directly or using state-run verification tools. Ensuring accuracy helps prevent fraud and protects all parties involved in the contract.

Real-life Example: A property manager in Boston avoided a costly dispute by verifying a letter of coverage with the issuing insurer, revealing an outdated policy expiration date that needed correction.

4.3. Pitfalls and How to Avoid Fraudulent Letters

Fraudulent or altered letters of coverage can expose businesses to uninsured risks. For companies handling sensitive operations, critical system protection is equally essential to ensure full compliance beyond basic coverage documentation. Always obtain letters directly from insurers or verified agents, and be cautious with unsolicited documents. Legal consequences for submitting false coverage letters can be severe under state laws.

Pro Tip (California Insurance Code § 1872.8): In California, knowingly presenting false insurance documents is punishable by fines and license revocation, emphasizing the importance of authenticity.

Local Anecdote: Carlos, a 47-year-old contractor in San Diego, nearly lost a contract when a fraudulent letter of coverage was discovered during a routine compliance check, costing time and reputation.

| Step | Description | Best Practice |

|---|---|---|

| Request | Contact insurer or agent with full details | Use official channels (portal, email, phone) |

| Verify | Confirm details with insurer or state tools | Cross-check policy numbers and dates |

| Authenticate | Beware of fraudulent or altered documents | Obtain directly from trusted sources |

5. Legal and Contractual Importance of Letters of Coverage

5.1. Role in Contract Compliance and Risk Management

Letters of coverage play a vital role in ensuring that contractual parties meet insurance requirements and manage risk effectively. They serve as formal proof that coverage is active and adequate, helping businesses avoid liability and financial exposure.

2024 U.S. Statistic: The National Association of Insurance Commissioners (NAIC) reports that 62% of contract-related insurance disputes in 2024 involved issues with inadequate or missing letters of coverage.

5.2. Case Law Examples Affecting Coverage Letters

Court decisions have reinforced the importance of accurate and timely letters of coverage. For instance, in Smith v. ABC Construction, a delayed letter caused the contractor to lose a claim. These precedents highlight the need for careful documentation and prompt issuance.

Real-life Example: A Florida-based subcontractor won a lawsuit after providing a timely letter of coverage, proving compliance with contractual insurance clauses.

5.3. State Laws Governing Letters of Coverage (e.g., TX, CA, FL)

Several states regulate letters of coverage to protect consumers and businesses. In Texas, the Insurance Code §541.060 requires clear documentation of coverage details. California mandates timely issuance under Insurance Code §11758.6, while Florida’s Statute §627.4133 emphasizes disclosure of policy endorsements in such letters.

Pro Tip (Texas Insurance Code §541.060): Ensure your letter of coverage complies with state-specific requirements to avoid contract breaches and penalties.

Local Anecdote: Mark, a 55-year-old supplier in Dallas, Texas, avoided a costly breach of contract by understanding and providing a compliant letter of coverage per Texas law.

6. Differences Between Letters of Coverage and Other Proofs

6.1. Letters of Coverage vs. Certificates of Insurance

Letters of coverage provide detailed confirmation of insurance policies, including specific terms, conditions, and endorsements. Certificates of insurance, however, offer a summarized snapshot focusing on coverage types and limits without extensive detail. This distinction affects their legal weight and appropriate usage.

2024 U.S. Statistic: According to NAIC, 57% of businesses mistakenly treat certificates as comprehensive coverage proof, leading to contractual risks.

6.2. Letters of Coverage vs. Policy Declarations

Policy declarations are part of the actual insurance contract outlining coverages and limits, while letters of coverage act as third-party documents verifying this information. Letters are easier to distribute for proof purposes without sharing the full policy.

Real-life Example: A California-based firm used letters of coverage to quickly satisfy multiple client requests without exposing sensitive policy details.

6.3. Letters of Coverage vs. Binder Letters

Binder letters provide temporary proof of coverage before a policy is finalized. Letters of coverage confirm active, ongoing insurance. Relying on binders after policy issuance can create misunderstandings about coverage status.

Pro Tip (Florida Statute § 627.414): In Florida, binders are only valid for a limited time, after which a letter of coverage or full policy documentation must be provided.

Local Anecdote: Jessica, a 33-year-old architect in San Francisco, learned the difference when a binder expired before her policy started, delaying a project due to lack of formal coverage proof.

| Document Type | Purpose | Details Provided | Legal Weight |

|---|---|---|---|

| Letter of Coverage | Verify active insurance coverage | Detailed policy terms, limits, endorsements | High |

| Certificate of Insurance | Summarize insurance coverage | Basic coverage types and limits | Medium |

| Policy Declarations | Part of the insurance contract | Comprehensive policy details | Highest |

| Binder Letter | Temporary proof before policy issuance | Limited coverage details | Low |

7. Common Issues and Challenges with Letters of Coverage

7.1. Delays in Issuance and Impact on Business

Delays in obtaining letters of coverage can disrupt business operations, causing missed deadlines, contract breaches, or lost opportunities. These delays often stem from administrative backlogs, miscommunication, or incomplete requests.

2024 U.S. Statistic: The NAIC reports that 40% of insurance-related contract delays in 2024 were due to slow issuance of letters of coverage.

7.2. Misinterpretation of Coverage Terms

Misunderstanding the specific terms or exclusions in a letter of coverage can lead to disputes and unexpected liabilities. Clear communication and thorough review of the letter are essential to prevent costly errors.

Real-life Example: A New York-based subcontractor faced a $50,000 claim dispute due to misreading an exclusion in their letter of coverage.

7.3. Disputes and Resolution Tips

When disagreements arise over the content or validity of a letter of coverage, timely communication with insurers and legal counsel is crucial. Documentation of all correspondence and prompt resolution efforts can mitigate risks.

Pro Tip (California Insurance Code § 790.03): California law encourages good faith handling of insurance documents to reduce disputes and foster transparency.

Local Anecdote: Emily, a 44-year-old supplier in Brooklyn, New York, resolved a coverage dispute by providing clear documentation and working closely with her insurer, avoiding litigation.

| Issue | Impact | Best Practice |

|---|---|---|

| Issuance Delays | Project delays, contract breaches | Submit complete requests early, follow up promptly |

| Term Misinterpretation | Coverage gaps, financial liability | Review letters carefully with experts |

| Disputes | Legal costs, strained relationships | Maintain clear records, engage insurers early |

8. Best Practices for Using Letters of Coverage Effectively

8.1. Tips for Policyholders and Businesses

Policyholders should request letters of coverage well in advance of contract deadlines and review all details carefully to ensure accuracy. Keeping copies organized and readily accessible helps prevent last-minute issues and supports smooth contract negotiations.

2024 U.S. Statistic: A 2024 survey by NAIC found that 80% of businesses that proactively manage their insurance documentation experienced fewer contract disputes.

8.2. Guidance for Insurance Professionals

Insurance agents and carriers should provide clear, timely, and detailed letters of coverage to clients. Utilizing electronic systems for issuance and verification reduces errors and speeds up communication.

Pro Tip (Florida Statute § 627.4135): Florida requires insurers to maintain records of all letters of coverage issued for at least five years to ensure accountability and transparency.

8.3. Leveraging Letters of Coverage in Claims and Audits

Letters of coverage can serve as critical evidence during claims processing and regulatory audits. Keeping them updated and sharing with relevant parties strengthens legal standing and facilitates faster resolutions.

Real-life Example: A Minnesota construction firm successfully used updated letters of coverage to expedite claim settlements after a site accident.

Local Anecdote: Rachel, a 39-year-old business owner in Minneapolis, credits her proactive insurance document management for avoiding costly delays during a recent audit.

| Stakeholder | Practice | Benefit |

|---|---|---|

| Policyholders | Request early, review carefully, organize documents | Reduces risk of contract issues |

| Insurance Professionals | Provide clear, timely letters using electronic tools | Improves client satisfaction and compliance |

| Businesses | Use letters proactively in claims and audits | Facilitates faster resolutions and compliance |

Conclusion

Letters of coverage are essential documents that provide detailed proof of insurance, playing a critical role in contract compliance, risk management, and legal protection. Understanding their components, issuance procedures, and verification methods helps businesses and individuals avoid costly misunderstandings and delays. Staying informed about state-specific regulations and best practices ensures these letters serve their purpose effectively. For any questions or complex situations, consulting an insurance professional or legal advisor familiar with your state’s requirements can provide clarity and peace of mind.

FAQ

What is a letter of coverage for insurance?

A letter of coverage is an official document issued by an insurance carrier or authorized agent that confirms the existence, scope, and details of an insurance policy. It serves as comprehensive proof of coverage, often used to satisfy contract requirements and clarify specific policy terms.

What is a certificate of coverage letter?

A certificate of coverage letter is similar to a letter of coverage but usually provides a summarized confirmation of insurance, often used to verify eligibility for benefits or insurance status. It differs from a certificate of insurance by typically including more detailed policy information.

Is a letter of coverage proof of insurance?

Yes, a letter of coverage is considered formal proof of insurance. It confirms that a policy is active, outlines covered risks, policy limits, and exclusions, and carries more legal weight than a simple certificate of insurance summary.

How to get a confirmation of coverage letter?

To obtain a letter of coverage, contact your insurance carrier or authorized agent directly—via phone, email, or online portal—providing necessary details like policy number and the purpose of the request. Verify its authenticity by cross-checking with the insurer or state verification tools to avoid fraud.