The Medicare Claims Processing Manual serves as the comprehensive administrative guide that governs how healthcare providers submit, process, and receive reimbursement for services provided to Medicare beneficiaries across the United States. This extensive documentation, maintained by the Centers for Medicare & Medicaid Services (CMS), establishes the standardized procedures that ensure consistent claim handling nationwide.

Understanding this manual becomes essential for healthcare providers, billing specialists, and administrative staff who interact with Medicare’s complex reimbursement system. The manual addresses everything from initial claim submission requirements to appeals processes, creating a unified framework for the nation’s largest health insurance program.

Medicare processes over one billion claims annually, making the standardization provided by this manual crucial for maintaining system efficiency. The document undergoes regular updates to reflect changing regulations, coverage determinations, and technological improvements in healthcare delivery.

Healthcare facilities that master the guidelines within this manual typically experience faster claim processing times, fewer denials, and improved cash flow, while those unfamiliar with its requirements often face delayed payments and administrative complications.

On This Page

Understanding the Manual Structure

The Medicare Claims Processing Manual operates as a multi-volume reference system organized into distinct chapters that address specific aspects of claim handling. Each chapter contains detailed instructions, examples, and regulatory citations that support the Medicare program’s administrative functions.

CMS structures the Medicare Claims Processing Manual to align with the Medicare Administrative Contractor (MAC) workflow, ensuring that different geographical regions follow consistent processing standards. The manual’s organization reflects the complexity of Medicare’s various parts, including Part A hospital coverage, Part B medical services, Part C Medicare Advantage plans, and Part D prescription drug benefits.

The primary manual, officially known as the Medicare Claims Processing Manual (Publication 100-04), contains over 30 chapters covering topics from general billing requirements to specialized services like durable medical equipment and ambulance services. Each chapter includes transmittal updates that communicate changes to existing policies, ensuring that all stakeholders receive current information.

Healthcare providers access the manual through the official CMS website, where updates appear in real-time as new regulations take effect. The business insurance compliance requirements for medical practices often reference these manual provisions to ensure proper Medicare billing procedures.

Regional variations in manual interpretation sometimes occur through local coverage determinations, but the core processing requirements remain consistent across all MAC jurisdictions. This standardization helps healthcare providers who operate in multiple states maintain uniform billing practices.

Key Components and Chapters

Chapter 1 of the manual establishes general billing requirements that apply to all Medicare claim types, including provider enrollment standards, claim submission deadlines, and basic documentation requirements. This foundational chapter serves as the starting point for understanding Medicare’s billing ecosystem.

Subsequent chapters of the Medicare Claims Processing Manual address specific service categories, with Chapter 12 focusing on physician and non-physician practitioner services, Chapter 15 covering ambulance services, and Chapter 20 detailing durable medical equipment requirements. Each chapter includes detailed coverage criteria, billing codes, and payment methodologies specific to that service category.

The manual incorporates cross-references between chapters to help users understand how different services interact within Medicare’s payment structure. For example, when a patient receives both physician services and durable medical equipment, multiple chapters may apply to a single patient encounter.

Quality reporting requirements appear throughout various chapters, reflecting Medicare’s emphasis on value-based care initiatives. These sections outline how providers must document quality measures to receive full reimbursement under current payment models.

Special attention focuses on fraud prevention measures embedded within each chapter’s requirements. The manual includes specific documentation standards designed to support appropriate utilization while preventing improper payments.

Regulatory Framework

The Medicare Claims Processing Manual operates under the authority of the Social Security Act and Code of Federal Regulations Title 42, which establish Medicare’s legal foundation. These regulatory sources provide the statutory authority that enables CMS to create detailed administrative procedures outlined in the manual.

Federal regulations establish broad policy directions, while the manual translates these policies into specific operational procedures that MACs and providers can implement consistently. This regulatory hierarchy ensures that manual provisions align with Congressional intent and federal oversight requirements.

The manual incorporates guidance from various federal agencies beyond CMS, including the Department of Health and Human Services Office of Inspector General and the Centers for Disease Control and Prevention. This inter-agency coordination helps ensure that Medicare policies support broader public health objectives.

Regulatory updates trigger corresponding manual revisions through a formal transmittal process that allows stakeholders to comment on proposed changes before implementation. This process helps balance administrative efficiency with stakeholder input on complex policy modifications.

The insurance claim process for Medicare shares similarities with private insurance but operates under more detailed federal oversight requirements outlined in the manual’s regulatory framework.

Enforcement mechanisms within the regulatory framework include provider audit procedures, payment suspensions, and exclusion from Medicare participation for serious compliance violations. The manual details these enforcement tools to help providers understand the consequences of non-compliance with established procedures.

Primary Stakeholders and Users

Healthcare providers represent the manual’s primary user base, including hospitals, physician practices, skilled nursing facilities, home health agencies, and specialized service providers like ambulance companies and durable medical equipment suppliers. Each provider type focuses on specific manual sections relevant to their service offerings.

Medicare Administrative Contractors use the manual as their operational guide for processing claims, conducting audits, and providing customer service to healthcare providers. MACs receive regular training on manual updates to ensure consistent application across different geographical regions.

Billing companies and revenue cycle management firms rely heavily on manual guidance to ensure accurate claim submission for their healthcare clients. These intermediary organizations often develop specialized expertise in complex manual provisions to maximize claim approval rates.

Government oversight agencies, including the HHS Office of Inspector General and the Government Accountability Office, reference the manual when evaluating Medicare program integrity and identifying areas for improvement. Their assessments often lead to manual modifications that strengthen program administration.

Healthcare compliance officers and internal auditors use the manual to develop monitoring procedures that identify potential billing errors before claim submission. This proactive approach helps healthcare organizations avoid costly audit findings and payment recoveries.

Medicare beneficiaries and their representatives occasionally consult the manual when appealing coverage decisions or seeking to understand their rights under the Medicare program. While the manual’s technical language can be challenging for non-professionals, it serves as the authoritative source for Medicare policy interpretations.

Claim Submission Procedures

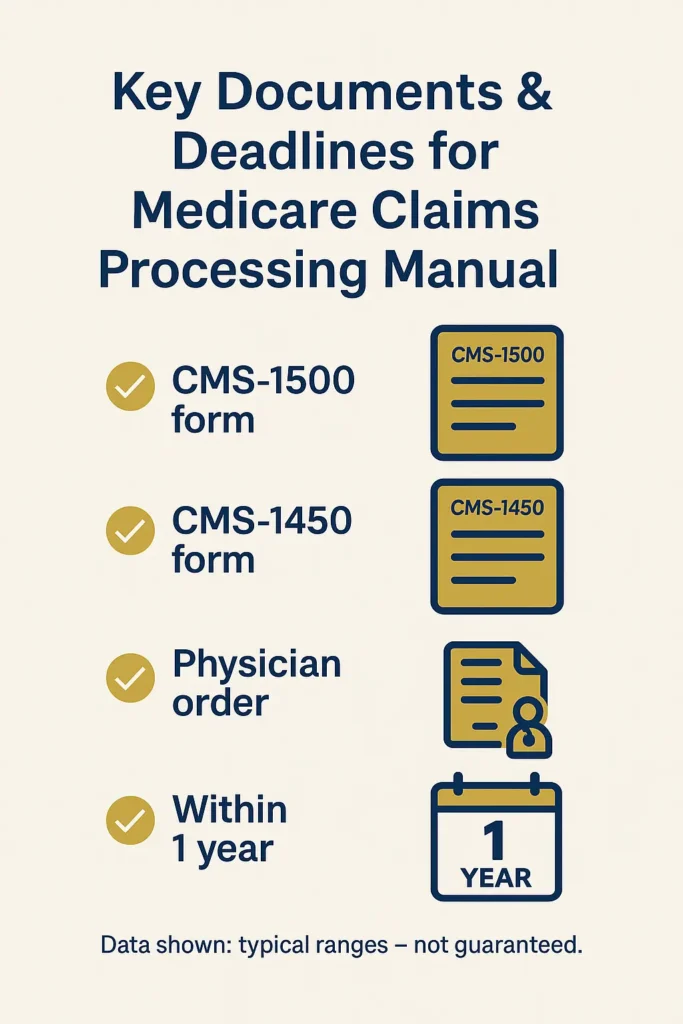

The Medicare Claims Processing Manual establishes specific timelines and methods for claim submission that healthcare providers must follow to ensure proper reimbursement. Claims must be submitted within one year of the service date, with limited exceptions for delayed billing circumstances outlined in the manual’s general provisions.

Electronic claim submission through the HIPAA-compliant EDI 837 format represents the standard method for most healthcare providers. The HHS guidance on electronic transactions specifies technical requirements for electronic submissions, including data field requirements, file transmission protocols, and error handling procedures that ensure successful claim processing.

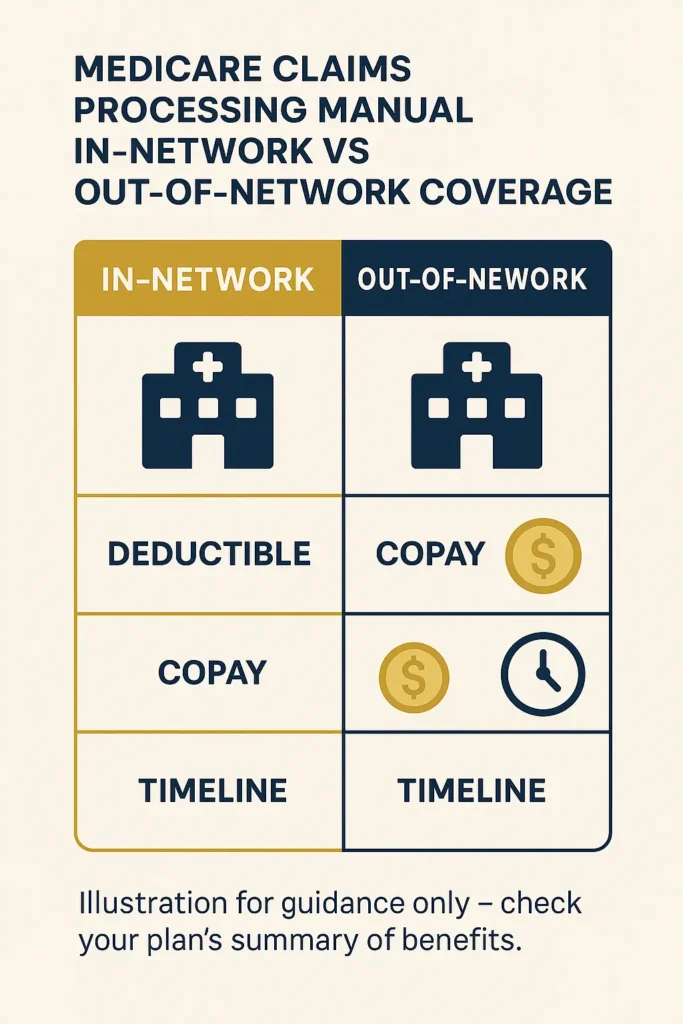

Paper claim submission using the CMS-1450 form for institutional providers and CMS-1500 form for professional services remains available for limited circumstances. The manual details when paper submissions are acceptable and includes specific mailing addresses for different claim types and geographical regions.

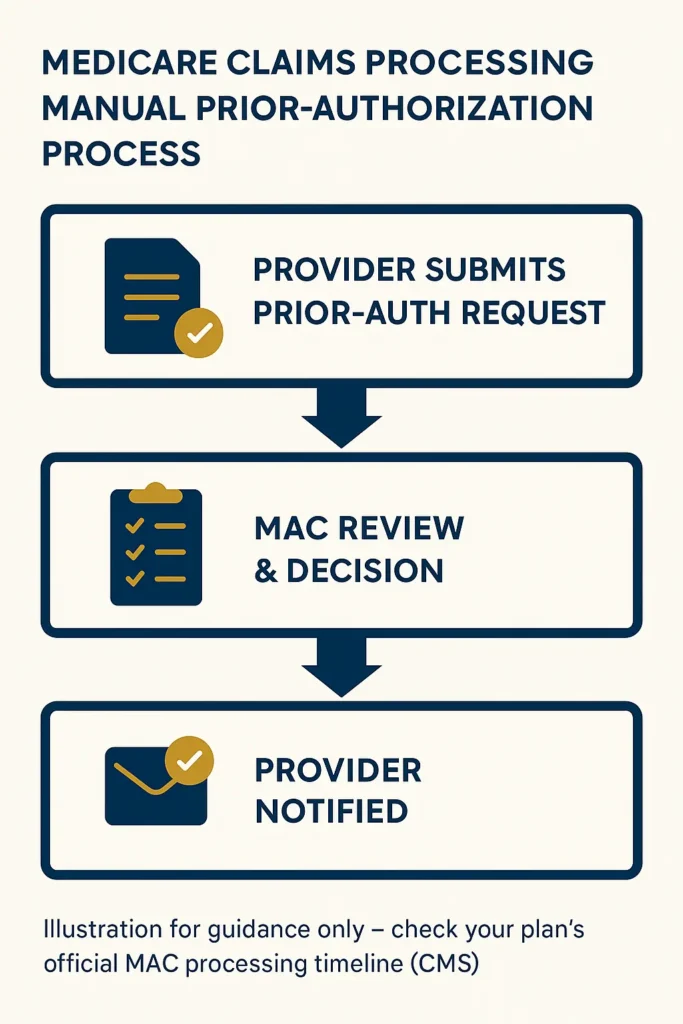

Prior authorization requirements appear throughout various manual chapters, with specific procedures for obtaining approval before providing certain services. The manual distinguishes between services requiring prior authorization and those subject to post-service review, helping providers understand when to seek approval before treatment.

Clean claim standards defined in the manual establish criteria for claims that contain all necessary information for processing without additional development. Claims meeting these standards typically process within established timeframes, while incomplete claims face delays until missing information is provided.

The manual includes detailed instructions for correcting and resubmitting claims that were initially denied or processed incorrectly. These procedures help providers understand when to submit corrected claims versus appeals, ensuring appropriate handling of different claim issues.

Documentation Requirements

Medical record documentation standards outlined in the manual support the medical necessity determinations that drive Medicare coverage decisions. The manual emphasizes that documentation must be legible, dated, signed, and maintained in the patient’s permanent medical record.

Physician orders serve as foundational documentation for most Medicare services, with specific requirements varying by service type. The manual details when verbal orders are acceptable, documentation timeframes for physician signature, and circumstances requiring additional physician involvement in care decisions.

The manual establishes documentation requirements for different provider types, recognizing that hospitals, physicians, and ancillary service providers maintain different types of records. Each provider type must maintain documentation that supports the services billed and demonstrates compliance with Medicare coverage criteria.

Progress notes and treatment records must demonstrate ongoing medical necessity for extended services like skilled nursing facility stays and home health episodes. The manual provides guidance on documentation frequency and content requirements that support continued coverage determinations.

The home insurance coverage components principle of detailed documentation applies similarly to Medicare claims, where comprehensive records support successful claim processing and audit defense.

Diagnostic testing documentation requires specific elements including ordering physician information, medical necessity justification, and result interpretation. The manual addresses how different types of diagnostic services should be documented to support appropriate utilization and payment.

Common Processing Scenarios

Routine physician office visits represent the most common Medicare claims processing scenario, involving evaluation and management services billed with specific CPT codes. The manual provides detailed guidance on documentation requirements for different visit complexity levels and billing procedures for common office-based services.

Hospital inpatient stays involve complex processing scenarios that include multiple provider types, various service categories, and coordination between different billing entities. The manual addresses how hospitals should handle physician services provided during inpatient stays and coordination with professional billing.

Surgical procedures require specific documentation and billing procedures that vary depending on whether the surgery occurs in a hospital, ambulatory surgery center, or physician office setting. The manual details pre-operative, intraoperative, and post-operative documentation requirements for different surgical scenarios.

Emergency department visits present unique processing challenges due to varying complexity levels and the need for rapid decision-making in urgent situations. The manual provides guidance on appropriate emergency department billing and documentation requirements that support medical necessity determinations.

Preventive services covered by Medicare involve specific processing procedures that differ from diagnostic and treatment services. The manual outlines coverage criteria for preventive services and billing procedures that ensure appropriate payment for covered screenings and counseling services.

Coordination of benefits situations occur when Medicare beneficiaries have additional insurance coverage, requiring specific processing procedures to determine primary and secondary payment responsibilities. The manual details how providers should handle these scenarios to ensure proper payment coordination.

Quality Control Measures

The Medicare Claims Processing Manual incorporates extensive quality control measures designed to ensure accurate claim processing and prevent improper payments. These measures include both automated system edits and manual review procedures that MACs apply to incoming claims.

Automated edits programmed into Medicare’s claims processing systems check for common billing errors, coverage criteria compliance, and suspicious billing patterns before claims reach manual review stages. The manual describes how these edits function and provides guidance for providers on avoiding common edit triggers.

Medical review procedures outlined in the manual establish criteria for selecting claims for detailed clinical review by qualified medical personnel. These reviews focus on medical necessity, appropriate coding, and compliance with coverage policies specific to the services provided.

Provider enrollment and credentialing requirements detailed in the manual ensure that only qualified healthcare providers participate in the Medicare program. The NAIC guidelines for provider standards help protect beneficiaries and program integrity by maintaining standards for provider qualifications and ongoing compliance monitoring.

Audit procedures described in the manual establish how MACs conduct comprehensive reviews of provider billing practices and documentation. The manual outlines provider rights during audits and procedures for responding to audit findings and potential payment recoveries.

Statistical sampling methodologies outlined in the manual provide guidance on how MACs select claims for review and extrapolate findings to larger claim populations. These procedures ensure that audit findings are statistically valid and appropriately represent provider billing patterns.

The manual includes fraud detection measures that help identify unusual billing patterns and potential program integrity violations. These measures work in conjunction with law enforcement agencies and include procedures for reporting suspected fraud and abuse activities.

Recovery procedures detailed in the manual establish how MACs handle overpayments and collect funds that were improperly disbursed to healthcare providers. These procedures include appeal rights and installment payment options for providers facing significant recoveries.

Provider education initiatives outlined in the manual emphasize prevention of billing errors through comprehensive training programs and educational resources. The manual describes how MACs should provide ongoing education to help providers understand complex billing requirements and avoid common mistakes.

Performance monitoring measures incorporated throughout the manual help ensure consistent application of processing procedures across different MAC jurisdictions. These measures include quality assessments and corrective action procedures that maintain program integrity standards nationwide.

Federal vs State Requirements

The Medicare Claims Processing Manual operates primarily under federal jurisdiction, creating uniform standards that apply across all states regardless of local insurance regulations. This federal oversight ensures that Medicare beneficiaries receive consistent coverage and claim processing procedures whether they live in California or Florida.

State Medicaid programs often coordinate with Medicare requirements when beneficiaries qualify for both programs, creating dual eligible scenarios that require careful coordination between federal and state administrative procedures. The manual addresses these coordination requirements and provides guidance for providers serving dual eligible patients.

Local Coverage Determinations issued by individual MACs represent the primary mechanism through which regional variations appear in Medicare administration. While the core manual requirements remain consistent, MACs may develop specific coverage policies for services that lack national coverage determinations.

State licensing requirements for healthcare providers must align with Medicare enrollment standards, though the manual defers to state authorities for professional licensing matters. Providers must maintain both state licensure and Medicare enrollment to participate in the program.

Workers’ compensation coordination varies significantly by state, requiring providers to understand both federal Medicare requirements and state-specific workers’ compensation procedures. The complete workers comp requirements by state demonstrate how these variations impact healthcare billing and coordination of benefits.

State fraud and abuse laws supplement federal Medicare regulations, creating additional compliance obligations for healthcare providers. The manual references these state requirements while focusing primarily on federal compliance standards.

Recent Updates and Changes

The 2025 updates to the Medicare Claims Processing Manual reflect significant changes in healthcare delivery models, including expanded telehealth coverage options that became permanent following the COVID-19 public health emergency. These updates, detailed in recent CMS announcements, include detailed billing procedures for virtual care services and documentation requirements for remote patient monitoring.

Prior authorization requirements expanded in 2025 to include additional services, with the manual providing updated procedures for obtaining authorization and handling situations where services are provided without proper approval. These changes aim to reduce inappropriate utilization while maintaining access to necessary care.

Quality payment program modifications incorporated into the 2025 manual updates reflect ongoing efforts to tie Medicare payments to quality outcomes rather than service volume. The manual now includes updated reporting requirements and penalty calculations for providers participating in these value-based programs.

Electronic health record interoperability requirements received significant updates in 2025, with the Medicare Claims Processing Manual addressing how providers must handle information sharing and patient data portability requirements. These changes support improved care coordination and reduced administrative burden.

Artificial intelligence and machine learning applications in healthcare received new coverage guidance in the 2025 manual updates, establishing criteria for when AI-assisted services qualify for Medicare reimbursement. This emerging technology guidance helps providers understand coverage boundaries for innovative care delivery methods.

Price transparency requirements incorporated into the 2025 updates mandate that healthcare providers make pricing information available to patients before service delivery. The Medicare Claims Processing Manual outlines implementation procedures and compliance monitoring for these transparency initiatives.

Enforcement Mechanisms

The Medicare Claims Processing Manual establishes comprehensive enforcement mechanisms that ensure provider compliance with program requirements through a graduated system of interventions ranging from education to program exclusion. Initial enforcement typically involves provider education and corrective action plans that allow providers to address compliance issues without financial penalties.

Payment suspensions represent an intermediate enforcement tool outlined in the manual, allowing MACs to temporarily halt payments to providers while investigating potential compliance violations. These suspensions include due process protections and timeframes for resolution that balance program integrity with provider rights.

Civil monetary penalties detailed in the manual provide financial consequences for violations including false claims submission, failure to maintain proper documentation, and violation of assignment agreements. The manual outlines penalty calculation methods and factors that MACs consider when determining appropriate sanctions.

Program exclusion procedures represent the most severe enforcement mechanism available under the manual, permanently removing providers from Medicare participation for serious violations including fraud convictions and patient abuse findings. The manual details exclusion procedures and limited circumstances under which excluded providers may apply for reinstatement.

The professional liability insurance protection often covers some enforcement actions, though providers remain personally responsible for compliance with manual requirements regardless of insurance coverage.

Recovery audit contractor programs outlined in the manual establish systematic review procedures for identifying and recovering improper payments. These programs operate independently of traditional MAC audit functions and focus specifically on payment accuracy across large claim volumes.

FAQ

What is the Medicare claims processing manual?

The Medicare Claims Processing Manual is a comprehensive administrative guide published by the Centers for Medicare & Medicaid Services that establishes standardized procedures for healthcare providers to submit, process, and receive reimbursement for services provided to Medicare beneficiaries.

This multi-volume reference system contains detailed instructions, regulatory citations, and examples that ensure consistent claim handling across all Medicare Administrative Contractor regions. The manual serves as the authoritative source for Medicare administrative procedures that govern the nation’s largest health insurance program.

What is the 2 2 2 rule in Medicare?

The 2 2 2 rule in Medicare refers to specific documentation and coverage requirements that vary by service type and are detailed throughout different chapters of the Medicare Claims Processing Manual. For some services, this rule establishes minimum documentation frequency, coverage duration limits, or quality reporting intervals that providers must meet to maintain Medicare compliance.

The rule’s specific application depends on the service category, with home health services, skilled nursing facility care, and durable medical equipment each having distinct requirements. Providers should consult the specific manual chapter relevant to their service type to understand how this rule applies to their billing and documentation requirements.

What are the steps in the Medicare claims process?

The Medicare claims process outlined in the manual follows a structured sequence beginning with service delivery and proper documentation, followed by claim preparation using appropriate billing codes and required supporting information. Providers submit claims electronically or via paper forms within the one-year filing deadline.

Medicare Administrative Contractors then review claims for completeness, coverage criteria, and medical necessity. The processing system applies automated edits and may select claims for additional medical review before determining payment amounts and issuing remittance advice to providers.

If claims are denied, providers may submit corrected claims or file appeals following established procedures, with beneficiaries receiving explanation of benefits statements that detail coverage decisions.

What is the Medicare 85% rule?

The Medicare 85% rule typically refers to reimbursement percentage calculations or coverage thresholds that apply to specific service categories detailed in various chapters of the Medicare Claims Processing Manual. This rule may establish minimum coverage percentages for certain services or define payment calculation methods for shared services.

The exact application varies by service type, with ambulance services, durable medical equipment, and facility-based care each having distinct 85% calculations outlined in their respective manual sections. Healthcare providers should reference the specific manual chapter relevant to their services to understand how this rule impacts their billing calculations.

What are the three M’s of Medicare services?

The three M’s of Medicare services represent fundamental criteria that the Medicare Claims Processing Manual emphasizes throughout its coverage determinations: Medical necessity, Medically reasonable, and Medically appropriate.

Medical necessity requires that services address a specific medical condition and represent standard treatment approaches supported by clinical evidence. Medically reasonable standards ensure that services are provided in the most cost-effective setting appropriate for the patient’s condition.

Medically appropriate criteria evaluate whether the timing, frequency, and intensity of services align with accepted clinical practice standards and the patient’s individual medical circumstances.

What are the six items needed to complete the CMS 1500 claim form?

The Medicare Claims Processing Manual specifies six essential elements required for completing the CMS 1500 claim form: patient demographics including name, date of birth, and Medicare identification number; provider information including National Provider Identifier and billing address; and service information including dates, procedure codes, and diagnosis codes.

Additional requirements include medical necessity documentation supporting the services provided, coordination of benefits information for patients with additional insurance coverage, and required signatures and certifications from both patient and provider.

Each element must meet specific formatting and content requirements detailed in the manual to ensure successful claim processing, with incomplete information resulting in claim denials that require resubmission.

Conclusion

The Medicare Claims Processing Manual serves as an indispensable resource for healthcare providers navigating the complex landscape of Medicare billing and reimbursement procedures. Understanding this comprehensive guide becomes essential for maintaining compliance, ensuring proper payment, and avoiding costly administrative errors that can impact healthcare organizations’ financial stability.

As healthcare delivery continues evolving with technological advances and changing patient needs, the manual’s regular updates help providers stay current with emerging requirements and coverage policies. The 2025 updates particularly emphasize quality-based care models and electronic health record interoperability, reflecting Medicare’s ongoing transformation toward value-based healthcare delivery.

Key Takeaways

- The Medicare Claims Processing Manual establishes uniform federal standards for claim submission, processing, and reimbursement that apply consistently across all states and Medicare Administrative Contractor regions

- Successful Medicare billing requires thorough understanding of documentation requirements, submission procedures, and quality control measures outlined in the manual’s service-specific chapters

- Recent 2025 updates expand telehealth coverage, strengthen prior authorization requirements, and incorporate new technology-assisted care delivery models into Medicare’s coverage framework

- Enforcement mechanisms ranging from provider education to program exclusion ensure compliance with manual requirements while providing due process protections for healthcare providers

Disclaimer: The information in this article is for educational purposes only and reflects data and regulations available at the time of publication. Insurance rules and Medicare provisions may change frequently, and specific benefits can vary by state. Readers should verify details with official sources such as CMS or their state Department of Insurance. For advice tailored to your personal situation, always consult a licensed insurance professional.