Medicare payment plan 2025 introduces the new Medicare Prescription Payment Plan that allows Part D enrollees to pay for covered prescription drugs in monthly capped installments instead of large out-of-pocket pharmacy bills. Announced by the Centers for Medicare & Medicaid Services (CMS) in its 2025 guidance, the option becomes available during the Annual Enrollment Period (AEP) — October 15 to December 7, 2025.

Quick Answer: Beginning in 2025, eligible Medicare Part D and Medicare Advantage-Prescription Drug (MAPD) enrollees may spread their yearly prescription costs across 12 equal monthly payments after they opt in during AEP.

On This Page

Medicare Payment Plan 2025 – How It Works

- Check eligibility: Available to all Medicare beneficiaries enrolled in a standalone Part D or a MAPD plan.

- Opt in during AEP: Beneficiaries can sign up for the plan directly through their Part D or MAPD sponsor during October 15 – December 7, 2025.

- Monthly capped bills: Instead of paying full cost at the pharmacy counter, the total annual cost is divided into capped monthly bills.

- Ongoing payments: Participants pay the plan sponsor each month by mail or online; pharmacies continue to be reimbursed as usual.

- Monitor or cancel: Enrollees can track payments via statements and may opt out during a future enrollment period if desired.

Tip: For a step‑by‑step visual, see our upcoming “5 Steps to Use the Medicare Payment Plan” Web Story.

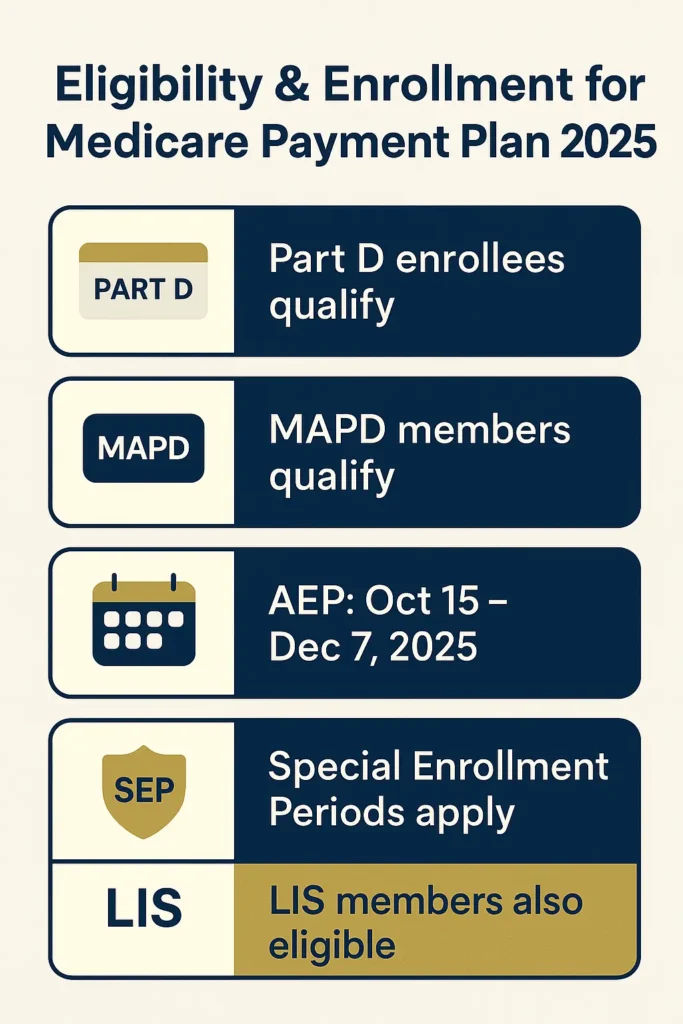

Eligibility and Enrollment During AEP (Oct 15 – Dec 7, 2025)

- Who qualifies: Any beneficiary who enrolls in a Medicare Part D or MAPD plan for 2025.

- Enrollment window: The opt‑in option is offered only during AEP — October 15 through December 7, 2025 (or when first eligible for Part D).

- Special Enrollment Periods (SEP): Beneficiaries qualifying for SEP, such as those newly eligible for Medicare, can also opt in at that time.

- Low‑Income Subsidy (LIS) members: Still eligible but will see less benefit if their cost‑sharing is already low.

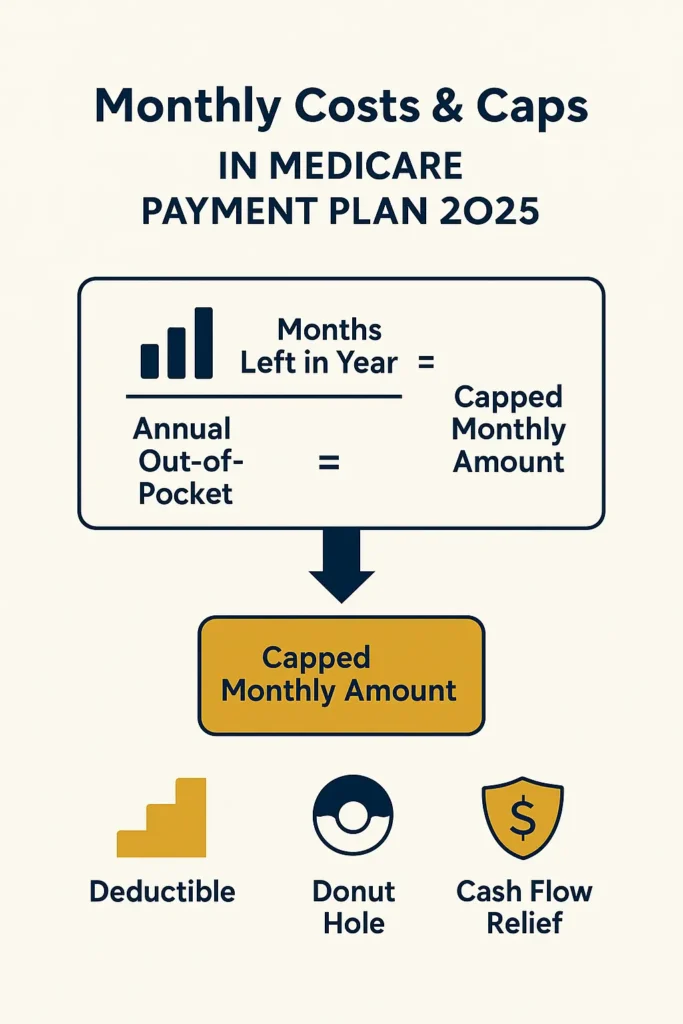

Medicare Payment Plan 2025 – Costs & Caps

- Monthly cap: The capped monthly amount is calculated by dividing the beneficiary’s total out‑of‑pocket prescription costs by the number of months left in the plan year.

- Annual costs unchanged: The plan does not reduce the total amount owed — it simply spreads costs out over the year.

- Helps with cash flow: Reduces financial strain at the pharmacy counter.

- Applies after deductible: Participants must still meet any plan deductible before cost‑sharing applies.

- Works through donut hole & catastrophic phase: Payments are calculated across all Part D coverage phases.

Impact on Pharmacies and Plan Sponsors

- Pharmacy transactions stay the same: Pharmacies continue to be paid by the plan; they no longer collect large sums from patients at the counter.

- Plan sponsor role: Sponsors manage the monthly billing, payment collection, and reporting to CMS.

- Goal: Encourage medication adherence by avoiding cost‑related treatment delays.

Medicare Payment Plan 2025 – FAQs

How much will the Medicare plan cost in 2025?

The national average Part D base premium in 2025 is projected by CMS to be about $34.70 per month, though actual premiums vary by plan and region. The payment plan itself does not change premiums; it affects how prescription drug cost‑sharing is billed.

What is the Medicare payment proposal for 2025?

The CMS Medicare Prescription Payment Plan is the proposal implemented in 2025. It lets eligible Part D and MAPD enrollees pay their annual prescription drug costs in monthly capped installments instead of paying in full at the point of sale.

What will happen to Medicare Advantage plans in 2025?

Medicare Advantage (MA) plans remain available with standard medical benefits; those that include MAPD coverage will also be required to offer the new monthly prescription payment option to members who opt in.

What is the Medicare donut hole for 2025?

The coverage gap (donut hole) in 2025 begins after a beneficiary and their plan together spend $5,030 on covered drugs; during this phase, beneficiaries pay 25% of the cost of both brand‑name and generic medications until they reach the catastrophic threshold of $8,000 in true out‑of‑pocket costs.

What’s the best Medicare Advantage plan for 2025?

The best plan depends on the beneficiary’s health needs, preferred provider network, prescription list, and total cost (premium + cost‑sharing). Shoppers should use the Medicare Plan Finder on Medicare.gov or speak with a licensed agent to compare options.

Does everyone have to pay $170 a month for Medicare?

No. The $170.10 figure was the standard Part B premium in 2022; current Part B premiums for 2025 are set annually by CMS (expected to be higher than in 2024). Not all beneficiaries pay the same amount — it depends on income‑related monthly adjustment amounts (IRMAA) and program changes.

When does Medicare payment plan 2025 enrollment start and end?

Enrollment for the payment plan coincides with the Annual Enrollment Period — October 15 to December 7, 2025. Eligible beneficiaries must opt in with their plan sponsor during that period or when first enrolling in Part D.

Key Takeaways

- Medicare payment plan 2025 introduces monthly capped billing for prescription drugs under Part D and MAPD plans.

- Enrollment opens during AEP — October 15 to December 7, 2025.

- The program helps spread annual out‑of‑pocket drug costs into 12 monthly payments without changing the total owed.

- Pharmacies are reimbursed as usual; beneficiaries pay their plan each month.

- Designed to improve affordability and adherence to needed medications.

Internal Links – Helpful Resources

- Visit our health insurance hub for comprehensive coverage basics.

- Explore prescription drug coverage to understand how Part D works.

- Check affordable health insurance strategies to learn ways to lower total health costs.

Conclusion

The Medicare payment plan 2025 marks an important shift in how seniors and other beneficiaries pay for their prescription medications. By opting in during the Annual Enrollment Period — October 15 through December 7, 2025, enrollees can avoid large upfront pharmacy bills and instead pay consistent monthly installments to their Part D or MAPD plan.

Beneficiaries should review their plan details carefully, confirm eligibility, and sign up during AEP to take advantage of this new budgeting tool. Those on expensive medications stand to benefit most from the predictable monthly cap.

Regulatory Disclaimers

- This article is for educational purposes only and does not constitute legal, financial, or medical advice. Beneficiaries should always confirm details with Medicare.gov or their plan sponsor.

- All data about premiums, caps, and thresholds reflects CMS announcements for the 2025 plan year as of publication and may change with future guidance.

- Individuals should consult a licensed insurance agent or State Health Insurance Assistance Program (SHIP) counselor for personalized advice on plan selection and eligibility.