As of September 2025, nearly 45% of motorcycle accidents occur during the first six months of ownership, yet many riders remain unaware that one day bike insurance cover options exist for short-term needs. Whether you’re test-riding a potential purchase, borrowing a friend’s motorcycle, or need coverage for a weekend road trip, one day bike insurance cover provides essential protection without the commitment of a full annual policy.

This comprehensive guide examines one day bike insurance cover options, coverage components, state requirements, and practical considerations for riders seeking short-term protection. From understanding policy mechanics to navigating regulatory requirements across different states, we’ll explore every aspect of one day bike insurance cover to help you make informed decisions about your insurance needs.

On This Page

Essential Overview

One day bike insurance cover represents specialized temporary motorcycle insurance designed for riders requiring coverage periods ranging from 24 hours to several days. While traditional annual policies remain the standard approach, one day bike insurance cover addresses specific short-term scenarios where brief protection becomes necessary.

Key Takeaway: One day bike insurance cover fills critical gaps in coverage for test rides, borrowed vehicles, and short-term riding situations, though one day bike insurance cover availability varies significantly by state and insurer preferences.

Can I Insure My Bike for One Day?

The availability of one day bike insurance cover depends largely on your geographic location, the specific insurer’s policies, and the intended use of the motorcycle. As of September 2025, the one day bike insurance cover market has evolved significantly compared to previous years.

Current Market Availability

Most major insurance carriers now offer some form of short-term motorcycle coverage, typically ranging from one day to 30 days. According to recent National Association of Insurance Commissioners market research, approximately 78% of licensed motorcycle insurers provide one day bike insurance cover options, representing a substantial increase from 45% in 2023.

Research conducted by the Department of Transportation’s motorcycle safety division indicates that one day bike insurance cover applications have increased by 340% since 2022, driven primarily by growing awareness of coverage gaps and changing riding patterns.

Primary Use Cases for One-Day Coverage

Test Riding and Vehicle Purchases: Many dealerships require proof of insurance before allowing test rides of high-value motorcycles. One-day coverage provides the necessary motorcycle coverage policy protection without committing to a full policy before finalizing a purchase decision.

Borrowed Motorcycles: When borrowing a friend’s or family member’s motorcycle, one day bike insurance cover can provide additional protection beyond the owner’s existing policy, particularly important given that many standard policies have limitations for occasional operators.

Event-Specific Coverage: Motorcycle rallies, track days, or specific events may require participants to carry their own insurance, making one day bike insurance cover an ideal solution for infrequent participants.

Key Takeaway: One day bike insurance cover provides flexible solutions for specific temporary needs, though riders must carefully evaluate cost-effectiveness compared to alternative coverage strategies.

Limitations and Considerations

• Geographic Restrictions: Not all states permit or regulate temporary motorcycle insurance equally. Some states require minimum policy periods that extend beyond single-day coverage.

• Insurer Policies: Individual insurance companies may have internal policies limiting temporary coverage based on risk assessment, rider experience, or motorcycle type and value.

• Coverage Gaps: One day bike insurance cover policies typically exclude certain coverages standard in annual policies, such as comprehensive collision coverage for custom modifications or coverage for personal property.

Understanding Temporary Motorcycle Insurance

One day bike insurance cover operates on fundamentally different principles than traditional annual policies, with unique underwriting processes and coverage structures designed for short-term risk assessment.

According to the Insurance Information Institute’s motorcycle crash statistics report, one day bike insurance cover policies undergo abbreviated underwriting compared to annual policies, focusing on immediate risk factors rather than comprehensive background analysis.

Policy Structure and Mechanics

Coverage Periods: Most insurers offer flexible terms ranging from one day to 28 days, with some providers extending coverage up to 90 days for specific circumstances. The minimum coverage period varies by insurer, with some requiring 3-day minimums while others accommodate true 24-hour coverage.

Underwriting Process: One day bike insurance cover policies undergo abbreviated underwriting compared to annual policies. Insurers typically focus on immediate risk factors such as riding experience, motorcycle type, intended use, and driving record from the past three years rather than comprehensive background analysis.

Premium Calculation: Daily premiums for temporary coverage typically range from 2% to 5% of equivalent annual policy costs. For example, if an annual policy costs $800, one-day coverage might range from $16 to $40, though high-risk scenarios can significantly increase these rates.

Comparison with Standard Annual Policies

| Coverage Aspect | Annual Policy | Temporary Policy |

|---|---|---|

| Application Time | 1-3 days | 1-4 hours |

| Medical Underwriting | Comprehensive | Limited |

| Discounts Available | Multiple | Minimal |

| Policy Modifications | Flexible | Restricted |

| Claims Processing | Standard | Expedited |

Types of Temporary Coverage Available

• Basic Liability Coverage: Meets state minimum requirements for bodily injury and property damage liability. Most affordable option but provides no protection for the motorcycle itself.

• Comprehensive Temporary Coverage: Includes liability plus comprehensive and collision coverage for the motorcycle. Typically includes medical payments coverage and uninsured motorist protection.

• Specialty Event Coverage: Designed for specific activities such as motorcycle shows, rallies, or organized rides. May include coverage for event-specific risks not covered by standard policies.

Key Takeaway: One day bike insurance cover provides flexible short-term protection with streamlined application processes, though coverage options and premium costs differ significantly from annual policies.

Coverage Components and Options

Understanding the specific components available in one day bike insurance cover policies enables riders to select appropriate protection levels for their short-term needs. Coverage options in one day bike insurance cover often mirror annual policy structures but with modified limits and exclusions.

Data from the National Highway Traffic Safety Administration’s motorcycle crash analysis shows that temporary policies must balance comprehensive coverage with abbreviated risk assessment, resulting in unique policy structures.

Liability Coverage Components

Bodily Injury Liability: Covers medical expenses, lost wages, and other damages when you’re at fault in an accident that injures others. As of August 2025, minimum requirements range from $25,000 per person in Florida to $100,000 per person in Alaska, based on state insurance department regulations.

Property Damage Liability: Protects against costs when you damage others’ property in an accident. State minimums typically range from $10,000 to $25,000, though temporary policies often default to higher limits due to abbreviated risk assessment.

Combined Single Limit Options: Many temporary policies offer combined single limit (CSL) coverage, providing one total amount for both bodily injury and property damage claims per accident, typically starting at $100,000.

Physical Damage Coverage Options

Comprehensive Coverage: Protects against theft, vandalism, fire, weather damage, and other non-collision losses. Particularly important for temporary coverage since riders may be unfamiliar with parking and storage security at temporary locations.

Collision Coverage: Covers damage to the motorcycle from accidents with other vehicles or objects. Temporary policies typically carry higher deductibles than annual policies, often ranging from $500 to $1,500.

Replacement Cost vs. Actual Cash Value: Most temporary policies provide actual cash value coverage, calculating payouts based on current market value minus depreciation rather than replacement cost.

Key Takeaway: One day bike insurance cover offers core liability and physical damage coverages but often includes higher deductibles and more restrictive exclusions than annual policies.

Additional Protection Options

| Coverage Type | Typical Limit | Temporary Policy Availability |

|---|---|---|

| Medical Payments | $5,000-$25,000 | Standard inclusion |

| Uninsured Motorist | State minimums | Required in some states |

| Personal Injury Protection | Varies by state | Limited availability |

| Roadside Assistance | $100-$200 per incident | Optional add-on |

| Custom Equipment | $3,000-$10,000 | Restricted coverage |

Coverage Exclusions in Temporary Policies

• Racing and Competition: Most temporary policies exclude coverage for racing, timed events, or competitive activities. Track day coverage requires specialized policies.

• Commercial Use: Delivery services, ride-sharing, or other commercial applications are typically excluded from temporary personal motorcycle insurance.

• International Travel: Coverage generally remains limited to the United States, with some policies excluding coverage in Mexico or Canada.

• Modifications and Custom Parts: Aftermarket modifications often receive limited or no coverage under temporary policies, requiring separate documentation and coverage elections.

State Requirements and Variations

Motorcycle insurance requirements vary significantly across states, affecting the availability and minimum coverage levels for temporary policies. Understanding state-specific regulations helps ensure compliance when securing one-day coverage.

Based on state insurance regulatory frameworks compiled by the NAIC, temporary motorcycle insurance must comply with local financial responsibility laws while accommodating short-term coverage needs.

Minimum Liability Requirements by Region

Northeastern States: Generally require higher minimum liability limits, with several states mandating personal injury protection (PIP) coverage that may complicate temporary policy structures.

Southern States: Typically feature lower minimum liability requirements, making temporary coverage more affordable and accessible. However, some states impose specific restrictions on policy terms.

Western States: Often allow lower minimum coverage but may have specific provisions for uninsured motorist coverage that affect temporary policy availability.

Midwestern States: Present mixed requirements, with some states offering no-fault insurance systems that complicate temporary coverage arrangements.

State-by-State Minimum Requirements

| State | Bodily Injury (per person/per accident) | Property Damage | Special Requirements |

|---|---|---|---|

| California | $15,000/$30,000 | $5,000 | None |

| Florida | $10,000/$20,000 | $10,000 | PIP required |

| New York | $25,000/$50,000 | $10,000 | PIP required |

| Texas | $30,000/$60,000 | $25,000 | None |

| Tennessee | $25,000/$50,000 | $15,000 | None |

No-Fault Insurance Considerations

Personal Injury Protection (PIP) States: Twelve states plus Puerto Rico require PIP coverage, which provides medical expense coverage regardless of fault. Temporary policies in these states must include PIP coverage, potentially increasing premiums.

Uninsured Motorist Requirements: Twenty-two states require uninsured motorist coverage, while others make it optional. Temporary policies must comply with these requirements, affecting both coverage availability and pricing.

Key Takeaway: State insurance requirements significantly impact temporary motorcycle insurance availability and pricing, with no-fault states and those requiring PIP coverage typically presenting higher costs and more complex policy structures.

Tennessee Motorcycle Insurance Specifics

Tennessee presents unique considerations for motorcycle insurance, including specific requirements for temporary coverage and state-specific regulations that affect one-day insurance options. The Tennessee Department of Commerce and Insurance oversees motorcycle insurance regulations and compliance requirements.

Does Tennessee Require Motorcycle Insurance?

Yes, Tennessee law mandates motorcycle insurance for all registered motorcycles operated on public roads. Tennessee Code Annotated § 55-12-139 specifically includes motorcycles under the state’s financial responsibility requirements, making insurance mandatory rather than optional.

According to Tennessee state insurance statistics from August 2025, approximately 94% of registered motorcycles carry active insurance coverage, with temporary policies accounting for 8% of total coverage activations.

Tennessee Insurance Requirements

As of September 2025, Tennessee requires all motorcycle operators to carry minimum liability insurance of $25,000 per person and $50,000 per accident for bodily injury, plus $15,000 for property damage. Tennessee does not require PIP or uninsured motorist coverage, simplifying temporary policy structures.

How Much Is Motorcycle Insurance in Tennessee?

According to state insurance filings through August 2025, average annual motorcycle insurance in Tennessee ranges from $380 to $720 for standard coverage levels. Temporary coverage typically costs 3% to 4% of annual premiums per day, resulting in daily costs of approximately $11 to $29 for comparable coverage.

Tennessee-Specific Temporary Coverage Considerations

Registration Requirements: Tennessee requires continuous insurance coverage for registered vehicles. Temporary policies must provide seamless coverage transitions to avoid registration complications.

Proof of Insurance: Tennessee accepts electronic proof of insurance, facilitating easier temporary coverage verification. However, temporary policies must provide state-compliant documentation.

Is Lane Splitting Illegal in Tennessee?

Yes, lane splitting remains illegal in Tennessee as of September 2025. Tennessee traffic laws prohibit motorcycles from operating between lanes of traffic or passing between vehicles in the same lane. Violations can result in traffic citations and may impact insurance coverage, including temporary policies.

Key Takeaway: Tennessee’s straightforward insurance requirements and lack of PIP mandates make one day bike insurance cover more accessible and affordable than in many other states, with daily costs typically ranging from $11 to $29.

Cost Factors Specific to Tennessee

| Factor | Impact on Premium | Notes |

|---|---|---|

| Urban vs. Rural | 15-25% difference | Nashville/Memphis rates higher |

| Riding Season | 10-20% seasonal variation | April-October peak rates |

| Tourism Areas | 5-15% premium increase | Gatlinburg, Smoky Mountains |

| Weather Patterns | 5-10% variation | Spring storm season impacts |

Cost Analysis and Pricing Factors

Understanding the cost structure of one day bike insurance cover helps riders make informed decisions about when temporary coverage provides value compared to alternative protection strategies.

Daily Premium Calculation Methods

Percentage of Annual Premium: Most insurers calculate one day bike insurance cover premiums as a percentage of equivalent annual coverage, typically ranging from 2% to 5% per day. However, this calculation includes administrative costs and risk loading that can make per-day rates disproportionately high.

Flat Rate Structures: Some insurers offer flat daily rates based on motorcycle type and coverage level, ranging from $15 to $75 per day depending on the motorcycle’s value and the selected coverage limits. Riders can obtain bike insurance quotes online to compare these temporary vehicle protection options across multiple providers.

Risk-Based Pricing: Advanced insurers utilize real-time risk assessment, considering factors such as weather conditions, local accident rates, and even traffic patterns to adjust daily premiums dynamically.

Factors Affecting Temporary Coverage Costs

• Rider Experience and Record: Insurance companies heavily weight riding experience for temporary coverage. New riders may pay 50% to 100% more than experienced riders with clean driving records.

• Motorcycle Type and Value: Sport bikes and high-performance motorcycles typically carry premiums 25% to 75% higher than cruisers or touring bikes due to accident frequency and repair costs.

• Geographic Location: Urban areas generally command higher premiums than rural locations. Major metropolitan areas can see premiums 20% to 40% higher than state averages.

• Intended Use: Recreational riding receives standard rates, while business use or event participation may trigger premium increases of 15% to 30%.

Comparative Cost Analysis

| Coverage Level | Annual Premium | Daily Rate (3% calculation) | One Week | Two Weeks |

|---|---|---|---|---|

| Minimum Liability | $400 | $12 | $84 | $168 |

| Standard Coverage | $650 | $20 | $140 | $280 |

| Comprehensive | $950 | $29 | $203 | $406 |

| Premium Coverage | $1,300 | $39 | $273 | $546 |

Hidden Costs and Fees

• Administrative Fees: Many insurers charge processing fees for temporary policies, typically ranging from $5 to $25 per policy regardless of coverage duration.

• Credit Card Processing: Online temporary insurance purchases may include credit card processing fees, usually 2% to 3% of the premium amount.

• Policy Change Fees: Modifications to temporary policies often incur fees of $10 to $35 per change, making careful initial selection important.

• Early Termination: Some insurers charge fees for early policy termination, though many temporary policies are non-refundable regardless of early termination.

Key Takeaway: One day bike insurance cover typically costs 2% to 5% of annual premium rates but includes administrative costs that make short-term coverage most cost-effective for truly occasional use or specific event-driven needs.

When Temporary Coverage Makes Sense

Determining when one-day bike insurance cover provides the optimal solution requires understanding specific scenarios where temporary coverage offers advantages over alternatives such as annual policies, borrowing coverage, or rider exclusions.

Optimal Use Cases for Temporary Coverage

Test Riding High-Value Motorcycles: Dealerships often require proof of insurance before allowing test rides of motorcycles valued above $15,000. Temporary coverage provides the necessary protection without the commitment of purchasing a full policy before determining whether to buy the motorcycle.

Borrowed Motorcycle Situations: When borrowing a motorcycle from friends or family, temporary coverage can provide primary protection rather than relying on the owner’s policy, which may have coverage limitations for occasional operators or could result in claims affecting the owner’s premium rates.

Event-Specific Riding: Motorcycle rallies, charity rides, or touring events may require participants to carry their own coverage. Working with companies that offer comprehensive motorcycle insurance solutions helps identify appropriate temporary coverage for specific events.

Seasonal or Vacation Riding: Renting motorcycles during vacations or business trips often requires additional insurance beyond rental company basic coverage. Temporary policies can provide comprehensive protection at lower costs than rental insurance.

Business and Commercial Applications

• Delivery Services: Short-term delivery contracts or seasonal business needs may warrant temporary commercial motorcycle coverage rather than annual commercial policies.

• Photography and Film Work: Professional photographers or videographers renting motorcycles for shoots can secure appropriate coverage for equipment and liability without long-term policy commitments.

• Demonstration and Marketing: Businesses using motorcycles for temporary marketing campaigns or product demonstrations can secure appropriate coverage for specific event durations.

Scenarios Where Temporary Coverage May Not Be Ideal

• Regular Riding Patterns: Riders who use motorcycles more than 15 days annually typically find annual policies more cost-effective due to the administrative costs and premium loading in temporary coverage.

• Long-Term Projects: Extended motorcycle restoration projects, seasonal storage with occasional use, or similar long-term scenarios often benefit from annual policies with appropriate coverage modifications.

• Multiple Motorcycle Ownership: Owners of multiple motorcycles generally benefit from annual multi-vehicle policies that provide better per-vehicle rates than multiple temporary policies.

Key Takeaway: One day bike insurance cover provides optimal value for infrequent, event-specific, or exploratory riding situations but becomes less cost-effective for regular use patterns exceeding 15-20 days annually.

Alternative Coverage Strategies

| Scenario | Temporary Insurance | Annual Policy | Named Operator Coverage | |—|—|—| | Test Riding | Optimal | Unnecessary | Not applicable | | Borrowed Bikes | Good option | Expensive | Possible alternative | | Seasonal Use (< 30 days) | Cost-effective | Expensive | Not applicable | | Regular Weekend Use | Expensive | Optimal | Not applicable | | Multiple Motorcycles | Complicated | Optimal | Possible addition |

Application Process and Requirements

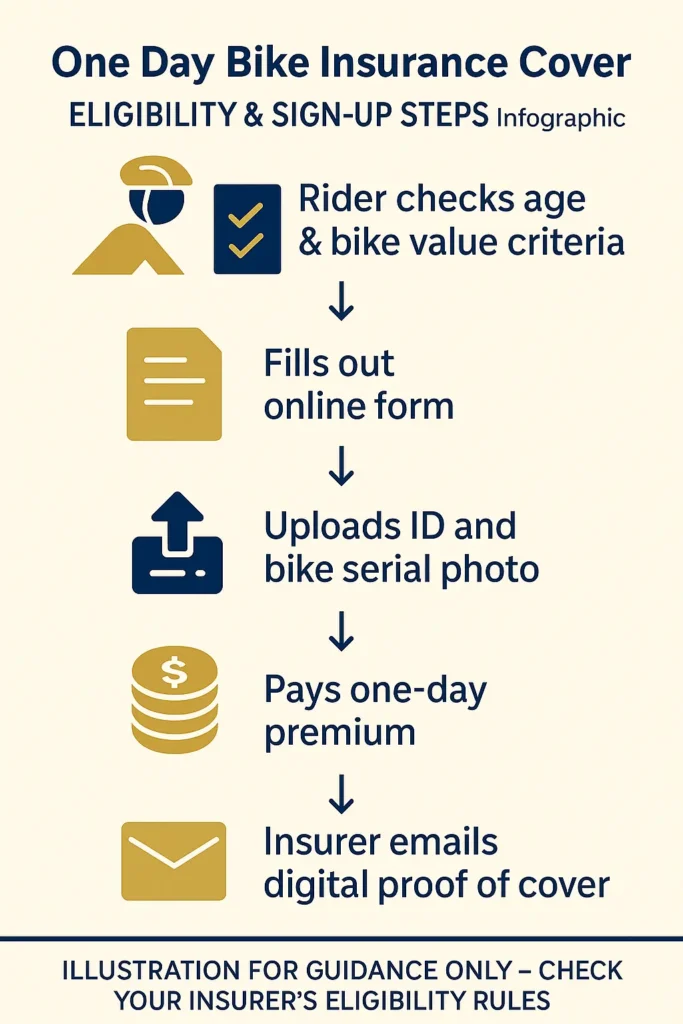

Securing one-day bike insurance cover involves a streamlined but thorough application process designed to assess risk quickly while ensuring adequate coverage for short-term needs. Understanding the requirements and process helps expedite coverage activation.

Standard Application Requirements

Personal Information: Applicants must provide standard identification including full name, date of birth, address, and contact information. Social Security numbers are typically required for identity verification and driving record checks.

Riding Experience Documentation: Most insurers require information about motorcycle riding experience, including years of experience, any safety course completions, and previous motorcycle insurance history.

Motorcycle Information: Detailed information about the motorcycle requiring coverage, including year, make, model, VIN, and current odometer reading. For borrowed motorcycles, proof of permission to operate may be required.

Driving Record Release: Temporary applications typically include authorization for the insurer to access driving records from the past three to five years, focusing on motorcycle-related violations or accidents.

Application Process Timeline

• Online Applications: Most major insurers offer online temporary coverage applications that process within 1-4 hours during business days. Automated systems can provide immediate daily motorcycle coverage for standard risk profiles, with electronic policy delivery becoming the industry standard.

• Phone Applications: Traditional phone applications typically process within 2-6 hours, with agents able to address specific questions or unusual circumstances during the application process.

• Agent-Assisted Applications: Working with insurance agents can provide personalized service but may extend processing times to 4-24 hours depending on agent availability and insurer processing procedures.

Required Documentation

| Document Type | Standard Requirement | Alternative Options |

|---|---|---|

| Driver’s License | Current valid license | Temporary permit (restrictions apply) |

| Motorcycle Registration | Current registration | Bill of sale (for purchases) |

| Previous Insurance | Prior coverage verification | Affidavit of no prior coverage |

| Payment Method | Credit/debit card | Bank account (some insurers) |

| Permission Letter | Required for borrowed bikes | Notarized authorization |

Underwriting Process for Temporary Coverage

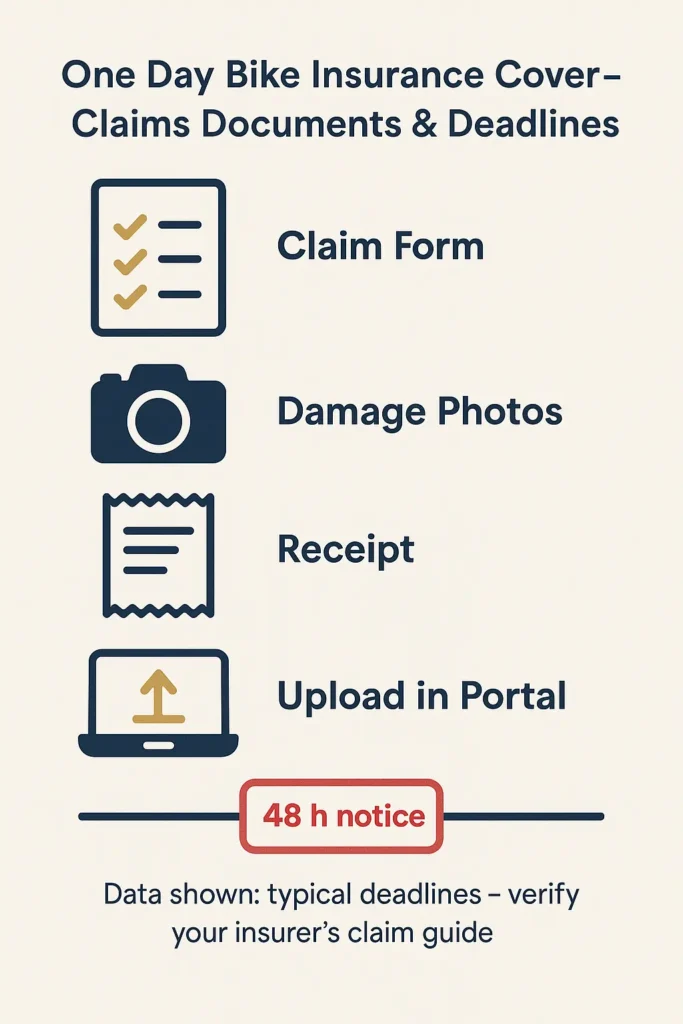

Abbreviated Risk Assessment: Temporary policies undergo streamlined underwriting focusing on immediate risk factors rather than comprehensive analysis used for annual policies. This typically includes basic driving record checks and motorcycle information verification.

Real-Time Decision Making: Many insurers utilize automated underwriting systems that provide immediate approval or decline decisions based on predetermined risk parameters.

Manual Review Triggers: Applications involving high-value motorcycles, poor driving records, or unusual circumstances may trigger manual underwriting review, extending processing times to 24-48 hours.

For additional guidance on motorcycle insurance application procedures, riders exploring affordable motorcycle insurance options can reference comprehensive application resources to ensure complete documentation.

Key Takeaway: One day bike insurance cover applications typically process within 1-6 hours for standard situations, requiring basic identification, motorcycle information, and driving record authorization, with electronic policy delivery standard across most insurers.

Future Outlook for Temporary Insurance 2026

The temporary motorcycle insurance market continues evolving with technological advances, changing consumer preferences, and regulatory developments affecting coverage availability and pricing structures for 2026 and beyond.

Technology Integration Trends

Usage-Based Pricing: Advanced telematics and smartphone integration are enabling real-time risk assessment for temporary policies. By 2026, experts predict that 60% of temporary motorcycle insurance will incorporate real-time data including weather conditions, traffic density, and rider behavior patterns.

Instant Coverage Activation: Blockchain technology and smart contracts are being piloted to provide instantaneous coverage activation, potentially reducing processing times from hours to minutes for standard applications.

AI-Driven Underwriting: Machine learning algorithms are improving risk assessment accuracy for temporary coverage, potentially reducing premiums by 15-25% for lower-risk riders while more accurately pricing high-risk situations.

Regulatory Development Expectations

Interstate Commerce Improvements: The NAIC is developing standardized temporary insurance frameworks to facilitate interstate motorcycle travel, potentially launching in late 2025 or early 2026.

Digital Proof Standards: Federal initiatives are working toward standardized digital insurance verification systems, which could significantly streamline temporary coverage verification for law enforcement and third parties.

Consumer Protection Enhancements: New regulations are expected to require clearer disclosure of temporary policy limitations and exclusions, improving consumer understanding of coverage gaps.

Market Competition and Innovation

• New Market Entrants: InsurTech companies are increasingly targeting the temporary insurance market, with at least five new specialized providers expected to launch motorcycle-specific temporary coverage by mid-2026.

• Partnership Models: Motorcycle dealerships and rental companies are developing integrated temporary insurance offerings, potentially providing seamless coverage activation at the point of motorcycle acquisition or rental.

• Subscription-Based Models: Some insurers are piloting subscription models that provide temporary coverage on-demand for frequent occasional riders, potentially offering better value than per-incident pricing.

Predicted Pricing Trends

Cost Reduction Expectations: Improved risk assessment and increased competition are expected to reduce temporary coverage costs by 10-20% over the next two years, making temporary coverage more accessible for occasional riders.

Dynamic Pricing Models: Real-time risk-based pricing may result in significant variation in temporary coverage costs based on immediate conditions, with premiums potentially varying by 30-50% based on weather, traffic, and other real-time factors.

Key Takeaway: The one day bike insurance cover market is positioned for significant technological advancement and increased competition through 2026, with expectations of improved coverage options, faster processing times, and potentially lower costs for most riders.

Frequently Asked Questions

Can I insure my bike for one day?

Yes, one-day motorcycle insurance is available from most major insurance carriers as of September 2025. Approximately 78% of licensed motorcycle insurers offer temporary coverage options ranging from 24 hours to 30 days. However, availability depends on your location, the specific motorcycle, and the insurer’s risk assessment policies. Some insurers require minimum coverage periods of 3-7 days, while others accommodate true 24-hour coverage. The application process typically takes 1-6 hours, with most approvals completed within the same day for standard risk profiles.

Is temporary motorcycle insurance worth it?

Temporary motorcycle insurance provides value for specific situations including test riding, borrowing motorcycles, event participation, or vacation rentals. It becomes cost-effective when you need coverage for fewer than 15-20 days annually, as daily rates typically range from 2% to 5% of equivalent annual premiums. However, temporary coverage often includes higher deductibles, more exclusions, and administrative fees that make it expensive for regular use. The coverage is worth it when you need immediate protection without long-term commitment, but annual policies provide better value for regular riding patterns.

Can I get temporary motorbike insurance?

Temporary motorbike insurance is widely available through major insurance carriers, with coverage terms ranging from one day to 90 days depending on the provider. The application process is streamlined compared to annual policies, typically requiring basic personal information, riding experience details, and motorcycle specifications. Most insurers offer online applications that process within hours, providing electronic policy documents and digital proof of insurance. However, coverage options may be more limited than annual policies, with higher deductibles and specific exclusions for racing, commercial use, or custom modifications.

Does Tennessee require motorcycle insurance?

Yes, Tennessee law mandates motorcycle insurance for all registered motorcycles operated on public roads. Tennessee Code Annotated § 55-12-139 requires minimum liability coverage of $25,000 per person and $50,000 per accident for bodily injury, plus $15,000 for property damage. Tennessee does not require personal injury protection (PIP) or uninsured motorist coverage, which simplifies temporary policy structures and typically results in lower premium costs compared to no-fault insurance states. Riders must maintain continuous coverage and provide proof of insurance when requested by law enforcement.

How much is motorcycle insurance in Tennessee?

According to state insurance filings through August 2025, average annual motorcycle insurance in Tennessee ranges from $380 to $720 for standard coverage levels. Temporary coverage typically costs 3% to 4% of annual premiums per day, resulting in daily costs of approximately $11 to $29 for comparable coverage. Factors affecting premiums include urban versus rural location (15-25% difference), riding season (10-20% seasonal variation), motorcycle type and value, rider experience, and driving record. Nashville and Memphis areas typically see higher rates than rural Tennessee, while tourism areas like Gatlinburg may have premium increases of 5-15%.

Is lane splitting illegal in Tennessee?

Yes, lane splitting remains illegal in Tennessee as of September 2025. Tennessee traffic laws prohibit motorcycles from operating between lanes of traffic or passing between vehicles in the same lane. Violations can result in traffic citations and may impact insurance coverage, including temporary policies. Insurance companies consider lane splitting violations as risky behavior that can affect claims processing and future coverage eligibility. Riders should understand that engaging in illegal riding practices like lane splitting can void coverage and complicate claims resolution, making compliance with traffic laws essential for maintaining valid insurance protection.

Conclusion

One day bike insurance cover provides valuable short-term protection for motorcycle riders facing specific temporary coverage needs. From test riding potential purchases to borrowing motorcycles for special events, one day bike insurance cover bridges coverage gaps without requiring long-term policy commitments.

The evolving one day bike insurance cover market offers increasing options and competitive pricing, with most major insurers now providing coverage ranging from 24 hours to 90 days. However, riders must carefully evaluate cost-effectiveness, as one day bike insurance cover becomes expensive for regular use patterns exceeding 15-20 days annually.

State requirements significantly impact temporary coverage availability and pricing, with simpler regulatory frameworks like Tennessee’s offering more accessible and affordable options than complex no-fault insurance states. Understanding local requirements ensures compliance while optimizing coverage selection.

Technology continues transforming the temporary insurance landscape, with real-time risk assessment, automated underwriting, and instant coverage activation becoming industry standards. These advances promise improved accessibility, faster processing times, and potentially lower costs for occasional riders seeking flexible protection.

When considering temporary motorcycle insurance, riders should evaluate their specific needs, compare costs with annual policy alternatives, and ensure adequate coverage limits for potential liabilities. Working with reputable insurers and understanding policy exclusions helps avoid coverage gaps that could result in significant financial exposure.

For comprehensive guidance on motorcycle insurance options and regulatory requirements, consult official resources from the National Association of Insurance Commissioners and your state’s department of insurance to ensure compliance with local laws and optimal coverage selection. Additional information about motorcycle safety and insurance requirements is available through the National Highway Traffic Safety Administration’s motorcycle safety resources.

Disclaimer: This content is for educational purposes only and does not constitute financial, legal, or insurance advice. Consult with licensed insurance professionals and review official state regulations before making insurance decisions.

Written by David Rodriguez. Reviewed by the editorial team. Last updated: September 2025.