Orthodontic Insurance Coverage is often one of the most misunderstood parts of a dental plan in the United States. Many families discover too late that braces, aligners, and other orthodontic treatments follow separate rules, with their own waiting periods, lifetime maximums, and pre-authorization steps. This guide clarifies how these benefits usually work and outlines the practical steps you can take to understand your policy and manage your out-of-pocket costs.

Essential Overview

“Orthodontic insurance coverage varies significantly between dental plans, with most covering 50% of treatment costs up to lifetime maximums of $1,000-$3,000. Adult coverage is less common than children’s benefits, and pre-authorization is typically required for major orthodontic procedures.”

On This Page

Does Insurance Cover Orthodontics for Adults?

Adult orthodontic insurance coverage presents a complex landscape that varies dramatically across dental plans and insurance providers. While pediatric orthodontic coverage is mandated as an essential health benefit under the Affordable Care Act, adult orthodontic benefits remain optional for most insurance plans.

Adult Coverage Availability: Most employer-sponsored dental plans offer limited adult orthodontic benefits, typically covering 25-50% of treatment costs compared to 50-80% for children. According to the NAIC 2023 Health Insurance Industry Annual Analysis, approximately 60% of group dental plans include some level of adult orthodontic coverage, though benefits are often restricted by age limits, waiting periods, and lifetime maximums.

IMPORTANT NOTE Adult orthodontic coverage typically includes age restrictions, with many plans cutting off benefits at age 19 or 26, depending on dependent status and plan specifications.

Coverage Limitations for Adults:

- Lifetime Maximums: Adult orthodontic benefits usually range from $1,000 to $2,500 per lifetime

- Waiting Periods: Most plans impose 6-24 month waiting periods before orthodontic benefits activate

- Pre-existing Condition Exclusions: Treatment beginning before coverage effective dates is typically excluded

- Annual Maximums: Some plans count orthodontic treatment toward overall annual dental maximums

Individual Market Challenges: Adults purchasing individual dental insurance face significant obstacles accessing orthodontic coverage. Most individual plans either exclude orthodontic benefits entirely or offer minimal coverage with extensive waiting periods. The individual market typically requires 12-24 months of continuous coverage before orthodontic benefits become available.

Medical Necessity Requirements: Insurance plans increasingly require documentation of medical necessity for adult orthodontic coverage. Cosmetic improvements alone rarely qualify for benefits, while functional issues affecting bite, speech, or jaw health may receive coverage consideration. Treatment must typically address diagnosed malocclusions, temporomandibular joint disorders, or other medically necessary conditions as outlined in CMS Dental Coverage Guidelines.

What Is Orthodontic Coverage in Dental Plans?

Orthodontic coverage represents a specialized dental insurance benefit designed to help offset the significant costs associated with teeth straightening and bite correction treatments. Understanding how orthodontic benefits function within dental insurance plans requires examining coverage structures, benefit calculations, and treatment categorizations.

Coverage Structure Overview: Orthodontic benefits operate differently from routine dental coverage, typically functioning as a separate benefit category with distinct deductibles, maximums, and coinsurance percentages. Most plans structure orthodontic coverage as a lifetime benefit rather than an annual benefit, reflecting the extended duration of most orthodontic treatments.

Standard Coverage Components:

| Coverage Element | Typical Range | Description |

|---|---|---|

| Coinsurance | 25-50% | Percentage covered by insurance |

| Lifetime Maximum | $1,000-$3,000 | Total benefits available per person |

| Deductible | $50-$200 | Amount paid before benefits begin |

| Waiting Period | 6-24 months | Time before benefits activate |

Treatment Categories: Dental plans typically categorize orthodontic procedures into preventive, interceptive, and comprehensive treatment levels. Preventive orthodontics may include space maintainers and minor tooth guidance, while comprehensive treatment encompasses full braces, clear aligners, and complex bite corrections.

PRO TIP Review your specific plan documents carefully, as orthodontic coverage terms can vary significantly even within the same insurance company’s different plan options.

Payment Methodology: Most insurance plans calculate orthodontic benefits based on the total treatment cost rather than monthly payments. If your treatment costs $4,000 and your plan covers 50% up to a $2,000 maximum, you’ll receive the full $2,000 benefit regardless of treatment duration. Some plans distribute payments over the treatment period, while others pay the total benefit amount upfront.

Age-Related Coverage Variations: Orthodontic coverage typically distinguishes between child and adult benefits, with pediatric coverage offering more generous terms. Children under 18 often receive higher coinsurance percentages, increased lifetime maximums, and reduced waiting periods. Some plans extend pediatric coverage through age 26 for dependent children as specified in HHS Essential Health Benefits Standards.

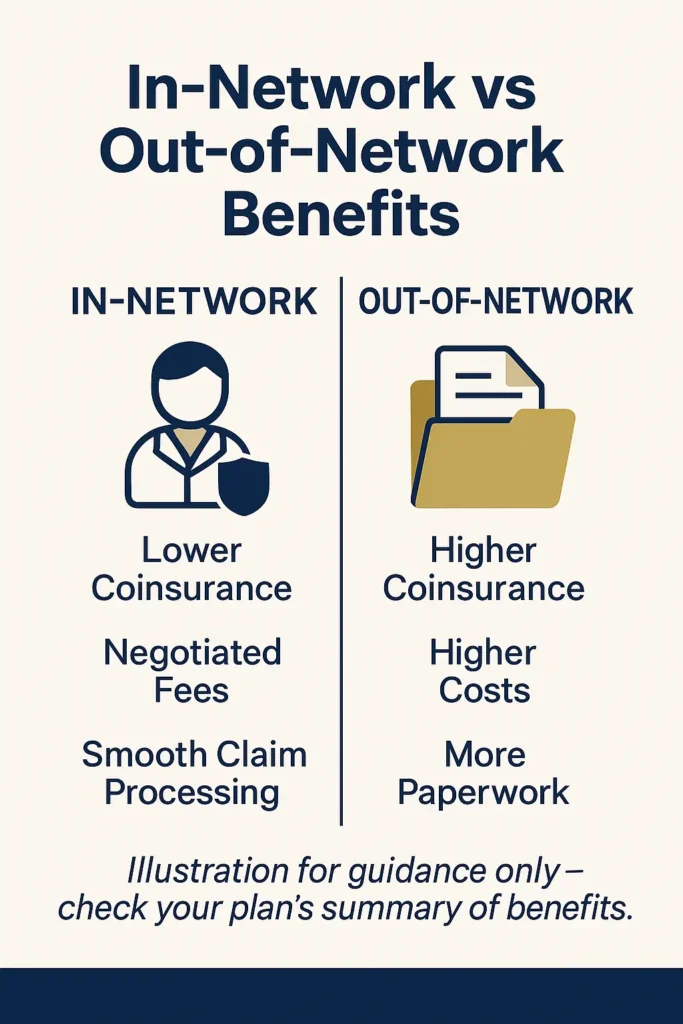

Network vs. Out-of-Network Benefits: In-network orthodontists typically offer better benefit utilization through negotiated fees and streamlined pre-authorization processes. Out-of-network treatment may result in reduced benefit payments, balance billing for amounts exceeding usual and customary rates, and increased administrative requirements for claim processing.

Do Dental Plans Require Pre-Authorization for Braces?

Pre-authorization requirements for orthodontic treatment represent a critical gatekeeping mechanism that most dental insurance plans employ to control costs and ensure medical necessity. Understanding pre-authorization processes can prevent treatment delays, claim denials, and unexpected out-of-pocket expenses for patients seeking orthodontic care.

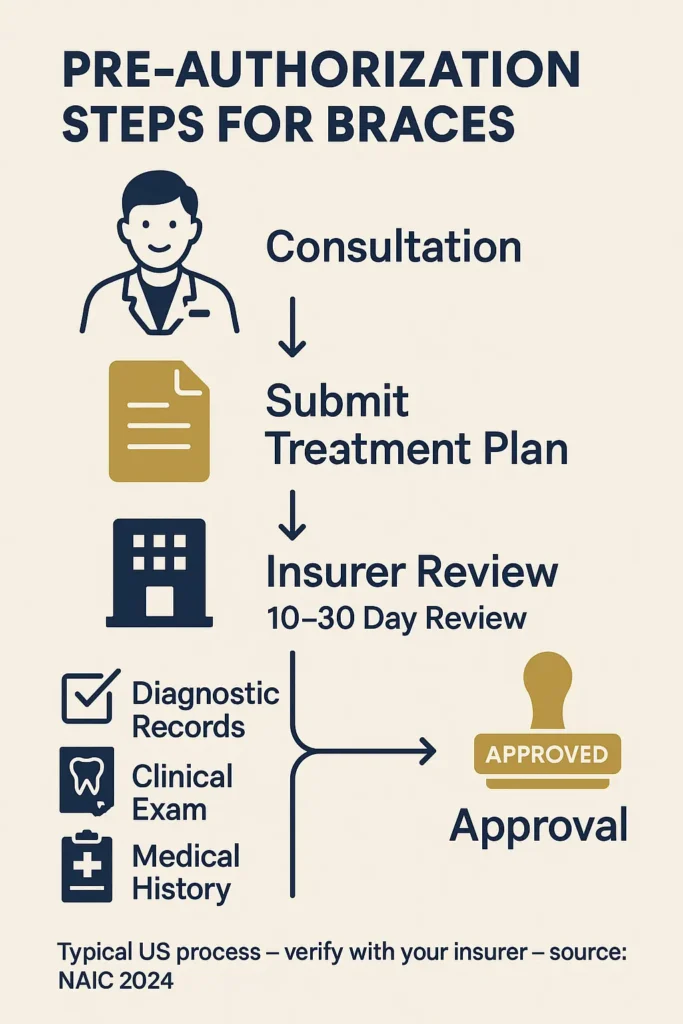

Universal Pre-Authorization Requirements: Nearly all dental insurance plans require pre-authorization for comprehensive orthodontic treatment, including traditional braces, clear aligners, and specialized appliances. According to NAIC 2024 Health Insurance Industry Analysis, over 95% of group dental plans mandate pre-authorization for treatment exceeding $500, with most orthodontic procedures falling well above this threshold.

Pre-Authorization Process Timeline:

- Initial Consultation: Orthodontist evaluates treatment needs and documents medical necessity

- Treatment Plan Submission: Detailed treatment plan with cost estimates submitted to insurance

- Insurance Review Period: 10-30 business days for plan review and determination

- Authorization Response: Approval, denial, or request for additional documentation

- Appeal Process: 30-60 days if initial authorization is denied

Required Documentation Standards:

| Documentation Type | Purpose | Typical Requirements |

|---|---|---|

| Clinical Examination | Medical necessity proof | Detailed oral health assessment |

| Diagnostic Records | Treatment justification | X-rays, photos, impressions |

| Treatment Plan | Cost transparency | Phased treatment timeline |

| Medical History | Risk assessment | Relevant health conditions |

Medical Necessity Criteria: Insurance plans evaluate orthodontic pre-authorization requests based on established medical necessity criteria, typically referencing the Handicapping Labio-lingual Deviations (HLD) index or similar objective measurement systems. Purely cosmetic concerns rarely qualify for coverage, while functional impairments affecting chewing, speaking, or oral health maintenance typically receive approval consideration.

IMPORTANT NOTE Beginning treatment before receiving pre-authorization approval almost always results in complete benefit denial, even if the treatment would have otherwise qualified for coverage.

Pre-Authorization Denial Factors: Common reasons for pre-authorization denials include insufficient medical necessity documentation, treatment plans exceeding reasonable and customary costs, providers not meeting network credentialing requirements, and patients failing to meet plan eligibility criteria such as waiting period completion or age restrictions as detailed in Medicaid Dental Care Coverage Requirements.

Alternative Treatment Considerations: Insurance plans may suggest alternative treatment approaches during the pre-authorization process, particularly if the proposed treatment appears excessive for the diagnosed condition. Plans might recommend phased treatment, less expensive appliance options, or referrals to different specialists based on their review of submitted documentation.

How Much Do Braces Cost with Dental Insurance?

The cost of orthodontic treatment with dental insurance involves complex calculations considering coverage percentages, lifetime maximums, deductibles, and treatment duration. Understanding these financial components helps patients budget effectively and maximize their insurance benefits throughout the treatment process.

Average Treatment Costs by Method:

| Treatment Type | National Average | Insurance Coverage | Typical Out-of-Pocket |

|---|---|---|---|

| Traditional Metal Braces | $4,500-$6,500 | 50% up to $2,000 | $2,500-$4,500 |

| Ceramic Braces | $5,500-$7,500 | 50% up to $2,000 | $3,500-$5,500 |

| Clear Aligners | $3,500-$8,000 | 50% up to $2,000 | $1,500-$6,000 |

| Lingual Braces | $8,000-$13,000 | 50% up to $2,000 | $6,000-$11,000 |

Insurance Benefit Calculation: Most dental plans calculate orthodontic benefits based on total treatment cost rather than monthly payment amounts. For example, if your treatment costs $5,000 and your plan covers 50% up to a $2,000 lifetime maximum, your insurance will pay $2,000 (50% of $4,000, limited by the maximum), leaving you responsible for $3,000 out-of-pocket.

Deductible Impact: Orthodontic deductibles typically range from $50 to $200 per person and must be satisfied before insurance benefits begin. Some plans apply separate orthodontic deductibles, while others count orthodontic expenses toward overall annual dental deductibles.

PRO TIP Time your orthodontic treatment start date strategically – beginning treatment late in your plan year may allow you to satisfy deductibles with routine dental care, maximizing your orthodontic benefit utilization.

Payment Structure Variations: Insurance companies employ different payment methodologies for orthodontic benefits. Some plans pay the total benefit amount upfront to the orthodontist, while others distribute payments over the treatment duration. Understanding your plan’s payment structure affects your monthly out-of-pocket obligations and payment planning with your orthodontist, much like understanding payment structures when dealing with business insurance compliance requirements helps companies manage their coverage costs effectively.

Geographic Cost Variations: Orthodontic treatment costs vary significantly by geographic region, with urban areas typically commanding higher fees than rural locations. Insurance plans often adjust their usual and customary rate calculations based on geographic factors, potentially affecting out-of-network benefit calculations and balance billing exposure as documented in Bureau of Labor Statistics Healthcare Cost Data.

Additional Cost Considerations: Beyond basic treatment costs, orthodontic patients should budget for retention appliances, emergency visits, extended treatment complications, and post-treatment monitoring appointments. Most insurance plans limit coverage to active treatment phases, leaving patients responsible for retention and maintenance costs.

What Orthodontic Treatments Are Typically Covered?

Insurance coverage for orthodontic treatments varies significantly based on treatment complexity, medical necessity, and plan specifications. Understanding which procedures typically receive coverage helps patients make informed treatment decisions and manage financial expectations throughout their orthodontic journey.

Commonly Covered Treatment Categories:

Comprehensive Orthodontic Treatment: Most insurance plans provide coverage for medically necessary comprehensive orthodontic care, including traditional metal braces, ceramic braces, and clear aligner therapy. Coverage typically applies when treatment addresses functional problems such as severe crowding, significant spacing, crossbites, overbites, underbites, or jaw alignment issues affecting oral health or function.

Interceptive Orthodontic Care: Early intervention orthodontics for children often receives favorable coverage consideration, particularly when treatment prevents more extensive problems later. Interceptive treatments may include space maintainers, palatal expanders, partial braces for specific teeth, and appliances addressing developing bite problems.

Coverage Determination Factors:

| Treatment Aspect | Coverage Likelihood | Typical Requirements |

|---|---|---|

| Medical Necessity | High | Documented functional impairment |

| Preventive Care | Medium | Early intervention justification |

| Cosmetic Enhancement | Low | Rarely covered without medical component |

| Retention | Variable | May require separate authorization |

Specialized Appliance Coverage: Insurance plans typically cover medically necessary specialized appliances including functional appliances for jaw development, surgical orthodontics coordination, and treatment of temporomandibular disorders when orthodontic intervention is indicated. Coverage often requires detailed documentation of medical necessity and may involve coordination with medical insurance for surgical components.

IMPORTANT NOTE Cosmetic orthodontic procedures, including treatment solely for aesthetic improvement, typically receive no insurance coverage regardless of patient preference or willingness to pay copayments.

Exclusions and Limitations: Common orthodontic exclusions include replacement of lost or damaged appliances due to patient negligence, treatment beyond reasonable completion timeframes, retreatment for relapse when retention instructions weren’t followed, and purely cosmetic procedures without functional benefit. Some plans also exclude certain premium treatment options like lingual braces or accelerated treatment methods as outlined in ADA Dental Coverage Position Statement.

Adult vs. Pediatric Coverage Differences: Pediatric orthodontic coverage often includes broader treatment categories and more generous benefit structures compared to adult coverage. Children may receive coverage for preventive and interceptive treatments that adults cannot access, reflecting the preventive focus of pediatric dental care and the developmental window for optimal treatment outcomes.

How to Maximize Orthodontic Insurance Benefits?

Maximizing orthodontic insurance benefits requires strategic planning, careful timing, and thorough understanding of plan provisions and limitations. Effective benefit optimization can save patients thousands of dollars while ensuring comprehensive treatment coverage throughout the orthodontic process.

Strategic Timing Considerations: Plan your orthodontic treatment start date carefully to maximize benefit utilization across plan years. If your plan operates on a calendar year basis and you begin treatment in January, you can potentially spread costs across multiple years while utilizing annual dental benefits for preparatory work and routine care.

Pre-Treatment Optimization Steps:

- Complete Diagnostic Phase: Finish all diagnostic work including X-rays, photographs, and impressions during the current benefit year

- Maximize Routine Benefits: Use annual dental benefits for cleanings, fillings, and oral health optimization before orthodontic treatment begins

- Deductible Strategy: Time elective procedures to satisfy deductibles efficiently across family members

- Provider Network Verification: Confirm orthodontist participation in your specific plan network to avoid balance billing

Documentation and Communication: Maintain detailed records of all communications with your insurance company, including pre-authorization requests, claim submissions, and benefit explanations. Request written confirmation of coverage determinations and keep copies of all submitted treatment plans and supporting documentation.

PRO TIP Coordinate with your orthodontist’s insurance coordinator before treatment begins to develop a comprehensive strategy for maximizing your benefits and minimizing out-of-pocket costs.

Multi-Year Planning Strategy: For treatments spanning multiple benefit years, coordinate with your orthodontist to time major milestones and payments strategically. Some patients benefit from delaying treatment start dates to align with benefit renewals or family coverage changes such as job transitions or dependent aging out of coverage.

Alternative Funding Coordination: Investigate supplemental coverage options including health savings accounts, flexible spending accounts, or supplemental dental insurance that might provide additional orthodontic benefits. Some employers offer voluntary dental insurance options with enhanced orthodontic coverage that can supplement primary plan benefits. These strategies parallel approaches used for reducing home insurance costs where combining multiple coverage options and timing can lead to significant savings.

Treatment Modification Negotiations: Work with your orthodontist to explore treatment modifications that maximize insurance coverage while maintaining clinical effectiveness. This might include phased treatment approaches, alternative appliance selections, or treatment plan modifications that align better with your plan’s coverage criteria as recommended in HealthCare.gov Dental Coverage Information.

FAQ

Does orthodontic insurance coverage apply immediately after enrollment?

Most dental plans impose waiting periods of 6-24 months before orthodontic benefits become available. Individual plans typically require longer waiting periods than group employer-sponsored plans. During waiting periods, patients remain responsible for all orthodontic costs, though routine dental benefits often activate immediately for preparatory care.

Can I change orthodontists during treatment without losing benefits?

Insurance plans typically allow orthodontist changes during treatment, though benefit calculations may become more complex. The new orthodontist must accept your existing pre-authorization and work within the remaining benefit amounts. Transferring care may result in additional fees for record transfers, new diagnostic procedures, and treatment plan modifications.

Do orthodontic benefits carry over if I change jobs?

Orthodontic benefits typically don’t transfer between insurance plans when changing employment. If you’re in active treatment, you’ll need to obtain new pre-authorization from your new plan, which may result in different coverage levels or benefit amounts. COBRA continuation coverage can maintain existing benefits temporarily while transitioning between employers.

Are retainers covered by orthodontic insurance?

Retention appliance coverage varies significantly between plans. Some include initial retainers as part of comprehensive treatment coverage, while others require separate authorization and payment. Replacement retainers due to loss or damage are typically not covered, making retention compliance crucial for long-term treatment success.

How does orthodontic coverage work with dual insurance?

When both parents carry dental insurance covering a child, coordination of benefits rules determine primary and secondary coverage responsibility. The primary plan pays benefits first according to its terms, while the secondary plan may cover additional costs up to its benefit limits. Total benefits typically cannot exceed 100% of treatment costs.

Can medical insurance cover orthodontic treatment?

Medical insurance may provide coverage for orthodontic treatment when procedures address medical conditions such as sleep apnea, temporomandibular disorders, or congenital conditions affecting jaw development. Medical coverage typically requires extensive documentation of medical necessity and may involve coordination with dental insurance benefits. This process often involves navigating complex procedures similar to those encountered when filing an insurance claim for other health-related expenses that require thorough documentation and coordination between multiple insurance providers.

Conclusion

Orthodontic insurance coverage presents a complex but navigable landscape requiring careful planning and thorough understanding of plan provisions. While adult coverage remains more limited than pediatric benefits, strategic approach to treatment timing, provider selection, and benefit maximization can significantly reduce out-of-pocket costs.

The key to successful orthodontic insurance utilization lies in comprehensive pre-treatment planning, including pre-authorization completion, network provider selection, and coordination with annual dental benefits. Understanding coverage limitations such as lifetime maximums, waiting periods, and medical necessity requirements helps patients make informed treatment decisions and avoid unexpected costs.

As orthodontic technology continues advancing with options like clear aligners and accelerated treatment methods, insurance coverage provisions continue evolving. Patients should regularly review their plan benefits, communicate proactively with insurance coordinators, and maintain detailed documentation throughout their treatment journey to ensure optimal benefit utilization and financial protection.

Key Takeaways

- Adult orthodontic coverage is less comprehensive than pediatric benefits, typically covering 25-50% of costs up to lifetime maximums of $1,000-$2,500

- Pre-authorization is required for virtually all orthodontic treatment, with 10-30 day processing periods and strict medical necessity criteria

- Strategic treatment timing can maximize benefit utilization across plan years and coordinate with routine dental care

- In-network providers offer better benefit realization through negotiated fees and streamlined administrative processes

- Comprehensive documentation and proactive communication with insurance coordinators prevent claim delays and coverage surprises

Disclaimer

This information is for educational purposes only and should not be considered professional insurance or orthodontic advice. Insurance coverage varies significantly between plans and providers, requiring individual policy review for specific benefit determination. Orthodontic treatment decisions should be made in consultation with qualified dental professionals and insurance representatives. Insurance rates and regulations change frequently, and data accuracy depends on timing of official releases from regulatory authorities.