Professional mistakes happen to even the most careful experts. A consulting firm recently faced a $2.4 million lawsuit when their strategic advice led to significant client losses. Their professional liability insurance covered the entire claim, saving the company from bankruptcy. Without this protection, they would have lost everything they’d built over decades.

Claims are on the rise throughout the insurance industry, mainly due to something called “social inflation.” This term refers to the increase in lawsuits and more expensive settlements. More professionals than ever face financial devastation from unexpected client claims, regardless of whether they actually made errors.

Professional liability insurance serves as your financial shield against claims alleging professional negligence, errors in service delivery, or failure to meet industry standards. This specialized coverage protects your business assets, reputation, and future when clients claim your professional services caused them financial harm. You’ll discover exactly how this insurance works, what it covers, typical costs across different professions, and practical steps for selecting the right policy.

The financial stakes couldn’t be higher—let’s explore how professional liability insurance can protect your career and business from devastating claims.

On This Page

1. Professional Liability Insurance Coverage Essentials

Professional liability insurance provides financial protection when clients allege your professional services caused them economic losses. This specialized coverage differs fundamentally from general liability insurance by focusing on intellectual property, advice, and service delivery rather than physical injuries or property damage.

Complete Coverage Protection: Professional liability insurance covers legal defense costs, settlement negotiations, court judgments, expert witness fees, and administrative expenses related to professional negligence claims. The coverage applies regardless of whether you actually made an error—even frivolous lawsuits require expensive legal defense.

1.1 How Professional Liability Insurance Functions

When clients file claims against your professional services, your insurance carrier assigns experienced attorneys and handles all legal proceedings. Attorney fees, which cost an average of $3,000 to $150,000. Court costs, like reserving a courtroom or paying for expert witnesses. These costs accumulate rapidly, making insurance protection essential for business survival.

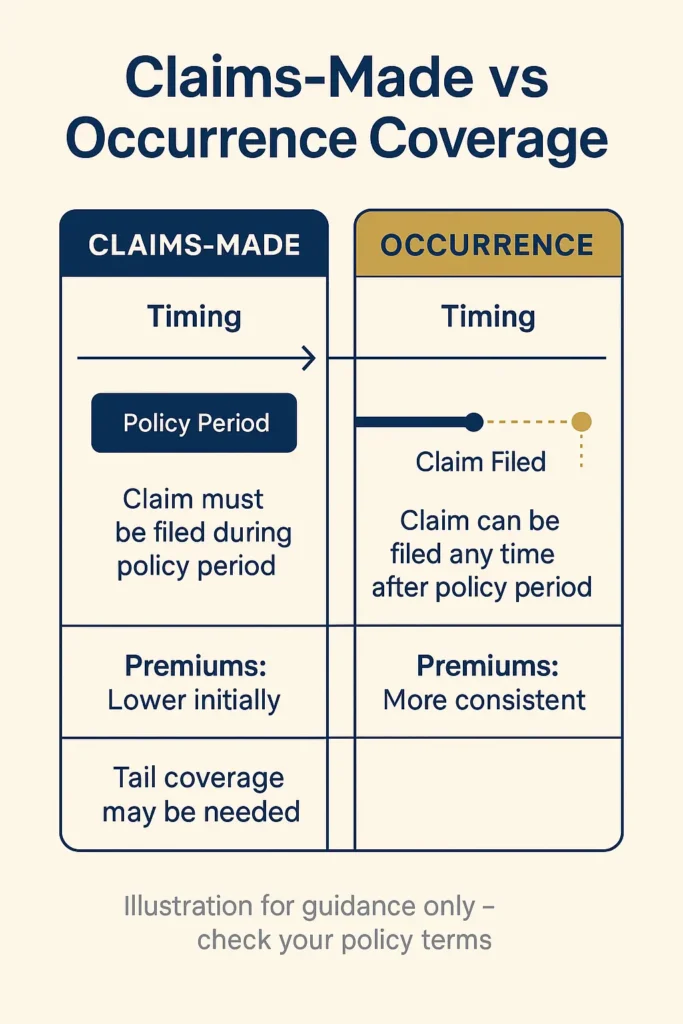

Most policies operate on a “claims-made” basis, meaning coverage applies to claims filed during the active policy period. This differs from occurrence-based policies that cover incidents happening during the policy period regardless of when claims are filed.

Professional liability insurance also provides crucial reputation management support during claims. Public perception matters tremendously for professional practices, and insurers often include crisis management services to protect your business image throughout legal proceedings.

1.2 Who Requires Professional Liability Protection

Any professional providing advice, expertise, or specialized services needs professional liability coverage. This includes consultants, healthcare providers, technology professionals, financial advisors, architects, engineers, real estate agents, and creative service providers.

Even seemingly low-risk professions face unexpected exposure. Professional liability claims range widely—from a business demanding a refund from a tax preparer that filed its federal tax returns but failed to complete state and local returns, to a manufacturer suing a consultant for recommending costly investments in new equipment that failed to lower production costs.

Many professional licensing boards and client contracts require specific coverage amounts. For comprehensive business protection beyond professional liability, understanding business insurance fundamentals helps you build complete coverage for your practice.

1.3 Professional Liability vs General Business Insurance

Professional liability insurance addresses errors and omissions in professional services, while general liability covers third-party bodily injury and property damage. Most professionals need both coverage types since they protect against different risk categories.

For example, if a client slips in your office, general liability handles the claim. If that same client sues because your professional advice cost them money, professional liability provides protection. Understanding these distinctions helps you build comprehensive coverage for your operations.

Workers’ compensation covers employee injuries, while employment practices liability protects against workplace discrimination claims. Each coverage type addresses specific business risks, making proper risk assessment crucial for adequate protection.

2. Types of Professional Liability Coverage Available

Professional liability insurance comes in various forms tailored to specific industries and professional exposures. Understanding these different coverage types helps you select protection that matches your particular risks and regulatory requirements.

Coverage Categories Include:

- Industry-specific professional liability policies

- Miscellaneous professional liability (MPL) for diverse professions

- Technology errors and omissions (Tech E&O) for IT professionals

- Medical malpractice for healthcare providers

- Legal malpractice for attorneys

2.1 Industry-Specific Professional Liability Policies

Different professions face unique risks requiring specialized coverage terms and exclusions. The global medical professional liability insurance market was valued at USD 16.4 billion in 2024. The market is anticipated to grow from USD 18.2 billion in 2025 to USD 46 billion in 2034, growing at a CAGR of 10.8% from 2025 to 2034.

Healthcare professionals require coverage addressing patient care decisions, treatment outcomes, and diagnostic errors. Technology professionals need protection for software failures, data breaches, and system malfunctions. Each industry’s policy language reflects specific professional standards and common claim scenarios.

Financial professionals face coverage for investment advice, fiduciary responsibilities, and regulatory violations. Architects and engineers need protection for design errors and construction defects. For specialized business insurance needs, exploring small business insurance cost factors helps you budget appropriately.

2.2 Claims-Made vs Occurrence Coverage Comparison

Most professional liability policies use claims-made coverage, protecting against claims filed during the active policy period. This approach allows insurers to better predict risk exposure since they know exactly when claims can be filed.

Claims-Made Coverage Benefits:

- Lower initial premiums compared to occurrence policies

- Easier to modify coverage terms annually

- More predictable for insurance carrier pricing

Occurrence coverage protects against incidents happening during the policy period, regardless of when claims are eventually filed. While less common for professional liability, some professionals prefer occurrence coverage for long-term protection certainty.

Extended reporting period (tail coverage) becomes crucial when switching carriers or retiring. This protection covers future claims for past work, though it can be expensive and requires careful consideration of coverage duration.

2.3 Policy Limits and Deductible Structure

Professional liability policies offer per-claim and aggregate annual limits ranging from $1 million to $10 million or higher. Most of our customers (63%) buy an errors and omissions or professional liability policy with a $1 million per-occurrence limit and $1 million aggregate limit.

Higher limits provide greater protection for significant claims but cost more in annual premiums. Consider your potential exposure when selecting limits—if your advice could cost clients millions, your coverage should reflect that exposure level.

Deductibles range from $1,000 to $25,000 or more, with higher deductibles reducing premium costs but increasing out-of-pocket exposure. Balance deductible amounts against your financial ability to handle claims costs when they occur.

3. Step-by-Step Professional Liability Claims Process

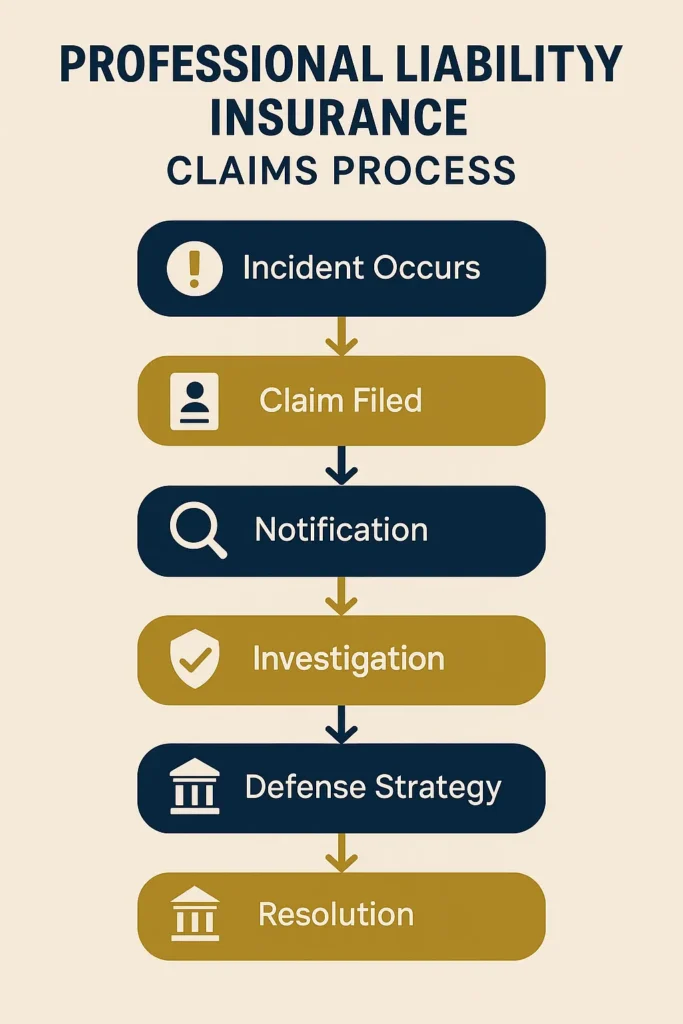

Understanding how professional liability claims work helps you prepare for potential scenarios and respond effectively if clients file lawsuits against your professional services.

Claims Process Overview:

- Incident Occurs – Professional error or client dissatisfaction

- Claim Filed – Client initiates lawsuit or formal complaint

- Notification – Report claim to insurance carrier immediately

- Investigation – Insurer evaluates claim merit and coverage

- Defense Strategy – Legal team develops response approach

- Resolution – Settlement negotiation or court proceedings

3.1 Covered Professional Activities and Services

Professional liability insurance covers claims arising from your normal business operations and professional services. Some of the most common errors and omissions claim types are negligence, misrepresentation, software security, breach of contract and more.

Coverage extends to advice, consulting, design work, professional recommendations, failure to deliver promised services, and errors in professional judgment. The policy typically covers employees working under your supervision and may include independent contractors performing services on your behalf.

However, coverage excludes intentional wrongdoing, criminal acts, and activities outside your professional scope. Policy definitions of “professional services” vary by carrier, making careful policy language review essential for understanding your protection.

3.2 Common Exclusions and Coverage Limitations

Professional liability policies exclude certain claims to keep coverage focused on true professional risks. Common exclusions include bodily injury, property damage, employment practices, intellectual property disputes, and cyber liability exposures.

Employment matters: Your policy doesn’t cover your business for claims alleging any improper employment practices committed against your employees or for any workers’ compensation claims or employer’s liability claims.

Many policies exclude claims related to guarantees of specific results, especially in consulting and advisory professions. Prior acts exclusions eliminate coverage for work performed before your policy effective date, though this can often be addressed through additional endorsements.

Understanding policy exclusions helps identify potential coverage gaps requiring additional insurance products. For specialized coverage needs like cyber liability, exploring cyber insurance for small business options provides essential digital protection.

3.3 Geographic Coverage Considerations

Most professional liability policies provide worldwide coverage for work performed by U.S.-based professionals, but coverage terms may vary for international operations. Some policies limit foreign coverage to temporary work or require additional endorsements for permanent international operations.

If you provide services to international clients or maintain foreign offices, verify that your policy covers these exposures adequately. Some international jurisdictions have different legal systems and damage award practices affecting your coverage needs and costs.

Regional factors also influence coverage requirements and costs within the United States. States with higher litigation rates or less favorable tort reform laws typically result in higher premiums and more restrictive coverage terms.

4. Choosing the Right Professional Liability Coverage

Selecting appropriate professional liability insurance requires careful evaluation of your specific risks, financial situation, and professional requirements. The right coverage balance protects your assets without overpaying for unnecessary features.

Selection Criteria Include:

- Professional risk assessment and exposure analysis

- Coverage limit determination based on potential claims

- Carrier financial strength and claims-handling reputation

- Policy features and exclusion evaluation

- Premium costs and budget considerations

4.1 Professional Risk Assessment Framework

Your profession, client types, project complexity, and business size influence your professional liability risk exposure. High-risk professions can expect to pay more for an E&O policy than low-risk professions. Consultants working with Fortune 500 companies face different risks than those serving small local businesses.

Consider your typical project values, client sophistication levels, and potential claim scenarios when evaluating coverage needs. Healthcare professionals, legal practitioners, and financial advisors typically require higher coverage limits due to increased claim frequency and severity.

Risk Assessment Checklist:

- Annual revenue and typical project values

- Client types and sophistication levels

- Regulatory requirements and professional standards

- Historical claim frequency in your profession

- Personal asset protection needs

- Business growth and expansion plans

4.2 Coverage Limit Selection Strategy

Professional liability coverage limits should reflect your potential exposure to claims and ability to pay damages beyond policy limits. Coverage limits range from $250,000 to $2 million, with higher limits increasing your insurance cost. Many small businesses choose $1 million per occurrence (per claim) and $1 million aggregate limits (total annual coverage) for balanced financial protection.

Consider potential client losses from your professional errors when setting coverage limits. If your advice could cost clients significant amounts, your coverage should reflect that exposure level. Some clients or contracts specify minimum coverage requirements influencing your decision.

Balance coverage limits against premium costs and overall risk management strategy. Higher limits provide better protection but cost more, requiring careful consideration of your budget and risk tolerance.

4.3 Insurance Carrier Selection Criteria

Choose professional liability carriers with strong financial ratings, experience in your profession, and good claims-handling reputations. Always choose insurers with an AM Best “A” or higher rating. An A-rating indicates financial strength, long-term solvency, and an established history of being able to defend physicians during costly malpractice claims.

Look for carriers specializing in your profession since they better understand your risks and provide more tailored coverage terms. Specialized carriers often offer better claim defense strategies and more reasonable settlement approaches than general market insurers.

Research carrier claim-handling practices through professional associations, online reviews, and broker recommendations. A carrier’s approach to claims defense significantly impacts your experience during stressful claim situations.

5. Professional Liability Insurance Costs and Premium Factors

Understanding factors influencing professional liability insurance premiums helps you budget for coverage and identify opportunities to reduce costs while maintaining adequate protection.

Cost Factors Include:

- Professional specialty and risk level

- Business size and annual revenue

- Geographic location and legal environment

- Claims history and risk management practices

- Coverage limits and deductible selection

5.1 Average Premium Costs by Professional Category

Professional liability insurance costs vary significantly across professions based on claim frequency, severity, and regulatory environments. Professional liability insurance costs small businesses an average of $82 monthly, but premiums range from $25 to $193, depending on your situation.

Typical Annual Premium Ranges:

- Consultants: $800 – $3,000

- Technology Professionals: $1,200 – $4,500

- Healthcare Providers: $3,000 – $15,000+

- Financial Advisors: $1,500 – $6,000

- Real Estate Professionals: $400 – $1,800

- Engineers/Architects: $2,000 – $8,000

These ranges reflect $1-2 million coverage limits and vary based on numerous individual factors including revenue, location, claims history, and specific coverage features. For comprehensive business insurance cost analysis, reviewing average cost business insurance helps you understand total protection expenses.

5.2 Premium Determination Factors

Several key factors influence professional liability insurance premiums, with some under your control and others representing fixed characteristics of your practice or profession.

Revenue and business size significantly impact premiums since larger practices typically face higher claim exposure. Business size: Businesses with employees or several client accounts have an increased chance of making a mistake and can therefore expect to pay more for errors and omissions insurance.

Geographic location affects rates due to varying legal environments, claim frequencies, and damage award levels across different states and regions. Your claims history plays a crucial role in premium determination, with clean records earning discounts while previous claims increase costs substantially.

Premium Factors You Can Control:

- Risk management practices and procedures

- Staff training and professional development

- Client screening and contract terms

- Coverage limits and deductible selection

- Claims prevention strategies

5.3 Cost Reduction Strategies and Discounts

Implementing strong risk management practices demonstrates to insurers that you’re a lower-risk client, potentially earning premium discounts. Risk Management Training: Many insurers offer premium discounts for completing approved training.

Choosing higher deductibles reduces premiums but increases out-of-pocket exposure when claims occur. This strategy works well for professionals with strong cash flow who can handle larger deductibles in exchange for lower annual premiums.

Consider bundling professional liability with other business insurance coverages through the same carrier, which often provides package discounts. Professional associations sometimes offer group insurance programs with preferential rates for members.

Additional Cost-Saving Opportunities:

- Annual policy payments vs monthly installments

- Multi-year policy commitments

- Claims-free history discounts

- Professional association group programs

- Independent broker comparison shopping

Conclusion

Professional liability insurance serves as an essential financial safeguard for anyone providing professional services or advice. This specialized coverage protects against unique risks that general liability insurance doesn’t address—claims arising from professional errors, omissions, and negligence that could result in devastating financial losses.

Key Protection Benefits:

- Professional liability insurance is crucial for service-based professionals across all industries

- Coverage protects against claims related to professional errors, advice, and service delivery

- Professional liability insurance costs an average of $82 per month or $984 per year for small businesses.

- Claims-made coverage requires careful consideration of extended reporting periods when changing carriers

- Risk management practices help reduce premiums while improving overall professional protection

The cost of professional liability insurance represents a small fraction of potential financial exposure from professional claims. Without errors and omissions insurance, the cost of liability claims can be so expensive that they could put your business at risk of closing. This coverage provides tremendous value for protecting your business and personal assets.

Making informed decisions about professional liability coverage requires understanding your specific risks, evaluating appropriate coverage limits, and selecting experienced carriers specializing in your profession. The peace of mind from knowing you’re protected against professional liability claims allows you to focus on delivering excellent service to clients.

For comprehensive protection of your business operations beyond professional liability, explore business insurance essentials to understand how different coverage types work together for complete risk management.

Related Coverage Considerations: Professional liability insurance integrates with general liability, cyber insurance, and workers compensation requirements for complete business protection tailored to your industry and location.

FAQ

What is a typical claim covered by professional liability insurance?

A typical professional liability claim involves a consultant whose strategic recommendations resulted in significant financial losses for their client. For example, a business consultant might advise a company to invest heavily in new technology, but the implementation fails and causes major operational disruptions. The client then sues for the cost of the failed project plus lost revenue during downtime. Professional liability insurance would cover the legal defense costs, settlement negotiations, and any judgment up to the policy limits, even if the consultant followed industry best practices but the outcome was poor.

What are the two basic types of professional liability policies?

The two main types are claims-made and occurrence-based policies. Claims-made policies cover claims that are filed during the active policy period, regardless of when the actual professional work was performed. This is the most common type for professional liability because it allows insurers to better predict their exposure. Occurrence-based policies cover incidents that happen during the policy period, no matter when the claim is eventually filed. While occurrence policies provide longer-term protection, they’re less common and typically more expensive for professional liability coverage.

What is an example of a professional liability?

A classic example is an architect whose building design contains a structural flaw that causes expensive construction delays and requires costly redesign work. Even though the architect followed standard design practices and building codes, the client suffers significant financial losses from the delay and additional construction costs. The client sues the architect for professional negligence, claiming the design should have anticipated and prevented the structural issues. Professional liability insurance would handle the legal defense and any settlement or judgment, protecting the architect’s business and personal assets.

Is professional liability insurance worth it?

Professional liability insurance is absolutely worth it for anyone providing professional services or advice. Legal defense costs alone can easily reach $50,000-$150,000, and settlements or judgments can reach millions depending on your profession. At an average cost of just $82 monthly, the insurance provides massive financial protection relative to its cost. Many clients and licensing boards also require minimum coverage amounts, so you may not be able to practice without it. The peace of mind alone makes it worthwhile – one lawsuit could destroy years of hard work building your practice.

What does professional liability insurance not cover?

Professional liability insurance excludes bodily injury and property damage (covered by general liability), employment practices like discrimination or harassment, intentional criminal acts, cyber attacks and data breaches, intellectual property disputes, and any work performed before your policy started (prior acts). It also won’t cover business debts, contract disputes unrelated to professional services, or guarantees about specific results. Many policies exclude claims related to securities law violations or serving as a company officer or director. These exclusions help keep the coverage focused on true professional service errors.

Who should have professional liability insurance?

Anyone who provides professional advice, consulting, or specialized services should carry professional liability insurance. This includes consultants, healthcare providers, lawyers, accountants, architects, engineers, IT professionals, real estate agents, financial advisors, and creative service providers. Even if you think your profession is low-risk, clients can sue for unexpected reasons. Many professional licenses and client contracts require specific coverage amounts. If your advice or services could potentially cost someone money if they go wrong, you need this protection regardless of how careful you are.

Can I get professional liability insurance as an individual?

Yes, you can absolutely purchase professional liability insurance as an individual practitioner, freelancer, or sole proprietor. In fact, individual professionals often face higher personal liability risks since they don’t have corporate protection. Many insurance companies offer policies specifically designed for individual professionals with coverage starting around $25-50 monthly depending on your profession. You don’t need employees or a formal business structure to qualify. Solo practitioners in consulting, healthcare, law, accounting, and other professional services regularly carry individual professional liability policies.

Does professional liability insurance cover lawsuits?

Professional liability insurance specifically covers lawsuits related to your professional services, including all legal defense costs, attorney fees, court costs, expert witness fees, and settlement or judgment amounts up to your policy limits. The insurance company typically assigns experienced attorneys who specialize in your profession and handles the entire legal process. This coverage applies whether you actually made an error or the lawsuit is completely frivolous – you’re protected either way. However, it only covers professional service-related lawsuits, not other types of litigation like employment disputes or general business contract issues.

Disclaimers

This information is educational only and does not constitute insurance advice. Coverage needs vary by individual circumstances. Consult licensed insurance professionals for personalized recommendations.