In early 2024, a Detroit renter faced unexpected losses after a sudden apartment fire destroyed most of their belongings — only to realize their insurance didn’t cover certain damages. This story is far from unique in Michigan, where renters often underestimate the importance of adequate coverage.

Renters insurance in Michigan offers vital protection for personal property, liability, and additional living expenses. With options like personal property coverage, liability limits, and endorsements available through providers such as State Farm and Progressive, renters can shield themselves from costly surprises. The Michigan Department of Insurance and Financial Services (DIFS) regularly updates guidelines to protect tenants and clarify coverage.

“According to the National Association of Insurance Commissioners, nearly 30% of renters nationwide lacked insurance coverage in 2023, putting millions at risk.” (NAIC, 03/2024)

For older tenants navigating legal or insurance disputes, the Senior Courts Act guide for 2025 offers practical legal protections.

On This Page

1. Core Definition of Renters Insurance Michigan

1.1 What Exactly is Renters Insurance Michigan? (Legal and Practical Overview)

Renters insurance Michigan is a specialized coverage tailored for tenants to protect their personal belongings, provide liability protection, and cover extra living expenses if their rental unit becomes uninhabitable. Unlike homeowner policies, renters insurance does not cover the physical structure itself. Instead, it focuses solely on the tenant’s possessions and legal responsibility for injuries or damages that happen inside their rented home.

While Michigan law doesn’t mandate renters insurance, many landlords require it in lease agreements to safeguard both parties. Common coverage options include protection against theft, fire damage, and liability claims, with customizable limits depending on individual needs.

Top insurers like Allstate, Farmers, and Geico offer Michigan renters insurance policies compliant with state regulations through the Michigan Department of Insurance and Financial Services.

1.2 How Michigan Renters Insurance Differs from Other States

Renters insurance Michigan differs in several ways due to state-specific laws, regulations, and environmental risks. For example, Michigan renters face unique weather-related challenges such as heavy snowfall and flooding, which can impact claims and coverage options. Unlike states with mandatory insurance laws, Michigan leaves coverage voluntary but enforces strict regulations on insurer transparency.

Michigan’s insurance market also features distinct premium averages compared to neighboring states. According to the National Association of Insurance Commissioners (NAIC), Michigan renters insurance premiums averaged $187 annually in 2023, slightly below the national average of $195.

Check the Michigan Department of Insurance and Financial Services for official updates: Michigan DIFS.

2. Deep Dive: Costs & Influencing Factors of Renters Insurance Michigan

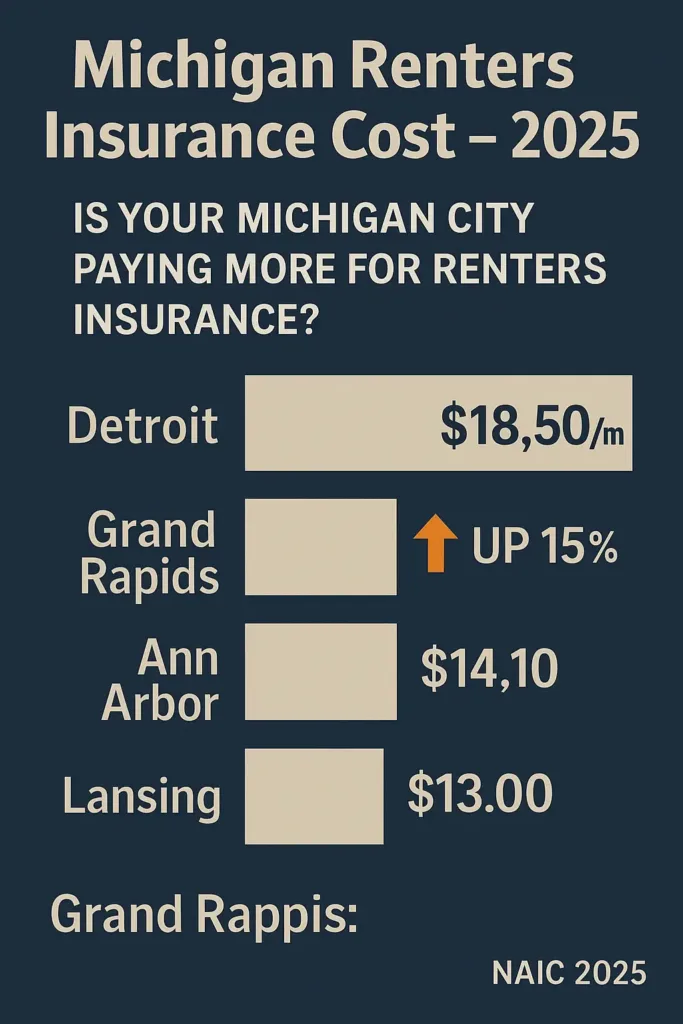

2.1 2024 Price Ranges for Renters Insurance Michigan (With City-by-City Breakdown)

In 2024, the average cost of renters insurance Michigan varies significantly depending on location, coverage limits, and provider. On average, renters pay between $12 and $20 per month, but costs in urban areas like Detroit or Grand Rapids tend to be higher due to increased risk factors such as crime rates and property values.

| City | Average Monthly Premium | Common Coverage Limits |

|---|---|---|

| Detroit | $18.50 | $30,000 personal property / $250,000 liability |

| Grand Rapids | $15.20 | $25,000 personal property / $200,000 liability |

| Ann Arbor | $14.10 | $20,000 personal property / $100,000 liability |

| Lansing | $13.00 | $20,000 personal property / $100,000 liability |

These price variations reflect local risks and housing market factors. For more detailed regional insights, the Michigan Department of Insurance and Financial Services provides annual reports (Michigan DIFS).

2.2 5 Hidden Factors That Can Skyrocket Your Renters Insurance Costs in Michigan

While basic renters insurance Michigan premiums may seem affordable, certain hidden factors can unexpectedly increase your costs:

- High Crime Neighborhoods: Renters in areas with elevated theft or vandalism rates often face higher premiums.

- Previous Claims History: Filing multiple claims, even unrelated to renters insurance, can raise your rates.

- Coverage Limits and Deductibles: Higher personal property limits or lower deductibles typically mean higher premiums.

- Proximity to Water Bodies: Living near lakes or rivers in Michigan may increase flood risk, which standard renters insurance excludes.

- Credit Score: Insurers in Michigan often use credit-based insurance scores, affecting your premium significantly.

Understanding these factors helps renters make informed choices to balance protection and cost.

3. Step-by-Step Process to Get Renters Insurance in Michigan

3.1 The Exact 7-Step Process to Obtain Renters Insurance Michigan

Securing renters insurance Michigan involves a straightforward, 7-step process to ensure you get adequate coverage at the best price:

- Assess Your Needs: Calculate the value of your personal belongings and decide on desired liability limits.

- Research Providers: Compare major insurers like State Farm, Progressive, and Allstate, focusing on their Michigan renters insurance offerings.

- Request Quotes: Obtain personalized quotes based on your coverage needs and address.

- Evaluate Policies: Review coverage details, deductibles, exclusions, and customer reviews.

- Check Discounts: Ask about bundling with auto insurance, security systems, or no-claims bonuses.

- Purchase Policy: Choose the best option and complete the application online or via agent.

- Keep Documentation: Store your policy documents safely and understand the claims process.

Following these steps helps Michigan renters avoid gaps in coverage and unnecessary expenses.

3.2 How to File a Renters Insurance Claim in Michigan (With Real-Life Examples)

Filing a renters insurance claim Michigan requires careful documentation and timely communication. Here’s a simple process based on recent cases:

- Report the Incident: Notify your insurer immediately after loss due to fire, theft, or water damage.

- Document Damage: Take photos and list damaged or stolen items with estimated values.

- Submit Claim Form: Complete required paperwork accurately, including police reports if applicable.

- Work with Adjuster: Coordinate inspections and provide any additional information requested.

- Receive Settlement: Review payout offers and negotiate if needed before accepting.

For example, a Lansing tenant recently recovered $5,000 after a water leak damaged electronics, thanks to thorough documentation and prompt filing.

Additional official guidance is available at the Michigan Department of Insurance and Financial Services.

4. Powerful Case Studies on Renters Insurance Michigan

4.1 How John Saved $350 on Renters Insurance Michigan in 2024

John, a renter in Grand Rapids, managed to cut his renters insurance Michigan premium by $350 annually through smart adjustments. By increasing his deductible from $500 to $1,000 and bundling his renters insurance with his auto policy at Progressive, he accessed multiple discounts. John also installed a security system, further lowering his risk profile.

Business owners managing vehicles should also review the commercial dump truck insurance guide for 2025 to ensure their fleet is adequately protected.

This case highlights how understanding policy details and insurer offerings in Michigan can result in significant savings without sacrificing essential coverage.

4.2 The Detroit Fire That Changed Renters Insurance Michigan Forever

In late 2023, a large fire swept through an apartment building in Detroit, leaving many renters without homes. The tragedy revealed that numerous tenants did not have sufficient coverage for additional living expenses, meaning they had to cover the costs of temporary housing on their own.

This situation motivated Michigan insurers and regulators to enhance awareness campaigns and clarify policy language about ALE coverage, resulting in improved protections for renters across the state.

5. Expert Secrets About Renters Insurance Michigan

5.1 3 Little-Known Loopholes in Michigan Renters Insurance

Many renters in Michigan miss out on coverage benefits due to little-known policy loopholes. First, some policies allow “replacement cost” coverage on personal property only if specifically requested, otherwise settling claims at depreciated value. Second, bundling renters insurance with other policies can unlock exclusive discounts not advertised widely. Third, some insurers offer “identity theft protection” as an add-on—an essential but often overlooked safeguard for Michigan renters.

Knowing these loopholes can save money and improve coverage quality.

5.2 What Michigan Renters Insurance Companies Won’t Tell You

Insurance companies in Michigan rarely highlight that renters insurance doesn’t cover flooding or earthquakes by default. Additionally, many policies exclude high-value items unless specifically scheduled, potentially leaving renters underinsured. Insurers also rely heavily on credit scores to set premiums, which can sometimes unfairly penalize good renters.

Being aware of these facts empowers Michigan renters to ask the right questions and tailor their coverage effectively.

6. Future-Proofing Your Renters Insurance Michigan

6.1 Emerging Trends in Renters Insurance Michigan (2025-2030)

As we move further into 2025 and beyond, renters insurance Michigan is evolving with new trends shaping the market. Increased use of smart home technology is influencing premiums, as devices like security cameras and leak detectors lower risk. Additionally, more insurers are offering customizable policies with flexible coverage options to meet diverse renter needs. Environmental concerns also drive changes, with policies adapting to cover risks related to climate change, such as severe storms and flooding.

Staying informed about these trends helps Michigan renters secure policies that will remain relevant and cost-effective.

| Trend | Impact on Renters Insurance | Expected Adoption by 2030 |

|---|---|---|

| Smart Home Devices | Lower premiums due to reduced risk | 70% |

| Customizable Policies | Better coverage tailored to renter needs | 60% |

| Climate Risk Coverage | Increased inclusion of flood and storm protection | 50% |

6.2 How AI is Revolutionizing Renters Insurance Michigan

Artificial intelligence is playing a growing role in renters insurance Michigan by enhancing how data is analyzed for risk evaluation. This enables insurers to offer more accurate premiums that reflect individual circumstances. For renters, this translates to quicker claim processing and more personalized policy options. However, transparency regarding data use remains critical when selecting AI-powered insurance providers.

| AI Application | Benefit to Renters | Potential Concerns |

|---|---|---|

| Claims Automation | Faster settlement times | Data privacy risks |

| Risk Assessment | More precise premiums | Algorithmic bias |

| Personalized Policies | Coverage tailored to needs | Lack of transparency |

Official sources like the National Association of Insurance Commissioners highlight AI’s expanding role in insurance oversight and consumer protection.

For more on AI’s impact, visit the NAIC official site.

Conclusion

Five Essential Guidelines for Choosing Renters Insurance in Michigan

- Make a Complete Inventory: Carefully document your belongings to ensure you select coverage that truly protects your valuables.

- Seek Multiple Quotes:Reach out to various Michigan-based insurance companies to discover the optimal balance between cost and coverage.

- Study Your Policy Details: Know exactly what your renters insurance covers and excludes, especially concerning liability and temporary housing.

- Explore Ways to Save: Ask about discounts for bundling with other policies, using security systems, or having a clean claims record.

- Regularly Reassess Your Coverage: Adjust your policy whenever your circumstances change to maintain adequate protection.

Next Steps to Secure Your Michigan Renters Insurance

After understanding your needs and comparing offers, reach out to licensed Michigan insurance agents or trusted online platforms to purchase a renters insurance policy that fits your lifestyle. Remember to review your coverage periodically and update it as your situation evolves to avoid gaps in protection.

Professionals offering services from rental properties, such as estheticians, should also explore our dedicated insurance guide for 2025.

Official Resources and Expert

The Michigan Department of Insurance and Financial Services (DIFS) serves as the main authority regulating renters insurance within the state. They offer comprehensive resources on policy standards, consumer protections, and ways to file complaints against insurers.

- National Association of Insurance Commissioners (NAIC)

- Federal Trade Commission: Guide to Renters Insurance

FAQ

How much is renters insurance in Michigan?

The average renters insurance premium in Michigan ranges between $12 and $20 per month, depending on the city and coverage limits. For example, Detroit renters typically pay around $18.50 monthly, while in Lansing or Ann Arbor, rates can be closer to $13-$14. Overall, the yearly cost averages about $187, slightly below the national average.

How much is $100,000 in renters insurance?

A renters insurance policy with $100,000 liability coverage generally costs less than higher limits, often a few hundred dollars annually. The exact price varies based on personal property coverage, deductible choices, and location, but it is significantly more affordable than policies with $250,000 or higher liability limits.

Is it mandatory to have renters insurance in Michigan?

No, renters insurance is not legally required by Michigan law. However, many landlords mandate tenants to carry renters insurance as a condition in lease agreements. This ensures protection for both parties and may be strictly enforced in rental contracts.

What is renters insurance used for?

Renters insurance protects tenants by covering losses to personal belongings from events like fire, theft, or vandalism. It also provides liability coverage if someone is injured on the rental property and covers additional living expenses if the rented home becomes temporarily uninhabitable due to a covered loss.