Introduction

Renters insurance payout time represents the duration between filing a claim and receiving compensation for covered losses. According to the National Association of Insurance Commissioners, most standard renters insurance claims are resolved within 15 to 30 days, though complex cases can extend significantly longer.

Understanding payout timelines helps renters set realistic expectations and take proactive steps to expedite claims processing. The Insurance Information Institute reports that 67% of renters insurance claims involve personal property losses, with theft and fire damage representing the most common scenarios requiring swift resolution.

The payout process involves multiple regulated stages, from initial claim filing through investigation, documentation review, and final settlement. Each stage presents potential delays, making it essential for policyholders to understand their role in facilitating swift resolution under state insurance regulations.

This comprehensive guide examines every aspect of renters insurance payout time, including federal oversight, state-specific requirements, and practical strategies for faster claim resolution. Whether you’re filing your first claim or seeking to understand industry standards, this analysis provides detailed insights needed to navigate the claims process effectively.

On This Page

Definition and Scope

Renters insurance payout time encompasses the complete duration from claim initiation to final payment disbursement. This timeframe includes several distinct phases regulated by state insurance departments and overseen by the National Association of Insurance Commissioners (NAIC).

Key Components of Payout Time:

- Initial acknowledgment period (1-3 business days)

- Investigation phase (5-15 days for standard claims)

- Documentation review (3-7 days)

- Settlement calculation (2-5 days)

- Payment processing (3-5 business days)

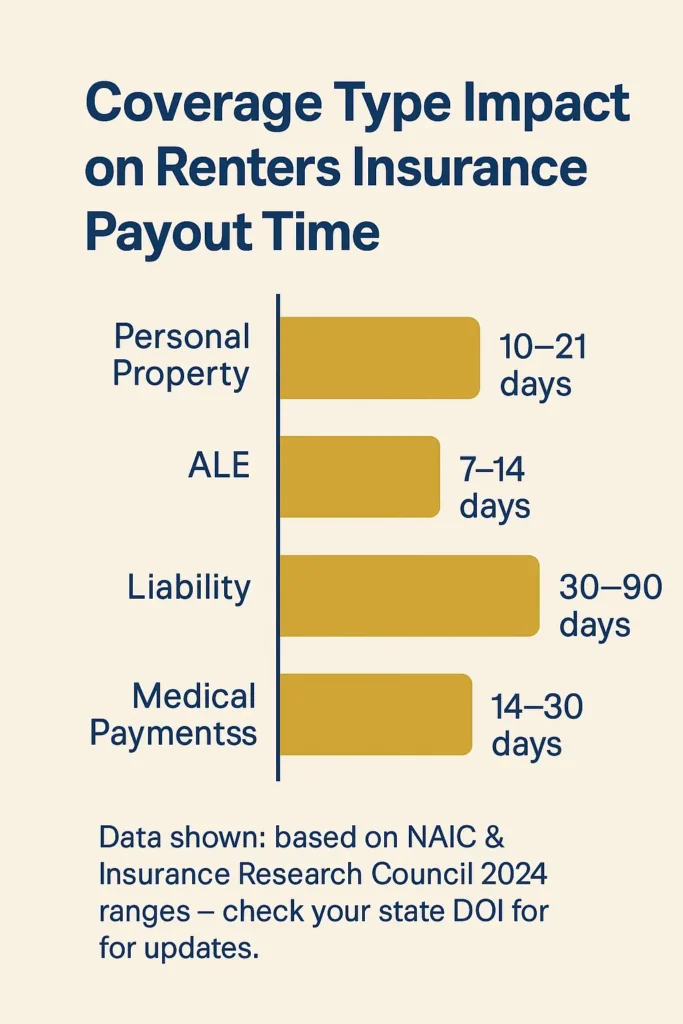

According to 2024 data from the Insurance Research Council, the scope of renters insurance payout time varies significantly based on claim complexity, coverage type, and state regulations. Simple personal property claims typically resolve faster than liability claims requiring extensive investigation.

Coverage Areas Affecting Payout Time:

| Coverage Type | Typical Payout Range | Complexity Factors |

|---|---|---|

| Personal Property | 10-21 days | Item valuation, proof of ownership |

| Additional Living Expenses | 7-14 days | Temporary housing verification |

| Liability Claims | 30-90 days | Investigation scope, legal review |

| Medical Payments | 14-30 days | Medical record verification |

The Consumer Federation of America emphasizes that understanding these components helps policyholders anticipate realistic timelines and identify potential bottlenecks in their specific situations.

Importance for U.S. Consumers

Renters insurance payout time directly impacts financial stability during stressful periods following property damage or theft. The Federal Trade Commission reports that quick resolution enables faster recovery, while extended delays compound financial hardship and emotional distress.

Financial Impact Considerations:

The timing of insurance payouts affects immediate cash flow needs according to research from the Urban Institute. Renters facing displacement must cover temporary housing, food, and replacement necessities while awaiting reimbursement. Extended delays can force reliance on credit cards, loans, or family assistance, creating additional financial strain.

Consumer Protection Benefits:

Most states mandate specific timeframes for insurance company responses through their renters insurance regulatory frameworks, protecting consumers from unreasonable delays. These regulations establish minimum standards for acknowledgment, investigation, and payment, ensuring companies cannot indefinitely postpone legitimate claims.

Key Consumer Protections:

- Prompt acknowledgment requirements (typically 15 days per NAIC guidelines)

- Investigation completion deadlines (usually 30-60 days)

- Payment processing timeframes (generally 5-15 days after agreement)

- Interest penalties for delayed payments beyond regulatory limits

Understanding these protections empowers renters to hold insurance companies accountable and seek appropriate remedies when facing unreasonable delays. The National Consumer Law Center provides resources for consumers experiencing claim processing issues.

Impact on Recovery Process:

Swift payout enables immediate action on essential needs. Delayed compensation can extend displacement periods, increase replacement costs due to price inflation, and complicate the restoration process according to disaster recovery research from FEMA. The psychological benefits of quick resolution also contribute to overall recovery outcomes.

Historical Background

The regulation of insurance payout timelines evolved significantly throughout the 20th century, driven by consumer advocacy and state legislative initiatives documented by the Insurance History Foundation. Early insurance practices lacked standardized timeframes, leading to inconsistent claim handling and consumer frustration.

Legislative Development:

The 1970s marked a turning point with the adoption of Unfair Claims Settlement Practices Acts across multiple states. These laws, based on NAIC model legislation, established fundamental standards for claim handling, including specific timeframes for various stages of the renters insurance payout time process.

Key Historical Milestones:

- 1971: Texas adopts first comprehensive claim handling timeframe requirements

- 1979: National Association of Insurance Commissioners issues model regulations at naic.org

- 1990s: Digital processing capabilities reduce average payout times by 25%

- 2000s: Online claim filing systems streamline initial stages

- 2010s: Mobile technology enables real-time documentation and faster processing

Modern Developments:

Contemporary trends focus on leveraging technology to accelerate claim processing while maintaining thorough investigation standards required by state insurance regulators. Artificial intelligence assists in initial claim triage, while digital documentation systems reduce paper-based delays significantly.

Industry Standardization:

The insurance industry has gradually adopted more consistent practices across companies and states according to Insurance Services Office data. While specific timeframes vary by jurisdiction, the general framework of acknowledgment, investigation, and payment phases remains standard across the United States per NAIC guidelines.

Recent Improvements:

Advanced data analytics help companies identify potentially fraudulent claims earlier, reducing investigation time for legitimate cases. Electronic payment systems have also eliminated traditional check processing delays, enabling same-day transfers in many situations as documented in recent industry reports.

Consumer Awareness Growth:

Increased consumer awareness of payout timeline rights has led to more informed policyholders who actively monitor claim progress and advocate for timely resolution. This awareness has contributed to overall improvements in industry responsiveness and accountability according to consumer protection agencies.

Key Procedures and Processes

The renters insurance payout process follows a structured sequence of steps, each with specific timeframes and requirements regulated by state insurance departments. Understanding these procedures helps policyholders navigate the system effectively and identify opportunities to expedite their claims.

Step-by-Step Payout Process:

- Immediate Claim Filing (Day 0)

- Contact insurer within 24-48 hours of loss per policy requirements

- Provide basic incident details and policy information

- Receive claim number and initial instructions

- Formal Acknowledgment (Days 1-3)

- Insurance company confirms receipt within state-mandated timeframes

- Assigns claim adjuster or representative

- Sends detailed documentation requirements

- Documentation Submission (Days 3-10)

- Submit proof of loss forms as required by state regulations

- Provide inventory of damaged/stolen items with valuations

- Include supporting evidence (photos, receipts, police reports)

- Investigation Phase (Days 5-20)

- Adjuster reviews submitted materials per NAIC guidelines

- May conduct property inspection or policyholder interview

- Verifies coverage details and policy limits

- Settlement Calculation (Days 18-25)

- Determine covered losses and applicable deductibles

- Calculate replacement cost or actual cash value

- Prepare settlement offer within regulatory timeframes

- Payment Processing (Days 23-30)

- Issue payment authorization following state requirements

- Transfer funds electronically or mail check

- Provide detailed settlement breakdown

Documentation Requirements That Affect Timing:

Proper documentation significantly impacts renters insurance payout time according to Insurance Information Institute research. Complete, organized submissions reduce back-and-forth communications and investigation delays substantially.

Essential Documentation Checklist:

- Police reports for theft or vandalism claims (required within 24-48 hours)

- Photos or video showing damage extent and affected areas

- Receipts or proof of purchase for valuable items over $500

- Inventory lists with item descriptions and estimated replacement values

- Repair estimates from licensed contractors when applicable

- Medical records for injury-related liability claims

Technology Integration Benefits:

Modern insurance companies leverage digital platforms to streamline processing and reduce renters insurance payout time significantly. Mobile apps enable instant photo uploads, while online portals provide real-time claim status updates as mandated by consumer protection regulations.

Digital Processing Advantages:

| Traditional Method | Digital Method | Time Savings |

|---|---|---|

| Mail documents (3-5 days) | Upload instantly | 3-5 days |

| Phone interviews (scheduling delays) | Video calls | 1-2 days |

| Paper check processing | Electronic transfer | 2-3 days |

| Manual review | AI-assisted triage | 1-3 days |

Common Challenges

Multiple factors can extend renters insurance payout time beyond standard expectations established by state insurance regulators. Identifying these challenges early helps policyholders take proactive measures to minimize delays and ensure compliance with their renters insurance claims procedures.

Documentation-Related Delays:

Incomplete or unclear documentation represents the most common cause of extended payout times according to National Association of Insurance Commissioners data. Missing receipts, inadequate damage photos, or incomplete inventory lists require additional correspondence that adds days or weeks to resolution.

Frequent Documentation Issues:

- Insufficient proof of ownership for high-value items exceeding coverage limits

- Poor quality photos that don’t clearly show damage extent or causation

- Missing police reports for theft or vandalism claims as required by law

- Incomplete inventory lists lacking detailed item descriptions or current values

- Outdated contact information causing communication delays with adjusters

Coverage Disputes:

Disagreements over coverage interpretation can significantly extend renters insurance payout time beyond regulatory expectations. These disputes typically require legal review, additional investigation, or third-party evaluation as outlined in state insurance codes.

Common Coverage Disputes:

- Exclusion applicability (flood vs. water damage distinctions per policy language)

- Policy limit interpretations for specific item categories or sublimits

- Depreciation calculations affecting actual cash value settlements

- Business property vs. personal property classifications

- Intentional damage vs. accidental loss determinations requiring investigation

Investigation Complexities:

Certain claim types require extensive investigation that naturally extends processing time beyond standard renters insurance payout time expectations. These situations often involve potential fraud concerns, liability questions, or coordination with other parties as mandated by state oversight.

Complex Investigation Scenarios:

- Large loss amounts exceeding specific dollar thresholds set by insurers

- Multiple party involvement in liability claims requiring coordination

- Suspicious circumstances triggering fraud investigation protocols

- Coordination with law enforcement for ongoing criminal investigations

- Third-party liability requiring legal consultation and extended review

Communication Breakdowns:

Poor communication between policyholders and insurance representatives creates unnecessary delays in the renters insurance payout time process. Missed calls, unreturned messages, or unclear instructions can stall progress for days or weeks beyond acceptable standards.

Communication Best Practices:

- Maintain detailed records of all interactions with claim representatives

- Respond promptly to insurer requests for additional information

- Ask for clarification when instructions are unclear or contradictory

- Use multiple contact methods (phone, email, online portal)

- Follow up regularly on pending items and claim status updates

Practical Examples

Real-world scenarios illustrate how various factors influence renters insurance payout time, demonstrating both typical timelines and exceptional circumstances encountered in practice.

Example 1: Standard Personal Property Claim

Scenario: Apartment break-in with stolen electronics and jewelry valued at $3,500

Timeline Breakdown:

- Day 0: Filed claim immediately after discovering theft

- Day 1: Insurance company acknowledged receipt per state requirements

- Day 3: Submitted police report and detailed item inventory

- Day 7: Adjuster requested additional documentation for jewelry items

- Day 10: Provided jewelry appraisal from previous year’s assessment

- Day 14: Settlement offer received meeting policy terms

- Day 16: Payment processed electronically to bank account

Total Renters Insurance Payout Time: 16 days

Key Success Factors:

- Prompt claim filing and immediate police report

- Organized documentation with existing appraisals for valuable items

- Quick response to adjuster requests for additional information

- Electronic payment processing reducing traditional mailing delays

Example 2: Complex Fire Damage Claim

Scenario: Kitchen fire causing smoke damage throughout two-bedroom apartment

Timeline Breakdown:

- Day 0: Filed claim immediately after fire department response

- Day 2: Met with adjuster for comprehensive property inspection

- Day 5: Submitted detailed inventory and extensive damage photos

- Day 12: Insurance company requested independent damage assessment

- Day 20: Second adjuster inspection completed with contractor estimates

- Day 28: Coverage dispute arose over certain smoke-damaged items

- Day 35: Negotiated settlement agreement reached after review

- Day 38: Payment issued following resolution of coverage questions

Total Renters Insurance Payout Time: 38 days

Complicating Factors:

- Extensive damage requiring professional assessment and multiple inspections

- Coverage disputes over salvageable items and depreciation calculations

- Coordination with landlord’s insurance for structural damage responsibilities

- Complex additional living expense calculations for temporary housing

Example 3: Liability Claim with Injury

Scenario: Guest injured due to defective apartment fixture, requiring medical treatment

Timeline Breakdown:

- Day 0: Reported incident to insurance company immediately

- Day 3: Formal claim filed with initial medical documentation

- Day 10: Adjuster interviewed all parties involved in the incident

- Day 18: Medical records requested from treating physician

- Day 30: Legal review of liability exposure initiated per company protocol

- Day 45: Settlement negotiations began with injured party’s representative

- Day 62: Final agreement reached after extensive legal consultation

- Day 65: Payment processed to all parties per settlement agreement

Total Renters Insurance Payout Time: 65 days

Extended Timeline Factors:

- Medical treatment ongoing during investigation period

- Liability investigation requirements per state insurance regulations

- Legal consultation needs for potential lawsuit exposure

- Multiple party coordination including medical providers and attorneys

Lessons from Practical Examples:

These examples demonstrate how claim complexity, documentation quality, and communication effectiveness directly impact renters insurance payout time outcomes. Simple personal property claims with complete documentation typically resolve within 15-20 days, while complex cases involving liability or extensive damage may require 60+ days for complete resolution.

Success Strategies Identified:

- Immediate reporting reduces initial processing delays significantly

- Complete documentation minimizes back-and-forth requests for information

- Professional assistance (appraisals, contractors) supports faster accurate evaluation

- Proactive communication keeps claims moving forward through required processes

- Understanding coverage prevents disputes and unnecessary confusion

Federal Regulations and Oversight

While insurance regulation primarily occurs at the state level, federal oversight influences renters insurance payout time through broader consumer protection initiatives and interstate commerce regulations. The Federal Trade Commission monitors insurance practices, while the National Association of Insurance Commissioners provides coordination between states to maintain consistent standards.

Federal Influence on Payout Timelines:

The Federal Trade Commission monitors insurance practices for unfair or deceptive acts, including unreasonable claim delays that affect renters insurance payout time. Though direct regulation remains limited, federal scrutiny through agencies like the Consumer Financial Protection Bureau encourages industry compliance with reasonable timeframes.

Key Federal Considerations:

- Interstate commerce regulations affecting multi-state insurers under federal jurisdiction

- Consumer protection enforcement through FTC oversight and investigation authority

- Fair Credit Reporting Act implications for claim investigations and background checks

- Electronic payment regulations governing fund transfer timelines and security requirements

NAIC Model Regulations:

The NAIC Unfair Claims Settlement Practices Act, available at naic.org, serves as the foundation for state-specific payout timeline requirements. According to NAIC data from 2024, most states adopt variations of this model, creating general consistency while allowing local adaptations for regional needs.

Standard NAIC Requirements:

| Requirement | Timeline | Purpose |

|---|---|---|

| Claim acknowledgment | 15 days | Initial communication requirement |

| Investigation completion | 30 days | Reasonable review period |

| Settlement offer | 15 days after agreement | Payment processing standard |

| Disputed claim resolution | 60 days | Extended review timeframe |

State-by-State Overview

Individual states maintain significant authority over insurance payout timeline requirements through their respective Departments of Insurance, creating variations that affect renters across different jurisdictions. Understanding your state’s specific requirements helps establish realistic expectations for renters insurance payout time and identify when delays exceed legal limits.

Major State Categories:

Strict Timeline States (California, New York, Florida):

- Acknowledgment: 15 days maximum per state insurance codes

- Investigation: 40 days for standard claims processing

- Payment: 30 days after agreement reached

- Penalties: Interest charges for delays, potential license sanctions

According to the California Department of Insurance, renters insurance payout time requirements include 10% annual interest on overdue amounts exceeding regulatory deadlines.

Standard Timeline States (Texas, Illinois, Ohio):

- Acknowledgment: 15-30 days depending on claim complexity

- Investigation: 60 days typical for most claim types

- Payment: 60 days after settlement agreement

- Penalties: Moderate interest charges, regulatory review procedures

Flexible Timeline States (Montana, Wyoming, South Dakota):

- Acknowledgment: 30 days standard

- Investigation: 90 days or “reasonable time” based on circumstances

- Payment: 30-60 days after agreement depending on complexity

- Penalties: Limited interest requirements, emphasis on good faith efforts

Notable State-Specific Requirements:

California’s Prompt Payment Laws: California requires payment within 30 days of reaching settlement agreement for renters insurance payout time, with 10% annual interest on overdue amounts. The California Department of Insurance also mandates detailed explanation letters for any claim denial or delay exceeding 40 days.

Texas Fair Claims Practices: Texas imposes 15-day acknowledgment requirements and 15-day payment processing after settlement. According to the Texas Department of Insurance, the state provides strong consumer remedies, including attorneys’ fees for successful delay lawsuits affecting renters insurance payout time.

New York Insurance Regulations: New York requires 30-day maximum investigation periods for standard renters insurance claims, with detailed documentation requirements for any extensions. The New York State Department of Financial Services also mandates electronic payment options to reduce processing delays.

Florida’s Claims Handling Standards: Florida emphasizes hurricane and weather-related claim efficiency, requiring 90-day maximum resolution for covered losses. The Florida Office of Insurance Regulation provides expedited procedures for displacement-related additional living expenses affecting renters insurance payout time.

Consumer Rights Variations:

Different states provide varying levels of consumer protection against unreasonable delays in renters insurance payout time. Some states offer robust legal remedies through their insurance departments, while others rely primarily on regulatory oversight and industry self-regulation.

Strong Consumer Protection States:

- Legal remedy access for delay damages through state courts

- Attorneys’ fees coverage for successful claims against insurers

- Punitive damages available for bad faith practices

- Expedited court procedures for claim disputes and appeals

Key Insights and Trends

The renters insurance industry continues evolving toward faster, more efficient payout processes driven by technological advancement, regulatory pressure, and competitive market forces. Understanding these trends helps consumers anticipate future improvements and leverage current best practices to minimize renters insurance payout time.

Technology-Driven Improvements:

Digital transformation significantly reduces traditional payout delays according to 2024 industry reports from the Insurance Information Institute. Mobile apps enable instant claim filing, while artificial intelligence assists in damage assessment and fraud detection, accelerating legitimate claim processing for renters insurance payout time optimization.

Current Technology Trends:

- AI-powered claim triage reducing initial review time by 40% industry-wide

- Drone inspections for property damage assessment and verification

- Blockchain verification for ownership documentation and fraud prevention

- Real-time payment processing enabling same-day transfers when approved

- Mobile documentation tools streamlining evidence collection and submission

Industry Benchmarking Data (2024-2025):

Recent industry data from the Property Casualty Insurers Association reveals improving renters insurance payout time across all claim types, with particular improvement in personal property and theft claims processing.

Average Payout Times by Claim Type:

| Claim Type | 2024 Average | 2025 Trend | Industry Best Practice |

|---|---|---|---|

| Personal Property | 18 days | ↓ 15 days | 12 days achievable |

| Theft Claims | 22 days | ↓ 19 days | 14 days with complete docs |

| Liability | 45 days | ↓ 42 days | 35 days minimum |

| Additional Living Expenses | 12 days | ↓ 10 days | 7 days optimal |

Consumer Expectations Evolution:

Modern renters increasingly expect insurance services matching other digital experiences, driving companies toward faster response times and more transparent communication throughout the claims process. This evolution directly influences renters insurance payout time standards and industry competition.

Emerging Best Practices:

Leading insurance companies implement comprehensive approaches combining technology, training, and process optimization to achieve superior payout performance and reduce overall renters insurance payout time for their customers.

Industry Innovation Examples:

- 24/7 claim filing through multiple digital channels and mobile apps

- Predictive analytics identifying potential delays early in the process

- Customer portal integration providing real-time status updates throughout

- Automated documentation review reducing human processing time significantly

- Electronic signature systems eliminating mailing delays completely

For comprehensive information about renters insurance coverage components, including how different types of coverage affect payout timelines, consult resources from your state insurance department and NAIC guidelines.

FAQ

How long does renters insurance take to pay out?

Most renters insurance claims are paid within 15 to 30 days of filing, depending on claim complexity and documentation completeness according to National Association of Insurance Commissioners data. Simple personal property claims with proper documentation typically resolve in 10-20 days, while complex cases involving liability or extensive damage may require 30-60 days for complete resolution. The renters insurance payout time includes investigation, settlement calculation, and payment processing phases regulated by state insurance departments. States regulate maximum timeframes, with most requiring payment within 30-60 days of reaching settlement agreement. Electronic payment methods can reduce final processing to same-day transfers, while traditional checks add 3-5 business days to the total timeline.

How long should an insurance payout take?

Insurance payout timelines vary by state regulation and claim complexity, but industry standards established by the NAIC suggest 30-45 days maximum for standard renters insurance claims. State laws typically require acknowledgment within 15 days, investigation completion within 30-60 days, and payment processing within 15-30 days after agreement per regulatory guidelines. Simple theft or personal property claims often resolve in 15-25 days, while liability claims may require 45-90 days due to investigation requirements mandated by state oversight. Delays beyond regulatory limits may result in interest penalties for insurance companies and provide grounds for consumer complaints to state insurance departments. Understanding your state’s specific requirements helps identify unreasonable delays in renters insurance payout time.

How much is $300,000 worth of renters insurance?

A $300,000 renters insurance policy typically costs between $180-$600 annually, depending on location, coverage components, and individual risk factors according to Insurance Information Institute pricing data. This coverage level far exceeds typical renters insurance needs, as most policies range from $20,000-$50,000 for personal property protection. The $300,000 amount might apply to combined coverage including personal property, liability protection, and additional living expenses under a comprehensive policy structure. Premium costs vary significantly by state, with high-cost areas like California or New York charging more than rural locations due to claims frequency and severity differences. Deductible selection, safety features, and bundling discounts also affect pricing for high-coverage policies, though such extensive coverage typically targets luxury renters with valuable possessions.

Why is my renters insurance taking so long?

Extended renters insurance payout delays typically result from incomplete documentation, coverage disputes, complex investigations, or communication issues according to state insurance department complaint data. Common causes include missing receipts for claimed items, inadequate damage photos, pending police reports, or disputes over coverage interpretation requiring legal review. Large claims may trigger enhanced fraud investigation protocols mandated by state regulations, while liability claims require legal review and potentially lengthy negotiations with multiple parties. Poor communication between policyholders and adjusters can also create unnecessary delays beyond reasonable processing times. To expedite processing, ensure complete initial documentation, respond promptly to requests, maintain organized records, and follow up regularly on claim status through available communication channels provided by your insurer.

Why would a renters insurance claim be denied?

Renters insurance claims face denial for several common reasons, including policy exclusions, coverage limits, documentation issues, or suspected fraud according to state insurance regulatory data. Typical exclusions involve flood damage, earthquakes, intentional acts, business property, or items exceeding specific coverage limits outlined in policy terms. Claims may be denied for lack of proof of ownership, failure to report within required timeframes established by policy language, or discrepancies in reported circumstances during investigation.

Pre-existing damage, normal wear and tear, or losses occurring outside coverage periods also result in denial under standard policy provisions. Understanding your renters insurance coverage components helps avoid denial by ensuring claims fall within covered perils and maintaining proper documentation as required by policy terms and state regulations.

Why is my insurance claim taking so long?

Insurance claim delays commonly stem from documentation issues, investigation complexity, coverage disputes, or administrative backlogs affecting renters insurance payout time significantly. Incomplete paperwork requires additional correspondence, extending timelines beyond standard processing periods established by state regulations. Complex claims involving multiple parties, substantial damages, or potential fraud require thorough investigation that naturally extends processing time per regulatory requirements and industry best practices.

High-volume periods following major storms or catastrophic events can create processing backlogs affecting all claims in the affected region. Communication delays between adjusters and policyholders also contribute to extended timelines beyond reasonable expectations. To minimize delays, submit complete documentation initially, respond quickly to requests, maintain organized records, use digital communication methods when available, and follow up regularly on progress through official channels provided by your insurance company.

Conclusion

Renters insurance payout time represents a critical factor in post-loss recovery, directly impacting your ability to replace belongings, secure temporary housing, and restore normalcy following covered events. Understanding the typical 15-30 day timeline for standard claims, along with factors that extend processing for complex cases, enables better preparation and more realistic expectations throughout the claims process.

The evolution toward digital processing, strengthened state regulatory protections, and increased industry competition continues improving payout speeds while maintaining investigation thoroughness required by law. Proactive policyholders who understand documentation requirements, communicate effectively with adjusters, and leverage available technology typically experience faster claim resolution than those relying on traditional paper-based processes.

Your role in facilitating swift renters insurance payout time cannot be overstated. Complete initial documentation, prompt response to requests, organized record-keeping, and persistent follow-up significantly influence timeline outcomes within regulatory frameworks.

Key Takeaways

- Standard payout timeline: Most renters insurance claims resolve within 15-30 days, with simple personal property cases often completing in 10-20 days per industry standards

- Documentation drives speed: Complete, organized initial submissions reduce delays more than any other factor under policyholder control

- State regulations protect consumers: Understanding your state’s specific timeline requirements through insurance department resources helps identify unreasonable delays

- Technology accelerates processing: Digital submission methods, electronic payments, and online communication tools can reduce total timeline by 5-10 days compared to traditional methods

Disclaimer

The information in this article is for educational purposes only and reflects data and regulations available at the time of publication. Insurance rules and renters insurance provisions may change frequently, and specific benefits can vary by state. Readers should verify details with official sources such as their state Department of Insurance or licensed insurance professionals. For advice tailored to your personal situation, always consult a licensed insurance professional.