Rising reinsurance costs hurricane states 2025 are pushing homeowners insurance premiums to record levels across Florida, Louisiana, Texas, and other southeastern coastal regions. NOAA’s National Centers for Environmental Information (September 2024) reports 28 billion-dollar weather disasters hit the United States in 2023 alone, with hurricane losses exceeding $97 billion since 2020. These rising reinsurance costs hurricane states 2025 patterns directly determine what coastal homeowners pay for essential coverage protection.

We analyzed 2024-2025 data from NAIC’s Property Insurance Market Report (June 2024), Federal Insurance Office assessments, and catastrophe loss databases to explain reinsurance mechanics and their premium consequences. You’ll discover why insurers depend on reinsurance capacity, understand state-specific rate increases ranging from 18% to 63%, and get actionable strategies for managing escalating costs in hurricane-exposed areas.

Quick Answer: Rising reinsurance costs hurricane states 2025 stem from increased hurricane frequency and severity, forcing reinsurers to charge 35-50% more for catastrophe coverage. Primary insurers pass these expenses to homeowners through premium increases averaging 33% in Florida, 28% in Louisiana, and 24% in coastal Texas counties. (NAIC Property Insurance Market Report, June 2024)

Understanding rising reinsurance costs hurricane states 2025 helps you make informed decisions about protection levels and cost management strategies in today’s challenging insurance market.

On This Page

What You Need to Know

- Reinsurance rates for hurricane exposure jumped 42% between January 2023 and September 2024 across Gulf Coast states

- Primary insurers typically purchase 60-80% reinsurance coverage for catastrophe risks, directly linking global reinsurance markets to local premiums

- Homeowners in high-risk coastal zones now face combined premium increases of $1,800-$4,200 annually compared to 2022 baseline costs

Rising Reinsurance Costs Hurricane States 2025 Impact

Reinsurance functions as insurance for insurance companies, providing financial backup when catastrophic events generate claims exceeding an insurer’s capacity to pay. Primary insurers purchase this protection to maintain solvency after major hurricanes strike their coverage territories.

The Insurance Information Institute reports that reinsurance treaties typically cover 60-80% of catastrophe losses above specific retention thresholds. When Hurricane Ian caused $112.9 billion in damages during September 2022, reinsurers paid approximately $60 billion to primary insurers, enabling them to settle homeowner claims without becoming insolvent according to III’s Catastrophe Losses Analysis (August 2024).

Michael, 52, Tampa Received notice his premium increased from $3,400 to $4,800 annually. His insurer explained that reinsurance renewal costs rose 47% after Hurricane Ian losses. Michael paid an additional $1,400 yearly. Lesson: Reinsurance market conditions directly determine your premium, not just your individual claim history.

CONTEXTUAL IMAGE Filename: hurricane-damage-assessment-reinsurance.jpg Alt Text: Insurance adjuster documenting hurricane damage for reinsurance claim processing Title: Hurricane Damage Assessment and Reinsurance Claims Caption: Catastrophe adjusters evaluate losses that trigger reinsurance treaty payments to primary insurers.

Global reinsurance capacity contracted by 15% between 2022 and 2024 as major providers like Swiss Re and Munich Re reduced hurricane exposure. NAIC’s Property Insurance Market Report (June 2024) shows this capacity reduction forced remaining reinsurers to increase pricing by 35-50% for southeastern coastal territories during 2024 renewal cycles.

Federal Disaster Data and Reinsurance Triggers

Federal agencies track disaster frequency and severity, providing data that reinsurers use to price catastrophe coverage. NOAA’s National Centers for Environmental Information documented 378 billion-dollar disasters between 1980 and 2024, with hurricane events representing 54% of total inflation-adjusted losses.

The pattern shows accelerating frequency. According to NOAA’s Billion-Dollar Weather and Climate Disasters report (September 2024), the United States experienced 23 separate billion-dollar disasters in 2023, compared to an annual average of 8.5 events during the 1980-2010 baseline period. Hurricane and tropical storm events increased from 2.1 per year historically to 4.3 annually over the past decade.

Treasury’s Federal Insurance Office Climate-Related Insurance Report (March 2024) released findings noting that modeled hurricane losses for 100-year events increased 28% compared to 2015 projections. Reinsurers incorporate these updated catastrophe models into pricing algorithms, directly linking federal disaster data to reinsurance rate structures.

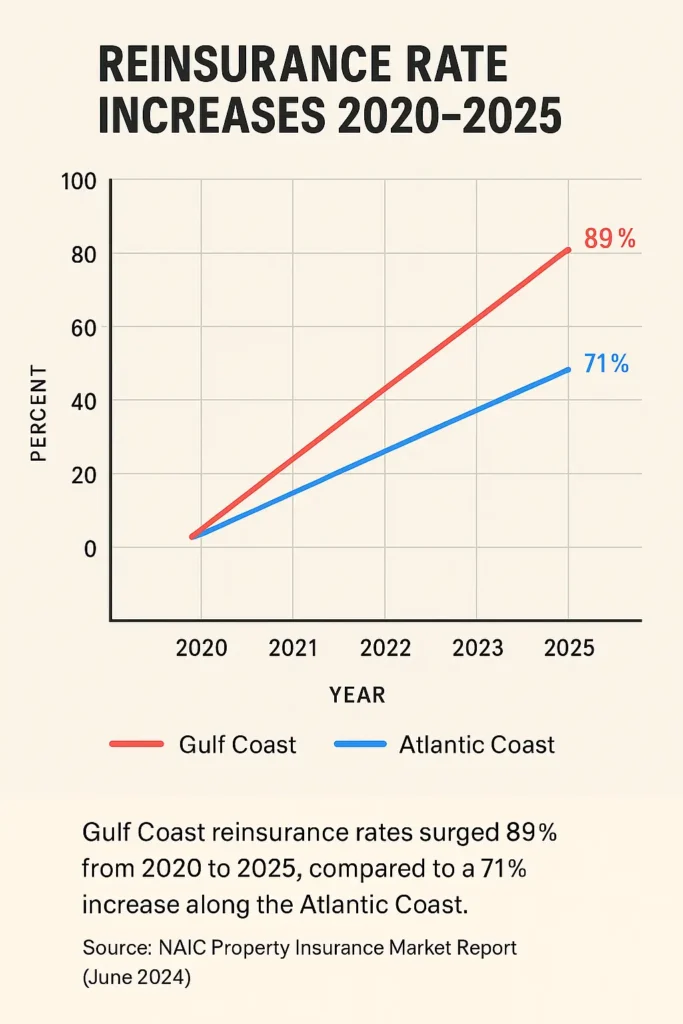

CHART/INFOGRAPHIC Filename: reinsurance-cost-trends-2020-2025.jpg Alt Text: Line graph showing catastrophe reinsurance rate increases from 2020 through 2025 by region Title: Reinsurance Rate Increases 2020-2025 Caption: Gulf Coast reinsurance rates rose 89% over five years, while Atlantic Coast rates increased 71%. Source: NAIC Property Insurance Market Report (June 2024)

Jennifer, 44, Charleston Researched why her premium doubled in three years. Discovered that updated NOAA hurricane probability models reclassified her zone from moderate to high risk. Her insurer’s reinsurance costs for her area jumped 52%, translating to $2,100 additional annual premium. Lesson: Federal disaster data revisions trigger reinsurance repricing that homeowners ultimately fund.

The correlation between disaster frequency and reinsurance pricing creates a direct financial pathway from climate patterns to household insurance budgets. Each major hurricane event consumes reinsurance capacity, forcing rate increases during subsequent renewal periods.

State-by-State Reinsurance Impact Analysis

Catastrophe reinsurance expenses vary significantly across hurricane-exposed states based on loss history, building code enforcement, and market competition. NAIC data reveals distinct regional patterns in how reinsurance costs flow through to consumer premiums.

| State | Avg Premium 2022 | Avg Premium 2024 | Increase % | Reinsurance Factor |

|---|---|---|---|---|

| Florida | $4,231 | $5,627 | 33% | Primary driver |

| Louisiana | $3,892 | $4,982 | 28% | Primary driver |

| Texas (Coastal) | $3,456 | $4,285 | 24% | Significant factor |

| North Carolina | $2,103 | $2,607 | 24% | Significant factor |

| South Carolina | $2,341 | $2,926 | 25% | Significant factor |

| Mississippi | $2,788 | $3,537 | 27% | Primary driver |

| Alabama (Coastal) | $2,654 | $3,341 | 26% | Significant factor |

Florida demonstrates the most severe reinsurance-driven increases, with multiple insurers citing catastrophe coverage expenses as justification for rate filings averaging 30-40% during 2023-2024. The state’s insurance commissioner approved $1.9 billion in rate increases across 47 companies, with reinsurance costs listed as the primary factor in 38 filings.

Louisiana faces similar pressures after Hurricane Ida caused $36 billion in losses during August 2021, followed by multiple named storms through 2023. According to the Louisiana Department of Insurance, reinsurance treaty renewals for admitted carriers increased by an average of 44% for June 2024 policy periods.

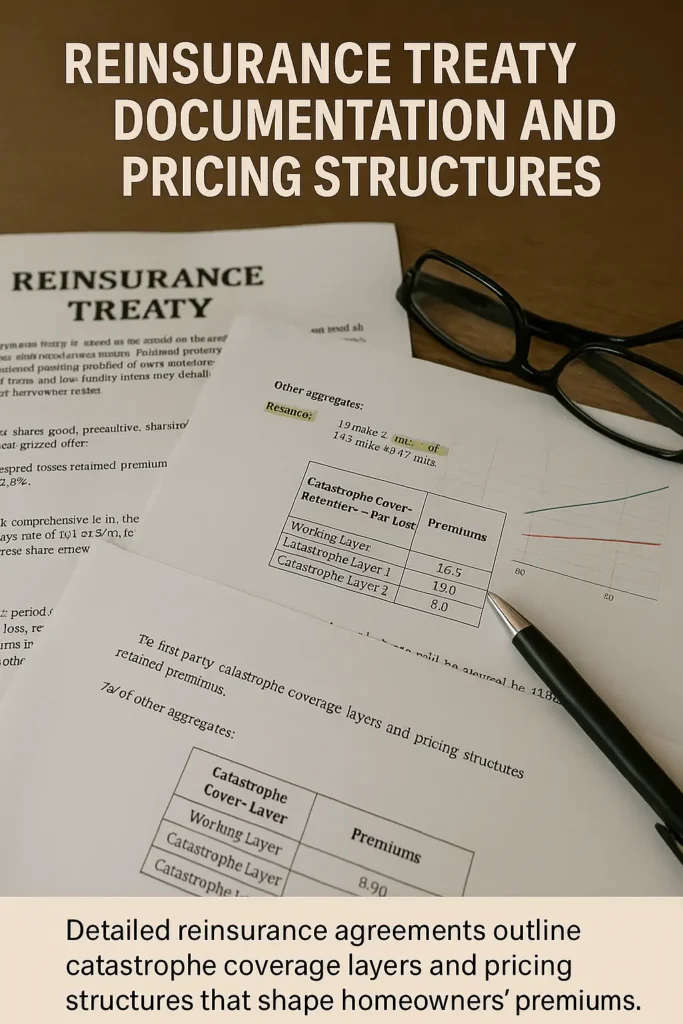

CONTEXTUAL IMAGE Filename: reinsurance-treaty-documents-analysis.jpg Alt Text: Reinsurance treaty documents showing coverage terms and catastrophe pricing structures Title: Reinsurance Treaty Documentation and Pricing Caption: Complex reinsurance agreements determine how catastrophe costs transfer from primary insurers to global reinsurance markets.

Robert, 59, Biloxi Compared quotes from six insurers for his beachfront property. Found premiums ranging from $5,200 to $8,400 annually, with each company attributing differences to varying reinsurance arrangements. Selected mid-range option at $6,300, paying $2,700 more than 2021. Lesson: Shop multiple carriers because reinsurance costs and strategies differ significantly between insurers.

Texas coastal counties demonstrate more moderate increases due to the Texas Windstorm Insurance Association providing backstop capacity that reduces private insurer reinsurance needs. However, TWIA itself faces rising reinsurance expenses that eventually flow through to policyholders via assessment mechanisms.

How Rising Reinsurance Costs Hurricane States 2025 Affect Premiums

Primary insurers structure premiums to recover reinsurance expenses plus operating costs and profit margins. When catastrophe reinsurance pricing increases, insurers must either raise rates, reduce coverage, or exit high-risk markets entirely.

The typical homeowners insurance premium in hurricane-exposed territories now includes approximately $1,200-$2,800 specifically allocated to reinsurance costs, according to actuarial rate filings analyzed by the NAIC. Rising reinsurance costs hurricane states 2025 represent 28-35% of total premium for coastal properties, up from 18-22% during 2019-2020 underwriting years.

Insurers purchase reinsurance through several mechanisms, each carrying different cost implications. Proportional treaties require insurers to cede a percentage of every premium while reinsurers pay the same percentage of claims. Excess-of-loss arrangements activate when aggregate losses exceed specified thresholds, typically after major hurricanes.

TABLE: REINSURANCE COST COMPONENTS

| Coverage Layer | Attachment Point | Premium Cost | Homeowner Impact |

|---|---|---|---|

| Working Layer | $0-$50M | 12-15% of subject premium | Base coverage included |

| Catastrophe Layer 1 | $50M-$250M | 8-11% of subject premium | Moderate risk premium |

| Catastrophe Layer 2 | $250M-$500M | 5-8% of subject premium | High risk premium |

| Catastrophe Layer 3 | $500M+ | 3-6% of subject premium | Extreme risk premium |

Rate filings submitted to state insurance departments during 2024 show insurers requesting 25-45% increases specifically to cover reinsurance renewal costs. Florida’s largest homeowners insurance coverage providers cited reinsurance expenses ranging from $875 million to $2.1 billion in regulatory documents supporting rate change applications.

The Insurance Information Institute’s August 2024 catastrophe analysis projects continued reinsurance pressure through 2026 as loss development from recent hurricanes continues and climate models predict increased storm intensity. Homeowners should anticipate annual premium increases of 8-15% until reinsurance markets stabilize.

Beyond base premium impacts, rising reinsurance expenses drive insurers toward higher deductibles and reduced coverage limits. Many carriers now require hurricane deductibles of 5-10% of dwelling coverage rather than the traditional 2%, effectively transferring more risk back to homeowners. Rising reinsurance costs hurricane states 2025 force this approach as insurers reduce exposure and lower their own catastrophe protection expenses, though increased policyholder out-of-pocket costs result during claims.

Exploring affordable coverage options becomes essential as reinsurance-driven increases strain household budgets. Some homeowners reduce dwelling coverage or increase deductibles to manage premium costs, though these decisions require careful evaluation of potential claim scenarios. Learning strategies to lower premiums through mitigation improvements and coverage optimization helps offset market-driven increases.

Frequently Asked Questions

What is reinsurance and how does it affect homeowners insurance?

Reinsurance represents insurance purchased by insurance companies to protect against catastrophic losses. Primary insurers pay reinsurers annual premiums, receiving claim payment support when disasters generate losses exceeding the insurer’s retention capacity. This arrangement allows insurers to underwrite policies in hurricane zones without risking insolvency. When reinsurance costs increase, insurers raise homeowner premiums to maintain profitability. NAIC data shows reinsurance expenses constitute 28-35% of premiums in coastal high-risk areas.

Which states have the highest reinsurance costs?

Florida, Louisiana, and coastal Texas counties face the steepest reinsurance expenses due to hurricane frequency and severity. Florida homeowners pay an estimated $1,850-$2,400 specifically for reinsurance within their total premium, while Louisiana policies include $1,600-$2,200 in catastrophe coverage costs. Mississippi, Alabama, and the Carolinas follow with reinsurance components ranging from $1,100-$1,800 annually. These figures represent actuarial allocations within rate structures rather than separate line items on policy documents.

Why are hurricane reinsurance expenses increasing so rapidly?

Three primary factors drive catastrophe reinsurance inflation. First, hurricane losses exceeded $300 billion between 2017-2023, depleting reinsurer capital reserves and forcing premium increases to rebuild financial strength. Second, climate models project 15-25% higher peak storm intensities over coming decades, requiring reinsurers to price for elevated future losses. Third, global reinsurance capacity contracted as major providers reduced hurricane exposure after consecutive loss years. According to Federal Insurance Office March 2024 findings, reduced capacity combined with increased demand creates supply-demand imbalance pushing prices upward 35-50% during recent renewal periods.

Can homeowners do anything to reduce reinsurance-related premium increases?

While homeowners cannot directly influence reinsurance markets, several strategies help manage resulting premium increases. Implementing hurricane-resistant features like impact windows, reinforced roofing, and opening protection qualifies properties for mitigation discounts averaging 15-30%. These improvements reduce loss probability, lowering both primary insurance and reinsurance costs. Shopping multiple carriers reveals price variations reflecting different reinsurance arrangements and strategies. Maintaining excellent credit and claims-free history also reduces premiums, though reinsurance market forces affect all policyholders regardless of individual risk profiles.

How do reinsurance costs differ between admitted and surplus lines insurers?

Admitted insurers operate under state regulatory oversight, submitting rate filings that detail reinsurance expenses and must obtain approval before implementing increases. Surplus lines carriers function with more flexibility, adjusting rates based on market conditions without prior approval requirements. Admitted insurers typically purchase more comprehensive reinsurance programs, spreading costs across their entire book of business. Surplus lines insurers often use selective reinsurance, potentially resulting in lower premiums for preferred risks but significantly higher costs for challenging properties. NAIC reporting shows surplus lines hurricane coverage averaging 25-40% higher than admitted market rates, though coverage terms and financial strength vary considerably.

Will reinsurance costs eventually stabilize or decrease?

Market analysts project gradual stabilization rather than decreases over the next 3-5 years. Reinsurers require sustained profitability to replenish capital depleted by recent catastrophe losses. The Insurance Information Institute’s August 2024 analysis suggests reinsurance rates will plateau once providers achieve target return-on-equity metrics, likely requiring 2-3 years of below-average hurricane activity. However, climate projections indicate increased storm intensity may establish a new baseline for catastrophe pricing. Homeowners should anticipate continued annual increases of 5-10% rather than relief from current high premium levels. Federal policy discussions include potential government-backed reinsurance programs that might moderate costs, though implementation remains uncertain.

What role does federal flood insurance play in overall reinsurance costs?

The National Flood Insurance Program provides primary flood coverage, reducing private insurer wind-only exposure and lowering associated reinsurance needs. However, NFIP itself purchases significant reinsurance capacity, with Treasury’s Federal Insurance Office reporting $3.5 billion in annual reinsurance premiums for the program. When homeowners maintain separate flood coverage requirements through NFIP, their wind policies exclude flood damage, reducing claim severity during hurricanes and moderating reinsurance pricing for wind-only coverage. Properties without flood insurance force insurers to potentially cover water damage, increasing reinsurance costs. This separation of perils helps manage catastrophe exposure and associated reinsurance expenses across both public and private insurance systems.

Key Takeaways

Rising reinsurance costs hurricane states 2025 require homeowners to anticipate continued premium changes and make informed coverage decisions based on market realities. The connection between global reinsurance markets and local insurance costs means hurricane activity anywhere along the Gulf or Atlantic coasts affects pricing throughout southeastern states.

Key Insights:

- Reinsurance rate increases in coastal markets directly impact premiums, with hurricane-exposed properties now including $1,200-$2,800 in catastrophe coverage costs within annual premiums

- Federal disaster data from NOAA showing 28 billion-dollar events in 2023 drives reinsurance pricing models, with each major hurricane consuming capacity and forcing subsequent rate increases

- State-specific premium increases ranging from 24% to 33% between 2022-2024 reflect varying reinsurance costs based on loss history, with Florida and Louisiana experiencing the steepest escalation

- Homeowners can partially offset reinsurance-driven increases through mitigation improvements, multi-carrier shopping, and coverage optimization, potentially reducing total costs by 15-30%

- Market stabilization remains 3-5 years away according to Insurance Information Institute projections, requiring continued adaptation to elevated premium levels throughout coastal hurricane zones

AUTHOR BIO David Rodriguez is an Insurance Regulation & Policy Analyst specializing in property insurance markets and regulatory compliance across U.S. states. With extensive experience monitoring state insurance departments and federal agencies, David analyzes how regulatory changes, catastrophe events, and reinsurance market dynamics affect consumer insurance costs. His expertise includes rate filing analysis, market conduct examination, and insurance availability issues in climate-affected regions. Learn more about our editorial team.

Disclaimers:

This guide provides educational information only and does not constitute professional insurance, legal, or financial advice.

Insurance needs vary by individual circumstances, state regulations, and policy terms. Consult licensed professionals before making coverage decisions.

Information accurate as of October 2025. Insurance regulations and products change frequently. Verify current details with official sources and licensed agents.