At 67, John from Orlando, Florida, thought he was well-prepared for his golden years. But when he turned 65, he found himself navigating the maze of Medicare eligibility and benefits. As he quickly discovered, “senior citizen age” isn’t just about a number—it’s a defining point that affects everything from healthcare to financial planning. In fact, in 2024, over 55% of Americans aged 65 and older report facing challenges in understanding their rights and benefits as they approach this milestone (AARP).

For many, the term “senior citizen” triggers automatic assumptions about retirement, health concerns, and eligibility for benefits. However, these assumptions often vary depending on age thresholds set by both federal and state programs. Understanding these definitions is crucial, not just for healthcare, but for financial security, protected veteran status, insurance premiums, and even social services.

In this guide, we’ll break down everything you need to know about “senior citizen age,” including the legal definitions, the impact on health insurance and retirement, and how it influences your daily life. Whether you’re approaching retirement or helping a loved one navigate this transition, this article will provide practical insights to help make the most of your senior years.

On This Page

1. What is Considered Senior Citizen Age in the USA?

1.1. Understanding Federal and State Criteria for Senior Citizen Age

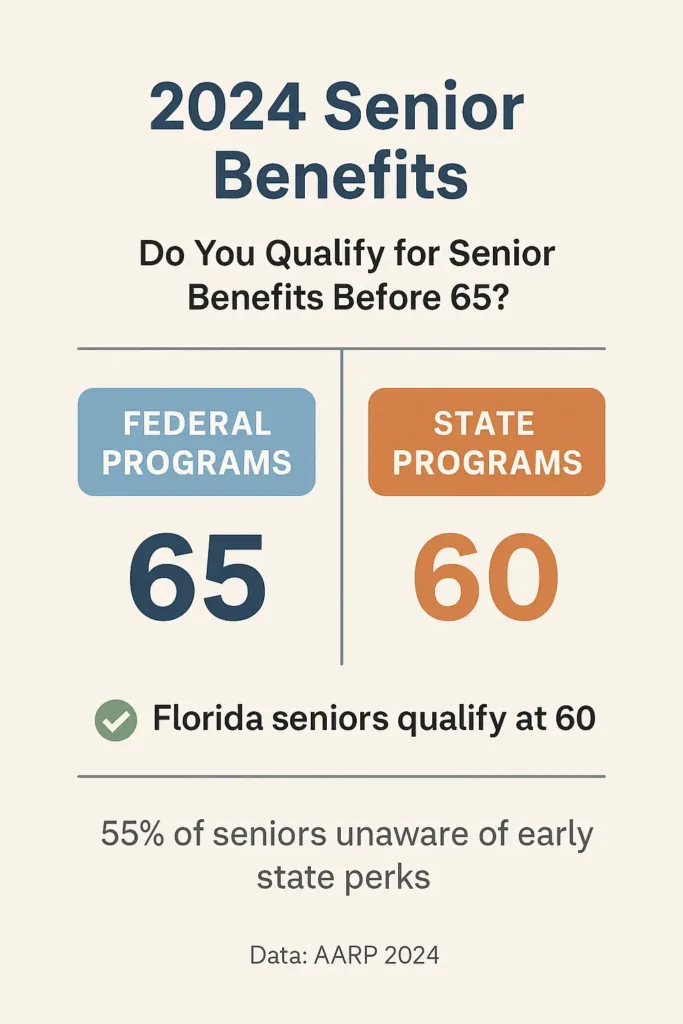

The meaning of ‘senior citizen age’ may differ based on the specific context in which it is applied. On the federal level, individuals generally reach senior citizen age when they turn 65. This key age serves as the benchmark for eligibility in several federal programs, including Medicare and Social Security, which offer health coverage and financial assistance to retirees. However, the definition of senior citizen age may differ across states, as state laws and private organizations often set their own criteria for when a person qualifies as a senior citizen. These varying definitions of senior citizen age can influence access to additional benefits, discounts, and housing assistance, depending on the region and specific program.

Pro Tip: While the federal government uses senior citizen age 65 as a benchmark for eligibility in programs like Medicare, several states, such as New York, offer senior benefits starting at age 60. This provides early access to valuable programs that can help reduce the cost of living for those approaching senior citizen age.

1.1.1. Senior Age Thresholds Across States

| State | Age for Senior Status | Program Example |

|---|---|---|

| Federal | 65 | Medicare, Social Security |

| California | 60 | Senior Discounts, State Health Programs |

| New York | 60 | Senior Discounts, State-Funded Housing |

| Florida | 60 | State Health Programs, Senior Living Assistance |

1.2. Age Thresholds for Social Security and Medicare Eligibility

In the U.S., eligibility for Social Security and Medicare is directly linked to an individual’s age. For Social Security, individuals can start receiving benefits as early as 62, but these benefits are reduced if claimed before the full retirement age. Medicare, on the other hand, begins at age 65, though people under 65 may qualify for it early if they have disabilities or specific health conditions. It’s essential for seniors to be aware of these ages to prevent any interruptions in their financial and healthcare coverage.

2024 U.S. Stat: According to the Social Security Administration, over 50 million Americans were enrolled in Medicare as of 2024, with the vast majority being seniors aged 65 or older (SSA, 2024).

1.2.1. Social Security and Medicare Age Eligibility Breakdown

| Program | Age to Begin Receiving Benefits | Full Retirement Age |

|---|---|---|

| Social Security | 62 (with reduction) | 66-67 (depending on birth year) |

| Medicare | 65 | N/A |

| Early Medicare Eligibility | Under 65 (with disability) | N/A |

1.3. Variations Across States: A State-by-State Breakdown

While age 65 is the most commonly accepted threshold for senior status, different states have their own rules and regulations regarding when seniors can access certain benefits. For example, Florida offers senior discounts starting at age 60, while other states may only provide such benefits at 65 or later. Understanding these variations is important as seniors seek access to discounts, tax relief programs, or healthcare benefits specific to their state of residence.

Local Anecdote: Linda, 69, from Los Angeles, California, shared, “I didn’t realize I was eligible for so many discounts until I turned 65. In California, there’s a great senior health program that I had no idea existed at 60.”

2. How Senior Citizen Age Affects Insurance Eligibility and Premiums

2.1. Health Insurance and Age: Medicare vs. Private Plans

As people grow older, their healthcare needs evolve, which is why understanding the impact of senior citizen age on health insurance is essential. For senior citizens, the federal government provides Medicare coverage starting at age 65, which includes hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D). While Medicare provides vital coverage, it doesn’t cover all health services, leading many senior citizens to consider additional private insurance plans, such as Medicare Advantage (Part C) or supplemental plans (Medigap).

Because senior citizen age is closely linked to healthcare costs, private health insurance premiums increase as individuals age. For example, a 65-year-old may pay between $200–$500 per month for a Medicare Advantage plan, depending on the level of coverage. In comparison, a senior citizen purchasing private insurance outside of Medicare might face premiums of $700–$1,000 per month.

Pro Tip: In some states, private insurance premiums for senior citizens are regulated to prevent excessive charges based solely on age. For example, California law restricts how much premiums can increase due to age (California Health Code § 1389.3).

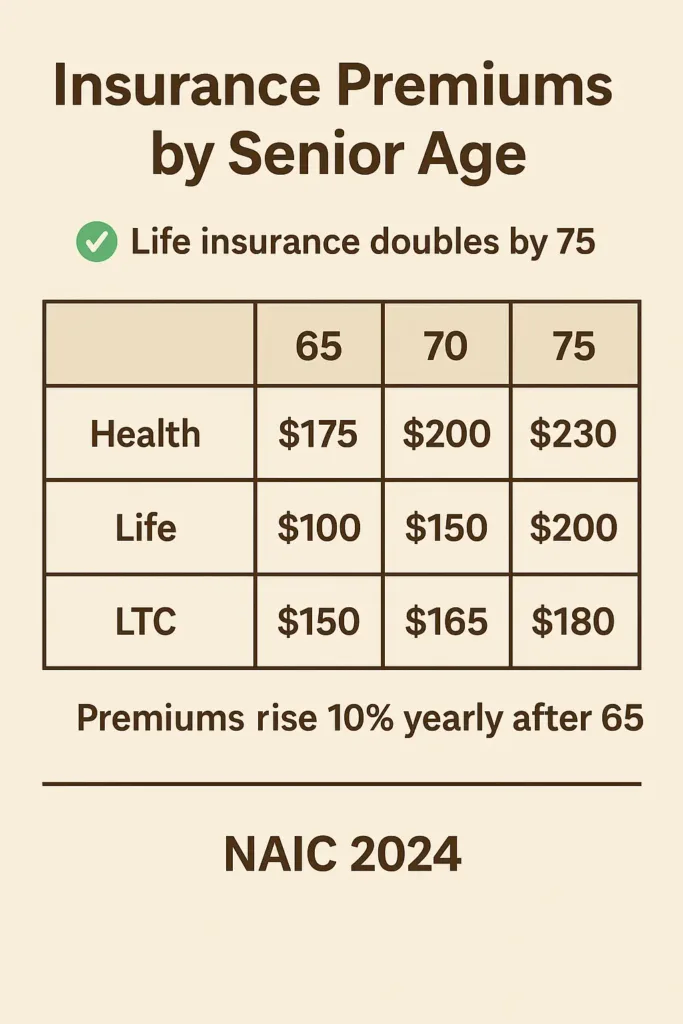

2.2. Life Insurance: Age-Based Premium Increases

Senior citizen age also affects life insurance premiums. Typically, the older a person is, the higher their life insurance premiums. Life insurance premiums are significantly lower for younger people, but once individuals reach 65, premiums increase by 5–10% annually. For many seniors, it becomes difficult to qualify for life insurance policies without a medical examination, and some insurers may impose an age limit, refusing coverage for individuals over 70 or 75.

2024 U.S. Stat: According to the National Association of Insurance Commissioners (NAIC), 50% of senior citizens aged 65 and older have some form of life insurance, although premiums rise substantially after age 70 (NAIC, 2024).

2.3. Long-Term Care Insurance and Age Limits

Long-term care (LTC) insurance becomes particularly important as people age. It covers the cost of nursing homes, in-home care, and assisted living. However, as senior citizen age increases, the cost of LTC insurance tends to rise, and many insurers impose age limits for new policies. Most insurers do not offer LTC policies to individuals over 75 due to the higher likelihood of needing care. Seniors who purchase LTC insurance at a younger age may pay anywhere from $2,000 to $5,000 annually, depending on the coverage level and their age at enrollment.

Real-life: George, 72, from Phoenix, Arizona, shared that when he applied for long-term care insurance at age 72, his premiums were twice as high as they would have been at 65. “I should have gotten it earlier,” he admitted, highlighting how senior citizen age impacts insurance costs.

2.3.1. Comparison of Insurance Premiums by Age

| Insurance Type | Age 65 | Age 70 | Age 75 |

|---|---|---|---|

| Medicare Advantage | $200–$500/month | $300–$600/month | $400–$800/month |

| Private Health Insurance | $700–$1,000/month | $900–$1,200/month | $1,200–$1,500/month |

| Life Insurance | $50–$100/month | $100–$150/month | $150–$200/month |

| Long-Term Care Insurance | $2,000–$4,000/year | $3,000–$5,000/year | $4,500–$6,500/year |

3. The Impact of Senior Citizen Age on Employment and Retirement Benefits

3.1. Retirement Plan Contributions: When Does the “Senior” Label Apply?

As individuals approach senior citizen age, they may begin to think about how their age impacts their ability to contribute to retirement plans. For most retirement plans, such as 401(k)s and IRAs, individuals can begin making catch-up contributions once they reach 50. However, seniors can continue contributing to these plans well into their 70s. In fact, the IRS allows seniors aged 70½ and older to contribute to IRAs, provided they have earned income. These age-related thresholds are important to understand in order to maximize retirement savings.

Pro Tip: Seniors should maximize their retirement contributions by taking advantage of catch-up provisions starting at age 50. In 2024, the IRS permits an additional $7,000 contribution to 401(k) accounts for individuals aged 50 and above (IRS, 2024).

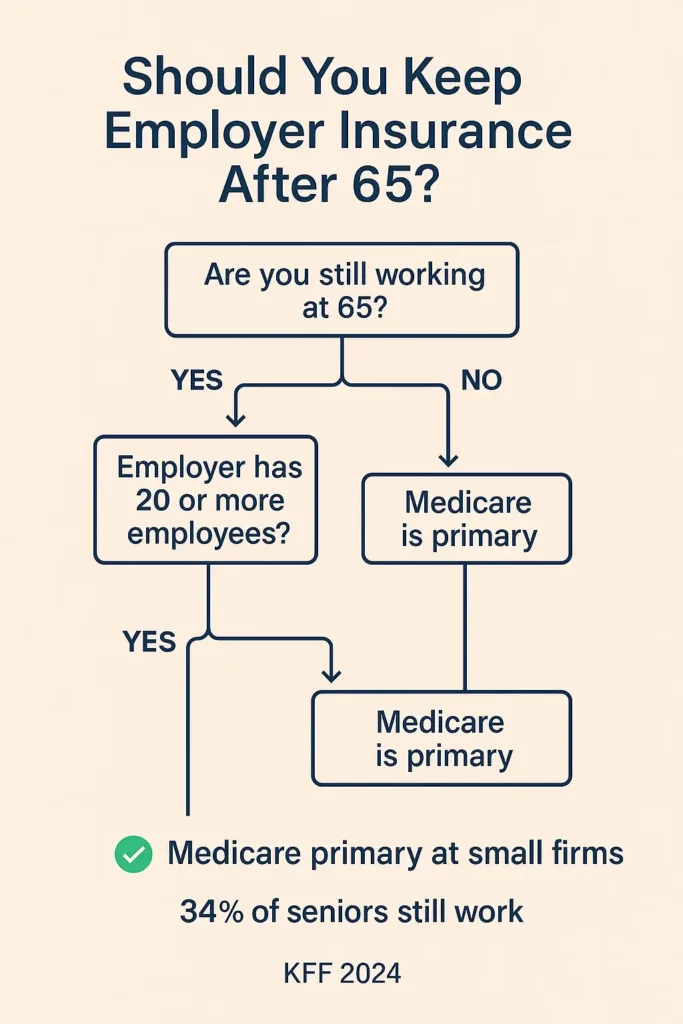

3.2. Employer Health Insurance vs. Medicare: Key Considerations

Many seniors still work past the age of 65, and for those who do, understanding how employer-provided health insurance interacts with Medicare is crucial. Employees over 65 can choose to continue their employer health insurance or switch to Medicare. The decision depends on factors such as whether the employer has fewer than 20 employees (in which case Medicare becomes the primary insurer) or if the employer offers a retiree health plan. Understanding these options ensures that seniors avoid gaps in coverage or additional out-of-pocket costs.

2024 U.S. Stat: According to the Kaiser Family Foundation, 34% of people aged 65–69 and 19% of those aged 70 and older continue to work and receive health insurance through their employer (KFF, 2024).

3.3. Social Security Benefits and Age-Based Milestones

Social Security benefits are another critical aspect of senior citizens’ financial security. Seniors can begin claiming Social Security benefits at age 62, though waiting until their full retirement age (around 66–67, depending on birth year) will increase their monthly benefit. Delaying benefits beyond the full retirement age increases the monthly amount even further, up to age 70. This milestone is particularly important for those looking to maximize their retirement income.

Real-life: Janet, 64, from Miami, Florida, said, “I decided to wait until 70 to claim my Social Security. I wanted to make sure I received the maximum monthly benefit, especially with rising healthcare costs.”

3.3.1. Social Security Benefits by Age

| Age to Begin Receiving Benefits | Monthly Benefits (Approx.) | Full Retirement Age (FRA) |

|---|---|---|

| 62 | Reduced by 25–30% | Full retirement age varies by birth year |

| 66-67 | Standard amount (FRA) | Defined by birth year |

| 70 | Increased by 8% per year | N/A |

4. Common Misconceptions About Senior Citizen Age

4.1. The Myth of “Retirement Age”

One of the most widespread misconceptions about senior citizen age is the belief that there is a fixed “retirement age.” Many people assume that they must stop working as soon as they reach 65, but this is not necessarily the case. While 65 is often associated with retirement, it is increasingly common for seniors to continue working beyond this age. Personal choices, financial readiness, and health factors all influence when an individual decides to retire, making the idea of a universal “retirement age” inaccurate.

Pro Tip: There is no law that requires a person to retire at age 65. In fact, many seniors work past 65 due to financial needs or personal fulfillment, and some even pursue new careers or hobbies later in life.

4.2. Age and Health: Not All Seniors Face Poor Health

A common misconception about senior citizen age is that aging automatically leads to poor health. While it’s true that certain conditions, like arthritis or heart disease, become more prevalent with age, many seniors remain in good health well into their 70s and beyond. Maintaining an active lifestyle, eating well, and staying socially engaged are all factors that can significantly improve health outcomes for older adults. It’s important to challenge the assumption that all seniors will inevitably experience a decline in health.

2024 U.S. Stat: According to the Centers for Disease Control and Prevention (CDC), nearly 40% of adults aged 65 and older report being in excellent or very good health, which challenges the common stereotype of declining health in old age (CDC, 2024).

4.3. Misunderstanding of Senior Discounts and Benefits

Seniors often believe that simply reaching a certain age automatically qualifies them for all senior discounts or benefits. However, eligibility for discounts and programs can vary widely depending on the state, the program’s guidelines, and the provider. For example, while many stores offer discounts for seniors aged 60 and older, some require seniors to show proof of age or membership in a specific program to qualify for the discount.

Local Anecdote: Bob, 72, from Dallas, Texas, assumed that every store would offer him senior discounts. “I was surprised to learn that I needed to sign up for certain programs or show my ID to get discounts,” he said.

4.3.1. Senior Discounts by Age and State

| State | Age for Senior Discounts | Program Requirements |

|---|---|---|

| California | 60 | Proof of age required for most stores and services |

| Texas | 65 | Eligibility for senior benefits such as transportation or health programs |

| Florida | 60 | Senior discounts available in most stores with ID or membership |

| New York | 60 | State-run senior programs offer discounted services and housing |

Conclusion

Understanding how senior citizen age affects eligibility for healthcare programs, insurance premiums, and retirement benefits is crucial for making informed decisions about the future. As people grow older, their healthcare and financial needs change, requiring senior citizens to actively manage these transitions. From becoming eligible for Medicare at age 65 to the rising costs of private insurance as they age, it’s essential to understand how aging influences these important aspects of life.

Additionally, older adults involved in digital industries or healthcare must consider critical system protection strategies to safeguard personal and financial data.

Senior citizen age influences everything from life insurance premiums to long-term care coverage. While myths and misconceptions abound about aging, it is vital for seniors to stay informed about their rights and options. With the right knowledge, senior citizens can take control of their healthcare and financial planning to ensure long-term security and well-being.

As you approach or continue in your senior years, remember that your senior citizen age should not limit your opportunities. Stay informed, seek professional advice, and make choices that best suit your evolving needs. Don’t hesitate to explore the many benefits and programs available to seniors based on age, and always consider how your age can work in your favor when planning for the future.

FAQ

Is 55 years old considered a senior citizen?

While age 55 is sometimes referred to as the “early senior” milestone, it typically doesn’t grant full senior status under federal programs like Medicare or Social Security. However, many private organizations and retailers begin offering discounts and early retirement benefits at 55, making it an important transitional age for planning.

What age is a senior citizen?

The standard age recognized as “senior citizen” in the U.S. is 65, which aligns with Medicare eligibility. Still, some states and programs use 60 or even 62 as their cutoff. It depends on whether you’re looking at healthcare benefits, retirement programs, or senior discounts—each may define “senior” differently.

What do I qualify for when I turn 55?

At 55, you may qualify for age-based perks such as early withdrawal options from certain retirement plans (without penalties in some cases), membership in senior-focused associations like AARP, and select discounts on travel, dining, or insurance. However, major government benefits like Medicare or full Social Security are still several years away.

What do 60 year olds get free?

By age 60, many states offer senior-specific benefits such as reduced transit fares, library privileges, discounted utility programs, or free admission to public parks. For those renting their home, it’s also a good time to review options like renters insurance in Michigan, which may offer tailored protection for seniors living independently. In states like California or Florida, seniors 60 and older may also gain early access to state-funded health and housing programs. Availability varies by location and program.