When Jason, a 62-year-old from Phoenix, sold his rental property last year, he didn’t want the proceeds sitting idle. His financial advisor mentioned single premium term insurance—a product Jason had never heard of. For short-term auto delivery needs, driveaway insurance might offer a better fit than long-term vehicle policies. A one-time payment for guaranteed term coverage? It sounded too simple. But with no ongoing premiums and clear death benefit terms, it checked all his boxes.

Single premium term insurance lets you purchase a life insurance policy by paying a lump sum up front, locking in coverage without monthly or annual bills. It’s often used by retirees, business owners, or anyone with liquid assets seeking low-maintenance protection. According to LIMRA’s May 2024 report, 18% of new life insurance policies in the $250K–$500K range were funded with a single premium structure—up from 11% the year before.

So is this the right tool for your situation—or a financial trap in disguise? Let’s break it down. You might also want to check out our guide on life insurance quotes to compare standard plans before deciding.

1. What Is Single Premium Term Insurance?

1.1 How Single Premium Term Insurance Works

One payment, one policy, and no bills ever again. That’s the promise behind single premium term insurance. Instead of paying monthly or annually like traditional term life, you make a single lump-sum payment when the policy starts. That one payment keeps your coverage active for the entire term—usually between 10 and 30 years.

Let’s say David, a 58-year-old in Ohio, sells his second home and wants to leave a legacy for his daughter. Rather than investing the cash or dealing with another long-term financial product, he uses part of the proceeds to fund a 20-year single premium term policy. That way, his daughter gets a guaranteed death benefit, and he doesn’t have to worry about missing payments down the road.

Riders can benefit from similar peace of mind with motorcycle breakdown insurance, which offers prepaid protection for unexpected mechanical failures.

But there’s a catch. When the coverage term ends, the policy expires—no cash back, no continuation, no savings component. It’s pure protection with a hard stop.

Recent data from LIMRA (March 2024) shows that over 23% of new term life purchases among people 50+ were funded by a single premium—up 9% year-over-year. That shift signals growing interest in simplified, upfront options as retirement nears.

| Aspect | Single Premium Term | Standard Term Life |

|---|---|---|

| Payment Style | Paid fully upfront | Paid monthly or annually |

| Policy Duration | Fixed (e.g. 10–30 years) | Fixed (e.g. 10–30 years) |

| Refund at Term End | No | No |

| Cash Value | None | None |

| Risk of Lapse | Very low | Moderate (if payment lapses) |

1.2 Key Features of Single Premium Term Insurance

The main appeal of single premium term insurance is how hands-off it is. Once you pay, you’re done. There’s no paperwork to keep track of, no automatic withdrawals, and no threat of losing coverage because you forgot a payment. It’s ideal for people who prefer simple solutions—especially those entering retirement or managing fixed budgets.

But this simplicity comes at a cost—literally. You need access to a large amount of money up front, and once you lock it in, it’s gone. If the term runs out while you’re still alive, the contract ends quietly—no payout, no continuation, just closure. There’s also no flexibility to adjust the coverage later. It’s a one-time decision with long-term consequences.

“This isn’t a plan for everyone,” says Michelle Ortega, a licensed financial advisor in Arizona. “It works best for clients who don’t want surprises. They want predictability and are okay trading liquidity for peace of mind.”

Source: NAIC Consumer Alert on Term Life Insurance, 2024

2. Compare Single Premium Term Insurance to Other Policies

2.1 Single Premium Term Insurance vs. Traditional Term Life

At first glance, both policies seem similar—they offer coverage for a set period and a fixed death benefit. But the funding structure makes a world of difference. Single premium term insurance requires one large payment upfront, while traditional term life spreads costs over time with monthly or annual premiums.

Take Marcus, 45, a tech consultant from Colorado. He had a windfall from a startup exit and chose single premium term coverage to avoid future budgeting. His brother, meanwhile, pays $35/month for a similar 20-year policy. Over time, the brother may pay more or less, depending on rate changes, but Marcus is locked in, worry-free.

For people with irregular income, traditional term can feel safer. But for those with savings or cash on hand, the simplicity of a one-and-done model is appealing—especially since it eliminates lapse risk due to missed payments.

| Criteria | Single Premium Term | Traditional Term Life |

|---|---|---|

| Payment Style | One-time upfront | Ongoing (monthly/annual) |

| Risk of Lapse | Low | Medium (if premiums stop) |

| Liquidity Impact | High (funds tied upfront) | Low (spread over time) |

| Policy Control | Fixed | May include renewals or conversions |

2.2 Differences Between Single Premium Term and Whole Life

The confusion between single premium term insurance and whole life is common, especially since both can involve large initial payments. But the core purpose is different: term coverage is temporary and pure protection; whole life includes lifetime coverage with a cash value component that grows over time.

Here’s an example. If Sarah, 52, buys a single premium term policy, she’s covered for, say, 20 years. If she lives beyond that, the policy ends. If she instead buys a single premium whole life policy, she’s insured for life—and part of her payment grows tax-deferred in a cash value account.

That said, whole life policies are significantly more expensive for the same death benefit. You’re also paying for investment features you may not need. Term offers simplicity and clarity; whole life offers permanence and savings potential—but with complexity and cost.

3. Understand the Pros and Cons of Single Premium Term Insurance

3.1 Key Advantages of Single Premium Term Insurance

One of the main appeals of single premium term insurance is its simplicity. You pay once, and you’re covered for a fixed period—no monthly billing, no payment lapses, and no administrative headaches. It’s ideal for people who prefer financial certainty and want to eliminate future payment obligations.

Below is a summary of the most compelling benefits:

| Benefit | What It Means |

|---|---|

| One-Time Payment | No recurring premiums—set it and forget it |

| No Lapse Risk | Coverage can’t expire due to missed payments |

| Clean Exit Strategy | Term ends cleanly, with no policy management afterward |

| Predictable Cost | Everything is paid upfront—no surprises later |

“It’s a great option for clients who want zero ongoing obligations,” says Diane McAllen, a licensed life insurance agent in Denver. “Once it’s funded, they don’t have to think about it again.”

3.2 Potential Downsides of Single Premium Term Insurance

Even though it’s designed for convenience, this type of policy has important restrictions you can’t ignore. One major challenge is the steep upfront cost, which can run into the thousands—even for a basic policy.

After you make that single payment, the coverage terms are locked in and can’t be changed. There’s no option to upgrade your benefit later, extend the term, or convert it into a more flexible product. It’s a one-shot deal—clear and simple, but not forgiving.

Another key limitation is what happens if you live past the term. In that case, your coverage simply ends, and no money comes back. There’s no refund, no accumulated value. You’re essentially paying in advance for temporary protection with no strings attached—but also no financial return.

Pro Tip: If you’re considering this option, ask yourself if you’re financially comfortable parting with that large sum upfront—especially knowing there’s no return unless you pass during the policy term.

Compare with accidental death coverage if your main concern is short-term protection on a tighter budget.

4. Who Should Consider Single Premium Term Insurance?

4.1 Ideal Financial Profiles for Single Premium Term Insurance

Not everyone is a good match for single premium term insurance. But for some, it’s a perfect financial fit—especially those who prefer certainty over flexibility. If you have extra capital sitting idle and don’t like the idea of making monthly payments for decades, this policy structure could be ideal.

Here are examples of people who typically benefit from this kind of coverage:

- Home sellers who’ve recently cashed out property equity

- High-earning professionals looking to secure coverage with a one-time move

- Business partners funding a buy-sell agreement

- Retirees who want to leave a guaranteed tax-free benefit

“If you’ve got the funds and want zero surprises, this product brings peace of mind,” says Jenna Worthing, an estate planner based in Colorado Springs. “It’s like locking the door behind you—you know your family’s protected, no matter what.”

| Profile Type | Why It Works |

|---|---|

| Cash-rich retiree | One payment simplifies finances in retirement |

| Business owner | Useful in succession or key-person strategies |

| Real estate investor | Reinvests profits into future-proofed coverage |

| Young high earner | Locks in a low rate long-term while healthy |

4.2 When Single Premium Term Insurance May Not Be the Right Fit

While single premium term insurance offers convenience, it also creates some limitations. The most obvious? The upfront cost. Not everyone can afford—or should commit to—a large one-time payment, especially if their income or expenses might shift in the near future.

Ask yourself:

- Will this payment drain my emergency savings?

- Do I expect big life changes in the next few years?

- Would I benefit more from flexible coverage that adapts over time?

- Am I okay with no refunds if I outlive the policy?

“This policy requires confidence, not just in your finances but in your long-term goals,” says Malcolm Reyes, a licensed advisor in Austin, Texas. “If there’s doubt, a more flexible approach might make sense.”

And unlike whole or universal life insurance, single premium term doesn’t build cash value or allow borrowing. You’re paying for protection only—not a savings vehicle.

5. Explore the Tax Implications of Single Premium Term Insurance

5.1 IRS Treatment of Single Premium Term Insurance

Although single premium term insurance feels simple on the surface, its tax treatment deserves a closer look. The good news? If the insured passes away during the term, the death benefit paid to the beneficiary is generally income tax-free under IRS code §101(a)(1). That applies whether the policy was funded monthly or all at once.

But the IRS does pay attention to how the premium is structured. Since you’re paying a large lump sum, it must clearly qualify as a term contract—not a modified endowment contract (MEC), which is taxed differently. Fortunately, because single premium term policies have no cash value and no lifetime component, they usually fall outside MEC rules.

According to IRS Publication 525 (updated January 2025), term life insurance proceeds are excluded from gross income, unless the policy was transferred for value or part of a business transaction.

Still, it’s smart to consult a tax advisor if you’re using this policy within an estate plan, buy-sell agreement, or as part of corporate key-person coverage.

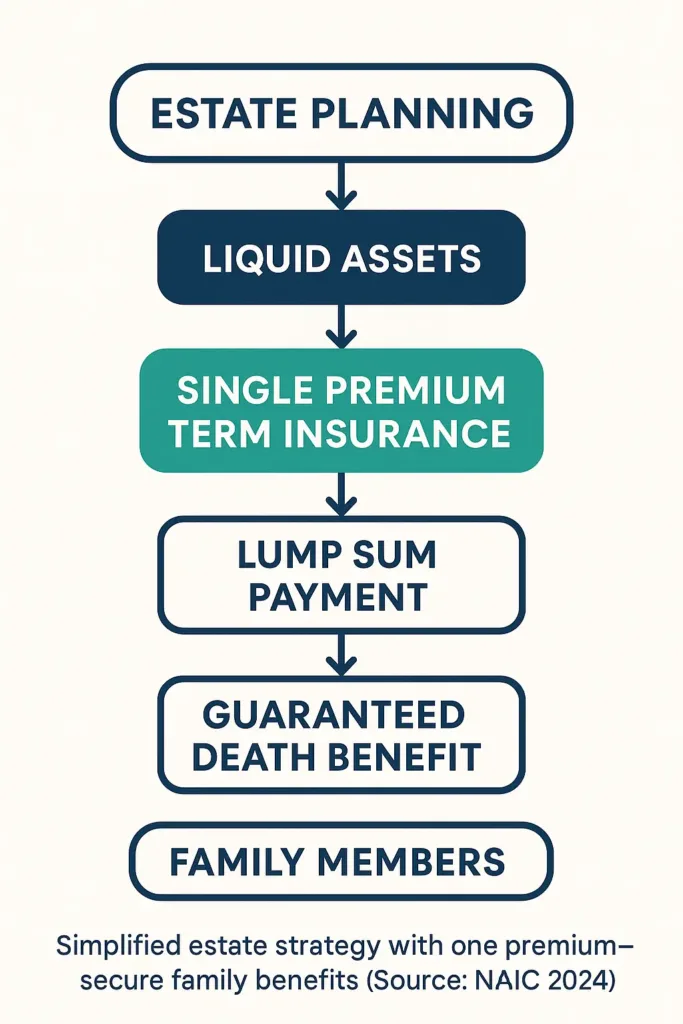

5.2 Estate Planning and Single Premium Term Insurance

Many people use single premium term insurance to simplify legacy planning. By making a one-time payment, they ensure their beneficiaries receive a set payout with no financial obligations later. But how this plays out in your estate can vary based on how the policy is owned and who receives the benefit.

If the insured owns the policy at death, the death benefit may be included in their taxable estate. That could matter if the estate exceeds the federal exemption (currently $13.61 million per individual in 2025). For high-net-worth households, this could trigger estate tax consequences—even if the insurance payout itself is income-tax-free.

One way around this is to have the policy owned by an irrevocable life insurance trust (ILIT), which removes it from the taxable estate entirely. This is a common strategy for lump-sum-funded policies used in wealth transfer planning.

“A single premium term policy can be a powerful estate planning tool—if structured correctly,” says Gerald Hunt, an estate attorney based in Virginia. “But if the ownership isn’t carefully assigned, the tax advantages can be lost.”

6. Real-Life Examples of Single Premium Term Insurance in Action

6.1 Case Study: Retiree Protecting a Legacy with Single Premium Term Insurance

Robert, 67, retired from the public school system in Missouri with a lump sum pension payout. He had no major debts and wanted to leave something meaningful to his two adult children—without locking his funds into a volatile market.

After consulting a financial advisor, Robert chose a single premium term insurance policy with a 20-year term and a $250,000 death benefit. He paid a one-time premium of $38,000. If he passes away within the term, the payout is guaranteed. If not, the contract ends quietly.

This gave Robert exactly what he wanted: a simple, no-maintenance way to create a tax-free inheritance with no future payments or obligations. And because it’s a term policy with no cash value, it stayed affordable.

6.2 Case Study: Small Business Owner Funding a Key-Person Policy

Jasmine owns a logistics company in Georgia with 14 employees. Her operations manager, Tom, has been with the firm for over a decade and plays a vital role in daily decisions and contracts. Losing him unexpectedly would cause serious disruption.

To protect the company, Jasmine purchased a single premium term insurance policy on Tom’s life, with the business named as beneficiary. She paid $52,000 up front for a $500,000, 15-year term policy. If Tom passes away during that period, the business receives a lump sum to help cover the cost of hiring, transition, and potential lost revenue.

This approach let Jasmine avoid ongoing accounting for premiums and locked in fixed protection without budgeting for future payments—a clean move for a growing operation.

7. What You’ll Pay for Single Premium Term Insurance in 2025

7.1 Example Rates for Single Premium Term Insurance by Age and Coverage Duration

The cost of single premium term insurance varies significantly depending on your age, health status, and how long you want coverage. Since you’re paying the full premium upfront, the amount can feel large—but remember, it replaces 10 to 30 years of monthly payments.

Below is a breakdown of typical single premiums for a healthy non-smoker male purchasing a $250,000 death benefit in 2025. Rates reflect standard underwriting, but exact quotes can differ by provider and region.

| Age | 10-Year Term | 20-Year Term | 30-Year Term |

|---|---|---|---|

| 35 | $5,800 | $8,900 | $12,700 |

| 45 | $7,400 | $12,300 | $17,800 |

| 55 | $11,200 | $18,900 | $27,600 |

| 65 | $16,300 | $28,700 | Not typically available |

These premiums are illustrative only. To get an exact quote, we recommend checking with a licensed provider in your state.

7.2 Factors That Influence the Price of Single Premium Term Insurance

Since single premium term insurance is funded upfront, insurers calculate cost based on the total risk over the full policy term. Several factors affect your price—some within your control, others not:

- Age at application: The older you are, the higher the risk—and cost.

- Length of term: Longer terms mean higher total risk, and higher upfront premiums.

- Health history: Chronic conditions, medication, or past diagnoses may increase your rate.

- Coverage amount: Naturally, $500,000 costs more than $250,000.

- Gender and smoking status: Non-smokers and females often receive lower premiums.

“Underwriting for single premium term insurance looks a lot like traditional term,” explains Nate Givens, an underwriter based in Portland, Oregon. “But with all the money upfront, even small health factors can swing the quote by thousands.”

Before applying, consider getting a pre-qualification review. It won’t impact your credit and can highlight potential red flags.

8. How to Buy Single Premium Term Insurance the Smart Way

8.1 What to Ask Before Buying Single Premium Term Insurance

Choosing single premium term insurance isn’t just a financial transaction—it’s a long-term commitment you make in one single move. To avoid costly missteps, you need to ask sharp questions before signing anything.

- Is this money truly disposable? If you’re dipping into emergency funds or retirement savings to pay the premium, it might not be the right time.

- Do I fully understand what’s covered—and for how long? A 10-year term isn’t the same as lifelong coverage. Make sure the timeline matches your needs.

- What happens if I live beyond the policy term? There’s no refund, no benefit. You’re paying for coverage that ends without payout unless death occurs during the term.

- Can I adjust or upgrade the policy later? You can’t. This product offers no flexibility after the payment is made.

Expert insight: “Single premium term insurance works best for people with stable finances and a clear-cut coverage goal,” says Julia Perez, CFP in Phoenix, AZ. “But don’t confuse simplicity with suitability.”

8.2 Common Mistakes to Avoid with Single Premium Term Insurance

Single premium term insurance sounds straightforward, but plenty of buyers get it wrong by focusing only on convenience. The truth? One misstep can lock you into a plan that doesn’t fit.

Here’s a clear look at frequent errors—and how to sidestep them:

| Costly Mistake | Better Move |

|---|---|

| Spending liquidity meant for emergencies | Use surplus funds or a dedicated savings vehicle instead |

| Picking a short term without considering future needs | Match the term to key milestones like children’s education or mortgage payoff |

| Trusting a single quote | Compare at least three offers and check insurer stability ratings. If you only need temporary coverage, consider one-week truck insurance as a flexible short-term solution. |

| Overlooking exclusions in the fine print | Read every clause and clarify coverage limits with your agent |

Pro Tip: Don’t rush the process. A polished sales pitch can’t replace thoughtful planning. Request all documentation in writing—and sleep on it before committing.

9. Final Thoughts on Single Premium Term Insurance

9.1 Is Single Premium Term Insurance Right for You?

There’s no one-size-fits-all answer when it comes to life insurance, and single premium term insurance is no exception. If you have a lump sum of cash set aside, want guaranteed coverage without recurring bills, and don’t need the policy to accumulate cash value, this product could make sense.

But it’s not ideal for everyone. Younger families, those with changing financial needs, or anyone unsure about locking up funds for years might be better served with traditional term life or even flexible universal life coverage.

Real-world example: A 58-year-old in Texas used a recent inheritance to fund a 10-year single premium term policy. It gave him peace of mind knowing his mortgage would be covered if something happened before retirement—without touching his monthly budget.

9.2 Summary: Key Takeaways from the Guide

- Single premium term insurance offers coverage paid in full upfront—no monthly premiums, no recurring costs.

- It does not build cash value and doesn’t refund your premium if you outlive the term.

- Best suited for individuals with stable finances and fixed coverage needs.

- Common pitfalls include using emergency savings or choosing a term length that doesn’t match your obligations.

- Always review your options, read the fine print, and ask the right questions before committing to a one-shot payment.

External resource: The National Association of Insurance Commissioners offers a helpful consumer guide on term life insurance at NAIC.org.

Now that you understand the pros and limitations of this coverage type, you’re better equipped to make a decision that protects your family—without overpaying or underplanning.

FAQ

What is single premium term insurance?

Single premium term insurance is a type of term life insurance where you pay one lump sum upfront to secure coverage for a fixed period—usually 10 to 30 years. Unlike traditional term policies that require monthly or annual payments, this policy requires no ongoing premiums, offering simple, hands-off protection with a guaranteed death benefit for the term length.

What is a single premium payment term?

A single premium payment term refers to the payment structure of certain term life insurance policies where the entire premium is paid once at the start of the policy. This one-time payment covers the entire term period, eliminating monthly or annual bills and reducing the risk of policy lapse due to missed payments.

What is a single term policy?

A single term policy typically means a term life insurance policy with a fixed coverage period (like 10, 20, or 30 years) and no cash value component. When linked to “single premium,” it highlights that the policy is funded with one upfront payment instead of recurring premiums, providing pure protection without savings or investment features.

What is the meaning of single premium?

The meaning of single premium is the full amount paid once at the start of an insurance policy to cover the entire term or coverage period. This contrasts with regular premium plans, which spread payments out over months or years. Single premiums are common in some life insurance products designed for simplicity and guaranteed coverage without ongoing payments.